Global Epigenetics Based Instruments Market

Market Size in USD Million

CAGR :

%

USD

675.50 Million

USD

2,222.21 Million

2025

2033

USD

675.50 Million

USD

2,222.21 Million

2025

2033

| 2026 –2033 | |

| USD 675.50 Million | |

| USD 2,222.21 Million | |

|

|

|

|

Epigenetics-Based Instruments Market Size

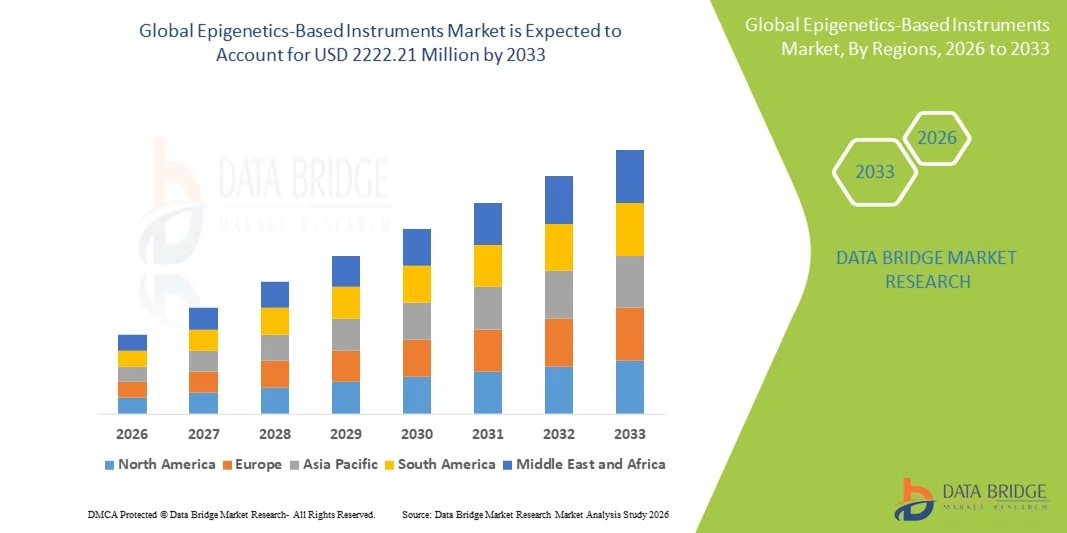

- The global Epigenetics-Based Instruments market size was valued at USD 675.5 Million in 2025 and is expected to reach USD 2222.21 Million by 2033, at a CAGR of 16.05% during the forecast period

- The market growth is largely fueled by rapid advancements in epigenetics research technologies and increasing adoption of high-precision analytical instruments, leading to greater integration of epigenetic profiling in both academic research and clinical applications

- Furthermore, rising demand for accurate gene regulation analysis, early disease detection, and personalized medicine is driving the adoption of epigenetics-based instruments across research laboratories, pharmaceutical companies, and diagnostic centers. These converging factors are accelerating the uptake of epigenetics-based instruments, thereby significantly boosting the overall market growth

Epigenetics-Based Instruments Market Analysis

- Epigenetics-based instruments, which enable the analysis of DNA methylation, histone modifications, and chromatin structure, are becoming essential tools in modern life science research and clinical studies due to their high sensitivity, accuracy, and ability to support advanced gene regulation analysis across research and diagnostic settings

- The escalating demand for epigenetics-based instruments is primarily driven by the rapid growth of epigenomics research, increasing focus on personalized medicine, rising oncology and rare disease studies, and expanding pharmaceutical and biotechnology R&D investments

- North America dominated the epigenetics-based instruments market with the largest revenue share of approximately 42% in 2025, supported by strong research funding, early adoption of advanced analytical technologies, and the presence of leading instrument manufacturers and well-established academic and clinical research infrastructure, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the epigenetics-based instruments market during the forecast period, projected to expand at a CAGR of around 9%, driven by increasing government investments in genomics research, expanding biotech sectors, growing academic collaborations, and rising healthcare R&D spending in countries such as China, Japan, and India

- The Oncology segment dominated the market with a revenue share of nearly 46.5% in 2025, due to the critical role of epigenetic modifications in cancer initiation, progression, and therapeutic resistance

Report Scope and Epigenetics-Based Instruments Market Segmentation

|

Attributes |

Epigenetics-Based Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Thermo Fisher Scientific (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Epigenetics-Based Instruments Market Trends

