Global Electroplating Services Market For Oil And Gas

Market Size in USD Billion

CAGR :

%

USD

3.75 Billion

USD

5.21 Billion

2024

2032

USD

3.75 Billion

USD

5.21 Billion

2024

2032

| 2025 –2032 | |

| USD 3.75 Billion | |

| USD 5.21 Billion | |

|

|

|

|

Electroplating Services Market Size

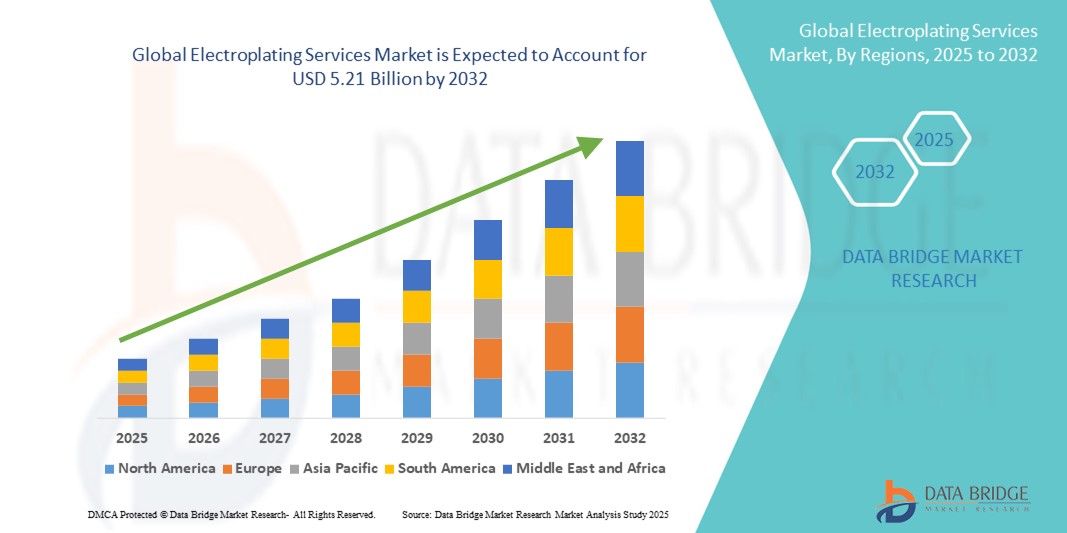

- The global electroplating services market size was valued at USD 3.75 billion in 2024 and is expected to reach USD 5.21 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is largely fueled by the increasing demand for corrosion-resistant and aesthetically appealing metal coatings across industries such as automotive, electronics, aerospace, and jewelry

- Rising adoption of advanced surface finishing techniques and growing industrialization in emerging economies are further driving the market

Electroplating Services Market Analysis

- The market is experiencing steady growth due to increasing demand for corrosion-resistant, durable, and visually enhanced metal surfaces

- Rising industrialization and manufacturing activities are driving the adoption of electroplating services to improve product longevity and performance

- North America dominated the electroplating services market with the largest revenue share of 39.85% in 2024, driven by high demand from automotive, aerospace, and electronics sectors, alongside strong regulatory frameworks emphasizing quality and environmental compliance

- Europe region is expected to witness the highest growth rate in the global electroplating services market, driven by stringent environmental regulations, advancements in eco-friendly plating processes, and rising demand from aerospace, medical devices, and electronics industries

- The Nickel segment held the largest market revenue share in 2024 due to its excellent corrosion resistance, durability, and widespread use across automotive, electronics, and machinery components. Nickel plating is particularly valued for enhancing product lifespan and providing a smooth, uniform finish

Report Scope and Electroplating Services Market Segmentation

|

Attributes |

Electroplating Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electroplating Services Market Trends

Adoption Of Eco-Friendly And Sustainable Electroplating Solutions

- The industry is undergoing a major transition as regulations on hazardous plating chemicals, including hexavalent chromium, drive adoption of eco-friendly alternatives. Companies are investing in processes that reduce emissions, minimize chemical waste, and align with global sustainability goals. This shift is expected to redefine competitive advantage among plating service providers

- Demand for cyanide-free and trivalent chromium plating is rising rapidly, as these methods provide safer and more environmentally responsible finishes. Industries under strict regulatory oversight, such as automotive and electronics, are leading this shift, pushing suppliers to comply with eco-focused procurement standards

- Sustainable plating practices not only reduce environmental risks but also lower long-term operational costs through efficient waste treatment and resource management. This dual benefit is prompting many manufacturers to adopt cleaner technologies to balance profitability with compliance requirements

- For instance, in 2023, several European automotive manufacturers mandated the exclusive use of trivalent chromium coatings for decorative components. This accelerated demand for green plating services across the supply chain, compelling smaller providers to invest in new technologies to remain competitive

