Global Endoscopic Camera Market

Market Size in USD Billion

CAGR :

%

USD

2.47 Billion

USD

3.82 Billion

2024

2032

USD

2.47 Billion

USD

3.82 Billion

2024

2032

| 2025 –2032 | |

| USD 2.47 Billion | |

| USD 3.82 Billion | |

|

|

|

|

Endoscopic Camera Market Size

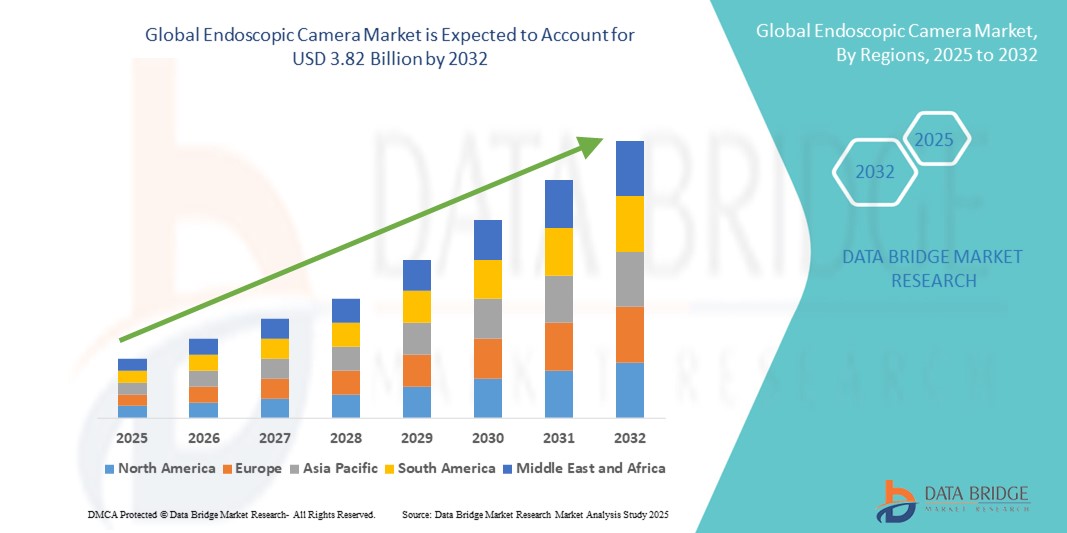

- The global endoscopic camera market size was valued at USD 2.47 billion in 2024 and is expected to reach USD 3.82 billion by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is primarily driven by the increasing adoption of minimally invasive surgeries, technological advancements in imaging systems, and the integration of high-definition and 3D visualization technologies in endoscopic procedures

- Moreover, the rising prevalence of chronic diseases, growing demand for precise diagnostics, and the need for enhanced surgical efficiency are positioning endoscopic cameras as essential tools in modern healthcare. These factors collectively are propelling the adoption of endoscopic camera systems, thereby strongly supporting the market’s expansion

Endoscopic Camera Market Analysis

- Endoscopic cameras, providing high-resolution visualization for minimally invasive surgeries, are becoming indispensable components in modern surgical and diagnostic settings due to their enhanced imaging quality, precision, and compatibility with advanced surgical systems

- The increasing prevalence of chronic diseases, rising adoption of minimally invasive procedures, and technological advancements in imaging systems are driving the demand for endoscopic cameras across hospitals and surgical centers

- North America dominated the endoscopic camera market with the largest revenue share of 39.4% in 2024, supported by advanced healthcare infrastructure, early adoption of minimally invasive surgeries, and the presence of leading medical device manufacturers, with the U.S. witnessing significant growth in endoscopic camera installations, particularly in hospitals and ambulatory surgical centers, fueled by innovations in high-definition and 3D imaging technologies

- Asia-Pacific is expected to be the fastest growing region in the endoscopic camera market during the forecast period due to increasing healthcare expenditure, rising number of surgical procedures, and expanding hospital infrastructure in countries such as China and India