Advancements in High-Throughput and Precision Epigenetic Analysis

- A prominent and accelerating trend in the global epigenetics-based instruments market is the continuous advancement of high-throughput, highly sensitive, and precise analytical technologies designed to study epigenetic modifications such as DNA methylation, histone modifications, and chromatin accessibility. These innovations are enabling researchers to generate large-scale, high-resolution epigenetic data with improved accuracy and reproducibility

- For instance, next-generation sequencing (NGS)-based epigenetic platforms and automated chromatin immunoprecipitation (ChIP) systems are increasingly being adopted by research laboratories to enhance workflow efficiency and data consistency. Instruments supporting bisulfite sequencing and ATAC-seq workflows are allowing deeper insights into epigenetic regulation across diverse biological samples

- The integration of automation within epigenetics-based instruments is further improving laboratory productivity by reducing manual handling errors and shortening turnaround times. Automated liquid handling and sample preparation systems are becoming standard in high-volume epigenomics laboratories

- In addition improvements in sensitivity are enabling the analysis of low-input and single-cell samples, which is critical for applications such as cancer research, developmental biology, and rare disease studies. These capabilities are expanding the scope of epigenetic research beyond bulk population studies

- The growing compatibility of epigenetics-based instruments with multi-omics workflows is another key trend, allowing researchers to correlate epigenetic data with genomic, transcriptomic, and proteomic datasets for more comprehensive biological insights

- This trend toward more advanced, scalable, and precise epigenetic instrumentation is reshaping research methodologies and accelerating discoveries in disease mechanisms, biomarker identification, and therapeutic target development, thereby strengthening demand across academic, pharmaceutical, and biotechnology sectors

Epigenetics-Based Instruments Market Dynamics

Driver

Rising Demand for Epigenetic Research in Disease Understanding and Drug Development

- The growing recognition of epigenetic mechanisms as critical regulators of gene expression in complex diseases is a major driver fueling demand for epigenetics-based instruments. Researchers increasingly rely on these tools to understand disease onset, progression, and treatment response in areas such as oncology, neurology, autoimmune disorders, and metabolic diseases

- For instance, pharmaceutical and biotechnology companies are expanding epigenetic research to support drug discovery and development programs, particularly for cancer therapeutics targeting histone modifiers and DNA methylation pathways. This has led to increased investment in advanced epigenetic instrumentation

- The rising focus on precision medicine is further accelerating market growth, as epigenetic profiling enables patient stratification and the identification of predictive and prognostic biomarkers. Epigenetics-based instruments play a critical role in generating high-quality data required for personalized treatment approaches

- In addition, expanding academic and government-funded research initiatives worldwide are supporting large-scale epigenomics projects, driving consistent demand for sophisticated analytical instruments

- The increasing availability of funding for life sciences research, combined with technological advancements that lower operational complexity, is encouraging wider adoption of epigenetics-based instruments across both established and emerging research institutions

Restraint/Challenge

High Instrument Costs and Technical Complexity

- One of the key challenges restraining the growth of the Epigenetics-Based Instruments market is the high initial cost associated with advanced instrumentation, including sequencing platforms, automated chromatin analysis systems, and specialized detection technologies. These costs can be prohibitive for smaller laboratories and institutions with limited research budgets

- For instance, high-end epigenetic sequencing and analysis instruments require substantial capital investment, along with recurring expenses for reagents, consumables, and maintenance, which can limit adoption in cost-sensitive regions

- In addition, the technical complexity of epigenetic experiments poses a significant barrier, as the operation of these instruments often requires skilled personnel with specialized training in molecular biology and bioinformatics

- Data interpretation challenges further compound this issue, as epigenetic datasets are large and complex, requiring advanced analytical expertise and computational infrastructure

- While manufacturers are working to improve usability and offer more integrated solutions, the combination of high costs, training requirements, and operational complexity continues to restrain widespread adoption. Addressing these challenges through cost-effective instrument development, user-friendly workflows, and expanded training programs will be critical for sustained market expansion

Epigenetics-Based Instruments Market Scope

The market is segmented on the basis of product, technology, application, and end-user.

