Global Electrophysiology Devices Market

Market Size in USD Billion

CAGR :

%

USD

7.84 Billion

USD

17.00 Billion

2025

2033

USD

7.84 Billion

USD

17.00 Billion

2025

2033

| 2026 –2033 | |

| USD 7.84 Billion | |

| USD 17.00 Billion | |

|

|

|

|

Electrophysiology Devices Market Size

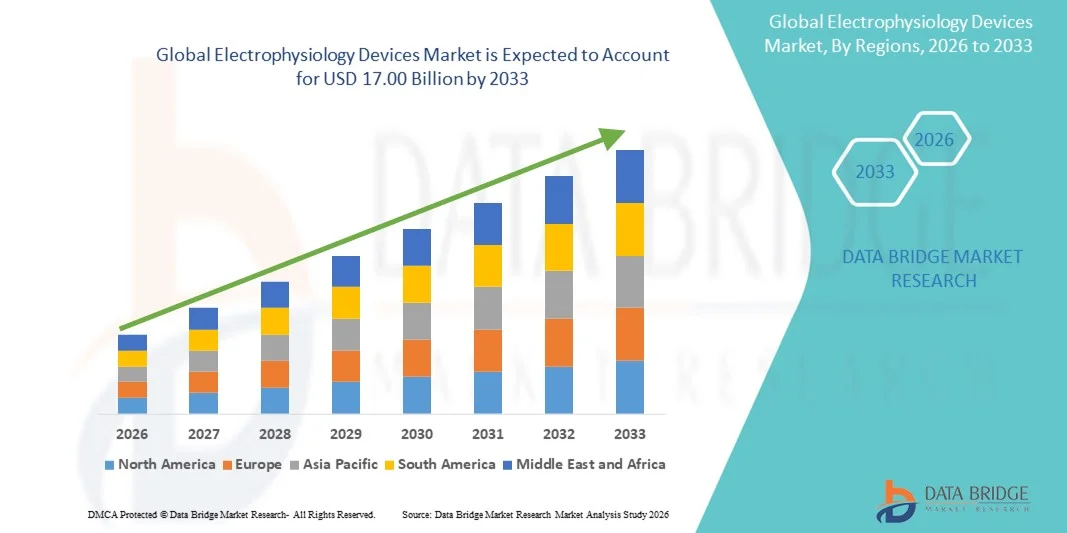

- The global electrophysiology devices market size was valued at USD 7.84 billion in 2025 and is expected to reach USD 17.00 billion by 2033, at a CAGR of 10.16% during the forecast period

- The market growth is largely driven by the rising prevalence of cardiac arrhythmias, technological advancements in mapping and ablation systems, and increasing adoption of minimally invasive cardiac procedures

- Furthermore, growing awareness among healthcare providers and patients regarding early diagnosis and effective treatment of heart rhythm disorders is propelling the demand for advanced electrophysiology devices. These factors collectively are fueling the expansion of the market and establishing electrophysiology devices as critical tools in modern cardiac care

Electrophysiology Devices Market Analysis

- Electrophysiology devices, encompassing diagnostic and therapeutic tools such as cardiac mapping systems, ablation catheters, and monitoring equipment, are increasingly critical in the management of heart rhythm disorders in both hospitals and specialized cardiac centers due to their precision, minimally invasive nature, and integration with advanced imaging and navigation technologies

- The rising demand for electrophysiology devices is primarily driven by the growing prevalence of cardiac arrhythmias, technological advancements in mapping and ablation systems, and increasing awareness among healthcare providers and patients regarding early diagnosis and effective treatment of heart rhythm disorders

- North America dominated the electrophysiology devices market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high adoption of innovative cardiac technologies, and a strong presence of leading medical device manufacturers, with the U.S. witnessing substantial growth in electrophysiology procedures, particularly in hospitals and specialized cardiac centers, supported by technological innovations in AI-assisted mapping and remote monitoring solutions

- Asia-Pacific is expected to be the fastest growing region in the electrophysiology devices market during the forecast period due to rising cardiovascular disease prevalence, expanding healthcare infrastructure, and increasing investments in advanced cardiac care facilities

- Treatment devices segment dominated the electrophysiology devices market with a market share of 45.3% in 2025, driven by their effectiveness in managing arrhythmias, integration with minimally invasive procedures, and continuous innovations improving procedural success and patient outcomes

