Global Enterprise Information Archiving Market

Market Size in USD Billion

CAGR :

%

USD

10.88 Billion

USD

29.36 Billion

2025

2033

USD

10.88 Billion

USD

29.36 Billion

2025

2033

| 2026 –2033 | |

| USD 10.88 Billion | |

| USD 29.36 Billion | |

|

|

|

|

Enterprise Information Archiving Market Size

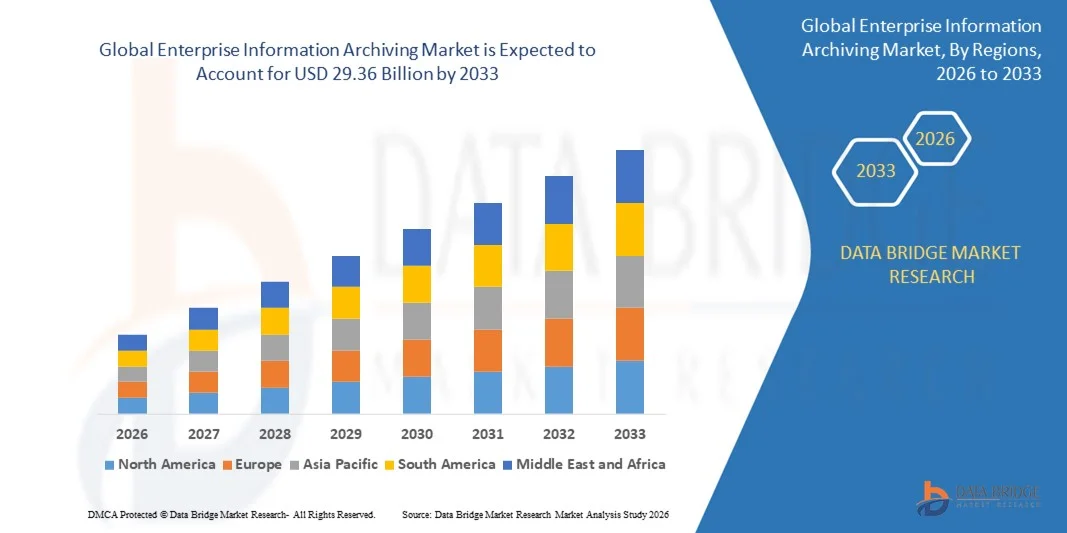

- The global enterprise information archiving market size was valued at USD 10.88 billion in 2025 and is expected to reach USD 29.36 billion by 2033, at a CAGR of 13.20% during the forecast period

- The market growth is largely fueled by the increasing volume of enterprise data and the growing need for secure, compliant, and easily retrievable storage solutions across organizations in multiple sectors, including BFSI, IT, healthcare, and government

- Furthermore, rising regulatory requirements for data retention, legal discovery, and internal auditing, combined with the shift toward digital communication and cloud adoption, are driving enterprises to implement advanced information archiving solutions. These converging factors are accelerating the uptake of archiving systems, thereby significantly boosting the industry’s growth

Enterprise Information Archiving Market Analysis

- Enterprise information archiving solutions, offering secure storage, compliance management, and efficient retrieval of business-critical content such as emails, files, and communication records, are increasingly vital for modern organizations. They help ensure operational continuity, regulatory compliance, and data integrity across SMEs and large enterprises

- The escalating demand for enterprise information archiving is primarily fueled by growing digitalization, rising data volumes, the shift toward cloud and hybrid deployment models, and increasing awareness among enterprises regarding cybersecurity, regulatory compliance, and efficient management of archived information

- North America dominated the enterprise information archiving market with a share of 41.4% in 2025, due to stringent regulatory compliance requirements, increasing data volumes, and widespread adoption of cloud-based archiving solutions

- Asia-Pacific is expected to be the fastest growing region in the enterprise information archiving market during the forecast period due to rapid digitalization, increasing adoption of cloud solutions, and growing regulatory focus in countries such as China, Japan, and India

- Email segment dominated the market with a market share of 45.5% in 2025, due to the critical need to securely store and manage massive volumes of corporate emails for regulatory compliance and internal auditing. Enterprises prioritize email archiving as it ensures easy retrieval, legal defensibility, and continuity in case of data loss. Strong adoption is also observed due to integration capabilities with popular email platforms such as Microsoft Outlook and Gmail, enabling seamless archival without disrupting daily communication workflows

Report Scope and Enterprise Information Archiving Market Segmentation

|

Attributes |

Enterprise Information Archiving Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Enterprise Information Archiving Market Trends

Rising Adoption of Cloud-Based and Hybrid Archiving Solutions

- A significant trend in the enterprise information archiving market is the growing adoption of cloud-based and hybrid deployment models, driven by the increasing need for scalable, secure, and easily accessible data storage solutions across enterprises. This adoption is enabling organizations to manage large volumes of emails, files, and communication records while reducing reliance on on-premises infrastructure and lowering overall IT costs

