Global Enhanced Vision System Market

Market Size in USD Million

CAGR :

%

USD

312.39 Million

USD

411.36 Million

2025

2033

USD

312.39 Million

USD

411.36 Million

2025

2033

| 2026 –2033 | |

| USD 312.39 Million | |

| USD 411.36 Million | |

|

|

|

|

Enhanced Vision System Market Size

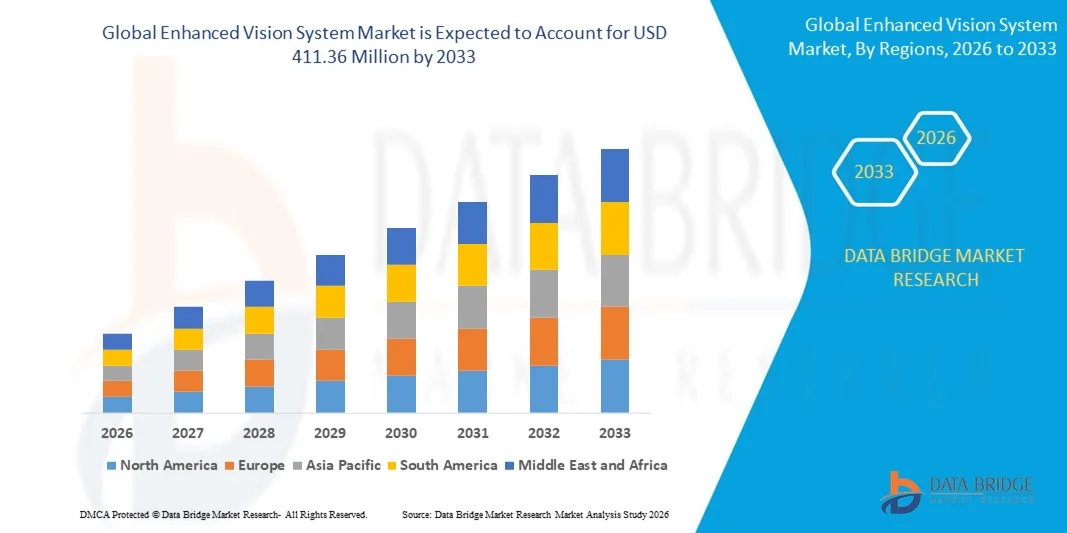

- The global enhanced vision system market size was valued at USD 312.39 million in 2025 and is expected to reach USD 411.36 million by 2033, at a CAGR of 3.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced avionics and enhanced cockpit technologies across commercial, military, and rotary-wing aircraft, driving the demand for improved situational awareness and safety in low-visibility and adverse weather conditions

- Furthermore, rising investments in flight safety, modernization of airline fleets, and growing focus on reducing weather-related operational disruptions are establishing enhanced vision systems as critical components of next-generation cockpit solutions. These converging factors are accelerating the adoption of EVS technologies, thereby significantly boosting market growth

Enhanced Vision System Market Analysis

- Enhanced vision systems, offering real-time imaging and situational awareness in low-light, fog, and adverse weather, are becoming essential for modern aircraft operations in both commercial and defense sectors due to their ability to enhance pilot visibility, reduce risk, and integrate with synthetic vision and head-up display systems

- The escalating demand for EVS is primarily driven by the modernization of aircraft fleets, the adoption of head-up displays and helmet-mounted display systems, growing emphasis on aviation safety, and the increasing requirement for reliable low-visibility operational capabilities in both fixed-wing and rotary-wing platforms

- North America dominated the enhanced vision system market with a share of 36.6% in 2025, due to increasing investments in aviation safety technologies and the growing adoption of advanced cockpit systems

- Asia-Pacific is expected to be the fastest growing region in the enhanced vision system market during the forecast period due to rapid modernization of airline fleets, rising air traffic, and government initiatives promoting aviation safety

- Infrared segment dominated the market with a market share of 43% in 2025, due to its ability to provide superior visibility in low-light and adverse weather conditions, including fog, smoke, and darkness. Infrared EVS helps pilots detect terrain, obstacles, and other aircraft, enhancing flight safety and operational efficiency. Its integration with existing avionics systems and minimal dependency on external signals makes it a preferred choice for both military and commercial aviation applications. The reliability, cost-effectiveness, and extensive adoption in various aircraft types further reinforce its dominance in the market

