Global Error Correction Code Ecc Memory Market

Market Size in USD Billion

CAGR :

%

USD

11.16 Billion

USD

18.47 Billion

2024

2032

USD

11.16 Billion

USD

18.47 Billion

2024

2032

| 2025 –2032 | |

| USD 11.16 Billion | |

| USD 18.47 Billion | |

|

|

|

|

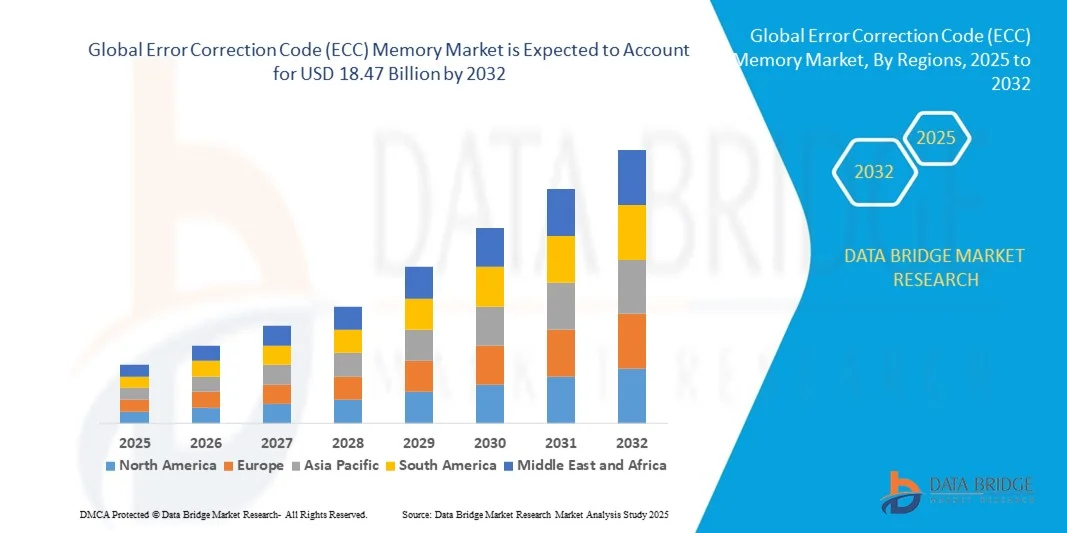

What is the Global Error Correction Code (ECC) Memory Market Size and Growth Rate?

- The global error correction code (ECC) Memory market size was valued at USD 11.16 billion in 2024 and is expected to reach USD 18.47 billion by 2032, at a CAGR of 6.50% during the forecast period

- The increasing adoption of data centers in various organizations, rising number of social networking platforms and IOT devices across the globe will emerge as the major factor driving market growth

- The increased demand for cloud computing along with rising adoption of error correction code DRAM memory in Smartphone’s and growing requirement of error correction code RAM memory for many media creators and CAD users will further aggravate the market value. However, high cost of error correction code (ECC) memory as compared to non- error correction code memory acts as a restraint for the market

What are the Major Takeaways of Error Correction Code (ECC) Memory Market?

- The market is driven by the increasing call for reliable and fault-tolerant memory answers in vital applications along with servers, records facilities, and high-performance computing. The growing complexity of computing architectures and the rise in records-centric applications further gasoline the adoption of ECC memory

- North America dominated the error correction code (ECC) memory market with the largest revenue share of 42.36% in 2024, driven by rising demand for reliable and high-performance memory solutions in data centers, cloud computing, and enterprise servers.

- Asia-Pacific is poised to grow at the fastest CAGR of 9.24% from 2025 to 2032, fueled by rapid digitalization, rising disposable incomes, and large-scale investments in IT infrastructure

- The soft error segment dominated the market with a 62.5% revenue share in 2024, driven by the increasing complexity of semiconductor devices and their susceptibility to radiation-induced and transient faults

Report Scope and Error Correction Code (ECC) Memory Market Segmentation

|

Attributes |

Error Correction Code (ECC) Memory Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Error Correction Code (ECC) Memory Market?

