Global Endoscopy Reprocessor Market

Market Size in USD Billion

CAGR :

%

USD

2.90 Billion

USD

5.55 Billion

2025

2033

USD

2.90 Billion

USD

5.55 Billion

2025

2033

| 2026 –2033 | |

| USD 2.90 Billion | |

| USD 5.55 Billion | |

|

|

|

|

Endoscopy Reprocessor Market Size

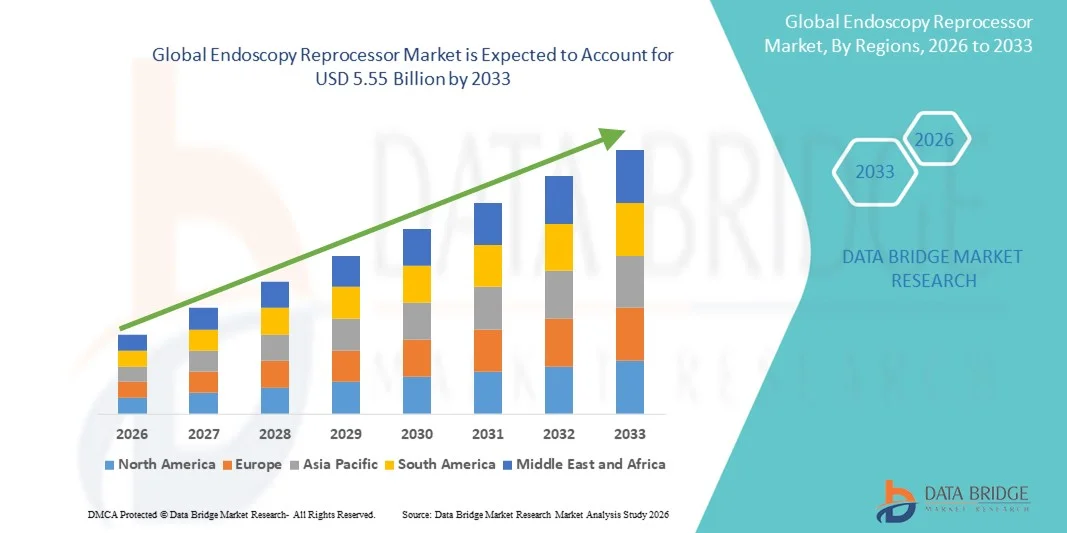

- The global endoscopy reprocessor market size was valued at USD 2.90 billion in 2025 and is expected to reach USD 5.55 billion by 2033, at a CAGR of 8.47% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced endoscopy reprocessing systems that ensure efficient, automated cleaning, disinfection, and sterilization of endoscopic instruments. Continuous technological advancements in high-level disinfection and automated workflows are driving higher utilization in hospitals, ambulatory surgical centers, and specialty clinics, improving patient safety and operational efficiency

- Furthermore, rising regulatory requirements for infection control, coupled with growing awareness of hospital-acquired infections, are increasing the demand for reliable and standardized endoscopy reprocessors. These converging factors are accelerating the uptake of Endoscopy Reprocessor solutions, thereby significantly boosting the industry's growth

Endoscopy Reprocessor Market Analysis

- Endoscopy reprocessors, offering automated cleaning, high-level disinfection, and sterilization of endoscopic instruments, are increasingly vital components in modern healthcare settings, ensuring patient safety, reducing infection risks, and improving operational efficiency in hospitals, ambulatory surgical centers, and specialty clinics

- The escalating demand for endoscopy reprocessors is primarily fueled by growing awareness of infection control, rising prevalence of endoscopic procedures, and stringent regulatory guidelines for device reprocessing. Healthcare providers are increasingly adopting automated systems to standardize processes and enhance compliance

- North America dominated the endoscopy reprocessor market with the largest revenue share of approximately 41.2% in 2025, supported by advanced healthcare infrastructure, high procedural volumes, strong presence of leading market players, and rapid adoption of automated reprocessing technologies. The U.S. market remains the key contributor, driven by extensive endoscopic procedures and increasing investments in infection prevention technologies

- Asia-Pacific is expected to be the fastest-growing region in the endoscopy reprocessor market during the forecast period, driven by rising healthcare spending, expanding access to surgical care, increasing procedural volumes, and growing awareness of infection control in countries such as China, India, and Japan

- The Automated Cleaning Solutions segment dominated the largest market revenue share of 57.8% in 2025, driven by its efficiency, standardized high-level disinfection, and reduction of human error in reprocessing procedures.