Report Scope and Electrophysiology Devices Market Segmentation

|

Attributes |

Electrophysiology Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Electrophysiology Devices Market Trends

Advancements in AI-Assisted Mapping and Ablation Systems

- A significant and accelerating trend in the global electrophysiology devices market is the integration of artificial intelligence (AI) and advanced imaging technologies into mapping and ablation systems, improving procedural precision and efficiency

- For instance, the EnSite X EP System leverages AI algorithms to create real-time 3D maps of the heart, enhancing accuracy in complex arrhythmia ablations. Similarly, CARTO 3 System integrates AI-driven navigation to streamline ablation workflows and reduce procedural time

- AI integration enables features such as predictive analysis of arrhythmia patterns, automated lesion assessment, and personalized therapy recommendations, enhancing treatment outcomes. For instance, some Biosense Webster models utilize AI to optimize ablation strategies and provide alerts for abnormal cardiac activity

- The seamless integration of electrophysiology devices with hospital information systems and remote monitoring platforms facilitates centralized patient data management and real-time procedural feedback. Through a single interface, physicians can monitor multiple patients, track device performance, and analyze outcomes, improving workflow efficiency

- This trend towards more intelligent, data-driven, and interconnected electrophysiology solutions is fundamentally transforming cardiac care. Consequently, companies such as Abbott and Medtronic are developing AI-enabled systems with features such as automated mapping, predictive arrhythmia alerts, and real-time procedural guidance

- The demand for electrophysiology devices with integrated AI and advanced imaging capabilities is growing rapidly across hospitals and specialized cardiac centers, as healthcare providers increasingly prioritize precision, safety, and improved patient outcomes

- Increasing integration of wearable cardiac monitoring devices with electrophysiology systems is enhancing continuous patient tracking, early detection of arrhythmias, and remote procedure planning

Electrophysiology Devices Market Dynamics

Driver

Increasing Prevalence of Cardiac Arrhythmias and Awareness of Early Diagnosis

- The rising incidence of cardiac arrhythmias, coupled with growing awareness among healthcare providers and patients about early diagnosis and effective treatment, is a major driver for electrophysiology device adoption

- For instance, in March 2025, Boston Scientific announced an expansion of its cardiac ablation portfolio to improve treatment accessibility for atrial fibrillation patients, which is expected to drive market growth

- As the prevalence of atrial fibrillation and other heart rhythm disorders continues to rise, electrophysiology devices offer advanced treatment options such as minimally invasive ablation, precise mapping, and remote monitoring

- Furthermore, increasing focus on preventive cardiac care and the integration of electrophysiology procedures in hospitals and specialized cardiac centers are making these devices essential for modern cardiac management

- The effectiveness of electrophysiology devices in reducing procedure times, improving success rates, and enabling personalized therapy contributes to their growing adoption in both developed and emerging markets

- Expansion of insurance coverage and reimbursement policies for electrophysiology procedures is further encouraging hospitals and clinics to adopt these devices

- Rising collaborations between device manufacturers and hospitals for clinical trials and technology development are driving innovation and broader adoption of electrophysiology solutions

Restraint/Challenge

High Device Costs and Regulatory Compliance Hurdles

- The high cost of advanced electrophysiology devices and stringent regulatory requirements pose significant challenges to broader market adoption. As these devices require complex technologies and rigorous clinical validation, prices can be prohibitive for smaller hospitals or clinics

- For instance, high-profile reports on procedural complications and device recalls have made some healthcare providers cautious in adopting newer electrophysiology systems

- Addressing these cost and regulatory challenges through device standardization, reimbursement support, and streamlined approval processes is crucial for wider adoption. Companies such as Abbott and Biosense Webster emphasize compliance with FDA and CE regulations to assure safety and efficacy

- In addition, limited availability of trained electrophysiologists and the need for specialized infrastructure can restrict device utilization, particularly in emerging regions

- While technological advancements improve outcomes, the perceived premium for AI-enabled and integrated systems can still hinder adoption in budget-constrained healthcare settings

- Overcoming these challenges through cost optimization, training programs, and regulatory support will be vital for sustained growth in the global electrophysiology devices market

- Rapid technological obsolescence and frequent software updates may increase maintenance costs, posing adoption challenges for smaller healthcare facilities

- Data privacy and cybersecurity concerns related to connected electrophysiology devices can create hesitancy among healthcare providers, necessitating robust security measures and compliance with patient data regulations

Electrophysiology Devices Market Scope

The market is segmented on the basis of application, indication, and end use.

