Global Energy Storage Optimization Market

Market Size in USD Billion

CAGR :

%

USD

53.78 Billion

USD

237.48 Billion

2024

2032

USD

53.78 Billion

USD

237.48 Billion

2024

2032

| 2025 –2032 | |

| USD 53.78 Billion | |

| USD 237.48 Billion | |

|

|

|

|

Energy Storage Optimization Market Size

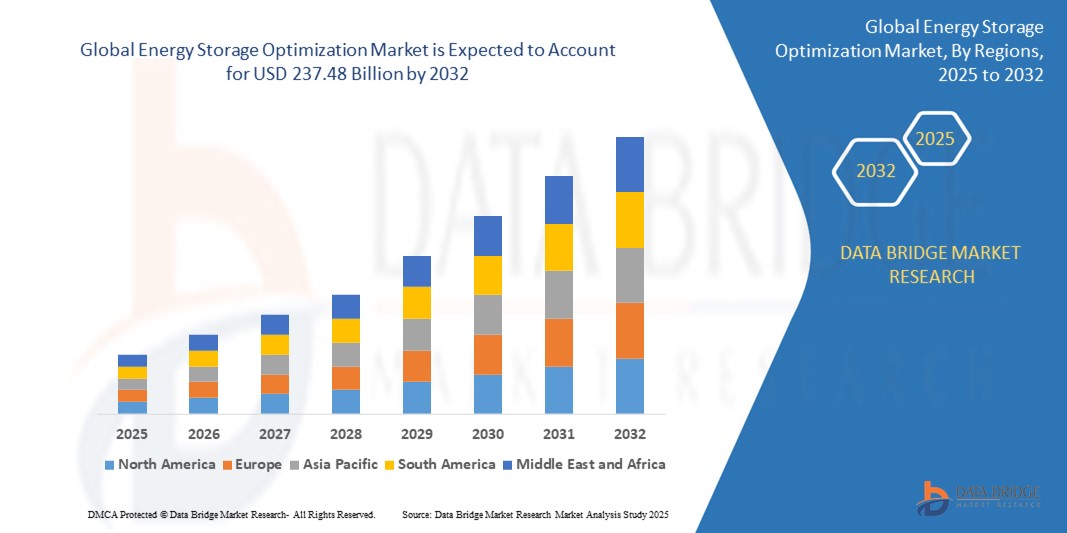

- The global Energy Storage Optimization market size was valued at USD 53.78 billion in 2024 and is expected to reach USD 237.48 billion by 2032, at a CAGR of 20.40% during the forecast period

- The market growth is primarily driven by the rising integration of renewable energy sources, such as solar and wind, which require effective storage solutions to balance supply and demand fluctuations and ensure grid stability

- In addition, supportive government policies, declining battery costs, and grid modernization initiatives are accelerating the deployment of energy storage optimization systems across residential, commercial, and utility-scale applications

- Moreover, technological innovations in AI-driven energy management systems, real-time analytics, and predictive optimization algorithms are enhancing the efficiency and performance of energy storage assets. These factors are collectively boosting the market’s adoption globally and positioning Energy Storage Optimization as a critical enabler of a sustainable and resilient energy future

Energy Storage Optimization Market Analysis

- Energy Storage Optimization systems, which leverage intelligent software and analytics to enhance the performance of energy storage assets, are becoming crucial in modern energy infrastructure due to their role in maximizing efficiency, reducing operational costs, and enabling seamless integration of renewable energy sources

- The accelerating demand for Energy Storage Optimization is primarily fueled by the global shift toward decarbonization, increasing reliance on intermittent renewable energy, growing electricity demand, and heightened focus on grid reliability and resiliency

- North America dominates the Energy Storage Optimization market, accounting for a market share of 38.4% in 2025, supported by strong federal and state-level incentives, expanding renewable energy capacity, and significant investments in smart grid technologies. The United States leads the region with growing adoption across utility-scale and commercial energy storage projects

- Asia-Pacific is expected to be the fastest-growing region, with a projected CAGR of 6.2% during the forecast period, driven by rapid industrialization, ambitious national energy storage targets, and favorable regulatory frameworks—especially in China, India, Japan, and South Korea

- The Lithium-ion Batteries segment is projected to dominate the Energy Storage Optimization market in 2025, capturing a market share of approximately 61.5%. This dominance is driven by their superior energy density, longer lifecycle, and extensive use in electric vehicles, grid storage, and consumer electronics. Lithium-ion batteries are favored for applications such as frequency regulation, peak shaving, and renewable energy integration across utility and commercial sectors.