Report Scope and Endoscopy Reprocessor Market Segmentation

|

Attributes |

Endoscopy Reprocessor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Getinge AB (Sweden) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Endoscopy Reprocessor Market Trends

Increasing Adoption of Automated and High-Level Disinfection Systems

- A key and accelerating trend in the global endoscopy reprocessor market is the rising adoption of automated endoscope reprocessing systems equipped with high-level disinfection capabilities. This trend is driven by the increasing need to ensure patient safety and reduce cross-contamination risks in healthcare facilities

- Automated endoscope reprocessors (AERs) offer standardized cleaning and disinfection cycles, reducing the dependence on manual processes and minimizing human error

- Healthcare providers are increasingly moving toward centralized reprocessing units in hospitals and specialty clinics to ensure compliance with stringent infection control guidelines

- For instance, the integration of validated AER protocols ensures that endoscopes meet regulatory standards from agencies such as the FDA and CDC, enhancing overall procedural safety

- Technological advancements in automated flushing, drying, and leak-testing are providing improved efficiency and throughput, allowing hospitals to handle higher volumes of endoscopic procedures without compromising quality

- The trend is also supported by the rising incidence of gastrointestinal and respiratory disorders, which increases endoscopy procedures worldwide, thereby driving demand for effective and reliable reprocessing solutions

- Manufacturers are increasingly focusing on compact, user-friendly, and energy-efficient AERs suitable for hospitals of various sizes, as well as ambulatory surgical centers and specialty clinics

- Healthcare facilities in emerging economies are gradually adopting these systems, highlighting the global reach of this trend

- The increasing emphasis on reducing hospital-acquired infections (HAIs) further accelerates the adoption of automated and high-level disinfection endoscopy reprocessors

- Training and digital interfaces in modern AERs help reduce errors, enhance monitoring, and facilitate adherence to hygiene protocols

- Overall, the shift toward automated, validated, and efficient reprocessing systems is fundamentally reshaping hospital and clinic workflows in endoscopy procedures

Endoscopy Reprocessor Market Dynamics

Driver

Rising Endoscopic Procedures and Stringent Infection Control Regulations

- The growing number of endoscopic procedures worldwide is a major driver of the Endoscopy Reprocessor market. Increasing prevalence of gastrointestinal, respiratory, and urological disorders has led to higher endoscopy demand

- For instance, in 2024, the WHO reported a significant rise in gastrointestinal disorders globally, which has increased the adoption of colonoscopies and gastroscopies in hospitals and clinics

- Strict infection control guidelines by regulatory agencies such as the FDA, CDC, and European Society of Gastrointestinal Endoscopy (ESGE) mandate high-level disinfection of endoscopes, creating a need for reliable reprocessing solutions. Healthcare institutions are increasingly focusing on minimizing cross-contamination risks to improve patient safety, thereby driving investment in advanced endoscope reprocessing technologies

- Technological innovations in AERs and validated protocols are reducing manual labor, enhancing consistency, and ensuring compliance, which supports adoption across hospitals and specialty clinics. The need for faster turnaround times in high-volume healthcare facilities encourages the installation of multi-endoscope reprocessors, increasing overall market growth

- Integration of digital tracking and monitoring in modern AERs allows healthcare providers to maintain audit trails and comply with regulatory documentation requirements. Training programs for hospital staff on automated reprocessors improve operational efficiency and encourage market acceptance

- The convenience, reliability, and efficiency of automated reprocessors compared to manual cleaning methods make them an attractive option for healthcare providers. The market is further supported by the expansion of ambulatory surgery centers (ASCs) and specialty clinics that require compact, high-performance reprocessing solutions

