Global Endoscopic Retrograde Cholangiopancreatography And Percutaneous Transhepatic Cholangiography Devices Market

Market Size in USD Million

CAGR :

%

USD

558.98 Million

USD

720.29 Million

2024

2032

USD

558.98 Million

USD

720.29 Million

2024

2032

| 2025 –2032 | |

| USD 558.98 Million | |

| USD 720.29 Million | |

|

|

|

|

Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Size

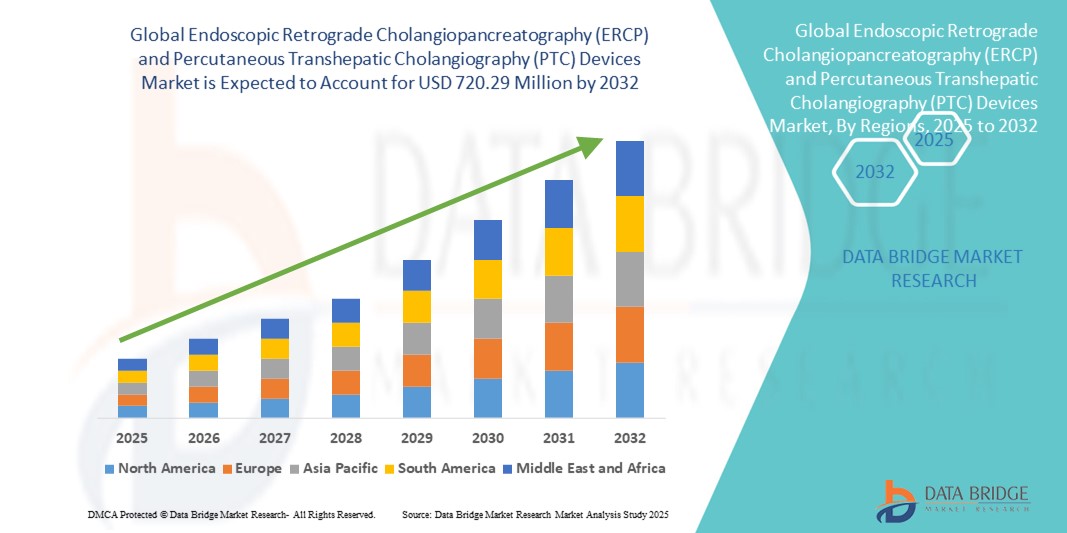

- The global endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market size was valued at USD 558.98 million in 2024 and is expected to reach USD 720.29 million by 2032, at a CAGR of 3.22% during the forecast period

- The market growth is largely driven by the increasing prevalence of biliary and pancreatic disorders, coupled with rising demand for minimally invasive diagnostic and therapeutic procedures

- In addition, expanding healthcare infrastructure, rising awareness of early disease detection, and growing preference for outpatient procedures are positioning ERCP and PTC devices as essential tools in modern gastroenterology and hepatology. These converging factors are accelerating market adoption, thereby significantly propelling industry growth

Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Analysis

- ERCP and PTC devices, enabling minimally invasive diagnostic and therapeutic procedures for biliary and pancreatic disorders, are increasingly vital components of modern gastroenterology and hepatology due to their precision, real-time imaging capabilities, and reduced patient recovery times

- The growing adoption of advanced endoscopic and percutaneous imaging technologies, rising prevalence of hepatobiliary diseases, and increasing demand for minimally invasive treatment options are the primary factors fueling market growth

- North America dominated the endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market with the largest revenue share of 38.9% in 2024, driven by advanced healthcare infrastructure, early adoption of innovative medical technologies, and strong presence of key device manufacturers. The U.S. is witnessing substantial growth in procedural volumes, particularly in tertiary care hospitals and specialized gastroenterology centers, driven by innovations in high-definition endoscopes, AI-assisted imaging, and digital guidance systems

- Asia-Pacific is expected to be the fastest growing region in the endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market during the forecast period due to increasing healthcare expenditure, expansion of modern medical facilities, and rising awareness about early diagnosis and minimally invasive treatments

- Endoscopes segment dominated the endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market with a market share of 42.4% in 2024, owing to their indispensable role in both diagnostic and therapeutic procedures, high-resolution imaging capabilities, and compatibility with a wide range of accessories and intervention tools

