Global Esthetic Dental Restoration Products Market

Market Size in USD Billion

CAGR :

%

USD

15.00 Billion

USD

23.26 Billion

2025

2033

USD

15.00 Billion

USD

23.26 Billion

2025

2033

| 2026 –2033 | |

| USD 15.00 Billion | |

| USD 23.26 Billion | |

|

|

|

|

Esthetic Dental Restoration Products Market Size

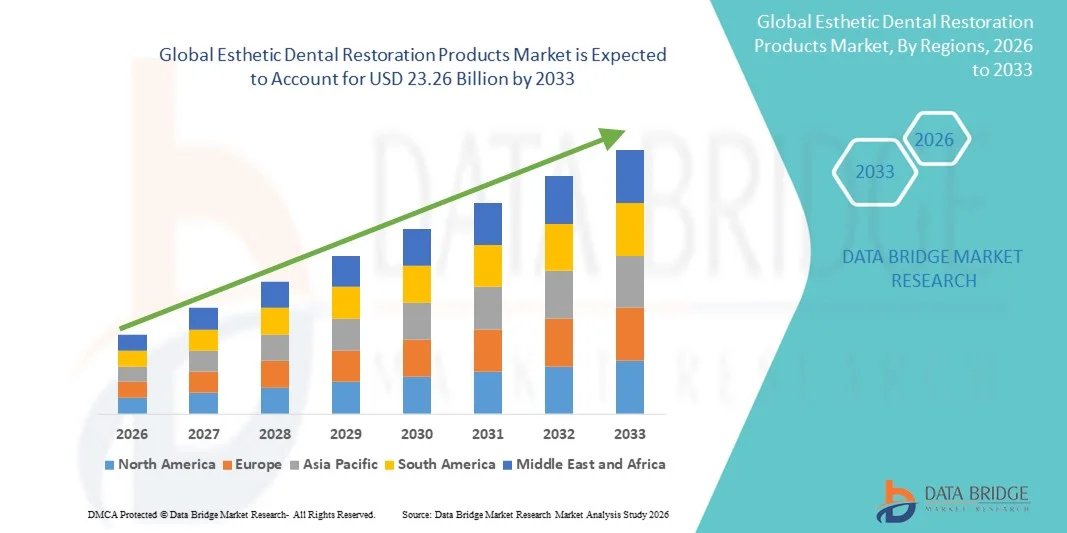

- The global esthetic dental restoration products market size was valued at USD 15.00 billion in 2025 and is expected to reach USD 23.26 billion by 2033, at a CAGR of 5.64% during the forecast period

- The market growth is largely fueled by the increasing adoption of aesthetic and cosmetic dental procedures, rising demand for tooth-colored restoratives, and technological advancements in restorative materials, driving enhanced outcomes in both restorative and cosmetic dentistry

- Furthermore, rising consumer preference for durable, natural-looking, and biocompatible dental solutions, coupled with growing dental awareness and an aging population, is establishing esthetic dental restoration products as the preferred choice in modern dentistry. These converging factors are accelerating the uptake of esthetic dental solutions, thereby significantly boosting the industry's growth

Esthetic Dental Restoration Products Market Analysis

- Esthetic dental restoration products, including restorative materials, dental implants, dental bridges, prosthetics, dental crowns, veneers, bonding agents, inlays/onlays, and restorative equipment, are increasingly vital components of modern dentistry due to their ability to restore function, enhance aesthetics, and support minimally invasive procedures in both clinical and research settings

- The escalating demand for esthetic dental restoration products is primarily fueled by growing consumer awareness of oral health and cosmetic dentistry, rising prevalence of dental disorders, and increasing preference for natural-looking, durable, and biocompatible dental solutions

- North America dominated the esthetic dental restoration products market with the largest revenue share of 38.2% in 2025, characterized by high dental expenditure, early adoption of advanced dental technologies, and a strong presence of key industry players, with the U.S. experiencing substantial growth in dental restorations, particularly in cosmetic procedures driven by innovations in CAD/CAM technology and advanced ceramic and composite materials

