Global Emulsifiers In Dietary Supplements Market

Market Size in USD Million

CAGR :

%

USD

187.69 Million

USD

296.22 Million

2024

2032

USD

187.69 Million

USD

296.22 Million

2024

2032

| 2025 –2032 | |

| USD 187.69 Million | |

| USD 296.22 Million | |

|

|

|

|

Emulsifiers in Dietary Supplements Market Size

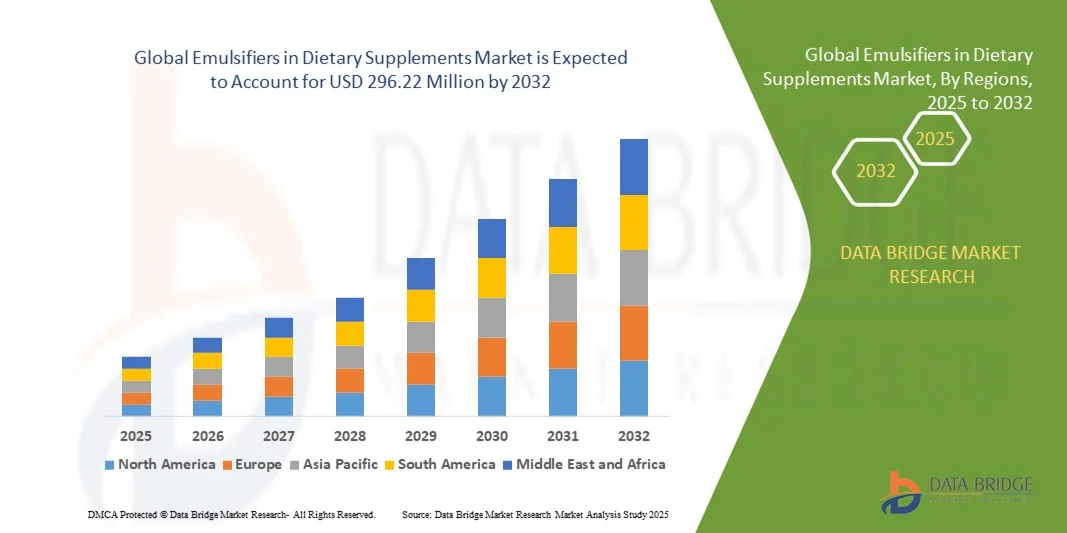

- The global emulsifiers in dietary supplements market size was valued at USD 187.69 million in 2024 and is expected to reach USD 296.22 million by 2032, at a CAGR of 5.87% during the forecast period

- The market growth is largely fueled by the increasing demand for dietary supplements and functional foods, which is driving the adoption of emulsifiers to improve solubility, stability, and bioavailability of active ingredients in both powder and liquid formulations

- Furthermore, rising consumer preference for clean-label, plant-based, and vegan-friendly products is encouraging manufacturers to develop natural and sustainable emulsifiers. These converging factors are accelerating the adoption of advanced emulsifier systems, thereby significantly boosting the growth of the dietary supplement industry

Emulsifiers in Dietary Supplements Market Analysis

- Emulsifiers are ingredients that enable the mixing of oil and water phases in dietary supplements, ensuring uniformity, improved texture, and enhanced stability. They play a critical role in soft gels, capsules, liquids, and powders, enhancing nutrient delivery and overall product performance

- The escalating demand for emulsifiers is primarily fueled by the growth of the nutraceutical and functional food sectors, rising health awareness among consumers, and the need for high-quality, stable, and bioavailable supplement formulations

- Asia-Pacific dominated the emulsifiers in dietary supplements market with a share of over 35% in 2024, due to rapid growth in functional food and nutraceutical industries, increasing health awareness, and a strong presence of dietary supplement manufacturers

- North America is expected to be the fastest growing region in the emulsifiers in dietary supplements market during the forecast period due to rising consumer demand for functional foods, dietary supplements, and high-potency formulations

