Global Ethernet Storage Fabric Market

Market Size in USD Billion

CAGR :

%

USD

3.47 Billion

USD

10.68 Billion

2024

2032

USD

3.47 Billion

USD

10.68 Billion

2024

2032

| 2025 –2032 | |

| USD 3.47 Billion | |

| USD 10.68 Billion | |

|

|

|

|

Ethernet Storage Fabric Market Size

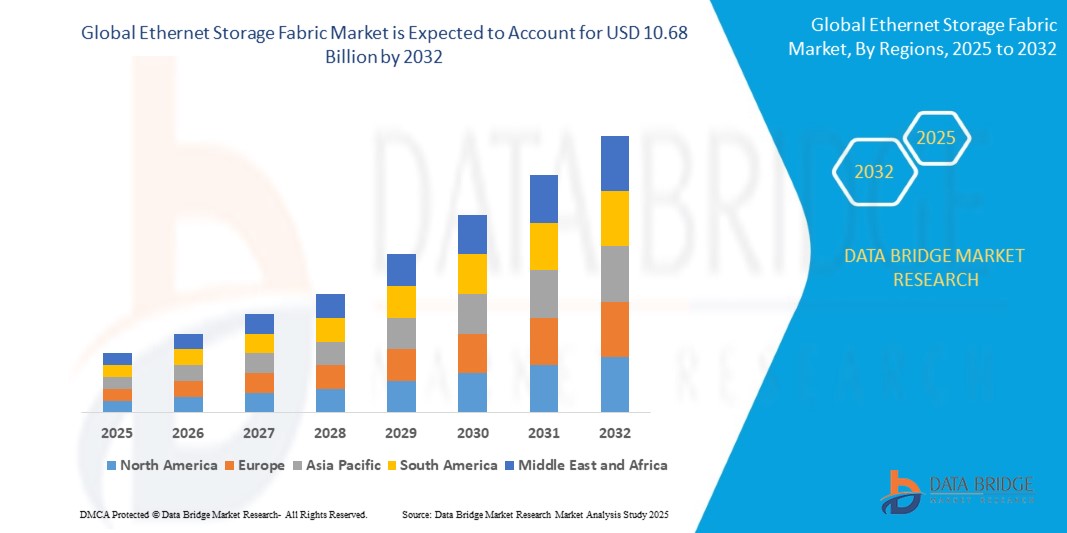

- The global ethernet storage fabric market was valued at USD 3.47 billion in 2024 and is projected to reach USD 10.68 billion by 2032, growing at a CAGR of 17.42% during the forecast period.

- Growth is driven by the rising need for high-speed, scalable, and low-latency data center storage networks, especially in cloud environments and enterprise applications with real-time analytics and AI workloads.

Ethernet Storage Fabric Market Analysis

- Ethernet Storage Fabric (ESF) enables high-bandwidth, lossless, and low-latency data transport between servers and storage arrays, particularly important in modern data centers where storage performance is critical to application delivery.

- Traditional Fibre Channel networks are increasingly being replaced by ESF due to Ethernet’s cost-effectiveness, scalability, and convergence capabilities, allowing storage, compute, and network traffic on a single infrastructure.

- Enterprises and hyperscale cloud providers are deploying NVMe over Fabrics (NVMe-oF) with Ethernet as the transport layer to maximize IOPS, reduce bottlenecks, and improve storage density across hybrid and multi-cloud architectures.

- The rise of AI, machine learning, big data analytics, and real-time transaction processing is pushing demand for high-performance storage fabrics that can scale seamlessly without compromising throughput.

- Software-defined networking (SDN), RDMA (Remote Direct Memory Access), and advancements in RoCE (RDMA over Converged Ethernet) are enabling highly efficient ESF architectures in both public and private cloud environments.

Report Scope and Ethernet Storage Fabric Market Segmentation

|

Attributes |

Ethernet Storage Fabric Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ethernet Storage Fabric Market Trends

AI-Driven Workloads, NVMe-oF Expansion, and Fabric Convergence Accelerate Adoption

- Proliferation of NVMe-over-Fabrics (NVMe-oF): Organizations are rapidly adopting NVMe-oF over Ethernet to unlock ultra-low latency and parallelized access to high-performance flash storage. This trend is transforming data center I/O architectures, particularly for analytics, HPC, and AI/ML use cases.

- Shift from Fibre Channel to Ethernet-Based Fabrics: As data centers transition from siloed Fibre Channel networks to Ethernet-based, software-defined fabrics, enterprises benefit from reduced complexity, lower costs, and greater interoperability.

- Edge Data Centers and Micro-Fabric Topologies: The rise of edge computing is fueling demand for compact Ethernet storage fabrics that offer real-time data access, especially in retail, telco, and industrial automation applications.

- RoCE (RDMA over Converged Ethernet) Optimization: Fabric designs are evolving to support lossless Ethernet, improving support for latency-sensitive applications in sectors like finance, autonomous vehicles, and genomics.

- Software-Defined Infrastructure (SDI) Integration: Enterprises are deploying Ethernet storage fabrics as part of hyperconverged and software-defined architectures, enabling automated provisioning, orchestration, and scale-out data services.

Ethernet Storage Fabric Market Dynamics

Driver

Explosion of AI, Real-Time Analytics, and Data-Intensive Workloads Across Hybrid Infrastructure

- The global shift to AI-powered business intelligence, real-time data processing, and hyperconnected enterprise ecosystems requires high-throughput and low-latency data access, propelling adoption of Ethernet storage fabrics.

