Global Enterprise Video Market

Market Size in USD Billion

CAGR :

%

USD

22.45 Billion

USD

55.21 Billion

2024

2032

USD

22.45 Billion

USD

55.21 Billion

2024

2032

| 2025 –2032 | |

| USD 22.45 Billion | |

| USD 55.21 Billion | |

|

|

|

|

Enterprise Video Market Size

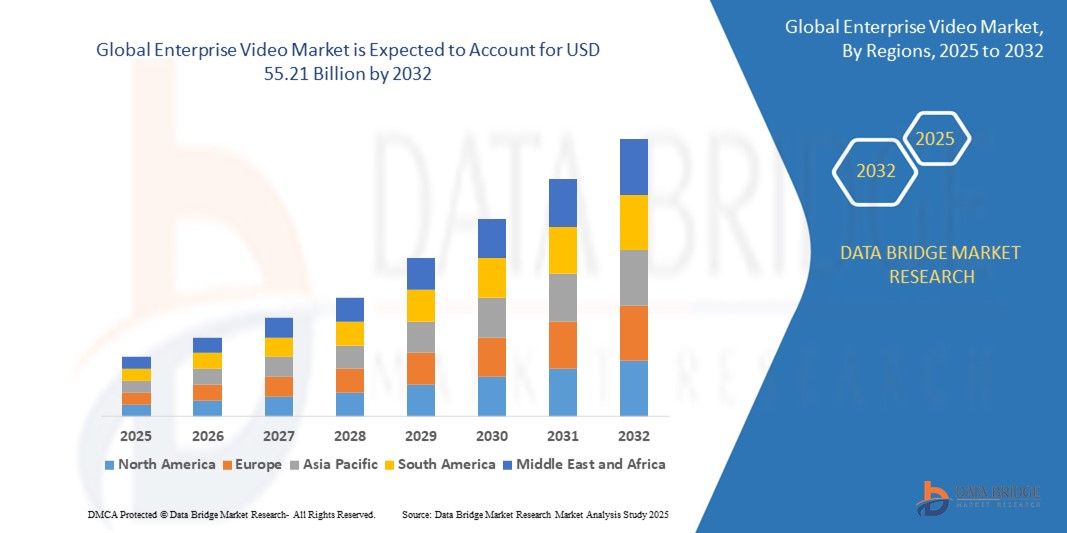

- The global enterprise video market size was valued at USD 22.45 billion in 2024 and is expected to reach USD 55.21 billion by 2032, at a CAGR of 11.90% during the forecast period

- The market growth is largely fuelled by the increasing adoption of remote work models, growing demand for video-based communication and collaboration tools, and the rising integration of video technologies into corporate training, marketing, and internal communications

- Technological advancements in cloud computing, video streaming, and artificial intelligence are further accelerating the development and deployment of scalable, secure, and interactive enterprise video solutions across industries

Enterprise Video Market Analysis

- Enterprises are increasingly leveraging video solutions to enhance employee engagement, customer outreach, and real-time collaboration, creating robust demand across sectors such as IT, healthcare, education, and finance

- The rise of hybrid work environments has made video communication platforms essential for meetings, training, and company-wide announcements, driving investment in video content management systems and real-time streaming solutions

- North America led the enterprise video market with the largest revenue share of 39.6% in 2024, driven by the increasing demand for remote communication, virtual training, and enhanced digital collaboration across enterprises

- Asia-Pacific region is expected to witness the highest growth rate in the global enterprise video market, driven by rising investments in IT infrastructure, expanding e-learning and telehealth services, and increased enterprise focus on video-based customer engagement and remote workforce management across emerging economies such as China, India, and Southeast Asia

- The solutions segment dominated the market with the largest revenue share in 2024, driven by increasing enterprise demand for video conferencing, content management, and streaming platforms. Organizations are leveraging these solutions to improve communication, boost training efficiency, and enable remote collaboration across global teams

Report Scope and Enterprise Video Market Segmentation

|

Attributes |

Enterprise Video Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Adoption of Cloud-Based Video Platforms • Increasing Demand for AI-Driven Video Analytics |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Enterprise Video Market Trends

“Integration of Artificial Intelligence into Enterprise Video Platforms”

- The rising integration of artificial intelligence (AI) in enterprise video platforms is transforming content management and delivery, as businesses seek smarter tools for transcription, translation, content discovery, and viewer engagement across distributed workforces

- AI capabilities such as auto-captioning, real-time translation, and intelligent video indexing are reducing manual workload and enabling searchable video libraries that improve internal knowledge sharing, especially in content-heavy organizations

- AI-based analytics are helping enterprises measure engagement, track viewer behavior, and tailor content strategies accordingly, improving communication efficiency and return on video investments

- For instance, Microsoft Stream uses AI to generate searchable transcripts and automatic subtitles, while IBM Watson Media provides content tagging, facial recognition, and sentiment analysis tools to support training and marketing initiatives

- This trend is making enterprise video platforms more scalable, accessible, and data-driven, enhancing their strategic value in hybrid work environments and long-term digital transformation efforts