- Plant segment dominated the market with a market share of 62.8% in 2024, due to increasing consumer preference for vegan, organic, and clean-label dietary supplements. Plant-based emulsifiers such as lecithin and polyglycerol esters offer functional benefits including stability, solubility, and enhanced nutrient delivery while aligning with sustainability trends. For instance, ADM offers sunflower lecithin widely used in plant-based capsules and powders to improve texture and shelf-life. Rising awareness of health and ethical concerns related to animal-derived ingredients is further driving the shift toward plant-based emulsifiers. These emulsifiers are compatible with a broad range of formulations and provide a versatile solution for both liquid and powdered dietary supplements

Report Scope and Emulsifiers in Dietary Supplements Market Segmentation

|

Attributes |

Emulsifiers in Dietary Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Emulsifiers in Dietary Supplements Market Trends

Growing Demand for Clean-Label and Plant-Based Emulsifiers

- A leading trend in the emulsifiers market for dietary supplements is the growing emphasis on clean-label and plant-based emulsifier sources driven by consumer interest in natural, minimally processed ingredients. Plant-derived options such as sunflower and soy lecithin are rapidly gaining share within supplement formulations, meeting demand for sustainable and allergen-free emulsification solutions that align with evolving wellness preferences

- For instance, major supplement and functional beverage brands such as Garden of Life and NOW Foods have launched ranges of plant-based and organic products leveraging lecithin and other plant-sourced emulsifiers, prioritizing transparency and natural ingredient claims. These industry leaders are optimizing product performance while expanding consumer loyalty through innovation and responsible ingredient sourcing

- Clean-label emulsifiers contribute to improved nutritional value and appeal by enabling stable product textures without reliance on synthetic additives. Their versatility supports the growth of vegan, gluten-free, and allergen-free supplement categories that address a broad spectrum of dietary restrictions and health objectives

- In addition, advances in bio-based extraction and improved processing technologies are driving the ability to deliver functionally consistent plant-based emulsifiers that meet rigorous consumer and manufacturer requirements. This momentum supports a shift away from legacy synthetic emulsifiers toward more transparent, eco-conscious alternatives

- Consumer advocacy regarding ingredient transparency and natural product labels is expected to further stimulate the development of innovative plant-derived emulsifiers. The clean-label trend is reshaping global supplement formulation standards and accelerating the search for sustainable, health-promoting ingredient solutions

- This transition toward plant-based and clean-label emulsification is anticipated to remain central to dietary supplement industry growth, setting new benchmarks for product quality, authenticity, and market positioning across premium and mainstream wellness segments

Emulsifiers in Dietary Supplements Market Dynamics

Driver

Rising Consumption of Functional Foods and Nutraceuticals

- A major driver for emulsifiers in dietary supplements is the surging global demand for functional foods and nutraceuticals supporting active lifestyles, preventive health, and specialized nutrition targets. The broadening scope of dietary supplementation, including sports nutrition, immunity, and cognitive health, is fueling demand for high-quality emulsifiers that ensure texture, stability, and bioavailability

- For instance, in 2025, Gnosis by Lesaffre and Archer Daniels Midland Company expanded their plant-sourced emulsifier portfolios to address rising demand in gut health and metabolic support categories. Such offerings are being adopted by leading supplement producers requiring functional ingredients for premium nutrition solutions

- Emulsifiers improve product shelf life and consumer experience by maintaining consistent appearance, mouthfeel, and dispersibility even in challenging formulations containing oils, vitamins, or micronutrients. Their role is critical in supporting formulation flexibility and product efficacy

- In addition, heightened interest in preventative health among millennials and Gen Z, coupled with rising disposable incomes and fitness culture, is driving strong market penetration for multi-functional supplement products

- The expansion of the global nutraceutical market and rapid growth in emerging economies are expected to maintain robust demand for advanced emulsification technologies in dietary supplements. Emulsifiers remain foundational as functional product delivery formats continue to diversify and intensify

Restraint/Challenge

Regulatory Hurdles and Formulation Complexities

- A significant challenge for the emulsifiers in dietary supplements market is ongoing regulatory scrutiny regarding additive safety, permissible labeling, and quality assurance. Differing standards across regions and evolving rules around clean-label claims create obstacles for manufacturers in achieving widespread market acceptance and seamless product launches

