Global Endocrine Disorders Market

Market Size in USD Billion

CAGR :

%

USD

12.73 Billion

USD

22.54 Billion

2024

2032

USD

12.73 Billion

USD

22.54 Billion

2024

2032

| 2025 –2032 | |

| USD 12.73 Billion | |

| USD 22.54 Billion | |

|

|

|

|

Endocrine Disorders Market Size

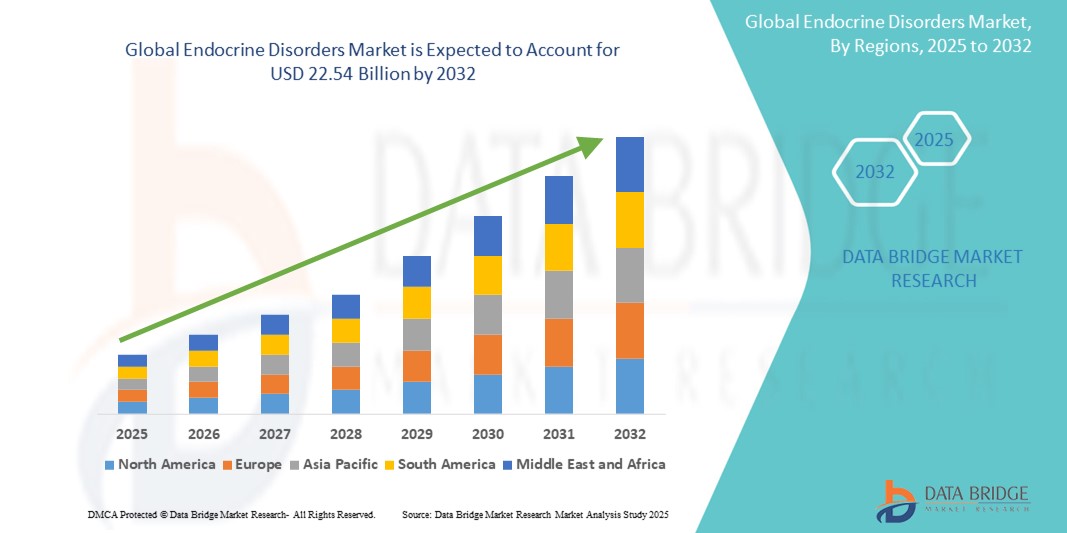

- The global endocrine disorders market size was valued at USD 12.73 billion in 2024 and is expected to reach USD 22.54 billion by 2032, at a CAGR of 7.40% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing smart locks as the modern access control system of choice. These converging factors are accelerating the uptake of Endocrine Disorders solutions, thereby significantly boosting the industry's growth

Endocrine Disorders Market Analysis

- Endocrine disorders, including diabetes, PCOS, and hormonal deficiencies, are increasingly being addressed with advanced therapeutic and diagnostic solutions due to rising global prevalence, growing health awareness, and technological progress in endocrinology care

- The escalating demand for endocrine disorder treatments is primarily fueled by increasing hormonal imbalances across populations, growing incidence of lifestyle-related conditions such as obesity and diabetes, and the surge in early screening and diagnosis owing to improved healthcare access and patient education

- North America dominated the endocrine disorders market with the largest revenue share of 41.8% in 2024, driven by robust healthcare infrastructure, high awareness levels, and a strong presence of major pharmaceutical companies. The U.S. leads the region, backed by early adoption of hormone therapies, continuous R&D investment, and growing patient preference for personalized medicine

- Asia-Pacific is expected to be the fastest-growing region with 12.4% CAGR in the endocrine disorders market during the forecast period, attributed to increasing urbanization, rising disposable incomes, growing awareness of endocrine health, and expansion of healthcare access in countries such as China and India

- Diabetes segment dominated the endocrine disorders market with a market share of 61.3% in 2024, owing to its high prevalence worldwide, increased screening rates, and strong product pipeline in insulin and non-insulin therapies. The demand is further propelled by innovations in glucose monitoring and digital health integration

Report Scope and Endocrine Disorders Market Segmentation

|

Attributes |

Endocrine Disorders Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Endocrine Disorders Market Trends

“Growing Technological Integration and Patient-Centric Solutions in Endocrine Disorders Management”

