Global Entertainment Content And Goods Market

Market Size in USD Billion

CAGR :

%

USD

152.45 Billion

USD

256.31 Billion

2024

2032

USD

152.45 Billion

USD

256.31 Billion

2024

2032

| 2025 –2032 | |

| USD 152.45 Billion | |

| USD 256.31 Billion | |

|

|

|

|

Entertainment Content and Goods Market Size

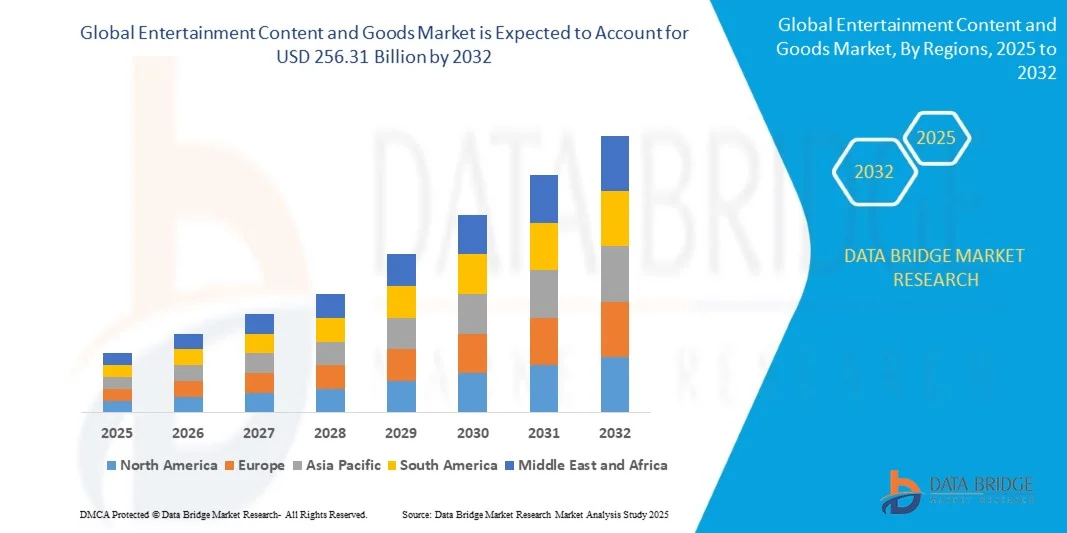

- The Entertainment Content and Goods Market size was valued at USD 152.45 billion in 2024 and is projected to reach USD 256.31 billion by 2032, growing at a CAGR of 6.71% during the forecast period.

- Market expansion is primarily driven by increasing digital content consumption, advancements in streaming technology, and the rise of immersive entertainment experiences such as AR and VR.

- Additionally, growing demand for personalized and on-demand entertainment, coupled with expanding internet penetration and smartphone usage worldwide, is fueling the market’s rapid adoption and innovation, thereby propelling industry growth significantly.

Entertainment Content and Goods Market Analysis

- The Entertainment Content and Goods Market encompasses a wide range of digital media, merchandise, and interactive experiences, playing a critical role in shaping modern entertainment consumption across residential and commercial environments due to its diverse content offerings and seamless multi-platform accessibility.

- The increasing demand for high-quality, on-demand entertainment, alongside technological innovations such as cloud gaming, augmented reality (AR), and virtual reality (VR), is a major driver fueling market growth and consumer engagement.

- North America led the Entertainment Content and Goods Market with the largest revenue share of 34.4% in 2024, driven by advanced digital infrastructure, high consumer spending, and the presence of major content creators and streaming platforms, with the U.S. showing significant expansion in subscription-based services and immersive content adoption.

- Asia-Pacific is anticipated to be the fastest-growing region in the Entertainment Content and Goods Market during the forecast period, supported by rising internet penetration, increasing smartphone usage, and expanding middle-class populations with growing disposable incomes.

- The film segment dominated the market with the largest revenue share of 41.8% in 2024, driven by high global box office collections, increasing demand for streaming content, and strong franchise popularity.

