Global Enterprise Very Small Aperture Terminal Vsat Market

Market Size in USD Billion

CAGR :

%

USD

1.68 Billion

USD

3.40 Billion

2024

2032

USD

1.68 Billion

USD

3.40 Billion

2024

2032

| 2025 –2032 | |

| USD 1.68 Billion | |

| USD 3.40 Billion | |

|

|

|

|

Enterprise Very Small Aperture Terminal (VSAT) Market Size

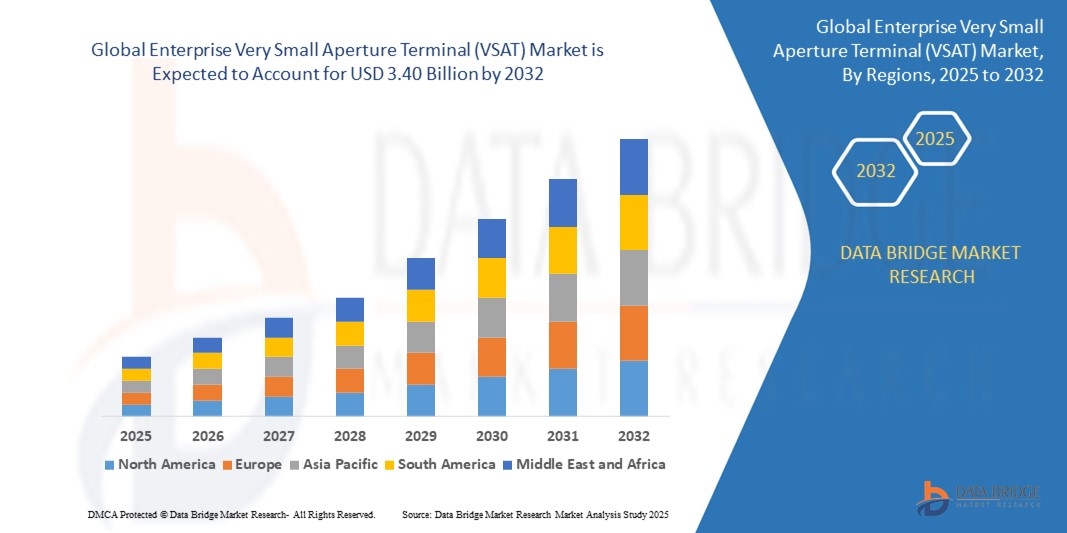

- The global Enterprise Very Small Aperture Terminal (VSAT) market size was valued at USD 1.68 billion in 2024 and is expected to reach USD 3.40 billion by 2032, at a CAGR of 9.20% during the forecast period

- The market growth is largely fueled by the increasing need for reliable, high-speed communication in remote and underserved areas across industries such as oil & gas, maritime, defense, and banking, where traditional terrestrial networks are limited or unavailable

- Furthermore, the rising adoption of cloud-based services, remote monitoring systems, and real-time data exchange is prompting enterprises to invest in VSAT solutions as a dependable means of ensuring continuous connectivity. These factors are significantly accelerating the deployment of enterprise VSAT systems worldwide

Enterprise Very Small Aperture Terminal (VSAT) Market Analysis

- Enterprise Very Small Aperture Terminal (VSAT) systems are satellite-based communication solutions that enable secure, two-way data transmission across geographically dispersed locations using compact ground terminals. These systems are essential for ensuring seamless connectivity in remote regions and mission-critical operations

- The growing demand for enterprise VSAT is primarily driven by digital transformation initiatives, government-backed rural broadband programs, and the rising need for uninterrupted data services in sectors with remote infrastructure and field operations

- North America dominated the Enterprise Very Small Aperture Terminal (VSAT) market with a share of 32.1% in 2024, due to strong demand across industries such as oil & gas, defense, and maritime, where remote communication is critical

- Asia-Pacific is expected to be the fastest growing region in the Enterprise Very Small Aperture Terminal (VSAT) market during the forecast period due to rapid digital transformation, expanding industrial activity in rural areas, and government-backed satellite connectivity initiatives

- Dedicated bandwidth VSAT systems segment dominated the market with a market share of 61.8% in 2024, due to the growing need for uninterrupted, high-speed connectivity in mission-critical operations such as defense, oil exploration, and financial transactions. These systems offer guaranteed data rates, low latency, and robust performance under varying network conditions, which are essential for applications that cannot tolerate downtime or fluctuation in speed

