Global Energy Demand Forecasting Market

Market Size in USD Billion

CAGR :

%

USD

23.00 Billion

USD

214.57 Billion

2024

2032

USD

23.00 Billion

USD

214.57 Billion

2024

2032

| 2025 –2032 | |

| USD 23.00 Billion | |

| USD 214.57 Billion | |

|

|

|

|

Energy Demand Forecasting Market Size

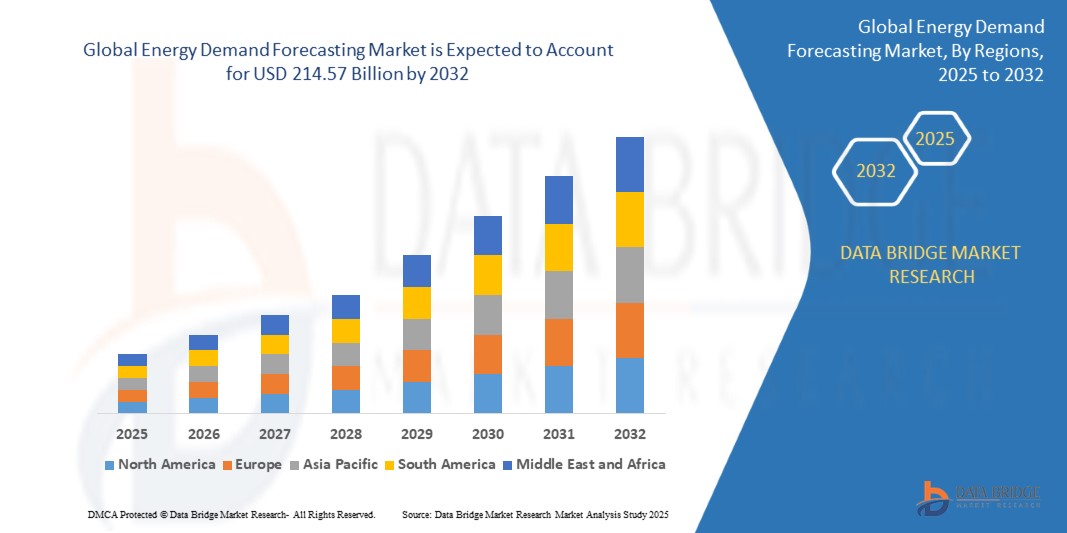

- The global energy demand forecasting market size was valued at USD 23.00 billion in 2024 and is expected to reach USD 214.57 billion by 2032, at a CAGR of 32.20% during the forecast period

- The market growth is largely fueled by the increasing integration of renewable energy sources into power grids and the rising complexity of energy systems, which necessitate advanced forecasting models for efficient demand management. Governments and utilities are focusing on energy optimization to balance supply and demand, reduce carbon emissions, and improve grid stability, thereby driving strong adoption of forecasting solutions

- Furthermore, the rising deployment of AI, big data analytics, and IoT-enabled sensors is enabling highly accurate, real-time forecasting. These technologies empower energy providers and industrial users to predict consumption patterns, minimize operational costs, and ensure energy reliability. Such advancements are accelerating the uptake of energy demand forecasting systems, significantly boosting the industry’s growth

Energy Demand Forecasting Market Analysis

- Energy demand forecasting refers to the use of advanced models and computational techniques to predict future energy consumption across sectors such as power, transportation, manufacturing, and agriculture. It plays a critical role in resource planning, policy-making, and optimizing energy distribution for both renewable and non-renewable sources

- The escalating demand for forecasting systems is primarily fueled by rapid urbanization, the global transition toward renewable energy, and increasing pressure on utilities to enhance energy efficiency. In addition, the growing need to address peak load variations, manage intermittent renewable supply, and support sustainable development goals is further propelling market expansion

- North America dominated the energy demand forecasting market in 2024, due to rising investments in smart grid infrastructure, renewable integration, and advanced analytics for utility planning

- Asia-Pacific is expected to be the fastest growing region in the energy demand forecasting market during the forecast period due to rapid industrialization, urbanization, and escalating electricity consumption in countries such as China, India, and Japan