Report Scope and Entertainment Content and Goods Market Segmentation

|

Attributes |

Entertainment Content and Goods Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Entertainment Content and Goods Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A significant and accelerating trend in the Entertainment Content and Goods Market is the deepening integration of artificial intelligence (AI) and popular voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple Siri. This fusion of technologies is revolutionizing user interaction by providing personalized, hands-free access to entertainment content and smart devices.

- For Instance, Netflix’s voice search feature allows users to find shows and movies through simple voice commands across multiple smart devices. Similarly, Sony’s AI-powered Bravia TVs offer voice control capabilities integrated with Google Assistant, enabling seamless content discovery and playback.

- AI integration enables personalized content recommendations by learning user preferences and viewing habits, enhancing user engagement. Platforms like Spotify and Amazon Prime Video use AI algorithms to curate playlists, suggest movies, and tailor ads based on individual tastes and behavior.

- The integration of entertainment services with smart home platforms allows users to control content playback, lighting, and sound settings through a unified interface. This interconnected ecosystem creates an immersive and convenient entertainment experience across devices and locations.

- This trend toward intelligent, voice-enabled, and AI-driven content delivery is reshaping consumer expectations for entertainment accessibility and personalization. Consequently, companies such as Netflix and Disney+ are investing heavily in AI and voice technology to enhance user engagement and satisfaction.

- The demand for entertainment content and goods that seamlessly integrate AI and voice control is rapidly growing across both residential and commercial sectors, as consumers increasingly seek convenient, personalized, and immersive entertainment experiences.

Entertainment Content and Goods Market Dynamics

Driver

Growing Need Due to Rising Security Concerns and Smart Home Adoption

- The increasing demand for secure, personalized, and convenient entertainment experiences, combined with the rapid adoption of smart home ecosystems, is a significant driver for the expansion of the Entertainment Content and Goods Market.

- For Instance, in 2024, Netflix expanded its AI-driven parental controls and account security features to enhance user safety and content management. Such innovations by leading companies are expected to fuel market growth during the forecast period.

- As consumers seek safer and more customized entertainment environments, platforms are introducing advanced features like multi-factor authentication, personalized content filters, and real-time usage monitoring, providing significant upgrades over traditional media consumption.

- Furthermore, the rising integration of entertainment devices with smart home systems makes content access seamless across multiple connected devices, creating a cohesive digital lifestyle.

- The convenience of on-demand content, multi-user profiles, and the ability to control entertainment through smartphones and voice assistants are key factors accelerating adoption across residential and commercial sectors. Additionally, the trend towards DIY smart entertainment setups and the growing availability of affordable streaming devices further support market growth.

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Concerns surrounding cybersecurity vulnerabilities of connected entertainment devices and platforms pose a significant challenge to broader market penetration. As entertainment services increasingly rely on internet connectivity and cloud infrastructure, they are susceptible to hacking attempts, data breaches, and piracy, raising anxieties among potential consumers about the privacy and security of their personal data and content.

- For instance, high-profile incidents of streaming account hacks and unauthorized content distribution have made some consumers hesitant to fully embrace digital entertainment ecosystems.

- Addressing these cybersecurity concerns through robust encryption, secure authentication protocols, and continuous software updates is crucial for building and maintaining consumer trust. Companies such as Netflix and Disney+ emphasize their advanced security measures in their marketing to reassure potential subscribers.

- Additionally, the relatively high initial cost of premium subscription packages and advanced streaming devices compared to traditional media can be a barrier for price-sensitive consumers, particularly in developing regions or among budget-conscious users. While basic streaming services and devices have become more affordable, premium features such as 4K streaming, exclusive content, or VR integration often come at a higher price point.

- Although prices are gradually decreasing, the perceived premium for cutting-edge entertainment technology and content can still hinder widespread adoption, especially among those who do not see an immediate need for the advanced features offered.

- Overcoming these challenges through enhanced cybersecurity protocols, consumer education on digital safety, and the development of more affordable content packages and devices will be vital for sustained growth in the Entertainment Content and Goods Market.

Entertainment Content and Goods Market Scope

The market is segmented on the basis of type, platform, revenue model, and age group.

