Global Embedded Display Market

Market Size in USD Billion

CAGR :

%

USD

23.54 Billion

USD

42.33 Billion

2024

2032

USD

23.54 Billion

USD

42.33 Billion

2024

2032

| 2025 –2032 | |

| USD 23.54 Billion | |

| USD 42.33 Billion | |

|

|

|

|

Embedded Display Market Size

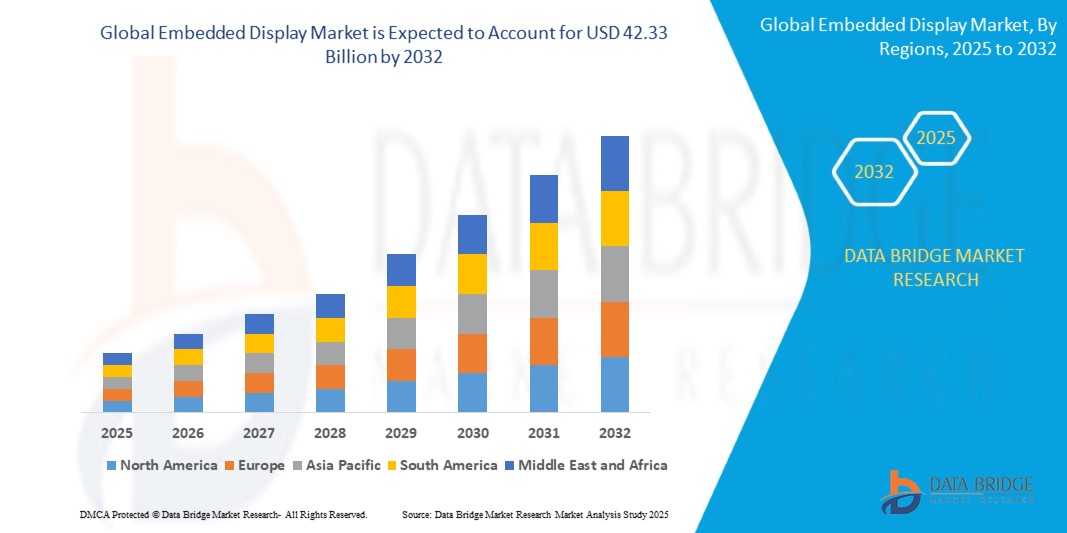

- The global embedded display market size was valued at USD 23.54 billion in 2024 and is expected to reach USD 42.33 billion by 2032, at a CAGR of 7.61% during the forecast period

- The market growth is largely fuelled by the increasing adoption of smart devices, connected technologies, and automation across automotive, industrial, and consumer electronics sectors

- Rising demand for advanced visualization, real-time data monitoring, and energy-efficient display solutions is further propelling market expansion

Embedded Display Market Analysis

- Embedded displays are witnessing increased application across automotive dashboards, fitness devices, home automation, and industrial control systems due to their versatility and reliability

- Growing focus on user interface enhancement, real-time monitoring, and energy-efficient solutions is driving adoption in both consumer and industrial electronics

- North America dominated the embedded display market with the largest revenue share of 38.5% in 2024, driven by the growing adoption of connected devices, advanced automotive dashboards, and industrial automation solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global embedded display market, driven by technological advancements, expanding electronics manufacturing hubs, urbanization, and supportive government policies promoting digitalization and smart device adoption

- The LCD segment held the largest market revenue share in 2024, driven by its widespread adoption in automotive, industrial, and consumer electronics due to cost-effectiveness, reliability, and established manufacturing infrastructure. LCD displays continue to be favored for applications requiring high visibility and energy efficiency

Report Scope and Embedded Display Market Segmentation

|

Attributes |

Embedded Display Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Adoption Of Embedded Displays In Automotive And Industrial Applications |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Embedded Display Market Trends

Rising Integration of Embedded Displays Across Industries

- The growing adoption of embedded displays is transforming industrial, automotive, and consumer electronics sectors by enabling real-time information visualization and interactive interfaces. The compact and high-performance displays allow users to access data instantly, enhancing operational efficiency and user experience. This leads to higher adoption rates across multiple applications

