Global Enterprise Networking Market

Market Size in USD Billion

CAGR :

%

USD

72.93 Billion

USD

427.20 Billion

2024

2032

USD

72.93 Billion

USD

427.20 Billion

2024

2032

| 2025 –2032 | |

| USD 72.93 Billion | |

| USD 427.20 Billion | |

|

|

|

|

Enterprise Networking Market Size

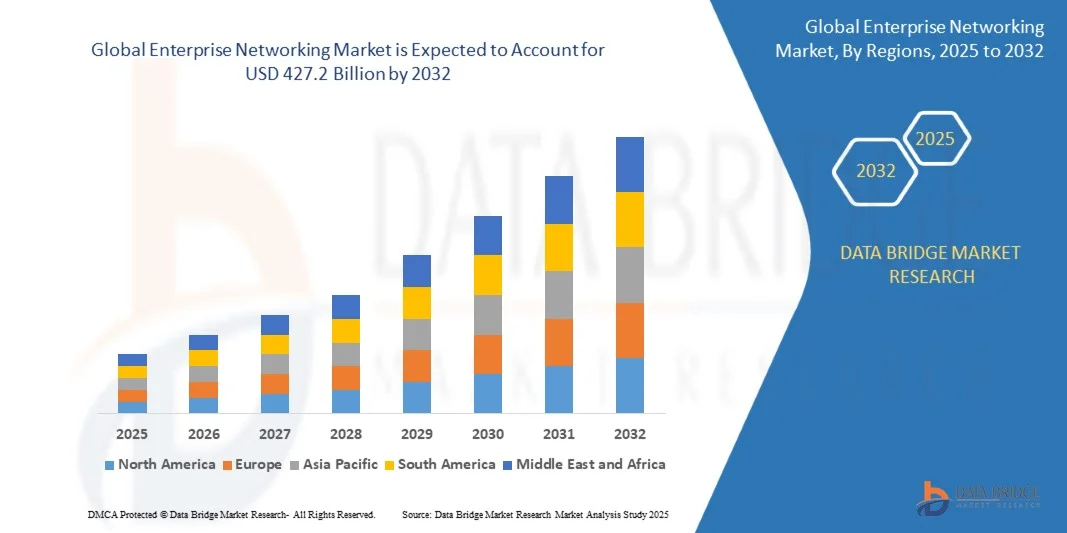

- The Enterprise Networking Market size was valued at USD 72.93 billion in 2024 and is projected to reach USD 427.2 billion by 2032, growing at a CAGR of 24.73% during the forecast period

- The market’s expansion is primarily driven by increasing demand for seamless connectivity, rising cloud adoption, and the proliferation of IoT devices across enterprise environments

- In addition, the need for robust, scalable, and secure network infrastructure is propelling organizations to invest in advanced networking technologies, thereby accelerating market growth and innovation within the enterprise networking space

Enterprise Networking Market Analysis

- Enterprise networking, encompassing solutions such as LAN, WAN, SD-WAN, and network security, is becoming a critical foundation for digital transformation in both large enterprises and SMEs due to its role in enabling secure, high-speed connectivity and cloud integration across distributed workforces and operations

- The surge in demand for enterprise networking is primarily driven by increased cloud service adoption, hybrid work models, growing IoT deployments, and the rising need for secure and scalable communication infrastructures

- North America dominated the Enterprise Networking Market with the largest revenue share of 35.8% in 2024, attributed to early cloud technology adoption, high IT spending, and a concentration of major networking providers, with the U.S. leading in enterprise network modernization and adoption of AI-powered network management tools

- Asia-Pacific is expected to be the fastest growing region in the Enterprise Networking Market during the forecast period due to rapid digitalization, expanding tech infrastructure, and increased investments in smart city and industrial automation projects

- The product segment dominated the market with the largest revenue share of approximately 62% in 2024. This dominance is driven by the increasing demand for physical networking equipment such as routers, switches, firewalls, and SD-WAN devices, which are essential for building and maintaining enterprise-grade networks.

Report Scope and Enterprise Networking Market Segmentation

|

Attributes |

Enterprise Networking Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Enterprise Networking Market Trends

“Enhanced Network Intelligence Through AI and Automation”

- A significant and rapidly growing trend in the Enterprise Networking Market is the integration of artificial intelligence (AI), machine learning (ML), and automation technologies to optimize network performance, security, and management. This evolution is transforming enterprise networks into more self-aware, adaptive, and efficient systems.

- For Instance, Cisco’s AI-driven networking solutions, such as Cisco DNA Center, use predictive analytics and intent-based networking to proactively detect issues, automate responses, and optimize traffic flows. Similarly, Juniper Networks’ Mist AI platform leverages machine learning to deliver network insights, automate operations, and improve user experiences across wired and wireless environments.