- A significant and accelerating trend in the global endocrine disorders market is the increasing convergence of digital health technologies and patient-centric care models aimed at improving disease monitoring, early diagnosis, and personalized treatment strategies. This advancement is streamlining how patients and healthcare providers interact and manage chronic endocrine conditions such as diabetes, thyroid dysfunction, and adrenal disorders

- For instance, digital health platforms such as Glooko and mySugr offer integrated solutions for diabetes management, allowing patients to track glucose levels, medication adherence, and diet through user-friendly mobile apps. These tools are often compatible with devices such as continuous glucose monitors (CGMs) and insulin pumps, enabling real-time data sharing with healthcare providers for timely interventions

- Integration with telehealth and remote monitoring systems has also enabled endocrinologists to remotely monitor hormonal levels and patient symptoms. This reduces the need for frequent clinic visits, especially for those in remote or underserved regions. Wearable health devices, including smartwatches and biosensors, are increasingly being used to track biometric indicators such as blood sugar levels, heart rate, and physical activity, further enhancing disease control

- These patient-centric tools empower individuals to take a more active role in managing their endocrine conditions. For instance, thyroid patients now have access to digital platforms that help track symptoms and medication side effects, while AI-powered algorithms support physicians in optimizing hormone replacement therapies based on patient-specific data.

- The integration of connected technologies into endocrine disorder management is not only enhancing clinical outcomes but also increasing treatment adherence and improving quality of life. Consequently, companies such as Medtronic, Dexcom, and Abbott are developing more advanced monitoring systems, while startups are innovating on mobile app solutions and connected platforms to address evolving patient needs

- The growing demand for accessible, intuitive, and technologically advanced solutions is transforming the endocrine care landscape, positioning digital integration as a core element of innovation in this expanding market

Endocrine Disorders Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Hormonal Imbalances and Advancements in Diagnostic Tools”

- The global rise in endocrine-related disorders, such as diabetes, thyroid dysfunction, adrenal and pituitary gland disorders, is a significant driver accelerating the demand for effective diagnostic and treatment solutions. With increasing awareness of hormonal health and its impact on overall well-being, the need for timely diagnosis and long-term management is becoming more critical than ever

- For instance, in March 2024, Ascendis Pharma A/S made notable progress with its TransCon technology platform aimed at treating rare endocrine diseases, signaling the industry's growing investment in advanced therapeutic options. This is further complemented by the development of combination therapies and long-acting hormone formulations by companies such as Eli Lilly and Novo Nordisk, which are reshaping the endocrine treatment landscape

- As patients and healthcare providers seek improved disease monitoring and tailored treatment plans, technological advancements in diagnostic tools, including point-of-care testing and continuous hormone monitoring systems, are supporting earlier intervention and better disease control. These innovations are particularly vital for chronic conditions such as diabetes and hypothyroidism, where continuous monitoring plays a key role in treatment success

- In addition, the increasing adoption of digital health platforms, such as mobile apps for tracking symptoms and medication adherence, is empowering patients to take a proactive approach in managing their endocrine health. The integration of these tools with telehealth services ensures accessible and efficient care, especially in underserved regions

- The growing burden of endocrine disorders across all age groups, combined with advancements in therapeutic options and diagnostics, is driving consistent market growth. Companies are increasingly focusing on patient-centric care, precision medicine, and long-term disease management strategies to address the complex nature of hormonal disorders

Restraint/Challenge

“Limited Access to Specialized Endocrine Care and High Treatment Costs”

- One of the major challenges limiting the growth of the endocrine disorders market is the limited availability of endocrinologists and specialized care in many regions, particularly in low- and middle-income countries. This often results in delayed diagnoses and suboptimal treatment, exacerbating the disease burden on patients

- Moreover, the high cost associated with diagnostic testing, hormone replacement therapies, and lifelong disease management can be a significant financial burden for patients. For instance, advanced biologics and hormone analogs used in treating conditions such as growth hormone deficiency or adrenal insufficiency can be prohibitively expensive for uninsured or underinsured populations

- While efforts are being made to expand insurance coverage and include endocrine therapies in national health plans, the cost barrier remains a concern in various healthcare systems. In addition, disparities in access to cutting-edge treatments and awareness campaigns further widen the gap in disease management outcomes across different demographic groups

- Addressing these challenges will require a multi-pronged approach that includes expanding healthcare infrastructure, incentivizing specialist training, increasing affordability through generic alternatives, and promoting early screening initiatives. As stakeholders collaborate to resolve these systemic issues, the potential for market expansion—particularly in emerging economies—remains significant

Endocrine Disorders Market Scope

The market is segmented on the basis of disease, drug class, route of administration, end-users, and distribution channel.