Report Scope and Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Segmentation

|

Attributes |

Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Trends

Advancements in High-Definition Imaging and AI-Guided Procedures

- A significant trend in the ERCP and PTC devices market is the integration of high-definition (HD) imaging and AI-guided procedural assistance, enhancing diagnostic accuracy and procedural safety. These innovations allow clinicians to visualize complex biliary and pancreatic structures with greater precision

- For instance, some modern endoscopes incorporate AI algorithms that can highlight lesions, detect strictures, and assist in real-time decision-making during ERCP procedures. Similarly, advanced PTC systems are being developed with AI-enabled imaging to guide needle placement and reduce procedural risks

- AI integration also enables predictive analytics, offering alerts for potential complications such as bile duct perforation or pancreatitis, improving patient outcomes. In addition, robotic-assisted guidance in some systems enhances procedural control, reducing operator fatigue and improving success rates in complex interventions

- The seamless combination of advanced imaging, AI support, and integration with hospital information systems allows centralized procedural management and better post-procedure documentation. Hospitals can track procedure outcomes, patient recovery, and device usage, optimizing operational efficiency

- This trend toward intelligent, data-driven, and highly precise ERCP and PTC devices is reshaping expectations in interventional gastroenterology and hepatology. Consequently, companies such as Boston Scientific and Olympus are developing AI-enhanced endoscopes and PTC devices with real-time analytics and image optimization capabilities

- The demand for advanced ERCP and PTC devices with AI-assisted visualization and robotic guidance is growing rapidly, driven by the need for higher procedural accuracy, improved patient safety, and reduced complications in both hospital and specialty clinic settings

Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Dynamics

Driver

Rising Prevalence of Biliary and Pancreatic Disorders and Preference for Minimally Invasive Procedures

- The increasing incidence of bile duct stones, pancreatitis, and other hepatobiliary disorders, combined with a growing preference for minimally invasive procedures, is a key driver for ERCP and PTC device adoption

- For instance, in 2024, Olympus Corporation introduced an advanced HD ERCP system designed for precise stone removal and stricture management, facilitating safer outpatient procedures. Such technological advancements by leading companies are expected to further boost market growth

- Patients and clinicians increasingly favor ERCP and PTC devices over conventional surgery due to reduced hospital stays, lower complication rates, and faster recovery

- The rising demand for early diagnosis and treatment of biliary and pancreatic disorders, coupled with expanding healthcare infrastructure, particularly in tertiary care hospitals and specialty centers, is making these devices a standard of care

- Growing awareness among clinicians and patients about the benefits of minimally invasive interventions, along with insurance coverage for these procedures in developed markets, is further accelerating adoption

Restraint/Challenge

High Cost of Advanced Devices and Regulatory Compliance Hurdles

- The relatively high cost of advanced ERCP and PTC devices, including HD endoscopes, AI-assisted systems, and disposable accessories, can limit adoption, especially in price-sensitive or emerging markets

- In addition, stringent regulatory requirements for device approvals, compliance with medical safety standards, and ongoing post-market surveillance pose challenges for manufacturers seeking faster market entry

- Reports of procedural complications, though rare, can raise concerns among clinicians regarding device safety, necessitating extensive training and support from manufacturers

- For instance, in 2023, the FDA issued a safety communication on certain ERCP devices highlighting the risk of guidewire-induced perforations, prompting manufacturers to update usage guidelines and provide additional clinician training

- Companies such as Medtronic and Boston Scientific address these challenges through clinician education programs, comprehensive post-sale support, and developing cost-effective device variations without compromising procedural efficacy

- Overcoming high costs and regulatory hurdles through innovations, localized manufacturing, and streamlined approval processes will be vital to sustain market growth and expand adoption across both developed and emerging regions

Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Scope

The market is segmented on the basis of product type, application, and end-user.

- By Product Type

On the basis of product type, the endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market is segmented into sphincterotomes, lithotripters, endoscopes, accessories, stents, cannulas, forceps, snares, catheters, guiding wires, balloons, baskets, and others. The endoscopes segment dominated the market with the largest market revenue share of 42.4% in 2024, driven by their essential role in both diagnostic and therapeutic procedures. Endoscopes provide high-resolution imaging, flexibility, and compatibility with a wide range of accessories, making them indispensable for precise interventions. The segment benefits from continuous technological advancements, including HD imaging, AI-assisted visualization, and enhanced maneuverability, which improve procedural efficiency and patient outcomes. Hospitals and specialty clinics prefer endoscopes for complex biliary and pancreatic interventions due to their reliability and multi-functionality.