- For instance, tightening regulations in the United States and European Union—addressing issues of ingredient disclosure, permitted claims, and additive purity—have prompted leading producers such as Lonza Group and DuPont to intensify compliance processes and invest in more sophisticated traceability systems

- Formulation complexity also presents operational challenges, particularly when stabilizing nutrient-rich or oil-heavy supplement blends. Natural emulsifiers sometimes require specialized processing or may interact unpredictably with bioactive ingredients, impacting efficacy and finished product stability

- In addition, sporadic supply chains for plant-derived emulsifiers and volatility in raw material prices can disrupt production scheduling and inflate costs, especially in commodity-sensitive markets

- Overcoming these challenges will require strategic adaptation through regulatory knowledge, ongoing research in formulation science, and efficient supply management. The capacity to innovate and maintain compliance will be key for producers expanding plant-based and premium supplement formulations

Emulsifiers in Dietary Supplements Market Scope

The market is segmented on the basis of type, source, function, and mode of application.

- By Type

On the basis of type, the emulsifiers in dietary supplements market is segmented into mono & di-glycerides & its derivatives, lecithin, sorbitan esters, stearoyl lactylates, polyglycerol esters, and others. The lecithin segment dominated the market with the largest market revenue share in 2024, driven by its widespread use as a natural emulsifier and compatibility with various dietary supplement formulations. Lecithin is often preferred by manufacturers due to its ability to improve bioavailability, enhance stability, and maintain consistency in both powder and liquid supplements. The strong demand for lecithin is further supported by its plant-based origin, making it suitable for vegan and clean-label products. Its versatility in encapsulation, solubilization, and texture enhancement contributes to its dominance in the market.

The mono & di-glycerides & its derivatives segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand in functional and fortified dietary supplements. For instance, companies such as Cargill are expanding their mono- and diglyceride product lines for capsules and soft gels to improve solubility and shelf-life. These emulsifiers help in stabilizing oil-in-water formulations and enhancing the absorption of fat-soluble nutrients. The growing preference for processed and ready-to-use supplement formulations is driving the adoption of mono & di-glycerides, particularly in North America and Europe. Their multifunctional properties in texture, solubility, and nutrient delivery make them an attractive choice for new product development.

- By Source

On the basis of source, the emulsifiers in dietary supplements market is segmented into plant and animal. The plant-based segment dominated the market with a share of 62.8% in 2024 due to increasing consumer preference for vegan, organic, and clean-label dietary supplements. Plant-based emulsifiers such as lecithin and polyglycerol esters offer functional benefits including stability, solubility, and enhanced nutrient delivery while aligning with sustainability trends. For instance, ADM offers sunflower lecithin widely used in plant-based capsules and powders to improve texture and shelf-life. Rising awareness of health and ethical concerns related to animal-derived ingredients is further driving the shift toward plant-based emulsifiers. These emulsifiers are compatible with a broad range of formulations and provide a versatile solution for both liquid and powdered dietary supplements.

The animal-based segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its high efficacy in stabilizing certain oil-soluble nutrients and functional compounds. For instance, glycerides sourced from dairy or egg derivatives are used in omega-3 and vitamin D supplements for improved absorption and uniformity. Animal-derived emulsifiers continue to see demand in specialized supplements where performance and bioavailability are critical. Their established history in the pharmaceutical and nutraceutical industry supports ongoing market growth despite the rising plant-based alternatives.

- By Function

On the basis of function, the emulsifiers in dietary supplements market is segmented into emulsification, starch complexing, protein interaction, aeration and stabilization, crystal modification, oil structuring, lubrication, and processing aids. The emulsification segment dominated the market in 2024, driven by its essential role in creating stable oil-in-water or water-in-oil formulations. Emulsifiers help maintain homogeneity, prevent phase separation, and enhance the bioavailability of fat-soluble vitamins and bioactive compounds. For instance, lecithin is widely used to emulsify omega-3 oils in soft gel capsules, ensuring consistent dosing and extended shelf-life. The strong demand for emulsification functions is supported by the rapid growth of functional foods, personalized nutrition, and liquid supplements across global markets.

