Global Equestrian Helmets Market

Market Size in USD Million

CAGR :

%

USD

106.76 Million

USD

165.09 Million

2024

2032

USD

106.76 Million

USD

165.09 Million

2024

2032

| 2025 –2032 | |

| USD 106.76 Million | |

| USD 165.09 Million | |

|

|

|

|

Equestrian Helmets Market Size

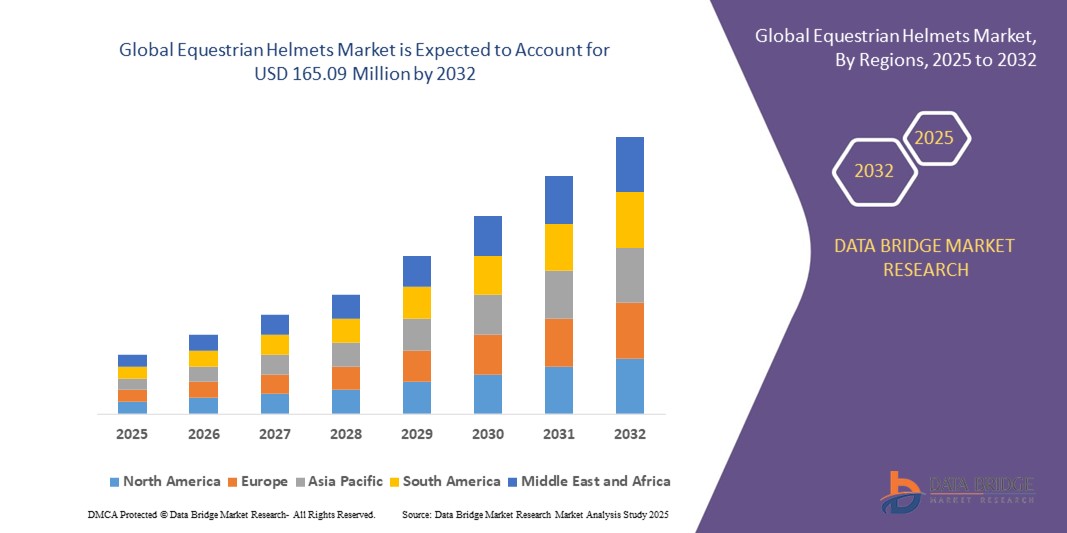

- The global equestrian helmets market size was valued at USD 106.76 million in 2024 and is expected to reach USD 165.09 million by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is largely fuelled by the increasing awareness regarding rider safety and the implementation of strict safety regulations in equestrian sports

- Rising participation in horse-riding events, recreational activities, and competitive sports is further boosting the adoption of certified equestrian helmets

Equestrian Helmets Market Analysis

- The equestrian helmets market is witnessing steady growth due to the rising popularity of equestrian sports across various age groups, particularly among young riders and women

- Leading manufacturers are focusing on developing lightweight, comfortable, and highly durable helmets that comply with international safety standards

- North America dominated the equestrian helmets market with the largest revenue share of 38.7% in 2024, driven by the rising popularity of equestrian sports, growing awareness about head injury prevention, and stringent safety regulations across competitive riding events

- Asia-Pacific region is expected to witness the highest growth rate in the global equestrian helmets market, driven by rapid urbanization, expanding middle-class population, and the increasing popularity of recreational horse-riding activities

- The Show Helmets segment held the largest market revenue share in 2024, driven by high adoption in competitive events and recreational riding due to their blend of style, comfort, and safety certifications. These helmets often come with advanced ventilation and impact protection features, making them the preferred choice for both professional and amateur riders.