- For instance, Mimecast and Veritas offer cloud-enabled archiving solutions that allow enterprises to seamlessly store, retrieve, and manage critical business data with high compliance standards. Such platforms improve operational efficiency and support remote access for distributed teams

- The adoption of hybrid archiving solutions is expanding as enterprises seek flexibility in balancing on-premises control with cloud scalability. Organizations benefit from the ability to store sensitive data locally while leveraging cloud resources for less critical content, ensuring regulatory compliance and efficient data management

- Sectors such as BFSI, healthcare, and government are increasingly implementing cloud-based archiving to meet stringent legal, regulatory, and data retention requirements. This is accelerating the market’s shift toward digital-first data management strategies

- The rise of remote work and distributed teams is further propelling cloud and hybrid archiving adoption, allowing employees to securely access archived content from any location without compromising compliance or security standards

- Enterprises are also integrating advanced features such as automated retention policies, AI-driven search, and analytics into archiving platforms. This trend is enhancing data visibility, improving audit readiness, and reinforcing the role of enterprise information archiving as a strategic IT solution

Enterprise Information Archiving Market Dynamics

Driver

Increasing Regulatory Compliance and Data Retention Requirements

- The growing emphasis on regulatory compliance and data retention is driving enterprises to adopt advanced archiving solutions that ensure secure, retrievable storage of emails, files, and other communications. Organizations require robust systems to meet mandates such as GDPR, HIPAA, SOX, and FINRA, which dictate precise retention periods and accessibility standards

- For instance, companies such as Commvault and Barracuda Networks provide archiving solutions tailored to meet strict compliance requirements, helping enterprises reduce the risk of penalties and legal exposure. These platforms enable efficient auditing, legal discovery, and internal investigations

- The increasing frequency of data-related legal disputes and audits compels organizations to implement centralized, reliable archiving systems. This ensures that critical business information can be accessed quickly and accurately when required

- Enterprises are also focusing on maintaining data integrity, preventing loss, and enabling traceable records to satisfy regulatory inspections. The adoption of automated compliance features within archiving platforms further reduces manual errors and administrative burden

- The requirement for cross-border compliance is encouraging organizations to deploy scalable and secure cloud or hybrid archiving solutions. These systems ensure adherence to regional regulations while supporting global business operations

Restraint/Challenge

Managing Growing Volumes of Enterprise Data Securely

- The enterprise information archiving market faces challenges in securely handling rapidly increasing volumes of digital content, including emails, files, instant messages, and collaboration data. Managing this data while maintaining regulatory compliance, privacy, and accessibility is becoming increasingly complex

- For instance, large enterprises using platforms from Veritas or ZL Technologies must balance storage scalability with high security standards to protect sensitive information. Ensuring encryption, access control, and audit trails adds operational complexity

- Enterprises must also address risks of cyberattacks, internal breaches, and accidental data loss while archiving high volumes of information. These risks necessitate robust security protocols, continuous monitoring, and disaster recovery measures

- The reliance on multiple communication and collaboration tools across distributed teams increases the challenge of consolidating and managing archived content effectively. Integrating diverse data sources while maintaining a unified compliance framework is a key hurdle

- The market continues to face pressure from IT budget constraints, resource limitations, and the need for skilled personnel to manage complex archiving systems. These challenges collectively slow adoption and require enterprises to invest in more advanced, automated, and secure solutions

Enterprise Information Archiving Market Scope

The market is segmented on the basis of content type, service, deployment type, and end-user.

- By Content Type

On the basis of content type, the enterprise information archiving market is segmented into email, social media, instant messaging, web, mobile communication, and files and enterprise file synchronization and sharing (EFFS). The email segment dominated the market with the largest revenue share of 45.5% in 2025, driven by the critical need to securely store and manage massive volumes of corporate emails for regulatory compliance and internal auditing. Enterprises prioritize email archiving as it ensures easy retrieval, legal defensibility, and continuity in case of data loss. Strong adoption is also observed due to integration capabilities with popular email platforms such as Microsoft Outlook and Gmail, enabling seamless archival without disrupting daily communication workflows.

The files and enterprise file synchronization and sharing (EFFS) segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising reliance on collaborative work environments and cloud-based document sharing. For instance, companies such as Box and Dropbox are enhancing their EFFS solutions with archiving capabilities to ensure secure, compliant storage of shared files. The increasing shift towards hybrid work models drives the demand for secure, easily retrievable file archiving, while regulatory requirements for document retention further support growth in this segment.