Enterprise Video Market Dynamics

Driver

“Surge In Remote and Hybrid Work Models Across Enterprises”

• The widespread adoption of remote and hybrid work models is significantly accelerating enterprise demand for video communication tools. Businesses aim to maintain real-time connectivity, collaboration, and continuity among dispersed teams. This shift has made video platforms an essential part of everyday enterprise operations

• Enterprise video platforms are now being used for live town halls, virtual training, onboarding, and global meetings. These uses reduce travel and logistics costs while enabling better scalability and engagement. Companies benefit from higher participation rates and consistent communication quality

• Increased digital transformation post-pandemic is embedding video deeper into core enterprise systems. Integration with HR platforms, LMSs, and CRM tools is becoming standard for many firms. This synergy enhances workflow efficiency and supports data-driven performance monitoring

• For instance, Cisco Webex and Zoom have seen exponential enterprise growth since 2020. Companies such as Accenture use them for training archives, compliance storage, and internal knowledge-sharing. These tools now go beyond communication, acting as enterprise-wide collaboration hubs

• These evolving use cases are positioning enterprise video as a mission-critical tool across industries. It supports productivity, continuous learning, and global team alignment in a scalable manner. Long-term demand remains strong as firms invest in future-ready communication solutions

Restraint/Challenge

“Concerns Over Data Security and Compliance Risks”

• Rising concerns over data privacy, security breaches, and regulatory compliance are creating significant barriers to enterprise video adoption, especially in industries handling sensitive or confidential content

• Many enterprise video systems store internal strategy sessions, proprietary training material, and employee or client information, making them potential targets for cyberattacks and data leaks if not properly encrypted and secured

• Compliance requirements under frameworks such as the General Data Protection Regulation (GDPR) or the Health Insurance Portability and Accountability Act (HIPAA) are forcing companies to invest in secure video platforms that support role-based access control, data masking, and encrypted storage

• For instance, healthcare providers and financial institutions using video for internal communication are required to ensure end-to-end encryption and audit trails, which significantly increases deployment costs and platform selection complexity

• These regulatory and security challenges are slowing market adoption in high-risk sectors and smaller organizations, highlighting the need for cost-effective, compliance-ready solutions that offer robust data protection without limiting scalability or ease of use

Enterprise Video Market Scope

The market is segmented on the basis of component, application, deployment mode, organization size, and industry vertical.

- By Component

On the basis of component, the enterprise video market is segmented into solutions and services. The solutions segment dominated the market with the largest revenue share in 2024, driven by increasing enterprise demand for video conferencing, content management, and streaming platforms. Organizations are leveraging these solutions to improve communication, boost training efficiency, and enable remote collaboration across global teams.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the growing need for deployment support, system integration, and technical maintenance. As video tools become more sophisticated and widespread, businesses are relying on professional services to ensure seamless platform functionality and user experience. The trend toward managed services and video-as-a-service (VaaS) models also contributes to segment growth.

- By Application

On the basis of application, the market is segmented into corporate communications, training and development, and marketing and client engagement. The corporate communications segment held the largest market revenue share in 2024, driven by the rising importance of transparent, real-time messaging between executives, employees, and stakeholders. Video communication platforms help companies streamline internal announcements, host virtual town halls, and manage crisis responses with visual clarity.

The training and development segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing investment in video-based e-learning and knowledge sharing. Enterprises are increasingly using video for employee onboarding, compliance training, and leadership development programs, helping reduce travel costs and improve learning outcomes.

- By Deployment Mode

On the basis of deployment mode, the enterprise video market is segmented into cloud and on-premises. The cloud segment dominated the market in 2024 with the largest share, driven by rising adoption of scalable, subscription-based solutions that reduce upfront infrastructure investment. Cloud-based video platforms offer flexible access, rapid deployment, and integration with other enterprise systems, making them ideal for dynamic work environments.

The on-premises segment is expected to witness the fastest growth rate from 2025 to 2032, particularly among large organizations and regulated industries requiring greater control over data storage and security. Enterprises operating in finance, defense, or healthcare often prefer on-premises deployment to meet internal compliance mandates and ensure system customization.

- By Organization Size

On the basis of organization size, the enterprise video market is segmented into large enterprise and small and medium enterprise (SME). The large enterprise segment accounted for the largest market share in 2024, attributed to strong budgets, early technology adoption, and global operations requiring unified video solutions. These organizations often invest in enterprise-grade platforms to support cross-functional collaboration, live events, and video analytics.

The small and medium enterprise (SME) segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing accessibility of cost-effective, cloud-based video tools. SMEs are embracing video platforms to enhance remote engagement, digital marketing, and training without extensive IT infrastructure or resource allocation.

- By Industry Vertical

On the basis of industry vertical, the market is segmented into banking, financial services and insurance (BFSI), information technology (IT) and telecom, healthcare and life sciences, education, media and entertainment, retail and consumer goods, and others. The IT and telecom segment held the largest revenue share in 2024, driven by continuous digital transformation and the use of video for internal collaboration, product demos, and virtual client meetings.