Report Scope and Equestrian Helmets Market Segmentation

|

Attributes |

Equestrian Helmets Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Equestrian Helmets Market Trends

Integration Of Advanced Safety Technologies In Equestrian Helmets

- The rising focus on rider safety is driving the adoption of helmets equipped with technologies such as Multi-Directional Impact Protection System (MIPS) and wavecel liners. These features enhance head protection by reducing rotational forces during falls, significantly lowering the risk of traumatic brain injuries. With more competitive riders prioritizing protection, demand for helmets meeting international safety certifications is growing rapidly, prompting manufacturers to invest heavily in R&D for next-gen safety solutions

- Demand for technologically advanced helmets is accelerating as competitive riders and safety-conscious consumers prioritize certified, high-performance products. Premium brands are responding with lightweight, impact-absorbing materials and enhanced ventilation systems. In addition, companies are integrating customizable fitting systems and aesthetic designs to cater to style-conscious consumers while maintaining safety as the primary focus, boosting adoption in professional and recreational riding segments

- The growing popularity of equestrian sports in emerging markets is also creating demand for affordable yet technologically advanced helmets, widening consumer access while maintaining safety standards. Rising disposable incomes in countries such as China and India, coupled with increased participation in equestrian clubs, are driving sales of helmets in mid-price ranges, pushing brands to balance innovation with cost-effectiveness to reach larger consumer bases

- For instance, in 2024, several European manufacturers introduced helmets with integrated crash sensors linked to smartphone apps, enabling real-time alerts to emergency contacts in case of accidents, thus enhancing rider safety and confidence. These smart helmets also offer GPS tracking features, allowing faster emergency response times and increasing overall rider security, particularly in competitive events or remote training locations

- While technology integration improves protection and user experience, long-term adoption depends on balancing safety, comfort, and affordability to cater to both professional and recreational riders worldwide. Manufacturers are therefore focusing on modular helmet designs that combine advanced safety layers with lightweight, ergonomic builds to ensure that helmets remain both effective and comfortable during extended use

Equestrian Helmets Market Dynamics

Driver

Rising Awareness About Head Injuries And Stringent Safety Regulations

- Growing awareness about head injuries in equestrian sports is boosting demand for certified helmets. Government bodies and equestrian associations worldwide are enforcing stricter safety norms for competitive and recreational riding, increasing helmet adoption rates. These initiatives are further strengthened by insurance companies offering incentives for riders using certified helmets, making compliance financially beneficial as well as essential for safety

- Riders and trainers recognize the financial and health risks linked to head injuries, including medical expenses and loss of professional opportunities. This awareness is fueling the preference for premium helmets offering advanced impact protection technologies. As a result, equestrian academies and sports clubs are increasingly mandating helmet usage for all trainees, creating a sustained demand for certified headgear across professional and amateur segments

- National safety campaigns and training programs highlight the importance of helmets, while subsidies and sponsorships from sports associations make certified helmets more accessible to amateur riders. Collaborations between helmet manufacturers and sporting bodies are further helping to educate rural and youth communities about the risks of riding without adequate head protection, encouraging wider adoption

- For instance, in 2023, the U.S. Equestrian Federation mandated ASTM/SEI-certified helmets for all junior riders in competitions, significantly driving helmet sales in North America. Similar regulatory trends are emerging in Europe and Asia-Pacific, where event organizers are incorporating helmet checks into competition guidelines, ensuring consistent enforcement of safety standards

- While regulations and awareness initiatives are pushing demand upward, further efforts are needed to promote consistent helmet usage across all riding disciplines, especially in rural and informal riding communities. Addressing cultural resistance, affordability gaps, and lack of enforcement in informal riding settings remains key to ensuring broader safety compliance globally

Restraint/Challenge

High Cost Of Premium Helmets And Limited Awareness In Emerging Markets

- The cost of technologically advanced helmets equipped with MIPS or sensor technology remains a barrier for price-sensitive consumers, particularly in emerging economies. Many riders in developing regions still opt for cheaper, uncertified helmets or forego them altogether. Without financial support or low-cost product lines, premium helmet adoption in rural and budget-conscious markets is likely to remain limited in the near term

- Limited awareness regarding helmet safety standards and benefits in rural areas hinders market penetration. Recreational riders often underestimate injury risks, leading to inconsistent helmet adoption outside competitive sports. Grassroots-level safety programs, along with promotional campaigns from industry leaders, are needed to change perceptions and educate riders about the life-saving importance of certified helmets

