Global Electrosurgical Generator Systems Market

Market Size in USD Billion

CAGR :

%

USD

2.29 Billion

USD

4.12 Billion

2024

2032

USD

2.29 Billion

USD

4.12 Billion

2024

2032

| 2025 –2032 | |

| USD 2.29 Billion | |

| USD 4.12 Billion | |

|

|

|

|

Electrosurgical Generator Systems Market Size

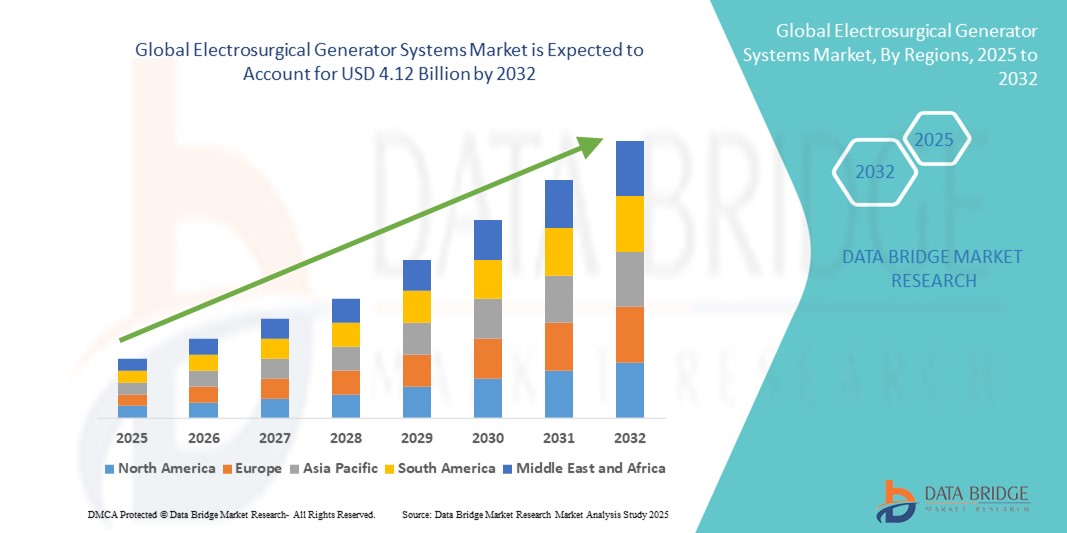

- The global electrosurgical generator systems market size was valued at USD 2.29 billion in 2024 and is expected to reach USD 4.12 billion by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely driven by the increasing adoption of minimally invasive surgical procedures, technological advancements in electrosurgical devices, and rising demand for efficient, precise, and safe surgical solutions across hospitals and surgical centers

- Furthermore, growing prevalence of chronic diseases, rising surgical volumes, and the need for advanced energy-based surgical equipment are positioning electrosurgical generator systems as a critical component in modern operating rooms. These combined factors are accelerating the demand for electrosurgical solutions, thereby substantially boosting the industry's growth

Electrosurgical Generator Systems Market Analysis

- Electrosurgical generator systems, providing controlled electrical energy for cutting, coagulation, and tissue ablation during surgical procedures, are becoming essential components in modern operating rooms across hospitals and surgical centers due to their precision, safety, and compatibility with minimally invasive techniques

- The rising demand for electrosurgical generator systems is primarily driven by the increasing adoption of minimally invasive surgeries, growing prevalence of chronic diseases requiring surgical intervention, and technological advancements enabling multifunctional, energy-efficient, and safer devices

- North America dominated the electrosurgical generator systems market with the largest revenue share of 39% in 2024, characterized by advanced healthcare infrastructure, early adoption of innovative surgical technologies, and a strong presence of leading device manufacturers. The U.S. recorded substantial growth in system installations, particularly in specialized surgical centers and high-volume hospitals, fueled by innovations in energy-based devices and integration with robotic and imaging systems

- Asia-Pacific is expected to be the fastest-growing region in the electrosurgical generator systems market during the forecast period due to rising healthcare expenditures, increasing surgical volumes, and expanding hospital infrastructure in urban and semi-urban areas

