Global Energy Retrofit Systems Market

Market Size in USD Billion

CAGR :

%

USD

163.92 Billion

USD

227.81 Billion

2024

2032

USD

163.92 Billion

USD

227.81 Billion

2024

2032

| 2025 –2032 | |

| USD 163.92 Billion | |

| USD 227.81 Billion | |

|

|

|

|

Energy Retrofit Systems Market Size

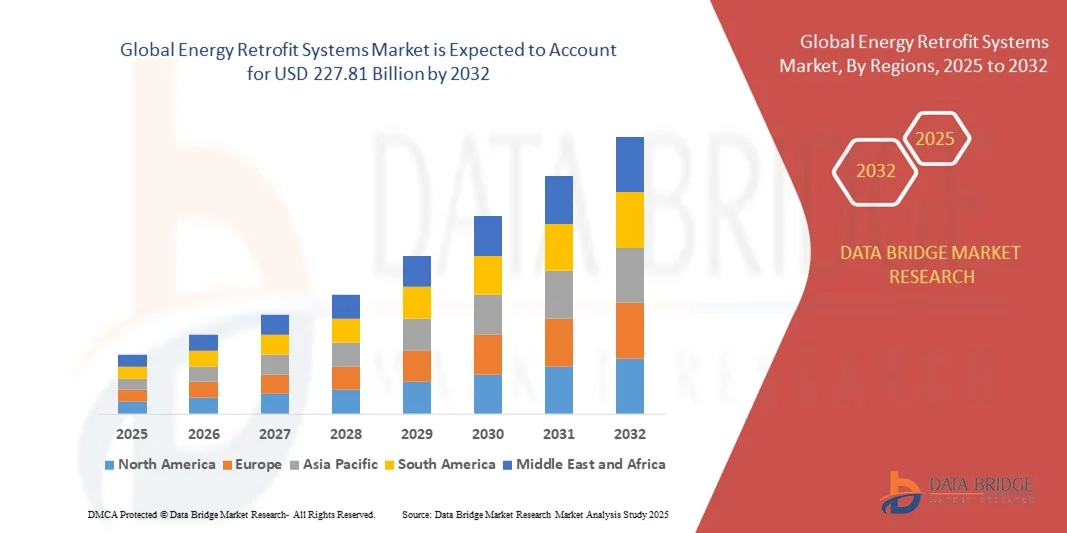

- The global energy retrofit systems market size was valued at USD 163.92 billion in 2024 and is expected to reach USD 227.81 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is largely driven by increasing emphasis on energy efficiency, sustainability, and carbon reduction across residential, commercial, and industrial sectors, leading to heightened adoption of energy retrofit solutions

- Furthermore, government incentives, stringent energy regulations, and growing awareness of long-term cost savings are motivating property owners to invest in retrofitting projects. These combined factors are accelerating the implementation of energy retrofit systems, thereby significantly boosting the market's growth

Energy Retrofit Systems Market Analysis

- Energy retrofit systems encompass solutions such as advanced HVAC upgrades, insulation, LED lighting, building automation, and smart energy management technologies aimed at improving energy efficiency in existing buildings

- The rising demand for these systems is primarily fueled by the need to reduce energy consumption, lower operational costs, comply with environmental regulations, and enhance sustainability across residential, commercial, and industrial applications

- Europe dominated the energy retrofit systems market with a share of 48.12% in 2024, due to stringent energy efficiency regulations, government incentives, and rising awareness of sustainable building practices

- Asia-Pacific is expected to be the fastest growing region in the energy retrofit systems market during the forecast period due to rapid urbanization, industrialization, and increasing environmental awareness in countries such as China, Japan, and India

- HVAC and controls segment dominated the market with a market share of 42% in 2024, due to the growing need to upgrade aging heating, ventilation, and air conditioning equipment to meet stricter energy-efficiency standards. Governments across various regions are introducing policies and incentives to reduce carbon emissions, prompting building owners to replace outdated HVAC units with high-performance, smart-controlled systems. The rising adoption of IoT-enabled HVAC solutions that optimize energy usage, along with escalating utility costs, further fuels demand for HVAC retrofits in both commercial and residential sectors. Continuous advancements in energy management software and integration with renewable energy sources also strengthen the dominance of this segment

Report Scope and Energy Retrofit Systems Market Segmentation

|

Attributes |

Energy Retrofit Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Energy Retrofit Systems Market Trends