- While sustainability presents a clear growth pathway, the market still requires continued R&D investments, lower-cost solutions, and training programs for small and mid-sized firms. Without these, widespread adoption of eco-friendly plating will remain limited to larger, well-capitalized players

Electroplating Services Market Dynamics

Driver

Rising Demand For Corrosion-Resistant And Aesthetic Metal Finishes

- Electroplating services are gaining traction as industries prioritize durability, performance, and visual appeal in finished products. Corrosion-resistant coatings are particularly valued in harsh operating environments, reducing replacement costs and extending equipment lifecycles for end-users

- In addition to protective qualities, electroplating enhances product aesthetics, making it highly desirable in consumer electronics, jewelry, and automotive trims. The dual function of decorative and functional benefits makes plating indispensable across diverse sectors

- Quality standards and customer expectations are increasing, leading manufacturers to adopt advanced plating solutions that provide uniform finishes, longer wear resistance, and reliable performance. This trend is pushing service providers to expand capabilities and upgrade equipment

- For instance, in 2022, major consumer electronics brands integrated nickel and gold-plated connectors to improve conductivity and reliability. This decision not only enhanced product performance but also set a new benchmark for quality in the sector

- While strong demand underpins market growth, companies must balance cost pressures with the need to continuously upgrade technologies. Ongoing innovation in plating methods will be essential to meeting rising industrial expectations for durability and appearance

Restraint/Challenge

High Operational Costs And Stringent Environmental Regulations

- The electroplating process is inherently resource-intensive, requiring significant expenditure on raw materials, energy, and skilled labor. Rising input costs create pressure on margins, particularly for small and medium-sized plating firms that lack economies of scale

- Compliance with stringent environmental regulations further increases financial burden. Restrictions on toxic substances such as cyanide and chromium demand costly waste treatment systems and monitoring protocols, limiting the ability of smaller firms to remain competitive

- Developing regions face additional barriers, including lack of modern infrastructure and limited access to advanced technologies. These gaps result in inconsistent quality, lower adoption rates, and in some cases, business closures due to non-compliance or high operational costs

- For instance, in 2023, multiple mid-sized plating providers in Southeast Asia shut down due to inability to meet new wastewater disposal regulations. This highlighted how compliance costs are reshaping market structures and reducing participation by smaller players

- Overcoming these challenges requires decentralized solutions, investment in affordable technologies, and government support for compliance infrastructure. Without such measures, the market may face consolidation, with only large service providers able to absorb rising costs and regulatory pressures

Electroplating Services Market Scope

The market is segmented on the basis of metal type, end-use industry, process type, and application

- By Metal Type

On the basis of metal type, the electroplating services market is segmented into Gold, Silver, Nickel, Copper, Chromium, Zinc, and Others. The Nickel segment held the largest market revenue share in 2024 due to its excellent corrosion resistance, durability, and widespread use across automotive, electronics, and machinery components. Nickel plating is particularly valued for enhancing product lifespan and providing a smooth, uniform finish.

The Gold segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in electronics and medical devices where high conductivity, biocompatibility, and resistance to tarnishing are critical. Gold electroplating is increasingly adopted for connectors, circuit boards, and implantable devices, reflecting its growing strategic importance.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into Automotive, Electronics, Aerospace and Defense, Jewelry, Medical Devices, Machinery and Equipment, and Others. The Automotive segment held the largest market revenue share in 2024, supported by the need for decorative finishes, corrosion protection, and improved durability of vehicle parts. Chrome and nickel plating remain key for both performance and visual appeal.

The Electronics segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the miniaturization of devices and growing demand for reliable connectors, semiconductors, and printed circuit boards. Precious metals such as gold and silver are increasingly used to enhance electrical conductivity and reliability in high-performance electronics.

- By Process Type

On the basis of process type, the market is segmented into Rack Plating, Barrel Plating, Continuous Plating, Electroless Plating, and Others. The Rack Plating segment held the largest share in 2024, favored for its precision and ability to handle complex or fragile components. It is widely applied in industries requiring high-quality finishes and uniform coating thickness.

The Electroless Plating segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its ability to provide uniform coatings on irregular surfaces without the need for an external power source. Its growing adoption in electronics, aerospace, and medical devices highlights its advantages in producing highly reliable and functional coatings.

- By Application

On the basis of application, the electroplating services market is segmented into Corrosion Protection, Decorative Coatings, Wear and Abrasion Resistance, Electrical Conductivity, Lubricity Enhancement, and Others. The Corrosion Protection segment accounted for the largest market revenue share in 2024, as industries increasingly rely on plating to extend the durability of components exposed to harsh environments.