- The increasing demand for energy-efficient and customizable displays is accelerating the use of OLED, LCD, and LED embedded displays in smart devices, automotive dashboards, and industrial control panels. These displays are particularly effective where space-saving, durability, and low power consumption are critical, supporting broader deployment in constrained environments

- The affordability and improved performance of modern embedded displays are making them attractive for both small-scale and large-scale applications. Consumers and manufacturers benefit from enhanced visualization, reduced energy costs, and flexible integration, which ultimately boosts market growth

- For instance, in 2023, several automotive and industrial electronics manufacturers in Europe and North America reported increased adoption of high-resolution OLED and LCD embedded displays, leading to better user interfaces and optimized device performance

- While embedded displays are driving operational efficiency and enhanced visualization, their market potential depends on continuous innovation, cost reduction, and compatibility with emerging technologies. Manufacturers must focus on industry-specific solutions and regulatory compliance to fully capitalize on growing demand

Embedded Display Market Dynamics

Driver

Increasing Demand for Interactive and Energy-Efficient Display Solutions

- The rising need for real-time visualization, compact form factors, and energy-efficient displays is pushing manufacturers across automotive, industrial, and consumer electronics sectors to integrate embedded displays. These solutions enhance performance, interactivity, and energy savings, while also enabling smarter decision-making and better monitoring across applications. Growing consumer expectations for high-quality visuals are further accelerating adoption

- Industries are increasingly aware of the benefits of embedded displays, including improved user interface, operational efficiency, and seamless integration with connected devices, driving higher adoption across diverse applications. Companies are leveraging these displays to differentiate products, enhance automation, and support predictive maintenance in industrial setups. The versatility of embedded displays is also opening opportunities in medical, retail, and aviation sectors

- Government initiatives promoting smart manufacturing, connected vehicles, and energy-efficient electronics are supporting the adoption of embedded display technology. Policies encouraging digitalization and reduced power consumption are boosting market interest, while subsidies for energy-efficient solutions and smart city projects create additional growth momentum. Public-private partnerships are also contributing to rapid deployment across sectors

- For instance, in 2022, multiple European automotive OEMs and industrial equipment manufacturers integrated embedded LCD and OLED displays into dashboards and control panels, resulting in improved operational efficiency and enhanced end-user experience. The trend extended to smart factories and commercial vehicles, where high-resolution displays enabled better monitoring and process control, creating a positive market ripple effect

- While industry demand is driving growth, consistent display quality, interoperability, and cost-effective manufacturing remain essential for sustained adoption and market expansion. Continuous R&D in flexible, low-power, and high-durability displays is required to meet evolving application needs and maintain competitive advantage

Restraint/Challenge

High Development Costs and Technical Complexity of Embedded Displays

- The high cost of advanced embedded displays, especially OLED and high-resolution LCD panels, makes them less accessible for price-sensitive markets and small-scale manufacturers. Additional expenses for integration, calibration, and software compatibility further elevate total deployment costs, limiting penetration in emerging regions. High R&D investment also remains a barrier for new entrants

- In several regions, limited technical expertise and complex integration requirements restrict deployment of embedded displays, especially in industrial and automotive applications. Training personnel, ensuring compatibility with existing systems, and managing software-hardware synchronization pose ongoing challenges, slowing local market growth and delaying project timelines

- Supply chain constraints, such as shortages of display components and raw materials, affect production capacity, delaying delivery to end users and limiting adoption in high-demand sectors. Geopolitical factors, import restrictions, and fluctuations in raw material prices can exacerbate delays, impacting pricing strategies and long-term market planning

- For instance, in 2023, several electronics manufacturers in Asia and North America reported delays in embedded display rollouts due to high component costs and integration complexity, impacting overall market penetration. The delays led to temporary reliance on legacy display systems, slightly affecting product innovation and market competitiveness in some segments

- While technology continues to evolve, addressing cost, technical expertise, and supply chain challenges is crucial for unlocking the long-term growth potential of the global embedded display market. Investment in localized manufacturing, modular designs, and strategic partnerships can help mitigate these issues and accelerate global adoption

Embedded Display Market Scope

The embedded display market is segmented on the basis of technology, type, device, and application.