- By Application

On the basis of application, the electrophysiology devices market is segmented into treatment devices and diagnostic devices. The treatment devices segment dominated the market with the largest revenue share of 45.3% in 2025, driven by their crucial role in managing cardiac arrhythmias through procedures such as catheter ablation. Hospitals and specialized cardiac centers prefer treatment devices due to their ability to provide minimally invasive, precise therapy, improving patient outcomes and reducing procedural complications. Continuous technological advancements, such as AI-assisted mapping and real-time ablation guidance, further strengthen the adoption of treatment devices. The integration of treatment devices with hospital information systems and remote monitoring platforms also supports workflow efficiency and patient safety. Physicians increasingly rely on these devices for complex arrhythmia cases, contributing to steady demand. Treatment devices’ compatibility with evolving healthcare infrastructure and their critical role in addressing rising cardiac disease prevalence sustain their market dominance.

The diagnostic devices segment is anticipated to witness the fastest growth rate of 22.1% from 2026 to 2033, fueled by the increasing emphasis on early detection and continuous monitoring of heart rhythm disorders. Diagnostic devices, including electrocardiography (ECG) systems, event monitors, and wearable cardiac monitors, allow physicians to detect arrhythmias promptly, enabling timely intervention. Their non-invasive nature and ease of integration with hospital systems make them attractive for both inpatient and outpatient care. Technological innovations, such as wireless monitoring and AI-based predictive algorithms, enhance diagnostic accuracy and patient convenience. Growing awareness among patients and healthcare providers regarding preventive cardiac care is driving adoption in both developed and emerging regions. The rise of home-based monitoring solutions and telehealth integration further accelerates the demand for diagnostic devices, making them a rapidly expanding segment in the market.

- By Indication

On the basis of indication, the market is segmented into atrial fibrillation (AF), supraventricular tachycardia, atrioventricular nodal re-entry tachycardia (AVNRT), Wolff-Parkinson-White syndrome (WPW), bradycardia, and others. The atrial fibrillation segment dominated the market with the largest revenue share of 39.8% in 2025, due to the high prevalence of AF worldwide and the growing need for effective therapeutic interventions. AF patients frequently require ablation therapy or advanced monitoring, making electrophysiology devices indispensable. Hospitals and cardiac centers prioritize devices specifically designed for AF treatment because of their proven efficacy and compatibility with minimally invasive procedures. Continuous innovations in mapping, ablation catheters, and AI-guided systems specifically for AF management further support the segment’s market leadership. Increased awareness campaigns and the rising burden of AF-related complications, such as stroke and heart failure, also drive demand. The segment benefits from the convergence of treatment and diagnostic solutions, enabling comprehensive management of AF cases.

The supraventricular tachycardia (SVT) segment is expected to witness the fastest growth rate of 21.5% from 2026 to 2033, driven by increasing diagnosis rates and the rising adoption of minimally invasive ablation procedures. SVT often affects younger patients, prompting the use of advanced electrophysiology devices for precise treatment. Growing awareness among healthcare providers and patients regarding symptom recognition and early intervention is fueling demand. Technological advancements, such as high-resolution mapping and AI-based procedural guidance, improve ablation success rates and reduce recurrence. Integration of SVT-specific treatment workflows in hospitals and ambulatory surgical centers further enhances adoption. Expanding healthcare infrastructure in emerging regions also supports the rapid growth of this segment.

- By End Use

On the basis of end use, the market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment dominated the market with the largest revenue share of 52.4% in 2025, due to the availability of specialized cardiac care units, experienced electrophysiologists, and advanced procedural infrastructure. Hospitals provide comprehensive facilities for complex arrhythmia management, including both diagnostic and therapeutic electrophysiology procedures. The adoption of treatment and diagnostic devices in hospital settings is supported by reimbursement policies and established clinical protocols. Hospitals also benefit from centralized patient monitoring systems, integration with electronic medical records, and skilled staff capable of performing sophisticated procedures. Rising cardiovascular disease prevalence and increasing procedural volumes contribute to the segment’s dominance. Continuous investments in hospital infrastructure and technological upgrades sustain the adoption of electrophysiology devices in this end-use segment.