- Complementary Metal Oxide Semiconductor (CMOS), sensors dominated the endoscopic camera market with a market share of 55.5% in 2024, driven by superior image quality, compact design, low power consumption, and growing preference among surgeons for advanced visualization in minimally invasive procedures

Report Scope and Endoscopic Camera Market Segmentation

|

Attributes |

Endoscopic Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Endoscopic Camera Market Trends

Enhanced Imaging and AI-Assisted Visualization

- A significant trend in the global endoscopic camera market is the increasing integration of advanced imaging technologies with artificial intelligence (AI) to enhance visualization, precision, and diagnostic accuracy during minimally invasive procedures

- For instance, systems such as the Olympus VISERA 4K UHD integrate high-definition imaging with AI-assisted tissue recognition, allowing surgeons to detect abnormalities in real time. Similarly, KARL STORZ IMAGE1 S provides modular visualization solutions that combine 3D imaging with advanced software analytics for better intraoperative guidance

- AI-enabled endoscopic cameras offer features such as automated lesion detection, improved image clarity, and predictive analytics to support surgical decision-making. Some systems can also track procedural patterns to optimize workflow efficiency and alert surgeons to potential complications

- The seamless integration of endoscopic cameras with broader surgical platforms facilitates centralized control over imaging, documentation, and analysis. Surgeons can manage multiple visualization devices through a single interface, creating a more efficient and coordinated operating environment

- This trend towards smarter, AI-assisted, and interconnected visualization systems is reshaping expectations for surgical precision and patient outcomes. Consequently, companies such as Medtronic and Stryker are developing AI-enabled endoscopic cameras with features such as automated tissue recognition and enhanced 3D imaging

- The demand for AI-integrated endoscopic cameras is growing rapidly across hospitals and ambulatory surgical centers, as healthcare providers increasingly prioritize precision, procedural efficiency, and improved patient outcomes

Endoscopic Camera Market Dynamics

Driver

Rising Demand Due to Minimally Invasive Surgeries and Technological Advancements

- The growing adoption of minimally invasive surgical procedures, coupled with advancements in high-definition and 3D imaging, is a major driver of endoscopic camera demand

- For instance, in March 2024, Olympus launched its next-generation ENDOEYE 4K Ultra HD camera system, enhancing visualization during complex laparoscopic and arthroscopic surgeries. Such innovations by leading manufacturers are expected to propel market growth in the forecast period

- The increasing prevalence of chronic diseases and rising surgical volumes are boosting demand for precise imaging solutions that reduce procedure times and improve outcomes

- Hospitals and surgical centers are increasingly seeking integrated endoscopic solutions that allow seamless connectivity with other operating room equipment, enabling efficient workflow management

- The growing preference for minimally invasive procedures among patients, combined with the need for real-time monitoring and documentation, is encouraging healthcare facilities to invest in advanced endoscopic camera systems

Restraint/Challenge

High Cost and Technical Complexity

- The high initial cost of advanced endoscopic camera systems, including 4K and 3D imaging technologies, can be a barrier to adoption, particularly in emerging markets or smaller healthcare facilities

- In addition, the complexity of integrating AI-assisted imaging and maintaining high-resolution cameras requires trained personnel and ongoing technical support, which can increase operational challenges

- For instance, in 2023, a report highlighted that several mid-sized hospitals in Latin America delayed upgrading to 4K endoscopic systems due to budget constraints and lack of trained staff to manage AI-integrated devices

- Hospitals must invest in regular maintenance, software updates, and staff training to fully leverage the benefits of these advanced systems, which may deter some facilities from upgrading their existing equipment

- While manufacturers such as Stryker and Medtronic are developing user-friendly interfaces and modular solutions, the perceived complexity and investment required for advanced systems continue to limit penetration in cost-sensitive regions

- Overcoming these challenges through more affordable, modular, and easy-to-use solutions, along with targeted training programs for healthcare professionals, will be critical for sustained market growth

Endoscopic Camera Market Scope

The market is segmented on the basis of product type, sensor type, hygiene, application, and end-user.

