Global Embedded Finance Market

Market Size in USD Billion

CAGR :

%

USD

112.67 Billion

USD

288.47 Billion

2025

2033

USD

112.67 Billion

USD

288.47 Billion

2025

2033

| 2026 –2033 | |

| USD 112.67 Billion | |

| USD 288.47 Billion | |

|

|

|

|

Embedded Finance Market Size

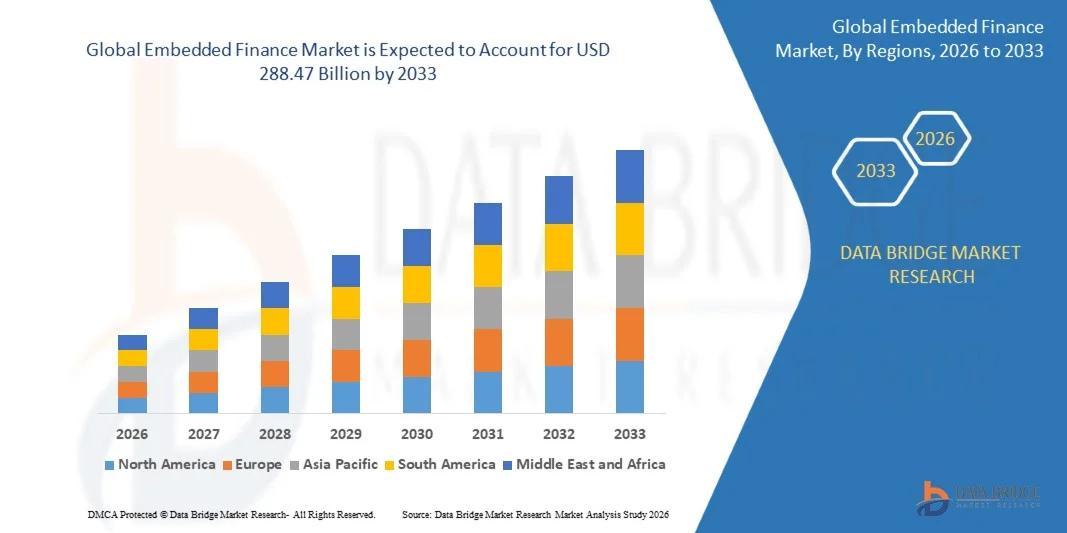

- The global embedded finance market size was valued at USD 112.67 billion in 2025 and is expected to reach USD 288.47 billion by 2033, at a CAGR of 12.47% during the forecast period

- The market growth is largely fuelled by the increasing integration of financial services into non-financial platforms, enabling seamless transactions, lending, and payments for consumers and businesses

- Growing adoption of digital wallets, buy-now-pay-later (BNPL) solutions, and embedded insurance across e-commerce, retail, and mobility platforms is driving demand

Embedded Finance Market Analysis

- The embedded finance market is witnessing strong growth due to the rising demand for personalized, convenient, and real-time financial services within non-banking platforms

- Strategic partnerships between fintech companies, traditional banks, and digital platforms are accelerating product offerings and enhancing consumer engagement across sectors

- North America dominated the embedded finance market with the largest revenue share of 38.75% in 2025, driven by the rapid adoption of digital banking solutions, fintech innovations, and increasing integration of financial services into non-financial platforms

- Asia-Pacific region is expected to witness the highest growth rate in the global embedded finance market, driven by rapid e-commerce expansion, growing digital payment adoption, government initiatives promoting cashless transactions, and rising demand for embedded financial services across SMEs and consumers

- The Embedded Payment segment held the largest market revenue share in 2025, driven by the increasing adoption of digital wallets, mobile payments, and integrated checkout solutions across e-commerce and service platforms. Embedded payment solutions simplify transactions, enhance user convenience, and increase customer engagement, making them highly preferred by both consumers and businesses

Report Scope and Embedded Finance Market Segmentation

|

Attributes |

Embedded Finance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Embedded Finance Market Trends

“Rise of Embedded Banking and Payment Solutions”