• By Disease

On the basis of disease, the endocrine disorders market is segmented into Addison’s Disease, Gigantism, Goiter, Cushing’s Syndrome, polycystic ovary syndrome (PCOS), diabetes, acromegaly, and others. The diabetes segment dominated the largest market revenue share of 61.3% in 2024, driven by its high global prevalence and continuous advancements in treatment and monitoring technologies.

The polycystic ovary syndrome (PCOS) segment is expected to register the fastest CAGR of 9.7% from 2025 to 2032, owing to increasing cases among women of reproductive age and rising awareness of hormonal health.

• By Drug Class

On the basis of drug class, the endocrine disorders market is segmented into estrogen, testosterone, and progesterone replacement therapy. Estrogen segment held the largest revenue share of 45.8% in 2024, supported by its extensive application in post-menopausal and hormonal imbalance conditions.

Testosterone segment is projected to expand at the fastest CAGR of 8.9% from 2025 to 2032, driven by rising diagnosis and treatment of testosterone deficiencies in aging men.

• By Route of Administration

On the basis of route of administration, the endocrine disorders market is segmented into oral and parenteral. The oral segment accounted for the largest revenue share of 68.5% in 2024, primarily due to high patient compliance and ease of administration.

The parenteral segment is anticipated to grow at the fastest CAGR of 7.8% from 2025 to 2032, with increased use in hospital settings and for long-acting therapies.

• By End-Users

On the basis of end-users, the endocrine disorders market is segmented into hospitals, homecare, specialty centres, and others. Hospitals dominated the market with a revenue share of 52.4% in 2024, owing to advanced treatment facilities and expert endocrine care.

Specialty centres are forecasted to grow at the highest CAGR of 8.6% from 2025 to 2032, fueled by increasing demand for outpatient care and targeted hormone therapy services.

• By Distribution Channel

On the basis of distribution channel, the endocrine disorders market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment captured the largest market share of 47.9% in 2024, due to its close association with hospital-based endocrine treatment and controlled prescription dispensing.

The online pharmacy segment is projected to register the highest CAGR of 10.3% from 2025 to 2032, supported by the rising popularity of e-commerce, convenience, and long-term medication subscriptions.

Endocrine Disorders Market Regional Analysis

- North America dominated the endocrine disorders market with the largest revenue share of 41.8% in 2024, driven by the rising prevalence of diabetes, thyroid disorders, and other hormonal imbalances, along with strong healthcare infrastructure and early access to innovative treatments

- The region's high healthcare spending, robust insurance coverage, and continuous advancements in hormone therapies contribute to greater diagnosis and treatment rates

- The presence of leading pharmaceutical companies and strong R&D investments further support the market's expansion, particularly across the U.S. and Canada

U.S. Endocrine Disorders Market Insight

The U.S. endocrine disorders market captured the largest share of 65% within North America in 2024, fueled by a high disease burden of conditions such as diabetes and PCOS, increased health awareness, and early adoption of advanced diagnostic and treatment options. Government initiatives to manage chronic endocrine conditions and a strong presence of specialty endocrinology clinics are enhancing treatment access. Moreover, the increasing availability of hormone replacement therapies (HRT) and advanced parenteral drug delivery methods further drive the market.

Europe Endocrine Disorders Market Insight

The Europe endocrine disorders market is projected to expand at a substantial CAGR during the forecast period, driven by heightened health consciousness, aging populations, and the demand for precision medicine in managing endocrine diseases. The region benefits from universal healthcare systems, advanced clinical research networks, and supportive reimbursement policies that promote early diagnosis and comprehensive disease management.

U.K. Endocrine Disorders Market Insight

The U.K. endocrine disorders market is anticipated to grow at a noteworthy CAGR, fueled by rising cases of thyroid disorders, PCOS, and diabetes. Public health campaigns focusing on women's reproductive health and metabolic conditions are enhancing patient awareness. In addition, the NHS’s emphasis on digital health solutions and telemedicine access for endocrinology consultations is improving patient outcomes and supporting market growth.

