Global Enclosed Motor Starter Market

Market Size in USD Billion

CAGR :

%

USD

1.87 Billion

USD

2.62 Billion

2024

2032

USD

1.87 Billion

USD

2.62 Billion

2024

2032

| 2025 –2032 | |

| USD 1.87 Billion | |

| USD 2.62 Billion | |

|

|

|

|

Enclosed Motor Starter Market Size

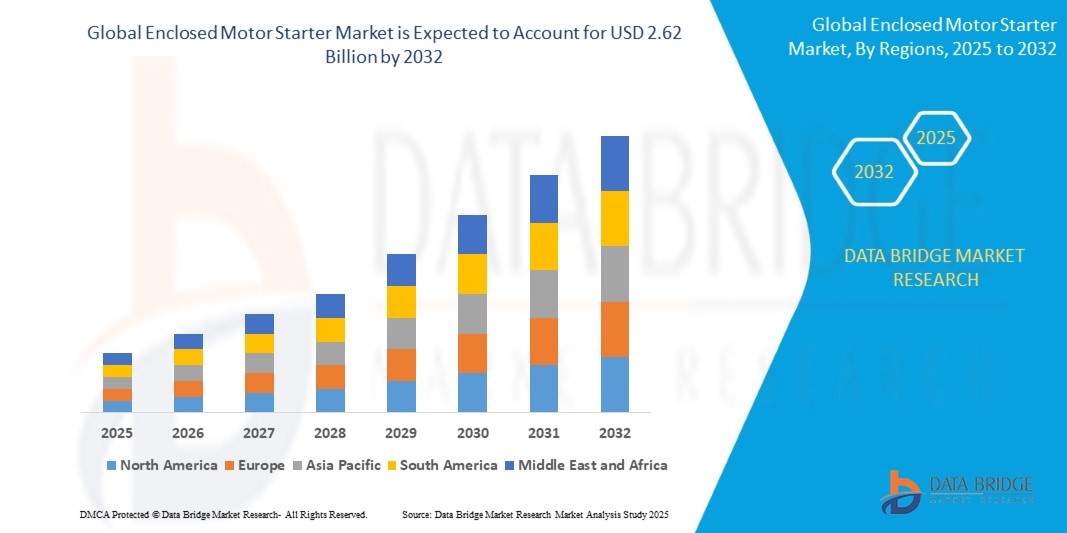

- The global enclosed motor starter market size was valued at USD 1.87 billion in 2024 and is expected to reach USD 2.62 billion by 2032, at a CAGR of 4.3% during the forecast period

- The market growth is largely fueled by the increasing adoption of automation and energy-efficient motor control systems across industrial and commercial sectors, driving demand for reliable enclosed motor starters

- Furthermore, rising focus on operational safety, reduction of equipment downtime, and compliance with stringent electrical and safety regulations is establishing enclosed motor starters as a critical solution for motor protection and control. These converging factors are accelerating the adoption of enclosed motor starters, thereby significantly boosting the industry’s growth

Enclosed Motor Starter Market Analysis

- Enclosed motor starters are electromechanical devices designed to control, start, and protect electric motors by providing overload, short-circuit, and phase-failure protection within a compact enclosure. These systems are widely deployed in industrial machinery, HVAC systems, water treatment plants, and commercial facilities, ensuring safe and efficient motor operation

- The escalating demand for enclosed motor starters is primarily driven by rapid industrialization, modernization of factories, growing implementation of automation technologies, and the need for energy-efficient solutions across various end-use industries

- North America dominated the enclosed motor starter market in 2024, due to advanced industrial infrastructure, high adoption of automation technologies, and strong demand for energy-efficient motor control solutions

- Asia-Pacific is expected to be the fastest growing region in the enclosed motor starter market during the forecast period due to rapid industrialization, urbanization, and increasing investments in manufacturing infrastructure in countries such as China, India, and Japan

- Industrial segment dominated the market with a market share of 68.8% in 2024, due to the widespread use of enclosed motor starters in manufacturing plants, process industries, and heavy machinery operations. Industrial facilities prioritize robust and reliable motor protection to prevent downtime, safeguard equipment, and ensure operational efficiency. The high demand is also supported by stringent safety regulations and the increasing adoption of automated production lines that require precise motor control solutions

Report Scope and Enclosed Motor Starter Market Segmentation

|

Attributes |

Enclosed Motor Starter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Enclosed Motor Starter Market Trends

Rising Technological Advancements

- Technological advancements are driving the enclosed motor starter market by improving energy efficiency, reliability, and control features. Integration of intelligent components and digital communication protocols in motor starters is enhancing system automation and diagnostics

- For instance, Siemens offers enclosed motor starters with embedded smart sensors and communication capabilities, enabling predictive maintenance and real-time operational monitoring across industrial settings

