Global Eprescription Market

Market Size in USD Billion

CAGR :

%

USD

110.29 Billion

USD

273.08 Billion

2024

2032

USD

110.29 Billion

USD

273.08 Billion

2024

2032

| 2025 –2032 | |

| USD 110.29 Billion | |

| USD 273.08 Billion | |

|

|

|

|

E-Prescription Market Size

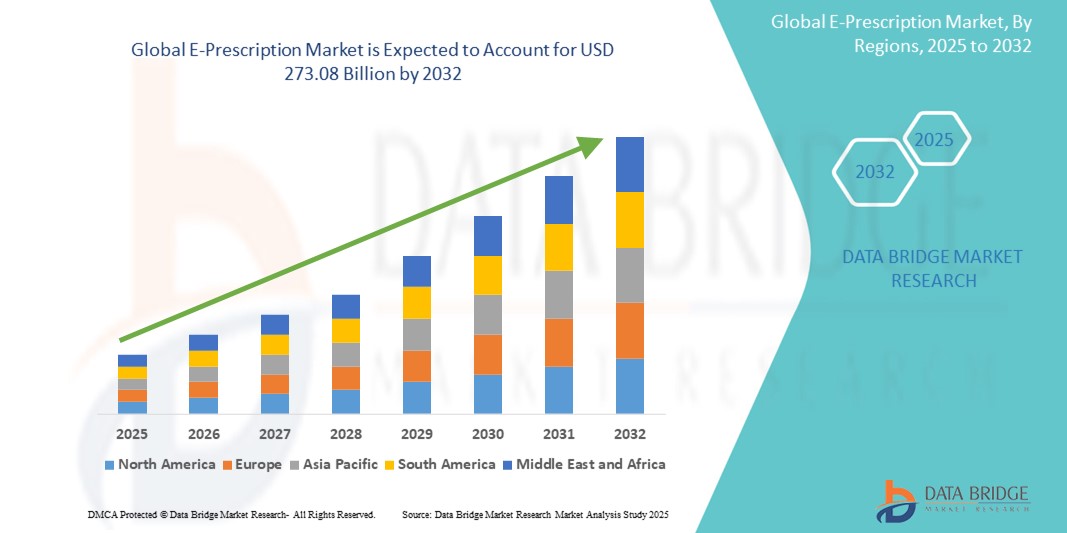

- The global E-prescription market size was valued at USD 110.29 billion in 2024 and is expected to reach USD 273.08 billion by 2032, at a CAGR of 12.00% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements within digital health ecosystems and electronic health record (EHR) systems, leading to increased digitalization in both outpatient and inpatient care settings

- Furthermore, rising provider demand for secure, efficient, and integrated prescription solutions is establishing e-prescriptions as the modern standard for medication management. These converging factors are accelerating the uptake of E-Prescription solutions, thereby significantly boosting the industry's growth

E-Prescription Market Analysis

- E-Prescription systems, offering electronic transmission of prescriptions from healthcare providers to pharmacies, are increasingly vital components of modern healthcare systems due to their enhanced accuracy, medication safety, and integration with EHRs and pharmacy networks

- The escalating demand for E-prescription platforms is primarily fueled by the widespread adoption of healthcare IT systems, growing focus on reducing medication errors, and regulatory mandates supporting digital prescription workflows

- North America dominated the E-prescription market with the largest revenue share of 40.01% in 2024, characterized by early healthcare digitalization, favorable government initiatives such as the Medicare Improvements for Patients and Providers Act (MIPPA), and a strong presence of key industry players. The U.S. experienced substantial growth in E Prescription adoption across hospitals, clinics, and retail pharmacies, driven by seamless EHR integration and interoperability features

- Asia-Pacific is expected to be the fastest-growing region with a CAGR of 18.7% in the E-Prescription market during the forecast period, driven by expanding healthcare infrastructure, rising digital health investments, and government programs supporting telehealth and digital prescriptions in countries such as India, China, and Japan