Report Scope and Enterprise Very Small Aperture Terminal (VSAT) Market Segmentation

|

Attributes |

Enterprise Very Small Aperture Terminal (VSAT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Enterprise Very Small Aperture Terminal (VSAT) Market Trends

“Rising Advancements in Satellite Technology”

- A significant and accelerating trend in the enterprise VSAT market is the rapid advancement of satellite technology, particularly the deployment of high-throughput satellites (HTS) and low Earth orbit (LEO) constellations, which are transforming connectivity capabilities for businesses worldwide

- For instance, leading companies such as Hughes Network Systems, Viasat, and SES Networks are launching new generations of satellites—such as Hughes’ “JUPITER 3” and SpaceX’s Starlink LEO network—that deliver higher bandwidth, lower latency, and expanded coverage, enabling robust broadband access even in the most remote and underserved regions

- These technological advancements are supporting the growing need for data-intensive applications such as cloud computing, video conferencing, IoT integration, and remote monitoring across industries including energy, maritime, mining, and financial services

- The integration of VSAT systems with terrestrial networks and 5G infrastructure is also gaining traction, allowing enterprises to build hybrid connectivity solutions that offer resilience and flexibility in diverse operational environments

- The trend toward more powerful, efficient, and cost-effective satellite solutions is fundamentally reshaping enterprise communication strategies, making VSAT a critical enabler for digital transformation and business continuity in geographically dispersed operations

- As satellite technology continues to evolve, the demand for enterprise VSAT solutions is expected to grow rapidly, particularly in regions with limited terrestrial infrastructure and among organizations prioritizing network reliability and global reach

Enterprise Very Small Aperture Terminal (VSAT) Market Dynamics

Driver

“Growing Global Connectivity Demand”

- The increasing demand for reliable, high-speed connectivity across remote and underserved locations is a major driver for the enterprise VSAT market, as organizations seek to ensure seamless communication and operational efficiency regardless of geography

- For instance, industries such as oil and gas, maritime, mining, and rural banking rely heavily on VSAT solutions from providers such as Viasat and SES Networks to maintain uninterrupted data and voice services where terrestrial networks are unavailable or unreliable

- The proliferation of cloud-based services, remote work, and digital transformation initiatives is further fueling the need for robust satellite communication infrastructure, enabling businesses to support mission-critical applications, remote monitoring, and real-time collaboration

- The ability of VSAT systems to provide scalable, secure, and easily deployable connectivity makes them indispensable for enterprises operating in challenging environments or expanding into new markets

- In addition, government initiatives to bridge the digital divide and improve broadband access in rural and isolated communities are supporting the adoption of enterprise VSAT solutions on a global scale

Restraint/Challenge

“Dependency on Satellite Lifespan”

- The dependency on satellite lifespan presents a significant challenge for the enterprise VSAT market, as the operational life of satellites directly impacts the reliability and continuity of service for end users

- For instance, while companies such as SES Networks and Viasat invest in launching new satellites to expand capacity and coverage, the finite lifespan of these assets—typically 10 to 15 years—means that service providers must plan for periodic replacements and upgrades to avoid disruptions

- Satellite failures, delays in replacement launches, or unexpected malfunctions can lead to service interruptions, increased costs, and challenges in maintaining consistent quality of service for enterprise customers

- This reliance on satellite infrastructure also exposes providers and users to risks associated with launch delays, regulatory hurdles, and the high capital expenditure required for satellite deployment and maintenance

- Addressing this challenge will require ongoing investment in satellite technology, diversified satellite fleets, and contingency planning to ensure long-term service reliability and customer satisfaction

Enterprise Very Small Aperture Terminal (VSAT) Market Scope

The market is segmented on the basis of component, type, enterprise size, and end-user.

- By Component

On the basis of component, the Enterprise VSAT market is segmented into hardware and services. The hardware segment dominated the largest market revenue share in 2024, primarily due to the consistent demand for ground equipment such as antennas, transceivers, and modems. These components form the backbone of VSAT infrastructure, especially in remote and underserved areas where traditional terrestrial connectivity is limited or non-existent. The growth in demand from sectors such as oil & gas, defense, and maritime—where durable, high-performance equipment is essential for reliable satellite communication—is driving the sustained adoption of VSAT hardware.