- By Product

On the basis of product, the Epigenetics-Based Instruments market is segmented into Mass Spectrometers, Next-Generation Sequencing (NGS) Systems, qPCR Systems, Sonicators, and Others. The Next-Generation Sequencing (NGS) systems segment dominated the largest market revenue share of approximately 38.6% in 2025, due to its unparalleled ability to provide high-throughput epigenomic profiling and genome-wide mapping of DNA methylation, histone modifications, and chromatin accessibility. NGS is widely adopted in academic research institutes, pharmaceutical companies, and biotechnology firms for comprehensive studies, including cancer biomarker discovery, developmental biology, and drug development. Its scalability, combined with the continuous introduction of faster, more accurate, and cost-effective platforms, supports research efficiency and reproducibility. NGS’s integration with bioinformatics pipelines further strengthens its adoption, providing researchers with robust data for advanced analytics. Additionally, the growing global emphasis on personalized medicine, precision oncology, and epigenetic therapeutics has reinforced NGS as a critical instrument in modern research workflows. Funding support from government programs and private initiatives for large-scale sequencing projects has also propelled NGS growth. Researchers rely on NGS for both discovery and translational applications, making it the primary instrument in the epigenetics market. Its compatibility with multi-omics studies and the ability to generate multi-layered epigenetic data continues to drive its dominant position.

The Mass Spectrometers segment is expected to witness the fastest growth, registering a CAGR of around 11.4% from 2026 to 2033, due to the increasing need for precise identification and quantification of histone modifications, post-translational modifications, and other epigenetic biomarkers. Mass spectrometry allows researchers to detect subtle molecular changes with high accuracy, supporting advanced drug discovery, functional epigenomics, and translational research. Growing pharmaceutical interest in epigenetic therapeutics, coupled with the rising demand for biomarker validation in oncology and other disease areas, is propelling mass spectrometer adoption. Innovations in sensitivity, resolution, and multiplexing capabilities make mass spectrometry a preferred tool for analyzing complex biological samples. The use of mass spectrometry in combination with NGS and qPCR for integrated multi-omics studies is expanding rapidly. Market growth is further supported by increasing investments in pharmaceutical and biotechnology research, particularly in North America, Europe, and Asia-Pacific. Continuous advancements in automation and software integration have made mass spectrometry more accessible and user-friendly for research laboratories. As drug pipelines increasingly rely on epigenetic data for decision-making, mass spectrometers are expected to play a pivotal role in next-generation research.

- By Technology

On the basis of technology, the Epigenetics-Based Instruments market is segmented into DNA Methylation, Histone Methylation, Histone Acetylation, Large Non-Coding RNA, MicroRNA Modification, and Chromatin Structure Analysis. The DNA methylation technology segment accounted for the largest revenue share of about 41.2% in 2025, driven by its central role in gene regulation, disease progression, and cancer diagnostics. DNA methylation profiling is critical for identifying biomarkers for early detection, prognosis, and therapy monitoring across oncology and non-oncology applications. Its compatibility with high-throughput instruments such as NGS and qPCR has further strengthened its adoption. The technology benefits from well-established protocols, reproducibility, and integration into clinical research pipelines, making it the preferred choice in academic and pharmaceutical research. Increased focus on precision medicine, personalized treatments, and regulatory approval of epigenetic biomarkers has further solidified DNA methylation’s market position. Large-scale epigenomic projects funded by government and private institutions have propelled the use of DNA methylation technologies. Researchers leverage this technology in studies ranging from cancer epigenetics to developmental biology, providing deep insights into disease mechanisms. The extensive literature, robust validation data, and broad applicability in multiple therapeutic areas reinforce the dominance of DNA methylation in the market.

The Chromatin structure analysis segment is projected to grow at the fastest CAGR of approximately 12.1% from 2026 to 2033, fueled by increasing interest in understanding the 3D organization of the genome and regulatory mechanisms beyond DNA methylation. Advanced methods such as ATAC-seq, Hi-C, and ChIP-seq allow mapping of chromatin accessibility, nucleosome positioning, and enhancer-promoter interactions. This technology is gaining traction in oncology, developmental biology, and drug discovery due to its ability to reveal complex regulatory networks that are critical for disease understanding and therapeutic interventions. Rising adoption of functional genomics approaches and multi-omics integration is driving demand for chromatin analysis. Government initiatives and industry investment in genomics and epigenomics research across North America, Europe, and Asia-Pacific support rapid growth. CROs and pharmaceutical companies are increasingly outsourcing chromatin analysis for high-throughput studies, contributing to market expansion. Continuous technological improvements in automation, resolution, and data interpretation tools are enhancing usability and output quality. Overall, chromatin structure analysis is becoming indispensable for mechanistic studies and targeted therapy development, positioning it as the fastest-growing technology in epigenetics research.

