Global Engineering Services Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

2.57 Billion

USD

19.87 Billion

2024

2032

USD

2.57 Billion

USD

19.87 Billion

2024

2032

| 2025 –2032 | |

| USD 2.57 Billion | |

| USD 19.87 Billion | |

|

|

|

|

Global Engineering Services Outsourcing Market Size

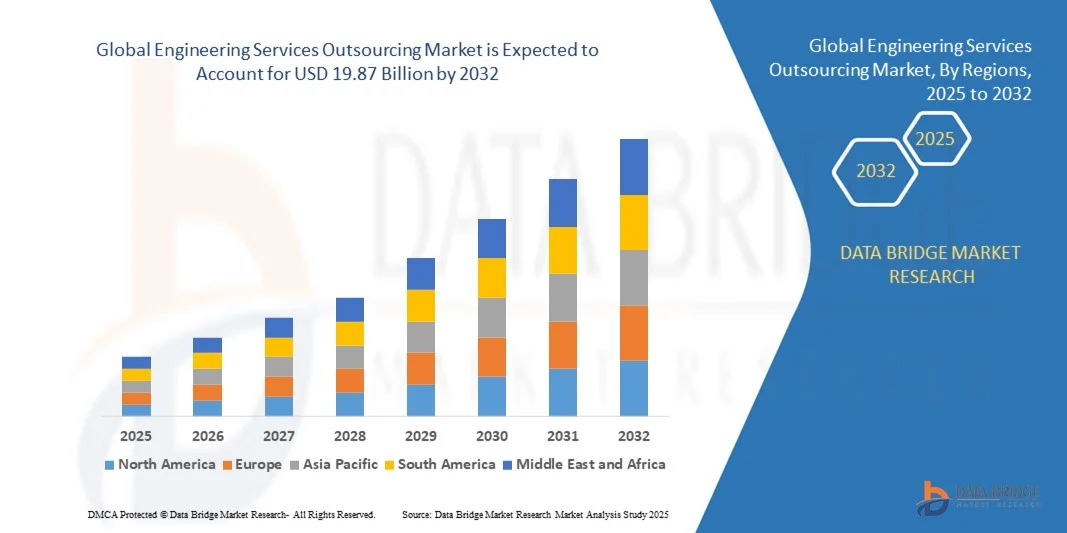

- The global Engineering Services Outsourcing Market size was valued at USD 2.57 billion in 2024 and is projected to reach USD 19.87 billion by 2032, growing at a CAGR of 29.10% during the forecast period.

- Market expansion is primarily driven by increasing demand for cost-effective, specialized engineering solutions across industries such as automotive, aerospace, and electronics, coupled with rapid advancements in digital engineering technologies.

- Additionally, the growing trend toward digital transformation, including AI, IoT, and cloud-based platforms, is encouraging companies to outsource complex engineering tasks to enhance innovation, efficiency, and time-to-market, thereby fueling market growth.

Global Engineering Services Outsourcing Market Analysis

- Engineering Services Outsourcing involves delegating specialized engineering tasks such as design, development, and testing to external service providers, playing a critical role in enhancing operational efficiency and innovation across industries like automotive, aerospace, and manufacturing.

- The rising demand for cost-effective engineering solutions, coupled with advancements in digital tools like CAD, simulation software, and IoT integration, is driving increased adoption of outsourcing services globally.

- Asia Pacific dominated the global engineering services outsourcing market with a revenue share of 38% in 2024, supported by the presence of major engineering firms, high technology adoption rates, and strong investments in R&D, particularly in sectors like aerospace and automotive engineering.

- North America is projected to be the fastest-growing region during the forecast period, driven by rapid industrialization, increasing infrastructure development, and expanding manufacturing capabilities in countries such as China and India.

- The designing segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the increasing demand for product innovation and customized engineering solutions.

Report Scope and Global Engineering Services Outsourcing Market Segmentation

|

Attributes |

Engineering Services Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration with Advanced Digital Technologies |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Engineering Services Outsourcing Market Trends

Enhanced Efficiency Through AI and Cloud Integration

- A significant and accelerating trend in the global Engineering Services Outsourcing Market is the deepening integration of artificial intelligence (AI) and cloud-based platforms into engineering workflows. This combination is significantly improving project accuracy, speed, and collaboration across geographically dispersed teams.