The sphincterotomes segment is anticipated to witness the fastest growth rate of 19.8% from 2025 to 2032, fueled by rising demand for minimally invasive therapeutic procedures such as stone removal and stricture management. Sphincterotomes allow precise cutting of the sphincter of Oddi, facilitating easier access for stone extraction or stent placement. Increasing awareness among gastroenterologists about the clinical advantages of sphincterotomes, coupled with product innovations that reduce procedural complications, is driving their rapid adoption. Growing incidence of biliary disorders in both developed and emerging markets further supports the expansion of this segment.

- By Application

On the basis of application, the endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market is segmented into jaundice, stone removal, postoperative or posttraumatic bile leakage, pancreatitis, and others. The stone removal segment dominated the market with a share of 37.8% in 2024, driven by the rising prevalence of bile duct and pancreatic stones. Minimally invasive procedures using ERCP and PTC devices for stone extraction reduce the need for open surgery, shorten hospital stays, and improve patient recovery times. Hospitals increasingly adopt stone removal procedures due to high success rates and lower complication risks.

The postoperative or posttraumatic bile leakage segment is expected to witness the fastest growth from 2025 to 2032, owing to increasing incidence of surgical and traumatic bile duct injuries. ERCP and PTC devices play a critical role in early detection and minimally invasive management of bile leaks, offering a safer alternative to revision surgery. Growing awareness among surgeons and gastroenterologists about these techniques is accelerating the adoption of these applications in tertiary care hospitals and specialty centers.

- By End-User

On the basis of end-user, the endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market is segmented into hospitals, specialty clinics, diagnostic laboratories, and others. Hospitals dominated the market with a share of 52.3% in 2024, due to their advanced infrastructure, high procedural volumes, and capacity to deploy specialized devices for complex biliary and pancreatic interventions. Tertiary care hospitals and gastroenterology centers are increasingly investing in high-end ERCP and PTC systems to cater to rising patient demand for minimally invasive procedures.

The specialty clinics segment is expected to witness the fastest growth rate of 18.5% from 2025 to 2032, supported by the expansion of outpatient gastroenterology centers and increasing patient preference for outpatient or day-care procedures. Specialty clinics benefit from the adoption of portable and cost-effective ERCP/PTC systems, enabling them to offer high-quality care while optimizing operational efficiency. Growing investments in private healthcare and the rising number of specialty clinics in emerging markets further drive growth in this segment.

Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Regional Analysis

- North America dominated the endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market with the largest revenue share of 38.9% in 2024, driven by advanced healthcare infrastructure, early adoption of innovative medical technologies, and strong presence of key device manufacturers

- Hospitals and specialty gastroenterology centers in the region prioritize minimally invasive procedures, valuing the precision, real-time imaging, and enhanced safety provided by ERCP and PTC devices. The availability of skilled clinicians and comprehensive training programs further supports widespread adoption

- This strong regional presence is also supported by high healthcare expenditure, advanced reimbursement frameworks, and ongoing innovations by key market players such as Boston Scientific, Olympus, and Medtronic. These factors collectively position North America as the leading market for ERCP and PTC devices, with continued growth expected in both diagnostic and therapeutic applications

U.S. Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Insight

The U.S. endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market captured the largest revenue share of 82% in North America in 2024, driven by advanced healthcare infrastructure, high procedural volumes, and early adoption of minimally invasive diagnostic and therapeutic technologies. Hospitals and specialty gastroenterology centers prioritize precision, real-time imaging, and patient safety offered by these devices. Moreover, ongoing innovations in high-definition endoscopes, AI-assisted imaging, and disposable accessories are fueling market expansion. The strong reimbursement framework and increasing awareness about early diagnosis of biliary and pancreatic disorders further bolster adoption in both hospital and outpatient settings.

Europe Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Insight

The Europe endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing prevalence of hepatobiliary and pancreatic disorders and rising demand for minimally invasive procedures. Growing investment in modern healthcare facilities, coupled with stringent regulatory standards ensuring device safety and efficacy, is fostering adoption. The market is witnessing growth across tertiary care hospitals and specialty clinics, with high adoption in countries such as Germany, France, and Italy for both diagnostic and therapeutic applications.

U.K. Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Insight

The U.K. endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the increasing trend of minimally invasive interventions and rising incidence of bile duct stones and pancreatitis. Advanced healthcare infrastructure, strong clinical expertise, and growing awareness of early intervention benefits are supporting market growth. In addition, outpatient gastroenterology centers and specialty clinics are expanding their procedural offerings with ERCP and PTC devices, enhancing patient convenience and reducing hospitalization times.

