Global Empty Intravenous Iv Bags Market

Market Size in USD Billion

CAGR :

%

USD

4.12 Billion

USD

6.27 Billion

2024

2032

USD

4.12 Billion

USD

6.27 Billion

2024

2032

| 2025 –2032 | |

| USD 4.12 Billion | |

| USD 6.27 Billion | |

|

|

|

|

Empty Intravenous (IV) Bags Market Size

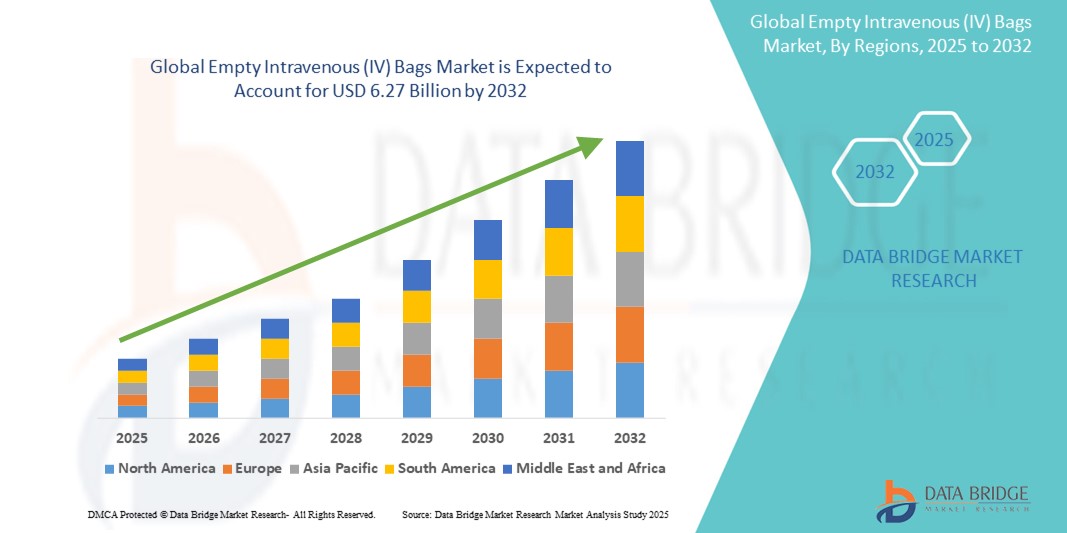

- The global empty intravenous (IV) bags market size was valued at USD 4.12 billion in 2024 and is expected to reach USD 6.27 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fueled by the increasing incidence of chronic illnesses, rising hospitalization rates, and expanding demand for sterile, contamination-free parenteral solutions in healthcare facilities worldwide

- Furthermore, the transition from PVC-based IV bags to non-PVC alternatives driven by environmental and safety concerns is establishing these products as the preferred choice in modern medical care. These converging factors are accelerating the uptake of empty IV bags globally

Empty Intravenous (IV) Bags Market Analysis

- Empty intravenous (IV) bags, essential for delivering medications, fluids, and nutrients, are critical components in modern healthcare settings, widely used across hospitals, clinics, and home care for parenteral administration due to their sterility, compatibility, and ease of use

- The escalating demand for empty IV bags is primarily fueled by the rising prevalence of chronic and infectious diseases, increasing surgical procedures, and growing emphasis on infection control and patient safety

- North America dominated the empty intravenous (IV) bags market with the largest revenue share of 39.5% in 2024, supported by well-established healthcare infrastructure, strong regulatory frameworks promoting non-PVC alternatives, and high hospital admission rates, especially in the U.S., which continues to adopt advanced medical delivery systems and eco-friendly materials

- Asia-Pacific is expected to be the fastest growing region in the empty intravenous (IV) bags market during the forecast period due to expanding healthcare access, growing medical tourism, and increased investment in hospital infrastructure

- Non-PVC segment dominated the empty intravenous (IV) bags market with a market share of 48% in 2024, driven by rising environmental and health concerns associated with DEHP leaching from traditional PVC materials and growing regulatory support for safer alternatives

Report Scope and Empty Intravenous (IV) Bags Market Segmentation

|

Attributes |

Empty Intravenous (IV) Bags Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Empty Intravenous (IV) Bags Market Trends

