Global Encapsulated Calcium Propionate Market

Market Size in USD Billion

CAGR :

%

USD

249.06 Billion

USD

402.99 Billion

2024

2032

USD

249.06 Billion

USD

402.99 Billion

2024

2032

| 2025 –2032 | |

| USD 249.06 Billion | |

| USD 402.99 Billion | |

|

|

|

|

Encapsulated Calcium Propionate Market Size

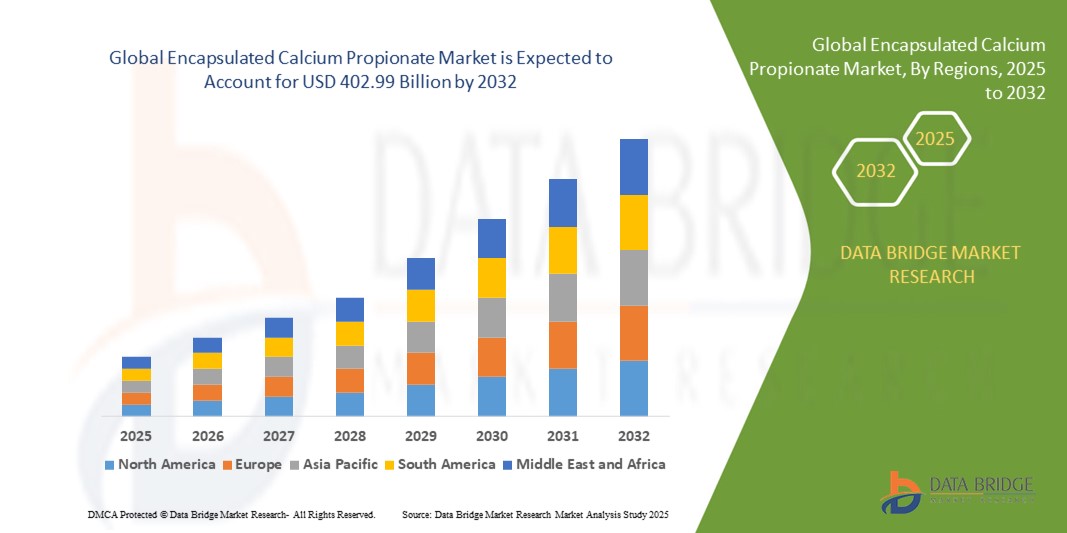

- The global encapsulated calcium propionate market size was valued at USD 249.06 billion in 2024 and is expected to reach USD 402.99 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is primarily driven by the increasing demand for extended shelf life in food products, rising awareness of food safety, and the growing use of natural preservatives in the food and feed industries

- Growing consumer preference for clean-label and natural food preservatives, along with increasing demand for animal feed additives, is further propelling the market for encapsulated calcium propionate across both food and feed applications

Encapsulated Calcium Propionate Market Analysis

- The encapsulated calcium propionate market is experiencing steady growth due to its widespread use as a safe and effective preservative in food and feed applications, ensuring prolonged shelf life and preventing microbial growth

- The rising demand from both the food & beverages and animal feed sectors is encouraging manufacturers to innovate with encapsulated forms that offer controlled release and enhanced stability

- Europe dominated the encapsulated calcium propionate market with the largest revenue share of 34.2% in 2024, driven by a well-established food processing industry and stringent regulations on food safety and preservation

- North America is expected to be the fastest-growing region during the forecast period, fueled by increasing consumer awareness of food safety, growing demand for processed and packaged foods, and the expansion of the animal feed industry in the U.S. and Canada

- The food grade segment dominated the largest market revenue share of 65.4% in 2024, driven by its widespread use in the food and beverage industry, particularly in bakery products. Food grade encapsulated calcium propionate is favored for its ability to extend shelf life by inhibiting mold and bacterial growth while maintaining product quality and safety

Report Scope and Encapsulated Calcium Propionate Market Segmentation

|

Attributes |

Encapsulated Calcium Propionate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Encapsulated Calcium Propionate Market Trends

Rising Demand for Clean-Label and Natural Preservatives

- The global encapsulated calcium propionate market is experiencing a significant trend toward the adoption of advanced encapsulation technologies to enhance product performance

- These technologies improve the controlled release and stability of calcium propionate, ensuring prolonged antimicrobial activity in food and feed applications

- Encapsulated calcium propionate allows for better integration into various food matrices, such as bakery and dairy products, without affecting taste, texture, or quality

- For instance, companies are developing innovative encapsulation methods, such as microencapsulation and nanoencapsulation, to optimize preservation efficacy and extend shelf life in packaged foods

- This trend enhances the appeal of encapsulated calcium propionate for both food and beverage manufacturers and feed producers, driving demand across diverse applications

- Advanced encapsulation techniques also enable precise delivery of calcium propionate, reducing waste and improving cost-efficiency in large-scale production environments

Encapsulated Calcium Propionate Market Dynamics

Driver

Growing Demand for Extended Shelf Life and Food Safety

- The global encapsulated calcium propionate market is experiencing a significant trend toward the adoption of advanced encapsulation technologies to enhance product performance

