Global Erythropoietin Epo Drugs Market

Market Size in USD Billion

CAGR :

%

USD

9.12 Billion

USD

22.60 Billion

2024

2032

USD

9.12 Billion

USD

22.60 Billion

2024

2032

| 2025 –2032 | |

| USD 9.12 Billion | |

| USD 22.60 Billion | |

|

|

|

|

Erythropoietin (EPO) Drugs Market Size

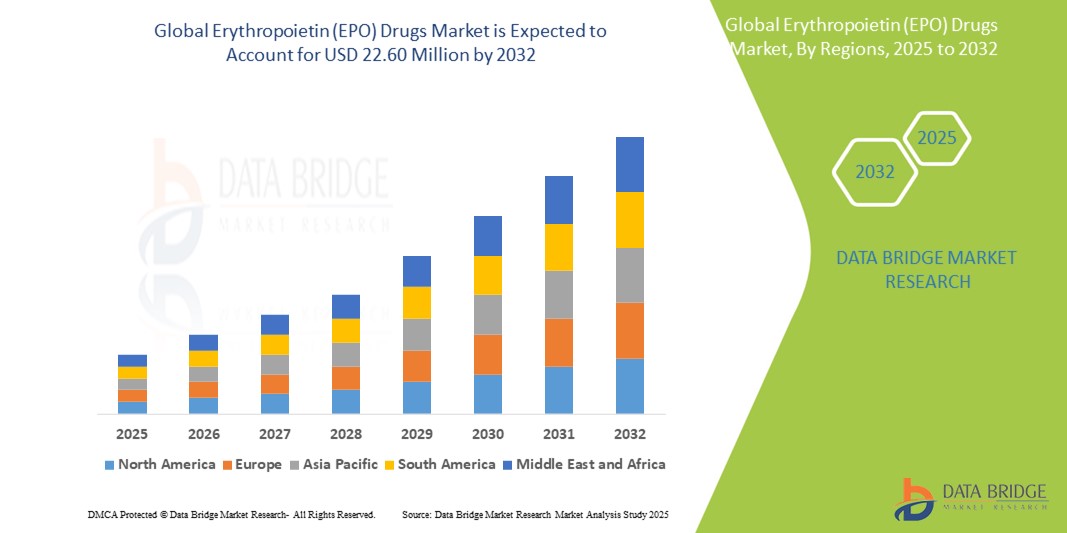

- The global erythropoietin (EPO) drugs market size was valued at USD 9.12 billion in 2024 and is expected to reach USD 22.60 billion by 2032, at a CAGR of 12.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic kidney disease (CKD), cancer-related anemia, and other hematologic conditions requiring EPO therapy, alongside the growing aging population worldwide

- Furthermore, rising demand for biosimilar EPO products and improved healthcare infrastructure in emerging economies are strengthening market dynamics. These converging factors are accelerating the adoption of erythropoietin drugs, thereby significantly boosting the industry's growth

Erythropoietin (EPO) Drugs Market Analysis

- Erythropoietin (EPO) drugs, which stimulate red blood cell production, are essential in the treatment of anemia related to chronic kidney disease (CKD), chemotherapy, and other critical conditions, gaining increasing relevance in modern clinical protocols due to their therapeutic efficacy and expanding indications across various healthcare settings

- The rising demand for EPO drugs is primarily fueled by the growing global burden of CKD and cancer, the increasing aging population, and a heightened focus on improving patient outcomes in chronic care management

- North America dominated the erythropoietin (EPO) drugs market with the largest revenue share of 39% in 2024, supported by advanced healthcare infrastructure, high awareness levels, and a robust reimbursement framework, with the United States showing significant uptake of both branded and biosimilar EPO products driven by strategic collaborations and government-supported anemia management initiatives

- Asia-Pacific is expected to be the fastest growing region in the erythropoietin (EPO) drugs market during the forecast period due to improving access to healthcare services, rising prevalence of anemia-inducing conditions, and increased investment in biosimilar production by regional pharmaceutical firms

- Epoetin alfa segment dominated the erythropoietin (EPO) drugs market with a market share of 47% in 2024, driven by its long-standing clinical use, proven safety profile, and widespread availability across both developed and emerging markets

Report Scope and Erythropoietin (EPO) Drugs Market Segmentation

|

Attributes |

Erythropoietin (EPO) Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Erythropoietin (EPO) Drugs Market Trends

“Biosimilar Expansion Driving Market Accessibility and Cost Efficiency”

- A significant and accelerating trend in the global erythropoietin (EPO) drugs market is the increasing adoption and development of biosimilar EPO products, which are offering cost-effective alternatives to branded biologics and expanding access to anemia treatments across emerging and developed markets