The oil structuring segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for structured oils in specialized and high-performance dietary supplements. For instance, BASF has introduced structured lipid emulsifiers that improve the stability of high-concentration omega-3 formulations and medium-chain triglyceride-based products. These emulsifiers help maintain viscosity, prevent crystallization, and improve the sensory profile of liquid supplements. The growing trend toward functional oils and high-potency liquid formulations is driving adoption in nutraceutical and sports nutrition applications.

- By Mode of Application

On the basis of mode of application, the emulsifiers in dietary supplements market is segmented into capsules, powder, liquids, soft gels, and gel caps. The capsule segment dominated the market in 2024, driven by the widespread consumer preference for easy-to-consume, convenient dosage forms. Capsules allow precise dosing, protect sensitive ingredients from degradation, and can incorporate emulsifiers to improve solubility and absorption. For instance, companies such as Lonza utilize lecithin and mono & diglycerides in omega-3 and vitamin capsules to enhance stability and bioavailability. The continued expansion of personalized nutrition and functional supplement products is supporting strong demand for capsule-based applications.

The soft gel segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing consumer demand for liquid-filled, easy-to-swallow supplements that require emulsifiers for stability and texture. For instance, DSM has expanded its soft gel emulsifier portfolio for high-potency omega-3 and fat-soluble vitamin supplements. Soft gels offer improved nutrient delivery, extended shelf-life, and convenience, making them highly attractive in both the dietary supplement and sports nutrition sectors. Rising preference for premium, ready-to-use liquid formulations is further accelerating growth in the soft gel segment.

Emulsifiers in Dietary Supplements Market Regional Analysis

- Asia-Pacific dominated the emulsifiers in dietary supplements market with the largest revenue share of over 35% in 2024, driven by rapid growth in functional food and nutraceutical industries, increasing health awareness, and a strong presence of dietary supplement manufacturers

- The region’s cost-effective production capabilities, rising investments in plant-based and clean-label ingredients, and expanding export opportunities are accelerating market growth

- The availability of skilled labor, favorable government initiatives promoting nutrition and health supplements, and rising disposable income in developing economies are contributing to increased consumption of emulsifiers in dietary supplements

China Emulsifiers Market Insight

China held the largest share in the Asia-Pacific emulsifiers market in 2024, owing to its leadership in dietary supplement manufacturing, extensive production of lecithin and mono & diglycerides, and increasing focus on functional foods. Government support for nutraceutical research, strong domestic consumption, and growing export opportunities are driving market expansion. Rising demand for high-quality plant-based emulsifiers and investment in R&D for new supplement formulations further bolster growth.

India Emulsifiers Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a booming dietary supplement sector, increasing production of capsules and soft gels, and rising consumer focus on health and wellness. For instance, companies such as Synthite and Glanbia are expanding their production of emulsifier-based formulations. Government initiatives promoting nutrition, growing middle-class disposable income, and rapid urbanization are supporting robust market growth.

Europe Emulsifiers Market Insight

The Europe emulsifiers market is expanding steadily, supported by high demand for natural and plant-based emulsifiers, stringent regulatory frameworks, and growing preference for clean-label dietary supplements. The region emphasizes sustainability, quality, and functional efficacy in supplement formulations. Increasing use of emulsifiers in protein-based powders, soft gels, and liquid supplements is further enhancing market growth.

Germany Emulsifiers Market Insight

Germany’s emulsifiers market is driven by its strong nutraceutical and pharmaceutical manufacturing base, focus on high-quality ingredient sourcing, and advanced R&D infrastructure. Companies are investing in innovative emulsifier solutions to improve bioavailability and stability of functional supplements. Demand is particularly strong in capsule, soft gel, and powder formulations for vitamins, omega-3, and protein supplements.

U.K. Emulsifiers Market Insight

The U.K. market is supported by a mature dietary supplement industry, increasing adoption of plant-based and clean-label ingredients, and focus on functional nutrition. Rising academic-industry collaboration, investment in R&D for novel emulsifiers, and increasing consumer awareness about supplement quality are driving growth. The demand for emulsifiers in specialized formulations such as soft gels and liquid supplements is particularly strong.