The ambulatory surgical centers (ASCs) segment is expected to witness the fastest growth rate of 23.2% from 2026 to 2033, driven by the shift toward outpatient care, cost-effective procedural delivery, and patient convenience. ASCs offer a streamlined setting for less complex ablations and diagnostic procedures, reducing hospital dependency. Integration of portable and AI-assisted electrophysiology devices allows ASCs to perform procedures efficiently while maintaining high procedural accuracy. Rising awareness of outpatient cardiac care and preference for shorter recovery periods fuel adoption. Collaborations between device manufacturers and ASCs to provide training and support further enhance market growth. The growing number of ASCs in emerging markets also contributes to the rapid expansion of this segment.

Electrophysiology Devices Market Regional Analysis

- North America dominated the electrophysiology devices market with the largest revenue share of 38.7% in 2025, characterized by advanced healthcare infrastructure, high adoption of innovative cardiac technologies, and a strong presence of leading medical device manufacturers

- Healthcare providers and patients in the region prioritize precision, minimally invasive procedures, and integration of AI-assisted mapping and ablation systems, which significantly enhance procedural outcomes and patient safety

- This strong adoption is further supported by well-established hospitals and specialized cardiac centers, high healthcare expenditure, skilled electrophysiologists, and favorable reimbursement policies, establishing electrophysiology devices as critical tools for cardiac care in both hospital and outpatient settings

U.S. Electrophysiology Devices Market Insight

The U.S. electrophysiology devices market captured the largest revenue share of 82% in 2025 within North America, driven by the high prevalence of cardiac arrhythmias and the widespread adoption of advanced cardiac care technologies. Healthcare providers are increasingly prioritizing minimally invasive ablation procedures, AI-assisted mapping systems, and remote monitoring solutions for enhanced procedural precision and patient outcomes. The strong presence of leading device manufacturers, robust reimbursement frameworks, and well-established hospitals and cardiac centers further support market growth. In addition, rising awareness among patients regarding early detection and treatment of heart rhythm disorders is propelling demand. The U.S. continues to lead in technological innovation, procedural volume, and adoption of integrated electrophysiology solutions.

Europe Electrophysiology Devices Market Insight

The Europe electrophysiology devices market is projected to expand at a substantial CAGR throughout the forecast period, driven by the rising incidence of cardiovascular diseases and growing awareness about early arrhythmia diagnosis. Healthcare systems across countries such as Germany, France, and Italy are increasingly integrating advanced diagnostic and treatment devices in hospitals and specialized cardiac centers. The emphasis on patient safety, clinical efficacy, and minimally invasive procedures is fostering adoption. The market also benefits from favorable reimbursement policies and increasing investments in state-of-the-art cardiac care infrastructure. In addition, regulatory initiatives and standardization in medical device approvals are supporting consistent market growth across the region.

U.K. Electrophysiology Devices Market Insight

The U.K. electrophysiology devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing prevalence of atrial fibrillation and other arrhythmias. Hospitals and specialized cardiac centers are adopting advanced mapping and ablation technologies for improved treatment precision and patient safety. The growing focus on outpatient care and minimally invasive procedures is further stimulating adoption. In addition, government initiatives and favorable reimbursement policies encourage the use of advanced electrophysiology devices. The U.K.’s strong healthcare infrastructure, coupled with rising patient awareness about early detection, supports sustained market growth.

Germany Electrophysiology Devices Market Insight

The Germany electrophysiology devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing cardiovascular disease prevalence and investments in advanced cardiac care facilities. Hospitals and specialized clinics prioritize precision-driven diagnostic and treatment devices for effective arrhythmia management. Germany’s emphasis on innovation, technological advancement, and high-quality healthcare standards promotes adoption. In addition, the integration of devices with hospital information systems and remote monitoring platforms enhances procedural efficiency. Government support and reimbursement policies further facilitate widespread utilization of electrophysiology devices in both inpatient and outpatient settings.

Asia-Pacific Electrophysiology Devices Market Insight

The Asia-Pacific electrophysiology devices market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising cardiovascular disease incidence, expanding healthcare infrastructure, and increasing adoption of advanced cardiac care technologies in countries such as China, Japan, and India. The growing focus on minimally invasive procedures, early arrhythmia diagnosis, and preventive cardiac care is accelerating demand. In addition, government initiatives promoting digital healthcare solutions, telemedicine, and hospital modernization support the adoption of electrophysiology devices. Increasing awareness among patients and healthcare providers further propels the market in both urban and semi-urban regions.