- Power segment dominated the market with a market share of 42.1% in 2024, due to the growing reliance on conventional and renewable power generation to meet increasing global electricity demand. Utilities and governments heavily invest in advanced forecasting solutions for power grids to ensure efficiency, prevent blackouts, and balance fluctuating supply and demand. Rising urbanization, industrialization, and electrification of transport systems further strengthen the demand for forecasting in this segment. The ability to optimize grid stability and improve operational planning makes power-based forecasting a critical component of energy transition strategies

Report Scope and Energy Demand Forecasting Market Segmentation

|

Attributes |

Energy Demand Forecasting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Energy Demand Forecasting Market Trends

Integration of AI and Machine Learning in Energy Forecasting

- The adoption of AI and machine learning (ML) technologies is revolutionizing energy demand forecasting by enabling more accurate, real-time predictions that incorporate diverse data sources such as weather patterns, consumption behavior, and grid conditions

- For instance, companies such as IBM, Siemens, and Schneider Electric are deploying AI-driven forecasting platforms that improve load balancing, resource allocation, and demand response in smart grids and utility operations

- Integration with IoT devices and smart meters provides granular consumption data, enhancing AI models’ precision and adaptability to dynamic energy usage patterns

- AI and ML facilitate scenario analysis, anomaly detection, and predictive maintenance, optimizing forecasting accuracy and minimizing operational risks

- Expansion of cloud computing and big data analytics enables scalable deployment of sophisticated forecasting algorithms across utility and industrial sectors

- Growing regulatory focus on grid stability and renewable integration necessitates advanced forecasting capabilities to manage variability and ensure reliable power supply

Energy Demand Forecasting Market Dynamics

Driver

Rising Adoption of Renewable Energy Sources

- Growing penetration of renewable energy sources such as solar and wind, characterized by variable and intermittent generation, is driving the need for advanced energy demand forecasting tools to balance supply and demand effectively

- For instance, utilities and grid operators worldwide are investing in forecasting solutions from providers such as Vestas, Enel X, and General Electric to integrate renewable assets while maintaining grid reliability and minimizing curtailment

- Increasing distributed energy resources (DERs) and prosumer participation complicate forecasting, necessitating AI-enhanced models for accurate load prediction and resource management

- Demand response programs and energy storage deployments further stimulate adoption of dynamic forecasting tools to optimize energy flow and cost-efficiency

- Decentralization of energy systems and microgrid expansion increase forecasting complexity, boosting demand for flexible and intelligent forecasting platforms

Restraint/Challenge

High Implementation and Maintenance Costs

- The advanced technologies and infrastructure required for AI-powered energy demand forecasting systems entail significant implementation, integration, and ongoing maintenance costs that can limit adoption, especially among smaller utilities and developing markets

- For instance, acquiring high-quality data, setting up cloud or edge computing resources, and employing skilled data scientists represent substantial initial investments and operational expenses for grid operators and energy companies

- Complexity in integrating forecasting solutions with legacy energy management systems can increase costs and extend deployment timelines

- Continuous updates, algorithm tuning, and cybersecurity measures contribute to recurring expenses, affecting total cost of ownership

- Smaller utilities may face financial constraints that delay adoption despite potential long-term benefits from reduced energy costs and improved grid management. Budget uncertainties, regulatory approval processes, and variable ROI perceptions may also impact investment decisions in advanced forecasting technologies

Energy Demand Forecasting Market Scope

The market is segmented on the basis of technology and end user.

• By Technology

On the basis of technology, the energy demand forecasting market is segmented into wind, power, hydro, geothermal, and nuclear. The power segment dominated the largest market revenue share of 42.1% in 2024, supported by the growing reliance on conventional and renewable power generation to meet increasing global electricity demand. Utilities and governments heavily invest in advanced forecasting solutions for power grids to ensure efficiency, prevent blackouts, and balance fluctuating supply and demand. Rising urbanization, industrialization, and electrification of transport systems further strengthen the demand for forecasting in this segment. The ability to optimize grid stability and improve operational planning makes power-based forecasting a critical component of energy transition strategies.

The wind segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the global acceleration in wind energy deployment and the variability of wind resources that require highly accurate demand forecasting models. Wind energy integration into national grids presents challenges due to intermittency, making real-time forecasting essential to maintain supply reliability. Governments and private investors are increasingly supporting advanced AI- and IoT-based forecasting platforms to maximize wind energy utilization and reduce curtailment. The rising number of offshore and onshore wind projects worldwide further boosts the need for predictive models, creating strong growth momentum in this segment.