North America Emulsifiers Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising consumer demand for functional foods, dietary supplements, and high-potency formulations. Growing adoption of plant-based and specialty emulsifiers, coupled with advancements in supplement processing technologies, is boosting market expansion. Increasing collaborations between nutraceutical manufacturers and ingredient suppliers are further supporting growth.

U.S. Emulsifiers Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its mature dietary supplement industry, strong R&D capabilities, and significant investments in functional ingredient development. For instance, companies such as Cargill and ADM are expanding their lecithin and mono & diglyceride portfolios for capsules, soft gels, and powders. Rising focus on clean-label, plant-based, and high-bioavailability emulsifiers is strengthening the country’s leading position in the region.

Emulsifiers in Dietary Supplements Market Share

The emulsifiers in dietary supplements industry is primarily led by well-established companies, including:

- ADM (U.S.)

- DuPont (U.S.)

- Cargill, Incorporated (U.S.)

- Dow (U.S.)

- Evonik Industries (Germany)

- Kerry Inc. (Ireland)

- Corbion, Incorporated (Netherlands)

- Kerry Group, Inc. (Ireland)

- Ingredion Incorporated (U.S.)

- Lonza (Switzerland)

- Palsgaard A/S (Denmark)

- Riken Vitamin Co., Ltd. (Japan)

- Beldem S.A. (Belgium)

- Tate & Lyle (U.K.)

- BASF SE (Germany)

- LASENOR EMUL, S.L. (Spain)

- Oleon NV (Belgium)

Latest Developments in Global Emulsifiers in Dietary Supplements Market

- In April 2025, Cosaic launched a yeast-derived emulsifier called Cosaic Neo, designed to replace dairy-, egg-, or conventional plant-based emulsifiers in dietary supplements. This development provides supplement manufacturers with a highly sustainable, vegan-friendly option that meets the growing demand for clean-label ingredients. Its yeast origin ensures high bioavailability and stability in both capsules and liquid formulations, enabling companies to differentiate products in a competitive market while appealing to health-conscious and plant-based consumers. The launch strengthens the adoption of alternative emulsifiers in high-value nutraceutical products and supports expansion into vegan and functional supplement segments

- In April 2025, ABITEC Corporation introduced its SENDS – Self-Emulsifying Nutraceutical Delivery System, which combines custom-designed emulsifiers, solubilizers, and surfactants for optimized performance in dietary supplements. This system enhances the absorption and bioavailability of poorly soluble active ingredients, allowing manufacturers to formulate high-potency supplements with lower dosages. The innovation impacts the market by enabling the development of more effective and consumer-friendly supplements, improving product efficacy and giving brands a competitive edge in both the domestic and international markets

- In January 2024, Kingswood Capital Management acquired the emulsifiers business of Corbion N.V. for approximately USD 326 million. This strategic acquisition consolidates the supply of high-quality emulsifiers and provides additional capital for research and development in advanced emulsifier technologies tailored for dietary supplements. The move is expected to increase innovation, ensure stable supply chains, and facilitate the introduction of specialized emulsifiers that improve the solubility, stability, and bioavailability of active ingredients, thereby supporting overall market growth

- In March 2024, Ingredion Incorporated launched Ticaloid Acacia Max, a high-performance acacia-derived emulsifier that offers improved oil-loading capability, lower usage levels, and enhanced emulsion stability. The product allows supplement manufacturers to create soft gels and liquid capsules with higher nutrient concentrations without compromising texture or shelf-life. This launch significantly impacts the market by enabling more efficient formulations, reducing production costs, and meeting consumer demand for potent, high-quality dietary supplements with clean-label profiles

- In September 2022, Kerry Group introduced Puremul, a new plant-based emulsifier and texture system intended to replace sunflower lecithin and mono-/diglycerides in dietary supplements and functional foods. The system allows manufacturers to develop natural, clean-label formulations that cater to allergen-free, vegan, and health-conscious consumers. By providing improved emulsification, solubility, and textural stability, this launch enhances product quality and shelf-life, supporting market expansion in the nutraceutical sector and addressing evolving consumer preferences

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Emulsifiers In Dietary Supplements Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Emulsifiers In Dietary Supplements Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Emulsifiers In Dietary Supplements Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.