- By Application

On the basis of application, the Epigenetics-Based Instruments market is segmented into Oncology, Non-Oncology, Developmental Biology, Drug Discovery, and Others. The Oncology segment dominated the market with a revenue share of nearly 46.5% in 2025, due to the critical role of epigenetic modifications in cancer initiation, progression, and therapeutic resistance. Instruments enabling DNA methylation profiling, histone modification analysis, and chromatin accessibility studies are essential for identifying biomarkers, understanding tumor heterogeneity, and supporting precision oncology. The rising global cancer burden, combined with increasing investment in early detection and targeted therapies, drives sustained demand. Pharmaceutical companies are heavily investing in epigenetic oncology pipelines, integrating these instruments into clinical and translational research. Academic research institutes are leveraging oncology-focused epigenetics tools to study molecular mechanisms, epigenetic drug responses, and resistance pathways. The widespread applicability in personalized medicine, biomarker discovery, and companion diagnostics further reinforces the segment’s dominance. Regulatory frameworks supporting epigenetic biomarker use in oncology also encourage market adoption. Continuous improvements in high-throughput instrumentation, analytical software, and sample processing workflows expand their usability in oncology research. Overall, the oncology application remains the largest contributor to market revenue.

The Drug Discovery segment is expected to register the fastest growth at a CAGR of around 10.8% from 2026 to 2033, driven by expanding epigenetic drug pipelines targeting DNA methyltransferases, histone acetyltransferases, and other chromatin-modifying enzymes. Epigenetics-based instruments are increasingly used for target validation, compound screening, and mechanistic studies, supporting both preclinical and clinical research. The shift toward personalized medicine and targeted therapeutics accelerates adoption. Pharmaceutical and biotechnology companies are investing heavily in epigenetics-driven drug development, utilizing high-throughput platforms such as NGS, mass spectrometry, and qPCR to optimize workflows. Collaborative research and outsourcing to CROs are further fueling segment growth. Technological advancements enabling precise, reproducible, and multiplexed analysis enhance utility in screening novel compounds. Additionally, government and private funding for epigenetic therapeutics supports research infrastructure expansion. Overall, drug discovery applications are poised to be the fastest-growing segment due to rising demand for innovative therapeutics and predictive biomarkers.

- By End-User

On the basis of end-user, the Epigenetics-Based Instruments market is segmented into Academic & Research Institutes, Pharmaceutical Companies, Biotechnology Companies, and Contract Research Organizations (CROs). The Academic & Research Institutes segment held the largest market revenue share of approximately 44.3% in 2025, due to extensive government and institutional funding for epigenomic studies. Universities and public research centers are primary contributors to fundamental epigenetic discoveries and large-scale population studies. The availability of skilled researchers, advanced laboratory infrastructure, and collaborations with technology providers further strengthens adoption. Academic users extensively leverage instruments such as NGS, mass spectrometers, and qPCR for cancer, developmental biology, and non-oncology research. The growing demand for mechanistic insights into gene regulation, biomarker identification, and multi-omics integration supports consistent revenue. High adoption in North America and Europe further consolidates market dominance. Continuous expansion of academic research infrastructure, integration of epigenetic instruments into curricula, and participation in international consortia reinforce the segment’s leading position. Academic institutes also play a crucial role in method development and validation, ensuring high instrument utilization.

The Contract Research Organizations (CROs) segment is anticipated to grow at the fastest CAGR of about 11.9% from 2026 to 2033, driven by increasing outsourcing of epigenetic studies by pharmaceutical and biotechnology companies. CROs are expanding their capabilities to support biomarker discovery, preclinical studies, and clinical trials requiring high-throughput epigenetic analysis. The adoption of advanced technologies such as NGS, mass spectrometry, and chromatin analysis in CRO workflows allows clients to accelerate timelines and reduce costs. Rising demand for specialized expertise, regulatory compliance, and large-scale study execution further drives segment growth. Market expansion is supported by increasing collaborations between CROs and pharma/biotech firms globally. Automation, streamlined workflows, and integration of multi-omics analyses enhance CRO capabilities, positioning them as the fastest-growing end-user segment. The trend toward outsourcing complex epigenetic assays for research efficiency ensures sustained CAGR growth.

Epigenetics-Based Instruments Market Regional Analysis

- North America dominated the epigenetics-based instruments market with the largest revenue share of approximately 42% in 2025, supported by strong research funding, early adoption of advanced analytical technologies, and the presence of leading instrument manufacturers and well-established academic and clinical research infrastructure, particularly in the U.S.