- The solutions segment dominated the E-Prescription market with a market share of 66.4% in 2024, as hospitals and clinics increasingly rely on cloud-based and integrated software solutions for secure, real-time e-prescribing, decision support, and drug interaction checks

Report Scope and E-Prescription Market Segmentation

|

Attributes |

E-Prescription Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

E-Prescription Market Trends

“Seamless Healthcare Connectivity and Patient Safety Enhancement”

- A significant and accelerating trend in the global E-prescription market is the growing integration of e-prescription systems with Electronic Health Records (EHRs), pharmacy management software, and health information exchanges. This enhanced connectivity is transforming how prescriptions are managed, ensuring that patient data flows seamlessly across healthcare providers and pharmacies

- For instance, leading platforms such as Epic and Cerner are enabling direct prescription transmission from physicians to pharmacies, minimizing errors caused by handwriting or verbal miscommunication. This integration not only expedites the prescribing process but also allows for real-time updates on drug availability, dosage adjustments, and refill alerts

- E-Prescription systems also enable clinical decision support features that help physicians identify potential drug interactions, allergies, or duplicate therapies during the prescribing process. These capabilities significantly improve patient safety and reduce adverse drug events

- The automation of prescription workflows helps reduce the administrative burden on healthcare providers and pharmacists, enabling them to focus more on patient care. In addition, electronic records ensure that all prescription data is accurately documented for compliance, insurance claims, and future reference

- Governments and regulatory bodies worldwide are increasingly mandating or incentivizing the adoption of e-prescription systems to improve healthcare outcomes and ensure regulatory compliance. For instance, the U.S. CMS e-prescribing requirements and Europe's eHealth digital agenda are key drivers of market adoption

- The rising demand for improved medication adherence, reduced prescription fraud, and faster dispensing of drugs is fueling the widespread uptake of E-Prescription solutions across hospitals, specialty clinics, and ambulatory surgical centers

E-Prescription Market Dynamics

Driver

“Growing Need Due to Rising Demand for Digital Healthcare and Prescription Accuracy”

- The increasing shift toward digital health solutions, coupled with the need to reduce prescription errors and streamline medication workflows, is a significant driver for the growing adoption of e-prescription systems globally

- For instance, in April 2024, the U.S. Department of Health and Human Services launched a nationwide initiative to promote EHR-integrated e-prescription adoption across community health centers, aiming to improve medication safety and reduce prescription fraud. Such initiatives are expected to propel the E-Prescription market during the forecast period

- As healthcare providers and pharmacies seek to enhance prescription accuracy and reduce medication errors, e-prescribing systems offer advanced features such as drug interaction checks, allergy alerts, and dosage validation, making them indispensable tools in modern healthcare

- Furthermore, the rising burden of chronic diseases and the associated long-term medication needs are pushing healthcare systems to adopt scalable and interoperable solutions, such as E-Prescription platforms, that ensure timely and accurate prescription delivery

- The convenience of paperless prescribing, real-time medication history access, and automated refill management are key factors driving the adoption of e-prescription solutions across hospitals, specialty clinics, and ambulatory surgical centers. In addition, compliance with regulatory mandates such as the U.S. Medicare Part D e-prescribing requirements is further accelerating market penetration

Restraint/Challenge

“Concerns Regarding Data Privacy and High Implementation Costs”

- Concerns surrounding data privacy and the security of patient health information remain significant challenges to the broader adoption of E-Prescription systems. As these solutions rely on cloud-based infrastructure and interconnected health IT systems, they are vulnerable to breaches, unauthorized access, and potential misuse of sensitive data

- For instance, high-profile data breaches in the healthcare sector have heightened consumer and provider concerns regarding the protection of e-prescription data and compliance with regulations such as HIPAA and GDPR

- Addressing these concerns through strong encryption, role-based access controls, and regular system audits is essential for building trust among healthcare providers and patients. Leading vendors such as Epic Systems and athenahealth are investing heavily in cybersecurity frameworks to enhance data security

- In addition, the high upfront costs associated with implementing e-prescription platforms—especially in terms of system integration, staff training, and IT support—can be a barrier for smaller clinics and practices in developing regions. While cloud-based subscription models are easing the cost burden, budget limitations and lack of digital infrastructure still hinder full-scale adoption

- Overcoming these challenges will require supportive government policies, funding for healthcare IT upgrades, and continuous efforts to improve system usability, interoperability, and cost-effectiveness in E-Prescription technologies

E-Prescription Market Scope

The market is segmented on the basis of product, usage mode, mode of delivery, and end-user.