- The increasing integration of financial services into non-financial platforms is transforming the embedded finance landscape by enabling seamless access to banking, lending, and payment solutions directly within apps or e-commerce platforms. This enhances user convenience, reduces transaction friction, and improves overall customer engagement, driving higher transaction volumes and repeat usage. As more industries embrace digital ecosystems, embedded finance is becoming a core component of customer experience strategies, fostering loyalty and long-term engagement

- Rising demand from digital-first consumers and SMEs for embedded credit, wallets, and payment processing is accelerating adoption. Platforms offering integrated financial services enable users to complete transactions without leaving the host application, enhancing efficiency and satisfaction. The trend also supports financial inclusion by providing access to banking services for underbanked populations, expanding the market potential across geographies and demographics

- The flexibility and scalability of embedded finance solutions are making them attractive for merchants and platforms aiming to offer tailored financial services. Businesses benefit from higher customer retention, increased transaction volumes, and data-driven insights into consumer behavior. Integration with analytics and AI tools allows providers to offer personalized credit, payment, and insurance options, further enhancing user experience and revenue growth

- For instance, in 2023, several e-commerce platforms in North America and Europe integrated BNPL (Buy-Now-Pay-Later) and digital wallet solutions, boosting sales, expanding customer reach, and driving higher engagement. These integrations also improved cash flow management for SMEs while enabling consumers to access flexible payment options, contributing to accelerated market adoption

- While embedded finance adoption is rising, long-term growth depends on continuous innovation, regulatory compliance, and the development of secure, scalable solutions to meet evolving market demands. Providers must focus on interoperability, seamless UX, and robust security measures to ensure sustainable expansion and maintain competitive advantage

Embedded Finance Market Dynamics

Driver

“Rising Demand for Seamless Digital Financial Services”

- The growing consumer preference for integrated, on-platform financial services is driving the adoption of embedded finance. Users increasingly seek quick, convenient, and frictionless access to credit, payments, and insurance without switching between apps. The demand is further amplified by mobile-first lifestyles, digital wallets, and the popularity of instant payment solutions across e-commerce and service platforms

- Digitalization of commerce and financial ecosystems is boosting demand for embedded banking, payments, and lending. Businesses are leveraging APIs and fintech partnerships to offer tailored financial products, increasing operational efficiency and revenue streams. Embedded finance also enables platforms to collect actionable customer insights, improving cross-selling and upselling opportunities, while fostering long-term engagement

- Regulatory frameworks promoting fintech innovation and open banking are supporting the integration of embedded financial services. These policies encourage secure, transparent, and compliant financial product offerings across various sectors. Governments and financial authorities are increasingly facilitating sandbox environments, licensing frameworks, and compliance guidance, which accelerates adoption and reduces entry barriers for new players

- For instance, in 2022, several global e-commerce and software platforms launched embedded lending and payment services to improve customer experience, enhance sales conversion, and expand financial inclusivity. The implementations allowed smoother checkout experiences, reduced cart abandonment rates, and improved access to financial products for small merchants and underserved populations

- While digitalization and customer demand are driving growth, continued investment in secure infrastructure, scalable APIs, and innovative product offerings is essential for long-term market expansion. Providers must prioritize continuous UX improvements, advanced risk management, and seamless integration with third-party platforms to sustain growth

Restraint/Challenge

“Regulatory Compliance And Security Concerns”

- The complex regulatory landscape across different regions poses challenges for embedded finance providers. Compliance with banking, payments, and data privacy regulations can increase operational costs and slow market entry for new players. Multijurisdictional compliance requirements, including AML/KYC standards, create additional operational and legal burdens for fintechs and platforms

- Security risks, including fraud and data breaches, remain a significant concern in embedded finance. Platforms must invest in robust cybersecurity measures to protect sensitive customer financial data, maintain trust, and comply with regulatory requirements. The rise of sophisticated cyber-attacks and data theft incidents increases liability risks and demands continuous monitoring, encryption, and secure authentication systems

- Integration challenges with legacy systems and diverse fintech platforms may limit adoption. Ensuring seamless interoperability between embedded finance solutions and host applications is crucial for delivering a smooth user experience. Technical glitches, API incompatibility, and delayed system updates can hinder real-time transactions and undermine user confidence, impacting overall adoption rates