- Consumers and researchers in the region highly value the availability of advanced epigenetic instruments such as NGS, mass spectrometers, and qPCRs for oncology, drug discovery, and developmental biology research

- This widespread adoption is further supported by strong government and private research grants, high R&D spending in biotechnology and pharmaceutical sectors, and a technologically advanced research ecosystem

U.S. Epigenetics-Based Instruments Market Insight

The U.S. epigenetics-based instruments market captured the largest revenue share within North America in 2025, fueled by extensive academic research, pharmaceutical R&D activities, and early adoption of advanced epigenetic solutions. Universities, research institutes, and pharmaceutical companies are heavily investing in DNA methylation, histone modification, and chromatin analysis technologies. Government initiatives and private funding support large-scale epigenomic projects, while demand for personalized medicine and precision oncology continues to expand.

Europe Epigenetics-Based Instruments Market Insight

The Europe epigenetics-based instruments market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in epigenetics research, stringent regulatory frameworks, and adoption of advanced analytical platforms in both academic and pharmaceutical sectors. Countries such as Germany, the U.K., and France are witnessing increased implementation of NGS, qPCR, and mass spectrometry for oncology, drug discovery, and developmental biology studies.

U.K. Epigenetics-Based Instruments Market Insight

The U.K. epigenetics-based instruments market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by strong academic research initiatives, robust government funding in life sciences, and rising adoption of advanced epigenetic instruments in clinical and preclinical research. The well-established biotech sector and focus on precision medicine applications further support market growth.

Germany Epigenetics-Based Instruments Market Insight

The Germany epigenetics-based instruments market is expected to expand at a considerable CAGR, fueled by advanced research infrastructure, increasing awareness of epigenetic mechanisms in disease, and adoption of automated instruments. Strong investments in translational research and drug discovery, along with collaborations between pharmaceutical companies and research institutes, are further driving growth.

Asia-Pacific Epigenetics-Based Instruments Market Insight

The Asia-Pacific epigenetics-based instruments market is poised to grow at the fastest CAGR of around 9% from 2026 to 2033, driven by increasing government investments in genomics and epigenetics research, growing biotech sectors, rising healthcare R&D spending, and expanding academic collaborations across countries such as China, Japan, and India. Adoption of high-throughput instruments such as NGS, qPCR, and mass spectrometry is increasing rapidly in research and clinical laboratories.

Japan Epigenetics-Based Instruments Market Insight

The Japanese epigenetics-based instruments market is gaining momentum due to high research investment, rapid technological adoption, and focus on precision medicine and oncology studies. Government support for genomics and epigenomics, coupled with the presence of advanced research infrastructure, is accelerating instrument adoption in both academic and clinical settings.

China Epigenetics-Based Instruments Market Insight

China epigenetics-based instruments market accounted for the largest revenue share in Asia Pacific in 2025, driven by increasing government funding, expansion of biotech companies, rapid urbanization, and growing focus on life sciences research. The rise of epigenetic studies in oncology, drug discovery, and developmental biology is fueling demand for advanced instruments.

Epigenetics-Based Instruments Market Share

The Epigenetics-Based Instruments industry is primarily led by well-established companies, including:

• Thermo Fisher Scientific (U.S.)

• Illumina (U.S.)

• Agilent Technologies (U.S.)

• Bio-Rad Laboratories (U.S.)

• PerkinElmer (U.S.)

• Danaher Corporation (U.S.)

• New England Biolabs (U.S.)

• Pacific Biosciences (U.S.)

• Eppendorf (Germany)

• Beckman Coulter (U.S.)

• Oxford Nanopore Technologies (U.K.)

• BGI Genomics (China)

• Takara Bio (Japan)

• F. Hoffmann-La Roche (Switzerland)

• Miltenyi Biotec (Germany)

• Agilent Technologies (U.S.)

• Tecan Group (Switzerland)

• Bio-Techne (U.S.)

• PerkinElmer (U.S.)

Latest Developments in Global Epigenetics-Based Instruments Market

- In March 2023, Illumina announced the launch of its next‑generation sequencing platform, NovaSeq 6000, featuring enhanced AI‑driven bioinformatics capabilities to simplify complex epigenomic data analysis and improve sequencing throughput for research applications. This development strengthened Illumina's position in advanced epigenetic analysis tools and supported broader adoption in academic and clinical research

- In February 2023, Tecan and Element Biosciences collaborated to develop a tabletop NGS method integrating MagicPrep NGS with the AVITI System, enhancing the efficiency and accessibility of high‑throughput sequencing platforms that are widely used in epigenetics studies and DNA methylation profiling. This partnership reflects ongoing innovation in sequencing technologies relevant to epigenetics research

- In January 2025, New England Biolabs launched the EM‑seq v2 kit, a high‑performance enzyme‑based sequencing solution that offers an alternative to traditional bisulfite sequencing for detecting DNA methylation with improved accuracy and reduced DNA damage, marking a significant advancement in epigenetic sequencing workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.