- Overall, the convergence of rising procedure volumes and stringent regulatory requirements is a critical driver for global market growth

Restraint/Challenge

High Cost of Equipment and Maintenance Requirements

- The relatively high initial cost of automated endoscopy reprocessors poses a challenge to market adoption, particularly for small clinics and facilities in developing regions

- For instance, purchasing, installation, and validation of high-level AER systems can cost several tens of thousands of dollars, creating a significant financial barrier

- Maintenance and servicing requirements, including periodic validation, software updates, and replacement of consumables, add to operational expenditures and may discourage adoption

- Staff training for proper operation and routine maintenance is also necessary, increasing indirect costs for healthcare facilities

- In some regions, budget constraints and limited reimbursement policies hinder the widespread adoption of automated reprocessors

- Facilities may continue to rely on manual or semi-automated cleaning processes due to lower upfront costs despite higher risks of contamination

- Smaller healthcare centers or rural hospitals may face challenges in procuring spare parts and servicing advanced equipment, which can affect long-term usability

- The complexity of integrating new systems into existing workflows may also slow adoption in established healthcare facilities

- While automated systems improve efficiency and safety, the high cost-to-benefit perception may limit purchases to larger hospitals and specialized clinics

- Manufacturers are addressing these challenges by offering financing options, rental programs, and compact cost-effective models, though barriers remain for some healthcare providers

- Thus, cost considerations and maintenance requirements remain significant restraints on the Endoscopy Reprocessor market

Endoscopy Reprocessor Market Scope

The market is segmented on the basis of type, product type, solution type, and end user.

- By Type

On the basis of type, the Endoscopy Reprocessor market is segmented into Manual Cleaning Solutions and Automated Cleaning Solutions. The Automated Cleaning Solutions segment dominated the largest market revenue share of 57.8% in 2025, driven by its efficiency, standardized high-level disinfection, and reduction of human error in reprocessing procedures. Hospitals and specialty clinics prioritize automated solutions to ensure consistent cleaning cycles and compliance with stringent infection control guidelines. Automated solutions reduce cross-contamination risks, improve turnaround times for endoscopes, and integrate with tracking and documentation systems for audit purposes. The demand is further supported by the growing number of endoscopic procedures globally and the adoption of multi-endoscope reprocessing units in high-volume healthcare facilities. Manufacturers are focusing on compact, user-friendly, and energy-efficient AERs to cater to both large hospitals and ambulatory centers. The integration of digital interfaces for monitoring, cycle validation, and maintenance tracking enhances operational reliability. In addition, automated systems minimize staff training requirements compared to manual cleaning and provide standardized results across different facilities. Automated Cleaning Solutions also support multi-site healthcare networks by ensuring uniformity in infection control. The ongoing development of faster cycle technologies and compliance with regulatory guidelines continues to drive adoption. Overall, automated solutions are considered essential for improving patient safety and operational efficiency in modern healthcare environments.

The Manual Cleaning Solutions segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by its cost-effectiveness, simplicity, and suitability for smaller clinics and ambulatory centers with budget constraints. Manual solutions are preferred in low-volume facilities where the upfront cost of automated systems may not be justified. Hospitals in developing regions rely on manual cleaning due to limited infrastructure and resource availability. Despite requiring more staff involvement, manual solutions remain flexible and compatible with a wide variety of endoscope types. Manufacturers are innovating in detergents, brushes, and wipes to improve the efficacy of manual cleaning processes. Training programs and detailed protocols for manual cleaning are increasingly being implemented to maintain compliance and reduce infection risks. Additionally, manual cleaning is often used as a supplementary step alongside automated systems to ensure thorough disinfection. The affordability and accessibility of manual cleaning products make them viable for rural healthcare centers. Growing awareness about infection control is encouraging even smaller facilities to adopt improved manual reprocessing protocols. Overall, manual cleaning solutions continue to expand due to their adaptability, low cost, and complementarity to automated processes.