• By Product

On the basis of product, the E-Prescription market is segmented into solutions and services. The solutions segment dominated the market with the largest revenue share of 66.4% in 2024, driven by widespread integration with EHRs and clinical decision tools.

The services segment is expected to witness the fastest CAGR of 22.7% from 2025 to 2032, owing to the growing need for implementation, maintenance, and support services, particularly in emerging healthcare markets.

• By Usage Mode

On the basis of usage mode, the E-Prescription market is segmented into handheld device and computer-based devices. The computer-based devices segment held the largest market share of 61.3% in 2024, attributed to their strong adoption across hospitals and clinics with established EHR systems.

The handheld device segment is projected to register the highest CAGR of 20.5% during 2025–2032, driven by increasing adoption of mHealth and mobile prescribing among clinicians.

• By Mode of Delivery

On the basis of mode of delivery, the E-Prescription market is segmented into web and cloud-based solutions and on-premise solutions. The web and cloud-based solutions segment dominated the market with a revenue share of 71.6% in 2024, due to their scalability, remote accessibility, and lower upfront costs.

The on-premise solutions segment is expected to grow at a CAGR of 14.2% from 2025 to 2032, as data-sensitive institutions continue to prioritize control and internal data management.

• By End-User

On the basis of end-user, the E-Prescription market is segmented into clinics, physicians, pharmacies, and hospitals. The hospitals segment accounted for the largest market share of 44.9% in 2024, driven by high prescription volumes and complex medication workflows.

The pharmacies segment is projected to witness the fastest CAGR of 23.6% from 2025 to 2032, supported by growing investment in digital prescription systems and automation. Clinics and physicians also contribute significantly, especially in outpatient settings and primary care.

E-Prescription Market Regional Analysis

- North America dominated the global E-prescription market with the largest revenue share of 40.01% in 2024, primarily due to strong regulatory mandates, early digitization of healthcare infrastructure, and widespread EHR adoption

- The region also benefits from well-established healthcare IT providers and a supportive reimbursement framework, making it a leader in e-prescribing implementation

- Initiatives such as the U.S. Medicare Improvements for Patients and Providers Act (MIPPA) and Meaningful Use incentives further accelerated adoption across healthcare facilities

U.S. E-Prescription Market Insight

The U.S. E-prescription market accounted for 76.3% of North America’s revenue in 2024, driven by a mature digital health ecosystem and increasing demand for medication error reduction. The country's EHR penetration is among the highest globally, and the shift toward value-based care models is fostering the widespread use of e-prescribing tools. Integration with decision support tools and pharmacy benefit managers (PBMs) is also enhancing clinical efficiency and patient safety.

Europe E-Prescription Market Insight

The Europe E-prescription market is projected to expand at a substantial CAGR throughout the forecast period, fueled by regulatory mandates such as the EU eHealth Action Plan and national digitization strategies. Countries such as Germany, France, and Sweden are emphasizing the digital transformation of healthcare systems to improve care delivery and minimize prescription fraud. Growing use of centralized electronic health records and health apps is further driving the regional market.

U.K. E-Prescription Market Insight

The U.K. E-prescription market is expected to expand significantly during the forecast period, driven by NHS Digital’s electronic prescription services (EPS) and increasing demand for paperless workflows. The adoption of cloud-based prescribing platforms is streamlining medication management and improving coordination between general practitioners and pharmacies.