- These technologies improve the controlled release and stability of calcium propionate, ensuring prolonged antimicrobial activity in food and feed applications

- Encapsulated calcium propionate allows for better integration into various food matrices, such as bakery and dairy products, without affecting taste, texture, or quality

- For instance, companies are developing innovative encapsulation methods, such as microencapsulation and nanoencapsulation, to optimize preservation efficacy and extend shelf life in packaged foods

- This trend enhances the appeal of encapsulated calcium propionate for both food and beverage manufacturers and feed producers, driving demand across diverse applications

- Advanced encapsulation techniques also enable precise delivery of calcium propionate, reducing waste and improving cost-efficiency in large-scale production environments

Restraint/Challenge

Consumer Shift toward Natural Preservatives and Cost Constraints

- Rising consumer demand for processed and packaged foods with extended shelf life is a primary driver for the global encapsulated calcium propionate market

- Encapsulated calcium propionate enhances food safety by inhibiting mold and bacterial growth in products such as bread, cakes, dairy, and animal feed, ensuring longer freshness and quality

- Regulatory support for safe food preservatives, particularly in Europe with stringent food safety standards, is boosting the adoption of encapsulated calcium propionate

- The expansion of the global food and beverage industry, coupled with increasing meat consumption and livestock production, is driving demand for effective preservatives in feed applications

- Manufacturers are increasingly incorporating encapsulated calcium propionate as a standard preservative to meet consumer expectations for safe, high-quality, and long-lasting products

- The rise of urbanization and changing consumer lifestyles, particularly in North America, further accelerates the need for convenient, preserved food products

Encapsulated Calcium Propionate market Scope

The market is segmented on the basis of grade, form, and application.

- By Grade

On the basis of grade, the global encapsulated calcium propionate market is segmented into food grade and feed grade. The food grade segment dominated the largest market revenue share of 65.4% in 2024, driven by its widespread use in the food and beverage industry, particularly in bakery products. Food grade encapsulated calcium propionate is favored for its ability to extend shelf life by inhibiting mold and bacterial growth while maintaining product quality and safety. Its compliance with stringent food safety regulations, such as those set by the FDA and EFSA, and its alignment with consumer demand for clean-label preservatives, make it highly appealing to manufacturers. The encapsulation technology enhances controlled release, minimizing impact on taste and texture, which further boosts its adoption in food applications.

The feed grade segment is expected to register the fastest growth rate from 2025 to 2032, driven by the increasing demand for high-quality animal feed in livestock and aquaculture industries. Feed grade encapsulated calcium propionate prevents spoilage and maintains nutritional value, supporting animal health and productivity. The growing global demand for meat, dairy, and poultry products, coupled with rising livestock production, fuels the need for effective feed preservatives, positioning this segment for rapid expansion.

- By Form

On the basis of form, the global encapsulated calcium propionate market is categorized into powder and granular. The powder segment accounted for the highest revenue share in 2024, attributed to its ease of handling, superior solubility, and uniform dispersion in food and feed formulations. Powdered encapsulated calcium propionate is particularly preferred in bakery applications, where it seamlessly integrates into dry mixes, ensuring effective mold inhibition without compromising product quality. Its versatility and compatibility with existing production processes make it the preferred choice for manufacturers seeking efficient preservation solutions.

The granular segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by its increasing use in animal feed applications. Granular encapsulated calcium propionate offers controlled release and better mixing properties, making it ideal for feed formulations where prolonged shelf life and nutritional stability are critical. The growing adoption of granular forms in poultry, swine, and cattle feed, particularly in emerging markets, supports this segment’s rapid growth trajectory. Advancements in encapsulation technologies further enhance the efficacy and applicability of granular forms, driving their demand.

- By Application

On the basis of application, the global encapsulated calcium propionate market is segmented into food & beverages and feed. The food & beverages segment held the largest revenue share in 2024, driven by the surging demand for bakery products, dairy, and processed foods. Encapsulated calcium propionate plays a critical role in extending the shelf life of bread, pastries, cakes, and dairy products by preventing mold and bacterial growth, thereby reducing food waste and ensuring safety. The rise in consumer preference for convenient, ready-to-eat food products and the expansion of the global food and beverage industry, particularly in urban areas, amplify the demand for advanced preservation solutions such as encapsulated calcium propionate.

The feed segment is projected to grow at the fastest rate from 2025 to 2032, fueled by the increasing global demand for animal protein and the expansion of the livestock and aquaculture sectors. Encapsulated calcium propionate is widely used in animal feed to prevent spoilage, maintain nutritional quality, and enhance animal health, particularly in poultry, swine, and cattle. The rising focus on feed safety and the need to meet stringent regulatory standards in the feed industry drive the adoption of encapsulated calcium propionate. In addition, the growth of aquaculture in North America and other regions further accelerates this segment’s growth.