• By Type

On the basis of type, the Entertainment Content and Goods Market is segmented into film, music, sports, gaming, amusement parks, and others. The film segment dominated the market with the largest revenue share of 41.8% in 2024, driven by high global box office collections, increasing demand for streaming content, and strong franchise popularity. Consumers often prioritize films for their entertainment value, multi-platform availability, and repeat viewing potential. The market also sees strong demand for film content due to the proliferation of OTT platforms, digital rentals, and subscription-based streaming services.

The gaming segment is anticipated to witness the fastest growth rate of 23.4% from 2025 to 2032, fueled by rising demand for interactive entertainment, cloud gaming adoption, and the increasing popularity of esports. Gaming content appeals to both casual and hardcore users due to immersive experiences, multiplayer features, and continuous content updates.

• By Platform

On the basis of platform, the Entertainment Content and Goods Market is segmented into digital and physical. The digital segment held the largest revenue share in 2024, driven by the rapid adoption of streaming services, online music platforms, and digital game distribution. Digital platforms provide convenience, on-demand access, multi-device compatibility, and personalized recommendations, making them the preferred choice for modern consumers.

The physical segment is expected to witness the fastest CAGR from 2025 to 2032, driven by collector editions, limited releases, and consumer preference for tangible media such as CDs, DVDs, vinyl records, and gaming cartridges. Physical platforms appeal to enthusiasts seeking ownership, special editions, and memorabilia.

• By Revenue Model

On the basis of revenue model, the Entertainment Content and Goods Market is segmented into subscription, advertisement, ticket sales, merchandise, and others. The subscription segment held the largest market revenue share in 2024, driven by the increasing popularity of OTT streaming services, music subscriptions, and digital gaming memberships. Subscription models provide predictable revenue streams for companies while offering consumers convenience, ad-free experiences, and exclusive content access.

The ticket sales segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the recovery and growth of cinemas, live sports events, concerts, and amusement park attendance. Ticketed events continue to drive consumer engagement and revenue, particularly in emerging markets.

• By Age Group

On the basis of age group, the Entertainment Content and Goods Market is segmented into children, teenagers, and adults. The adult segment accounted for the largest market revenue share in 2024, driven by high consumption of films, music, gaming, and live entertainment. Adults are major consumers of subscription-based platforms, premium content, and merchandise.

The teenagers segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by high engagement with digital gaming, social media-integrated content, and interactive entertainment. Teen-focused content often includes esports, mobile gaming, music streaming, and video-sharing platforms, which continue to attract significant user participation and spending.

Entertainment Content and Goods Market Regional Analysis

- North America dominated the Entertainment Content and Goods Market with the largest revenue share of 34.4% in 2024, driven by strong consumer spending on entertainment, early adoption of digital platforms, and a well-established infrastructure for content distribution.

- Consumers in the region highly value convenience, high-quality content, and access to diverse entertainment formats, including streaming services, live events, and gaming.

- This widespread adoption is further supported by high disposable incomes, a tech-savvy population, and the presence of major content providers and production studios, establishing North America as a key hub for both content creation and consumption in the global market.

U.S. Entertainment Content and Goods Market Insight

The U.S. market captured the largest revenue share of 81% in 2024 within North America, driven by widespread adoption of digital entertainment platforms, high consumer spending on media and content, and a strong infrastructure for content distribution. Consumers increasingly prioritize access to on-demand streaming services, gaming, live events, and merchandise. The robust presence of major production studios and tech companies, coupled with the popularity of subscription-based and ad-supported content models, further propels market growth.

Europe Entertainment Content and Goods Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the growing demand for digital entertainment, high internet penetration, and favorable government policies supporting content creation and distribution. Consumers show increasing interest in multi-platform content access, including streaming, gaming, and live sports. The region sees significant adoption across both residential and commercial segments, with content providers focusing on localized and multilingual offerings to enhance engagement.

U.K. Entertainment Content and Goods Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing consumption of digital content, rising popularity of subscription services, and demand for high-quality, interactive entertainment experiences. The country’s advanced internet infrastructure and tech-savvy population support the rapid adoption of digital platforms. Moreover, streaming services, gaming, and live event content are increasingly integrated into daily entertainment habits, further stimulating market expansion.