The education segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by growing demand for virtual classrooms, hybrid learning models, and video-based course delivery. Institutions are increasingly deploying enterprise video platforms to reach geographically dispersed learners, enhance engagement, and facilitate interactive learning experiences.

Enterprise Video Market Regional Analysis

• North America led the enterprise video market with the largest revenue share of 39.6% in 2024, driven by the increasing demand for remote communication, virtual training, and enhanced digital collaboration across enterprises

• Organizations in the region are investing heavily in video-enabled platforms to streamline internal communications and improve client engagement, particularly in sectors such as banking and healthcare

• The widespread presence of key vendors, high-speed internet infrastructure, and rapid adoption of cloud-based services further support the strong market position of enterprise video solutions across North America

U.S. Enterprise Video Market Insight

The U.S. enterprise video market accounted the revenue share in North America in 2024, propelled by the rising shift toward hybrid work models and the need for scalable communication platforms. Enterprises are deploying video conferencing tools to improve employee training, customer interaction, and marketing efficiency. The strong integration of artificial intelligence and real-time analytics into video platforms is further accelerating adoption across large and small organizations

Europe Enterprise Video Market Insight

The Europe enterprise video market is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing digital transformation across enterprises and stricter compliance with data security regulations. Businesses in the region are utilizing video communication to enhance workforce productivity and reduce operational costs. The demand is particularly high in industries such as education, financial services, and retail, where video is used for training, outreach, and consumer engagement

U.K. Enterprise Video Market Insight

The U.K. enterprise video market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing reliance on digital tools for internal and external communications. The country’s mature IT infrastructure and widespread adoption of flexible work arrangements support the use of enterprise video in various sectors. The rising use of video for corporate learning, webinars, and client retention strategies is also playing a pivotal role in market expansion

Germany Enterprise Video Market Insight

The Germany enterprise video market is expected to witness the fastest growth rate from 2025 to 2032, growth due to the country’s emphasis on operational efficiency, workforce collaboration, and digital innovation. Enterprises are embracing secure video platforms for knowledge sharing, virtual conferencing, and product demonstrations. The increased need for multilingual support and localized solutions in a diverse business environment is encouraging vendors to tailor their offerings for German enterprises

Asia-Pacific Enterprise Video Market Insight

The Asia-Pacific enterprise video market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising internet penetration, mobile usage, and cloud infrastructure across emerging economies. Countries such as China, India, and Japan are experiencing a surge in demand for enterprise video tools to support learning, collaboration, and marketing. Government initiatives toward digitalization and the rapid expansion of small and medium enterprises are key growth drivers

China Enterprise Video Market Insight

The China enterprise video market held the largest share within Asia-Pacific in 2024, supported by widespread digitization, strong demand from education and corporate sectors, and the proliferation of local technology providers. Businesses are leveraging enterprise video for corporate broadcasting, e-learning, and brand outreach. The country's focus on building smart cities and enhancing digital infrastructure further propels the adoption of advanced video solutions

Japan Enterprise Video Market Insight

The Japan enterprise video market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s highly connected digital ecosystem and the growing need for seamless corporate communication. Enterprises in Japan are increasingly using video content to improve employee training, customer support, and stakeholder engagement. The integration of enterprise video with artificial intelligence, analytics, and cloud platforms enhances functionality and aligns with the nation’s innovation-led business culture

Enterprise Video Market Share

The enterprise video industry is primarily led by well-established companies, including:

- Adobe, Inc. (U.S.)

- Avaya LLC (U.S.)

- Cisco Systems, Inc. (U.S.)

- IBM (U.S.)

- Kaltura, Inc. (U.S.)

- Microsoft (U.S.)

- Vbrick (U.S.)

- Enghouse Video (U.S.)

- Rimage (U.S.)

- Verizon (U.S.)

- Zoom Video Communications, Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- LogMeIn, Inc. (U.S.)

- Panopto (U.S.)

Latest Developments in Global Enterprise Video Market

- In October 2022, Avaya and Alcatel-Lucent Enterprise (ALE) entered into a strategic partnership to drive innovation through seamless integration, avoiding the need for disruptive technology overhauls. This collaboration enables organizations to modernize their communication systems without replacing existing infrastructure. The initiative enhances operational efficiency and supports scalable growth, positioning both companies to expand their footprint in the enterprise video market

- In January 2022, BlueJeans by Verizon was selected as the official video conferencing provider for Canada’s National Research and Education Network (NREN), which includes institutions across 13 provinces and territories. The partnership aims to deliver a unified platform that supports interactive, high-quality virtual learning for students nationwide. This development boosts BlueJeans' visibility in the education sector and reinforces the role of enterprise video in remote learning environments

- In January 2022, StrikeForce Technologies introduced a new video conferencing security model designed for enterprises and government bodies navigating the post-pandemic collaboration landscape. The model includes four confidentiality tiers, allowing organizations to apply security settings based on content sensitivity. This launch significantly strengthens data privacy in enterprise communications and is expected to increase the adoption of secure video platforms in high-risk sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.