Adoption of Smart, IoT-Enabled Energy Retrofit Solutions

- The adoption of smart, IoT-enabled energy retrofit systems is rapidly transforming the energy efficiency landscape, where buildings and industrial facilities are upgrading to incorporate real-time monitoring, predictive maintenance, and intelligent control systems. Smart retrofits allow organizations to optimize energy consumption while reducing operational costs and greenhouse gas emissions

- For instance, Johnson Controls has been integrating IoT-enabled building management systems that connect HVAC, lighting, and energy monitoring tools into centralized platforms. These systems provide real-time data analytics and remote control, showcasing how leading companies are driving the adoption of connected retrofit solutions

- IoT-enabled retrofits facilitate predictive analytics, allowing operators to forecast equipment performance and detect potential faults before they cause costly downtime. This proactive approach enhances equipment reliability and also helps in maintaining compliance with strict energy efficiency standards

- The integration of sensors and cloud-based software in retrofitted systems enables deeper insights into energy usage patterns, empowering facility managers to make data-driven decisions for sustainability. Such intelligence allows organizations to balance efficiency targets with occupant comfort and operational continuity

- The growing awareness of sustainable building management has led to increased adoption of smart energy retrofits in commercial spaces, healthcare facilities, and educational institutions. These retrofits are aligning with green certification frameworks such as LEED, further contributing to their rising demand across global construction markets

- The adoption of IoT-enabled retrofit solutions is positioning sustainable energy management as a long-term investment strategy, where organizations benefit from enhanced performance visibility, reduced carbon footprint, and alignment with global sustainability commitments. This trend is expected to drive widespread transformation in building and industrial energy infrastructure

Energy Retrofit Systems Market Dynamics

Driver

Government Incentives and Energy Efficiency Regulations

- Government initiatives promoting energy efficiency and emission reduction are a strong driver for the energy retrofit systems market. Regulatory frameworks encourage commercial and industrial entities to upgrade their facilities with modern retrofit solutions that improve energy performance and reduce environmental impacts

- For instance, the U.S. Department of Energy and the European Commission have launched energy efficiency programs that provide tax incentives, subsidies, and low-interest financing options for building retrofits. Energy service companies such as Siemens and Schneider Electric are leveraging these incentives to expand retrofit implementation across developed and developing nations

- Mandatory energy performance standards and certification initiatives are compelling property owners to adopt retrofit measures for compliance with regulations. These standards often require regular energy audits, efficient technology integration, and clear reporting on carbon reduction efforts, fostering higher adoption rates of retrofit solutions

- In addition, the alignment of retrofit projects with national renewable energy goals and decarbonization roadmaps is fostering adoption across both urban and industrial settings. Government support is enabling the development of advanced retrofit technologies such as digital energy platforms and next-generation HVAC solutions

- The direct financial savings generated through energy efficiency improvements combined with government-backed incentives make retrofitting projects increasingly attractive. This policy-driven environment is ensuring strong momentum for retrofit adoption as part of long-term sustainability and energy transition strategies globally

Restraint/Challenge

High Upfront Costs and Long Payback Periods

- A significant challenge in the energy retrofit systems market is the high upfront investment required for advanced technologies such as IoT-enabled systems, smart sensors, and energy-efficient HVAC equipment. The substantial capital expenditure often becomes a barrier to adoption for cost-sensitive businesses and property owners

- For instance, smaller commercial building operators often delay or opt out of retrofit projects due to the initial cost burden despite the availability of long-term savings. Even with financing schemes, companies face hesitation in committing to upgrades offered by providers such as Honeywell and Johnson Controls due to immediate capital requirements

- Long payback periods for retrofit investments also deter potential adopters, especially in markets with lower energy prices or limited awareness of lifecycle savings. Stakeholders often prioritize short-term cost control over long-term efficiency, which hinders broader adoption of retrofit strategies

- The complexity of retrofitting older buildings presents additional challenges, as these structures require significant modifications to accommodate new technologies, thereby increasing overall project costs and risks. This complexity further amplifies concerns about delayed returns

- Addressing these challenges requires innovative financing options, performance-based contracting models, and greater awareness of long-term benefits. Reducing upfront costs through scalable solutions and collaborative funding will be essential for making energy retrofit systems more accessible and accelerating market growth

Energy Retrofit Systems Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the energy retrofit systems market is segmented into HVAC and Controls, Insulation and Glazing, Lighting and Controls, and Water Heating. The HVAC and Controls segment dominated the largest market revenue share of 42% in 2024, driven by the growing need to upgrade aging heating, ventilation, and air conditioning equipment to meet stricter energy-efficiency standards. Governments across various regions are introducing policies and incentives to reduce carbon emissions, prompting building owners to replace outdated HVAC units with high-performance, smart-controlled systems. The rising adoption of IoT-enabled HVAC solutions that optimize energy usage, along with escalating utility costs, further fuels demand for HVAC retrofits in both commercial and residential sectors. Continuous advancements in energy management software and integration with renewable energy sources also strengthen the dominance of this segment.

