Global Environmental Remediation Market

Market Size in USD Million

CAGR :

%

USD

111.80 Million

USD

202.38 Million

2024

2032

USD

111.80 Million

USD

202.38 Million

2024

2032

| 2025 –2032 | |

| USD 111.80 Million | |

| USD 202.38 Million | |

|

|

|

|

Environmental Remediation Market Analysis

The environmental remediation market has experienced significant growth driven by technological advancements and the adoption of innovative methods. One notable advancement is the integration of bioremediation, where microorganisms are used to degrade pollutants, offering an eco-friendlier approach. The use of nanotechnology in remediation techniques, such as nanoparticles for groundwater treatment, has proven effective in breaking down contaminants at the molecular level, providing greater precision and efficiency. In addition, electrokinetic soil remediation methods are gaining traction, allowing contaminants to be removed through electrical currents, especially in challenging soil conditions.

Furthermore, advancements in remote sensing technologies and drones enable more accurate monitoring of polluted sites, reducing human intervention and improving site management efficiency. The use of AI and machine learning to predict contamination levels and optimize remediation processes is also becoming more prevalent.

The growth of the market is fueled by increasing environmental regulations, rising awareness about sustainability, and growing investment in clean-up initiatives. These technologies are expected to lead the market toward more efficient, sustainable, and cost-effective environmental remediation solutions.

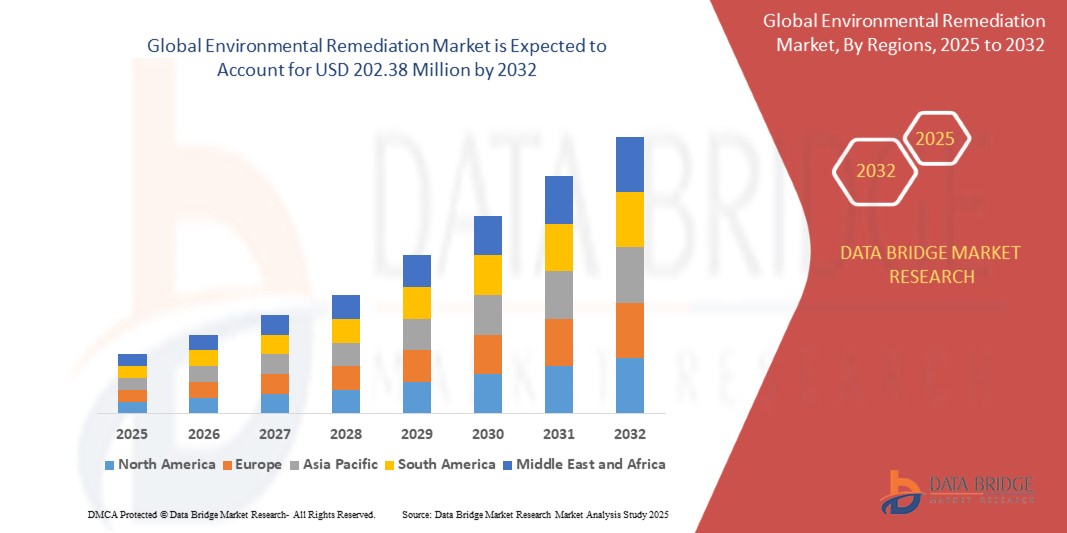

Environmental Remediation Market Size

The global environmental remediation market size was valued at USD 111.80 million in 2024 and is projected to reach USD 202.38 million by 2032, with a CAGR of 7.7% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Environmental Remediation Market Trends

“Adoption of Bioremediation Technologies”

One specific trend driving growth in the environmental remediation market is the increasing adoption of bioremediation technologies. Bioremediation, which utilizes microorganisms to degrade or detoxify environmental contaminants, is gaining traction due to its eco-friendly and cost-effective nature. This method is being widely used for the cleanup of soil, groundwater, and industrial waste. For instance, bioremediation has been successfully applied at oil spill sites, such as the Deepwater Horizon oil spill in 2010, to restore affected ecosystems. With governments and industries focusing on sustainable practices and regulations tightening, bioremediation offers a practical solution to meet both environmental and economic goals, further propelling the growth of the environmental remediation market.