“Shift Towards Non-PVC and Eco-Friendly Alternatives”

- A significant and accelerating trend in the global empty intravenous (IV) bags market is the increasing shift towards non-PVC, DEHP-free, and eco-friendly bag materials. This transition is being driven by rising environmental awareness, growing concerns over chemical leaching, and stricter regulatory mandates across major healthcare markets

- For instance, Baxter International and B. Braun have introduced non-PVC IV bags designed to eliminate phthalates and reduce environmental impact. These products meet emerging regulatory standards and offer healthcare providers safer alternatives to traditional PVC bags

- Non-PVC materials such as polypropylene and ethylene-vinyl acetate (EVA) are gaining traction due to their chemical stability, flexibility, and reduced risk of contamination. This trend is particularly relevant for delivering sensitive drugs such as chemotherapy agents or lipid-based infusions

- The demand for eco-conscious medical products is also being supported by institutional sustainability goals and national healthcare regulations that encourage the use of recyclable and low-toxicity materials. As a result, companies are innovating to develop IV bags that are both patient-safe and environmentally responsible

- In addition, the growing popularity of ready-to-fill and pre-mixed IV solutions is reinforcing the demand for customizable and contamination-resistant bag formats, accelerating adoption among healthcare providers

- This trend towards sustainable, high-performance, and compliant IV bag solutions is reshaping industry standards and influencing procurement preferences among hospitals, clinics, and pharmaceutical companies globally

Empty Intravenous (IV) Bags Market Dynamics

Driver

“Increasing Healthcare Needs and Demand for Sterile Parenteral Delivery”

- The growing global burden of chronic diseases, increasing hospitalization rates, and a higher number of surgical procedures are major drivers boosting the demand for empty IV bags, which are crucial for intravenous fluid and drug administration

- For instance, the World Health Organization (WHO) reports a rising incidence of cardiovascular diseases and diabetes, conditions that frequently require parenteral therapy. This is leading to an increased need for reliable and sterile IV bag solutions in both inpatient and outpatient settings

- Hospitals and clinics are increasingly seeking sterile, flexible, and durable IV bags to ensure safe delivery of fluids, medications, and nutritional formulations, particularly for critical care and emergency situations

- Furthermore, the growth in geriatric population and the expansion of home healthcare services are contributing to the adoption of IV bags beyond traditional hospital environments, reinforcing market demand

- Manufacturers are responding with a range of advanced, contamination-resistant IV bag options suited for multiple clinical and therapeutic uses, supporting the evolving needs of modern healthcare systems

Restraint/Challenge

“Environmental Concerns and Regulatory Compliance with PVC-based Bags”

- The widespread use of PVC-based IV bags poses environmental and health concerns due to the leaching of harmful plasticizers such as DEHP, which can pose reproductive and developmental risks, especially with prolonged exposure

- For instance, regulatory bodies such as the European Chemicals Agency (ECHA) and the U.S. FDA have issued guidance limiting or discouraging the use of DEHP-containing medical devices, pushing manufacturers to seek safer alternatives

- However, transitioning to non-PVC materials comes with challenges such as higher production costs, revalidation requirements for drug compatibility, and limited supplier availability in some regions. These factors can delay adoption or restrict access to advanced IV bag options

- In addition, healthcare institutions in lower-income regions may face affordability issues when procuring non-PVC IV bags, thus continuing reliance on cheaper PVC-based products

- Overcoming these barriers through cost-effective innovation, clearer regulatory alignment, and increased awareness of the clinical benefits of non-toxic alternatives will be crucial for achieving long-term market growth and compliance sustainability

Empty Intravenous (IV) Bags Market Scope

The market is segmented on the basis of product and type.

- By Product

On the basis of product, the empty intravenous (IV) bags market is segmented into PVC and non-PVC. The non-PVC segment dominated the market with the largest market revenue share in 2024, driven by rising concerns over DEHP leaching from PVC bags and increasing regulatory support for DEHP-free alternatives. Non-PVC IV bags made from materials such as polypropylene (PP) and ethylene-vinyl acetate (EVA) offer superior safety, compatibility with sensitive drug formulations, and are environmentally safer. Hospitals and pharmaceutical companies are increasingly adopting non-PVC bags for critical care, oncology, and pediatric applications, contributing to the segment’s strong market presence.