The Electrical Conductivity segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the surging demand for conductive coatings in electronics, energy, and medical sectors. Gold, silver, and copper plating are extensively applied to ensure efficient current flow and performance reliability in critical applications.

Electroplating Services Market Regional Analysis

- North America dominated the electroplating services market with the largest revenue share of 39.85% in 2024, driven by high demand from automotive, aerospace, and electronics sectors, alongside strong regulatory frameworks emphasizing quality and environmental compliance.

- Consumers and industries in the region value advanced plating solutions for their durability, corrosion resistance, and decorative appeal, particularly in high-end applications such as aerospace and defense equipment.

- This dominance is further supported by significant investments in R&D, adoption of eco-friendly plating technologies, and the presence of major global service providers, establishing North America as a leader in the electroplating services market

U.S. Electroplating Services Market Insight

The U.S. electroplating services market captured the largest revenue share in 2024 within North America, fueled by strong demand from aerospace, defense, medical devices, and high-performance automotive industries. Increasing adoption of eco-conscious plating processes in line with strict EPA regulations is accelerating market evolution. Furthermore, continuous advancements in precision plating for electronics and semiconductors, coupled with the country’s robust industrial base, solidify the U.S. as the regional growth driver.

Europe Electroplating Services Market Insight

The Europe electroplating services market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict environmental standards and growing demand in automotive and machinery sectors. European industries rely on electroplating for corrosion protection, wear resistance, and high-quality decorative finishes, particularly in luxury consumer goods. The region is also witnessing rapid adoption of sustainable and REACH-compliant plating solutions, which are reshaping service provider strategies across both established and emerging markets.

Germany Electroplating Services Market Insight

The Germany electroplating services market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s strong industrial and automotive base. German manufacturers emphasize precision engineering and sustainability, creating demand for high-performance plating technologies. The integration of plating in industrial machinery, aerospace, and luxury vehicles is further boosting market penetration, with local companies increasingly focusing on eco-friendly solutions aligned with national and EU-level green policies.

U.K. Electroplating Services Market Insight

The U.K. electroplating services market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand across aerospace, automotive, and jewelry industries. The country’s focus on advanced manufacturing and precision engineering is driving the adoption of high-quality plating solutions. In addition, growing emphasis on sustainability, combined with strong demand for decorative and corrosion-resistant coatings in consumer and industrial applications, is creating new opportunities for electroplating service providers in the U.K.

Asia-Pacific Electroplating Services Market Insight

The Asia-Pacific electroplating services market i is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and expanding manufacturing bases in countries such as China, India, and Japan. The region’s large-scale production of electronics, automotive components, and consumer goods is fueling widespread adoption of plating services. In addition, government initiatives promoting industrial growth and digitalization, along with increasing investments in cost-effective plating technologies, are broadening the regional market scope.

China Electroplating Services Market Insight

The China electroplating services market accounted for the largest revenue share in Asia-Pacific in 2024, driven by its strong electronics and automotive manufacturing sectors. Electroplating is widely utilized for circuit boards, semiconductors, and decorative coatings across multiple industries. Moreover, government-led initiatives promoting greener industrial practices are accelerating the adoption of advanced, eco-friendly plating solutions, strengthening China’s role as a key regional contributor.

Japan Electroplating Services Market Insight

The Japan electroplating services market is expected to witness the fastest growth rate from 2025 to 2032 due to its advanced electronics and automotive industries, which require precision plating for miniaturized components and high-performance materials. Growing emphasis on innovation and eco-conscious practices is driving demand for advanced plating processes. The country’s strong culture of quality manufacturing and integration with cutting-edge technologies further establishes Japan as a key player in the regional electroplating services market

Electroplating Services Market Share

The Electroplating Services industry is primarily led by well-established companies, including:

- Atotech Deutschland GmbH (Germany)

- Interplex Holdings Pte. Ltd (Singapore)

- Kuntz Electroplating Inc. (Canada)

- Pioneer Metal Finishing Inc. (U.S.)

- Roy Metal Finishing Inc. (U.S.)

- Bajaj Electroplaters (India)

- J & N Metal Products LLC (U.S.)

- Peninsula Metal Finishing, Inc (U.S.)

Latest Developments in Global Electroplating Services Market

- In December 2020, Atotech introduced its innovative DynaSmart plating line as part of its product development strategy. The system is designed to deliver advanced corrosion-resistant coatings while incorporating a unique automation concept that allows multiple product carriers to move simultaneously across different plating tanks. With its compact size and modular design, DynaSmart can be seamlessly integrated into existing factory layouts, offering manufacturers greater flexibility and efficiency. This advancement is expected to enhance production capabilities, reduce operational costs, and support the growing demand for high-quality electroplating solutions, thereby positively impacting the overall electroplating services market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.