Global Engine Components Market

Market Size in USD Billion

CAGR :

%

USD

7.05 Billion

USD

7.75 Billion

2025

2033

USD

7.05 Billion

USD

7.75 Billion

2025

2033

| 2026 –2033 | |

| USD 7.05 Billion | |

| USD 7.75 Billion | |

|

|

|

|

Engine Components Market Size

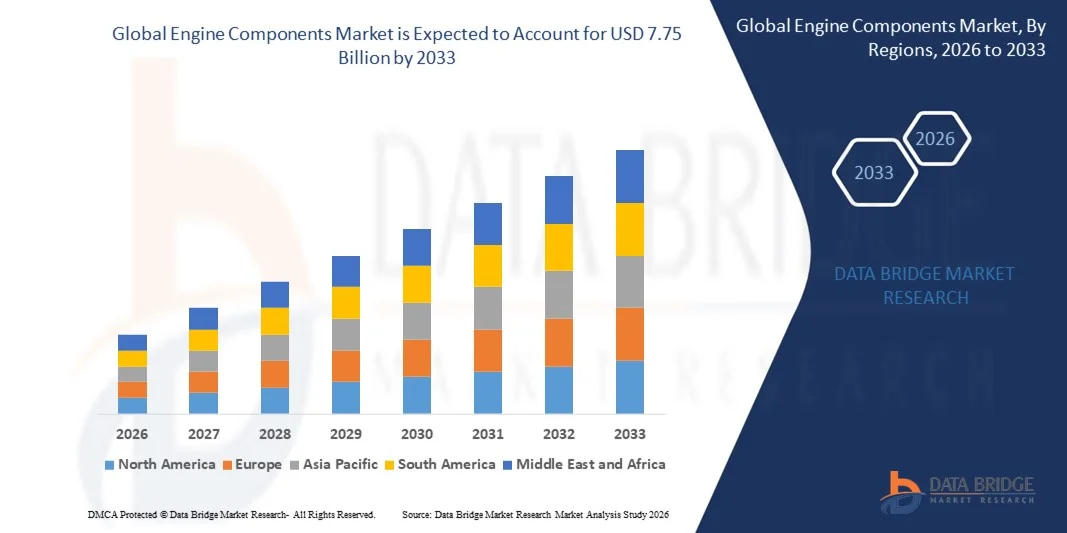

- The global engine components market size was valued at USD 7.05 billion in 2025 and is expected to reach USD 7.75 billion by 2033, at a CAGR of 1.20% during the forecast period

- The market growth is largely fueled by the increasing demand for high-performance, fuel-efficient, and durable engine components across automotive, industrial, and commercial applications. Rapid adoption of advanced engines and growing focus on emission reduction standards are driving manufacturers to invest in precision-engineered components that enhance engine efficiency and longevity

- Furthermore, rising adoption of electric, hybrid, and next-generation internal combustion engines is establishing advanced engine components as critical enablers of performance, reliability, and regulatory compliance. These converging factors are accelerating the uptake of innovative engine components, thereby significantly boosting the industry’s growth

Engine Components Market Analysis

- Engine components, including valve tappets, retainers, pistons, and fuel system parts, are increasingly vital in optimizing engine performance, improving fuel efficiency, and ensuring durability in automotive, construction, agriculture, and industrial engines. Their role is essential in meeting evolving emission norms and enhancing overall engine reliability

- The escalating demand for engine components is primarily fueled by the rapid expansion of the automotive sector, growing mechanization in agriculture and construction equipment, and rising focus on reducing operational costs and emissions. In addition, increasing technological advancements in materials, coatings, and precision manufacturing are further driving market growth

- Asia-Pacific dominated the engine components market with a share of 50.25% in 2025, due to expanding automotive production, increasing demand for high-performance engines, and a strong presence of manufacturing hubs

- North America is expected to be the fastest growing region in the engine components market during the forecast period due to robust demand for engine components in automotive, construction, and industrial equipment applications

- Valve tappet/roller tappets segment dominated the market with a market share of 43% in 2025, due to its critical role in optimizing engine performance and reducing friction-related wear. Automotive manufacturers often prioritize valve tappets and roller tappets for their ability to enhance fuel efficiency and minimize engine noise, ensuring compliance with stringent emission norms. The segment also benefits from widespread adoption across both passenger and commercial vehicles due to its compatibility with diverse engine types and configurations. Strong aftermarket demand for high-quality replacement tappets further reinforces the segment’s leading position