- Monopole electrosurgical generators dominated the electrosurgical generator systems market with a share of 45.9% in 2024, driven by their versatility, ease of use across multiple surgical procedures, and widespread adoption in both traditional and minimally invasive surgeries

Report Scope and Electrosurgical Generator Systems Market Segmentation

|

Attributes |

Electrosurgical Generator Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Electrosurgical Generator Systems Market Trends

Advancements in Energy-Based and Multi-Mode Technologies

- A significant trend in the global electrosurgical generator systems market is the development of advanced energy-based devices that offer multiple modes such as cutting, coagulation, and vessel sealing within a single generator. This versatility enhances surgical precision and efficiency across a wide range of procedures

- For instance, the Valleylab FT10 generator from Medtronic integrates both monopolar and bipolar capabilities with intelligent tissue sensing, allowing surgeons to optimize energy delivery based on tissue type. Similarly, Olympus ESG-400 combines high-frequency cutting and coagulation in a compact platform suitable for minimally invasive surgeries

- Technological innovations also include adaptive energy modulation, automated safety features, and integration with surgical visualization systems, improving intraoperative safety and reducing collateral tissue damage. These features provide surgeons with enhanced control and reduce procedural complications

- Integration with robotic and laparoscopic systems facilitates seamless operation in minimally invasive surgeries, allowing energy delivery to be precisely controlled via console interfaces. This enables more consistent outcomes and shorter recovery times for patients

- The trend toward multi-mode, energy-efficient, and intelligent generators is reshaping expectations for surgical performance and safety. Companies such as Stryker and Johnson & Johnson are actively developing next-generation generators with AI-assisted energy modulation and smart feedback systems to enhance surgical precision

- Adoption of these advanced electrosurgical generators is increasing across hospitals and surgical centers, driven by the demand for safer, faster, and more effective procedures, particularly in high-volume surgical specialties such as general, gynecologic, and orthopedic surgery

Electrosurgical Generator Systems Market Dynamics

Driver

Rising Adoption of Minimally Invasive Surgeries and Advanced Surgical Techniques

- The growing preference for minimally invasive surgeries, which reduce patient recovery time and improve clinical outcomes, is a key driver for the adoption of electrosurgical generator systems

- For instance, in March 2024, Medtronic announced the expansion of its Valleylab FT10 generator in multiple surgical centers in the U.S., emphasizing its compatibility with laparoscopic and robotic-assisted procedures. Such initiatives by key players are expected to further accelerate market growth

- Increasing surgical volumes, coupled with the need for precise tissue control and reduced intraoperative blood loss, make electrosurgical generators a critical component of modern operating rooms

- The integration of advanced features such as automated tissue recognition, multifunctional energy modes, and real-time feedback enhances surgical efficiency and safety, supporting greater adoption across hospitals and specialty centers

- The global trend toward digital operating rooms and connected surgical platforms further reinforces the demand for intelligent, high-performance electrosurgical generators

Restraint/Challenge

Safety Concerns and Regulatory Compliance Complexity

- Concerns regarding patient safety, including inadvertent burns, tissue damage, and device malfunction, pose significant challenges to market growth. Electrosurgical generators require strict adherence to safety protocols and effective training for surgical teams

- For instance, reports of unintended tissue injury due to improper energy settings or faulty grounding pads have highlighted the need for rigorous quality control and user education

- Regulatory compliance and approvals vary across regions, requiring manufacturers to navigate complex standards set by organizations such as the FDA, CE, and ISO, which can delay product launches

- High initial acquisition and maintenance costs of advanced generators can limit adoption in budget-constrained hospitals or emerging markets. While basic generators are more affordable, advanced models with AI-assisted modes, multi-functionality, and robotic integration come at a premium

- Overcoming these challenges requires manufacturers to enhance device safety features, provide comprehensive training and support, and develop cost-effective solutions to encourage broader adoption globally

Electrosurgical Generator Systems Market Scope

The market is segmented on the basis of type, application, end user, and distribution channel.

