Global Emission Equipment Market

Market Size in USD Billion

CAGR :

%

USD

157.47 Billion

USD

285.06 Billion

2024

2032

USD

157.47 Billion

USD

285.06 Billion

2024

2032

| 2025 –2032 | |

| USD 157.47 Billion | |

| USD 285.06 Billion | |

|

|

|

|

Emission Equipment Market Size

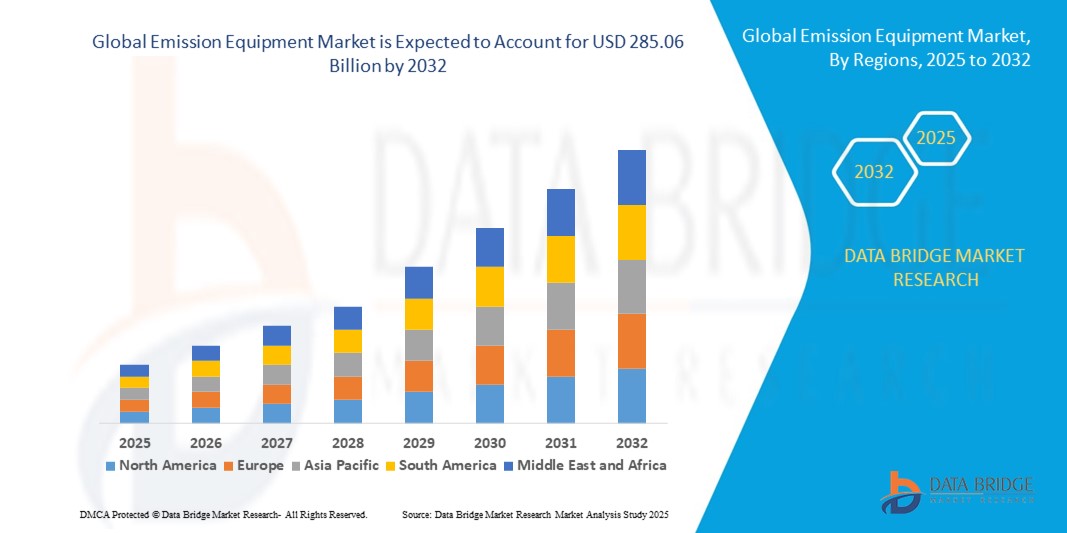

- The global emission equipment market size was valued at USD 157.47 billion in 2024 and is expected to reach USD 285.06 billion by 2032, at a CAGR of 7.7% during the forecast period

- The market growth is largely fuelled by the increasing need to comply with stringent environmental regulations, rising awareness about air pollution control, and growing industrialization across emerging economies.

- Adoption of advanced emission monitoring and control technologies across automotive, power generation, and industrial sectors is further driving market expansion

Emission Equipment Market Analysis

- Rising government initiatives and policies targeting emission reduction are creating significant growth opportunities for market players.

- The increasing global focus on reducing greenhouse gas emissions and improving air quality is encouraging investments in advanced emission equipment solutions

- North America dominated the emission equipment market with the largest revenue share of 38.5% in 2024, driven by stringent environmental regulations, advanced industrial infrastructure, and rising awareness about air pollution control

- Asia-Pacific region is expected to witness the highest growth rate in the global emission equipment market, driven by rapid urbanization, industrialization, and government policies promoting cleaner technologies in countries such as China, Japan, and South Korea

- The Particulate Matter (PM) Control Equipment segment held the largest market revenue share in 2024, driven by the increasing focus on reducing airborne particulates across industrial and automotive sectors. PM control systems are widely adopted due to stringent regulatory standards and the need to maintain cleaner air quality in urban and industrial areas

Report Scope and Emission Equipment Market Segmentation

|

Attributes |

Emission Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand For Advanced Emission Control Technologies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Emission Equipment Market Trends

Adoption of Advanced Emission Control Technologies Across Industries

- The increasing adoption of advanced emission control equipment is transforming the industrial and automotive sectors by enabling real-time monitoring and reduction of pollutants. These systems, including catalytic converters, scrubbers, and particulate filters, allow immediate compliance with environmental standards, reducing harmful emissions and ensuring regulatory adherence

- The rising demand for emission monitoring in remote industrial zones and emerging economies is accelerating the deployment of portable analyzers and automated emission control systems. These solutions are particularly effective where on-site environmental testing is limited, helping reduce regulatory violations and improve air quality

- The affordability and ease of integration of modern emission equipment are driving adoption among small and mid-sized industrial operators, facilitating frequent emission monitoring without significant operational disruption