Integration of AI and Machine Learning for Predictive Reliability

- A major and accelerating trend in the global error correction code Memory market is the incorporation of artificial intelligence (AI) and machine learning (ML) algorithms to enhance error detection and correction processes. These advanced solutions are enabling systems to correct errors and predict potential faults before they occur, significantly improving system reliability

- For instance, Samsung and Micron Technology are working on AI-enhanced error correction code memory modules capable of real-time data error prediction in high-performance computing and data center environments. These innovations allow critical workloads to operate with minimal downtime

- AI-driven error correction code systems also enhance performance by reducing unnecessary corrections and improving latency-sensitive applications. By learning from data error patterns, such solutions optimize energy efficiency and extend the lifespan of memory modules

- The seamless integration of error correction code memory with AI-powered data center infrastructure is driving demand across cloud computing, HPC, and enterprise servers. This trend is reshaping customer expectations for memory solutions that correct and anticipate errors proactively

- Consequently, major vendors such as IBM and SK hynix are investing in next-generation error correction code memory solutions that combine predictive analytics with high-bandwidth performance

- As workloads in AI, 5G, and edge computing intensify, the demand for error correction code memory with AI-enhanced predictive capabilities is expected to grow rapidly, driving innovation across both enterprise and consumer applications

What are the Key Drivers of Error Correction Code (ECC) Memory Market?

- The rising demand for data integrity and system reliability in data-intensive applications is the foremost driver of the error correction code memory market. With organizations increasingly dependent on cloud computing, AI, and big data analytics, error correction code memory ensures uninterrupted performance

- For instance, in February 2024, Micron Technology launched DDR5 error correction code memory modules optimized for AI and ML workloads in hyperscale data centers, highlighting the industry’s focus on data resilience

- Growing adoption of autonomous vehicles, 5G infrastructure, and IoT devices is further fueling demand for error correction code memory to ensure fault tolerance in mission-critical applications

- Rising cybersecurity concerns and regulatory compliance in sectors such as finance and healthcare are also contributing, as error correction code memory provides secure data storage and prevents costly downtime due to errors

- In addition, the surge in AI-driven applications and edge computing is expanding the need for error correction code memory in devices beyond traditional servers, including industrial automation systems, automotive electronics, and consumer electronics

- The shift towards high-performance computing (HPC) and real-time analytics is ensuring error correction code memory remains a core enabler of reliability and efficiency across industries

Which Factor is Challenging the Growth of the Error Correction Code (ECC) Memory Market?

- One of the major challenges facing the error correction code memory market is its high cost compared to standard memory modules. error correction code memory requires additional circuitry and design complexity, making it less accessible for price-sensitive segments, particularly in consumer electronics

- For instance, consumer laptops and desktops often avoid error correction code modules due to cost considerations, limiting adoption primarily to servers, data centers, and enterprise systems

- Another barrier is the compatibility constraint, as error correction code memory requires motherboards and CPUs specifically designed to support error correction, narrowing its application range

- Furthermore, increasing system complexity—especially in AI-driven and high-bandwidth environments—demands constant innovation in error correction code technologies. However, rapid technological shifts create challenges for vendors in terms of R&D investment and scalability

- Cybersecurity remains a parallel concern, as even error correction code -protected systems can be exposed to sophisticated hardware attacks if not paired with robust encryption and authentication measures

- Overcoming these hurdles will require cost optimization, consumer education, and stronger ecosystem collaboration between hardware manufacturers and system integrators. Addressing these challenges is vital for ensuring widespread adoption and sustained market growth

How is the Error Correction Code (ECC) Memory Market Segmented?

The market is segmented on the basis of memory error, type, application, and industry.

- By Memory Error

On the basis of memory error, the error correction code Memory market is segmented into hard error and soft error. The soft error segment dominated the market with a 62.5% revenue share in 2024, driven by the increasing complexity of semiconductor devices and their susceptibility to radiation-induced and transient faults. Soft errors are common in high-density DRAMs used in servers and data centers, creating strong demand for error correction code -enabled modules to ensure reliability and prevent data corruption.

The hard error segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the rising use of high-performance computing and mission-critical applications, where manufacturing defects or physical failures must be mitigated through error correction. Growing adoption of AI-driven workloads and enterprise servers is further fueling the need for ECC systems that can address both transient and permanent memory errors effectively.

- By Type

On the basis of type, the error correction code Memory market is segmented into DDR4, DDR3, DDR2, DDR1, and others. The DDR4 segment accounted for the largest market share of 48.7% in 2024, driven by its widespread adoption in data centers and enterprise servers due to higher bandwidth, energy efficiency, and compatibility with modern processors. DDR4 error correction code memory remains the backbone of large-scale storage and cloud infrastructure because of its reliability and scalability.