Report Scope and Enhanced Vision System Market Segmentation

|

Attributes |

Enhanced Vision System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Enhanced Vision System Market Trends

Adoption of Multispectral and Integrated Vision Systems

- The enhanced vision system market is witnessing considerable growth due to the increasing adoption of multispectral and integrated vision technologies that improve situational awareness for pilots. These systems combine infrared, visible light, and other sensor inputs to provide comprehensive imaging, significantly enhancing visibility in challenging environments

- For instance, companies such as Rockwell Collins (now part of Collins Aerospace) and Elbit Systems have developed advanced integrated vision systems that fuse data from multiple spectral bands to offer real-time, high-resolution images. These innovations improve navigation and obstacle detection during adverse weather or low-light conditions

- Multispectral systems aid in penetrating through fog, smoke, and darkness, reducing risks associated with poor visibility. The ability to integrate with existing cockpit displays and heads-up displays (HUDs) allows seamless, intuitive information presentation to flight crews

- In addition, technological advances in sensor miniaturization and processing power enable the development of lighter, more compact enhanced vision equipment suitable for a broad range of aircraft types, from commercial airliners to military helicopters. This versatility expands potential applications of vision systems across aviation segments

- Growing regulatory emphasis on flight safety and operational reliability during night and adverse weather operations is encouraging wider adoption of enhanced vision technologies. Integration with other avionics systems also supports increased automation and pilot situational awareness

- Overall, the trend toward multispectral and integrated vision systems represents a critical advancement in flight safety technology. It underscores the aviation industry's commitment to improving operational capabilities in all weather and lighting conditions

Enhanced Vision System Market Dynamics

Driver

Growing Focus on Flight Safety in Low-Visibility Conditions

- Heightened awareness of the risks posed by low-visibility conditions is driving demand for enhanced vision systems in aviation. Pilots require reliable tools that enable safe navigation and landing operations when traditional visual references are limited or obscured, making these systems essential for operational safety

- For instance, the Federal Aviation Administration (FAA) has encouraged the adoption of enhanced vision systems through certification guidelines and support for technology integration in commercial aircraft. Such initiatives boost industry confidence and investment in vision system technologies

- Increased flight operations at night and in adverse weather due to expanding air traffic volume further necessitate advanced vision aids. Enhanced vision technologies provide real-time imaging that supplements pilot vision, reducing spatial disorientation and human error during critical flight phases

- In addition, military and defense aviation sectors are also emphasizing enhanced vision capabilities to support mission readiness and safety in complex operational environments. These requirements are fostering continuous improvements in system accuracy, resolution, and reliability

- The convergence of safety priorities, regulatory support, and technological advancements ensures robust growth of enhanced vision systems to address the challenges of low-visibility flight. Continued focus on these safety concerns will remain a primary demand driver

Restraint/Challenge

High Implementation and Maintenance Costs

- The significant costs involved in implementing and maintaining enhanced vision systems can limit their adoption, especially among smaller operators and general aviation segments. These expenses include initial equipment procurement, installation, system integration, and ongoing calibration and support

- For instance, regional airlines and private aircraft owners have expressed concerns regarding the high capital expenditure and complexity of retrofitting legacy aircraft with advanced vision systems. Such financial barriers delay widespread market penetration despite clear safety benefits

- Furthermore, the need for specialized training and certification for pilots and maintenance personnel adds operational costs and logistical challenges. Ensuring continuous system performance and compliance with regulatory standards requires dedicated resources and periodic upgrades

- In addition, integration issues with diverse avionics suites and varying aircraft architectures can increase deployment complexity and cost. Compatibility challenges may lead to longer implementation timelines and higher overall investment

- Addressing these cost and operational challenges through modular, scalable solutions and flexible financing options will be critical to broadening enhanced vision system adoption. Cost containment strategies are essential to balance safety improvements with economic feasibility across the aviation market

Enhanced Vision System Market Scope

The market is segmented on the basis of technology, component, platform, type, and system.