- By Product Type

On the basis of product type, the Endoscopy Reprocessor market is segmented into Automated Endoscope Reprocessors (AERs), High-Level Disinfectants and Test Strips, Detergents and Wipes, Endoscope Drying, Storage and Transport Systems, Endoscope Tracking Systems, and Others. The Automated Endoscope Reprocessors segment held the largest market revenue share of 48.5% in 2025, driven by the growing adoption of multi-endoscope AERs in hospitals and specialty clinics. These systems ensure standardized disinfection cycles, compliance with regulatory guidelines, and improved turnaround times. AERs reduce human error, minimize infection risks, and integrate with digital documentation and tracking systems. The market demand is further supported by increasing endoscopic procedures and heightened emphasis on patient safety. Healthcare facilities prioritize high-capacity units that allow simultaneous processing of multiple endoscopes. Manufacturers are focusing on compact and energy-efficient models to cater to different healthcare setups. Continuous technological innovations, such as automated leak testing and cycle validation, enhance operational reliability. Training and user-friendly interfaces in AERs further encourage adoption. Integration with hospital information systems allows tracking and reporting for audit purposes. AERs also facilitate workflow optimization in high-volume endoscopy departments. Regulatory compliance and improved infection control drive hospitals to adopt automated reprocessors extensively.

The High-Level Disinfectants and Test Strips segment is expected to witness the fastest CAGR of 20.4% from 2026 to 2033, fueled by increasing awareness about infection prevention and the rising number of endoscopic procedures globally. Test strips and disinfectants are crucial for validating cleaning efficacy and ensuring compliance with hygiene standards. Hospitals, ambulatory centers, and clinics adopt these products to monitor disinfectant concentrations and maintain operational safety. The trend is further accelerated by frequent updates to international disinfection guidelines. Manufacturers are innovating with eco-friendly and high-efficacy disinfectants suitable for various endoscope types. Disposable wipes and pre-prepared solutions also contribute to the ease of adoption. The demand for validation products is strong in regions with stringent infection control regulations. Rising concerns about hospital-acquired infections (HAIs) and cross-contamination are encouraging more healthcare facilities to implement proper monitoring practices. Overall, this segment is expected to grow rapidly due to its critical role in ensuring patient safety and compliance.

- By Solution Type

On the basis of solution type, the Endoscopy Reprocessor market is segmented into Glutaraldehyde, Phtharal, Peracetic Acid, Highly-acidic Electrolyzed Water, Aldehyde-based Disinfectants, Hypochlorous Acid, Chlorine Dioxide, and Alcohols. The Glutaraldehyde segment dominated the largest market revenue share of 35.6% in 2025, driven by its widespread use as a high-level disinfectant and proven efficacy against bacteria, viruses, and fungi. Glutaraldehyde solutions are compatible with a variety of endoscope types and are widely adopted in hospitals and specialty clinics. The availability of pre-mixed, ready-to-use glutaraldehyde solutions ensures ease of use and standardized disinfection. Strong regulatory support and established clinical protocols encourage the use of glutaraldehyde in both developed and emerging markets. Training programs for proper handling and safety further enhance its adoption. Glutaraldehyde-based disinfectants offer reliable performance, cost-effectiveness, and long shelf-life, making them a preferred choice for high-volume healthcare centers. Hospitals benefit from consistent disinfection results and compliance with international infection control guidelines. Manufacturers continue to innovate with stabilized formulations to reduce toxicity while maintaining efficacy. Overall, glutaraldehyde remains the dominant solution type in the global endoscopy reprocessor market.

The Peracetic Acid segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, driven by its high efficacy, rapid action, and environmentally friendly properties. Peracetic acid solutions are gaining preference in hospitals and ambulatory centers seeking faster turnaround times for endoscope processing. The solution is effective against a broad spectrum of pathogens and does not leave harmful residues. Healthcare facilities adopting peracetic acid systems benefit from reduced reprocessing cycle times and minimized environmental impact. Manufacturers are introducing automated dosing systems and pre-mixed formulations to simplify usage. The growing awareness about eco-friendly and non-toxic disinfectants further boosts adoption. Peracetic acid also meets regulatory standards in multiple countries, supporting its increasing popularity. Rising endoscopy volumes and the need for rapid, reliable disinfection in high-volume centers accelerate demand. Overall, peracetic acid is expected to register significant growth as a preferred high-level disinfectant.