The PVC segment is anticipated to witness a slower growth rate compared to non-PVC, as many healthcare systems move away from PVC due to regulatory pressure and growing awareness of patient safety. However, in cost-sensitive markets, PVC bags continue to hold relevance due to their affordability and established supply chains.

- By Type

On the basis of type, the empty intravenous (IV) bags market is segmented into single-chamber and multi-chamber. The single-chamber segment dominated the market with the largest market revenue share in 2024, owing to its widespread use in routine IV therapies such as hydration, antibiotic infusion, and electrolyte replenishment. Single-chamber IV bags are cost-effective, easy to fill, and compatible with most intravenous delivery systems, making them the preferred choice for general hospital and clinical applications.

The multi-chamber segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the increasing need for compartmentalized drug delivery systems that allow for on-site mixing of complex solutions. These bags are increasingly utilized in applications such as total parenteral nutrition (TPN), chemotherapy, and emergency care due to their ability to maintain drug stability and reduce the risk of contamination. The demand for multi-chamber IV bags is also rising in home healthcare and critical care settings.

Empty Intravenous (IV) Bags Market Regional Analysis

- North America dominated the empty intravenous (IV) bags market with the largest revenue share of 39.5% in 2024, supported by well-established healthcare infrastructure, strong regulatory frameworks promoting non-PVC alternatives, and high hospital admission rates, especially in the U.S., which continues to adopt advanced medical delivery systems and eco-friendly materials

- Healthcare providers in the region increasingly prefer non-PVC IV bags due to their safety profile, especially for vulnerable populations such as pediatric and oncology patients. This preference is further reinforced by environmental sustainability goals and compliance with evolving health regulations

- The widespread adoption of advanced medical technologies, rising demand for sterile and customizable IV delivery solutions, and significant investments in hospital and outpatient care facilities contribute to North America's leadership position in the global empty IV bags market

U.S. Empty Intravenous (IV) Bags Market Insight

The U.S. empty intravenous (IV) bags market captured the largest revenue share of 82.4% in 2024 within North America, driven by the country’s robust healthcare infrastructure and high demand for sterile, contamination-free IV solutions. The shift towards non-PVC and DEHP-free materials, supported by FDA guidelines and hospital sustainability initiatives, is significantly accelerating market adoption. In addition, the rising number of chronic disease cases, surgical procedures, and a growing geriatric population further contribute to the expanding use of IV bags across hospital and outpatient care settings.

Europe Empty Intravenous (IV) Bags Market Insight

The Europe empty IV bags market is projected to expand at a substantial CAGR throughout the forecast period, supported by strict environmental regulations, growing demand for DEHP-free solutions, and rising healthcare expenditures. EU regulatory frameworks favor the transition toward non-toxic, recyclable IV bag materials, fueling demand for non-PVC alternatives. The region’s focus on healthcare modernization and infection control across both public and private facilities is fostering IV bag adoption across a wide range of medical applications.

U.K. Empty Intravenous (IV) Bags Market Insight

The U.K. empty IV bags market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of eco-friendly medical products and greater emphasis on hospital safety standards. Rising chronic illness rates, growing outpatient treatment demand, and regulatory encouragement for DEHP-free alternatives are prompting a shift towards non-PVC bags in both the NHS and private sector. The country’s push for greener healthcare practices also supports the adoption of recyclable, non-toxic IV solutions.

Germany Empty Intravenous (IV) Bags Market Insight

The Germany empty IV bags market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s commitment to innovation, safety, and sustainability in healthcare. Germany’s advanced hospital infrastructure and pharmaceutical manufacturing base drive demand for high-quality, contamination-resistant IV bag solutions. Increasing use of multi-chamber IV bags for complex therapies, along with policies discouraging PVC use, are shaping the shift toward modern intravenous delivery technologies.