- Supply chain challenges in remote markets further restrict helmet availability, with few retailers offering certified products or after-sales services, reducing consumer confidence in premium brands. The lack of localized distribution networks and high shipping costs also result in long waiting periods for product delivery, discouraging repeat purchases and slowing overall market expansion

- For instance, in 2023, safety advocacy groups in Latin America reported that less than 40% of riders used certified helmets regularly, citing affordability and lack of local suppliers as key obstacles. Similar challenges were observed in parts of Africa and Southeast Asia, where inadequate retail presence of certified brands has left the market dominated by low-cost, non-compliant helmets

- To overcome these barriers, manufacturers must focus on cost-effective production, awareness campaigns, and digital retail channels to ensure broader access to high-quality safety gear. Partnerships with e-commerce platforms and regional distributors can also reduce supply gaps, bringing affordable certified helmets to rural and semi-urban consumers at scale

Equestrian Helmets Market Scope

The market is segmented on the basis of product type, material, end-user, and distribution channel.

- By Product Type

On the basis of product type, the equestrian helmets market is segmented into Racing Helmets, Skull Helmets, Show Helmets, Trail/Endurance Helmets, and Others. The Show Helmets segment held the largest market revenue share in 2024, driven by high adoption in competitive events and recreational riding due to their blend of style, comfort, and safety certifications. These helmets often come with advanced ventilation and impact protection features, making them the preferred choice for both professional and amateur riders.

The Trail/Endurance Helmets segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing participation in adventure and leisure riding activities. Riders in rural and semi-urban regions prefer these helmets for their durability, lightweight design, and extended comfort during long riding sessions, boosting their demand globally.

- By Material

On the basis of material, the equestrian helmets market is segmented into Acrylonitrile Butadiene Styrene (ABS), Fiberglass, Polycarbonate, Carbon Fiber, and Others. The ABS segment held the largest market revenue share in 2024 owing to its affordability, strength, and wide availability across multiple price ranges. ABS helmets provide a cost-effective balance of durability and safety, making them popular among recreational and entry-level riders worldwide.

The Carbon Fiber segment is expected to witness the fastest growth rate from 2025 to 2032 due to rising demand for premium, lightweight, and high-strength helmets among professional riders. Their superior impact resistance and sleek designs are increasingly attracting safety-conscious consumers willing to invest in advanced materials for enhanced protection.

- By End-User

On the basis of end-user, the equestrian helmets market is segmented into Professional Riders, Recreational Riders, and Riding Schools. The Recreational Riders segment accounted for the largest revenue share in 2024, driven by growing participation in leisure equestrian activities and rising awareness regarding rider safety across developed and emerging economies.

The Professional Riders segment is expected to witness the fastest growth rate from 2025 to 2032, supported by stringent competition safety norms and rising sponsorship opportunities in professional equestrian sports, encouraging the adoption of certified helmets with advanced safety technologies.

- By Distribution Channel

On the basis of distribution channel, the equestrian helmets market is segmented into Sports Equipment Stores, Specialty Stores, E-Commerce, Company Websites, and Others. The Sports Equipment Stores segment held the largest market revenue share in 2024 due to the strong offline presence of leading brands and consumer preference for product trials before purchase.

The E-Commerce segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid growth of online retail platforms, digital marketing campaigns, and convenient home delivery options, making certified helmets more accessible to consumers in remote and semi-urban locations.

Equestrian Helmets Market Regional Analysis

- North America dominated the equestrian helmets market with the largest revenue share of 38.7% in 2024, driven by the rising popularity of equestrian sports, growing awareness about head injury prevention, and stringent safety regulations across competitive riding events

- Consumers in the region value certified, high-performance helmets offering advanced safety features such as MIPS technology, crash sensors, and lightweight materials for enhanced comfort and protection

- The combination of well-established equestrian traditions, strong purchasing power, and the presence of leading helmet manufacturers supports the widespread adoption of premium riding helmets across professional, recreational, and youth riders

U.S. Equestrian Helmets Market Insight

The U.S. equestrian helmets market captured the largest revenue share in 2024 within North America, fueled by mandatory safety standards for competitive riders and rising participation in horseback riding events. Growing demand for technologically advanced helmets featuring impact-absorbing liners, improved ventilation, and smart connectivity options further accelerates market growth. In addition, the expansion of equestrian training academies and riding schools enhances helmet adoption across both professional and amateur segments.