Report Scope and Environmental Remediation Market Segmentation

|

Attributes |

Environmental Remediation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

ENTACT (U.S.), DEME (Belgium), WSP (Canada), CLEAN HARBORS, INC. (U.S.), Sequoia Environmental Remediation Inc. (U.S.), In-Situ Oxidative Technologies, Inc. (U.S.), HDR, Inc. (U.S.), AECOM (U.S.), Tetra Tech, Inc. (U.S.), BRISEA (U.S.), Jacobs (U.S.), Fluor Corporation (U.S.), Bechtel Corporation (U.S.), The GEO Group, Inc. (U.S.), Amentum Services, Inc. (U.S.), Black & Veatch Corporation (U.S.), HEPACO (U.S.), and Clean Earth (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Environmental Remediation Market Definition

Environmental remediation refers to the process of cleaning up and restoring polluted or contaminated environments to a safe and healthy state. It involves removing harmful substances such as chemicals, heavy metals, and toxins from soil, water, and air, often using techniques such as excavation, bioremediation, chemical treatment, or filtration. The goal is to reduce environmental hazards, restore ecosystems, and protect public health. Remediation is critical for industrial sites, landfills, and areas affected by oil spills or hazardous waste. It also contributes to meeting environmental regulations and sustainability goals.

Environmental Remediation Market Dynamics

Drivers

- Increase in Brownfield Redevelopment

The trend of brownfield redevelopment is significantly driving the environmental remediation market. Brownfields, which are abandoned or underused industrial properties, often have contamination from hazardous materials such as heavy metals or petroleum products. Redeveloping these sites for commercial, residential, or mixed-use purposes requires cleaning up contamination to ensure safety for future use. For instance, in cities such as Detroit and New York, brownfield sites are being transformed into housing complexes and retail spaces. These redevelopment projects stimulate demand for remediation technologies such as soil excavation, bioremediation, and groundwater treatment. This trend revitalizes urban areas and also drives the growth of the environmental remediation market, ensuring these sites are safe for redevelopment.

- Expansion of Soil and Groundwater Contamination

Soil erosion, agricultural runoff, and groundwater contamination are significant environmental challenges that demand immediate remediation. Agricultural practices, such as excessive pesticide and fertilizer use, contribute to the contamination of both soil and groundwater. For instance, the contamination of the Ogallala Aquifer in the U.S. with nitrates from farming has led to heightened concerns about drinking water safety. This issue drives the need for remediation technologies such as bioremediation, which use microorganisms to break down pollutants, and phytoremediation, which employs plants to restore soil health. As a result, efforts to address soil and groundwater contamination are fueling the growth of the environmental remediation market across the globe.

Opportunities

- Increasing Hazardous Waste Generation

The rising volume of hazardous waste, especially from industries such as chemicals, oil, and manufacturing, presents a significant opportunity for the environmental remediation market. As hazardous materials accumulate, the need for efficient and effective waste management and contamination mitigation becomes crucial. This demand drives innovation in advanced remediation technologies, including bioremediation, soil washing, and thermal desorption, offering cost-effective and sustainable solutions. Furthermore, governments and industries are increasingly investing in cleaner production processes and waste management systems to mitigate environmental risks. This trend presents lucrative opportunities for companies that specialize in waste treatment, site restoration, and long-term environmental monitoring, contributing to market growth.

- Rising Awareness of Environmental Issues

Rising awareness of environmental issues, such as pollution and climate change, presents significant opportunities in the environmental remediation market. As public concern grows over the long-term impacts of environmental degradation on health and ecosystems, there is increasing pressure on governments, corporations, and communities to take action. This heightened awareness leads to a demand for remediation services to restore contaminated sites, clean up polluted air, soil, and water, and mitigate the effects of climate change. The growing recognition of the need for sustainable practices and cleaner environments fuels investments in green technologies and innovative solutions, creating opportunities for companies specializing in environmental remediation to expand their services and expertise.

Restraints/Challenges

- High Implementation Costs

The high cost of implementation is a major barrier to the growth of the environmental remediation market. Advanced technologies such as bioremediation, chemical treatments, and soil washing often require substantial initial capital investment and ongoing operational costs, making them inaccessible for many organizations. This is particularly challenging in developing countries, where limited financial resources and the need for cost-effective solutions are prevalent. Furthermore, the complexity of these technologies often requires specialized equipment and skilled personnel, adding to the overall cost burden. As a result, many potential remediation projects are delayed or abandoned, limiting the market's expansion and slowing progress in addressing environmental contamination.

