Global Electrostatic Discharge Packaging Market

Market Size in USD Billion

CAGR :

%

USD

1.03 Billion

USD

2.16 Billion

2025

2033

USD

1.03 Billion

USD

2.16 Billion

2025

2033

| 2026 –2033 | |

| USD 1.03 Billion | |

| USD 2.16 Billion | |

|

|

|

|

Global Electrostatic Discharge (ESD) Packaging Market Size

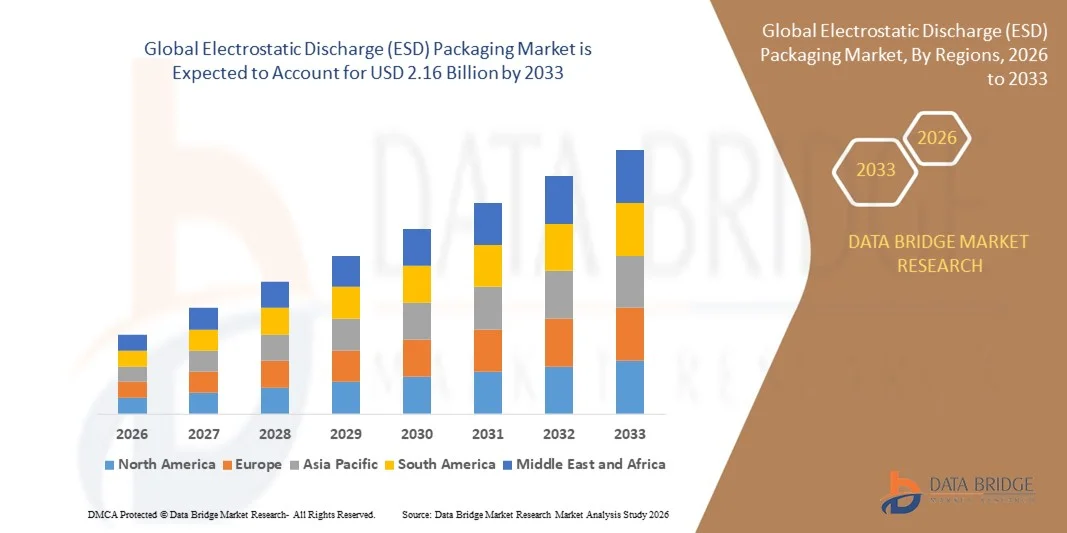

- The global Electrostatic Discharge (ESD) Packaging Market size was valued at USD 1.03 billion in 2025 and is projected to reach USD 2.16 billion by 2033, growing at a CAGR of 9.69% during the forecast period.

- Market growth is primarily driven by increasing adoption of advanced electronic devices and the need for effective protection of sensitive components from electrostatic discharge, particularly in the consumer electronics, automotive, and semiconductor sectors.

- Additionally, rising awareness among manufacturers about product reliability, regulatory compliance, and the prevention of costly equipment failures is fueling demand for innovative ESD packaging solutions, further propelling market expansion.

Global Electrostatic Discharge (ESD) Packaging Market Analysis

- Electrostatic Discharge (ESD) packaging, designed to protect sensitive electronic components from damage caused by static electricity, is increasingly critical across industries such as consumer electronics, automotive, and semiconductors, due to growing reliance on advanced electronic devices and circuits.

- The rising demand for ESD packaging is primarily driven by the need to ensure product reliability, prevent costly equipment failures, comply with industry standards, and support the increasing miniaturization of electronic components that are more susceptible to electrostatic discharge.

- Asia-Pacific dominated the Global Electrostatic Discharge (ESD) Packaging Market with the largest revenue share of 32.9% in 2025, characterized by early adoption of advanced electronics, stringent industry regulations, and the strong presence of key semiconductor and packaging players, with the U.S. witnessing substantial growth in ESD-protected packaging solutions for consumer electronics and automotive applications.

- North America is expected to be the fastest-growing region in the Global Electrostatic Discharge (ESD) Packaging Market during the forecast period due to rapid industrialization, increasing electronics manufacturing, and rising investments in semiconductor fabrication facilities.

- The consumer electronics segment dominated the market with the largest revenue share of 41.5% in 2025, driven by the widespread adoption of smartphones, laptops, tablets, and wearable devices, which require sensitive components to be protected from electrostatic discharge throughout manufacturing, storage, and transportation.