Europe Equestrian Helmets Market Insight

The Europe equestrian helmets market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the strong equestrian culture in countries such as Germany, the U.K., and France. Rising safety awareness campaigns, coupled with regulatory mandates from equestrian associations, are fostering the adoption of certified helmets. In addition, the increasing popularity of recreational riding and equestrian tourism across Europe supports demand for both premium and mid-range helmet segments.

U.K. Equestrian Helmets Market Insight

The U.K. equestrian helmets market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict helmet usage regulations across competitive events and growing investments in equestrian training facilities. A surge in recreational riding activities, along with technological advancements in helmet design for improved comfort and style, is boosting adoption rates among diverse rider categories, including youth and amateur riders.

Germany Equestrian Helmets Market Insight

The Germany equestrian helmets market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s strong equestrian heritage, rising safety standards, and technological innovations in helmet manufacturing. Germany’s focus on sustainable materials, advanced ventilation systems, and high-performance designs aligns with consumer demand for eco-conscious yet protective riding gear across professional and recreational segments.

Asia-Pacific Equestrian Helmets Market Insight

The Asia-Pacific equestrian helmets market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing participation in equestrian sports across China, Japan, and India. Rising disposable incomes, growing safety awareness, and the rapid expansion of equestrian clubs and training centers are boosting demand for certified helmets. The presence of emerging domestic manufacturers offering affordable, high-quality products further accelerates market penetration in the region.

Japan Equestrian Helmets Market Insight

The Japan equestrian helmets market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on rider safety, urbanization, and the growing popularity of horseback riding as a recreational activity. Technological innovations, such as helmets integrated with crash sensors and lightweight composite materials, are attracting both professional and leisure riders. Moreover, the country’s aging population is expected to drive demand for helmets offering enhanced comfort and ease of use.

China Equestrian Helmets Market Insight

The China equestrian helmets market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rising equestrian sports participation, government investments in training infrastructure, and the increasing influence of Western riding practices. Affordable product availability, coupled with the presence of local manufacturers offering certified helmets, is boosting adoption across recreational riders, professional athletes, and equestrian clubs nationwide.

Equestrian Helmets Market Share

The Equestrian Helmets industry is primarily led by well-established companies, including:

- Charles Owen & Company (Bow) Ltd. (U.K.)

- GPA Safety Legend (France)

- Samshield (France)

- Uvex Sports GmbH & Co. KG (Germany)

- KASK S.p.A. (Italy)

- Troxel LLC (U.S.)

- IRH International Riding Helmets, Inc. (U.S.)

- KEP Italia S.r.l. (Italy)

- Phoenix Performance Products Inc. (Canada)

- Limpido & Co. s.r.l. (Italy)

- Zandona Srl (Italy)

- Harry Hall International (U.K.)

- Back on Track USA (U.S.)

- Horseware Ireland (Ireland)

- Champion Manufacturing Ltd. (U.K.)

- Devon-Aire (U.S.)

- Schuberth GmbH (Germany)

- Horze Equestrian (Finland)

Latest Developments in Global Equestrian Helmets Market

- In July 2024, Samshield announced the launch of its new 2.0 helmet line, designed with advanced materials to enhance durability and reliability. This development introduces helmets featuring scratch-resistant paint, ensuring long-lasting aesthetics even with regular use. The innovation aims to provide riders with premium safety gear combining performance and style, strengthening Samshield’s position in the high-end equestrian helmet market

- In May 2023, Charles Owen launched its new brand EQX, aimed at offering affordable yet stylish riding helmets and equipment. The flagship Kylo helmet, available in multiple finishes and optional MIPS integration, starts at just EUR 88. This development is expected to increase accessibility to certified safety gear for budget-conscious riders, expanding the company’s customer base and boosting market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.