- By Service

On the basis of service, the market is segmented into planning and consulting services, system integration, training and support services, operations and maintenance services, and data migration. The system integration segment dominated the market with the largest revenue share in 2025, driven by the complexity of integrating archiving solutions with existing enterprise IT infrastructure. Enterprises often rely on experienced providers to ensure seamless interoperability between archiving platforms and content sources while maintaining data integrity. System integration services also enhance compliance, streamline workflows, and reduce operational risks associated with improper data handling.

The data migration segment is expected to witness the fastest growth from 2026 to 2033, driven by enterprises transitioning from legacy systems to modern cloud-based archiving platforms. For instance, companies such as Iron Mountain offer specialized data migration services to move critical business data securely and efficiently. The growing volume of enterprise data and the need to consolidate it into a compliant, easily searchable repository is a key factor supporting the rapid adoption of data migration services.

- By Deployment Type

On the basis of deployment type, the enterprise information archiving market is segmented into cloud and on-premises. The cloud segment dominated the market with the largest revenue share in 2025, driven by its scalability, lower upfront costs, and flexibility in handling large volumes of enterprise content. Cloud-based archiving allows organizations to maintain compliance across geographies while providing secure, remote access to archived information. Enterprises also benefit from automated updates, managed security, and seamless integration with other cloud-based enterprise tools.

The on-premises segment is anticipated to witness the fastest growth from 2026 to 2033, driven by organizations with strict data sovereignty, security, and compliance requirements. For instance, financial institutions and government agencies often prefer on-premises archiving solutions offered by providers such as Veritas. On-premises deployment allows for complete control over sensitive data while enabling customization to align with internal IT policies and regulatory mandates.

- By End-User

On the basis of end-user, the market is segmented into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment dominated the market with the largest revenue share in 2025, driven by their higher data volumes, complex IT environments, and stringent regulatory compliance obligations. Large organizations often implement enterprise information archiving solutions to support legal discovery, internal investigations, and efficient information retrieval across multiple departments. These enterprises also prioritize solutions that can scale with growing data and integrate with enterprise-wide communication and collaboration platforms.

The SMEs segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing adoption of affordable, cloud-based archiving solutions that do not require extensive IT infrastructure. For instance, companies such as Mimecast provide SME-focused archiving platforms with easy deployment and compliance features. The growing awareness among SMEs regarding data protection, legal compliance, and efficient information management is accelerating adoption in this segment.

Enterprise Information Archiving Market Regional Analysis

- North America dominated the enterprise information archiving market with the largest revenue share of 41.4% in 2025, driven by stringent regulatory compliance requirements, increasing data volumes, and widespread adoption of cloud-based archiving solutions

- Organizations in the region prioritize secure, easily retrievable storage of critical business information, including emails, files, and communication records, to ensure legal defensibility and operational continuity

- This strong adoption is further supported by high IT infrastructure maturity, a technologically skilled workforce, and the growing preference for automated, scalable archiving solutions across enterprises

U.S. Enterprise Information Archiving Market Insight

The U.S. enterprise information archiving market captured the largest revenue share in 2025 within North America, fueled by robust adoption of cloud services and increasing regulatory pressures for data retention and compliance. Businesses are focusing on secure, compliant storage for emails, files, and collaboration tools, ensuring accessibility for legal discovery and audits. The growing trend of hybrid work models and reliance on digital communication platforms further drives demand. In addition, advanced analytics and AI-enabled archiving features offered by providers such as Mimecast and Veritas enhance operational efficiency and compliance, accelerating market growth.

Europe Enterprise Information Archiving Market Insight

The Europe enterprise information archiving market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent GDPR regulations and increasing digitalization across industries. Enterprises are increasingly adopting archiving solutions to securely manage emails, social media communications, and business-critical documents. The region witnesses strong growth in sectors such as BFSI, healthcare, and government, where compliance and data retention are key priorities. Cloud-based and hybrid archiving deployments are gaining traction, providing flexibility and cost efficiency while supporting secure information governance.

U.K. Enterprise Information Archiving Market Insight

The U.K. enterprise information archiving market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by regulatory compliance requirements and rising awareness of cybersecurity risks. Businesses are adopting archiving solutions to ensure secure storage of emails, files, and instant messaging records, supporting audits and legal discovery. The market is further strengthened by the presence of cloud service providers and increasing reliance on digital communication platforms across SMEs and large enterprises

Germany Enterprise Information Archiving Market Insight

The Germany enterprise information archiving market is expected to expand at a considerable CAGR during the forecast period, driven by compliance mandates and the increasing need for secure, structured data storage. Enterprises are adopting archiving solutions that integrate with existing IT systems to efficiently manage large volumes of emails, EFFS files, and other communication records. Germany’s advanced IT infrastructure and focus on innovation and data privacy encourage deployment of both cloud and on-premises archiving solutions.

