Global Engineered Wood Packaging Market

Market Size in USD Billion

CAGR :

%

USD

2.52 Billion

USD

3.25 Billion

2024

2032

USD

2.52 Billion

USD

3.25 Billion

2024

2032

| 2025 –2032 | |

| USD 2.52 Billion | |

| USD 3.25 Billion | |

|

|

|

|

Engineered Wood Packaging Market Size

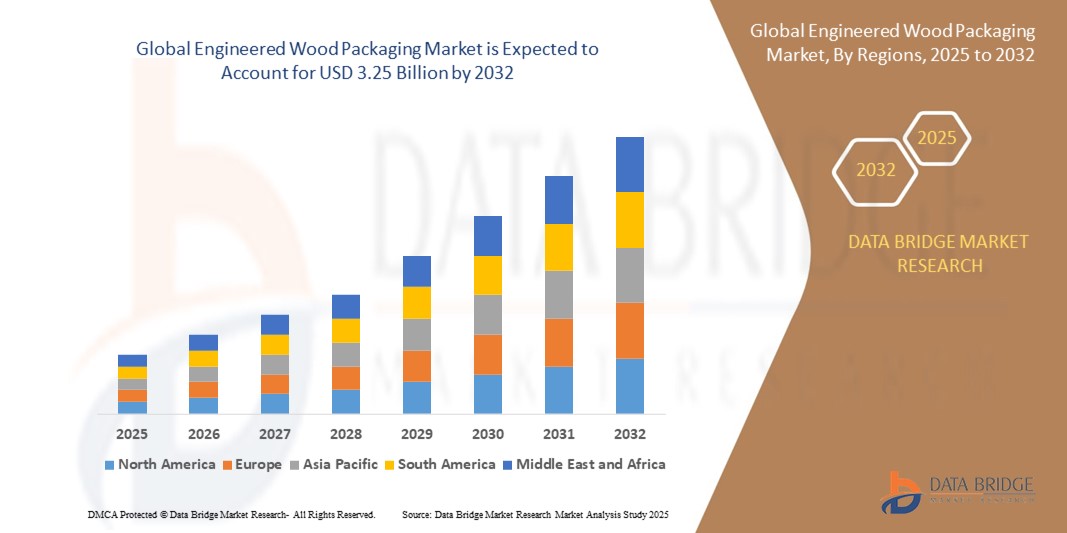

- The global engineered wood packaging market size was valued at USD 2.52 billion in 2024 and is expected to reach USD 3.25 billion by 2032, at a CAGR of 3.20% during the forecast period

- The market growth is largely fuelled by the rising demand for sustainable and durable packaging solutions across industries such as logistics, automotive, and electronics

- In addition, growing export activities, cost advantages over solid wood, and the increasing focus on lightweight yet high-strength packaging materials are further contributing to market expansion

Engineered Wood Packaging Market Analysis

- The market is witnessing steady growth due to the shift toward eco-friendly packaging alternatives that offer structural stability, reduced weight, and ease of handling

- Engineered wood, including plywood, particle board, and oriented strand board (OSB), is being increasingly adopted for pallets, crates, and boxes, particularly for international shipping due to its resistance to warping, pests, and humidity

- North America dominated the engineered wood packaging market with the largest revenue share of 38.26% in 2024, driven by the strong presence of manufacturing and export-oriented industries that rely on high-strength and sustainable packaging solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global engineered wood packaging market, driven by increasing demand for cost-effective, lightweight packaging across emerging economies, government support for sustainable materials, and rising activity in export-oriented manufacturing industries

- The plywood segment dominated the market with the largest market revenue share of 36.4% in 2024, driven by its widespread use in crate and pallet construction due to its high strength-to-weight ratio and dimensional stability. Its resistance to warping and splitting makes it ideal for transporting sensitive and heavy industrial goods, especially in export packaging. In addition, plywood is readily available and complies with international shipping standards, enhancing its preference across sectors

Report Scope and Engineered Wood Packaging Market Segmentation

|

Attributes |

Engineered Wood Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Export-Oriented Manufacturing Sectors |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Engineered Wood Packaging Market Trends

Increased Adoption of Sustainable and Customizable Packaging Solutions

- The growing preference for environmentally responsible packaging is driving demand for engineered wood products, which are often sourced from recycled or fast-growing wood species. These materials offer an eco-friendly alternative to traditional solid wood and plastic, aligning with global sustainability goals and corporate green initiatives