• By Technology

On the basis of technology, the embedded display market is segmented into LCD (Liquid Crystal Display), LED (Light Emitting Diode), OLED (Organic Light Emitting Diode), and Others. The LCD segment held the largest market revenue share in 2024, driven by its widespread adoption in automotive, industrial, and consumer electronics due to cost-effectiveness, reliability, and established manufacturing infrastructure. LCD displays continue to be favored for applications requiring high visibility and energy efficiency.

The OLED segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its superior color reproduction, thinner form factor, and flexibility, making it ideal for premium smartphones, wearables, and advanced automotive dashboards. OLED-enabled displays are particularly popular for their lightweight design and high-contrast performance, enhancing user experience across interactive applications.

• By Technology

On the basis of technology, the embedded display market is segmented into LCD (Liquid Crystal Display), LED (Light Emitting Diode), OLED (Organic Light Emitting Diode), and Others. The LCD segment held the largest market revenue share in 2024, driven by its widespread adoption in automotive, industrial, and consumer electronics due to cost-effectiveness, reliability, and established manufacturing infrastructure. LCD displays continue to be favored for applications requiring high visibility, energy efficiency, and long-term durability.

The OLED segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its superior color reproduction, thinner form factor, and flexibility, making it ideal for premium smartphones, wearables, and advanced automotive dashboards. OLED-enabled displays are particularly popular for their lightweight design, high-contrast performance, and ability to support curved and foldable designs, enhancing user experience across interactive applications.

• By Type

On the basis of type, the embedded display market is segmented into touch displays and non-touch displays. The touch display segment held the largest revenue share in 2024, driven by the increasing demand for interactive interfaces in smartphones, automotive dashboards, industrial panels, and home automation systems. Touch displays offer intuitive control, faster response times, and enhanced user engagement.

Non-touch displays is expected to witness the fastest growth rate from 2025 to 2032, owing to their cost-effectiveness, energy efficiency, and suitability for monitoring, signage, and simple visualization applications across industrial and consumer electronics sectors.

• By Device

On the basis of device, the embedded display market is segmented into smartphones and tablets, wearables, automotive displays, home automation and HVAC systems, industrial equipment, and others. The smartphones and tablets segment held the largest market revenue share in 2024, driven by growing mobile device penetration and rising consumer expectations for high-quality, responsive screens.

Wearables and automotive displays is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption of smartwatches, fitness trackers, connected vehicles, and advanced driver-assistance systems (ADAS). These devices require compact, energy-efficient, and high-resolution displays to support enhanced functionality and user experience.

• By Application

On the basis of application, the embedded display market is segmented into automobile displays, fitness devices and wearables, home automation and HVAC systems, healthcare devices, industrial equipment, consumer electronics, and others. The automobile displays and consumer electronics segments held the largest revenue shares in 2024, driven by demand for interactive dashboards, infotainment systems, and smart consumer devices.

The fitness devices and wearables segments is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising adoption of IoT-enabled devices, smart homes, and energy-efficient solutions that enhance user interaction, convenience, and connectivity.

Embedded Display Market Regional Analysis

- North America dominated the embedded display market with the largest revenue share of 38.5% in 2024, driven by the growing adoption of connected devices, advanced automotive dashboards, and industrial automation solutions

- Consumers and enterprises in the region highly value interactive displays, energy-efficient panels, and seamless integration with smart devices and industrial equipment

- This widespread adoption is further supported by high disposable incomes, technological infrastructure, and strong R&D capabilities, establishing embedded displays as a preferred solution for automotive, industrial, and consumer electronics applications

U.S. Embedded Display Market Insight

The U.S. embedded display market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of connected devices and smart manufacturing initiatives. Manufacturers are increasingly integrating LCD and OLED displays into automotive dashboards, industrial control panels, and consumer electronics. The rising preference for interactive and energy-efficient displays, combined with demand for IoT-enabled solutions, continues to drive market expansion. Moreover, increasing government and industry focus on energy-efficient technologies and smart systems is further boosting adoption.