Germany Endocrine Disorders Market Insight

The Germany endocrine disorders market is expected to witness considerable growth, underpinned by a high prevalence of hormonal disorders and strong government funding for chronic disease management. Germany's well-developed healthcare infrastructure, combined with its emphasis on early detection and preventive care, is promoting the use of innovative hormone therapies, particularly in aging populations.

Asia-Pacific Endocrine Disorders Market Insight

The Asia-Pacific endocrine disorders market is poised to grow at the fastest CAGR of 12.4% from 2025 to 2032, driven by increasing urbanization, rising healthcare awareness, and improved access to endocrinology specialists. Countries such as India, China, and Japan are investing in expanding healthcare coverage, boosting early screening for diabetes and thyroid disorders, and launching awareness programs on PCOS and menopause management. The rise of private hospitals and telemedicine platforms is also making endocrine care more accessible in rural and underserved regions.

Japan Endocrine Disorders Market Insight

The Japan endocrine disorders market is growing steadily due to a rising geriatric population and high demand for hormone-related therapies. The country's commitment to personalized healthcare, combined with its well-established diagnostic systems and government backing for chronic disease prevention, continues to drive adoption of advanced treatments for conditions such as hypothyroidism and adrenal insufficiency.

China Endocrine Disorders Market Insight

The China endocrine disorders market accounted for the largest market revenue share in the Asia-Pacific region in 2024, owing to an increasing prevalence of diabetes, improved healthcare access, and government initiatives supporting chronic disease management. Rapid urbanization, a growing middle-class population, and expansion of specialty endocrinology clinics are further accelerating the demand for endocrine disorder treatments. Domestic pharmaceutical manufacturers are also investing heavily in developing cost-effective hormone therapies, fueling market growth.

Endocrine Disorders Market Share

The endocrine disorders industry is primarily led by well-established companies, including:

- Teva Pharmaceutical Industries Ltd. (Israel)

- Johnson & Johnson Services, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Lilly (U.S.)

- Merck & Co., Inc. (U.S.)

- Aurobindo Pharma Limited (India)

- Bristol-Myers Squibb Company (U.S.)

- GSK plc. (U.K.)

- Ascendis Pharma A/S (Denmark)

- Bio-Rad Laboratories, Inc. (U.S.)

Latest Developments in Global Endocrine Disorders Market

- In April 2024, Pfizer Inc. announced the launch of its next-generation hormone replacement therapy (HRT) for managing postmenopausal symptoms and osteoporosis associated with estrogen deficiency. The therapy integrates a novel delivery system to enhance hormone absorption and patient compliance, underscoring Pfizer’s commitment to advancing treatment options in the endocrine disorders landscape

- In March 2024, Eli Lilly and Company received FDA approval for its new long-acting GLP-1 receptor agonist aimed at improving glycemic control in patients with Type 2 diabetes. This milestone expands the company’s endocrinology portfolio and emphasizes its strategic focus on metabolic and endocrine health innovations

- In February 2024, Novartis AG announced positive Phase III trial results for its investigational therapy targeting acromegaly, a rare endocrine disorder. The new formulation demonstrated improved efficacy and safety over existing treatments, positioning Novartis to meet the growing demand for targeted endocrine therapeutics

- In January 2024, Abbott Laboratories introduced an upgraded version of its continuous glucose monitoring (CGM) system tailored for pediatric patients with diabetes. The launch addresses an underserved population within the endocrine disorders market and highlights Abbott's efforts in advancing pediatric endocrinology care through wearable technologies

- In December 2023, Sanofi entered into a strategic collaboration with a leading biotech firm to co-develop innovative gene therapies for congenital endocrine disorders such as congenital adrenal hyperplasia. This partnership reflects Sanofi’s ambition to explore curative approaches and expand its footprint in the rare endocrine disease segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ENDOCRINE DISORDERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ENDOCRINE DISORDERS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ENDOCRINE DISORDERS MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR GLOBAL ENDOCRINE DISORDERS MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL ENDOCRINE DISORDERS MARKET , BY DISORDER TYPE

