Global Epigenetics Market

Market Size in USD Billion

CAGR :

%

USD

19.02 Billion

USD

99.66 Billion

2025

2033

USD

19.02 Billion

USD

99.66 Billion

2025

2033

| 2026 –2033 | |

| USD 19.02 Billion | |

| USD 99.66 Billion | |

|

|

|

|

What is the Epigenetics Market Size and Growth Rate?

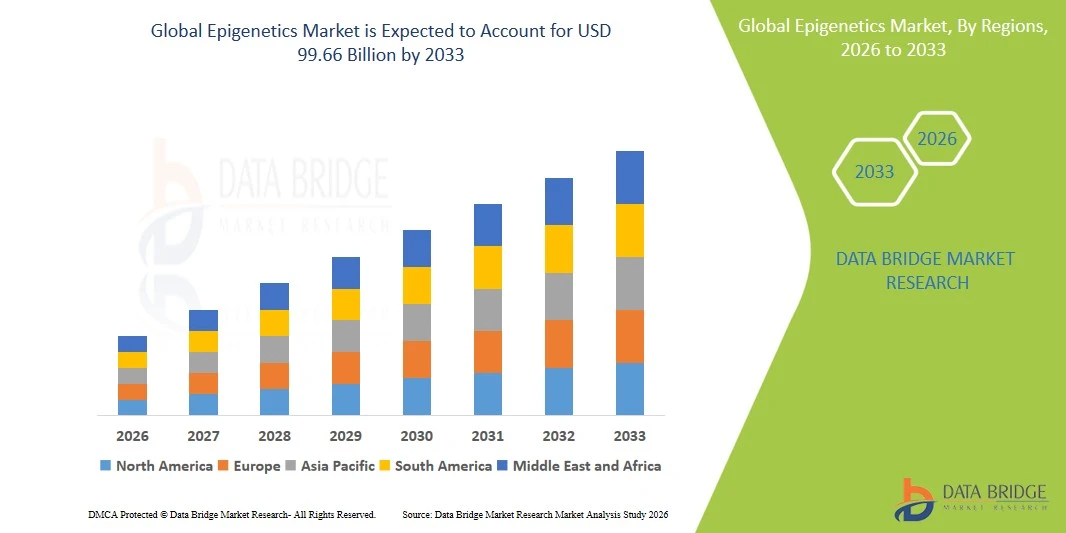

The global epigenetics market size was valued at USD 22.88 billion in 2025 and is expected to reach USD 99.66 billion by 2033, at a CAGR of 20.20% during the forecast period. This growth is driven by factors such as the rising cancer prevalence, increasing research funding, and advancements in epigenetic therapies and diagnostic technologies

Market Size and Forecast:

- Market Size (2025): USD 22.88 Billion

- Projected Market Size (2033): USD 99.66 Billion

- CAGR (2026-2033): 20.20%

What are the Major Takeaways of Epigenetics Market?

- Epigenetics involves changes in gene expression without altering the DNA sequence, playing a crucial role in gene regulation, development, and disease mechanisms, especially in cancer and neurological disorders

- The demand for epigenetics technologies is driven by increasing cancer incidence, growing focus on personalized medicine, and advancements in genomics and molecular biology tools

- North America is expected to dominate the epigenetics market with a market share of 38.24%, due to advanced healthcare infrastructure, high adoption of cutting-edge genomic and biotechnology technologies, and strong presence of leading research institutions and pharmaceutical companies

- Asia-Pacific is expected to be the fastest growing region in the epigenetics market with a market share of 23.42%, during the forecast period due to rapid advancements in biotechnology, increasing healthcare investments, and rising awareness of the importance of genetic-based treatments

- Reagents segment is expected to dominate the market with a market share of 44.50% due to its essential role in various epigenetic research applications, including DNA methylation, histone modification, and chromatin analysis.

Report Scope and Epigenetics Market Segmentation

|

Attributes |

Epigenetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Epigenetics Market?