Germany Entertainment Content and Goods Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by high consumer spending on digital and live entertainment, a well-developed distribution infrastructure, and growing interest in immersive experiences such as gaming and virtual reality content. German consumers are particularly drawn to high-quality, secure, and personalized content offerings. The integration of digital platforms with mobile and smart devices is enhancing convenience and boosting market adoption.

Asia-Pacific Entertainment Content and Goods Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by rising disposable incomes, rapid urbanization, and technological advancements in countries such as China, Japan, and India. The region’s young and digitally connected population is increasingly consuming streaming media, gaming, live sports, and amusement-based content. Strong government initiatives promoting digitalization and local content production are further driving the growth of the entertainment content and goods market.

Japan Entertainment Content and Goods Market Insight

The Japan market is gaining momentum due to high digital penetration, a tech-savvy population, and strong demand for high-quality entertainment content. Consumers increasingly engage with streaming services, gaming, and immersive media experiences. The integration of entertainment content with mobile devices, smart TVs, and connected home systems is further enhancing accessibility and convenience, particularly in urban areas.

China Entertainment Content and Goods Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s large population, expanding middle class, and rapid digital adoption. High engagement in gaming, streaming, and live events, coupled with government support for local content production and digital platforms, is driving market growth. Affordable devices, widespread internet connectivity, and the emergence of domestic content providers further strengthen the market’s expansion.

Entertainment Content and Goods Market Share

The Entertainment Content and Goods industry is primarily led by well-established companies, including:

- The Walt Disney Company (U.S.)

- Netflix, Inc. (U.S.)

- Warner Bros. Discovery, Inc. (U.S.)

- Sony Corporation (Japan)

- Universal Music Group N.V. (Netherlands)

- Paramount Global (U.S.)

- Amazon Prime Video (U.S.)

- Comcast Corporation (U.S.)

- Apple Inc. (U.S.)

- Spotify Technology S.A. (Sweden)

- Alibaba Group (China)

- Tencent Music Entertainment Group (China)

- Sony Music Entertainment (U.S.)

- Warner Music Group Corp. (U.S.)

- Fanatics, Inc. (U.S.)

- Mattel, Inc. (U.S.)

- Hasbro, Inc. (U.S.)

- Spin Master Corp. (Canada)

- WildBrain Ltd. (Canada)

What are the Recent Developments in Entertainment Content and Goods Market?

- In April 2023, Disney (U.S.) launched a strategic initiative in South Africa to expand access to its streaming platform Disney+ and offer localized entertainment content. This initiative reflects Disney’s focus on delivering high-quality, engaging content tailored to regional preferences, leveraging its global expertise to strengthen its position in the growing Entertainment Content and Goods Market.

- In March 2023, Sony Interactive Entertainment (Japan) introduced a new version of the PlayStation Network designed for educational institutions and gaming centers, providing enhanced interactive features and secure digital environments. This launch highlights Sony’s commitment to developing innovative entertainment solutions that offer engaging and safe experiences for diverse audiences.

- In March 2023, Tencent (China) deployed a digital content initiative in Bengaluru, India, aimed at promoting safe and interactive access to online gaming and streaming platforms. This project utilizes Tencent’s advanced technology to enhance digital engagement and accessibility, emphasizing the importance of localized content in the expanding global entertainment market.

- In February 2023, Netflix (U.S.) announced a strategic partnership with the European Broadcasting Union (EBU) to create a streaming marketplace for independent content creators. This collaboration is intended to improve content accessibility, simplify licensing, and promote diverse storytelling, reinforcing Netflix’s role in driving innovation and operational efficiency in the entertainment content sector.

- In January 2023, Warner Bros. (U.S.) launched an interactive digital content platform at CES 2023, allowing users to access movies, series, and merchandise through a connected ecosystem. This launch demonstrates Warner Bros.’ commitment to integrating technology with entertainment offerings, enhancing audience engagement, convenience, and immersive experiences while expanding its global market presence.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Entertainment Content And Goods Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Entertainment Content And Goods Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Entertainment Content And Goods Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.