- For instance, companies such as Pfizer and Dr. Reddy’s Laboratories are actively promoting biosimilars such as Retacrit and Reditux, targeting markets with high anemia prevalence but limited affordability for originator biologics. These products offer comparable efficacy and safety at reduced costs, thereby appealing to public health systems and cost-conscious patients

- The proliferation of biosimilars is promoting healthy competition in the market, pushing originator companies to innovate and optimize production, while providing wider availability of erythropoietin drugs for conditions such as chronic kidney disease (CKD) and chemotherapy-induced anemia

- Moreover, biosimilar EPO drugs are increasingly gaining regulatory approvals in various countries, helping to broaden their usage in healthcare systems with budget constraints. Regions such as Asia-Pacific and Latin America are especially benefiting from the entry of these affordable therapeutic alternatives

- The trend toward biosimilars is not only enhancing treatment accessibility but also contributing to the sustainability of national healthcare budgets. In addition, partnerships between biosimilar developers and local distributors are facilitating quicker market penetration and improved supply chain efficiencies

- This growing emphasis on biosimilar development and commercialization is fundamentally reshaping the competitive landscape of the EPO drugs market, enabling better therapeutic coverage, especially in underserved populations

Erythropoietin (EPO) Drugs Market Dynamics

Driver

“Rising Burden of Chronic Kidney Disease and Cancer-Associated Anemia”

- The growing global prevalence of chronic kidney disease (CKD) and anemia associated with chemotherapy treatments in cancer patients is a major driver for the increasing demand for erythropoietin (EPO) drugs

- For instance, the International Society of Nephrology has highlighted that over 850 million people worldwide live with kidney diseases, many of whom require long-term anemia management, making EPO therapy a clinical necessity. In parallel, rising global cancer incidence has amplified the need for erythropoiesis-stimulating agents (ESAs) to manage treatment-related anemia

- EPO drugs play a critical role in reducing the need for blood transfusions, improving patient quality of life, and enabling the continuation of essential treatments such as dialysis or chemotherapy

- In addition, the growing elderly population, who are more prone to both CKD and cancer, further contributes to the rising patient pool dependent on EPO therapies

- Healthcare advancements, increased awareness about anemia management, and broader reimbursement policies in developed regions are also driving the market forward. The development of more convenient formulations, including less frequent dosing schedules, is enhancing patient compliance and treatment outcomes

Restraint/Challenge

“Patent Expirations and Regulatory Complexity for Biosimilars”

- The expiry of patents for major branded EPO drugs has opened the market to biosimilar competition, which while beneficial for access, presents significant challenges for innovator companies in terms of revenue retention and market share

- For instance, Amgen's Epogen and Johnson & Johnson’s Procrit have faced intense biosimilar competition post-patent expiry, leading to pricing pressures and necessitating strategic pivots towards differentiated product offerings or next-generation biologics

- Furthermore, regulatory pathways for biosimilar EPO drugs remain complex and inconsistent across different markets. Companies must invest significantly in comparative clinical trials and pharmacovigilance programs to meet varying regional approval standards

- These regulatory requirements can prolong product development timelines and increase costs, particularly for smaller firms entering the biosimilar space

- In addition, lingering skepticism among some healthcare providers regarding the interchangeability of biosimilars with originator drugs may hinder full-scale adoption, especially in conservative markets

- Overcoming these challenges will require collaborative efforts between pharmaceutical companies, regulators, and healthcare providers to streamline biosimilar approvals, educate stakeholders on biosimilar efficacy, and ensure long-term cost and quality balance in anemia management

Erythropoietin (EPO) Drugs Market Scope

The market is segmented on the basis of drug type, drugs, indication, end-users, and distribution channel.

- By Drug Type

On the basis of drug type, the erythropoietin (EPO) drugs market is segmented into biologics and biosimilars. The biologics segment dominated the market with the largest market revenue share in 2024, driven by the established use of originator drugs such as Epogen and Aranesp, which have been widely prescribed for anemia management in patients with chronic kidney disease and cancer. The reliability, regulatory approvals, and physician familiarity with biologics contribute to their sustained dominance in clinical settings.

The biosimilars segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing cost pressures on healthcare systems and the global drive to enhance treatment accessibility. Biosimilars offer a cost-effective alternative without compromising efficacy, making them highly attractive in emerging markets and for budget-conscious healthcare providers.