- By Technology

On the basis of technology, the Enhanced Vision System market is segmented into Infrared, Synthetic Vision, Global Positioning System (GPS), and Millimeter Wave Radar. The Infrared segment dominated the market in 2025 with the largest revenue share of 43%, driven by its ability to provide superior visibility in low-light and adverse weather conditions, including fog, smoke, and darkness. Infrared EVS helps pilots detect terrain, obstacles, and other aircraft, enhancing flight safety and operational efficiency. Its integration with existing avionics systems and minimal dependency on external signals makes it a preferred choice for both military and commercial aviation applications. The reliability, cost-effectiveness, and extensive adoption in various aircraft types further reinforce its dominance in the market.

The Millimeter Wave Radar segment is anticipated to witness the fastest growth from 2026 to 2033, driven by its advanced capability to detect obstacles and weather patterns at long ranges under diverse environmental conditions. For instance, companies such as Honeywell are innovating radar-based EVS for both fixed-wing and rotary-wing aircraft to improve situational awareness during critical flight phases. The growing adoption of autonomous and semi-autonomous flight technologies also fuels demand for radar systems, as they provide real-time, high-resolution data to onboard displays.

- By Component

On the basis of components, the EVS market is segmented into Displays, Cameras, Processing Units, Sensors, and Control Electronics. The Displays segment dominated the market in 2025, accounting for the largest revenue share, due to the critical role of high-definition cockpit displays in translating sensor data into actionable visual information for pilots. High-resolution displays improve situational awareness by presenting terrain, runway, and obstacle information in real time, which is essential for safe takeoffs, landings, and low-visibility operations. The adoption of head-up displays (HUDs) and helmet-mounted displays further supports the preference for advanced display solutions.

The Cameras segment is expected to witness the fastest growth from 2026 to 2033, driven by rapid advancements in infrared and low-light camera technologies. For instance, FLIR Systems has developed high-performance EVS cameras capable of integrating with synthetic vision systems for enhanced safety. Cameras provide the raw visual input for multiple technologies, and their miniaturization and improved image resolution are driving widespread adoption across both commercial and military aircraft.

- By Platform

On the basis of platform, the EVS market is segmented into Fixed Wing and Rotary Wing aircraft. The Fixed Wing segment dominated the market in 2025, holding the largest revenue share due to the extensive deployment of EVS in commercial airliners and regional aircraft. Fixed-wing aircraft operate over long distances and require enhanced situational awareness in low-visibility conditions, making EVS an essential safety feature. These systems aid pilots in navigation, obstacle detection, and compliance with increasingly stringent aviation safety regulations, reinforcing the segment’s market leadership.

The Rotary Wing segment is expected to witness the fastest growth from 2026 to 2033, driven by the rising adoption of helicopters in emergency medical services, search and rescue operations, and defense missions. For instance, companies such as Leonardo are equipping rotary-wing aircraft with EVS to enhance night operations and all-weather capabilities. The compact design requirements and increased operational demand in urban environments are contributing to the rapid expansion of this segment.

- By Type

On the basis of type, the EVS market is segmented into Stand-Alone EVS and Combined Vision Systems (EVS+SVS). The Stand-Alone EVS segment dominated the market in 2025, accounting for the largest revenue share, due to its simpler integration, cost-effectiveness, and ability to independently enhance pilot visibility in poor weather and nighttime conditions. Stand-alone systems offer high reliability for commercial and military operators who require dedicated imaging solutions without extensive reliance on additional technologies.

The Combined Vision Systems (EVS+SVS) segment is anticipated to witness the fastest growth from 2026 to 2033, driven by the increasing demand for integrated systems that merge real-world infrared imagery with synthetic terrain and navigation data. For instance, Rockwell Collins has developed combined systems that provide pilots with real-time situational awareness while reducing workload during complex maneuvers. The synergy of EVS and SVS offers superior safety and operational efficiency, driving adoption across next-generation aircraft fleets.

- By System

On the basis of system, the EVS market is segmented into Cockpit Voice Recorder, Flight Data Recorder, Quick Access Recorder, and Data Logger. The Flight Data Recorder segment dominated the market in 2025, holding the largest revenue share due to its crucial role in recording flight parameters, enabling post-flight analysis, and ensuring regulatory compliance. Flight data recorders integrated with EVS help monitor system performance, detect anomalies, and support aviation safety investigations. Their reliability and long-standing adoption in the aviation sector further strengthen their dominance.

