Global Electronically Scanned Array Market

Market Size in USD Billion

CAGR :

%

USD

10.03 Billion

USD

15.99 Billion

2024

2032

USD

10.03 Billion

USD

15.99 Billion

2024

2032

| 2025 –2032 | |

| USD 10.03 Billion | |

| USD 15.99 Billion | |

|

|

|

|

Electronically Scanned Array Market Size

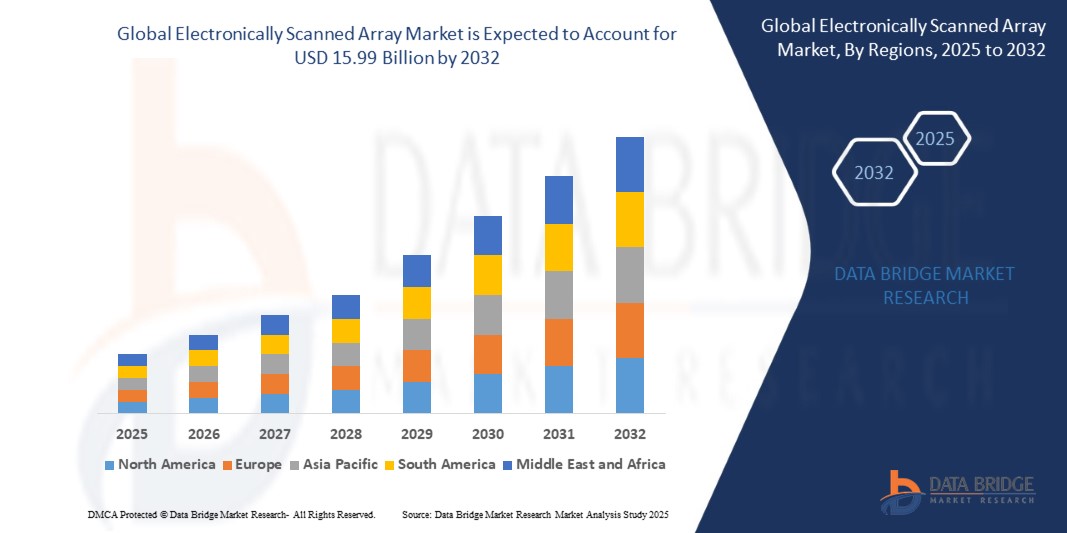

- The global electronically scanned array market size was valued at USD 10.03 billion in 2024 and is expected to reach USD 15.99 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for advanced radar systems in defense applications, rising investments in electronic warfare capabilities, and growing adoption of electronically scanned arrays in commercial and space-based surveillance systems

- The surge in cross-border conflicts, emphasis on real-time situational awareness, and rising deployment of network-centric warfare technologies are further contributing to market expansion

Electronically Scanned Array Market Analysis

- Rising geopolitical tensions and defense modernization programs across developed and emerging economies are boosting the demand for electronically scanned array radar systems due to their superior tracking, detection, and target identification capabilities

- Technological advancements in solid-state electronics, miniaturization of radar modules, and integration with unmanned systems and fifth-generation fighter aircraft are expected to drive the market over the coming years

- North America led the electronically scanned array market with the largest revenue share of 38.7% in 2024, primarily driven by extensive defense spending and the integration of cutting-edge radar technologies across airborne and naval platforms

- Asia-Pacific region is expected to witness the highest growth rate in the global electronically scanned array market, driven by escalating regional tensions, growing focus on defense modernization across countries such as China, India, South Korea, and Japan, and rising adoption of advanced radar and sensor technologies for national security and maritime surveillance

- The active segment accounted for the largest market share in 2024, driven by its advanced capabilities in electronic beam steering and signal amplification. Active electronically scanned arrays (AESAs) are widely adopted in modern radar systems due to their high resolution, reliability, and fast scanning speeds. Their ability to transmit and receive through each module individually enhances detection accuracy and situational awareness in real-time, particularly in military surveillance, target tracking, and air traffic control applications

Report Scope and Electronically Scanned Array Market Segmentation

|

Attributes |

Electronically Scanned Array Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Electronically Scanned Array Market Trends