Germany E-Prescription Market Insight

The Germany E-prescription market is anticipated to grow at a robust pace during the forecast period, underpinned by the Telematics Infrastructure and ePA (Electronic Patient Record) initiatives. In 2024, Germany mandated e-prescriptions for statutory health-insured patients, significantly boosting the market. Increasing digital literacy and government funding in health IT infrastructure are enhancing adoption rates.

Asia-Pacific E-Prescription Market Insight

The Asia-Pacific E-prescription market is projected to register the fastest CAGR of 18.7% from 2025 to 2032, driven by rapid digitalization in healthcare systems and government eHealth initiatives across India, China, and Japan. The region benefits from large patient populations, rising smartphone and internet penetration, and an expanding base of health tech startups. Investment in telemedicine and mobile health apps is also encouraging adoption of integrated e-prescription tools.

Japan E-Prescription Market Insight

The Japan’s E-Prescription market is advancing due to its tech-savvy healthcare ecosystem and growing aging population requiring chronic disease management. Hospitals and clinics are integrating e-prescribing into broader HIS (Hospital Information System) platforms to streamline patient care and reduce administrative burden.

China E-Prescription Market Insight

The China E-Prescription market held the largest market revenue share within Asia-Pacific in 2024, supported by the government's push for smart hospitals and electronic health records through initiatives such as “Healthy China 2030.” E-prescription tools are becoming standard in urban healthcare institutions, and the integration with teleconsultation platforms is improving access in rural areas.

E-Prescription Market Share

The E-Prescription industry is primarily led by well-established companies, including:

- Epic Systems Corporation (U.S.)

- Veradigm LLC (U.S.)

- NXGN Management, LLC. (U.S.)

- athenahealth, Inc. (U.S.)

- RelayHealth (U.S.)

- Henry Schein, Inc. (U.S.)

- General Electric Company (U.S.)

- DRFIRST (U.S.)

- Medical Information Technology, Inc. (U.S.)

- GPI Spa (Italy)

Latest Developments in Global E-Prescription Market

- In April 2024, Surescripts, a key player in health information exchange, announced an upgrade to its E-Prescribing platform by integrating Real-Time Prescription Benefit (RTPB) tools. This enhancement enables healthcare providers to view patient-specific medication cost information at the point of care, helping them make more informed prescribing decisions and improve medication adherence. The upgrade demonstrates Surescripts' continued commitment to streamlining the prescribing process and reducing out-of-pocket costs for patients

- In March 2024, DrFirst, a health technology innovator, launched SmartRenew, an AI-powered solution designed to automate prescription refill authorization workflows. The solution reduces administrative burden for healthcare providers by eliminating manual refill tasks, leading to improved clinical efficiency and faster response times for pharmacies and patients. This marks a significant advancement in the digital transformation of medication management

- In February 2024, Oracle Health introduced a next-generation cloud-based E-Prescription system as part of its unified EHR platform. The system includes drug interaction alerts, formulary compliance checks, and streamlined workflows tailored for both outpatient and inpatient care settings. Oracle’s solution is aimed at improving prescribing accuracy and reducing medication errors, particularly in large hospital systems

- In January 2024, Allscripts Healthcare Solutions (now part of Veradigm) announced a collaboration with Amazon Web Services (AWS) to enhance the scalability and security of its E-Prescribing and electronic health record services. This partnership is focused on improving system uptime, supporting high-volume prescription processing, and ensuring compliance with HIPAA and other data protection standards

- In December 2023, Epic Systems Corporation introduced new E-Prescription modules integrated with its MyChart patient portal, enabling patients to track prescription status, receive medication reminders, and directly communicate with pharmacies. This patient-centric enhancement reflects a growing trend toward empowering individuals in their healthcare journey and boosting medication adherence rates through better digital engagement

- In November 2023, NextGen Healthcare released analytics tools within its E-Prescription platform to help healthcare organizations monitor prescribing patterns, identify potential overuse of controlled substances, and ensure compliance with PDMP (Prescription Drug Monitoring Program) regulations. These tools aim to support safer prescribing practices and reduce the risk of opioid misuse

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.