Report Scope and Energy Storage Optimization Market Segmentation

|

Attributes |

Energy Storage Optimization Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Energy Storage Optimization Market Trends

“Advancements in AI-Driven Energy Management and Grid Integration”

- A dominant and rapidly evolving trend in the global Energy Storage Optimization market is the widespread adoption of artificial intelligence (AI) and machine learning (ML) algorithms to enhance energy management efficiency and predictive analytics for storage systems. This shift is enabling more accurate demand forecasting and optimized energy dispatch

- Leading energy storage providers such as Tesla, Siemens, and AES Corporation are implementing AI-powered software platforms that analyze grid load patterns, weather forecasts, and consumption data in real time, allowing utilities and end-users to optimize battery charging and discharging cycles to reduce costs and maximize lifespan

- The trend toward smart grid integration is accelerating, where energy storage systems are interconnected with distributed energy resources (DERs), renewable generation (solar, wind), and demand response programs. These systems support grid stability by balancing supply-demand fluctuations and enhancing energy resiliency

- The emergence of vehicle-to-grid (V2G) technology enables electric vehicles (EVs) to act as mobile energy storage units, feeding excess energy back to the grid during peak demand. Companies such as Nuvve and Enel X are pioneering commercial V2G platforms, expanding the role of EVs in energy optimization

- Energy storage solutions are increasingly integrated with Internet of Things (IoT) sensors and cloud-based platforms, allowing remote monitoring, real-time performance optimization, and predictive maintenance to minimize downtime and operational costs

- The rise of decentralized energy systems and microgrids in residential, commercial, and industrial sectors is creating new opportunities for optimized energy storage deployments that enhance local energy autonomy and reduce dependence on centralized grids

- Market leaders such as LG Chem, Panasonic, and CATL are innovating in battery chemistries (solid-state, lithium-ion improvements) and modular system designs, enabling scalable and customizable energy storage solutions tailored to diverse applications, from utility-scale to residential

- Regulatory support and government incentives for renewable integration and grid modernization, especially in regions such as Europe, North America, and Asia-Pacific, are further driving the adoption of advanced energy storage optimization technologies

Energy Storage Optimization Market Dynamics

Driver

“Increasing Demand for Efficient and Sustainable Energy Management Solutions”

- The accelerating global transition to renewable energy sources, combined with the need for grid reliability and energy cost savings, is a key driver propelling demand for energy storage optimization technologies. Governments, utilities, and commercial enterprises are prioritizing energy storage to enhance renewable integration and reduce carbon footprints

- For instance, in March 2024, the European Commission announced a €1.5 billion funding package to support energy storage projects that improve grid flexibility and renewable energy uptake across the EU. Similar initiatives are underway in North America and Asia-Pacific regions

- Growing adoption of electric vehicles (EVs) and distributed energy resources (DERs) is driving the need for optimized battery management systems that maximize battery lifespan, energy efficiency, and cost-effectiveness

- Increasing focus on energy cost optimization in industrial and commercial sectors is boosting deployment of AI-powered and IoT-enabled energy storage systems that enable real-time energy load balancing and predictive maintenance

- Expansion of microgrids and off-grid energy solutions in remote and developing areas is further creating demand for scalable and smart energy storage optimization solutions to ensure energy access and reliability

Restraint/Challenge

“High Capital Expenditure and Technical Limitations in Energy Storage Systems”

- The significant initial investment required for energy storage optimization systems, particularly for utility-scale battery installations and advanced software platforms, remains a major adoption barrier in cost-sensitive markets

- For instance, state-of-the-art lithium-ion battery systems integrated with AI management software can cost several hundred dollars per kWh of capacity, limiting accessibility for smaller consumers and emerging markets

- Battery performance issues such as degradation over cycles, limited charge-discharge efficiency, and thermal management challenges impact system reliability and user confidence

- Recycling, disposal, and environmental concerns related to battery materials, especially lithium and cobalt, continue to pressure manufacturers and policymakers to develop sustainable end-of-life solutions

- Moreover, the complexity of integrating diverse energy sources and legacy grid infrastructure with optimization technologies can delay deployment and increase operational risks

- Addressing these challenges requires ongoing advancements in battery chemistries (such as solid-state batteries), cost reduction through economies of scale, regulatory support, and enhanced consumer education on lifecycle benefits

Energy Storage Optimization Market Scope

The market is segmented on the basis technology, end use, application, and energy capacity.