- By End User

On the basis of end user, the Endoscopy Reprocessor market is segmented into Hospitals, Ambulatory Centers, and Others. The Hospitals segment accounted for the largest market revenue share of 62.3% in 2025, driven by the high volume of endoscopic procedures, investment capacity, and the need for regulatory compliance. Hospitals prefer automated reprocessors and high-quality disinfectants to ensure patient safety and reduce hospital-acquired infections. Centralized reprocessing units in hospitals optimize workflow, enable multi-endoscope processing, and facilitate integration with digital tracking systems. Hospitals also benefit from staff training programs, standardized protocols, and audit trails that are easier to implement with automated systems. The increasing adoption of minimally invasive procedures further supports the demand for endoscope reprocessors. Manufacturers focus on high-capacity, reliable, and validated systems to cater to hospital requirements. Strong government and accreditation mandates regarding infection control encourage hospital adoption. Continuous monitoring of reprocessing efficacy through tracking and reporting systems is another key factor. Overall, hospitals remain the dominant end-user segment globally.

The Ambulatory Centers segment is expected to witness the fastest CAGR of 19.5% from 2026 to 2033, driven by the rising number of outpatient endoscopic procedures and smaller surgical interventions in these facilities. Ambulatory centers seek compact, cost-effective, and efficient endoscope reprocessing solutions to meet growing patient demand. The trend is further supported by technological innovations in small-scale automated reprocessors and portable high-level disinfectants. Ambulatory centers benefit from reduced turnaround times, ease of use, and compliance with infection control guidelines. Growing awareness about patient safety and rising outpatient procedures globally accelerate adoption. Manufacturers are offering tailored solutions for these centers, including modular AERs and ready-to-use disinfectants. Overall, ambulatory centers are emerging as a rapidly growing end-user segment due to their expanding role in outpatient care.

Endoscopy Reprocessor Market Regional Analysis

- North America dominated the endoscopy reprocessor market with the largest revenue share of approximately 41.2% in 2025, supported by advanced healthcare infrastructure, high procedural volumes, strong presence of leading market players, and rapid adoption of automated reprocessing technologies

- The market remains the key contributor, driven by extensive endoscopic procedures and increasing investments in infection prevention technologies

- Hospitals and ambulatory surgical centers are increasingly investing in automated and semi-automated reprocessors, advanced high-level disinfection systems, and integrated traceability solutions to improve workflow efficiency and patient safety

U.S. Endoscopy Reprocessor Market Insight

The U.S. endoscopy reprocessor market captured the largest revenue share in North America in 2025, fueled by high procedural volumes across gastroenterology, urology, and pulmonology, as well as growing adoption of advanced automated reprocessing technologies. Investments in infection prevention, strict regulatory compliance requirements, and the need for efficient reprocessing workflows are driving demand for high-performance endoscope reprocessors in hospitals and specialty clinics.

Europe Endoscopy Reprocessor Market Insight

The Europe endoscopy reprocessor market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent regulatory standards for endoscope reprocessing, rising procedural volumes, and increasing adoption of automated reprocessing systems across hospitals and clinics. Germany, France, and the U.K. are witnessing significant investments in infection prevention technologies and integration of high-level disinfection systems into hospital workflows.

U.K. Endoscopy Reprocessor Market Insight

The U.K. endoscopy reprocessor market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of automated endoscope reprocessing systems, rising procedural volumes, and stringent regulatory oversight on infection control. Hospitals and specialty clinics are increasingly implementing traceability solutions and advanced automated systems to ensure compliance and enhance patient safety.

Germany Endoscopy Reprocessor Market Insight

The Germany endoscopy reprocessor market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of infection control, high adoption of automated reprocessing technologies, and continuous investments in hospital infrastructure. The integration of automated reprocessors with hospital IT and quality management systems is becoming prevalent, improving efficiency and reducing contamination risks.