The DDR5 (considered under “Others”) and DDR4 hybrid systems are projected to witness the fastest growth from 2025 to 2032. Rising demand for AI, machine learning, and edge computing applications will accelerate the transition toward newer-generation memory with higher speeds and capacity. With increasing workloads in HPC and cloud computing, DDR5-based error correction code memory is set to become the preferred choice for high-throughput environments, gradually replacing DDR3 and older technologies.

- By Application

On the basis of application, the error correction code Memory market is segmented into data centers, workstation servers, cloud servers, and others. The data centers segment dominated the market with a 54.1% revenue share in 2024, owing to the massive expansion of hyperscale data centers and the growing reliance on error correction code memory for minimizing downtime and ensuring uninterrupted data integrity. Enterprises increasingly depend on error correction code -enabled modules to support virtualization, database management, and storage-intensive workloads.

The cloud servers segment is expected to register the fastest CAGR from 2025 to 2032, fueled by the surge in cloud adoption across industries. Cloud service providers prioritize ECC memory integration to support mission-critical applications, SaaS platforms, and secure multi-user environments. The rise of 5G, IoT, and AI-driven applications will further strengthen cloud infrastructure demand, driving substantial growth for error correction code -enabled solutions in distributed and scalable computing environments.

- By Industry

On the basis of industry, the error correction code Memory market is segmented into personal use and business use. The business use segment dominated the market with a 67.3% share in 2024, supported by the widespread adoption of error correction code memory in enterprise-grade servers, data centers, and HPC environments. Businesses prioritize error correction code integration to maintain secure operations, prevent system crashes, and protect critical datasets from corruption, particularly in finance, healthcare, and telecommunications.

The personal use segment is anticipated to witness the fastest growth from 2025 to 2032. Increasing adoption of error correction code memory in gaming PCs, high-performance desktops, and consumer-level workstations is driving this trend. With the rise of home-based digital content creation and professional freelancing, individuals are recognizing the value of error correction code memory in enhancing reliability. Furthermore, affordable error correction code -compatible consumer hardware is expanding personal adoption, creating new growth opportunities in this segment.

Which Region Holds the Largest Share of the Error Correction Code (ECC) Memory Market?

- North America dominated the error correction code (ECC) memory market with the largest revenue share of 42.36% in 2024, driven by rising demand for reliable and high-performance memory solutions in data centers, cloud computing, and enterprise servers

- The region benefits from strong adoption of AI, machine learning, and big data analytics, which require robust error correction code -enabled systems to prevent downtime and ensure data accuracy

- The presence of leading technology companies and semiconductor manufacturers, combined with high IT spending, makes North America a major hub for error correction code memory adoption across industries

U.S. Error Correction Code (ECC) Memory Market Insight

The U.S. market captured 81% of North America’s revenue share in 2024, supported by the rapid expansion of hyperscale data centers and cloud providers such as AWS, Microsoft Azure, and Google Cloud. Enterprises are prioritizing error correction code memory to safeguard critical workloads, including financial transactions, healthcare records, and AI-driven computations. The growing prevalence of high-performance computing (HPC), combined with government initiatives in cybersecurity and advanced computing, further strengthens the country’s position as a global leader in error correction code memory deployment.

Europe Error Correction Code (ECC) Memory Market Insight

The Europe error correction code Memory market is projected to grow at a substantial CAGR during the forecast period, supported by stringent data security regulations such as GDPR and increasing demand for reliable computing infrastructure. The rise of Industry 4.0, edge computing, and smart manufacturing is driving error correction code adoption across both enterprise and industrial applications. Moreover, European enterprises are investing in energy-efficient and sustainable IT solutions, creating a strong pull for error correction code -enabled systems that enhance data integrity while supporting eco-friendly operations.

U.K. Error Correction Code (ECC) Memory Market Insight

The U.K. market is expected to expand at a noteworthy CAGR during the forecast period, propelled by the increasing digitalization of financial services, e-commerce, and government sectors. Data protection concerns and the surge in cloud service usage are accelerating error correction code adoption. In addition, the country’s growing base of small and medium enterprises (SMEs) is embracing affordable error correction code -enabled server solutions to secure operations, while large corporations continue to upgrade their IT infrastructure with high-reliability memory systems.