16.1 OVERVIEW

16.2 DIABETES

16.2.1 TYPE 1 DIABETES

16.2.2 TYPE 2 DIABETES

16.2.3 GESTATIONAL DIABETES

16.2.4 PRE-DIABETES

16.3 THYROID DISORDERS

16.3.1 1.2.1 HYPOTHYROIDISM

16.3.2 1.2.2 HYPERTHYROIDISM

16.3.3 1.2.3 THYROID CANCER

16.3.4 1.2.4 THYROID NODULES

16.3.5 GOITER

16.4 ADRENAL DISORDERS

16.4.1 ADDISON'S DISEASE

16.4.2 CUSHING'S SYNDROME

16.4.3 ADRENAL INSUFFICIENCY

16.4.4 ADRENAL HYPERPLASIA

16.5 PITUITARY DISORDERS

16.5.1 PITUITARY TUMORS

16.5.2 HYPOPITUITARISM

16.5.3 HYPERPROLACTINEMIA

16.5.4 ACROMEGALY

16.6 PARATHYROID DISORDERS

16.6.1 HYPERPARATHYROIDISM

16.6.2 HYPOPARATHYROIDISM

16.6.3 PARATHYROID CANCER

16.7 OTHER

17 GLOBAL ENDOCRINE DISORDERS MARKET , BY TREATMENT TYPE

17.1 OVERVIEW

17.2 DRUG THERAPY

17.2.1 BY TYPE

17.2.1.1. HORMONE REPLACEMENT THERAPY (HRT)

17.2.1.1.1. ESTROGEN

17.2.1.1.2. TESTOSTERONE

17.2.1.1.3. GROWTH HORMONE

17.2.1.1.4. PROGESTERONE REPLACEMENT

17.2.1.1.5. OTHERS

17.2.1.2. INSULIN THERAPY

17.2.1.2.1. RAPID-ACTING INSULIN

17.2.1.2.2. LONG-ACTING INSULIN

17.2.1.2.3. INTERMEDIATE-ACTING INSULIN

17.2.1.3. CORTICOSTEROIDS

17.2.1.4. ANTI-THYROID MEDICATIONS

17.2.1.5. HYPOGLYCEMICS

17.2.1.6. OTHERS

17.2.2 BY ROUTE OF ADMINISTRATION

17.2.2.1. ORAL

17.2.2.2. PARENTERAL

17.2.2.3. OTHERS

17.2.3 BY DRUG CLASS

17.2.3.1. BRANDED

17.2.3.2. GENERIC

17.3 SURGERY

17.3.1 THYROIDECTOMY

17.3.1.1. PARTIAL THYROIDECTOMY

17.3.1.2. TOTAL THYROIDECTOMY

17.3.2 ADRENALECTOMY

17.3.2.1. LAPAROSCOPIC ADRENALECTOMY

17.3.2.2. OPEN ADRENALECTOMY

17.3.3 PARATHYROIDECTOMY

17.3.4 PITUITARY SURGERY

17.3.4.1. TRANSSPHENOIDAL SURGERY

17.3.4.2. CRANIOTOMY

17.4 RADIOTHERAPY

17.4.1 RADIOACTIVE IODINE THERAPY

17.4.2 STEREOTACTIC RADIOSURGERY

17.5 OTHERS

18 GLOBAL ENDOCRINE DISORDERS MARKET , BY DIAGNOSTIC TYPE

18.1 OVERVIEW

18.2 BLOOD TESTS

18.2.1 HORMONE LEVEL TESTS

18.2.2 GLUCOSE TESTS

18.2.3 ANTIBODY TESTS

18.2.4 GENETIC TESTING

18.3 IMAGING TESTS

18.3.1 ULTRASOUND