By Technology

On the basis of technology, the Energy Storage Optimization market is segmented into Lithium-ion Batteries, Flow Batteries, Lead-Acid Batteries, and Sodium-Sulfur Batteries. The Lithium-ion Batteries segment dominates the largest market revenue share in 2025, driven by its high energy density, long lifecycle, and fast response times. These batteries are preferred for their performance reliability, scalability, and widespread applicability in both stationary and mobile energy storage systems

The Flow Batteries segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by their scalability, long-duration storage capabilities, and suitability for large-scale renewable energy integration. Increasing demand for long-cycle, low-degradation systems in utility applications is accelerating the adoption of this technology

• By End Use

On the basis of end use, the Energy Storage Optimization market is segmented into Residential, Commercial, Utility, and Transportation. The Utility segment held the largest market revenue share in 2025, owing to significant investments in grid modernization, frequency regulation, and renewable energy storage. Energy storage optimization is increasingly adopted by utilities to manage peak loads and ensure energy reliability

The Transportation segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the electrification of public transit, logistics fleets, and personal electric vehicles. Optimization systems in this segment are enabling efficient battery management and improved energy efficiency across the transport sector

• By Application

On the basis of application, the Energy Storage Optimization market is segmented into Grid Storage, Renewable Energy Integration, Backup Power, and Electric Vehicle Charging. The Grid Storage segment dominated the market with the highest revenue share in 2025, as it supports peak shaving, frequency control, and load balancing for national and regional electricity grids

The Renewable Energy Integration segment is projected to grow steadily, favored for its role in addressing the intermittency of solar and wind power and enhancing the stability of decentralized energy networks. Optimization technologies enable seamless coordination between renewable inputs and storage assets

• By Energy Capacity

On the basis of energy capacity, the market is segmented into Small Scale, Medium Scale, and Large Scale. The Medium Scale segment led the market in 2025, widely deployed in commercial and industrial applications for load shifting and demand charge reduction. These systems strike a balance between cost and performance, making them attractive for mid-size facilities

The Large Scale segment is anticipated to grow at the fastest pace during the forecast period, fueled by the rising deployment of utility-scale storage farms, renewable integration projects, and national energy storage mandates. These installations require advanced optimization systems to handle high power throughput, long-duration storage, and complex grid interactions

Energy Storage Optimization Regional Analysis

- North America dominates the energy storage optimization market with the largest revenue share of 38.4% in 2025, driven by the widespread deployment of utility-scale and behind-the-meter storage solutions aimed at enhancing grid resilience, supporting renewable integration, and improving energy efficiency

- Utilities and commercial entities across the region are increasingly adopting Energy Storage Optimization platforms to manage energy loads, reduce peak demand charges, and comply with stringent carbon reduction targets

- This growth is further supported by favorable federal policies such as the Investment Tax Credit (ITC), advancements in AI-powered grid management tools, and the strong presence of leading energy storage technology firms and solution providers, reinforcing North America’s leadership position in the global market

U.S. Energy Storage Optimization Market Insight

The U.S. Energy Storage Optimization market captured the largest revenue share of 81% within North America in 2025, driven by robust investments in utility-scale energy storage projects and increasing integration of renewables such as solar and wind. Government incentives such as the Investment Tax Credit (ITC) and state-level mandates are encouraging deployment of energy storage optimization software. In addition, the rising adoption of distributed energy resources (DERs) and microgrids is pushing demand for intelligent storage management platforms capable of real-time monitoring, predictive analytics, and peak load management

Europe Energy Storage Optimization Market Insight

The European Energy Storage Optimization market is projected to expand at a substantial CAGR throughout the forecast period, supported by the EU’s decarbonization targets and increasing deployment of renewable energy sources. Strict regulations promoting grid flexibility and carbon neutrality are accelerating adoption across both residential and utility sectors. The growing emphasis on cross-border electricity trade and smart grid upgrades is also fostering demand for advanced optimization tools that manage energy storage with greater precision and transparency