- AI in enterprise networking enables dynamic traffic management, anomaly detection, and intelligent threat response, significantly reducing manual oversight. Tools like HPE Aruba’s AIOps can predict network outages, suggest configuration changes, and provide automated remediation, improving uptime and service quality.

- Automation combined with AI facilitates the creation of self-healing and self-optimizing networks. These systems can automatically adjust bandwidth allocation, reroute traffic during congestion, or respond to cyber threats in real time—minimizing downtime and enhancing operational efficiency.

- The integration of AI with network orchestration platforms allows IT teams to centralize control over hybrid and multi-cloud environments. Enterprises can now manage WAN, LAN, and cloud networks from unified dashboards, improving visibility and simplifying policy enforcement across distributed infrastructure.

- This growing emphasis on AI-powered, intelligent networking is redefining enterprise IT strategies. As digital transformation accelerates and network complexity increases, organizations across sectors are increasingly adopting AI-integrated solutions to ensure agility, resilience, and cost-efficiency in their network operations.

Enterprise Networking Market Dynamics

Driver

“Growing Need Due to Rising Data Security Concerns and Cloud-First Strategies”

- The escalating concerns around data breaches, ransomware attacks, and cyber espionage are significantly driving demand for advanced enterprise networking solutions that prioritize security, scalability, and performance. Organizations are increasingly shifting toward cloud-first strategies, further amplifying the need for secure and efficient network infrastructures.

- For Instance, in March 2024, Fortinet announced the expansion of its Secure SD-WAN offering with advanced AI-powered threat detection and zero-trust access controls, catering to growing enterprise needs for secure cloud connectivity. Such innovations are expected to fuel continued growth in the enterprise networking sector.

- As businesses embrace hybrid and remote work environments, secure connectivity between data centers, branch offices, and cloud platforms has become a top priority. Enterprise networking solutions offer advanced features like end-to-end encryption, network segmentation, and identity-based access control to mitigate security risks.

- Furthermore, the proliferation of cloud services, SaaS applications, and edge computing is making next-generation network architectures—like SD-WAN and SASE—essential for ensuring reliable, secure access to distributed digital resources.

- The demand for intelligent, software-defined networking platforms that allow centralized visibility, automation, and proactive threat response is accelerating across industries. From small enterprises to large multinationals, organizations are prioritizing network infrastructure investments that enhance both agility and cyber resilience.

Restraint/Challenge

“Cybersecurity Risks and High Implementation Costs”

- Concerns about cybersecurity vulnerabilities within enterprise networking systems present a major barrier to adoption, particularly as networks become more complex and distributed. With the rise of cloud computing, IoT integration, and remote work, enterprises face heightened risks of cyberattacks, data breaches, and unauthorized access, leading to increased apprehension among decision-makers.

- For Instance, High-profile incidents involving compromised enterprise networks or misconfigured cloud infrastructure have intensified scrutiny, making organizations—especially in regulated sectors—cautious about transitioning to next-generation networking solutions.

- Mitigating these cybersecurity concerns requires the deployment of advanced tools such as zero-trust security frameworks, AI-powered threat detection, network segmentation, and continuous monitoring. Leading vendors like Cisco and Palo Alto Networks emphasize integrated security features within their enterprise networking portfolios to address these risks.

- In addition to security concerns, the high upfront investment in enterprise-grade networking infrastructure—covering hardware, software licenses, skilled personnel, and ongoing maintenance—can be a significant constraint, particularly for small and medium-sized enterprises (SMEs).

- Although software-defined and cloud-based networking solutions are making deployments more cost-effective over time, the initial financial outlay and complexity of integration into existing systems remain key deterrents.

- To support broader market adoption, vendors must prioritize affordable, scalable solutions while also offering robust security, clear ROI models, and simplified deployment processes. Education around secure network practices and the long-term benefits of resilient enterprise networking will be essential for overcoming these challenges and unlocking future growth.

Enterprise Networking Market Scope

The market is segmented on the basis of component, deployment mode, organization size, and end user.

• By Component

On the basis of component, the Enterprise Networking Market is segmented into product and services. The product segment dominated the market with the largest revenue share of approximately 62% in 2024. This dominance is driven by the increasing demand for physical networking equipment such as routers, switches, firewalls, and SD-WAN devices, which are essential for building and maintaining enterprise-grade networks. Enterprises are investing heavily in upgrading infrastructure to meet growing data demands and enhance network security.

The services segment is expected to witness the fastest CAGR of around 22% from 2025 to 2032. This growth is fueled by the rising need for network consulting, integration, maintenance, and managed services as organizations increasingly seek expert assistance to manage complex networks and cybersecurity threats. The growing adoption of cloud-managed networking and outsourcing of network management functions is driving demand for professional services, particularly among small and medium-sized enterprises looking to optimize network performance and reduce operational costs.