- Lack of Skilled Workforce

The lack of a skilled workforce is a significant challenge for the environmental remediation market. Effective remediation requires specialized knowledge in areas such as chemical engineering, environmental science, and site-specific treatment methods. However, there is a shortage of professionals with the necessary expertise, which impedes the implementation of advanced technologies. This shortage leads to delays in projects, reduced efficiency, and higher costs due to reliance on a limited pool of qualified personnel. In addition, the demand for skilled workers often outpaces supply, making it difficult for companies to meet project timelines or deliver optimal results. This workforce gap hinders the growth and progress of the environmental remediation market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Environmental Remediation Market Scope

The market is segmented on the basis of technology type, environment medium, site type, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology Type

- Air Sparging

- Soil Washing

- Chemical Treatment

- Bioremediation

- Electrokinetic Remediation

- Excavation

- Permeable Reactive Barriers

- In-situ Grouting

- Phytoremediation

- Pump and Treat

- Soil Vapor Extraction

- In-situ Vitrification

- Thermal Treatment

Environment Medium

- Soil

- Groundwater

Site Type

- Private

- Public

Application

- Mining and Forestry

- Oil and Gas

- Agriculture

- Automotive

- Landfills and Waste Disposal Sites

- Manufacturing, Industrial and Chemical Production/Processing

- Construction and Land Development

Environmental Remediation Market Regional Analysis

The market is analysed and market size insights and trends are provided by technology type, environment medium, site type, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the environmental remediation market due to its well-established industry and technological innovations. Companies in the region lead in developing advanced remediation technologies such as bioremediation and nanoremediation, which address complex contamination challenges. These innovations not only improve the efficiency of environmental cleanup but also contribute to sustainable practices, further driving market growth. The region’s commitment to environmental protection and technological advancement ensures its continued market leadership.

Asia-Pacific is expected to show significant growth in the environmental remediation market, driven by rapid industrialization and urbanization in countries such as China, India, and Southeast Asia. The surge in industrial activities and population growth has escalated pollution, prompting the need for advanced remediation solutions. In addition, rising public awareness about environmental sustainability and increasing advocacy for air and water quality are encouraging governments and corporations to invest in effective remediation technologies and cleaner practices.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Environmental Remediation Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Environmental Remediation Market Leaders Operating in the Market Are:

- ENTACT (U.S.)

- DEME (Belgium)

- WSP (Canada)

- CLEAN HARBORS, INC. (U.S.)

- Sequoia Environmental Remediation Inc. (U.S.)

- In-Situ Oxidative Technologies, Inc. (U.S.)

- HDR, Inc. (U.S.)

- AECOM (U.S.)

- Tetra Tech Inc. (U.S.)

- BRISEA (U.S.)

- Jacobs (U.S.)

- Fluor Corporation (U.S.)

- Bechtel Corporation (U.S.)

- The GEO Group, Inc. (U.S.)

- Amentum Services, Inc. (U.S.)

- Black & Veatch Corporation (U.S.)

- HEPACO (U.S.)

- Clean Earth (U.S.)

Latest Developments in Environmental Remediation Market

- In September 2023, ENTACT expanded its sediment management expertise through the strategic acquisition of White Lake Dock & Dredge. This move enhances ENTACT's ability to provide comprehensive sediment remediation services by combining their environmental expertise with White Lake’s specialized dredging capabilities. The acquisition will strengthen ENTACT's position in sediment control and broader environmental remediation markets

- In October 2022, Newterra acquired H2O Engineering, Inc. to advance technologies focused on addressing complex environmental and water challenges. This acquisition allows Newterra to expand its technological offerings in water treatment, particularly in areas involving water sustainability and complex environmental issues. The partnership is expected to drive innovation in water and environmental solutions

- In October 2021, Clean Harbors completed the acquisition of HydroChemPSC, a U.S.-based provider of industrial cleaning, specialty maintenance, and utility services. This acquisition strengthens Clean Harbors' ability to offer a wide range of environmental and industrial services, particularly in specialized maintenance and cleaning solutions for the industrial and utility sectors, enhancing their service portfolio

- In March 2022, The DEME group (70%) and Mourik (30%) invested USD 7.8 million to establish soil recycling centers for handling soil contaminated with Polyfluoroalkyl Substances (PFAS). This collaboration aims to develop innovative methods for recycling PFAS-containing soil, addressing environmental pollution, and supporting sustainable soil remediation practices, with a focus on PFAS contamination

- In August 2021, HDR, Inc. expanded its capabilities by acquiring WRECO, a firm specializing in environmental compliance, civil engineering, water resources planning, and geotechnical engineering. This acquisition bolstered HDR’s ability to address complex environmental challenges and deliver comprehensive engineering solutions in water resource management, geotechnical services, and environmental compliance for clients

- In March 2021, AECOM unveiled its first large-scale field demonstration of DE-FLUORO, a groundbreaking sustainable treatment technology designed to eliminate Per- and Polyfluoroalkyl Substances (PFAS) from contaminated liquids. This innovative solution treats PFAS without generating hazardous waste, positioning AECOM as a leader in the sustainable management of PFAS contamination and advancing environmental remediation practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Environmental Remediation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Environmental Remediation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Environmental Remediation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.