U.K. Energy Storage Optimization Market Insight

The U.K. Energy Storage Optimization market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a rapid shift towards renewable energy integration and increased grid instability concerns. National policies supporting net-zero emissions by 2050 and the rollout of energy storage incentive programs are encouraging the adoption of optimization platforms in both front-of-the-meter and behind-the-meter systems. The market is further fueled by the U.K.’s strong digital infrastructure and innovation-led approach to clean energy

Germany Energy Storage Optimization Market Insight

The German Energy Storage Optimization market is expected to expand at a considerable CAGR during the forecast period, supported by Germany’s leadership in clean energy transition and technological innovation. The rising number of decentralized energy systems and residential solar + storage installations are propelling demand for intelligent energy optimization solutions. Moreover, government incentives under the KfW programs and focus on grid decentralization make Germany a key market for software-driven storage management tools

Asia-Pacific Energy Storage Optimization Market Insight

The Asia-Pacific Energy Storage Optimization market is poised to grow at the fastest CAGR of over 24% in 2025, driven by surging investments in renewable energy infrastructure, urbanization, and digital transformation. Countries such as China, Japan, India, and South Korea are actively deploying energy storage systems to stabilize their power grids and meet rising electricity demand. Government-led clean energy initiatives and the growing presence of domestic tech players are further accelerating adoption of optimization platforms

Japan Energy Storage Optimization Market Insight

The Japan Energy Storage Optimization market is gaining traction due to its high-tech energy ecosystem, aging population, and increasing vulnerability to natural disasters, which emphasize the need for resilient energy systems. Energy storage optimization solutions are being widely adopted to manage renewable intermittency and support grid independence. Japan’s emphasis on smart cities and IoT integration is also fostering the development of AI-enabled energy platforms for efficient load balancing and cost reduction

China Energy Storage Optimization Market Insight

The China Energy Storage Optimization market accounted for the largest market revenue share in Asia Pacific in 2025, driven by aggressive government targets for renewable integration and massive urban expansion. The country's role as a global manufacturing hub for batteries and energy storage systems enables cost-effective deployments. Moreover, initiatives such as the "New Infrastructure" policy and the national focus on carbon neutrality by 2060 are catalyzing the adoption of intelligent energy storage management platforms across commercial, industrial, and utility sectors

Energy Storage Optimization Market Share

The energy storage optimization industry is primarily led by well-established companies, including:

- Panasonic (Japan)

- AES Corporation (U.S.)

- Saft (France)

- Tesla (U.S.)

- Schneider Electric (France)

- BYD (China)

- Samsung SDI (South Korea)

- SunPower (U.S.)

- Enphase Energy (U.S.)

- Siemens (Germany)

- VARTA (Germany)

- Contemporary Amperex Technology Co. Limited (CATL) (China)

- Hitachi (Japan)

- LG Chem (South Korea)

- General Electric (U.S.)

Latest Developments in Global Energy Storage Optimization Market

- In November 2024, Hydrostor signed a Crown Lands agreement with the New South Wales (NSW) government to develop the Silver City Energy Storage Centre. This project aims to enhance energy stability in the region by establishing a mini-grid system and providing essential backup power to Broken Hill. The facility will generate 200 MW of power, offering 8 hours of storage at full capacity and longer durations at lower output levels

- In March 2024, Schneider Electric and Hy Stor Energy signed a memorandum of understanding to advance the Mississippi Clean Hydrogen Hub (MCHH) and its broader U.S. development platform. This collaboration focuses on tackling large-scale energy and sustainability challenges, facilitating the transition to renewable and fossil-free energy systems. Schneider Electric will contribute automation, safety solutions, AI optimization software, weather analysis, predictive operations, and digital energy management tools

- In December 2023, Customized Energy Solutions (CES) and Peninsula Clean Energy entered a long-term partnership to enhance the management and optimization of Peninsula Clean Energy’s renewables and energy storage portfolio within the California Independent System Operator (CAISO) markets. This collaboration supports Peninsula Clean Energy’s goal of delivering 100% renewable energy to customers in the City of Los Banos and San Mateo County by 2025

- In November 2023, Schneider Electric invested USD 1.7 million in a state-of-the-art battery lab in Bengaluru. The facility is designed with advanced diagnostic equipment, modern safety systems, and dedicated testing chambers to ensure optimal battery performance while meeting stringent safety standards. This initiative reinforces Schneider Electric’s commitment to sustainable energy solutions and innovation in battery technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.