- By Drugs

On the basis of drugs, the erythropoietin (EPO) drugs market is segmented into epoetin-alfa, darbepoetin-alfa, epoetin-beta, and others. The epoetin-alfa segment dominated the market with the largest market revenue share of 47% in 2024, driven by its early introduction, extensive clinical usage, and wide regulatory approvals across multiple indications. Epoetin-Alfa remains the most prescribed EPO drug due to its proven effectiveness and availability in both branded and biosimilar forms.

The darbepoetin-alfa segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by its longer half-life and less frequent dosing schedule, which improves patient adherence and quality of life. Its increasing use in dialysis centers and among elderly populations is also driving its market momentum.

- By Indication

On the basis of indication, the erythropoietin (EPO) drugs market is segmented into cancer, neurology, hematology, renal diseases, and others. The renal diseases segment dominated the market with the largest market revenue share in 2024, due to the widespread use of EPO therapy in managing anemia associated with chronic kidney disease, particularly among patients undergoing dialysis. The rising global burden of CKD is a major contributor to this segment’s dominance.

The cancer segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing global cancer incidence and the use of EPO drugs in managing chemotherapy-induced anemia. Improved supportive care in oncology and rising awareness of anemia management are propelling this segment forward.

- By End User

On the basis of end-users, the erythropoietin (EPO) drugs market is segmented into hospitals, homecare, specialty centres, and others. The hospitals segment dominated the market with the largest market revenue share in 2024, driven by the high concentration of patients receiving EPO therapy in inpatient and outpatient hospital settings. Hospitals remain the primary points of administration for biologic drugs under physician supervision.

The homecare segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the growing trend toward home-based care, increased availability of subcutaneous formulations, and a preference for self-administration among patients with chronic conditions. This shift is particularly notable in developed regions with robust homecare infrastructure.

- By Distribution Channel

On the basis of distribution channel, the erythropoietin (EPO) drugs market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment held the largest market revenue share in 2024, supported by the close integration of EPO drug administration with inpatient care, oncology, and dialysis services. Hospital pharmacies play a key role in managing prescriptions for biologics and ensuring patient adherence.

The online pharmacy segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing digitalization in healthcare, patient preference for convenience, and the expansion of telemedicine services. Online platforms are enabling broader access to EPO therapies, especially in urban and remote areas.

Erythropoietin (EPO) Drugs Market Regional Analysis

- North America dominated the erythropoietin (EPO) drugs market with the largest revenue share of 39% in 2024, supported by advanced healthcare infrastructure, high awareness levels, and a robust reimbursement framework, with the United States showing significant uptake of both branded and biosimilar EPO products driven by strategic collaborations and government-supported anemia management initiatives

- The region’s market leadership is reinforced by a well-established healthcare infrastructure, high healthcare expenditure, and the strong presence of leading pharmaceutical companies actively investing in biologics and biosimilars

- Patients and healthcare providers in North America demonstrate a high degree of trust in erythropoiesis-stimulating agents, and widespread insurance coverage ensures accessibility to both branded and biosimilar EPO drugs. In addition, ongoing advancements in biotechnology and early adoption of next-generation therapies continue to strengthen the region’s dominance in the EPO drugs market

U.S. Erythropoietin (EPO) Drugs Market Insight

The U.S. erythropoietin (EPO) drugs market captured the largest revenue share of over 85% in 2024 within North America, driven by the high prevalence of chronic kidney disease, cancer-related anemia, and favorable reimbursement policies. The strong presence of key biopharmaceutical manufacturers and the availability of both originator biologics and biosimilars ensure widespread access to EPO therapies. In addition, advanced healthcare infrastructure, rising awareness of anemia management, and rapid uptake of biosimilars due to cost-saving initiatives are further accelerating market growth.

Europe Erythropoietin (EPO) Drugs Market Insight

The Europe erythropoietin (EPO) drugs market is projected to grow at a substantial CAGR throughout the forecast period, supported by rising incidences of anemia, an aging population, and increased healthcare expenditure across the region. The European Medicines Agency’s support for biosimilar approvals has also fostered competition and affordability. Enhanced diagnostic capabilities, strong pharmaceutical research, and national anemia management programs across countries such as Germany and France are driving adoption in both hospital and home settings.

U.K. Erythropoietin (EPO) Drugs Market Insight

The U.K. erythropoietin (EPO) drugs market is anticipated to grow at a noteworthy CAGR during the forecast period, spurred by national initiatives to improve cancer and renal care outcomes. With the NHS encouraging the use of biosimilars to reduce healthcare costs, the demand for cost-effective EPO treatments is rising. An increasing number of dialysis centers and oncology treatment units are integrating biosimilar EPO drugs into clinical care, enabling broader access to anemia management solutions.