- Asia-Pacific is expected to be the fastest growing region in the esthetic dental restoration products market during the forecast period due to increasing urbanization, rising disposable incomes, and growing dental awareness among middle-class populations

- Restorative materials segment dominated the esthetic dental restoration products market with a market share of 42.5% in 2025, driven by their versatility, ease of application, and broad adoption across hospitals, clinics, and dental laboratories

Report Scope and Esthetic Dental Restoration Products Market Segmentation

|

Attributes |

Esthetic Dental Restoration Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Esthetic Dental Restoration Products Market Trends

Advancements Through Digital Dentistry and CAD/CAM Integration

- A significant and accelerating trend in the global esthetic dental restoration products market is the increasing integration of digital dentistry solutions, including CAD/CAM systems, 3D printing, and intraoral scanners, enhancing precision, customization, and efficiency in restorative procedures

- For instance, digital workflows in clinics allow dentists to design and fabricate crowns, veneers, and bridges in a single visit, significantly reducing turnaround times and improving patient satisfaction

- CAD/CAM integration enables features such as real-time adjustments of restoration fit, color matching for natural aesthetics, and improved reproducibility of prosthetics. For instance, some systems such as CEREC and Planmeca PlanCAD optimize restoration design and milling accuracy, enhancing clinical outcomes

- The seamless integration of digital solutions with restorative procedures facilitates centralized control over treatment planning, production, and delivery, enabling dental laboratories and clinics to deliver consistent, high-quality results

- This trend towards more intelligent, precise, and digitally integrated restorative systems is fundamentally reshaping patient and dentist expectations for aesthetics and efficiency. Consequently, companies such as Dentsply Sirona are developing AI-enabled design tools that optimize material selection and restoration design

- The demand for esthetic dental restoration products that offer digital and CAD/CAM integration is growing rapidly across both clinical and laboratory sectors, as dentists increasingly prioritize precision, speed, and patient satisfaction

- Increasing patient preference for minimally invasive treatments and same-day restorations is encouraging innovation in resin composites and ceramic materials, boosting market adoption

- Collaborations between dental product manufacturers and software companies to enhance digital workflows and treatment planning are creating new opportunities for advanced restorative solutions

Esthetic Dental Restoration Products Market Dynamics

Driver

Growing Demand Due to Rising Cosmetic Dentistry Awareness

- The increasing awareness of cosmetic dentistry among consumers, coupled with the rising adoption of restorative and aesthetic dental procedures, is a significant driver for the heightened demand for esthetic dental restoration products

- For instance, in April 2025, Ivoclar Vivadent launched a new line of high-translucency composites targeting aesthetic restorations, designed for long-lasting natural results, driving adoption in cosmetic treatments

- As patients seek enhanced smiles, natural aesthetics, and durable restorations, esthetic dental products offer advanced features such as tooth-colored materials, biocompatibility, and minimally invasive application, providing a compelling alternative to traditional materials

- Furthermore, the growing popularity of digitally aided restorative procedures and aesthetic treatments in urban areas is making esthetic dental products an integral component of modern dentistry, offering seamless integration with digital workflows

- The convenience of same-day restorations, rapid fabrication of crowns and veneers, and the ability to customize solutions according to patient needs are key factors propelling adoption in hospitals, clinics, and dental laboratories. The trend towards patient-centric, technologically advanced procedures further contributes to market growth

- Rising government initiatives promoting oral health and cosmetic dentistry awareness in emerging economies are expanding the potential consumer base for esthetic dental restoration products

- Increasing collaborations between dental schools, research institutes, and manufacturers for R&D in advanced restorative materials is accelerating product innovation and adoption

Restraint/Challenge

Material Limitations and Regulatory Compliance Hurdles

- Concerns regarding material durability, color stability, and potential biocompatibility issues pose a significant challenge to broader market adoption of esthetic dental restoration products. As materials are exposed to wear, staining, and oral environment variations, long-term performance can be affected