Asia-Pacific Enterprise Information Archiving Market Insight

The Asia-Pacific enterprise information archiving market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid digitalization, increasing adoption of cloud solutions, and growing regulatory focus in countries such as China, Japan, and India. Enterprises are focusing on secure, scalable archiving solutions to manage emails, files, and collaborative communication platforms. The expansion of IT infrastructure and increasing awareness of data compliance and cybersecurity is driving adoption across SMEs and large enterprises.

Japan Enterprise Information Archiving Market Insight

The Japan enterprise information archiving market is gaining momentum due to the country’s highly digitized business environment, focus on regulatory compliance, and growing need for secure data management. Organizations are increasingly implementing archiving solutions for emails, files, and mobile communications, enhancing operational efficiency and compliance readiness. The integration of archiving with cloud and hybrid platforms, as well as advanced analytics, is further driving market growth.

China Enterprise Information Archiving Market Insight

The China enterprise information archiving market accounted for the largest revenue share in Asia-Pacific in 2025, driven by the rapid expansion of digital enterprises, increasing regulatory requirements, and adoption of cloud-based archiving solutions. Enterprises across BFSI, e-commerce, and manufacturing sectors are implementing archiving systems to manage emails, EFFS files, and instant messaging data. Strong domestic IT infrastructure, availability of cost-effective solutions, and government initiatives promoting data governance are key factors propelling market growth.

Enterprise Information Archiving Market Share

The enterprise information archiving industry is primarily led by well-established companies, including:

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Barracuda Networks, Inc. (U.S.)

- Commvault Systems, Inc. (U.S.)

- Mimecast Services Limited (U.K.)

- Smarsh Inc. (U.S.)

- Proofpoint, Inc. (U.S.)

- Global Relay Communications Inc. (Canada)

- Cross Road Infosystem (P) Ltd (India)

- Softage Information Technology Limited (India)

- Veritas Technologies LLC (U.S.)

- ZL Technologies, Inc. (U.S.)

- Micro Focus International plc (U.K.)

- Bloomberg Finance LP (U.S.)

- Atos SE (France)

- Actiance, Inc. (U.S.)

Latest Developments in Global Enterprise Information Archiving Market

- In October 2025, Sharp Archive partnered with Trinax Pte Ltd to expand the distribution of its communication-archiving suite across the Asia-Pacific region. This strategic collaboration is expected to significantly strengthen Sharp Archive’s presence in high-growth APAC markets, enabling the company to reach a broader enterprise base, including SMEs and large organizations. By enhancing the accessibility of its archiving solutions, Sharp Archive supports enterprises in managing regulatory compliance, secure data storage, and seamless retrieval of communications. The partnership is likely to accelerate adoption of advanced archiving systems in sectors such as BFSI, IT, and manufacturing, where secure recordkeeping is increasingly critical

- In January 2025, Preservica launched its new Enterprise Digital Preservation platform featuring enhanced security measures, automated preservation workflows, and AI/ML integration. This innovation is set to advance the enterprise information archiving market by addressing the growing need for long-term, secure, and intelligent digital preservation. Enterprises can leverage the platform to safeguard critical communications, emails, and files while using AI-driven analytics to ensure compliance with evolving data regulations. The launch is expected to improve operational efficiency, reduce risks associated with data loss, and enhance decision-making through actionable insights derived from archived content

- In September 2024, Datasite acquired Paris-based Sealk, incorporating AI-powered M&A search capabilities into its enterprise information archiving portfolio. This acquisition strengthens Datasite’s position in the market by enabling more efficient management and retrieval of high-value transactional data, critical emails, and corporate documents. Enterprises engaging in mergers and acquisitions benefit from faster, more accurate access to archived communications, which enhances due diligence, risk assessment, and strategic decision-making. The integration of AI-driven search tools positions Datasite as a key solution provider for organizations prioritizing efficiency, compliance, and intelligent archiving

- In June 2024, SOLIX Technologies upgraded its SOLIXCloud archiving platform with advanced analytics capabilities. This upgrade allows enterprises to gain actionable insights from archived data, improve compliance tracking, and optimize storage management across emails, files, and collaborative communications. The enhancement strengthens SOLIX Technologies’ competitive edge by addressing the growing demand for cloud-based, analytics-enabled archiving solutions that support regulatory compliance, operational efficiency, and secure, scalable storage for enterprise data

- In March 2024, Barracuda Networks introduced its next-generation cloud-native archiving solution with automated compliance, real-time data indexing, and improved scalability. This development is expected to reshape the market by offering enterprises, particularly SMEs, a cost-effective, secure, and easily deployable archiving option. The solution addresses the increasing volumes of email and file-based communications, while ensuring regulatory adherence, rapid data retrieval, and operational continuity. Barracuda’s offering enhances the overall adoption of cloud-native archiving solutions in sectors such as healthcare, BFSI, and education

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.