Encapsulated Calcium Propionate Market Regional Analysis

- Europe dominated the encapsulated calcium propionate market with the largest revenue share of 34.2% in 2024, driven by a well-established food processing industry and stringent regulations on food safety and preservation

- Consumers prioritize encapsulated calcium propionate for its ability to inhibit mold and bacteria growth, ensuring product freshness, particularly in bakery and feed applications across diverse markets

- Growth is supported by advancements in encapsulation technology, including improved stability and controlled release, alongside rising adoption in both food and beverage and animal feed segments

U.K. Encapsulated Calcium Propionate Market Insight

The U.K. market for encapsulated calcium propionate is expected to witness significant growth, driven by demand for enhanced food preservation and quality in urban and suburban settings. Increased interest in clean-label preservatives and rising awareness of microbial contamination prevention encourage adoption. Evolving food safety regulations influence consumer choices, balancing efficacy with compliance.

Germany Encapsulated Calcium Propionate Market Insight

Germany is expected to witness robust growth in the encapsulated calcium propionate market, attributed to its advanced food processing sector and high consumer focus on product safety and shelf-life extension. German consumers prefer technologically advanced encapsulated calcium propionate for its ability to maintain food freshness and support sustainable feed solutions. The integration of these products in premium food brands and animal feed supports sustained market growth.

U.S. Encapsulated Calcium Propionate Market Insight

The U.S. encapsulated calcium propionate market is expected to witness significant growth, fueled by strong demand in the food and beverage sector and growing consumer awareness of food safety and preservation benefits. The trend towards clean-label products and increasing regulations for food quality standards further boost market expansion. The integration of encapsulated calcium propionate in processed foods and animal feed complements aftermarket sales, creating a diverse product ecosystem.

Asia-Pacific Encapsulated Calcium Propionate Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding food and beverage production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of food safety, mold prevention, and feed quality is boosting demand. Government initiatives promoting food security and animal health further encourage the use of advanced encapsulated calcium propionate.

Japan Encapsulated Calcium Propionate Market Insight

Japan’s encapsulated calcium propionate market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced preservatives that enhance food safety and feed quality. The presence of major food manufacturers and integration of encapsulated calcium propionate in processed foods and animal feed accelerate market penetration. Rising interest in clean-label and sustainable products also contributes to growth.

China Encapsulated Calcium Propionate Market Insight

China holds the largest share of the Asia-Pacific encapsulated calcium propionate market, propelled by rapid urbanization, rising food consumption, and increasing demand for preservation solutions. The country’s growing middle class and focus on food safety support the adoption of advanced encapsulated calcium propionate. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Encapsulated Calcium Propionate Market Share

The encapsulated calcium propionate industry is primarily led by well-established companies, including:

- Glanbia plc (Ireland)

- Sudeep Nutrition (India)

- PHS Life Sciences (U.S.)

- Balchem Corp (U.S.)

- LloparTec (Spain)

- TasteTech (U.K.)

- Ingrizo NV (Belgium)

What are the Recent Developments in Global Encapsulated Calcium Propionate Market?

- In December 2024, Jainex Speciality Chemical introduced a new range of encapsulated calcium propionate specifically formulated for the bakery industry. Using proprietary encapsulation technology, the product enhances thermal stability and enables controlled release during baking. This innovation helps extend the shelf life of breads, cakes, and pastries by 30–50%, while preserving taste and texture. It also effectively inhibits mold and rope bacteria without disrupting yeast activity

- In August 2024, Manuchar, a global chemical distributor based in Belgium, announced the acquisition of Proquiel Químicos, a Chilean company specializing in chemical distribution across sectors such as mining, water treatment, and nutrition. This strategic move aims to broaden Manuchar’s product portfolio, which now includes calcium propionate, and strengthen its presence in Latin America. Proquiel’s diversified offerings and strong market position complement Manuchar’s growth strategy, particularly in human and animal nutrition. The acquisition is expected to close in Q4 2024, pending regulatory approval, and marks a significant step in consolidating the global chemical distribution landscape

- In January 2024, Perstorp, a leading producer of propionic acid—a key raw material for calcium propionate—announced a strategic collaboration with DSM to develop a bio-based production process for propionic acid. This partnership aims to reduce the environmental footprint of calcium propionate synthesis by shifting away from fossil-based inputs toward more sustainable, renewable alternatives. The initiative reflects growing industry demand for clean-label preservatives and green chemistry solutions in food and feed applications. By combining Perstorp’s chemical expertise with DSM’s biotechnology capabilities, the collaboration marks a significant step toward more eco-friendly food preservation technologies

- In January 2024, Fine Organics, a leading Indian manufacturer of specialty food additives, announced plans to expand its calcium propionate production facility in India. The initiative aims to increase manufacturing capacity by 20%, responding to rising regional demand for effective food preservatives in bakery and dairy applications. This expansion supports Fine Organics’ commitment to innovation and sustainability, ensuring consistent supply of high-quality calcium propionate while meeting evolving food safety standards. The move also aligns with broader industry trends favoring clean-label solutions and longer shelf-life technologies in processed foods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Encapsulated Calcium Propionate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Encapsulated Calcium Propionate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Encapsulated Calcium Propionate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.