Japan Electrophysiology Devices Market Insight

The Japan electrophysiology devices market is gaining momentum due to the country’s high healthcare standards, technological advancement, and focus on precision cardiac care. The market growth is driven by increasing incidence of atrial fibrillation, adoption of AI-assisted mapping and ablation systems, and a rising number of specialized cardiac centers. Hospitals are integrating electrophysiology devices with remote monitoring and diagnostic platforms for enhanced procedural efficiency. Moreover, government initiatives supporting cardiac care and reimbursement coverage contribute to market expansion. Japan’s aging population also fuels demand for minimally invasive, safe, and patient-friendly electrophysiology solutions across hospitals and outpatient settings.

India Electrophysiology Devices Market Insight

The India electrophysiology devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising cardiovascular disease prevalence, expanding healthcare infrastructure, and increasing adoption of advanced cardiac care technologies. Hospitals and specialized cardiac centers are increasingly investing in diagnostic and treatment devices for arrhythmia management. Government programs promoting digital healthcare, telemedicine, and cardiac care facilities are further supporting market growth. In addition, the availability of cost-effective devices, partnerships with international manufacturers, and rising patient awareness regarding early detection and minimally invasive procedures are key factors driving the adoption of electrophysiology devices in India.

Electrophysiology Devices Market Share

The Electrophysiology Devices industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- BIOTRONIK SE & Co. KG (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- MicroPort Scientific Corporation (China)

- AtriCure, Inc. (U.S.)

- Stereotaxis Inc. (U.S.)

- CardioFocus, Inc. (U.S.)

- CathRx Ltd. (Australia)

- Osypka AG (Germany)

- Japan Lifeline Co., Ltd. (Japan)

- EP Solutions SA (Switzerland)

- Imricor Medical Systems, Inc. (U.S.)

- Baylis Medical Company, Inc. (Canada)

- LivaNova PLC (U.K.)

- GE Healthcare (U.K.)

- C.R. Bard, Inc. (U.S.)

What are the Recent Developments in Global Electrophysiology Devices Market?

- In July 2025, Boston Scientific secured expanded FDA labeling for FARAPULSE — extending its approved use to persistent AF, including pulmonary vein and posterior‑wall ablation. This expansion broadens the eligible patient base and reflects confidence in the safety/efficacy of PFA technology. It positions FARAPULSE as a major competitor to thermal ablation for a larger segment of AF patients, possibly accelerating shift from traditional ablation in favor of PFA

- In May 2025, Medtronic published promising evidence reinforcing the performance of its Affera + Sphere‑9 PFA technology in persistent AF patients, further supporting its use alongside its PulseSelect system. Having two different PFA offerings a single‑shot system (PulseSelect) and a flexible focal/dual‑energy system gives clinicians choice depending on patient anatomy and disease complexity, strengthening PFA adoption and broadening the therapeutic toolkit in electrophysiology

- In October 2024, Medtronic received FDA approval for its Affera™ Mapping and Ablation System together with the Sphere‑9™ Catheter a high‑density (HD) cardiac mapping plus dual‑energy ablation catheter. This “all-in-one” system enables physicians to perform both detailed mapping and flexible ablation in a single procedure, offering workflow efficiency, procedural flexibility (PF or RF energy), and potentially safer, more precise treatment of complex arrhythmias such as persistent AF or atrial flutter

- In January 2024, Boston Scientific gained FDA approval for its FARAPULSE™ Pulsed Field Ablation System, indicated for pulmonary‑vein isolation in patients with recurrent, symptomatic paroxysmal AF offering a non‑thermal, tissue‑selective alternative to conventional thermal ablation. The FARAPULSE system reportedly treated over 40,000 patients globally by that time, with clinical data from the pivotal study and large registries showing comparable efficacy to thermal ablation and lower risk of collateral injury

- In December 2023, Medtronic secured FDA approval for its PulseSelect™ Pulsed Field Ablation System the first pulsed‑field ablation (PFA) system cleared by FDA for both paroxysmal and persistent Atrial Fibrillation (AF). This approval marked a paradigm shift in AF care because PulseSelect uses non‑thermal electroporation rather than heat or cold to isolate pulmonary veins offering a faster procedure, reduced risk of collateral tissue damage and a simpler workflow for clinicians

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.