The Insulation and Glazing segment is projected to witness the fastest growth rate from 2025 to 2032, supported by increasing emphasis on minimizing energy loss and improving thermal performance of buildings. Rapid urbanization and the construction of energy-intensive high-rise structures are creating strong demand for advanced insulation materials and high-performance glazing solutions to maintain indoor comfort while reducing heating and cooling costs. Government initiatives promoting net-zero energy buildings and stricter building codes mandating better insulation standards further drive this trend. In addition, the growing popularity of sustainable construction practices and the rising awareness among property owners about long-term cost savings are accelerating the adoption of insulation and glazing retrofits.

- By Application

On the basis of application, the energy retrofit systems market is segmented into Residential Building, Commercial, and Public Building. The Commercial segment held the largest market revenue share in 2024, propelled by the significant need for energy-efficient upgrades in office complexes, retail spaces, hotels, and industrial facilities. Businesses are increasingly investing in retrofit projects to reduce operational expenses, meet corporate sustainability goals, and comply with tightening environmental regulations. The integration of smart controls and building automation systems within commercial properties enhances energy optimization and provides attractive ROI, encouraging widespread adoption across small and large enterprises. The presence of government incentives and energy performance certifications further supports strong market growth within this segment.

The Residential Building segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by rising consumer awareness of energy conservation and the financial benefits of lower utility bills. Homeowners are increasingly adopting energy retrofit solutions such as smart HVAC systems, LED lighting upgrades, and advanced insulation to improve comfort while reducing carbon footprints. Growing government rebate programs, favorable mortgage incentives for green renovations, and the surging popularity of smart home technologies are key drivers of this rapid expansion. In addition, the shift toward sustainable living and the rising cost of electricity are motivating homeowners to invest in efficient retrofit systems that provide long-term savings and enhanced property value.

Energy Retrofit Systems Market Regional Analysis

- Europe dominated the energy retrofit systems market with the largest revenue share of 48.12% in 2024, driven by stringent energy efficiency regulations, government incentives, and rising awareness of sustainable building practices

- Consumers and businesses in the region are increasingly prioritizing retrofitting projects that reduce energy consumption, lower operational costs, and comply with carbon reduction targets

- The widespread adoption is further supported by advanced technological solutions, strong financing mechanisms, and growing interest in smart energy management systems, establishing energy retrofit systems as a preferred choice across residential, commercial, and industrial properties

Germany Energy Retrofit Systems Market Insight

The Germany market captured the largest revenue share in Europe in 2024, fueled by the country’s strong focus on energy efficiency and sustainability. Stringent building codes and government-funded incentives for retrofitting existing buildings are driving demand. Consumers and businesses are adopting innovative insulation, HVAC upgrades, and energy management solutions to reduce costs and environmental impact. Germany’s well-established construction and engineering sectors, combined with a high level of technological adoption, further support market growth.

U.K. Energy Retrofit Systems Market Insight

The U.K. market is expected to grow at a robust CAGR during the forecast period, driven by government-led energy efficiency programs and rising energy costs. The push for net-zero carbon emissions is encouraging both homeowners and commercial property owners to invest in retrofitting projects. Integration of advanced energy monitoring systems and smart building solutions is becoming increasingly common, enhancing operational efficiency and energy savings. The U.K.’s mature real estate sector and public awareness of sustainability are significant growth enablers.

France Energy Retrofit Systems Market Insight

The France market is witnessing steady growth due to strict energy performance standards and growing adoption of green building technologies. Renovation initiatives targeting older buildings, combined with incentives for solar panels, insulation, and energy-efficient heating, are propelling market expansion. France’s emphasis on sustainability and urban modernization supports the integration of advanced energy retrofit systems in both residential and commercial projects.