Germany Error Correction Code (ECC) Memory Market Insight

The Germany error correction code Memory market is projected to expand considerably, driven by strong demand in automotive, industrial automation, and research sectors. As Europe’s manufacturing powerhouse, Germany’s reliance on HPC and advanced computing in automotive R&D and engineering is fueling error correction code adoption. Furthermore, the country’s commitment to innovation and sustainability supports the integration of high-efficiency error correction code memory in both enterprise and government infrastructures, aligning with its push toward digital sovereignty and secure IT ecosystems.

Which Region is the Fastest Growing Region in the Error Correction Code (ECC) Memory Market?

Asia-Pacific is poised to grow at the fastest CAGR of 9.24% from 2025 to 2032, fueled by rapid digitalization, rising disposable incomes, and large-scale investments in IT infrastructure. Countries such as China, Japan, and India are leading demand with expanding cloud ecosystems, 5G rollout, and increasing adoption of AI-driven technologies. The region’s strong semiconductor manufacturing base, coupled with cost-efficient error correction code memory production, makes APAC both a key consumer and producer, driving accessibility across enterprise and consumer segments.

Japan Error Correction Code (ECC) Memory Market Insight

The Japan error correction code Memory market is expanding steadily, supported by the country’s advanced technological infrastructure and demand for highly secure and reliable computing systems. The integration of error correction code memory into servers powering IoT ecosystems, healthcare, and financial services is fueling adoption. Moreover, Japan’s aging population and growing emphasis on automation and connected systems are expected to accelerate demand for user-friendly yet highly secure error correction code -enabled solutions.

China Error Correction Code (ECC) Memory Market Insight

The China error correction code Memory market accounted for the largest share in Asia-Pacific in 2024, underpinned by its expanding middle class, government-backed smart city initiatives, and rapid adoption of cloud services. China is also home to major semiconductor companies, boosting the local supply of affordable ECC memory solutions. The strong demand for consumer electronics, AI platforms, and enterprise-grade servers ensures continued growth, positioning China as a central driver of the APAC ECC Memory market.

Which are the Top Companies in Error Correction Code (ECC) Memory Market?

The error correction code (ECC) memory industry is primarily led by well-established companies, including:

- 4DS Memory Limited (Australia)

- Adesto Technologies Corporation (U.S.)

- Avalanche Technology (U.S)

- Cypress Semiconductor Corporation (U.S.)

- Everspin Technologies, Inc. (U.S.)

- FUJITSU (Japan)

- IBM (U.S.)

- Microchip Technology Inc. (U.S.)

- Nantero (U.S.)

- Samsung (South Korea)

- Rambus (U.S.)

- SK hynix Inc. (South Korea)

- Spin Memory Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Toshiba Corporation (Japan)

- Texas Instruments Incorporated (U.S.)

- Western Digital Corporation (U.S.)

- Viking Technology (U.S.)

What are the Recent Developments in Global Error Correction Code (ECC) Memory Market?

- In March 2023, Kingston Technology introduced its latest DDR5 ECC memory, delivering improved performance and enhanced data integrity. The new DDR5 ECC is equipped with the capability to detect and correct multi-bit errors, ensuring more reliable operations. This advancement reinforces Kingston’s position in meeting the growing demand for high-performance and secure memory solutions

- In January 2023, Alliance Memory launched new low-power static random-access memory (SRAM) chips with enhanced reliability. These 1Mb and 4Mb devices (AS6CE1016A and AS6CE4016B) feature built-in error correction code (ECC) for better data integrity, offering reduced soft error rates (SER) and longer failure time metrics compared to previous generations. This development broadens the applicability of ECC-based SRAM across consumer electronics, industrial automation, communication systems, and medical devices

- In December 2022, Micron confirmed that its DDR5 server memory lineup is now compatible with Intel's 4th Gen Xeon Scalable processors. This validation unlocks the full potential of DDR5 memory, delivering twice the bandwidth of earlier generations to support the rising core counts of modern data center processors. This compatibility marks a critical step in accelerating next-generation data center performance and scalability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Error Correction Code Ecc Memory Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Error Correction Code Ecc Memory Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Error Correction Code Ecc Memory Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.