Asia-Pacific Empty Intravenous (IV) Bags Market Insight

The Asia-Pacific empty IV bags market is poised to grow at the fastest CAGR of 23.6% during the forecast period of 2025 to 2032, due to rapid healthcare infrastructure development, rising surgical procedures, and the expansion of medical tourism. Countries such as China, India, and Japan are leading regional growth through increased public health investments and the push for domestic manufacturing. Demand is also fueled by the need for cost-effective, sterile, and safe IV solutions across both urban and rural healthcare settings.

Japan Empty Intravenous (IV) Bags Market Insight

The Japan empty IV bags market is gaining momentum due to the nation’s advanced healthcare system, aging population, and demand for high-quality medical devices. The country places strong emphasis on patient safety and eco-conscious medical solutions, encouraging adoption of non-PVC IV bags. Growing demand for home healthcare and parenteral nutrition is also accelerating the use of IV bags with better safety and usability profiles.

India Empty Intravenous (IV) Bags Market Insight

The India empty IV bags market accounted for the largest market revenue share in Asia Pacific in 2024, supported by the country’s large population, increasing healthcare access, and government-led initiatives to improve hospital infrastructure. The shift towards affordable, locally produced non-PVC IV bags is gaining pace, particularly in urban hospitals and clinics. Rising prevalence of chronic diseases, greater awareness of sterile infusion practices, and domestic manufacturing capacity continue to drive strong market growth in India.

Empty Intravenous (IV) Bags Market Share

The empty intravenous (IV) Bags industry is primarily led by well-established companies, including:

- Baxter International Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- B. Braun SE (Germany)

- ICU Medical, Inc. (U.S.)

- Otsuka Pharmaceutical Factory, Inc. (Japan)

- Poly Medicure Ltd. (India)

- Technoflex (France)

- Sippex IV Bags (France)

- Kraton Corporation (U.S.)

- RENOLIT SE (Germany)

- Wuhan W.E.O. Science & Technology Co., Ltd. (China)

- Shanghai Xin Gen Eco-Technologies Co., Ltd. (China)

- Jiangsu Rongye Technology Co., Ltd. (China)

- Haemotronic S.p.A. (Italy)

- ALCOR Scientific (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Medline Industries, LP (U.S.)

- Weigao Group Medical Polymer Co., Ltd. (China)

- Zhejiang Kindly Medical Devices Co., Ltd. (China)

What are the Recent Developments in Global Empty Intravenous (IV) Bags Market?

- In April 2023, B. Braun Melsungen AG announced the expansion of its non-PVC IV bag production facilities in Spain to meet the growing global demand for DEHP-free, eco-friendly infusion solutions. This strategic investment aligns with the company’s commitment to environmental sustainability and regulatory compliance, enhancing its manufacturing capacity for advanced intravenous delivery products while reinforcing its position in the European and global markets

- In March 2023, Fresenius Kabi launched a new line of multi-chamber non-PVC IV bags tailored for total parenteral nutrition (TPN) therapies across North American and European markets. These innovations support aseptic mixing at the point of care, enabling safer and more efficient administration of complex nutrient formulations. The development highlights Fresenius Kabi’s focus on advanced drug delivery technologies and patient-centric infusion systems

- In March 2023, Baxter International Inc. introduced a next-generation IV bag system featuring collapsible, non-PVC material designed to reduce waste and enhance storage efficiency. This system supports a broader sustainability initiative across Baxter’s global operations and caters to hospitals seeking safer, environmentally responsible infusion options. The product line extension aims to meet both clinical performance and environmental goals

- In February 2023, Otsuka Pharmaceutical Factory, Inc. announced a new manufacturing facility in Japan dedicated to the production of non-PVC, ready-to-fill IV bags, aiming to address rising demand in the Asia-Pacific region. The new facility integrates smart manufacturing technologies and complies with stringent safety and quality regulations, positioning Otsuka to expand its presence in rapidly growing markets such as China, India, and Southeast Asia

- In January 2023, ICU Medical, Inc. partnered with global healthcare providers to pilot an advanced non-PVC IV bag solution optimized for high-risk infusions, including chemotherapy and sensitive biologics. The pilot program focuses on improving patient safety, reducing contamination risks, and ensuring compatibility with automated compounding systems. This development underscores ICU Medical’s innovation-driven approach and its commitment to enhancing infusion safety in critical care environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.