• By End User

On the basis of end user, the energy demand forecasting market is segmented into agriculture, construction, transportation, power, and others. The power sector held the largest market share in 2024, driven by the critical requirement to forecast energy loads across generation, transmission, and distribution networks. Utilities adopt forecasting solutions to optimize resource allocation, integrate renewables, and manage peak demand, directly influencing operational efficiency and profitability. Growing investments in smart grid infrastructure and digital transformation of energy utilities further propel this dominance. The sector’s reliance on precise forecasting for long-term planning and real-time decision-making reinforces its leading position in the market.

The transportation sector is projected to record the fastest CAGR from 2025 to 2032, attributed to the rapid electrification of mobility and rising adoption of electric vehicles (EVs). Forecasting models are becoming vital to predict EV charging demand patterns, optimize charging infrastructure, and balance grid loads during peak usage. Governments and private firms are heavily investing in EV infrastructure, making accurate demand forecasting a necessity to avoid grid stress and enhance efficiency. The rise of smart charging stations and connected vehicle ecosystems further amplifies the importance of forecasting in this sector, establishing transportation as the fastest-growing end user.

Energy Demand Forecasting Market Regional Analysis

- North America dominated the energy demand forecasting market with the largest revenue share in 2024, driven by rising investments in smart grid infrastructure, renewable integration, and advanced analytics for utility planning

- The region benefits from early adoption of AI- and IoT-based forecasting tools, which help utilities manage fluctuating energy demand and enhance operational efficiency

- Growing reliance on clean energy sources and the rapid electrification of transport are also fueling demand for accurate forecasting models, making North America a leading market hub for innovative solutions

U.S. Energy Demand Forecasting Market Insight

The U.S. energy demand forecasting market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of smart grids and the push towards decarbonization. Growing electricity consumption from data centers, electric vehicles, and urban infrastructure has intensified the need for highly accurate forecasting models. Utilities are deploying predictive analytics to enhance grid stability and manage peak demand effectively. Furthermore, federal initiatives supporting clean energy transitions and digital infrastructure investments are accelerating the uptake of forecasting technologies in the U.S.

Europe Energy Demand Forecasting Market Insight

The Europe energy demand forecasting market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent energy efficiency regulations and the EU’s aggressive renewable energy targets. The rising penetration of solar, wind, and distributed energy resources is making demand forecasting critical to balance fluctuating supply. Increasing urbanization and the shift towards electrified transportation are also boosting forecasting adoption. European energy providers are emphasizing smart grid infrastructure and advanced analytics to ensure reliable power delivery, making the region a fast-growing hub for forecasting solutions.

U.K. Energy Demand Forecasting Market Insight

The U.K. energy demand forecasting market is anticipated to grow at a noteworthy CAGR, supported by the country’s ambitious net-zero targets and expanding renewable energy mix. The increasing adoption of electric vehicles and smart home technologies is intensifying the need for predictive energy demand models. Utilities and government agencies are investing in AI-based forecasting systems to optimize energy planning and avoid grid imbalances. Moreover, the U.K.’s regulatory push for sustainable energy usage and the modernization of energy infrastructure further stimulate market growth.

Germany Energy Demand Forecasting Market Insight

The Germany energy demand forecasting market is expected to expand at a considerable CAGR, driven by the nation’s strong focus on innovation, digitalization, and renewable energy integration. Germany’s “Energiewende” (energy transition) policies have amplified the importance of accurate forecasting to balance intermittent renewable power sources such as wind and solar. With a well-developed industrial base, Germany also faces growing energy requirements that necessitate advanced demand prediction. Increasing reliance on smart meters and IoT-enabled energy management systems is enhancing forecasting adoption across both residential and industrial sectors.

Asia-Pacific Energy Demand Forecasting Market Insight

The Asia-Pacific energy demand forecasting market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid industrialization, urbanization, and escalating electricity consumption in countries such as China, India, and Japan. The region’s rising adoption of renewable energy and government-led digitalization initiatives are creating strong opportunities for advanced forecasting systems. Growing investments in smart grid projects and the expansion of EV infrastructure are also accelerating demand. With APAC emerging as a major hub for both energy consumption and clean energy development, forecasting technologies are gaining strong traction.