- By Type

On the basis of type, the electrosurgical generator systems market is segmented into monopole electrosurgical generator, bipolar electrosurgical generator, and vessel sealing generator. The monopole electrosurgical generator segment dominated the market with the largest revenue share of 45.9% in 2024, driven by its versatility and extensive adoption across multiple surgical procedures. Monopolar generators are widely preferred for general surgeries due to their precise cutting and coagulation capabilities and compatibility with various surgical instruments. Hospitals and surgical centers favor them for their reliability, ease of use, and cost-effectiveness. Moreover, monopolar systems remain a standard choice in minimally invasive surgeries. Their broad applicability across high-volume operating rooms ensures continued dominance in the market.

The vessel sealing generator segment is anticipated to witness the fastest growth at a CAGR of 22.1% from 2025 to 2032, fueled by the rising demand for advanced energy-based devices in complex surgeries such as bariatric, urological, and oncological procedures. Vessel sealing generators provide superior hemostasis, reduce intraoperative blood loss, and shorten procedure times, making them increasingly preferred in specialty hospitals. Technological advancements, including intelligent feedback systems and robotic integration, further enhance their adoption. Surgeons value vessel sealing generators for safety, precision, and efficiency in high-risk procedures. The segment’s growth is also supported by increasing awareness of the benefits of energy-based surgical technologies.

- By Application

On the basis of application, the electrosurgical generator systems market is segmented into open surgery and minimally invasive surgery. The minimally invasive surgery segment dominated the market with a revenue share of 51.7% in 2024, driven by the increasing adoption of laparoscopic, endoscopic, and robotic-assisted surgeries. These procedures demand precise energy delivery, minimal thermal spread, and multifunctional generators, which electrosurgical systems effectively provide. Hospitals are investing in operating rooms equipped with generators suitable for minimally invasive techniques to meet rising patient demand. The segment benefits from the global trend toward faster recovery times and shorter hospital stays. Growing awareness among patients and physicians about the advantages of minimally invasive surgery also fuels this demand. Manufacturers are innovating generators tailored specifically for these advanced procedures, enhancing their market dominance.

The open surgery segment is expected to witness the fastest CAGR of 20.8% from 2025 to 2032 due to the continued need for traditional surgical interventions in developing regions and for complex procedures where open access is essential. Generators for open surgery offer high power output, reliable coagulation, and versatility, making them critical in trauma, emergency, and general surgeries. Surgeons rely on these systems for precise tissue management and efficient operative performance. Expanding hospital infrastructure in emerging markets is increasing demand for open surgery-compatible generators. The segment also benefits from ongoing technological upgrades that improve safety and efficiency during major surgical procedures.

- By End User

On the basis of end user, the electrosurgical generator systems market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and others. The hospitals segment dominated the market with a share of 60.2% in 2024 due to high surgical volumes and advanced infrastructure requirements. Hospitals prefer high-performance generators that support multiple surgical specialties and complex procedures. They invest in multifunctional systems to optimize operating room efficiency and ensure patient safety. Strong relationships between manufacturers and hospital procurement teams further support this dominance. The segment’s growth is bolstered by the increasing trend of digital operating rooms and energy-based surgical adoption. Hospitals also prioritize generators with advanced safety features to reduce surgical complications.

The ambulatory surgical centers segment is expected to witness the fastest growth at a CAGR of 23.5% from 2025 to 2032, driven by the rise in outpatient procedures and minimally invasive surgeries. These centers require compact, multifunctional generators that are cost-effective and easy to operate. Ambulatory centers increasingly adopt electrosurgical systems to enhance procedural efficiency and patient throughput. The growth is supported by favorable healthcare policies promoting outpatient care. Manufacturers are introducing portable, user-friendly systems tailored for these centers. Rising investments in ambulatory care infrastructure also contribute to the segment’s rapid expansion.

- By Distribution Channel

On the basis of distribution channel, the electrosurgical generator systems market is segmented into direct and retail. The direct channel segment dominated the market in 2024, as manufacturers prefer selling directly to hospitals and surgical centers to provide installation support, customization, and after-sales service. Direct sales ensure proper training for surgical teams and compliance with clinical standards. This approach also helps build strong manufacturer–hospital relationships and enables feedback-driven product improvements. Hospitals and high-volume surgical centers benefit from direct support and timely upgrades. Direct distribution remains the preferred choice for premium, multifunctional generators. The segment continues to grow with rising demand for personalized surgical solutions.