- For instance, in 2023, several fintech platforms in Europe and Asia faced delays in rolling out embedded banking and BNPL solutions due to compliance audits and security enhancements, affecting market growth. These delays also impacted revenue projections and slowed the onboarding of SMEs and consumer users, highlighting the importance of regulatory preparedness

- While technology continues to advance, addressing regulatory, security, and integration challenges remains critical for sustaining long-term adoption and competitiveness in the global embedded finance market. Companies must focus on proactive compliance strategies, advanced fraud detection, and seamless technical integration to mitigate risks and ensure sustainable expansion

Embedded Finance Market Scope

The embedded finance market is segmented on the basis of type, business model, and end-use.

• By Type

On the basis of type, the embedded finance market is segmented into Embedded Payment, Embedded Insurance, Embedded Investment, Embedded Lending, and Embedded Banking. The Embedded Payment segment held the largest market revenue share in 2025, driven by the increasing adoption of digital wallets, mobile payments, and integrated checkout solutions across e-commerce and service platforms. Embedded payment solutions simplify transactions, enhance user convenience, and increase customer engagement, making them highly preferred by both consumers and businesses.

The Embedded Lending segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for Buy-Now-Pay-Later (BNPL) solutions, instant credit access, and point-of-sale financing. Embedded lending enables platforms to provide seamless credit options without redirecting users to external financial services, increasing transaction volumes and improving overall customer satisfaction.

• By Business Model

On the basis of business model, the embedded finance market is segmented into B2B, B2C, B2B2B, and B2B2C. The B2C segment held the largest market revenue share in 2025, fueled by the integration of financial services directly into consumer-facing applications such as e-commerce, travel, and ride-hailing platforms. B2C embedded finance enhances customer experience, encourages repeat usage, and supports digital financial inclusion.

The B2B2C segment is expected to witness the fastest growth rate from 2026 to 2033, driven by companies offering embedded financial services to businesses that, in turn, serve end consumers. This model enables wider market penetration, supports SMEs in providing financing options, and increases adoption across multiple industries.

• By End-use

On the basis of end-use, the embedded finance market is segmented into Retail, Healthcare, Logistics, Manufacturing, Travel & Entertainment, and Others. The Retail segment held the largest market revenue share in 2025, propelled by the growing demand for integrated payment solutions, digital wallets, and financing options at point-of-sale within e-commerce and brick-and-mortar retail channels. Embedded finance in retail enhances transaction efficiency, loyalty programs, and customer engagement.

The Healthcare segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising adoption of embedded payment and lending solutions for medical services, insurance claims, and patient financing. These solutions streamline payments, reduce administrative burden, and improve access to healthcare services, fueling market expansion.

Embedded Finance Market Regional Analysis

- North America dominated the embedded finance market with the largest revenue share of 38.75% in 2025, driven by the rapid adoption of digital banking solutions, fintech innovations, and increasing integration of financial services into non-financial platforms.

- Consumers and businesses in the region highly value seamless on-platform payment, lending, and banking solutions, which reduce transaction friction and enhance operational efficiency.

- This widespread adoption is further supported by high digital penetration, growing SME adoption, and regulatory frameworks promoting open banking, establishing embedded finance as a key driver of financial inclusion and digital commerce.

U.S. Embedded Finance Market Insight

The U.S. embedded finance market captured the largest revenue share in 2025 within North America, fueled by the swift integration of payment, lending, and insurance services into e-commerce and software platforms. Consumers and SMEs increasingly prioritize convenient, frictionless access to financial services without leaving host applications. The growing adoption of BNPL (Buy-Now-Pay-Later), digital wallets, and embedded lending solutions, combined with robust API infrastructure and fintech partnerships, is significantly contributing to market expansion.

Europe Embedded Finance Market Insight

The Europe embedded finance market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent regulatory frameworks, increasing fintech adoption, and the demand for integrated financial solutions across industries. European businesses and consumers are embracing on-platform banking, lending, and payment services, benefiting from enhanced user experience, operational efficiency, and financial inclusivity. The region is witnessing significant growth across retail, travel, and healthcare sectors.