Germany Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Insight

The Germany endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s well-developed healthcare infrastructure, high adoption of advanced medical technologies, and emphasis on patient safety. German hospitals increasingly prefer high-definition and AI-assisted endoscopes for complex biliary and pancreatic procedures. The focus on innovation, quality standards, and compliance with EU medical device regulations further strengthens market growth in the region.

Asia-Pacific Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Insight

The Asia-Pacific endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rising prevalence of hepatobiliary and pancreatic diseases, increasing healthcare expenditure, and expansion of modern hospital infrastructure. Countries such as China, Japan, and India are witnessing growing adoption of minimally invasive procedures, supported by government initiatives promoting advanced healthcare technology. The region is also emerging as a manufacturing and supply hub for endoscopic and percutaneous devices, improving accessibility and affordability across developing markets.

Japan Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Insight

The Japan endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market is gaining momentum due to the country’s high healthcare standards, advanced technological adoption, and focus on minimally invasive interventions. Increasing incidence of pancreatic and bile duct disorders, coupled with the growing number of outpatient gastroenterology centers, is driving device adoption. Integration of AI-assisted imaging and robotic guidance in high-end endoscopes is enhancing procedural precision and efficiency, further supporting market growth.

India Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Insight

The India endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) devices market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the expansion of tertiary care hospitals, increasing prevalence of hepatobiliary diseases, and rising awareness about minimally invasive procedures. The growing private healthcare sector, rising disposable incomes, and increasing availability of cost-effective devices from domestic and international manufacturers are key factors propelling market growth. Government initiatives promoting modern healthcare facilities and diagnostic capabilities further enhance adoption in both urban and semi-urban regions.

Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market Share

The Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices industry is primarily led by well-established companies, including:

- Olympus Corporation (Japan)

- Boston Scientific Corporation (U.S.)

- FUJIFILM Corporation (Japan)

- Johnson & Johnson and its affiliates (U.S.)

- Medtronic (Ireland)

- Cook (U.S.)

- ConMed Corporation (U.S.)

- KARL STORZ (Germany)

- STERIS Corporation (U.S.)

- HOYA Corporation (Japan)

- Ambu A/S (Denmark)

- Micro-Tech Co., Ltd. (China)

- Taewoong Medical Co., Ltd. (South Korea)

- ERBE Elektromedizin GmbH (Germany)

- Endo-Flex GmbH (Germany)

- TeleMed Systems, Inc. (U.S.)

- SonoScape Medical Corp. (China)

- DCC Healthcare (Medi-Globe) (Ireland)

- Huger Medical Instrument Co., Ltd. (China)

- Merit Medical Systems, Inc. (U.S.)

What are the Recent Developments in Global Endoscopic Retrograde Cholangiopancreatography (ERCP) and Percutaneous Transhepatic Cholangiography (PTC) Devices Market?

- In May 2024. At ESGE Days 2024, SwiftDuct presented positive clinical study results of SwiftGlide, an electrochemical navigation method aimed at improving ERCP procedures and outcomes, marking a step towards fluoroscopy-free ERCP cannulation

- In January 2024, EndoSound received FDA 510(k) clearance for its EndoSound Vision System (EVS), a novel endoscopic ultrasound (EUS) device that attaches to upper gastrointestinal endoscopes. The EVS integrates seamlessly into existing endoscopy centers, offering a more economical and accessible solution for EUS procedures. This advancement aims to enhance patient safety and expand access to critical imaging and therapeutic procedures

- In November 2023, Olympus Corporation announced the launch of its next-generation EVIS X1 endoscopy system in China, making it available in all of its major markets globally. The EVIS X1, which was first launched in other regions in 2020 and later in the U.S. in October 2023, is designed to enhance diagnostic and therapeutic procedures

- In October 2023, EndoSound and AdaptivEndo announced a partnership to develop a groundbreaking single-use endoscopic ultrasound (EUS) and endoscopic retrograde cholangiopancreatography (ERCP) device. This collaboration aims to enhance patient safety and expand access to advanced endoscopic procedures

- In January 2022, Cook Medical launched the Instinct Plus Endoscopic Clipping Device. This device is compatible with a duodenoscope and is used for defect closure, anchoring, and prophylactic clipping in the gastrointestinal tract. This development highlights the continued innovation in single-use and complementary devices that enhance the safety and efficacy of ERCP procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.