The retail segment is expected to witness the fastest growth during the forecast period due to the increasing adoption of compact and portable electrosurgical generators by specialty clinics and ambulatory surgical centers. Retail distribution offers quicker procurement, broader accessibility, and standardized solutions in regions with limited direct manufacturer presence. Specialty clinics benefit from cost-effective options available through retail channels. The segment’s growth is driven by the need for flexible, easy-to-operate devices in smaller surgical setups. Manufacturers are expanding retail networks to reach emerging markets and untapped regions. Increasing awareness of multifunctional generators also supports retail channel expansion.

Electrosurgical Generator Systems Market Regional Analysis

- North America dominated the electrosurgical generator systems market with the largest revenue share of 39% in 2024, characterized by advanced healthcare infrastructure, early adoption of innovative surgical technologies, and a strong presence of leading device manufacturers

- Hospitals and surgical centers in the region increasingly prioritize high-performance electrosurgical generators that offer multifunctional energy modes, precision, and safety, supporting a growing demand for advanced surgical procedures

- The widespread adoption is further supported by strong R&D activities, early adoption of robotic and AI-assisted surgical platforms, and favorable reimbursement policies, establishing electrosurgical generators as a critical component in modern operating rooms

U.S. Electrosurgical Generator Systems Market Insight

The U.S. electrosurgical generator systems market captured the largest revenue share of 42% in 2024 within North America, driven by the widespread adoption of minimally invasive and robotic-assisted surgical procedures. Hospitals and specialty surgical centers are increasingly investing in advanced energy-based generators that provide precise cutting, coagulation, and vessel sealing capabilities. The growing emphasis on patient safety, reduced operative time, and improved surgical outcomes is fueling market demand. Furthermore, integration with AI-assisted platforms and digital operating room systems enhances procedural efficiency, contributing to market expansion. The availability of technologically advanced generators from leading manufacturers also supports the sustained growth of the U.S. market.

Europe Electrosurgical Generator Systems Market Insight

The Europe electrosurgical generator systems market is projected to expand at a notable CAGR throughout the forecast period, primarily driven by rising healthcare expenditures, increased surgical volumes, and stringent regulatory standards for surgical safety. Hospitals and surgical centers across the region are adopting multifunctional electrosurgical generators to improve procedural precision and efficiency. In addition, the trend toward minimally invasive surgeries and outpatient surgical procedures is fostering higher demand. European healthcare providers also value energy-efficient, reliable, and advanced systems that integrate seamlessly with existing surgical infrastructure, supporting steady market growth.

U.K. Electrosurgical Generator Systems Market Insight

The U.K. electrosurgical generator systems market is anticipated to grow at a significant CAGR during the forecast period, driven by the adoption of modern surgical technologies and the increasing prevalence of minimally invasive procedures. Healthcare providers are focusing on upgrading operating rooms with advanced energy-based surgical devices to enhance procedural outcomes and patient safety. The rising number of surgical procedures and investments in hospital infrastructure further contribute to market growth. In addition, the U.K.’s strong presence of leading medical device manufacturers and distributors ensures availability and adoption of advanced generators across hospitals and specialty clinics.

Germany Electrosurgical Generator Systems Market Insight

The Germany electrosurgical generator systems market is expected to expand at a considerable CAGR during the forecast period, fueled by technological advancements, well-developed healthcare infrastructure, and high surgical procedure volumes. Hospitals in Germany are increasingly implementing multifunctional and energy-efficient generators to support both open and minimally invasive surgeries. The emphasis on patient safety, precision, and integration with robotic and laparoscopic platforms encourages adoption. Germany’s focus on innovation, research, and regulatory compliance further strengthens the market, particularly in high-end hospitals and specialty surgical centers.