- For instance, in 2023, several power generation plants in India implemented advanced scrubber systems and online emission monitoring tools, resulting in reduced pollutant levels and compliance with local environmental regulations

- While emission control technologies are advancing, their effectiveness depends on proper maintenance, operator training, and technology adaptation. Manufacturers must focus on cost-effective, scalable, and reliable solutions to fully capitalize on this growing demand

Emission Equipment Market Dynamics

Driver

Increasing Environmental Regulations and Rising Awareness About Air Pollution

• The implementation of stringent environmental regulations globally is pushing industries and automotive manufacturers to adopt emission control equipment to comply with legal standards. This includes monitoring and reducing greenhouse gases, particulate matter, and other harmful emissions. Additionally, international agreements on climate change and carbon reduction targets are compelling companies to invest in greener technologies to meet compliance deadlines

• Companies are increasingly aware of the financial and reputational risks associated with non-compliance, driving investment in advanced emission control systems to minimize penalties, operational disruptions, and environmental impact. Failure to comply can result in hefty fines, legal challenges, and negative brand perception, making proactive investment in emission control a strategic necessity.

• Technological advancements, such as real-time emission monitoring and automated control systems, are further supporting market growth by enabling precise measurement and efficient pollutant reduction. Innovations like IoT-enabled sensors, AI-based predictive analytics, and remote monitoring are enhancing operational efficiency while reducing human intervention and error

• For instance, in 2022, European industrial facilities upgraded to advanced emission monitoring and scrubber systems to comply with EU industrial emission directives, enhancing operational efficiency and environmental performance. The adoption of these systems also facilitated better reporting to regulatory authorities and improved transparency in sustainability practices

• While regulatory pressure and awareness are major growth drivers, ensuring affordability, ease of use, and compatibility with existing industrial processes remains crucial for sustained adoption. Companies require solutions that integrate seamlessly into legacy systems without causing major downtime or additional operational costs

Restraint/Challenge

High Cost of Advanced Emission Equipment and Limited Adoption in Small-Scale Operations

• The premium cost of advanced emission control systems limits accessibility for small and mid-sized industries, as high investment requirements deter widespread adoption. Cost remains a significant barrier, particularly in emerging economies, where financial resources for compliance are often limited

• In many regions, limited availability of technical support, maintenance services, and skilled operators further reduces usage, especially for complex monitoring and control systems. Without trained personnel, equipment downtime increases, and optimal performance cannot be achieved

• Supply chain constraints, such as the limited production of high-quality filters, catalytic materials, and sensors, can restrict market penetration in remote or underdeveloped regions. Delays in sourcing essential components can impact installation timelines and operational continuity

• For instance, in 2023, small-scale manufacturing units in Sub-Saharan Africa reported difficulty in procuring advanced emission control systems due to high costs and logistical challenges. Many units continued to operate with minimal emission control equipment, exposing them to potential regulatory penalties and environmental risks. The situation highlighted the need for localized production and cost-effective solutions to improve accessibility

• While emission equipment technologies continue to improve, addressing affordability, local availability, and training is essential to unlock long-term market potential and expand adoption across diverse industrial and automotive segments. Industry stakeholders are increasingly exploring partnerships, leasing models, and government subsidies to reduce upfront costs and facilitate broader adoption

Emission Equipment Market Scope

The market is segmented on the basis of emission type, application, and technology.

- By Emission Type

On the basis of emission type, the emission equipment market is segmented into Particulate Matter (PM) Control Equipment, Nitrogen Oxides (NOx) Control Equipment, Sulfur Oxides (SOx) Control Equipment, Volatile Organic Compounds (VOC) Control Equipment, and Others. The Particulate Matter (PM) Control Equipment segment held the largest market revenue share in 2024, driven by the increasing focus on reducing airborne particulates across industrial and automotive sectors. PM control systems are widely adopted due to stringent regulatory standards and the need to maintain cleaner air quality in urban and industrial areas.

The Nitrogen Oxides (NOx) Control Equipment segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the rising adoption of advanced catalytic converters and selective catalytic reduction systems in automotive and industrial applications. NOx control technologies are particularly effective in meeting increasingly strict emission regulations, providing industries with compliance solutions while enhancing operational efficiency.

- By Application

On the basis of application, the emission equipment market is segmented into Industrial, Automotive, Marine, Aerospace, and Others. The Industrial segment held the largest market revenue share in 2024, driven by the stringent environmental standards imposed on manufacturing plants, power generation units, and chemical processing facilities. Industrial emission equipment is widely deployed to control multiple pollutants, ensuring compliance with local and international regulations.