- Industries such as electronics, automotive, and heavy machinery are increasingly adopting engineered wood packaging for its high strength-to-weight ratio and ability to be customized for irregular or heavy-duty goods. This adaptability is especially valuable for products requiring secure transport over long distances

- Advancements in design technology have enabled manufacturers to offer modular and reusable engineered wood packaging options. These solutions contribute to cost savings and reduced environmental impact by extending product lifecycle and minimizing waste

- For instance, in 2023, multiple logistics firms across North America began integrating collapsible engineered wood crates into their supply chain to reduce return shipping costs and storage needs, while maintaining load stability during transit

- While demand for sustainable solutions is rising, ongoing innovation in treatment processes and digital design tools will be essential to enhance durability, moisture resistance, and load optimization. Companies that invest in next-generation engineered wood designs are well-positioned to capture emerging opportunities across industrial applications

Engineered Wood Packaging Market Dynamics

Driver

Rising Demand for Durable and Cost-Effective Export Packaging

• As global trade expands, the need for reliable export packaging has grown substantially. Engineered wood packaging offers a balance of strength, cost-efficiency, and compliance with international phytosanitary regulations, making it ideal for long-haul shipping across varied climatic conditions

• Exporters prefer engineered wood crates and pallets because they can withstand high weight loads and rough handling while maintaining structural integrity. This is particularly important in sectors such as chemicals, electronics, and manufacturing equipment, where product damage during transit can result in significant financial losses

• The cost benefits of engineered wood over solid hardwood—due to more efficient use of raw material and lighter weight—further enhance its appeal for export applications. This allows companies to reduce freight charges and material expenses without compromising on packaging quality

• For instance, in 2022, a major machinery exporter in Europe transitioned to engineered wood containers for transatlantic shipments, reporting a 12% reduction in damage claims and an 18% drop in shipping costs

• While demand is supported by performance and cost factors, continued innovation in packaging configurations and load simulation technologies will be critical to meet evolving export standards and customer expectations

Restraint/Challenge

Raw Material Price Volatility and Limited Awareness in Emerging Markets

• One of the major challenges facing the engineered wood packaging market is the volatility in the cost of raw materials such as plywood and OSB. Supply chain disruptions, fluctuating timber prices, and increased demand from construction sectors often result in price spikes that squeeze manufacturer margins

• In addition, awareness and adoption of engineered wood packaging remain low in several developing economies where traditional solid wood packaging is still dominant. Lack of technical knowledge, misconceptions about durability, and limited access to affordable engineered options hinder market penetration

• These regions may also lack supportive regulations or incentives to shift toward sustainable materials, slowing the pace of transition despite global trends. The absence of skilled labor and standardized manufacturing practices further restricts the development of localized supply chains

• For instance, in 2023, several small-scale exporters in Southeast Asia cited cost and limited supplier availability as key barriers to switching from solid wood crates to engineered alternatives

• To overcome these challenges, stakeholders must focus on expanding education, developing low-cost engineered wood options, and building regional supply hubs to improve accessibility and pricing stability across high-potential markets

Engineered Wood Packaging Market Scope

The market is segmented on the basis of type product type, application, grade type, treatment type, and end user.

- By Type

On the basis of type, the engineered wood packaging market is segmented into I-beams, plywood, laminated veneer lumber (LVL), glulam (glued laminated timber), oriented strand boards (OSB), cross-laminated timber (CLT), and others. The plywood segment dominated the market with the largest market revenue share of 36.4% in 2024, driven by its widespread use in crate and pallet construction due to its high strength-to-weight ratio and dimensional stability. Its resistance to warping and splitting makes it ideal for transporting sensitive and heavy industrial goods, especially in export packaging. In addition, plywood is readily available and complies with international shipping standards, enhancing its preference across sectors.

The oriented strand board (OSB) segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its cost-efficiency and ability to provide uniform strength and performance. OSB is increasingly adopted for packaging large or irregular-shaped products, particularly in the electronics and machinery industries. Its versatility, affordability, and recyclability are key drivers behind its growing acceptance as a sustainable engineered wood option for protective packaging applications.