Asia-Pacific Electrosurgical Generator Systems Market Insight

The Asia-Pacific electrosurgical generator systems market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rising healthcare investments, expanding hospital infrastructure, and increasing surgical volumes in countries such as China, Japan, and India. The growing adoption of minimally invasive procedures, coupled with technological advancements in energy-based surgical devices, is accelerating market growth. Moreover, the region is witnessing an increase in private hospital establishments and ambulatory surgical centers, further boosting demand. Affordable local manufacturing and government initiatives promoting advanced healthcare services are also key growth drivers in the APAC region.

Japan Electrosurgical Generator Systems Market Insight

The Japan electrosurgical generator systems market is gaining momentum due to high healthcare standards, an aging population, and increasing demand for minimally invasive and robotic-assisted surgeries. Hospitals prioritize precision, safety, and multifunctional generators that support advanced procedures. Integration with digital operating room platforms and laparoscopic systems is enhancing procedural efficiency and patient outcomes. Moreover, Japan’s strong technological ecosystem and high adoption of innovative medical devices are driving the uptake of electrosurgical generators in both hospital and specialty clinic settings.

India Electrosurgical Generator Systems Market Insight

The India electrosurgical generator systems market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid hospital infrastructure expansion, increasing surgical volumes, and rising awareness of minimally invasive surgeries. Growing investments in private hospitals, specialty clinics, and ambulatory surgical centers are driving the demand for multifunctional electrosurgical generators. In addition, the availability of cost-effective devices, local manufacturing capabilities, and government initiatives to modernize healthcare facilities are key factors propelling the market. Rising patient awareness about advanced surgical procedures also supports sustained growth in India.

Electrosurgical Generator Systems Market Share

The electrosurgical generator systems industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Johnson & Johnson and its affiliates (U.S.)

- Olympus Corporation (Japan)

- CONMED Corporation (U.S.)

- B. Braun SE (Germany)

- Erbe Elektromedizin GmbH (Germany)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

- Smith + Nephew (U.K.)

- Zimmer Biomet (U.S.)

- Applied Medical Resources Corporation (U.S.)

- Acoma Medical Industry Co., Ltd. (Japan)

- Xcellance Medical Technologies (U.S.)

- Guangdong Wego Medical Instruments Co., Ltd. (China)

- Microline Surgical (U.S.)

- Ellman International, Inc. (U.S.)

- Bovie Medical Corporation (U.S.)

- Telea Electronic Engineering S.r.l. (Italy)

- Ackermann Instrumente GmbH (Germany)

- Plasma Surgical, Inc. (U.S.)

What are the Recent Developments in Global Electrosurgical Generator Systems Market?

- In March 2025, Johnson & Johnson MedTech introduced the DUALTO Energy System, an electrosurgical generator that combines monopolar, bipolar, ultrasonic, and advanced bipolar energy modalities into a single platform. The system is compatible with the Ottava surgical robot and features the Polyphonic Fleet digital device management application

- In January 2024, Olympus Corporation announced the full market availability of its redesigned ESG-410™ Surgical Energy Platform. This updated generator provides a comprehensive energy solution for a wide range of surgical specialties. A key development is the platform's ability to power THUNDERBEAT and SONICBEAT devices from the same generator as other energy modes, allowing for greater versatility and a smaller footprint in the operating room

- In June 2023, Olympus announced the launch of its ESG-410 Electrosurgical Generator, designed for the treatment of non-muscle-invasive bladder cancer (NMIBC) and benign prostatic hyperplasia (BPH). The ESG-410 offers faster ignition and improved plasma stability, enhancing procedural efficiency

- In April 2023, Innoblative Designs, Inc. announced that its SIRA RFA Electrosurgical Device (SIRA) received Breakthrough Device Designation from the U.S. Food and Drug Administration (FDA). The SIRA device is specifically designed for use in breast cancer patients undergoing breast-conserving surgery, also known as a lumpectomy

- In October 2021, Taiwan's Industrial Technology Research Institute (ITRI) and Catcher Technology, a major electronics casing supplier, announced a collaboration to jointly develop a next-generation integrated electrosurgery system. The partnership, supported by the Department of Industrial Technology (DoIT), Ministry of Economic Affairs (MOEA), aims to combine ITRI's software-hardware integration capabilities with Catcher Technology's expertise in material manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.