• By Deployment Mode

On the basis of deployment mode, the Enterprise Networking Market is segmented into cloud-based and on-premises solutions. The on-premises segment held the largest market revenue share of about 58% in 2024, as many enterprises prefer to maintain direct control over their critical networking infrastructure, especially in sectors such as finance, healthcare, and government where data privacy and regulatory compliance are paramount. On-premises deployments allow for greater customization and security management.

The cloud-based segment is projected to be the fastest growing, with a CAGR of approximately 24% from 2025 to 2032. This rapid growth is driven by increasing digital transformation initiatives, hybrid working models, and the need for flexible, scalable networking solutions. Cloud-based deployment offers benefits like simplified management, cost efficiency, and rapid scalability, attracting both large enterprises and SMEs seeking agility and reduced capital expenditure.

• By Organization Size

On the basis of organization size, the market is segmented into large enterprises and small and medium-sized enterprises (SMEs). Large enterprises dominated the market with a revenue share of roughly 65% in 2024, reflecting their extensive IT infrastructure requirements and significant investment capabilities. These organizations demand highly scalable, secure, and resilient enterprise networks to support global operations, large data centers, and complex workflows. Their focus on innovation also drives adoption of advanced networking technologies such as AI-powered network management and zero-trust security.

SMEs are anticipated to witness the fastest CAGR of nearly 23% from 2025 to 2032. The growth is propelled by increasing digitalization, government initiatives promoting IT adoption, and the availability of cost-effective, cloud-based networking solutions. SMEs are adopting managed services and simpler networking platforms to enhance operational efficiency and competitiveness without needing extensive in-house IT resources.

• By End User

On the basis of end user, the Enterprise Networking Market is segmented into aerospace and defense, education, media and communication, and others. The aerospace and defense segment accounted for the largest market revenue share of about 38% in 2024, driven by stringent security requirements, the need for highly reliable and secure communication networks, and significant investments in advanced networking infrastructure. The critical nature of operations demands robust, resilient, and secure enterprise networking solutions.

The education segment is projected to register the fastest CAGR of around 25% from 2025 to 2032. Growing adoption of digital learning platforms, remote education, and smart campus initiatives are driving demand for scalable, high-performance networking solutions. The media and communication sector also contributes significantly to market growth, adopting advanced enterprise networking to support high-bandwidth content delivery, cloud workflows, and real-time collaboration.

Enterprise Networking Market Regional Analysis

- North America dominated the Enterprise Networking Market with the largest revenue share of 35.8% in 2024, driven by extensive digital transformation initiatives and high adoption of advanced networking technologies across various industries.

- Enterprises in the region highly prioritize robust, scalable, and secure network infrastructures to support cloud computing, remote work, and growing data traffic demands.

- This widespread adoption is further supported by strong IT infrastructure, presence of major technology vendors, high investment in network modernization, and increasing demand for seamless connectivity and network automation, establishing North America as the leading market for enterprise networking solutions in both commercial and government sectors.

U.S. Enterprise Networking Market Insight

The U.S. enterprise networking market captured the largest revenue share of 81% in North America in 2024, driven by widespread digital transformation initiatives and rapid adoption of cloud computing and advanced networking technologies. Enterprises are prioritizing high-performance, secure, and scalable networks to support remote work, data-intensive applications, and IoT integration. Additionally, strong investments in 5G infrastructure and edge computing are accelerating the need for robust enterprise networking solutions. The U.S. market benefits from the presence of major technology vendors and a favorable regulatory environment encouraging innovation and cybersecurity, fueling sustained growth.

Europe Enterprise Networking Market Insight

The Europe enterprise networking market is projected to expand at a substantial CAGR during the forecast period, driven by stringent data protection regulations such as GDPR and increased demand for secure, flexible, and automated network infrastructures. The rise in cloud adoption and digitalization across industries, alongside government initiatives promoting smart city and Industry 4.0 projects, is fostering market growth. European enterprises are increasingly deploying software-defined networking (SDN) and network function virtualization (NFV) to enhance operational efficiency and reduce costs, contributing to significant growth across the region.

U.K. Enterprise Networking Market Insight

The U.K. enterprise networking market is expected to grow at a noteworthy CAGR over the forecast period, fueled by accelerating digital transformation and cloud migration among businesses. The increasing need for enhanced cybersecurity, network agility, and support for remote work is driving demand for advanced networking solutions. The U.K.’s well-established IT infrastructure and strong focus on innovation, combined with investments in 5G and edge computing, continue to support market expansion. Additionally, government-led initiatives on digital connectivity and smart infrastructure development are key growth drivers.