- The development of compact, modular starter designs allows for flexible installation in constrained spaces, supporting modern industrial automation and retrofitting initiatives

- Growth in variable frequency drives (VFDs) and soft starters integrated with enclosed motor starters provides precise motor control, reducing energy consumption and mechanical stress during operation

- In addition, advancements in materials and enclosure designs are improving starter durability and resistance to harsh environments such as dust, moisture, and corrosive atmospheres

- The adoption of IEC and NEMA standards ensures interoperability of enclosed motor starters across global markets, facilitating easier integration and maintenance. Increasing focus on customization and application-specific starter configurations supports diverse industry needs, from HVAC to water treatment and manufacturing

Enclosed Motor Starter Market Dynamics

Driver

Rise in Renewable Energy Projects

- The expansion of renewable energy installations worldwide creates strong demand for enclosed motor starters capable of reliable operation in solar, wind, and hydroelectric power generation sectors. These projects require durable and efficient motor control solutions to manage pumps, fans, and turbines

- For instance, ABB supplies enclosed motor starters to numerous wind farm projects, providing advanced motor control that supports efficient operation and longevity under variable load conditions in remote locations

- Growing investments in decentralized energy generation and smart grid development further drive demand, as renewable projects need robust motor control integrated with automated systems for optimal performance

- In addition, government incentives and regulatory mandates promoting renewable energy adoption increase deployment of control equipment including enclosed motor starters in new power infrastructures

- The rise of energy storage systems and related ancillary equipment creates additional motor control requirements, reinforcing market growth across the renewable energy value chain. Industrial sectors incorporating renewable energy sources into their energy mix demand compatible motor starters to ensure seamless integration and operational efficiency

Restraint/Challenge

Cost Constraints and Budget Considerations

- High upfront costs and budget limitations represent key restraints for the adoption of advanced enclosed motor starters, especially among small and medium enterprises and in developing regions

- For instance, manufacturers requiring starters from companies such as Schneider Electric have noted that premium features and integrated diagnostics come with price premiums that are not always feasible for limited capital expenditure projects

- The complexity of installing and configuring intelligent starters increases labor and commissioning costs, adding to initial investment concerns

- In addition, ongoing maintenance expenses and potential requirements for software updates or service contracts can strain operational budgets, particularly for smaller industrial users

- Variability in procurement cycles and budget allocations within industries impacts timely adoption of newer, more efficient enclosed motor starter technologies. Price sensitivity in emerging markets often drives preference toward low-cost, less-featured starter units, limiting the penetration of technologically advanced solutions

Enclosed Motor Starter Market Scope

The market is segmented on the basis of product type and application.

• By Product Type

On the basis of product type, the enclosed motor starter market is segmented into combination starters and non-combination starters. The combination starter segment dominated the largest market revenue share in 2024, driven by its integrated design that combines protection and control in a single unit. Industries often prefer combination starters for their ease of installation, compact form factor, and enhanced motor protection features including overload, short-circuit, and phase-failure safeguards. The segment’s dominance is further supported by the growing demand for reliable motor control solutions in heavy machinery and manufacturing units, where operational continuity and safety are critical. In addition, combination starters offer better scalability and compatibility with various motor types, enhancing their adoption across industrial setups.

The non-combination starter segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by increasing demand in customized motor control solutions and retrofit applications. Non-combination starters offer flexibility for users who prefer separate protective and control components, enabling tailored configurations for specific industrial and commercial operations. Rising awareness about energy efficiency and modular control systems is further accelerating the uptake of non-combination starters, particularly in small-to-medium enterprises and commercial facilities seeking cost-effective yet reliable motor control solutions.

• By Application

On the basis of application, the enclosed motor starter market is segmented into industrial and commercial. The industrial segment held the largest market revenue share of 68.8% in 2024, driven by the widespread use of enclosed motor starters in manufacturing plants, process industries, and heavy machinery operations. Industrial facilities prioritize robust and reliable motor protection to prevent downtime, safeguard equipment, and ensure operational efficiency. The high demand is also supported by stringent safety regulations and the increasing adoption of automated production lines that require precise motor control solutions.

The commercial segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising installation of motor-driven systems in commercial buildings, HVAC systems, water treatment plants, and small-scale facilities. Commercial operators increasingly prefer enclosed motor starters for their easy installation, low maintenance requirements, and seamless integration with building automation and energy management systems. The segment’s growth is further accelerated by the trend toward modernization of older commercial infrastructure and the push for energy-efficient electrical systems in urban developments.