“Rising Adoption of Epigenetic Biomarkers & Personalized Medicine”

- One prominent trend in the epigenetics market is the increasing adoption of epigenetic biomarkers in disease diagnosis, prognosis, and treatment monitoring, especially in oncology and neurology

- This trend is driven by the growing demand for personalized medicine, as epigenetic profiling enables tailored therapeutic strategies based on an individual’s gene expression patterns

- For instance, the use of DNA methylation markers in cancer screening (for instance, colorectal or lung cancer) allows for earlier detection and more accurate risk assessment, improving treatment outcomes

- The integration of epigenetic data with next-generation sequencing and AI-powered analytics is accelerating biomarker discovery and precision diagnostics, fueling market growth and innovation

What are the Key Drivers of Epigenetics Market?

Driver

“Growing Focus on Cancer Research and Personalized Medicine”

- The increasing prevalence of cancer and the growing demand for personalized medicine are significantly driving the demand for epigenetics-based tools and therapies

- Cancer research has shifted toward understanding the molecular mechanisms of gene expression regulation, with epigenetic alterations such as DNA methylation and histone modification playing crucial roles in cancer progression

- The rise of targeted therapies and precision medicine further increases the demand for epigenetic diagnostics and treatments, as personalized approaches based on an individual’s epigenetic profile are shown to improve treatment outcomes

For instance,

- In 2021, the American Cancer Society reported that over 1.9 million new cancer cases were expected in the U.S. alone, highlighting the growing need for more accurate and personalized diagnostic and therapeutic solutions

- As a result of the rising prevalence of cancer and advancements in personalized medicine, there is a significant increase in the demand for epigenetics technologies for diagnosis, prognosis, and treatment planning

Opportunity

“Integration of Artificial Intelligence in Epigenetics Research and Diagnostics”

- AI-powered tools are revolutionizing the field of epigenetics by enhancing the analysis of complex genetic data, improving the accuracy of diagnostics, and identifying novel

- AI algorithms can rapidly analyze large datasets generated by next-generation sequencing and epigenomic profiling, providing researchers with deeper insights into gene expression regulation and epigenetic modifications

- In addition, AI technologies can be used to predict patient outcomes and optimize personalized treatment plans based on epigenetic information, accelerating the development of precision medicine

For instance,

- In March 2024, a study published in Nature Biotechnology demonstrated the use of deep learning models to analyze DNA methylation data, identifying epigenetic biomarkers that predict cancer risk with high accuracy

- The integration of AI in epigenetics research and diagnostics offers significant potential for improving treatment strategies, reducing healthcare costs, and advancing personalized medicine, thus creating substantial growth opportunities in the market

Restraint/Challenge

“High Costs of Epigenetic Technologies and Limited Accessibility”

- The high cost of advanced epigenetic technologies, such as next-generation sequencing (NGS) and epigenomic profiling tools, is a significant challenge for market penetration, particularly in developing regions with limited healthcare budgets

- These technologies, essential for comprehensive epigenetic research and diagnostics, often require substantial investments, making them inaccessible to smaller research institutions and healthcare providers with constrained financial resources

- The high costs of these tools may also limit widespread adoption, particularly in low- and middle-income countries, where the financial barriers prevent the deployment of cutting-edge epigenetic technologies for disease diagnosis and treatment

For instance,

- In January 2024, a report from Global Health Action highlighted that the high costs of molecular diagnostics, including epigenetic technologies, remain a major obstacle in providing equitable healthcare solutions in low-resource settings, affecting patient access to timely and accurate diagnoses

- Consequently, the limitations in affordability and accessibility can slow down the adoption of epigenetic technologies, hindering the growth and potential applications of epigenetics in personalized medicine and disease management

How is the Epigenetics Market Segmented?

The market is segmented on the basis of product, application, technology, and end user

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By Technology |

|

|

By End User

|

|

In 2025, the reagents is projected to dominate the market with a largest share in product segment

The reagents segment is expected to dominate the epigenetics market with the largest share of 44.50% in 2025 due to its essential role in various epigenetic research applications, including DNA methylation, histone modification, and chromatin analysis. These reagents are critical for accurate and reproducible experimental outcomes. The continuous development of high-quality, specialized reagents and their repeated use in laboratory procedures further drive segment growth

The DNA methylation is expected to account for the largest share during the forecast period in technology market

In 2025, the DNA methylation segment is expected to dominate the market with the largest market share of 41.4% due to its vital role in gene regulation, early disease detection, and cancer diagnostics. It is one of the most widely studied epigenetic mechanisms, making it central to both basic research and clinical applications. The growing demand for DNA methylation analysis in personalized medicine and biomarker discovery further supports its market leadership

Which Region Holds the Largest Share of the Epigenetics Market?