Report Scope and Engine Components Market Segmentation

|

Attributes |

Engine Components Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Engine Components Market Trends

Growth in High-Performance and Fuel-Efficient Engine Components

- A significant trend in the engine components market is the increasing adoption of high-performance and fuel-efficient components, driven by the growing demand for optimized engine performance, reduced fuel consumption, and compliance with stringent emission regulations. This trend is positioning components such as valve tappets, retainers, pistons, and fuel system parts as critical elements for modern automotive, industrial, and commercial engines

- For instance, Schaeffler and Mahle are developing advanced engine bearings and piston components that enhance fuel efficiency and reduce friction in both conventional and hybrid engines. Such components strengthen engine reliability and enable manufacturers to meet evolving environmental and efficiency standards

- The rising integration of advanced materials and precision engineering in engine components is supporting enhanced durability and performance under high-stress conditions. This adoption is accelerating the transition toward lightweight, energy-efficient, and high-output engines across passenger vehicles and heavy-duty machinery

- Automotive manufacturers are increasingly using optimized components to improve fuel economy and extend engine life, which is driving demand for precision-engineered parts. This trend is positioning engine components as essential enablers of sustainability and operational efficiency in internal combustion and hybrid engines

- The construction, mining, and agricultural equipment sectors are also expanding the use of high-performance components to ensure reliability and longevity in heavy-duty engines. Such applications are reinforcing the critical role of durable and fuel-efficient components in maintaining productivity and reducing maintenance costs

- The market is witnessing strong growth in the adoption of components compatible with electric and hybrid powertrains, where lightweight and high-efficiency parts contribute to overall powertrain optimization. This rising incorporation of advanced engine components is reinforcing the shift toward sustainable, high-performing engines across multiple sectors

Engine Components Market Dynamics

Driver

Rising Demand in Automotive and Industrial Engines

- The growing production of passenger vehicles, commercial vehicles, and industrial machinery is driving the demand for advanced engine components that ensure efficiency, reliability, and compliance with emission norms. These components are essential for improving fuel economy, reducing operational costs, and enhancing engine lifespan

- For instance, Cummins and Bosch supply high-performance engine parts such as fuel injectors and tappets that support both conventional and hybrid engines in automotive and industrial applications. These components help manufacturers meet stringent global emission regulations and performance standards

- Rapid industrialization and infrastructure development are increasing the use of construction, mining, and agricultural equipment, further boosting demand for robust engine components. Manufacturers are adopting precision-engineered parts to enhance durability, reduce downtime, and improve productivity

- The ongoing transition toward hybrid and electric powertrains is increasing the need for specialized engine components that support optimized performance and energy efficiency. This shift is further reinforcing market growth as manufacturers invest in innovative solutions

- Increasing aftermarket demand for replacement and upgraded components is contributing to sustained revenue growth. Consumers and fleet operators are prioritizing durable, high-quality engine parts to extend engine life and ensure optimal performance

Restraint/Challenge

High Cost and Complexity of Precision Components

- The engine components market faces challenges due to the high cost and technical complexity involved in manufacturing precision-engineered parts. Advanced materials, precision machining, and stringent quality control requirements increase production difficulty and overall costs

- For instance, companies such as Schaeffler and Mahle employ specialized manufacturing processes and high-grade materials for components such as tappets, retainers, and pistons. These intricate procedures demand skilled labor, advanced equipment, and strict adherence to tolerance standards, elevating production expenses

- Producing components that meet high-performance, durability, and emission compliance standards involves long manufacturing cycles and rigorous testing. This further adds to operational costs and limits cost flexibility for manufacturers

- The reliance on advanced alloys, coatings, and high-precision machining introduces supply chain complexities, making production more vulnerable to raw material fluctuations. Manufacturers face pressure to balance performance requirements with cost efficiency

- Scaling production while maintaining precision and quality remains a significant challenge. These factors collectively constrain rapid expansion and require continuous process optimization to meet growing demand in both automotive and industrial engine segments

Engine Components Market Scope

The market is segmented on the basis of component and application.