- For instance, companies such as Infosys leverage AI-driven analytics and cloud computing to optimize design processes and predictive maintenance solutions, enabling faster decision-making and reduced time-to-market. Similarly, Tech Mahindra uses AI-powered automation tools to enhance product development efficiency and quality control.

- AI integration in engineering services enables advanced capabilities such as predictive modeling, anomaly detection, and process optimization. For example, AI algorithms can analyze large datasets from product simulations to identify potential design flaws early, while cloud platforms provide scalable resources for real-time collaboration and data sharing.

- The seamless integration of AI and cloud technologies facilitates centralized project management, allowing clients and service providers to monitor progress, share updates, and coordinate tasks through unified digital platforms. This creates a more agile, transparent, and efficient engineering process.

- This trend towards intelligent, connected, and data-driven engineering services is fundamentally reshaping client expectations for outsourcing partners. Consequently, firms like L&T Technology Services are investing heavily in AI and cloud capabilities to deliver smarter, faster, and more cost-effective engineering solutions.

- The demand for engineering services that leverage AI and cloud integration is growing rapidly across industries such as automotive, aerospace, and electronics, as companies seek to enhance innovation, reduce costs, and accelerate product development cycles.

Global Engineering Services Outsourcing Market Dynamics

Driver

Growing Need Due to Increasing Demand for Cost Efficiency and Digital Transformation

- The rising pressure on companies to reduce operational costs while accelerating innovation is a major driver behind the growing demand for engineering services outsourcing. Businesses across sectors such as automotive, aerospace, and electronics are increasingly leveraging outsourced expertise to optimize resources and focus on core competencies.

- For instance, in early 2024, Tech Mahindra announced expanded digital engineering capabilities designed to support clients in AI-driven product development and IoT integration, reflecting a broader industry shift toward embracing advanced technologies through outsourcing partnerships. Such initiatives by key players are expected to drive significant market growth during the forecast period.

- As organizations face growing complexity in product design and manufacturing, outsourced engineering services offer access to specialized skills, advanced tools, and scalable resources, enabling faster development cycles and improved product quality.

- Furthermore, the push toward Industry 4.0 and digital transformation has made seamless integration of cloud computing, AI, and automation essential, positioning engineering services outsourcing as a strategic enabler of these trends.

- The flexibility to manage fluctuating project demands, combined with cost-effective access to global talent pools, makes engineering outsourcing attractive to both large enterprises and SMEs, fueling adoption across diverse regions.

Restraint/Challenge

Concerns Regarding Data Security and High Switching Costs

- Data security and intellectual property (IP) protection concerns present significant challenges for companies considering outsourcing critical engineering functions. Since outsourcing involves sharing sensitive designs, proprietary data, and product information, risks related to data breaches and IP theft are major barriers to broader adoption.

- For Instance, reports of cyberattacks targeting outsourced engineering platforms have heightened client anxieties, leading some companies to limit the scope of outsourced activities or prefer onshore vendors with stricter security protocols.

- Addressing these concerns requires robust cybersecurity frameworks, stringent IP protection policies, and transparent governance models. Leading firms such as Infosys and L&T Technology Services emphasize their compliance with global security standards and use of encrypted collaboration tools to build client confidence.

- Additionally, the relatively high switching costs involved in transitioning engineering projects to outsourcing partners—such as training, process alignment, and integration of new workflows—can deter organizations, especially those with established internal teams.

- While outsourcing offers cost benefits, initial investments in vendor selection, knowledge transfer, and contract management remain significant. Companies must carefully weigh these factors alongside potential gains to ensure successful engagements.

- Overcoming these challenges through enhanced security measures, client education on best practices, and streamlined onboarding processes will be critical to sustaining growth in the Engineering Services Outsourcing Market.

Global Engineering Services Outsourcing Market Scope

Engineering services outsourcing market is segmented on the basis of services, location and application.