Emergence of Multi-Functionality in Electronically Scanned Arrays

- The trend toward integrating multiple functionalities—such as radar, electronic warfare, and communication—into a single electronically scanned array (ESA) system is redefining defense and aerospace capabilities. These multi-role arrays offer significant benefits in terms of weight reduction, cost savings, and operational efficiency by eliminating the need for separate subsystems

- The growing demand for platform versatility, especially in naval and airborne defense systems, is encouraging the adoption of electronically scanned arrays that support a broad spectrum of operations without compromising performance. Multifunctional ESA systems streamline architecture and reduce the number of hardware components required

- Advanced signal processing and modular designs are enabling real-time switching between functionalities, enhancing the responsiveness of modern defense systems. This adaptability ensures quicker reaction times in high-threat environments and optimizes situational awareness

- For instance, in 2023, Northrop Grumman developed an ESA system capable of simultaneously handling long-range tracking and tactical jamming for the U.S. Navy, providing a single solution for radar surveillance and electronic attack. This marked a major step toward platform consolidation and mission flexibility

- The trend toward multi-functionality is expected to continue as military organizations seek compact, powerful systems capable of meeting evolving mission demands. Continued innovation in component miniaturization and power efficiency will further accelerate this transformation across platforms

Electronically Scanned Array Market Dynamics

Driver

Surge in Defense Spending and Border Security Modernization Programs

- The global rise in geopolitical tensions has driven increased defense budgets, leading to robust investments in advanced radar and surveillance technologies. Electronically scanned arrays are central to modern military operations, particularly for threat detection, airspace monitoring, and missile defense

- Countries are modernizing border security with upgraded radar systems that incorporate active electronically scanned arrays (AESA), offering higher precision, faster target acquisition, and reduced maintenance requirements. These systems are key to national defense strategies, especially in regions prone to cross-border threats

- The defense sector is also pushing for domestic manufacturing of radar components to strengthen supply chains and reduce dependence on foreign technology. This move is fostering new partnerships and stimulating innovation in ESA development across markets

- For instance, in 2024, India announced a USD 2.3 billion initiative to deploy indigenously developed AESA radar systems along its northern borders, significantly boosting domestic demand and research in phased array technology

- While defense remains the largest contributor, ESA systems are also finding applications in civil aviation and weather forecasting, further expanding their market relevance. Continuous technological improvements and favorable policy frameworks are reinforcing long-term growth potential

Restraint/Challenge

High Development Costs and Complex Integration Requirements

- The development of electronically scanned array systems involves extensive research, high-precision manufacturing, and advanced materials, resulting in significant upfront costs. These financial barriers limit the market to large defense contractors and well-funded government projects

- Integration challenges are prominent, especially when retrofitting ESA systems into legacy platforms. Compatibility with existing command and control systems, power supply limitations, and structural constraints often require costly and time-consuming customizations

- Smaller defense forces and developing nations face difficulties adopting ESA technology due to limited procurement budgets and lack of skilled technical personnel. This leads to a preference for conventional radar systems despite their limitations in performance and versatility

- For instance, in 2023, several countries in Latin America delayed planned AESA deployments due to budget reallocations and integration bottlenecks, citing challenges in meeting interoperability and infrastructure requirements

- Although ESA technology offers unmatched performance benefits, market expansion depends on reducing development and deployment costs. Greater focus on modular design, open architecture systems, and scalable solutions will be essential to drive adoption across broader user bases

Electronically Scanned Array Market Scope

The market is segmented on the basis of type, platform, range, array geometry, and component.

• By Type

On the basis of type, the electronically scanned array market is segmented into active and passive. The active segment accounted for the largest market share in 2024, driven by its advanced capabilities in electronic beam steering and signal amplification. Active electronically scanned arrays (AESAs) are widely adopted in modern radar systems due to their high resolution, reliability, and fast scanning speeds. Their ability to transmit and receive through each module individually enhances detection accuracy and situational awareness in real-time, particularly in military surveillance, target tracking, and air traffic control applications.

The passive segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its lower cost and simpler design architecture. Passive electronically scanned arrays (PESAs) are increasingly being deployed in legacy systems and cost-sensitive platforms. Their operational efficiency and suitability for long-range applications without the complexity of integrated transmit modules make them favorable for naval and fixed ground-based radar systems.