Japan Energy Demand Forecasting Market Insight

The Japan energy demand forecasting market is gaining momentum due to the country’s high reliance on technology, advanced infrastructure, and growing renewable energy penetration. Forecasting solutions are vital in Japan to balance fluctuating demand from solar and wind power sources while ensuring grid reliability. The increasing electrification of transport and the rising number of smart homes are driving demand for precise predictive models. In addition, Japan’s aging population is creating unique patterns of energy use, making advanced forecasting tools essential for effective planning and distribution.

China Energy Demand Forecasting Market Insight

The China energy demand forecasting market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the nation’s massive electricity demand, rapid industrial growth, and strong renewable energy investments. China is one of the largest consumers of energy globally, and the integration of forecasting models is crucial for managing its extensive grid networks. Government initiatives supporting smart city projects and the expansion of EV infrastructure further amplify market growth. The presence of domestic technology providers and large-scale renewable installations ensures China remains at the forefront of forecasting adoption.

Energy Demand Forecasting Market Share

The energy demand forecasting industry is primarily led by well-established companies, including:

- Hitachi Energy (Switzerland)

- IBM (U.S.)

- Oracle (U.S.)

- Schneider Electric (France)

- Siemens (Germany)

- General Electric (U.S.)

- ABB (Switzerland)

- SAS Institute (U.S.)

- Tata Consultancy Services (India)

- Autogrid Systems (U.S.)

Latest Developments in Global Energy Demand Forecasting Market

- In August 2025, ENGIE India integrated AI-based forecasting tools into its Smart & Energy Management (S&EM) platform to optimize energy dispatch, manage grid fluctuations, and support renewable energy integration. With India’s electricity demand rising rapidly and renewable capacity expanding at record pace, such AI-powered solutions help utilities predict consumption patterns with higher accuracy, minimize curtailment of solar and wind power, and strengthen grid stability. This development positions India as a frontrunner in adopting next-gen forecasting to meet its clean energy transition goals

- In June 2025, RWE entered a strategic partnership with Amazon Web Services (AWS) to advance renewable forecasting and trading efficiency. While RWE supplies clean energy to Amazon’s operations, AWS brings AI, ML, and cloud-based analytics to enhance RWE’s ability to forecast variable renewable output. This collaboration demonstrates how big tech and energy giants are converging to solve grid volatility challenges and highlights the growing reliance on cloud-native forecasting for renewable-heavy power systems

- In May 2025, Nextracker acquired Bentek Corporation for $78 million, expanding into solar project electrification and electrical balance of system (eBOS) capabilities. By combining hardware expertise with advanced software-driven energy optimization, Nextracker strengthens its ability to offer integrated solar infrastructure solutions. This acquisition enhances real-time monitoring, energy dispatch forecasting, and efficiency in utility-scale solar projects, making forecasting an embedded part of solar project deployment

- In March 2025, Apollo Global Management acquired a majority stake in OEG Energy Group to accelerate its green energy services, particularly offshore wind and solar. The move strengthens OEG’s renewable portfolio and also boosts its energy management and forecasting capabilities. For Apollo, the investment signifies confidence in the value of digital forecasting platforms to maximize renewable energy efficiency, reduce operational risk, and increase profitability of large-scale clean energy projects

- In November 2024, Hitachi Energy launched Nostradamus AI, an advanced cloud-native forecasting solution combining grid analytics, asset monitoring, and predictive modeling. The tool enables grid operators and utilities to anticipate demand surges, equipment failures, and renewable fluctuations with greater accuracy. Its launch signals a significant leap in digital energy forecasting, giving stakeholders a smarter way to balance renewables while ensuring resilience against outages and price volatility

- In October 2024, Google partnered with Kairos Power to co-develop small modular reactors (SMRs) capable of generating up to 500 MW of carbon-free power. For Google, this ensures long-term, reliable energy for its AI-driven infrastructure. From a forecasting perspective, SMRs provide a predictable and steady power supply that complements intermittent renewables, reducing forecasting uncertainty and stabilizing energy demand planning

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.