- By Services

On the basis of services, the Global Engineering Services Outsourcing Market is segmented into designing, prototyping, system integration, testing, and others. The designing segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the increasing demand for product innovation and customized engineering solutions. Designing services provide critical value in conceptualizing and developing new products, leveraging advanced CAD tools and simulation technologies to reduce development time and costs. Companies prioritize outsourcing design functions to access specialized expertise and cutting-edge technologies without heavy capital investments.

The prototyping segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, fueled by rapid advancements in 3D printing and rapid prototyping technologies. This growth is driven by the need for faster validation and iteration during product development, allowing companies to refine designs before mass production while minimizing risks and expenses.

- By Location

On the basis of location, the Global Engineering Services Outsourcing Market is segmented into onshore, offshore, and others. The offshore segment held the largest market revenue share of 45.6% in 2024, attributed to the cost advantages offered by outsourcing to countries with lower labor costs and the availability of skilled engineering talent pools in regions like India and Eastern Europe. Offshore outsourcing enables companies to reduce operational expenses while maintaining access to specialized skills and scalable resources.

The onshore segment is projected to witness the fastest CAGR of 19.8% from 2025 to 2032, driven by increasing client preferences for closer geographic proximity, better communication, and stricter control over sensitive engineering projects. Onshore outsourcing also benefits industries with stringent compliance and regulatory requirements, making it attractive for high-security sectors such as aerospace and defense.

- By Application

On the basis of application, the Global Engineering Services Outsourcing Market is segmented into aerospace, automotive, construction, consumer electronics, semiconductors, pharmaceuticals, telecom, and others. The automotive segment dominated the market with a revenue share of 29.7% in 2024, driven by the growing demand for electric vehicles, autonomous driving technologies, and lightweight materials, which require advanced engineering expertise. Automotive companies increasingly outsource design, prototyping, and testing to accelerate innovation and reduce costs in a highly competitive market.

The semiconductor segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, fueled by rising demand for chips across consumer electronics, automotive, and industrial automation. This growth is supported by the complexity of semiconductor manufacturing and design, which encourages outsourcing to specialized firms with niche technical capabilities to enhance efficiency and time-to-market.

Global Engineering Services Outsourcing Market Regional Analysis

- Asia-Pacific dominated the Global Engineering Services Outsourcing Market with the largest revenue share of 38% in 2024, driven by increasing demand for cost-effective engineering solutions and advanced technological adoption across various industries.

- Clients in the region prioritize access to specialized engineering expertise, improved operational efficiency, and scalability offered by outsourcing partners, enabling them to focus on core business functions.

- This strong market presence is further supported by the presence of major engineering firms, a skilled workforce, and rising investments in sectors such as automotive, aerospace, and manufacturing, making North America a key hub for engineering services outsourcing.

India Engineering Services Outsourcing Market Insight

The India engineering services outsourcing market is rapidly expanding due to the country’s abundant talent pool, cost advantages, and growing expertise in digital engineering and R&D. India has become a preferred destination for global companies seeking end-to-end engineering solutions, from product design to testing and validation. The government's focus on Make in India and Industry 4.0 initiatives is further boosting the sector. Additionally, the rise of start-ups and increasing investments in sectors such as automotive, aerospace, and consumer electronics are driving demand for outsourced engineering services.

China Engineering Services Outsourcing Market Insight

The China engineering services outsourcing market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s massive manufacturing ecosystem and rapid technological advancements. China is increasingly focusing on high-value engineering outsourcing services, including design, prototyping, and digital engineering. The push for smart manufacturing and innovation under initiatives like “Made in China 2025” is enhancing the adoption of outsourced engineering services. Strong government support and the availability of competitive pricing make China a vital hub for engineering services outsourcing in the region.

U.S. Engineering Services Outsourcing Market Insight

The U.S. engineering services outsourcing market captured the largest revenue share of 75% in 2024 within North America, driven by increasing demand for cost-effective and innovative engineering solutions across automotive, aerospace, and manufacturing sectors. Organizations are leveraging outsourcing to access specialized technical expertise and improve time-to-market for new products. The rise of digital transformation, coupled with the integration of advanced technologies such as AI and IoT in engineering processes, is further accelerating market growth. Additionally, a strong focus on quality and compliance is fueling demand for outsourcing partners with domain-specific knowledge and global delivery capabilities.