Asia-Pacific Endoscopy Reprocessor Market Insight

Asia-Pacific endoscopy reprocessor market is expected to be the fastest-growing region in the Endoscopy Reprocessor market during the forecast period, driven by rising healthcare spending, expanding access to surgical care, increasing procedural volumes, and growing awareness of infection control in countries such as China, India, and Japan. Hospitals and ambulatory surgical centers are investing in automated endoscope reprocessors, high-level disinfection systems, and workflow integration technologies to meet increasing procedural demands and safety standards.

Japan Endoscopy Reprocessor Market Insight

The Japan endoscopy reprocessor market is gaining momentum due to the country’s advanced healthcare infrastructure, high procedural volumes, and strong emphasis on infection control. Adoption of automated reprocessing systems and integration with hospital IT networks for workflow efficiency and traceability is driving growth across hospitals and specialty clinics.

China Endoscopy Reprocessor Market Insight

The China endoscopy reprocessor market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing procedural volumes, expanding hospital networks, and rising awareness of infection prevention. Strong government initiatives to improve surgical care quality, coupled with investments in automated reprocessing systems and traceability solutions, are key factors propelling market growth.

Endoscopy Reprocessor Market Share

The Endoscopy Reprocessor industry is primarily led by well-established companies, including:

• Getinge AB (Sweden)

• STERIS plc (U.K.)

• Olympus Corporation (Japan)

• B. Braun SE (Germany)

• Stryker Corporation (U.S.)

• Advanced Sterilization Products (U.S.)

• Minntech Corporation (U.S.)

• Aesculap AG (Germany)

• Smith & Nephew plc (U.K.)

• Nikkiso Co., Ltd. (Japan)

• Welch Allyn (U.S.)

• Pentax Medical (Japan)

• MediPro Systems (China)

• SOMED Medical (Germany)

• Fujifilm Holdings Corporation (Japan)

• Hologic, Inc. (U.S.)

• RMD Instruments (U.S.)

• Shenzhen Anke Biotechnology (China)

Latest Developments in Global Endoscopy Reprocessor Market

- In September 2021, Steelco S.p.A., a provider of infection control solutions, launched the EW 1 S MAXI, an advanced automated endoscope reprocessor designed to set new standards for safety, effectiveness, and usability in endoscope reprocessing by incorporating sophisticated automation features to minimize operator interaction

- In February 2021, Steris Corporation, a U.S.-based medical equipment company specializing in sterilization and surgical products, completed the acquisition of Cantel Medical Corporation, expanding Steris’s product and service offerings in infection prevention and endoscope reprocessing and enhancing its global reach in the market

- In June 2022, Getinge introduced an updated version of its ED‑Flow automated endoscope reprocessor, featuring enhanced digital connectivity and improved data management to increase uptime and productivity in healthcare facilities performing high volumes of endoscopic procedures

- In March 2023, PENTAX Medical, a division of the HOYA Group, received the CE mark for its AquaTYPHOON automated pre‑cleaning solution — an innovative device designed to automate the pre‑cleaning step in endoscope reprocessing and improve clinical workflow efficiency across endoscopy units

- In June 2023, Olympus Corporation launched the ETD (Endoscope Washer Disinfector) in two variants — ETD Basic and ETD Premium — designed to meet busy endoscopy unit requirements, providing simultaneous reprocessing of up to three endoscopes and enhancing operational throughput and infection control

- In November 2023, HOYA Corporation completed the acquisition of Wassenburg Medical B.V., a Netherlands‑based manufacturer of endoscope reprocessing systems and consumables, to strengthen its position in global endoscope reprocessing and leverage combined engineering capabilities for innovation in reprocessing solutions

- In January 2024, Global market analysis reports highlighted continued growth in the endoscope reprocessing market with increased acceptance of sophisticated medical procedures and investments in automated endoscopy reprocessing systems, signaling sustained innovation and expanded product portfolios across key manufacturers

- In February 2025, industry trend reports noted that Nanosonics continued advancing its strategic product expansion efforts by significantly increasing R&D investment toward its upcoming CORIS endoscope reprocessing platform, reflecting broader industry focus on next‑generation reprocessing technologies that enhance infection control and procedural safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.