Report Scope and Global Electrostatic Discharge (ESD) Packaging Market Segmentation

|

Attributes |

Electrostatic Discharge (ESD) Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Electrostatic Discharge (ESD) Packaging Market Trends

Enhanced Protection Through Advanced ESD Solutions

- A significant and accelerating trend in the global Electrostatic Discharge (ESD) Packaging Market is the increasing adoption of advanced materials and smart packaging solutions that provide enhanced protection for sensitive electronic components throughout manufacturing, storage, and transportation. This trend is driven by the growing complexity and miniaturization of electronic devices, which makes components more susceptible to electrostatic discharge.

- For instance, multi-layered ESD bags and conductive foam are now being designed with anti-static and static-dissipative properties, ensuring superior protection against both low- and high-voltage ESD events. Similarly, ESD-safe trays and containers can be customized to accommodate various component sizes while maintaining effective charge dissipation.

- Advanced ESD packaging solutions increasingly integrate monitoring and feedback mechanisms, such as charge-detection indicators or RFID-enabled tracking, to alert manufacturers if components are exposed to potential electrostatic risks during handling or transit. These innovations allow for proactive quality control and minimize the risk of costly failures.

- The seamless integration of ESD packaging with automated manufacturing and assembly lines facilitates centralized monitoring of component safety across production processes. Through a unified approach, manufacturers can ensure consistent protection while reducing human error and downtime, optimizing both efficiency and reliability.

- This trend toward more intelligent, resilient, and integrated ESD packaging solutions is fundamentally reshaping industry standards for electronic component protection. Consequently, companies such as 3M, Desco Industries, and Simco-Ion are developing next-generation ESD packaging with enhanced charge-dissipation properties, built-in monitoring capabilities, and compatibility with automated production systems.

- The demand for advanced ESD packaging solutions that combine superior protection, monitoring, and automation compatibility is growing rapidly across both consumer electronics and industrial applications, as manufacturers increasingly prioritize product reliability, regulatory compliance, and operational efficiency.

Global Electrostatic Discharge (ESD) Packaging Market Dynamics

Driver

Growing Need Due to Rising Electronics Usage and Miniaturization

- The increasing prevalence of sensitive electronic devices across consumer, automotive, and industrial applications, coupled with the accelerating miniaturization of components, is a significant driver for the heightened demand for Electrostatic Discharge (ESD) packaging.

- For instance, in March 2025, 3M introduced advanced multilayer ESD shielding bags designed for next-generation semiconductor components, aiming to reduce the risk of static-induced failures during shipping and storage. Strategies such as these by key companies are expected to drive the ESD packaging market growth during the forecast period.

- As manufacturers face greater exposure to costly ESD-related damages and product recalls, ESD packaging provides reliable solutions such as static-dissipative materials, shielding films, and conductive foam, offering critical protection for sensitive components throughout the supply chain.

- Furthermore, the growing adoption of automated production lines and interconnected electronic systems in smart devices, electric vehicles, and industrial equipment is making ESD packaging an essential component of manufacturing and logistics processes, ensuring safe handling and storage of high-value electronics.

- The convenience of standardized packaging solutions, compatibility with automated assembly systems, and ease of transportation while maintaining component integrity are key factors propelling the adoption of ESD packaging across both developed and emerging markets. The trend toward customized ESD solutions and the increasing availability of cost-effective options further contribute to market growth.

Restraint/Challenge

Concerns Regarding Compliance and Cost of Advanced ESD Solutions

- Challenges related to meeting stringent ESD protection standards and regulations, along with the relatively high cost of advanced packaging materials, pose significant barriers to broader market adoption. As ESD packaging often requires specialized materials and handling procedures, smaller manufacturers may face difficulties in implementation.

- For instance, reports of ESD-related product failures in high-value electronics highlight the need for rigorous compliance, making some companies hesitant to invest in advanced ESD solutions due to perceived complexity and cost.

- Addressing these challenges through standardized testing, certification, and cost-effective packaging innovations is crucial for fostering adoption. Companies such as Desco Industries and Simco-Ion emphasize their compliance with industry standards and offer modular solutions to reassure manufacturers.

- Additionally, while basic ESD packaging solutions are more affordable, premium options such as multilayer shielding, conductive foams, and automated monitoring systems often carry a higher price tag, which can be a barrier for cost-sensitive manufacturers, particularly in emerging markets.

- Overcoming these challenges through the development of more economical ESD solutions, widespread education on best practices for static protection, and simplified compliance processes will be vital for sustained growth in the ESD packaging market.

Global Electrostatic Discharge (ESD) Packaging Market Scope

Electrostatic discharge (ESD) packaging market is segmented on the basis of end-users and product.