- By Product Type

On the basis of product type, the endoscopic camera market is segmented into endoscope, endoscopic mechanical equipment, visualization & documentation systems, accessories, and others. The endoscope segment dominated the market with the largest revenue share of 48% in 2024, driven by its wide application across multiple minimally invasive procedures such as laparoscopy, arthroscopy, and gastrointestinal endoscopy. Endoscopes are preferred for their superior imaging capabilities, ergonomic designs, and compatibility with advanced visualization systems. Hospitals and surgical centers rely on endoscopes for precise diagnostics and enhanced procedural outcomes, contributing to sustained demand. The increasing number of minimally invasive procedures globally and continuous technological advancements are further boosting the adoption of endoscopes in both established and emerging healthcare markets.

The visualization & documentation systems segment is anticipated to witness the fastest growth from 2025 to 2032 due to increasing adoption of high-definition (HD) and 4K imaging, coupled with the rising need for surgical documentation, telemedicine integration, and educational applications. These systems enable real-time recording, remote collaboration, and AI-assisted analytics, making them increasingly essential in modern operating rooms. In addition, growing demand for digital record-keeping and cloud-based storage solutions in hospitals is further accelerating market expansion for this segment.

- By Sensor Type

On the basis of sensor type, the endoscopic camera market is segmented into CMOS (Complementary Metal Oxide Semiconductor) and CCD (Charge-Coupled Device). The CMOS segment dominated with a market share of 55.5% in 2024, attributed to its high image quality, low power consumption, compact design, and growing adoption in advanced endoscopic cameras. CMOS sensors are widely used in minimally invasive surgeries requiring precise visualization and reliable performance. Moreover, their compatibility with AI-assisted imaging systems and integration with 4K and 3D technologies makes CMOS sensors a preferred choice among surgeons. Hospitals and surgical centers increasingly rely on CMOS-based systems for improved workflow efficiency and better patient outcomes.

The CCD segment is expected to witness the fastest growth during the forecast period due to its superior light sensitivity and lower noise levels, making it suitable for complex procedures such as neuroendoscopy and urology endoscopy, where enhanced image clarity is critical for accurate diagnostics and surgical safety. Rising investments in research and development to improve CCD performance and affordability are also contributing to growth. Efforts to reduce manufacturing costs are also making CCD-based cameras increasingly affordable for hospitals and clinics. The combination of technical superiority and improving accessibility is driving rapid adoption of CCD sensors in endoscopic imaging.

- By Hygiene

On the basis of hygiene, the endoscopic camera market is segmented into single-use, reprocessing, and sterilization. The reprocessing segment dominated with a share of 62% in 2024, as hospitals prefer reusable endoscopic cameras for cost efficiency, standard sterilization protocols, and multi-procedure compatibility. Reprocessing allows healthcare facilities to maximize utilization while maintaining strict hygiene standards. Large hospitals and surgical centers benefit from reduced long-term operational costs through reprocessed systems, further reinforcing dominance. The segment is also supported by stringent regulatory guidelines requiring proper sterilization for patient safety.

The single-use segment is projected to witness the fastest growth during forecast period, due to increasing concerns regarding cross-contamination and hospital-acquired infections. Disposable endoscopes reduce infection risks, eliminate the need for extensive cleaning, and are particularly gaining traction in outpatient settings and emerging markets. Rising awareness about patient safety, coupled with supportive reimbursement policies in some regions, is further propelling the adoption of single-use devices.

- By Application

On the basis of application, the endoscopic camera market is segmented into bronchoscopy, arthroscopy, laparoscopy, urology endoscopy, neuroendoscopy, gastrointestinal endoscopy, gynecology endoscopy, ENT endoscopy, and others. The laparoscopy segment dominated with a market share of 41% in 2024, driven by the high adoption of minimally invasive abdominal surgeries, faster patient recovery, and growing preference among surgeons for advanced imaging solutions. Increasing demand for outpatient surgical procedures, better clinical outcomes, and technological enhancements in imaging systems are further boosting the segment.