- By Product Type

On the basis of product type, the global engineered wood packaging market is segmented into engineered wood pallets and engineered wood crates. The engineered wood pallets segment dominated the market with the largest market revenue share in 2024, driven by their strength, durability, and cost-effectiveness in bulk transport. These pallets are widely adopted in shipping and logistics industries as they offer a sustainable alternative to traditional hardwood pallets while maintaining structural integrity during heavy loads and long-distance transport. The engineered construction also reduces variability in performance, increasing reliability for exporters and warehouse operators.

The engineered wood crates segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand from sectors requiring added protection for sensitive or high-value goods. Crates provide better shielding from impact and external elements, making them ideal for fragile components in manufacturing, electronics, and heavy machinery. Additionally, increased export regulations mandating safer and eco-friendly packaging are supporting the demand for high-performance wood crate solutions.

- By Application

On the basis of application, the market is segmented into aerospace and defense and food and beverages. The aerospace and defense segment held the largest market share in 2024, supported by the need for robust packaging to ensure safe transport of precision components, machinery, and sensitive instruments. Engineered wood packaging is valued in this sector for its customizable sizing, strength-to-weight ratio, and compliance with international shipping standards.

The food and beverages segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing demand for hygienic and sustainable packaging materials in global food supply chains. Engineered wood packaging offers pest-resistant and heat-treatable properties that align well with sanitary transport regulations and export protocols for consumable goods.

- By Grade Type

Based on grade type, the market is segmented into structural grade and non-structural grade. The structural grade segment dominated the market in 2024, attributed to its ability to withstand heavy loads and harsh handling conditions, which are common in industrial shipping. These high-performance materials are frequently chosen for long-haul and high-risk transit scenarios where reliability is critical.

The non-structural grade segment is expected to witness the fastest growth rate from 2025 to 2032, catering to lighter packaging requirements in sectors such as retail, food service, and consumer goods. These grades are cost-effective, easy to handle, and often used where packaging strength can be balanced with sustainability and price sensitivity.

- By Treatment Type

On the basis of treatment type, the global engineered wood packaging market is segmented into untreated and heat treated. The heat treated segment held the largest revenue share in 2024, driven by regulatory mandates such as ISPM 15, which require heat treatment for international wood packaging to prevent pest infestations. Heat treated engineered wood offers added safety and ensures compliance in cross-border logistics, making it the preferred choice for exporters.

The untreated segment is expected to witness the fastest growth rate from 2025 to 2032, continues to find usage in domestic applications and short-haul transportation where regulatory compliance is not mandatory. These solutions are often selected for their affordability and environmental friendliness, especially in closed-loop supply chains or internal warehouse logistics.

- By End User

On the basis of end user, the engineered wood packaging market is segmented into residential and commercial, and industrial. The industrial segment held the largest market share in 2024, driven by strong demand for engineered wood solutions in automotive, manufacturing, and heavy equipment exports. Engineered wood products offer durable, customizable, and lightweight packaging that can withstand rigorous handling during shipping.

The residential and commercial segment is expected to witness the fastest growth rate from 2025 to 2032, due to the increasing trend of modular furniture packaging and home improvement goods requiring protective transit solutions. Rising e-commerce penetration and consumer preference for sustainable packaging in retail and furnishing applications are supporting segment expansion.

Engineered Wood Packaging Market Regional Analysis

• North America dominated the engineered wood packaging market with the largest revenue share of 38.26% in 2024, driven by the strong presence of manufacturing and export-oriented industries that rely on high-strength and sustainable packaging solutions

• The region benefits from well-established infrastructure, stringent packaging regulations, and increasing adoption of eco-friendly alternatives to solid wood. Industrial users across the U.S. and Canada are incorporating engineered wood products due to their structural integrity, ease of customization, and cost efficiency for both domestic and international shipments

• Rising focus on circular economy practices and the use of certified sustainable wood sources further support the widespread acceptance of engineered wood packaging across logistics and heavy-duty applications

U.S. Engineered Wood Packaging Market Insight

The U.S. engineered wood packaging market accounted for the largest revenue share in North America in 2024, attributed to a mature industrial sector, robust exports, and advanced manufacturing capabilities. Growing emphasis on lightweight, durable, and compliant packaging is encouraging businesses to shift from traditional materials to engineered alternatives. The market is further supported by government incentives promoting sustainability and the availability of high-performance engineered wood solutions for diverse packaging needs.