The Automotive segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing focus on vehicle emission reduction and adoption of advanced exhaust treatment systems. Automotive emission equipment, such as catalytic converters and diesel particulate filters, plays a critical role in meeting global emission norms and reducing environmental impact.

- By Technology

On the basis of technology, the emission equipment market is segmented into Wet Scrubbers, Electrostatic Precipitators (ESP), Catalytic Converters, Absorption Towers, and Others. The Wet Scrubbers segment held the largest market revenue share in 2024, driven by their efficiency in removing particulate matter, sulfur oxides, and acidic gases from industrial flue streams. Wet scrubbers are highly preferred in chemical, power, and cement industries due to their reliability and scalability.

The Catalytic Converters segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing adoption in automotive and industrial applications to reduce nitrogen oxide and carbon monoxide emissions. Advanced catalytic technologies are being integrated with engine and industrial systems, helping manufacturers meet stringent emission standards while maintaining high operational efficiency.

Emission Equipment Market Regional Analysis

• North America dominated the emission equipment market with the largest revenue share of 38.5% in 2024, driven by stringent environmental regulations, advanced industrial infrastructure, and rising awareness about air pollution control

• Industries and automotive manufacturers in the region are increasingly investing in emission control solutions to comply with legal standards and reduce environmental impact

• High adoption is further supported by government incentives, technological advancements, and a strong focus on sustainability, positioning emission equipment as an essential solution across industrial and transportation sectors

U.S. Emission Equipment Market Insight

The U.S. emission equipment market accounted for the largest revenue share in North America in 2024, propelled by strict federal emission standards and growing demand from industrial, automotive, and marine sectors. Companies are increasingly integrating advanced emission monitoring and control systems to ensure regulatory compliance, reduce penalties, and maintain operational efficiency. The adoption of real-time monitoring, automated scrubbers, and catalytic converters is further enhancing market expansion.

Europe Emission Equipment Market Insight

The Europe emission equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by the enforcement of stringent EU emission directives and sustainability initiatives. The region’s industrial base, coupled with the demand for cleaner transportation solutions, is accelerating adoption. Countries such as Germany, France, and Italy are witnessing high demand for catalytic converters, electrostatic precipitators, and VOC control systems in both industrial and automotive applications.

U.K. Emission Equipment Market Insight

The U.K. emission equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent environmental regulations and government initiatives aimed at reducing industrial and vehicular emissions. Adoption of advanced emission control technologies, including catalytic converters, wet scrubbers, and VOC control systems, is increasing across manufacturing, automotive, and aerospace sectors. The U.K.’s strong focus on sustainability, clean energy transition, and smart industrial practices is further supporting market expansion.

Germany Emission Equipment Market Insight

The Germany emission equipment market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s strong emphasis on environmental regulations, green technology, and innovation. German industries and automotive manufacturers are rapidly adopting advanced emission control systems, including wet scrubbers and absorption towers. The integration of emission monitoring systems with industrial automation enhances operational efficiency while ensuring compliance with EU emission norms.

Asia-Pacific Emission Equipment Market Insight

The Asia-Pacific emission equipment market is expected to witness the fastest growth rate from 2025 to 2032, fueled by industrialization, urbanization, and increasing environmental awareness in countries such as China, Japan, and India. Government initiatives promoting clean technologies and stricter emission standards are accelerating market adoption. APAC is emerging as a hub for emission equipment manufacturing, making solutions more affordable and accessible to industries and automotive sectors.

China Emission Equipment Market Insight

The China emission equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrial growth, rising vehicle production, and strict government policies on emission reduction. Widespread adoption of catalytic converters, scrubbers, and ESP systems in industrial and transportation sectors is helping reduce pollution and comply with environmental regulations. The country’s focus on smart city development and green industrial practices is further propelling market expansion.

Japan Emission Equipment Market Insight

The Japan emission equipment market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s technological advancements, stringent emission standards, and strong focus on sustainable manufacturing. Adoption of real-time monitoring systems and advanced emission control technologies is high in automotive and industrial sectors. Japan’s emphasis on energy efficiency and pollution control drives continued investment in emission equipment solutions.

Emission Equipment Market Share

The Emission Equipment industry is primarily led by well-established companies, including:

- Babcock & Wilcox Enterprises, Inc. (U.S.)

- Mitsubishi Hitachi Power Systems, Ltd. (Japan)

- General Electric Company (U.S.)

- Alstom SA (France)

- Siemens AG (Germany)

- Doosan Heavy Industries & Construction Co., Ltd. (South Korea)

- Thermax Limited (India)

- ANDRITZ AG (Austria)

- Johnson Matthey PLC (U.K.)

- Amec Foster Wheeler (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Emission Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Emission Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Emission Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.