Enclosed Motor Starter Market Regional Analysis

- North America dominated the enclosed motor starter market with the largest revenue share in 2024, driven by advanced industrial infrastructure, high adoption of automation technologies, and strong demand for energy-efficient motor control solutions

- Industries in the region prioritize reliable and safe motor operation, which boosts the adoption of enclosed motor starters in manufacturing plants, water treatment facilities, and heavy machinery operations

- The widespread uptake is further supported by stringent safety regulations, high technological awareness, and increasing focus on reducing downtime and operational costs, establishing enclosed motor starters as a preferred solution for industrial and commercial applications

U.S. Enclosed Motor Starter Market Insight

The U.S. enclosed motor starter market captured the largest revenue share in 2024 within North America, fueled by the rapid implementation of automation, smart motor control systems, and energy-efficient equipment. Industrial players are increasingly investing in motor protection solutions to ensure operational continuity and reduce maintenance costs. The integration of smart technologies, predictive maintenance, and IoT-enabled monitoring systems is further propelling market growth. Moreover, the U.S.’s robust industrial base, focus on sustainability, and high adoption of advanced manufacturing practices significantly contribute to the expansion of the enclosed motor starter market.

Europe Enclosed Motor Starter Market Insight

The Europe enclosed motor starter market is projected to grow steadily during the forecast period, driven by rising industrial automation, adoption of energy-efficient motors, and stringent electrical safety standards. Countries such as Germany, France, and Italy are increasingly investing in motor protection solutions to enhance industrial productivity and ensure regulatory compliance. The shift towards smart manufacturing, along with modernization of older factories, is boosting demand for reliable enclosed motor starters. Europe’s emphasis on sustainable energy practices and technological upgrades further strengthens market adoption across industrial and commercial applications.

Germany Enclosed Motor Starter Market Insight

Germany’s enclosed motor starter market is expected to expand at a considerable CAGR, fueled by well-developed industrial infrastructure, strong emphasis on innovation, and increasing awareness of energy-efficient solutions. Industrial players in Germany prioritize motor protection and reliability, leading to high adoption of enclosed motor starters in manufacturing, processing, and automation sectors. Integration with advanced control systems and predictive maintenance technologies is further accelerating market growth, aligning with Germany’s focus on sustainability and technological advancement.

Asia-Pacific Enclosed Motor Starter Market Insight

The Asia-Pacific enclosed motor starter market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, urbanization, and increasing investments in manufacturing infrastructure in countries such as China, India, and Japan. Rising demand for motor protection solutions, modernization of factories, and adoption of automation and smart manufacturing systems are key factors propelling market growth. The region’s cost-competitive manufacturing ecosystem, coupled with government initiatives promoting industrial efficiency, is further expanding the adoption of enclosed motor starters across industrial and commercial sectors.

China Enclosed Motor Starter Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by its booming manufacturing sector, rapid industrial growth, and high adoption of automation and energy-efficient systems. Enclosed motor starters are increasingly integrated into industrial facilities, commercial buildings, and manufacturing plants to enhance operational safety and efficiency. Government support for industrial modernization, coupled with the presence of domestic manufacturers and competitive pricing, is significantly contributing to the growth of the market in China.

Japan Enclosed Motor Starter Market Insight

Japan’s enclosed motor starter market is gaining traction due to advanced industrial infrastructure, high-tech manufacturing facilities, and increasing focus on predictive maintenance and operational efficiency. The market benefits from the integration of smart motor control systems and automation technologies in industrial and commercial applications. In addition, Japan’s commitment to energy efficiency and adoption of advanced manufacturing practices is further driving the adoption of enclosed motor starters.

Enclosed Motor Starter Market Share

The enclosed motor starter industry is primarily led by well-established companies, including:

- Siemens (Germany)

- Eaton (Ireland)

- Schneider Electric (France)

- Rockwell Automation (U.S.)

- ABB (Switzerland)

- Sprecher + Schuh (U.S.)

- Leviton (U.S.)

- Danfoss Drives (Denmark)

- MCI Controls Solutions (U.S.)

- WEG (Brazil)

- Franklin Electric (U.S.)

- Allied Power and Control (U.S.)

- C3controls (U.S.)

- Springer Controls (U.S.)

Latest Developments in Global Enclosed Motor Starter Market

- In April 2024, Regal Rexnord Corporation finalized the sale of its Industrial Motors and Generators business to WEG S.A. for $400 million. This strategic move allows WEG to expand its global footprint, integrating renowned brands such as Marathon, Cemp, and Rotor into its portfolio. The acquisition enhances WEG's capabilities in the electric motors and generators markets, positioning the company for increased growth and efficiency across multiple regions

- In September 2021, Danfoss introduced the VLT Soft Starter MCD 600, an advanced motor control system designed for fixed-speed applications. This compact and intelligent soft starter combines adaptive functionality with comprehensive motor protection, offering superior performance. Its flexibility is enhanced by a wide variety of Ethernet and serial-based communication option cards, application-dedicated smart cards, and support for multiple languages, making it a versatile choice for various industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Enclosed Motor Starter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Enclosed Motor Starter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Enclosed Motor Starter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.