Europe Engineered Wood Packaging Market Insight

The Europe engineered wood packaging market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict environmental regulations, increased demand for recyclable packaging, and a strong focus on reducing carbon emissions. The region is experiencing increased usage of engineered wood for industrial and commercial packaging, particularly in Germany, France, and the Netherlands. Innovations in panelized wood designs and rising awareness of forest certification programs are contributing to wider adoption in export and retail supply chains.

Germany Engineered Wood Packaging Market Insight

The Germany engineered wood packaging market is expected to witness the fastest growth rate from 2025 to 2032, growth owing to the country's leadership in sustainable industrial practices and precision engineering. High export volumes and regulatory compliance requirements are prompting industries to adopt engineered wood as a preferred material for safe and eco-conscious packaging. Germany's technical expertise and emphasis on product quality are also fostering innovations in moisture-resistant and heavy-duty wood packaging formats.

U.K. Engineered Wood Packaging Market Insight

The U.K. engineered wood packaging market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by a rising shift toward sustainable packaging and compliance with circular economy goals. Businesses in retail, industrial goods, and e-commerce are actively adopting engineered wood packaging to meet regulatory standards and consumer demand for eco-friendly alternatives. The increasing need for lightweight, durable, and customizable packaging formats, especially in export-oriented sectors, is contributing to the market’s expansion. Moreover, the presence of local engineered wood producers and growing awareness around deforestation and waste reduction support the trend in the U.K.

Asia-Pacific Engineered Wood Packaging Market Insight

The Asia-Pacific engineered wood packaging market is expected to witness the fastest growth rate from 2025 to 2032, led by rapid industrialization, infrastructure expansion, and rising intra-regional trade. Countries such as China, India, and Southeast Asian nations are boosting demand due to increased manufacturing activity and the need for cost-effective, lightweight, and compliant packaging. The availability of raw materials and labor advantages are also attracting global companies to source engineered wood packaging solutions from this region.

China Engineered Wood Packaging Market Insight

China accounted for the largest market share in the Asia-Pacific region in 2024, owing to its dominant role in global manufacturing and exports. The country’s growing focus on improving packaging quality and reducing wood waste is propelling the shift to engineered solutions. Government-led green policies, rising logistics activities, and the presence of domestic manufacturers offering affordable engineered wood packaging further support market growth in China.

Japan Engineered Wood Packaging Market Insight

The Japan engineered wood packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s strong emphasis on product quality, compact packaging formats, and environmental sustainability. Japanese industries, particularly electronics and automotive, are increasingly utilizing engineered wood for export packaging due to its high strength-to-weight ratio and precision adaptability. With stringent packaging standards and a focus on reducing carbon footprints, the adoption of laminated veneer lumber (LVL) and plywood-based solutions is growing across manufacturing and logistics sectors. The market is further supported by Japan’s policies promoting renewable resources and recyclable materials.

Engineered Wood Packaging Market Share

The Engineered Wood Packaging industry is primarily led by well-established companies, including:

- Boise Cascade (U.S.)

- Celulosa Arauco Y Constitucion (Chile)

- Huber Engineered Woods LLC (U.S.)

- Kahrs (Sweden)

- Louisiana-Pacific Corporation (U.S.)

- West Fraser (Canada)

- Patrick (U.S.)

- Futamura (Japan)

- Celanese Corporation (U.S.)

- Hubei Golden Ring New Materials (China)

- Rotofil Srl (Italy)

- Weifang Henglian International Trade Co., Ltd (China)

- Eastman Chemical Company (U.S.)

- Sappi (South Africa)

- Tembec Inc. (Canada)

Latest Developments in Global Engineered Wood Packaging Market

- In June 2024, SCA Wood launched a sustainable packaging innovation using 70 percent recycled material, marking the first of its kind in the industry. This development aims to reduce reliance on virgin plastics while maintaining product quality. The initiative is expected to enhance SCA Wood’s position as a leader in eco-conscious packaging and influence broader market adoption of high-recycled-content solutions

- In April 2024, Metsä Group, through its innovation arm Metsä Spring, began a pre-engineering project to establish the first commercial facility for producing Muoto™ wood fiber packaging. The development focuses on creating wood-based alternatives to conventional plastic packaging. This move strengthens Metsä Group’s sustainability portfolio and is anticipated to accelerate the shift toward biodegradable and renewable packaging in global markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Engineered Wood Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Engineered Wood Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Engineered Wood Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.