- For instance, high-profile reports of composite discoloration or ceramic chipping have made some dentists hesitant to adopt certain materials for anterior restorations

- Addressing these material concerns through improved formulations, stringent clinical testing, and adherence to international regulatory standards is crucial for building dentist and patient trust. Companies such as 3M and Kuraray emphasize rigorous material testing and certifications to reassure buyers. In addition, the relatively high cost of advanced restorative materials compared to traditional options can be a barrier for budget-conscious clinics or dental labs. While some basic composites are affordable, premium materials such as high-strength ceramics or bioactive composites often carry a higher price tag

- While prices are gradually stabilizing, the perceived premium for advanced materials and equipment can still hinder widespread adoption, particularly in emerging markets or smaller clinics

- Overcoming these challenges through material innovation, regulatory compliance, dentist education, and development of cost-effective yet high-quality restorative solutions will be vital for sustained market growth

- Limited availability of trained dental professionals skilled in handling advanced esthetic materials can slow adoption in some regions, creating a talent gap challenge

- Variability in local regulatory approvals for new dental materials and devices may delay product launches and limit market expansion in certain countries

Esthetic Dental Restoration Products Market Scope

The market is segmented on the basis of product type and end user.

- By Product Type

On the basis of product type, the esthetic dental restoration products market is segmented into restorative materials, dental implants, dental bridges, prosthetics, dental crowns, dental veneers, bonding agents, inlays and onlays, and restorative equipment. Restorative Materials segment dominated the market with the largest market revenue share of 42.5% in 2025, driven by their versatility, ease of application, and broad adoption across hospitals, clinics, and dental laboratories. These materials include composites and ceramics, widely used for both anterior and posterior restorations, offering superior esthetics and durability. Dental professionals often prefer restorative materials due to their minimal invasiveness and ability to match natural tooth color, enhancing patient satisfaction. The high demand is also supported by technological advancements, such as nano-filled composites and bioactive materials that improve strength and longevity. Their adaptability to CAD/CAM workflows and faster curing times further contribute to their dominant position. In addition, growing awareness of cosmetic dentistry and increasing cosmetic procedures in urban populations bolster restorative materials’ market share.

Dental Implants segment is anticipated to witness the fastest growth rate of 9.5% CAGR from 2026 to 2033, fueled by rising patient preference for permanent, natural-looking tooth replacement solutions. Implants are increasingly adopted due to their ability to restore function and aesthetics in edentulous patients. The aging global population, coupled with higher incidence of tooth loss, is boosting demand for implants across both developed and emerging markets. Advancements in implant design, surface coatings, and integration with digital planning software are enhancing success rates and treatment predictability. Growing awareness among dentists and patients regarding long-term oral health benefits of implants over traditional bridges is driving adoption. Increasing availability of affordable implant solutions in emerging regions further supports growth in this segment.

- By End User

On the basis of end user, the esthetic dental restoration products market is segmented into hospitals, clinics, dental laboratories, dental schools and research institutes, and others. Clinics segment dominated the market with the largest market revenue share of 39% in 2025, driven by their high patient throughput and focus on cosmetic and restorative procedures. Private dental clinics often invest in advanced restorative materials and CAD/CAM equipment to meet patient demand for same-day restorations and aesthetically pleasing outcomes. Clinics benefit from the flexibility to provide a wide range of restorative treatments, including veneers, crowns, and inlays/onlays, boosting the consumption of esthetic products. High adoption is also supported by increasing dental awareness and growing demand for minimally invasive procedures. Clinics frequently serve as early adopters for new restorative materials, which further reinforces their dominant share. Moreover, growing urban populations and higher disposable incomes in key regions contribute to the strong clinic segment performance.