The urology endoscopy segment is expected to witness the fastest growth during forecast period, due to the rising prevalence of urological disorders, increasing outpatient procedures, and the adoption of AI-assisted imaging technologies for improved precision in procedures such as ureteroscopy and cystoscopy. Advances in instrument miniaturization and better patient comfort during procedures are also contributing to this growth. Improved patient comfort and reduced recovery times are further encouraging the use of endoscopic procedures in urology. Collectively, these factors are accelerating the growth of the urology endoscopy segment in both developed and emerging markets.

- By End-User

On the basis of end-user, the endoscopic camera market is segmented into hospitals, ambulatory surgery centers & clinics, and others. The hospitals segment dominated with a market share of 57% in 2024, supported by large patient volumes, well-equipped surgical infrastructure, and higher budgets for adopting advanced endoscopic camera systems. Hospitals also have dedicated surgical teams and specialized operating rooms that facilitate the use of sophisticated imaging systems. The continuous increase in chronic diseases and surgical procedures further strengthens the demand in hospital settings.

The ambulatory surgery centers & clinics segment is expected to witness the fastest growth during forecast period, due to the increasing number of outpatient minimally invasive procedures, cost-effectiveness of these facilities, and rising investments in compact endoscopic systems suitable for smaller clinical settings. The convenience of outpatient procedures and growing awareness of minimally invasive surgeries among patients are driving this trend. Emerging markets and private clinics are also adopting portable endoscopic cameras, further fueling growth.

Endoscopic Camera Market Regional Analysis

- North America dominated the endoscopic camera market with the largest revenue share of 39.4% in 2024, supported by advanced healthcare infrastructure, early adoption of minimally invasive surgeries, and the presence of leading medical device manufacturers

- Healthcare providers in the region increasingly prioritize high-definition imaging, AI-assisted visualization, and integrated surgical systems to improve procedural accuracy and patient outcomes

- The widespread adoption is further supported by high healthcare expenditure, well-established hospitals and surgical centers, and the presence of key market players such as Olympus, Stryker, and Medtronic. Advanced training programs and skilled surgical teams also contribute to the region’s leading position in endoscopic camera usage

U.S. Endoscopic Camera Market Insight

The U.S. endoscopic camera market captured the largest revenue share of 82% in North America in 2024, driven by the high adoption of minimally invasive surgeries and advanced surgical technologies. Hospitals and ambulatory surgical centers are increasingly investing in high-definition (HD) and 4K endoscopic cameras to improve procedural precision and patient outcomes. The growing integration of AI-assisted imaging systems, coupled with the demand for real-time documentation and telemedicine support, is further propelling market growth. In addition, the U.S. has a strong presence of leading endoscopic camera manufacturers, which contributes to continuous technological innovations and widespread adoption.

Europe Endoscopic Camera Market Insight

The Europe endoscopic camera market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of chronic diseases and increasing demand for minimally invasive procedures. Stringent healthcare regulations and the focus on improving surgical outcomes are fostering the adoption of advanced imaging systems. The market is witnessing significant growth across hospitals, clinics, and ambulatory surgical centers, with endoscopic cameras being incorporated into both new healthcare facilities and modernization projects of existing setups.

U.K. Endoscopic Camera Market Insight

The U.K. endoscopic camera market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing awareness of advanced surgical procedures and rising patient preference for minimally invasive surgeries. Hospitals and surgical centers are adopting high-definition and 3D imaging technologies to improve precision and reduce recovery times. In addition, government initiatives to modernize healthcare infrastructure and support for digital health solutions are encouraging the adoption of AI-assisted and high-resolution endoscopic camera systems.