Germany Enterprise Networking Market Insight

The Germany enterprise networking market is anticipated to grow at a considerable CAGR during the forecast period, supported by the country’s advanced industrial sector and emphasis on Industry 4.0. German enterprises are investing heavily in resilient, scalable, and secure network architectures to support automation, AI applications, and real-time data analytics. The market is also driven by the demand for eco-friendly and energy-efficient networking solutions in alignment with Germany’s sustainability goals. Integration with cloud platforms and robust cybersecurity frameworks remains a priority for both large enterprises and SMEs.

Asia-Pacific Enterprise Networking Market Insight

The Asia-Pacific enterprise networking market is poised to register the fastest CAGR of 24% between 2025 and 2032, propelled by rapid urbanization, digital infrastructure development, and the expanding adoption of cloud and IoT technologies in countries like China, India, Japan, and South Korea. The region is witnessing increased investments in 5G networks and smart city projects, which are driving demand for advanced enterprise networking solutions. Moreover, the growing presence of key technology vendors and local manufacturers enhances affordability and accessibility, boosting market penetration across commercial, industrial, and government sectors.

Japan Enterprise Networking Market Insight

The Japan enterprise networking market is gaining momentum due to the country’s focus on technological innovation and digital transformation across industries. High demand for ultra-reliable low latency communications (URLLC) and edge computing to support robotics, AI, and IoT applications is driving market growth. Japan’s strong infrastructure and government initiatives aimed at smart manufacturing and smart cities foster the deployment of advanced networking solutions. The market also benefits from a growing need for robust cybersecurity measures to protect critical infrastructure and business data.

China Enterprise Networking Market Insight

China’s enterprise networking market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by massive investments in digital infrastructure, cloud computing, and 5G deployment. China’s expanding industrial base and rapid urbanization fuel demand for scalable, high-speed, and secure enterprise networks. The country is also a leading hub for networking equipment manufacturing, which supports competitive pricing and innovation. Government initiatives such as “Made in China 2025” and smart city programs further accelerate enterprise networking adoption in commercial, industrial, and public sectors.

Enterprise Networking Market Share

The Enterprise Networking industry is primarily led by well-established companies, including:

- Cisco Systems (U.S.)

- HPE (Hewlett Packard Enterprise) (U.S.)

- Juniper Networks (U.S.)

- Huawei (China)

- Arista Networks (U.S.)

- Fortinet (U.S.)

- Broadcom (U.S.)

- Microsoft (U.S.)

- Dell Technologies (U.S.)

- Extreme Networks (U.S.)

- Alcatel-Lucent Enterprise (France)

- Check Point Software Technologies (Israel)

- Palo Alto Networks (U.S.)

- F5 Networks (U.S.)

- Cloudflare (U.S.)

- Nokia (Finland)

- Ericsson (Sweden)

What are the Recent Developments in Enterprise Networking Market?

- In April 2023, Cisco Systems, a global leader in networking solutions, announced the launch of a new enterprise-grade secure networking initiative in South Africa aimed at enhancing digital infrastructure for businesses and public institutions. This program focuses on deploying advanced network security and management technologies tailored to address regional connectivity challenges. By leveraging its extensive global expertise and cutting-edge solutions, Cisco is reinforcing its leadership position while supporting the rapid growth of the Enterprise Networking Market in emerging economies.

- In March 2023, Juniper Networks introduced its latest AI-driven network automation platform designed specifically for large-scale educational and commercial environments. The platform enhances network reliability, security, and real-time threat detection, helping institutions streamline operations and improve resilience. This launch demonstrates Juniper’s dedication to delivering innovative networking technologies that address the evolving security and performance needs of modern enterprises.

- In March 2023, Huawei Technologies successfully implemented the Shenzhen Smart City Network Project, aimed at optimizing urban connectivity and public safety through advanced enterprise networking solutions. The project leverages high-speed 5G networks, cloud integration, and AI-powered analytics to build a secure, responsive city infrastructure. This initiative highlights Huawei’s commitment to fostering safer, smarter urban environments through cutting-edge network technologies.

- In February 2023, Aruba Networks, a Hewlett Packard Enterprise company, announced a strategic partnership with the National Association of Realtors (NAR) to develop secure, cloud-managed networking solutions tailored for the real estate sector. This collaboration aims to enhance network security and streamline connectivity for real estate professionals, enabling more efficient and secure digital transactions. The partnership underscores Aruba’s focus on innovation and operational excellence within vertical markets.

- In January 2023, Extreme Networks unveiled its latest enterprise network management platform at the CES 2023, featuring enhanced AI-based security and remote access controls. The platform supports seamless integration across wired and wireless networks, empowering organizations with greater control and visibility over their infrastructure. Extreme Networks’ latest offering reflects the company’s commitment to advancing enterprise networking capabilities with a focus on security, scalability, and user convenience.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.