18.3.1.1. HYPOTHYROIDISM THYROID ULTRASOUND

18.3.1.2. ADRENAL GLAND ULTRASOUND

18.3.2 MRI

18.3.3 CT SCAN

18.3.4 OTHERS

18.4 BIOPSY

18.4.1 CORE NEEDLE BIOPSY

18.4.2 FINE NEEDLE ASPIRATION BIOPSY (FNAB)

18.5 FUNCTIONAL TESTS

18.6 OTHERS

19 GLOBAL ENDOCRINE DISORDERS MARKET , BY PATIENT AGE GROUP

19.1 OVERVIEW

19.2 PEDIATRICS

19.3 ADULTS

19.4 GERIARTIC

20 GLOBAL ENDOCRINE DISORDERS MARKET , BY END USER

20.1 OVERVIEW

20.2 HOSPITALS

20.3 SPECIALITY CLINICS

20.4 HOMECARE

20.5 ACADEMIC AND RESEARCH INSTITUTES

20.6 OTHERS

21 GLOBAL ENDOCRINE DISORDERS MARKET , BY DISTRIBUTION CHANNEL

21.1 OVERVIEW

21.2 DIRECT TENDERS

21.3 RETAIL SALES

21.3.1 OFFLINE PHARMACIES

21.3.2 ONLINE PHARMACIES

21.4 OTHERS

22 GLOBAL ENDOCRINE DISORDERS MARKET , BY GEOGRAPHY

GLOBAL ENDOCRINE DISORDERS MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1 NORTH AMERICA

22.1.1 U.S.

22.1.2 CANADA

22.1.3 MEXICO

22.2 EUROPE

22.2.1 GERMANY

22.2.2 FRANCE

22.2.3 U.K.

22.2.4 ITALY

22.2.5 SPAIN

22.2.6 RUSSIA

22.2.7 TURKEY

22.2.8 BELGIUM

22.2.9 NETHERLANDS

22.2.10 SWITZERLAND

22.2.11 REST OF EUROPE

22.3 ASIA-PACIFIC

22.3.1 JAPAN

22.3.2 CHINA

22.3.3 SOUTH KOREA

22.3.4 INDIA

22.3.5 AUSTRALIA

22.3.6 SINGAPORE

22.3.7 THAILAND

22.3.8 MALAYSIA

22.3.9 INDONESIA

22.3.10 PHILIPPINES

22.3.11 REST OF ASIA-PACIFIC

22.4 SOUTH AMERICA

22.4.1 BRAZIL

22.4.2 ARGENTINA

22.4.3 PERU

22.4.4 CHILE

22.4.5 COLOMBIA

22.4.6 VENEZUELA

22.4.7 REST OF SOUTH AMERICA

22.5 MIDDLE EAST AND AFRICA

22.5.1 SOUTH AFRICA

22.5.2 SAUDI ARABIA

22.5.3 UAE

22.5.4 EGYPT

22.5.5 ISRAEL

22.5.6 REST OF MIDDLE EAST AND AFRICA

22.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

23 GLOBAL ENDOCRINE DISORDERS MARKET , COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: GLOBAL

23.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.3 COMPANY SHARE ANALYSIS: EUROPE

23.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.5 MERGERS & ACQUISITIONS