The services segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by the rising trend of managed network services and the increasing need for bandwidth optimization, real-time monitoring, and 24/7 technical support. As enterprises increasingly move toward outsourcing network management to focus on core operations, value-added services such as network design, remote diagnostics, and cybersecurity are becoming vital. The shift toward service-oriented business models across industries further enhances the growth potential of this segment.

- By Type

On the basis of type, the market is bifurcated into dedicated bandwidth VSAT systems and shared bandwidth VSAT systems. The dedicated bandwidth VSAT systems segment accounted for the largest market share of 61.8% in 2024, driven by the growing need for uninterrupted, high-speed connectivity in mission-critical operations such as defense, oil exploration, and financial transactions. These systems offer guaranteed data rates, low latency, and robust performance under varying network conditions, which are essential for applications that cannot tolerate downtime or fluctuation in speed.

The shared bandwidth VSAT systems segment is anticipated to grow at the fastest CAGR between 2025 and 2032, owing to their cost-effective model and suitability for businesses with less intensive bandwidth requirements. These systems are especially popular among small-scale enterprises and educational institutions where occasional high-speed access is sufficient, and budget constraints favor shared resource models. As satellite capacity increases and technological advances reduce bandwidth contention, shared VSAT systems are becoming more efficient and appealing across broader industry segments.

- By Enterprise Size

On the basis of enterprise size, the market is categorized into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment led the market in 2024 due to their widespread operational footprints, global communication requirements, and significant investment capacity. Industries such as defense, oil & gas, and multinational BFSI firms demand enterprise-grade VSAT solutions that provide secure, scalable, and high-throughput connectivity across geographically dispersed sites. These organizations prioritize network uptime and performance, which aligns with the capabilities of VSAT systems.

The small and medium enterprises (SMEs) segment is expected to register the highest growth rate over the forecast period, supported by the falling costs of satellite services, flexible pricing models, and increasing awareness of VSAT's role in bridging connectivity gaps in rural and underserved areas. SMEs in sectors such as education, healthcare, and remote retail are adopting VSAT as a viable alternative to traditional broadband, especially in regions lacking reliable terrestrial infrastructure.

- By End Users

On the basis of end users, the Enterprise VSAT market is segmented into aerospace and defense, energy, oil and gas, maritime, BFSI, IT, entertainment and media, education, healthcare, and government. The oil and gas segment dominated the market in 2024, driven by the critical need for real-time communication and monitoring in remote drilling and exploration sites. VSAT systems enable continuous data flow for operational analytics, safety alerts, and video surveillance, which are essential for efficient and safe operations in isolated environments.

The education segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the rising emphasis on digital learning and the deployment of satellite internet in remote and rural schools. Governments and NGOs are increasingly investing in satellite connectivity to bridge the digital divide and provide consistent access to online educational resources. VSAT systems offer reliable internet infrastructure that supports e-learning platforms, virtual classrooms, and administrative communication in regions where terrestrial options are limited or unavailable.

Enterprise Very Small Aperture Terminal (VSAT) Market Regional Analysis

- North America dominated the Enterprise Very Small Aperture Terminal (VSAT) market with the largest revenue share of 32.1% in 2024, driven by strong demand across industries such as oil & gas, defense, and maritime, where remote communication is critical

- The region benefits from early adoption of satellite communication infrastructure, well-established satellite operators, and rising demand for high-throughput satellite services in both urban and rural areas

- The continued deployment of VSAT for reliable connectivity in underserved areas, particularly in sectors requiring real-time monitoring and remote site coordination, reinforces the region’s dominance in the global market

U.S. Enterprise VSAT Market Insight

The U.S. Enterprise VSAT market captured the largest revenue share in 2024 within North America, fueled by rising investments in satellite broadband, defense modernization, and energy infrastructure. The country’s vast rural landscape and offshore energy operations demand robust satellite connectivity, while government initiatives such as the Rural Digital Opportunity Fund are also boosting VSAT deployment. The presence of major satellite service providers and growing digitization across enterprises further strengthen the market outlook.

Europe Enterprise VSAT Market Insight

The Europe Enterprise VSAT market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing reliance on satellite communication in the maritime, energy, and defense sectors. Growing efforts to ensure broadband access in remote and rural parts of Europe, coupled with strong regulatory support for digital inclusion, are key growth enablers. The push toward next-generation satellite networks and integrated ICT infrastructure is accelerating adoption in both public and private sectors.