“North America Holds the Largest Share in the Epigenetics Market”

- North America dominates the epigenetics market with a market share of estimated 38.24% driven, by advanced healthcare infrastructure, high adoption of cutting-edge genomic and biotechnology technologies, and strong presence of leading research institutions and pharmaceutical companies

- U.S. holds a market share of 35.6%, due to increased demand for personalized medicine, the rising prevalence of genetic disorders, and advancements in cancer and neurological research

- The availability of government funding, well-established healthcare policies, and increasing investments in research and development by biotechnology companies further strengthen the market

- In addition, the growing adoption of next-generation sequencing (NGS) and epigenomic profiling tools for disease diagnosis, prognosis, and personalized treatment is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Epigenetics Market”

- Asia-Pacific is expected to witness the highest growth rate in the epigenetics market with a market share of 23.42%, driven by rapid advancements in biotechnology, increasing healthcare investments, and rising awareness of the importance of genetic-based treatments

- Countries such as China, India, and Japan are emerging as key markets due to the growing prevalence of genetic disorders, cancer, and chronic diseases that benefit from epigenetic research and therapies

- Japan, with its advanced medical technology and increasing focus on personalized medicine, remains a critical market for epigenetics, particularly in cancer genomics, drug development, and genetic diagnostics

- India is projected to register the highest CAGR in the epigenetics market, driven by expanding biotechnology research, increasing healthcare needs, and growing adoption of epigenetic technologies in both clinical and research settings

Which are the Top Companies in Epigenetics Market?

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bio-Techne (U.S.)

- Promega Corporation (U.S.)

- GeneTex, Inc. (U.S.)

- PacBio. (U.S.)

- Illumina, Inc. (U.S.)

- Merck KGaA (Germany)

- QIAGEN (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Eisai Co., Ltd. (Japan)

- Novartis AG (Switzerland)

- Abcam Limited (U.K.)

- Diagenode S.A. (U.S.)

- Active Motif, Inc. (U.S.)

- Zymo Research Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- CellCentric Limited (Germany)

- Syndax Pharmaceuticals (U.S.)

- New England Biolabs (U.S.)

- Epizyme, Inc. (U.S.)

- Domainex (U.K.)

What are the Recent Developments in Epigenetics Market?

- In April 2025, researchers published a review in Nature Reviews Clinical Oncology highlighting the growing significance of epigenetic modifications as therapeutic targets in oncology and beyond. The study emphasized that the next generation of epigenetic drugs is focusing on precise modulation of gene expression without altering DNA sequences, holding promise for cancer, autoimmune, and neurological disorders

- In March 2025, the Keystone Symposia hosted a major conference titled "Epigenetics in Development and Disease" in Banff, Canada. The event brought together leading researchers and biotech innovators to discuss advancements in chromatin biology, histone modifications, and transcriptional regulation, underlining their implications for precision medicine and regenerative therapy

- In November 2024, Tune Therapeutics, a U.S.-based epigenetic medicine company, announced that its therapy Tune-401—targeting chronic hepatitis B virus (HBV)—is preparing for clinical trials. The therapy uses the company's proprietary "Epigenetic Reprogramming" technology to silence viral gene expression, showing promise in preclinical models as a potential cure rather than a suppression therapy

- In October 2024, Wired magazine reported on a new wave of epigenetic editing technologies, which aim to fine-tune gene expression without modifying the DNA code itself. These tools—distinct from CRISPR—are gaining traction in neuroscience, with recent animal studies demonstrating that targeted epigenetic modulation can reverse anxiety behaviors and addiction tendencies

- In December 2023, BioLabs and Promega expanded their collaborative efforts to drive global innovation in life sciences by supporting early-stage startups. Promega GmbH, the German subsidiary of the global life sciences manufacturer, located in Walldorf, now provides advanced equipment, comprehensive services, and specialized training to BioLabs Heidelberg, enhancing their capacity to nurture emerging biotech ventures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.