23.6 NEW PRODUCT DEVELOPMENT & APPROVALS

23.7 EXPANSIONS

23.8 REGULATORY CHANGES

23.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 GLOBAL ENDOCRINE DISORDERS MARKET , SWOT AND DBMR ANALYSIS

25 GLOBAL ENDOCRINE DISORDERS MARKET , COMPANY PROFILE

25.1 NOVO NORDISK

25.1.1 COMPANY OVERVIEW

25.1.2 REVENUE ANALYSIS

25.1.3 GEOGRAPHIC PRESENCE

25.1.4 PRODUCT PORTFOLIO

25.1.5 RECENT DEVELOPMENTS

25.2 SANOFI

25.2.1 COMPANY OVERVIEW

25.2.2 REVENUE ANALYSIS

25.2.3 GEOGRAPHIC PRESENCE

25.2.4 PRODUCT PORTFOLIO

25.2.5 RECENT DEVELOPMENTS

25.3 ABBVIE

25.3.1 COMPANY OVERVIEW

25.3.2 REVENUE ANALYSIS

25.3.3 GEOGRAPHIC PRESENCE

25.3.4 PRODUCT PORTFOLIO

25.3.5 RECENT DEVELOPMENTS

25.4 MERCK & CO., INC.

25.4.1 COMPANY OVERVIEW

25.4.2 REVENUE ANALYSIS

25.4.3 GEOGRAPHIC PRESENCE

25.4.4 PRODUCT PORTFOLIO

25.4.5 RECENT DEVELOPMENTS

25.5 PFIZER

25.5.1 COMPANY OVERVIEW

25.5.2 REVENUE ANALYSIS

25.5.3 GEOGRAPHIC PRESENCE

25.5.4 PRODUCT PORTFOLIO

25.5.5 RECENT DEVELOPMENTS

25.6 BOEHRINGER INGELHEIM

25.6.1 COMPANY OVERVIEW

25.6.2 REVENUE ANALYSIS

25.6.3 GEOGRAPHIC PRESENCE

25.6.4 PRODUCT PORTFOLIO

25.6.5 RECENT DEVELOPMENTS

25.7 ROCHE

25.7.1 COMPANY OVERVIEW

25.7.2 REVENUE ANALYSIS

25.7.3 GEOGRAPHIC PRESENCE

25.7.4 PRODUCT PORTFOLIO

25.7.5 RECENT DEVELOPMENTS

25.8 NOVARTIS

25.8.1 COMPANY OVERVIEW

25.8.2 REVENUE ANALYSIS

25.8.3 GEOGRAPHIC PRESENCE

25.8.4 PRODUCT PORTFOLIO

25.8.5 RECENT DEVELOPMENTS

25.9 ABBOTT LABORATORIES

25.9.1 COMPANY OVERVIEW

25.9.2 REVENUE ANALYSIS

25.9.3 GEOGRAPHIC PRESENCE

25.9.4 PRODUCT PORTFOLIO

25.9.5 RECENT DEVELOPEMENTS

25.1 BRISTOL-MYERS SQUIBB

25.10.1 COMPANY OVERVIEW

25.10.2 REVENUE ANALYSIS

25.10.3 GEOGRAPHIC PRESENCE

25.10.4 PRODUCT PORTFOLIO

25.10.5 RECENT DEVELOPMENTS

25.11 FRESENIUS KABI

25.11.1 COMPANY OVERVIEW

25.11.2 REVENUE ANALYSIS

25.11.3 GEOGRAPHIC PRESENCE

25.11.4 PRODUCT PORTFOLIO

25.11.5 RECENT DEVELOPMENTS

25.12 IPSEN

25.12.1 COMPANY OVERVIEW

25.12.2 REVENUE ANALYSIS

25.12.3 GEOGRAPHIC PRESENCE

25.12.4 PRODUCT PORTFOLIO

25.12.5 RECENT DEVELOPMENTS

25.13 HORIZON THERAPEUTICS

25.13.1 COMPANY OVERVIEW

25.13.2 REVENUE ANALYSIS

25.13.3 GEOGRAPHIC PRESENCE

25.13.4 PRODUCT PORTFOLIO

25.13.5 RECENT DEVELOPMENTS

25.14 TAKEDA PHARMACEUTICAL COMPANY

25.14.1 COMPANY OVERVIEW

25.14.2 REVENUE ANALYSIS

25.14.3 GEOGRAPHIC PRESENCE

25.14.4 PRODUCT PORTFOLIO

25.14.5 RECENT DEVELOPMENTS

25.15 ASCENDIS PHARMA A/S

25.15.1 COMPANY OVERVIEW

25.15.2 REVENUE ANALYSIS

25.15.3 GEOGRAPHIC PRESENCE

25.15.4 PRODUCT PORTFOLIO

25.15.5 RECENT DEVELOPMENTS

25.16 BIO-RAD LABORATORIES, INC.

25.16.1 COMPANY OVERVIEW

25.16.2 REVENUE ANALYSIS

25.16.3 GEOGRAPHIC PRESENCE

25.16.4 PRODUCT PORTFOLIO

25.16.5 RECENT DEVELOPMENTS

25.17 AUROBINDO PHARMA

25.17.1 COMPANY OVERVIEW

25.17.2 REVENUE ANALYSIS

25.17.3 GEOGRAPHIC PRESENCE

25.17.4 PRODUCT PORTFOLIO

25.17.5 RECENT DEVELOPMENTS

25.18 JOHNSON & JOHNSON SERVICES, INC.

25.18.1 COMPANY OVERVIEW

25.18.2 REVENUE ANALYSIS

25.18.3 GEOGRAPHIC PRESENCE

25.18.4 PRODUCT PORTFOLIO

25.18.5 RECENT DEVELOPMENTS

25.19 ENDO INTERNATIONAL

25.19.1 COMPANY OVERVIEW

25.19.2 REVENUE ANALYSIS

25.19.3 GEOGRAPHIC PRESENCE

25.19.4 PRODUCT PORTFOLIO

25.19.5 RECENT DEVELOPMENTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.