The Quick Access Recorder segment is expected to witness the fastest growth from 2026 to 2033, driven by its ability to provide rapid access to flight and system data for analysis and troubleshooting. For instance, companies such as Universal Avionics are innovating quick access recorders that interface seamlessly with EVS for both fixed-wing and rotary-wing platforms. The demand for real-time analytics and proactive maintenance in modern aviation operations is accelerating the adoption of these systems.

Enhanced Vision System Market Regional Analysis

- North America dominated the enhanced vision system market with the largest revenue share of 36.6% in 2025, driven by increasing investments in aviation safety technologies and the growing adoption of advanced cockpit systems

- Airlines and defense organizations in the region are prioritizing enhanced situational awareness for pilots, fueling demand for EVS solutions

- This widespread adoption is further supported by high technological readiness, well-established aerospace infrastructure, and regulatory mandates promoting safety enhancements in commercial and military aircraft

U.S. Enhanced Vision System Market Insight

The U.S. EVS market captured the largest revenue share in 2025 within North America, propelled by the rapid modernization of commercial and military aircraft fleets. Operators are increasingly adopting infrared and synthetic vision systems to improve visibility under low-light and adverse weather conditions. The demand is further boosted by the integration of EVS with head-up displays and cockpit automation systems, enhancing operational safety and efficiency. Government safety regulations and defense modernization programs also significantly contribute to market growth.

Europe Enhanced Vision System Market Insight

The Europe enhanced vision system market is projected to expand at a substantial CAGR during the forecast period, primarily driven by the region’s focus on aviation safety, innovation in avionics, and the adoption of next-generation aircraft technologies. European airlines and defense agencies are investing in EVS for improved situational awareness, particularly in low-visibility operations. The presence of major aerospace manufacturers and research initiatives in countries such as Germany and France is fostering adoption. In addition, urban air mobility initiatives and modernization of regional fleets are boosting demand across commercial and military applications.

U.K. Enhanced Vision System Market Insight

The U.K. EVS market is anticipated to grow at a notable CAGR during the forecast period, driven by the increasing emphasis on flight safety and adoption of advanced cockpit systems. The country’s aerospace and defense sectors are leveraging EVS technologies to enhance pilot visibility during night and adverse weather operations. The trend of integrating EVS with synthetic vision systems and cockpit automation solutions is stimulating market demand. Furthermore, government aviation safety programs and investments in commercial and military aircraft modernization are expected to continue supporting market expansion.

Germany Enhanced Vision System Market Insight

The Germany EVS market is expected to expand at a significant CAGR during the forecast period, fueled by the country’s strong aerospace manufacturing base and technological innovation. Increasing adoption of high-performance infrared and radar-based EVS in both commercial and defense aircraft supports market growth. The emphasis on environmental compliance, safety regulations, and integration with cockpit automation systems further reinforces the adoption of enhanced vision solutions. Germany’s focus on innovation and precision engineering also drives investments in next-generation avionics technologies.

Asia-Pacific Enhanced Vision System Market Insight

The Asia-Pacific enhanced vision system market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid modernization of airline fleets, rising air traffic, and government initiatives promoting aviation safety. Countries such as China, Japan, and India are investing heavily in EVS for commercial, military, and rotary-wing aircraft. The region’s increasing focus on urban air mobility, smart airports, and low-visibility operations is further fueling adoption. Availability of cost-effective solutions and rising collaborations between local manufacturers and global EVS technology providers are also accelerating growth.

Japan Enhanced Vision System Market Insight

The Japan EVS market is gaining momentum due to the country’s technologically advanced aviation sector and high safety standards. Airlines and defense organizations are adopting EVS to improve situational awareness in low-light, foggy, and adverse weather conditions. The integration of EVS with synthetic vision and cockpit automation systems enhances operational efficiency and reduces pilot workload. Japan’s aging population and the demand for safer, user-friendly flight operations in commercial and rotary-wing aircraft are further contributing to market growth.