• By Platform

On the basis of platform, the market is categorized into airborne, land, and naval. The airborne segment held the largest market share in 2024 due to the rising deployment of advanced radar systems in fighter jets, unmanned aerial vehicles, and surveillance aircraft. The integration of electronically scanned arrays in airborne platforms enhances situational awareness, threat detection, and tracking capabilities during both combat and reconnaissance missions.

The naval segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to the rising investments in naval modernization programs. As naval forces increasingly require robust radar capabilities for maritime surveillance, missile guidance, and vessel tracking, electronically scanned arrays offer an ideal solution due to their range, resilience, and adaptability to harsh sea environments.

• By Range

On the basis of range, the market is segmented into short, medium, and long. The long-range segment accounted for the largest revenue share in 2024, driven by the demand for advanced radar systems in missile defense, strategic surveillance, and border security operations. Long-range arrays provide wide-area coverage and early threat detection capabilities, which are critical for defense readiness and airspace management.

The short-range segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its rising usage in vehicle collision avoidance systems, ground surveillance, and airport monitoring applications. The compact size, energy efficiency, and cost-effectiveness of short-range electronically scanned arrays make them highly suitable for both civilian and military short-range detection systems.

• By Array Geometry

On the basis of array geometry, the electronically scanned array market is divided into linear, planar, and frequency scanning. The planar segment dominated the market in 2024 due to its superior beamforming capabilities and versatility in adapting to complex signal environments. Planar arrays are favored in radar systems requiring precision, such as missile tracking, battlefield surveillance, and advanced weather monitoring.

The frequency scanning segment is expected to witness the fastest growth rate from 2025 to 2032, as it enables beam steering by varying the operating frequency, eliminating the need for phase shifters. This results in simplified system architecture and reduced hardware costs, making it attractive for resource-constrained defense and commercial applications.

• By Component

On the basis of component, the market is segmented into TRM (transmit receive module), phase shifters, beamforming network (BFN), signal processing, radar data processor (RDP), power supply module, and cooling system. The TRM segment held the largest share in 2024 due to its critical role in enhancing the performance, reliability, and signal accuracy of electronically scanned arrays. TRMs act as the core functional units in active arrays, enabling precise control of transmitted and received signals.

The signal processing segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by advances in artificial intelligence and machine learning integration for real-time target recognition and data analytics. As radar systems evolve to manage more data with greater speed and accuracy, the demand for robust, scalable signal processing units is set to surge across defense and civilian applications.

Electronically Scanned Array Market Regional Analysis

- North America led the electronically scanned array market with the largest revenue share of 38.7% in 2024, primarily driven by extensive defense spending and the integration of cutting-edge radar technologies across airborne and naval platforms

- The region’s defense modernization programs, emphasis on border security, and adoption of advanced surveillance systems are fostering widespread deployment of electronically scanned arrays, particularly in radar and communication systems

- The presence of established aerospace and defense firms, such as Raytheon and Northrop Grumman, along with sustained government funding and research initiatives, further supports the market's expansion across military and homeland security applications

U.S. Electronically Scanned Array Market Insight

The U.S. electronically scanned array market accounted for a dominant revenue share in North America in 2024, supported by the nation’s robust investments in aerospace and defense modernization. The increasing deployment of active electronically scanned arrays (AESA) in military aircraft, such as the F-35 and F-22, is driving adoption. Furthermore, the push toward multi-mission capabilities and situational awareness in both domestic and overseas operations is boosting the use of ESA technology in ground-based and naval systems. Strategic government contracts, coupled with the country’s thriving defense R&D ecosystem, are expected to maintain the U.S. market’s leadership position throughout the forecast period

Europe Electronically Scanned Array Market Insight

The Europe electronically scanned array market is expected to witness the fastest growth rate from 2025 to 2032, supported by joint defense collaborations and increasing demand for next-generation radar systems across land and naval platforms. Growing geopolitical tensions, especially in Eastern Europe, have led to increased investments in surveillance and countermeasure technologies. Countries such as France, the United Kingdom, and Germany are prioritizing the upgrade of existing radar infrastructure to electronically scanned arrays to improve detection accuracy and response times. Technological partnerships between defense contractors and national governments continue to drive innovation in the region