Germany Erythropoietin (EPO) Drugs Market Insight

The Germany erythropoietin (EPO) drugs market is expected to expand at a considerable CAGR during the forecast period, propelled by robust healthcare policies, a high burden of chronic kidney and cancer-related diseases, and strong biosimilar penetration. Germany’s pharmaceutical industry is also at the forefront of developing and distributing erythropoietin biosimilars, benefiting from established logistics, regulatory alignment, and physician confidence in biosimilar efficacy.

Asia-Pacific Erythropoietin (EPO) Drugs Market Insight

The Asia-Pacific erythropoietin (EPO) drugs market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing patient populations suffering from CKD, cancer, and other chronic illnesses. Government-led healthcare reforms, expanding dialysis networks, and growing biosimilar manufacturing capabilities are key drivers across emerging markets. The improving affordability of biosimilars and awareness of anemia management are enabling broader adoption, especially in China and India.

Japan Erythropoietin (EPO) Drugs Market Insight

The Japan erythropoietin (EPO) drugs market is gaining momentum due to its highly developed healthcare system, aging population, and elevated incidence of renal disorders. Japanese pharmaceutical companies continue to play a vital role in developing advanced EPO formulations, while integration with home-based dialysis and cancer care is becoming more common. Regulatory support for innovation and patient-centric therapies is helping accelerate market growth.

India Erythropoietin (EPO) Drugs Market Insight

The India erythropoietin (EPO) drugs market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the country’s expanding dialysis infrastructure, growing burden of chronic diseases, and strong local biosimilar manufacturing sector. Increasing access to low-cost biosimilar EPOs, along with rising government and private investment in nephrology and oncology care, is expanding treatment accessibility. In addition, domestic players are enhancing availability across tier 2 and tier 3 cities, contributing to robust market growth.

Erythropoietin (EPO) Drugs Market Share

The erythropoietin (EPO) drugs industry is primarily led by well-established companies, including:

- Pfizer Inc (U.S.)

- AstraZeneca (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Dr. Reddy's Laboratories Ltd (India)

- Endo International plc (Ireland)

- Teva Pharmaceutical Industries Ltd (Israel)

- Sun Pharmaceutical Industries Ltd (India)

- Viatris Inc. (U.S.)

- Novartis AG (Switzerland)

- Lupin (India)

- Cipla Inc (India)

- Shanghai Dahua Pharmaceutical Co., Ltd (China)

- JCR Pharmaceuticals Co., Ltd (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sandoz International GmbH (Germany)

- Intas Pharmaceuticals Ltd. (India)

- LG Chem Ltd. (South Korea)

- Zydus Group (India)

- Kyowa Kirin Co., Ltd. (Japan)

- 3SBio Inc. (China)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Panacea Biotec Ltd. (India)

- Biocon Limited (India)

- Celltrion Healthcare Co., Ltd. (South Korea)

What are the Recent Developments in Global Erythropoietin (EPO) Drugs Market?

- In May 2025, the Rotary Club of Kuala Lumpur DiRaja, in collaboration with local healthcare partners, launched a large-scale initiative in Malaysia to distribute erythropoietin injections to over 300 underprivileged end-stage kidney disease (ESKD) patients nationwide. This program aims to improve treatment adherence and reduce anemia-related complications in vulnerable populations, highlighting the increasing emphasis on equitable access to biologic therapies in emerging markets.

- In March 2024, the U.S. Food and Drug Administration (FDA) approved a record number of 18 biosimilars in a single year, including multiple biosimilars for reference products such as Epoetin Alfa. This surge in biosimilar approvals reflects a favorable regulatory environment and strengthens the global competitive landscape of the EPO drugs market by improving affordability and patient access

- In January 2024, Dr. Reddy’s Laboratories announced the expansion of its biosimilar portfolio with the launch of Epoetin Alfa biosimilar in select European markets. The move aligns with the company’s strategy to capitalize on the growing demand for cost-effective anemia treatments and underscores the biosimilar’s increasing acceptance across key regions

- In December 2023, Pfizer reported positive results from a real-world evidence study demonstrating the comparable efficacy and safety of its Retacrit (epoetin alfa-epbx) biosimilar in managing anemia among chronic kidney disease and oncology patients. The findings are expected to bolster confidence in biosimilar adoption among healthcare providers and support broader utilization in clinical practice

- In November 2023, Biosidus S.A., a leading Latin American biopharmaceutical company, expanded its EPO product line by securing new distribution agreements across Southeast Asia and the Middle East. This development marks a strategic effort to strengthen its international footprint and meet the rising regional demand for erythropoiesis-stimulating agents, particularly in dialysis and cancer care settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.