China Enhanced Vision System Market Insight

The China EVS market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the rapid expansion of commercial aviation, modernization of defense fleets, and high technological adoption. China is investing heavily in smart airport infrastructure and advanced cockpit technologies, promoting the integration of EVS in both fixed-wing and rotary-wing platforms. Domestic manufacturers are increasingly offering cost-effective and innovative solutions, driving broader adoption across commercial airlines, defense applications, and urban air mobility projects.

Enhanced Vision System Market Share

The enhanced vision system industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Thales Group (France)

- Elbit Systems Ltd. (Israel)

- Collins Aerospace (U.S.)

- Transdigm Group, Inc. (U.S.)

- Astronics Corporation (U.S.)

- MBDA (France)

- Opgal Optronic Industries Ltd. (Israel)

- FLIR Systems, Inc. (U.S.)

- Safran (France)

- Dassault Falcon Jet Corp. (France)

- Gulfstream Aerospace Corporation (U.S.)

- BAE Systems (U.K.)

- Bombardier (Canada)

- Embraer (Brazil)

- Cirrus Design Corporation (U.S.)

- Sierra Nevada Corporation (U.S.)

- Lexavia Integrated Systems (U.S.)

- Textron Inc. (U.S.)

Latest Developments in Global Enhanced Vision System Market

- In October 2024, Universal Avionics achieved FAA supplemental type certification for its ClearVision™ EFVS on the Beechcraft King Air B200/300, marking a significant milestone for operators in special missions, medical evacuations, and aerial‑firefighting. The certification enables pilots to operate safely in smoke, haze, or complete darkness, reducing flight delays and cancellations in low‑visibility conditions. This development is expected to accelerate adoption of enhanced vision systems in niche and small aircraft segments, providing retrofit opportunities for existing fleets and expanding the market for advanced EFVS solutions across general aviation and mission-critical operations

- In October 2024, Universal Avionics announced that its ClearVision system successfully addressed new challenges posed by LED approach lighting at airports, providing pilots with a 50 % visual advantage over unaided vision in low-visibility conditions. This advancement demonstrates how multispectral camera technology can enhance pilot situational awareness and maintain safety standards despite evolving airport infrastructure. The development signals a shift in the EVS market toward integrating advanced sensor-based solutions that can adapt to new lighting and environmental conditions, driving demand for next-generation, high-performance EVS technologies in both commercial and business aviation sectors

- In February 2024, Collins Elbit Vision Systems, a joint venture between Collins Aerospace and Elbit Systems Ltd., delivered its 3,000th F‑35 Gen III Helmet‑Mounted Display System (HMDS) to the Joint Strike Fighter programme, representing a major achievement in military aviation technology. The system provides pilots with intuitive access to essential flight, tactical, and sensor information, significantly enhancing operational safety and mission efficiency. This development highlights the growth of the EVS market beyond commercial aviation into defense applications, expanding the total addressable market for helmet-mounted and cockpit vision systems while reinforcing the importance of situational awareness technologies in modern fighter aircraft

- In June 2023, Honeywell International, Inc. acquired the heads-up display (HUD) assets of Saab AB and entered a collaborative agreement to further develop the HUD product line. This strategic move allows Honeywell to integrate advanced HUD solutions with its avionics offerings, creating combined HUD-plus-EVS systems that enhance pilot awareness and flight safety. The acquisition and partnership accelerate innovation in cockpit vision technologies and increase competitive pressure in the EVS market by offering integrated, high-value solutions for both commercial and defense aircraft, driving consolidation and technology convergence in the sector

- In May 2022, Collins Aerospace began large-scale installations of its EVS‑3600 multispectral enhanced vision system on Boeing 737 NG aircraft, marking one of the first airline-level adoptions of EFVS in commercial aviation. The system improves visibility in rain, fog, and darkness, allowing airlines to operate safely under low-visibility conditions and reducing weather-related disruptions. This deployment signaled the transition of enhanced vision systems from niche corporate and business aircraft into mainstream airline fleets, expanding the market size, enabling economies of scale, and paving the way for broader adoption of EFVS technologies in large commercial aircraft globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Enhanced Vision System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Enhanced Vision System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Enhanced Vision System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.