Germany Endoscopic Camera Market Insight

The Germany endoscopic camera market is expected to expand at a considerable CAGR during the forecast period, supported by well-established healthcare infrastructure and a focus on innovative medical technologies. The growing demand for precise diagnostics and minimally invasive surgical procedures is driving adoption across hospitals and specialized surgical centers. Integration of endoscopic cameras with AI-assisted visualization and surgical navigation systems is becoming increasingly prevalent, particularly in tertiary care hospitals and research-focused medical institutions.

Asia-Pacific Endoscopic Camera Market Insight

The Asia-Pacific endoscopic camera market is poised to grow at the fastest CAGR during the forecast period, driven by rising healthcare expenditure, increasing surgical volumes, and growing awareness of minimally invasive procedures in countries such as China, Japan, and India. Expansion of hospital infrastructure, government initiatives promoting advanced healthcare technologies, and the increasing number of outpatient surgical procedures are accelerating market adoption. The region’s emerging medical device manufacturing capabilities also improve accessibility and affordability of advanced endoscopic camera systems.

Japan Endoscopic Camera Market Insight

The Japan endoscopic camera market is witnessing significant growth due to high adoption of advanced surgical technologies, increasing number of minimally invasive procedures, and focus on improving surgical outcomes. Hospitals and specialized clinics are increasingly integrating endoscopic cameras with AI-assisted imaging and robotic-assisted systems. In addition, the country’s aging population and demand for precise, safe surgical interventions are further driving adoption in both hospitals and outpatient centers.

India Endoscopic Camera Market Insight

The India endoscopic camera market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising healthcare infrastructure, and increasing preference for minimally invasive procedures. The growing number of hospitals, ambulatory surgical centers, and specialized clinics is boosting demand for high-definition and AI-enabled endoscopic cameras. Government initiatives for healthcare modernization and the rising adoption of cost-effective medical technologies are key factors propelling the market in India.

Endoscopic Camera Market Share

The Endoscopic Camera industry is primarily led by well-established companies, including:

- FUJIFILM Holdings Corporation (Japan)

- Stryker (U.S.)

- Olympus Corporation (Japan)

- Hoya Corporation (Japan)

- Smith + Nephew (U.K.)

- Arthrex Inc. (U.S.)

- KARL STORZ (Germany)

- Conmed Corporation (U.S.)

- Richard Wolf GmbH (Germany)

- Ackermann Instrumente GmbH (Germany)

- Henke-Sass Wolf GmbH (Germany)

- XION (Germany)

- Cogentix Medical Inc. (U.S.)

What are the Recent Developments in Global Endoscopic Camera Market?

- In July 2025, researchers developed a prototype LED-based imaging system that could significantly improve the detection of cancerous tissues during endoscopic procedures. By combining light-emitting diodes with hyperspectral imaging technology, the system creates detailed maps of tissue properties, potentially enabling earlier and more accurate diagnosis of cancer

- In October 2024, Olympus announced CE approval for three cloud-based AI medical devices and outlined plans to launch an AI-powered endoscopy ecosystem in 2025. This initiative aims to integrate artificial intelligence into endoscopic procedures, enhancing diagnostic capabilities and operational efficiency through advanced data analytics and machine learning algorithms

- In September 2024, Olympus introduced the CH-S700-08-LB 4K camera head, designed specifically for urological endoscopy. This system offers true 4K imaging, Narrow Band Imaging (NBI), and blue light observation, enhancing visualization during procedures such as cystoscopy and ureteroscopy. The integration of these features aims to improve diagnostic accuracy and surgical outcomes in urology

- In July 2024, Integrated Endoscopy announced the commercial release of the Nuvis wireless camera system for international markets. This next-generation wireless system offers surgeons and healthcare centers a cost-effective alternative to traditional corded cameras, promoting greater flexibility and efficiency in surgical settings

- In September 2023, Stryker's 1788 4K Camera System received FDA approval. This system features advanced imaging modalities, including a wider color gamut, improved fluorescence imaging, and high dynamic range capabilities. These enhancements are designed to provide surgeons with clearer and more detailed visuals, facilitating better decision-making during minimally invasive procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.