Dental Laboratories segment is expected to witness the fastest growth rate of 10.2% CAGR from 2026 to 2033, driven by rising demand for custom-fabricated crowns, bridges, veneers, and other prosthetics. Laboratories increasingly adopt digital technologies, including CAD/CAM milling, 3D printing, and scanning solutions, enabling faster production with higher precision. Collaborations with dental clinics to deliver same-day restorations are expanding lab services globally. Rising outsourcing of dental restorations from clinics to laboratories fuels growth, especially in regions with growing cosmetic dentistry adoption. Laboratories also benefit from technological advancements in restorative materials, improving aesthetics and durability. The growing emphasis on personalized and high-quality dental restorations makes laboratories a rapidly expanding end-user segment.

Esthetic Dental Restoration Products Market Regional Analysis

- North America dominated the esthetic dental restoration products market with the largest revenue share of 38.2% in 2025, characterized by high dental expenditure, early adoption of advanced dental technologies, and a strong presence of key industry players

- Consumers and dental professionals in the region highly value high-quality, durable, and natural-looking restorations, alongside the seamless integration of advanced materials with digital workflows such as CAD/CAM systems and 3D printing

- This widespread adoption is further supported by high healthcare expenditure, a technologically advanced dental infrastructure, and the growing preference for minimally invasive procedures, establishing esthetic dental restoration products as the preferred choice in both clinical and laboratory settings

U.S. Esthetic Dental Restoration Products Market Insight

The U.S. esthetic dental restoration products market captured the largest revenue share of 45% in 2025 within North America, fueled by the rapid adoption of advanced restorative materials and growing demand for cosmetic dentistry. Consumers and patients are increasingly prioritizing natural-looking, durable restorations such as veneers, crowns, and dental implants. The rising preference for minimally invasive procedures, combined with robust demand for digital workflows and CAD/CAM-enabled solutions, further propels the market. Moreover, the integration of advanced restorative materials with 3D printing and intraoral scanning technologies is significantly contributing to market expansion.

Europe Esthetic Dental Restoration Products Market Insight

The Europe esthetic dental restoration products market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing awareness of cosmetic dentistry and stringent dental regulatory standards. Increasing urbanization, along with rising disposable incomes, is fostering the adoption of aesthetic and restorative dental solutions. European patients and dentists are drawn to materials offering durability, natural aesthetics, and biocompatibility. The region is experiencing significant growth across private clinics, hospitals, and dental laboratories, with esthetic restorations being incorporated into both new treatments and refurbishment procedures.

U.K. Esthetic Dental Restoration Products Market Insight

The U.K. esthetic dental restoration products market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing interest in cosmetic dentistry and the desire for high-quality, natural-looking restorations. Rising concerns over oral aesthetics and patient demand for minimally invasive solutions are encouraging both clinics and hospitals to adopt advanced restorative materials. The UK’s well-developed dental healthcare infrastructure, combined with its high patient awareness and strong private sector, is expected to continue to stimulate market growth.

Germany Esthetic Dental Restoration Products Market Insight

The Germany esthetic dental restoration products market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of oral health, technological advancements, and the growing emphasis on aesthetics in restorative procedures. Germany’s robust healthcare system, combined with a strong focus on innovation, promotes the adoption of advanced restorative materials, dental implants, and CAD/CAM-integrated workflows. The preference for durable, biocompatible, and environmentally-friendly materials is also driving adoption in both private and hospital-based clinics.

Asia-Pacific Esthetic Dental Restoration Products Market Insight

The Asia-Pacific esthetic dental restoration products market is poised to grow at the fastest CAGR of 10% during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. Growing awareness of cosmetic dentistry, coupled with government initiatives promoting oral health, is driving adoption. Furthermore, as APAC emerges as both a manufacturing hub and a rapidly expanding consumer base for dental materials, the affordability and accessibility of esthetic restorative products are increasing across clinics, hospitals, and laboratories.