U.K. Enterprise VSAT Market Insight

The U.K. Enterprise VSAT market is anticipated to grow at a healthy CAGR through the forecast period, driven by increasing demand for secure and stable communication in offshore energy platforms, remote healthcare setups, and defense operations. The U.K.'s strategic initiatives to enhance satellite coverage and invest in space-tech infrastructure are creating favorable conditions for market expansion, especially in critical sectors requiring always-on connectivity.

Germany Enterprise VSAT Market Insight

The Germany Enterprise VSAT market is expected to witness robust growth, supported by the country’s advanced industrial base and demand for uninterrupted communication in logistics, manufacturing, and public safety. Germany’s emphasis on digital infrastructure development and sustainability is encouraging the integration of satellite-based networks to improve efficiency, reduce latency, and support green communication solutions in rural and remote regions.

Asia-Pacific Enterprise VSAT Market Insight

The Asia-Pacific Enterprise VSAT market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid digital transformation, expanding industrial activity in rural areas, and government-backed satellite connectivity initiatives. Countries such as China, India, and Indonesia are increasingly relying on VSAT to support economic development in remote zones lacking terrestrial infrastructure. The region’s growing demand for broadband, coupled with satellite capacity expansion, is unlocking new opportunities.

Japan Enterprise VSAT Market Insight

The Japan Enterprise VSAT market is growing steadily due to the country's high demand for disaster-resilient communication systems, particularly in areas vulnerable to earthquakes and typhoons. Government and private sector collaboration to enhance digital readiness and emergency communication infrastructure is fostering VSAT deployment. Japan's emphasis on smart cities and next-generation satellite constellations is also propelling market growth.

China Enterprise VSAT Market Insight

The China Enterprise VSAT market held the largest revenue share in Asia-Pacific in 2024, driven by aggressive government support for rural connectivity, rapid industrialization, and major investments in satellite communication infrastructure. China's Belt and Road Initiative, along with its growing commercial satellite fleet, is significantly boosting the application of VSAT across transportation, energy, and public service sectors, positioning the country as a dominant force in the regional market.

Enterprise Very Small Aperture Terminal (VSAT) Market Share

The Enterprise Very Small Aperture Terminal (VSAT) industry is primarily led by well-established companies, including:

- GILAT SATELLITE NETWORKS (Israel)

- Comtech Telecommunications Corp. (U.S.)

- Cambium Networks, Ltd. (U.S.)

- Telefónica S.A. (Spain)

- Embratel (Brazil)

- Ultra (U.K.)

- Hughes Network Systems, LLC (U.S.)

- Airtel India (India)

- Nelco (India)

- ND SatCom GmbH (Germany)

- Link Communications Systems. (U.S.)

- SageNet (U.S.)

- KVH Industries, Inc. (U.S.)

- Orion Satellite Systems Pty Ltd (U.S.)

- Viasat, Inc. (U.S.)

- ST Engineering iDirect, Inc. (U.S.)

Latest Developments in Global Enterprise Very Small Aperture Terminal (VSAT) Market

- In March 2022, Hughes Network Systems, LLC (HUGHES) showcased innovative technologies at the SATELLITE 2022 trade show in Washington, D.C. Hughes introduced a groundbreaking technology that seamlessly integrates Geostationary (GEO) satellite and LTE transports, creating a single, reliable, low-latency broadband internet connection for consumers. In addition, Hughes revealed its new electronically steerable, flat-panel antennas, including a prototype for delivering OneWeb Low Earth Orbit (LEO) connectivity services

- In February 2022, Gilat Satellite Networks Ltd., a global leader in satellite networking technology, solutions, and services, expanded its strategic partnership with SES. SES selected Gilat’s advanced SkyEdge IV platform to operate with its SES-17 satellite. This very high throughput satellite (VHTS) is designed to provide both fixed and mobility services, enhancing connectivity and service delivery

- In January 2022, KVH Industries announced that ScanReach, a pioneer in onboard wireless connectivity solutions tailored for steel vessel environments, had joined the KVH Watch Solution Partner program. This partnership aims to offer KVH Watch Cloud Connect services, enabling ScanReach’s innovative onboard wireless technology to transmit data across vessels without cabling. This data can be sent to the cloud for analysis, improving vessel performance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.