U.K. Embedded Finance Market Insight

The U.K. embedded finance market is expected to witness the fastest growth rate from 2026 to 2033, driven by growing fintech innovation, widespread digital adoption, and the rising preference for seamless financial transactions. Businesses and consumers are increasingly leveraging embedded banking and payment solutions to streamline operations and improve customer engagement. The U.K.’s strong e-commerce ecosystem, coupled with regulatory support for open banking, is expected to continue driving market growth.

Germany Embedded Finance Market Insight

The Germany embedded finance market is expected to witness rapid growth from 2026 to 2033, fueled by a technology-driven banking culture, increasing SME adoption, and demand for integrated financial services. Germany’s mature financial infrastructure and focus on innovation are promoting embedded payments, lending, and insurance solutions, particularly across retail and manufacturing sectors. The growing integration of APIs and fintech partnerships supports seamless user experiences and operational efficiency.

Asia-Pacific Embedded Finance Market Insight

The Asia-Pacific embedded finance market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid digitalization, rising smartphone penetration, and government initiatives supporting fintech innovation in countries such as China, Japan, and India. The region’s expanding e-commerce and digital payment ecosystems are encouraging widespread adoption of embedded banking, lending, and payment solutions. APAC is also emerging as a hub for fintech development, increasing accessibility and affordability of embedded financial services.

Japan Embedded Finance Market Insight

The Japan embedded finance market is expected to witness strong growth from 2026 to 2033 due to the country’s tech-savvy population, high digital adoption, and preference for convenient financial services. Embedded banking, lending, and payment solutions are increasingly integrated into e-commerce platforms and mobile applications, enhancing user experience and engagement. Japan’s aging population is also likely to drive demand for simpler, secure, and accessible financial solutions for both consumers and SMEs.

China Embedded Finance Market Insight

The China embedded finance market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly growing digital economy, high fintech adoption, and expanding middle class. Embedded payments, lending, and insurance services are increasingly integrated into e-commerce, retail, and service platforms. The push toward digital wallets, BNPL solutions, and smart financial ecosystems, along with strong domestic fintech innovation, is propelling the market in China.

Embedded Finance Market Share

The Embedded Finance industry is primarily led by well-established companies, including:

- Stripe, Inc. (U.S.)

- PAYRIX (U.S.)

- Cybrid Technology Inc. (U.S.)

- Walnut Insurance Inc. (U.S.)

- Lendflow (U.S.)

- Finastra (U.K.)

- Zopa Bank Limited (U.K.)

- Fortis Payment Systems, LLC (U.S.)

- Transcard Payments (U.S.)

- Fluenccy Pty Limited (Australia)

Latest Developments in Global Embedded Finance Market

- In March 2023, Stripe Inc. launched a strategic partnership with Weave, a customer engagement and communication platform for SMEs, to process payments via Stripe Connect for over 27,000 specialty healthcare customers across the U.S. This collaboration enhances payment efficiency, streamlines financial operations for SMEs, and strengthens Stripe’s presence in the healthcare fintech segment, driving greater adoption of embedded payment solutions

- In March 2023, Bidmii, a Toronto-based technology startup, introduced its embedded financial product “Get it Done, Pay Later,” combining Humm Group’s consumer financing program with Bidmii’s payment protection platform. The solution enables homeowners to finance home improvement projects seamlessly, improving customer access to credit while promoting adoption of embedded financing in the home services sector

- In February 2023, Transcard Payments announced an integration with Skyscend, Inc., incorporating Skyscend Pay into Transcard’s SMART Suite embedded payments platform. This development allows organizations to manage and disburse payments from any account or accounting system, enhancing operational efficiency, reducing processing times, and expanding the reach of embedded payment solutions in supply chain finance

- In February 2023, Zopa Bank Limited revealed plans to acquire the POS finance technology and lending platform of U.K.-based DivideBuy to launch its BNPL 2.0 offering. This embedded finance solution integrates instant credit decisions, regulated bank safeguards, and seamless consumer journeys at the point of sale, strengthening Zopa’s competitive position and driving broader adoption of buy-now-pay-later services in the U.K. market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.