- By End-Users

On the basis of end-users, the Global Electrostatic Discharge (ESD) Packaging Market is segmented into communication network infrastructure, consumer electronics, computer peripherals, automotive industry, and others. The consumer electronics segment dominated the market with the largest revenue share of 41.5% in 2025, driven by the widespread adoption of smartphones, laptops, tablets, and wearable devices, which require sensitive components to be protected from electrostatic discharge throughout manufacturing, storage, and transportation. High-value components such as semiconductors, ICs, and PCBs are particularly vulnerable to ESD damage, further boosting the demand in this segment.

The automotive industry segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, fueled by the increasing use of electronic control units (ECUs), sensors, infotainment systems, and electric vehicle components that require ESD-safe packaging solutions. Rising automotive electronics production, coupled with regulatory compliance requirements for component safety, is driving accelerated adoption.

- By Product

On the basis of product, the Global Electrostatic Discharge (ESD) Packaging Market is segmented into bags, trays, boxes and containers, ESD foams, and others. The bags segment dominated the market with the largest revenue share of 43.2% in 2025, owing to their versatility, cost-effectiveness, and widespread use in transporting and storing sensitive electronic components across industries. ESD shielding and static-dissipative bags are widely adopted due to their proven reliability in preventing component damage and supporting automated handling in manufacturing and logistics processes.

The trays segment is expected to witness the fastest CAGR of 21.8% from 2026 to 2033, driven by the increasing need for custom-fit solutions for complex PCBs, semiconductor wafers, and high-value components that require precise positioning and protection during automated assembly. Rising adoption in electronics, automotive, and industrial sectors for safe handling and transportation of delicate parts is fueling this segment’s rapid growth.

Global Electrostatic Discharge (ESD) Packaging Market Regional Analysis

- Asia-Pacific dominated the Global Electrostatic Discharge (ESD) Packaging Market with the largest revenue share of 32.9% in 2025, driven by the strong presence of electronics manufacturing, semiconductor production, and high-value consumer electronics industries.

- Manufacturers in the region prioritize protecting sensitive components such as ICs, PCBs, and semiconductors from electrostatic discharge, which is critical for maintaining product reliability, preventing costly failures, and complying with industry standards.

- This widespread adoption is further supported by advanced manufacturing infrastructure, high technological expertise, and stringent regulatory frameworks for ESD safety, establishing North America as a key hub for both ESD packaging production and consumption across commercial, industrial, and consumer electronics sectors.

U.S. ESD Packaging Market Insight

The U.S. ESD packaging market captured the largest revenue share of 38% in North America in 2025, driven by the country’s strong electronics manufacturing, semiconductor production, and high-value consumer electronics industries. The demand for reliable ESD protection solutions is fueled by the need to safeguard sensitive components such as ICs, PCBs, and semiconductors throughout manufacturing, transportation, and storage. The increasing adoption of automated assembly lines and IoT-enabled devices further propels the market. Additionally, the focus on quality assurance, stringent regulatory compliance, and advanced research and development in ESD-safe materials contributes to steady market growth.

Europe ESD Packaging Market Insight

The Europe ESD packaging market is projected to expand at a significant CAGR during the forecast period, driven by strict regulatory standards for electronics safety and growing industrial automation across countries like Germany, France, and Italy. The rising production of consumer electronics, automotive electronics, and industrial equipment has increased the demand for ESD packaging solutions. Manufacturers are adopting advanced materials such as conductive foams, ESD shielding bags, and trays to ensure component integrity, making Europe a key market for high-quality and certified ESD packaging.

U.K. ESD Packaging Market Insight

The U.K. ESD packaging market is expected to witness notable growth during the forecast period, propelled by the increasing electronics manufacturing activities and rising demand for robust protection of semiconductors and computer peripherals. The country’s emphasis on technological innovation, quality standards, and adoption of automated production lines encourages investment in ESD-safe packaging. Additionally, growing awareness among manufacturers regarding potential losses due to ESD-related damage is driving adoption in both industrial and consumer electronics sectors.

Germany ESD Packaging Market Insight

The Germany ESD packaging market is anticipated to grow at a considerable CAGR, fueled by the country’s position as a leader in industrial automation, electronics manufacturing, and automotive electronics. The demand for environmentally friendly and sustainable ESD packaging solutions is rising, as manufacturers adopt recyclable and reusable materials. Integration of ESD-safe packaging with automated handling and smart manufacturing systems is becoming increasingly prevalent, supporting Germany’s focus on precision, reliability, and compliance with international standards.