Germany Electronically Scanned Array Market Insight

The Germany electronically scanned array market is expected to witness the fastest growth rate from 2025 to 2032, driven by its strategic emphasis on enhancing air defense capabilities and modernizing military infrastructure. Germany’s participation in multinational projects, such as the Future Combat Air System (FCAS), is promoting the adoption of ESA-based radar systems in both airborne and ground applications. In addition, the government’s increasing defense budget, commitment to NATO standards, and domestic manufacturing strengths support the widespread deployment of advanced radar arrays

U.K. Electronically Scanned Array Market Insight

The U.K. electronically scanned array market is expected to witness the fastest growth rate from 2025 to 2032, supported by continued investments in naval radar modernization and air defense upgrades. The Royal Navy’s transition to integrated radar solutions, including the Sea Ceptor missile system and Type 26 Global Combat Ships, is accelerating ESA deployment. Furthermore, the U.K.’s focus on homegrown innovation and collaboration with key industry players such as BAE Systems ensures the development and scaling of high-performance radar technologies for both domestic use and export

Asia-Pacific Electronically Scanned Array Market Insight

The Asia-Pacific electronically scanned array market is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing defense budgets, geopolitical tensions, and rapid military modernization in countries such as China, India, and Japan. The region's focus on indigenizing defense technologies, improving surveillance systems, and bolstering maritime security has accelerated the adoption of active and passive ESA systems across all platforms. Furthermore, local manufacturers and government-backed programs are playing a pivotal role in enhancing self-reliance and expanding domestic production capabilities

China Electronically Scanned Array Market Insight

The China electronically scanned array market dominated the Asia-Pacific region in 2024 with the largest revenue share, underpinned by aggressive investments in defense and surveillance systems. China’s development of homegrown AESA radars for fighter jets such as the J-20, and deployment across naval and ground-based platforms, signals a commitment to technological self-sufficiency. The country’s Belt and Road Initiative and expansion of maritime infrastructure are also fueling demand for ESA-based solutions in coastal monitoring and border protection

Japan Electronically Scanned Array Market Insight

The Japan electronically scanned array market is expected to witness the fastest growth rate from 2025 to 2032, fueled by a national push for enhanced maritime and air surveillance amid regional tensions. Japan’s Self-Defense Forces are investing in next-generation radar systems to improve threat detection and response capabilities. The country's collaboration with international partners, combined with its focus on indigenous technological development and sensor innovation, is further accelerating ESA adoption. The deployment of ESA technologies in both civilian and military applications reflects Japan’s strategy for securing critical infrastructure and maintaining regional stability

Electronically Scanned Array Market Share

The electronically scanned array industry is primarily led by well-established companies, including:

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman (U.S.)

- Leonardo-Finmeccanica (Italy)

- Raytheon (U.S.)

- Saab AB (Sweden)

- Israel Aerospace Industries (Israel)

- Thales Group (France)

- Toshiba India Pvt. Ltd. (India)

- RADA Electronic Industries (Israel)

- Reutech Radar Systems (South Africa)

Latest Developments in Global Electronically Scanned Array Market

- In February 2024, Northrop Grumman secured a multi-billion dollar contract with the U.S. Air Force to supply advanced AESA radars for the F-35 fighter jet program. This significant agreement guarantees production work for several years, solidifying Northrop Grumman’s pivotal role in enhancing the F-35’s combat effectiveness. The contract underscores the company’s commitment to delivering state-of-the-art technology, ensuring the operational readiness and superiority of this vital defense platform

- In March 2023, The Indian Ministry of Defence (MoD) signed contracts worth USD 448.44 million with Bharat Electronics Limited (BEL), a government-owned aerospace and defense electronics firm. These contracts aim to supply radar and warning receivers for the Indian Air Force, enhancing its operational capabilities. This partnership highlights the Indian government’s focus on strengthening domestic defense production and ensuring the armed forces are equipped with advanced technological solutions

- In September 2022, Raytheon was awarded a contract valued at USD 19.4 million to procure 129 items essential for servicing the APG-79 AESA radar system installed on F/A-18 aircraft. This contract, issued by the Naval Supply Systems Command Weapon Systems Support in Philadelphia, PA, reinforces Raytheon's commitment to maintaining the operational effectiveness of this crucial radar system. The agreement reflects ongoing efforts to enhance the F/A-18's combat readiness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.