- By Component

On the basis of component, the engine components market is segmented into valve tappet/roller tappets, screw cap assembly, collet/cotter, retainer, and others. The valve tappet/roller tappets segment dominated the market with the largest market revenue share of 43% in 2025, driven by its critical role in optimizing engine performance and reducing friction-related wear. Automotive manufacturers often prioritize valve tappets and roller tappets for their ability to enhance fuel efficiency and minimize engine noise, ensuring compliance with stringent emission norms. The segment also benefits from widespread adoption across both passenger and commercial vehicles due to its compatibility with diverse engine types and configurations. Strong aftermarket demand for high-quality replacement tappets further reinforces the segment’s leading position.

The retainer segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing usage in modern high-performance engines across automotive and industrial applications. Retainers provide structural stability to valve trains and enable efficient engine operation at higher speeds, making them essential in performance-focused vehicles. For instance, companies such as Federal-Mogul Motorparts are innovating in retainer materials and coatings to enhance durability and reduce maintenance intervals. Rising adoption in construction, mining, and heavy-duty equipment engines further accelerates growth, while improvements in lightweight and high-strength retainer designs make them attractive for fuel efficiency optimization in next-generation engines.

- By Application

On the basis of application, the engine components market is segmented into automotive, agriculture, construction and mining equipment, marine, stationary engines, and rolling stock diesel engine. The automotive segment dominated the market with the largest market revenue share in 2025, driven by the rapid expansion of passenger and commercial vehicle production globally. Automotive engines require high-precision components such as tappets, retainers, and screw cap assemblies to meet performance, efficiency, and emission standards, leading to strong demand for reliable engine parts. The segment also benefits from increasing consumer preference for vehicles with enhanced durability and reduced maintenance requirements, alongside rising integration of advanced engine technologies in both gasoline and diesel engines. Continuous replacement demand in the aftermarket further reinforces the automotive segment’s dominance in the engine components market.

The construction and mining equipment segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising infrastructure development and mechanization in emerging markets. Heavy-duty engines used in construction machinery rely on robust engine components that can withstand high loads and harsh operating conditions. For instance, companies such as Cummins are innovating in high-strength tappets and retainers for mining equipment engines to improve reliability and operational uptime. Increasing government investments in road, rail, and industrial projects, coupled with the growing use of automated and efficient machinery, contribute to the accelerating adoption of engine components in this segment.

Engine Components Market Regional Analysis

- Asia-Pacific dominated the engine components market with the largest revenue share of 50.25% in 2025, driven by expanding automotive production, increasing demand for high-performance engines, and a strong presence of manufacturing hubs

- The region’s cost-effective manufacturing landscape, rising investments in precision engineering, and growing exports of automotive and industrial engines are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased adoption of engine components in automotive, agriculture, and construction equipment applications

China Engine Components Market Insight

China held the largest share in the Asia-Pacific engine components market in 2025, owing to its status as a global leader in automotive and industrial engine manufacturing. The country's strong industrial base, favorable government policies supporting automotive sector expansion, and extensive export capabilities for engine parts are major growth drivers. Demand is also bolstered by ongoing investments in high-performance engines, precision components, and advanced manufacturing technologies for both domestic and international markets.

India Engine Components Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding automotive sector, increasing mechanization in agriculture and construction equipment, and rising investments in engine component manufacturing infrastructure. Government initiatives supporting Make in India, alongside a push for self-reliance in industrial components, are strengthening the demand for engine components. In addition, growing R&D capabilities and modernization of engine production facilities are contributing to robust market expansion.

Europe Engine Components Market Insight

The Europe engine components market is expanding steadily, supported by stringent emission and safety regulations, high demand for durable and fuel-efficient engines, and growing investments in advanced manufacturing and lightweight materials. The region places strong emphasis on quality, environmental compliance, and innovation in engine technology, particularly in automotive and industrial sectors. Increasing adoption of precision-engineered components and advanced coatings is further enhancing market growth.

Germany Engine Components Market Insight

Germany’s engine components market is driven by its leadership in automotive and industrial engine manufacturing, strong engineering expertise, and export-oriented production model. The country has well-established R&D networks and partnerships between academic institutions and manufacturers, fostering continuous innovation in engine component design and materials. Demand is particularly strong for high-performance engines used in automotive, construction, and industrial applications.