Japan Esthetic Dental Restoration Products Market Insight

The Japan esthetic dental restoration products market is gaining momentum due to the country’s high-tech dental infrastructure, aging population, and demand for convenience in restorative procedures. The Japanese market emphasizes long-lasting, natural-looking restorations, and the adoption of advanced materials such as ceramics and composites is rising. Integration of CAD/CAM systems, digital scanning, and 3D printing in dental clinics is fueling market growth. Moreover, Japan’s focus on minimally invasive, patient-friendly treatments is expected to spur demand in both residential and institutional dental practices.

India Esthetic Dental Restoration Products Market Insight

The India esthetic dental restoration products market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the expanding middle class, rapid urbanization, and rising awareness of cosmetic dentistry. India represents one of the largest emerging markets for advanced restorative materials, including composites, crowns, and implants. The push towards dental digitalization and cosmetic procedures, along with the availability of affordable materials and strong domestic manufacturers, are key factors propelling market growth. Furthermore, rising investments in dental education and clinic modernization are boosting adoption across hospitals, private clinics, and dental laboratories.

Esthetic Dental Restoration Products Market Share

The Esthetic Dental Restoration Products industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Ivoclar Vivadent AG (Liechtenstein)

- GC International AG (Japan)

- Dentsply Sirona Inc. (U.S.)

- VOCO GmbH (Germany)

- COLTENE (Switzerland)

- Glidewell Dental (U.S.)

- Shofu Dental Corporation (Japan)

- Kulzer GmbH (Germany)

- Kuraray Co., Ltd. (Japan)

- Septodont Holding (France)

- Zimmer Biomet (U.S.)

- Envista Holdings Corporation (U.S.)

- Nobel Biocare (Switzerland)

- Den‑Mat Holdings, LLC (U.S.)

- Ultradent Products, Inc. (U.S.)

- BISCO, Inc. (U.S.)

- Tokuyama Dental Corporation (Japan)

- Henry Schein, Inc. (U.S.)

- Straumann Holding AG (Switzerland)

What are the Recent Developments in Global Esthetic Dental Restoration Products Market?

- In October 2025, researchers at University of Texas at Dallas unveiled a breakthrough technology enabling same‑day, 3D‑printed dental restorations made of zirconia often considered the “gold standard” for permanent dental work. Their method significantly reduces the traditionally lengthy “debinding” step from 20–100 hours down to under 30 minutes using porous graphite felt and enhanced heat transfer paving the way for customized, chair‑side crowns, bridges, or veneers within hours instead of weeks

- In October 2025, following the UT Dallas breakthrough, multiple dental‑industry media outlets highlighted the potential of 30‑minute 3D‑printed zirconia restorations. The coverage underscored that this method may overcome long‑standing barriers to same‑day permanent ceramic restorations, offering better customization, color matching, and efficiency and reducing material waste compared to traditional milling-based zirconia fabrication

- In November 2024, Pulpdent introduced ACTIVA BioACTIVE Bulk Flow, a next‑generation bulk‑fill restorative material that supports natural remineralization, offers universal shade matching reduces shrinkage stress, and allows true self‑leveling, one‑step restorations without the need for a capping layer enabling more efficient Class II procedures and enhancing protection against secondary caries

- In February 2023, SprintRay Inc. a digital‑dentistry and 3D‑printing solutions provider introduced its new SprintRay Ceramic Crown 3D Printing Ecosystem, the world's first fully integrated workflow for chair‑side printing of definitive ceramic single crowns and veneers. With this system, dental practices can potentially design and deliver high-quality ceramic restorations in a single appointment, significantly accelerating restoration workflows and enabling same‑day cosmetic and restorative care

- In October 2022, 3M Oral Care launched 3M Filtek Matrix a new restorative solution that uses a patient‑specific digital “matrix” to transfer composite restorations onto teeth. This additive composite technique reduces or eliminates the need for extensive tooth reduction, making procedures less invasive. Clinicians reported more predictable, aesthetic results and reduced “chair‑time,” enhancing both patient comfort and operational efficiency in restorative procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.