Europe Engineering Services Outsourcing Market Insight

The Europe engineering services outsourcing market is expected to grow at a robust CAGR throughout the forecast period, primarily driven by rising industrial automation and strict regulatory standards. European industries are increasingly adopting outsourcing to enhance operational efficiency and focus on core competencies. The push towards sustainability and green engineering practices is also encouraging companies to collaborate with specialized outsourcing providers. Growth is particularly notable in the automotive, energy, and industrial machinery sectors, supported by a skilled engineering workforce and government incentives promoting innovation.

U.K. Engineering Services Outsourcing Market Insight

The U.K. engineering services outsourcing market is projected to witness significant growth, supported by the country’s focus on digital innovation and manufacturing excellence. Increasing pressure on cost reduction and the demand for faster project delivery timelines are motivating businesses to outsource engineering functions. The expanding startup ecosystem and investments in smart infrastructure projects are further driving market expansion. Additionally, Brexit-related shifts are encouraging companies to explore global outsourcing partnerships to maintain competitiveness.

Germany Engineering Services Outsourcing Market Insight

The Germany engineering services outsourcing market is poised for steady growth, fueled by the nation’s strong industrial base and commitment to Industry 4.0 adoption. German companies are outsourcing complex engineering tasks to improve innovation and reduce operational costs, especially in automotive, mechanical engineering, and electronics sectors. Emphasis on precision engineering and quality control drives demand for experienced engineering service providers. Furthermore, Germany’s focus on sustainability and energy-efficient technologies is fostering demand for green engineering solutions through outsourcing.

Global Engineering Services Outsourcing Market Share

The Engineering Services Outsourcing industry is primarily led by well-established companies, including:

- L&T Technology Services (India)

- Tata Elxsi (India)

- Tech Mahindra (India)

- Cyient (India)

- QuEST Global (India)

- Neilsoft (India)

- HCL Technologies (India)

- Infosys (India)

- Wipro (India)

- Capgemini Engineering (France)

- Alten Group (France)

- AKKA Technologies (Akkodis) (France)

- Assystem (France)

- Segula Technologies (France)

- Semcon (Sweden)

- Bertrandt (Germany)

- EDAG Engineering (Germany)

- Ferchau Engineering (Germany)

What are the Recent Developments in Global Engineering Services Outsourcing Market?

- In April 2023, Tata Consultancy Services (TCS), a global leader in IT and engineering services, launched a strategic initiative in South Africa to expand its engineering outsourcing capabilities, focusing on delivering innovative, cost-effective solutions for automotive and aerospace clients. This initiative reflects TCS’s commitment to addressing regional infrastructure challenges while leveraging its global expertise to strengthen its position in the rapidly growing Global Engineering Services Outsourcing Market.

- In March 2023, Wipro Limited, a major player in engineering services outsourcing, introduced its next-generation Digital Engineering platform tailored for manufacturing and industrial clients. The platform integrates AI, IoT, and cloud-based technologies to enhance product development cycles and operational efficiency. This advancement showcases Wipro’s dedication to driving innovation and offering scalable, tech-driven engineering solutions to global customers.

- In March 2023, Honeywell International Inc. successfully partnered on the Bengaluru Smart Infrastructure Project, providing cutting-edge engineering services for urban infrastructure modernization. This project utilizes advanced automation and IoT-enabled solutions to enhance city planning and resource management, underscoring Honeywell’s leadership in applying engineering outsourcing to smart city development and sustainable growth initiatives.

- In February 2023, Capgemini Engineering announced a strategic collaboration with the European Automotive Suppliers Association to develop a specialized engineering services marketplace. This partnership aims to streamline access to advanced engineering expertise and accelerate innovation within the automotive sector, highlighting Capgemini’s commitment to fostering industry collaborations and enhancing service delivery through outsourcing.

- In January 2023, Allegion Plc expanded its engineering services portfolio by unveiling an advanced product lifecycle management (PLM) system designed to support the design and development of security and access control products. This new system integrates cloud computing and digital twin technologies, enabling clients to improve efficiency and reduce time-to-market. The launch reinforces Allegion’s focus on leveraging digital transformation to enhance engineering outsourcing capabilities.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.