U.K. Engine Components Market Insight

The U.K. market is supported by a mature automotive and industrial machinery sector, growing efforts to localize engine manufacturing and supply chains, and increased demand for high-precision components. With rising focus on R&D, academic-industry collaboration, and investments in advanced manufacturing technologies, the U.K. continues to play a significant role in high-value engine component markets.

North America Engine Components Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust demand for engine components in automotive, construction, and industrial equipment applications. A strong focus on vehicle electrification, advancements in engine efficiency, and growing reliance on high-quality components are boosting demand. In addition, reshoring of manufacturing, adoption of advanced materials, and increasing collaboration between automotive OEMs and component suppliers are supporting market expansion.

U.S. Engine Components Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive automotive and industrial machinery industry, strong R&D infrastructure, and significant investment in precision engine component production. The country’s focus on innovation, regulatory compliance, and sustainability is encouraging the use of high-performance engine components in both conventional and next-generation engines. Presence of key manufacturers and a mature distribution network further solidify the U.S.'s leading position in the region.

Engine Components Market Share

The engine components industry is primarily led by well-established companies, including:

- Nittan Valve Co., Ltd. (Japan)

- Schaeffler Technologies AG & Co. KG (Germany)

- LISI AUTOMOTIVE (France)

- Kent Automotive (U.S.)

- Illinois Tool Works Inc. (U.S.)

- Indo Schöttle Pvt. Ltd. (India)

- GT Technologies (U.S.)

- Tenneco Inc. (U.S.)

- EFC International (U.K.)

- Eaton (U.S.)

- DREWCO Corporation (U.S.)

- DNJ Engine Components, Inc. (U.S.)

- Decora Auto Forge Pvt. Ltd. (India)

- Burgess-Norton (U.S.)

- AmTech International (U.S.)

- General Motors (U.S.)

- Cummins Inc. (U.S.)

- Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (Japan)

- AB Volvo (Sweden)

- Scania (Sweden)

Latest Developments in Global Engine Components Market

- In 2023, Schaeffler developed a new type of engine bearing designed to reduce friction and enhance fuel efficiency, which is expected to strengthen its position in the global engine components market. The innovation allows for up to 2% reduction in fuel consumption, making it highly attractive to automotive manufacturers seeking improved vehicle efficiency and lower emissions. This development supports Schaeffler’s competitive advantage in supplying high-performance components for both conventional and hybrid engines, while addressing growing market demand for energy-efficient and sustainable engine solutions

- In 2023, Bosch introduced a new fuel injector component aimed at improving emissions control, projected to impact the engine components market significantly. The injector is capable of reducing nitrogen oxide emissions by up to 50%, aligning with stricter global emission regulations. This advancement enhances Bosch’s product portfolio, enabling automotive OEMs to comply with environmental standards and strengthen their green vehicle offerings. The technology is likely to drive adoption in both passenger and commercial vehicle segments, reinforcing Bosch’s market leadership in emission-reducing engine components

- In 2023, Automotive Components Europe (ACE) acquired Hutchinson’s fuel system business for USD 1.31 billion, a move expected to expand ACE’s presence in the engine components market. The acquisition provides ACE access to Hutchinson’s expertise in fuel system technology, enhancing its product portfolio and enabling the company to offer more integrated and advanced solutions. This strategic expansion strengthens ACE’s competitiveness, particularly in supplying precision fuel components to automotive OEMs globally, and positions it to capitalize on the growing demand for high-performance and emission-compliant fuel systems

- In 2023, Cummins partnered with Tata Power to develop and manufacture electric powertrains for commercial vehicles in India, expected to accelerate its share in the evolving engine components and EV powertrain market. The collaboration leverages Cummins’ powertrain expertise and Tata Power’s electric vehicle infrastructure capabilities, enabling the development of advanced EV drivetrains for commercial applications. This initiative positions both companies to meet rising demand for electric commercial vehicles, while enhancing technological capabilities and market footprint in the fast-growing Indian EV sector

- In 2023, Mahle announced an investment of USD 65 million in its Neuenstadt am Kocher plant in Germany to expand production of pistons and piston pins for electric vehicles, projected to influence the global engine components market. The expansion is expected to create 200 new jobs, highlighting Mahle’s commitment to scaling EV component production. This investment addresses increasing demand for high-precision, lightweight components in electric powertrains, strengthening Mahle’s market position and readiness to cater to the growing EV manufacturing industry in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.