Asia-Pacific ESD Packaging Market Insight

The Asia-Pacific ESD packaging market is poised to grow at the fastest CAGR of 23% from 2026 to 2033, driven by rapid industrialization, urbanization, and the expanding electronics and semiconductor manufacturing sectors in China, Japan, India, and South Korea. The region’s rise as a global electronics manufacturing hub is fueling the adoption of ESD packaging to prevent component damage during assembly, shipping, and storage. Government initiatives promoting smart manufacturing, combined with rising disposable incomes and technological advancement, are further supporting market growth.

Japan ESD Packaging Market Insight

The Japan ESD packaging market is experiencing steady growth due to the country’s advanced electronics industry, emphasis on precision manufacturing, and high demand for reliable protection of semiconductors, PCBs, and other sensitive components. The integration of automated production systems, smart factories, and IoT-enabled devices is increasing the need for advanced ESD-safe packaging solutions. Additionally, Japan’s focus on sustainability and adoption of eco-friendly materials supports the market’s expansion across industrial and consumer electronics sectors.

China ESD Packaging Market Insight

The China ESD packaging market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid electronics manufacturing, semiconductor production, and the rise of smart consumer electronics. The country’s expanding middle-class workforce, large-scale industrialization, and government-backed initiatives for smart manufacturing and electronics safety are key factors propelling the market. Increasing demand for cost-effective, reusable, and high-performance ESD packaging solutions, along with strong domestic manufacturers, is further accelerating market adoption across residential, commercial, and industrial applications.

Global Electrostatic Discharge (ESD) Packaging Market Share

The Electrostatic Discharge (ESD) Packaging industry is primarily led by well-established companies, including:

• 3M Company (U.S.)

• Desco Industries, Inc. (U.S.)

• Henkel AG & Co. KGaA (Germany)

• Mentor Graphics / Siemens (U.S.)

• Brady Corporation (U.S.)

• Panax EDS (South Korea)

• TestEquity (U.S.)

• Vanguard Products Group (U.S.)

• Nicomatic (France)

• Astatic Corporation (U.S.)

• Avid Technology (U.S.)

• Techni-Tool, Inc. (U.S.)

• Simco-Ion (U.S.)

• IKA Works, Inc. (Germany)

• Showa Denko (Japan)

• Fujipoly (Japan)

• Molex, LLC (U.S.)

• Antistat Inc. (U.S.)

• Intercept Packaging (U.S.)

• Electrotech Systems Pvt. Ltd. (India)

What are the Recent Developments in Global Electrostatic Discharge (ESD) Packaging Market?

- In April 2024, 3M Company, a global leader in electronics and industrial solutions, launched a new line of advanced ESD-safe packaging materials in Southeast Asia, aimed at protecting sensitive electronic components in semiconductor manufacturing. This initiative underscores 3M’s commitment to delivering innovative, high-performance ESD packaging solutions tailored to regional industrial requirements, strengthening its position in the rapidly growing global ESD packaging market.

- In March 2024, Desco Industries, Inc., a U.S.-based leader in ESD control products, introduced its latest conductive foam and shielding bags designed specifically for high-density PCB transport. The new product line enhances protection against electrostatic discharge during shipping and storage, reflecting Desco’s dedication to ensuring reliability and compliance with industry ESD standards in commercial and industrial applications.

- In March 2024, Henkel AG & Co. KGaA successfully deployed advanced ESD packaging solutions for a major electronics manufacturing hub in Bengaluru, India. The initiative aimed to minimize ESD-related failures in semiconductor assembly, highlighting Henkel’s expertise in integrating protective packaging with industrial production processes and contributing to the development of safer, more efficient manufacturing ecosystems.

- In February 2024, Mentor Graphics (Siemens) announced a strategic collaboration with leading consumer electronics manufacturers in North America to provide high-performance ESD-safe trays and containers for delicate ICs and microprocessors. The partnership is designed to enhance product reliability, streamline logistics, and ensure compliance with strict ESD standards, reinforcing Mentor Graphics’ commitment to innovation and operational efficiency in electronics supply chains.

- In January 2024, Brady Corporation unveiled its new line of ESD foam and shielding boxes at the CES 2024 trade show. Equipped with advanced anti-static properties, these solutions allow manufacturers to safely transport and store sensitive electronics while maintaining performance and compliance with global ESD regulations. This launch highlights Brady’s focus on integrating advanced technology into ESD packaging, offering manufacturers enhanced protection and operational convenience.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Electrostatic Discharge Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Electrostatic Discharge Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Electrostatic Discharge Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.