Europe Embedded Display Market Insight

The Europe embedded display market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the integration of advanced displays in automotive, industrial, and medical sectors. Increasing urbanization and the demand for connected devices are fostering the adoption of interactive and energy-efficient embedded displays. The region is witnessing growth across automotive dashboards, industrial control systems, and smart consumer electronics, with displays being incorporated into both new products and retrofit applications.

U.K. Embedded Display Market Insight

The U.K. embedded display market is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising trend of smart and connected systems in automotive, industrial, and healthcare applications. Consumers and businesses are increasingly adopting interactive and energy-efficient displays to enhance user experience and operational efficiency. The U.K.’s robust manufacturing and technology infrastructure, combined with strong e-commerce and retail distribution channels, is expected to continue supporting market growth.

Germany Embedded Display Market Insight

The Germany embedded display market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising awareness of energy-efficient technologies and the demand for advanced automotive and industrial displays. Germany’s well-developed industrial infrastructure, emphasis on smart manufacturing, and innovation-focused ecosystem are promoting the adoption of embedded displays across automotive dashboards, industrial control panels, and medical devices. Integration with IoT and connected systems is further enhancing market opportunities.

Asia-Pacific Embedded Display Market Insight

The Asia-Pacific embedded display market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region’s growing inclination toward connected automotive systems, smart industrial equipment, and consumer electronics is driving adoption. Government initiatives promoting digitalization, smart manufacturing, and energy-efficient technologies are supporting market growth. APAC’s position as a manufacturing hub for display components is also increasing the affordability and accessibility of embedded displays across the region.

Japan Embedded Display Market Insight

The Japan embedded display market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high-tech culture, automotive innovation, and growing demand for energy-efficient and interactive displays. Adoption is driven by smart automotive dashboards, industrial automation, and advanced consumer electronics. The integration of embedded displays with IoT and connected systems is further stimulating growth, while an aging population and focus on ease-of-use solutions are encouraging wider adoption in both residential and industrial applications.

China Embedded Display Market Insight

The China embedded display market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, a large middle-class population, and high technological adoption. Embedded displays are increasingly used in automotive dashboards, industrial equipment, consumer electronics, and smart home systems. The push toward smart cities, government initiatives supporting digitalization, and strong domestic manufacturing capabilities are key factors driving market expansion in China.

Embedded Display Market Share

The Embedded Display industry is primarily led by well-established companies, including:

- Kyocera Corporation (Japan)

- LG Display Co., Ltd. (South Korea)

- Samsung Electronics Co., Ltd. (South Korea)

- AU Optronics Corp. (Taiwan)

- BOE Technology Group Co., Ltd. (China)

- Sharp Corporation (Japan)

- Panasonic Corporation (Japan)

- Planar Systems, Inc. (U.S.)

- NEC Display Solutions, Ltd. (Japan)

- CPT Technology Group, Ltd. (Taiwan)

Latest Developments in Global Embedded Display Market

- In September 2023, JDI, a privately owned ship-building company, launched its eLEAP OLED technology, representing a significant advancement in display solutions. The development focuses on delivering extended lifespan, higher brightness, and improved energy efficiency through an innovative, cost-effective manufacturing process. This technology is designed to provide superior performance at a lower cost, making OLED displays more accessible for commercial and industrial applications. The introduction of eLEAP OLED is expected to enhance user experience, reduce operational costs, and stimulate broader adoption of OLED technology across multiple markets. Its impact is anticipated to drive competitive innovation and strengthen market growth in high-performance display solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Embedded Display Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Embedded Display Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Embedded Display Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.