North America Energy Retrofit Systems Market Insight

The North America market is growing steadily, driven by increasing energy costs and government programs promoting energy efficiency in buildings. The U.S. is the largest contributor, with demand focused on retrofitting commercial buildings and residential properties with energy-efficient solutions. Advanced HVAC systems, insulation, and smart energy management platforms are key components driving adoption. The region benefits from strong technological infrastructure, financial incentives, and heightened awareness of environmental sustainability.

U.S. Energy Retrofit Systems Market Insight

The U.S. market accounted for the largest revenue share in North America in 2024, fueled by rising energy costs and growing adoption of smart energy solutions. Retrofitting initiatives are increasingly supported by federal and state-level incentives, as well as growing corporate sustainability programs. Consumers and businesses are focused on reducing operational expenses and achieving long-term energy efficiency goals.

Asia-Pacific Energy Retrofit Systems Market Insight

The Asia-Pacific market is expected to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, industrialization, and increasing environmental awareness in countries such as China, Japan, and India. Government initiatives promoting energy-efficient buildings, coupled with rising disposable incomes, are accelerating adoption. APAC is also emerging as a hub for innovative retrofit technologies, making solutions more accessible and cost-effective for a wide range of consumers.

China Energy Retrofit Systems Market Insight

China dominates the APAC region in 2024, attributed to strong government policies supporting energy efficiency and the modernization of aging infrastructure. Demand for retrofit solutions spans residential, commercial, and industrial sectors, with emphasis on insulation, HVAC upgrades, and smart energy management. Rapid urbanization and government-driven green building initiatives are major factors driving market expansion.

Japan Energy Retrofit Systems Market Insight

The Japan market is growing steadily due to technological advancement, urbanization, and increasing focus on sustainability. Consumers and businesses are investing in retrofitting solutions to improve energy efficiency and reduce operational costs. Integration with IoT-enabled building management systems and smart energy monitoring solutions is driving adoption, particularly in commercial and multi-family residential buildings.

Energy Retrofit Systems Market Share

The energy retrofit systems industry is primarily led by well-established companies, including:

- Danfoss (Denmark)

- Orion Energy Systems, Inc. (U.S.)

- Siemens (Germany)

- E.ON SE (Germany)

- Ameresco (U.S.)

- ROI-Energy (U.S.)

- Eaton (U.S.)

- AECOM (U.S.)

- Johnson Controls (U.S.)

- Chevron Corporation (U.S.)

- Signify Holding (Netherlands)

- Trane Technologies (U.S.)

- Burns & McDonnell (U.S.)

- Benham (U.S.)

- CEG Solutions LLC (U.S.)

- Schneider Electric (France)

- SUEZ (France)

- Con Edison Clean Energy Businesses (U.S.)

- WAHASO (U.S.)

- Kontrol Energy Inc. (Canada)

Latest Developments in Global Energy Retrofit Systems Market

- In January 2024, Danfoss and Google entered a strategic partnership to integrate Danfoss' heat reuse modules into Google's data centers. This collaboration enables the capture and repurposing of excess heat from data centers, transforming it into renewable energy for on-site heating and neighboring commercial and residential buildings. By leveraging advanced technologies, this initiative is expected to significantly reduce energy consumption and carbon emissions, setting a new benchmark for sustainable data center operations

- In January 2024, Honeywell and NXP Semiconductors collaborated to integrate NXP's neural network-enabled, industrial-grade application processors into Honeywell’s building management systems. This integration enhances the intelligence and efficiency of building operations, allowing real-time energy optimization and improved occupant comfort. The partnership strengthens the adoption of smart building technologies and promotes significant energy savings across commercial and residential applications

- In October 2021, Ameresco partnered with Wells County, Indiana, to renovate and modernize the county's jail facility. The project involved replacing outdated HVAC systems, upgrading lighting to energy-efficient LED fixtures, enhancing the controls system, and constructing a new building expansion. These energy retrofit initiatives are projected to substantially lower operational costs and energy consumption, showcasing the tangible impact of retrofitting in public infrastructure

- In December 2020, Orion Energy Systems secured a contract extension valued at approximately $40 million for turnkey LED lighting and controls retrofits at 290 additional locations for a large national retail customer. The project included installing advanced LED lighting fixtures and IoT-enabled control systems, highlighting the growing commercial demand for energy-efficient solutions and the potential for significant energy and cost savings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Energy Retrofit Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Energy Retrofit Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Energy Retrofit Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.