- NVMe SSDs are now standard in enterprise infrastructure, and only fabric-based Ethernet networks can meet their IOPS and latency demands in distributed storage environments.

- Cloud-native applications, especially in edge AI, autonomous systems, and financial services, need deterministic performance, which traditional TCP/IP or Fibre Channel often cannot guarantee.

- Ethernet storage fabrics support multi-tenancy, QoS enforcement, and storage disaggregation, aligning with cloud operating models and digital transformation strategies.

Restraint/Challenge

High Infrastructure Transition Costs and Protocol Interoperability Barriers

- Shifting from traditional Fibre Channel or TCP/IP storage networks to high-speed Ethernet fabrics requires new switches, NICs, software, and training—creating CapEx and skillset barriers for mid-sized enterprises.

- Inconsistencies in RoCE vs. iWARP vs. TCP performance and compatibility can cause deployment challenges, especially in multi-vendor environments where end-to-end interoperability is not always seamless.

- Realizing the benefits of Ethernet fabrics often depends on network tuning, congestion management, and hardware optimization, which may require specialized expertise.

- Organizations with legacy infrastructure may be hesitant to switch due to integration risk, downtime concerns, or uncertainty around long-term support for evolving protocols like NVMe-oF.

Ethernet Storage Fabric Market Scope

The market is segmented by type, switch type, storage type, and end user, reflecting the range of ESF implementations across industries and infrastructure environments.

- By Type

Includes Hardware, Software, and Services. Hardware dominates the market in 2025, comprising Ethernet switches, NICs, and storage adapters needed to build high-speed, low-latency fabrics. Software is the fastest-growing segment, fueled by demand for fabric management platforms, QoS tools, and virtualization.

- By Switch Type

Segmented into Top of Rack (ToR), Leaf, and Spine switches. Top of Rack switches lead due to their wide usage in enterprise racks and modular data centers. Spine switches are rapidly expanding in hyperscale and cloud environments, supporting fabric-wide interconnects and east-west traffic.

- By Storage Type

Includes All Flash Arrays (AFAs), Hybrid Storage Arrays, and HDDs. AFAs dominate in 2025 due to the increasing use of NVMe flash storage, which requires low-latency Ethernet fabrics to operate efficiently. Hybrid arrays remain relevant in mixed-performance environments where cost optimization is key.

- By End User

Includes Enterprises, Cloud Service Providers, Telecom, Government, and Others. Cloud service providers lead the market, driven by massive storage scaling needs for SaaS, IaaS, and data lake applications. Telecom and enterprises are rapidly adopting ESF for edge computing, 5G backhaul, and AI workloads.

Ethernet Storage Fabric Market Regional Analysis

- North America dominates the market in 2025 due to early adoption of cloud-native storage, AI/ML deployments, and hyperscaler investments in next-gen data center networks. Enterprises and CSPs are rapidly integrating RoCE-enabled Ethernet fabrics into hybrid cloud and HPC stacks.

- Europe is growing steadily, driven by digitization across BFSI, automotive, and government sectors. Countries like Germany, the U.K., and France are upgrading data centers with NVMe-over-Ethernet infrastructures, particularly in regulated industries that demand low-latency, localized processing.

- Asia-Pacific is the fastest-growing region, with China, Japan, India, and South Korea ramping up investments in cloud, AI training clusters, and smart city infrastructures. ESF is being adopted in telco data centers, fintech, and education sectors to handle growing workloads and real-time access demands.

- Middle East & Africa (MEA) is seeing increased investments in digital infrastructure, sovereign cloud, and smart government initiatives, especially in UAE, Saudi Arabia, and South Africa, where ESF is being introduced into greenfield cloud projects.

- South America, led by Brazil and Chile, is embracing Ethernet storage fabrics in financial services, national telecoms, and scientific computing, supported by regional cloud expansion and edge data center deployments.

United States

The U.S. leads the market due to the presence of major cloud providers, AI-focused enterprises, and early adoption of NVMe-oF and Ethernet-based HPC fabrics. Enterprises are migrating from Fibre Channel to ESF for better agility, especially in data-driven sectors.

Germany

Germany’s industrial backbone and strong focus on digital twin, automotive simulation, and cloud-first IT modernization are fueling demand for high-speed fabric storage in data centers and enterprise networks.

India

India is rapidly adopting Ethernet storage fabrics across BFSI, education, and IT outsourcing, driven by local data center growth, AI startup activity, and government support for Make in India cloud infrastructure.

China

China is investing heavily in AI supercomputing clusters, smart city backbones, and telecom 5G infrastructure, where Ethernet fabrics are being deployed to manage petabyte-scale analytics and video surveillance workloads.

Brazil

Brazil’s telecoms, e-government agencies, and scientific research networks are implementing ESF to handle real-time transaction processing, hybrid cloud platforms, and remote learning systems that demand scalable bandwidth and reduced latency.

Ethernet Storage Fabric Market Share

The ethernet storage fabric industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- Arista Networks, Inc. (U.S.)

- Broadcom Inc. (U.S.)

- Mellanox Technologies (NVIDIA Corporation) (Israel / U.S.)

- Intel Corporation (U.S.)

- Juniper Networks, Inc. (U.S.)

- Dell Technologies Inc. (U.S.)

- Hewlett Packard Enterprise (HPE) (U.S.)

- Fujitsu Limited (Japan)

- Huawei Technologies Co., Ltd. (China)

- Super Micro Computer, Inc. (U.S.)

Latest Developments in Global Ethernet Storage Fabric Market

- In April 2025, NVIDIA (Mellanox Technologies) launched its latest ConnectX-8 SmartNICs supporting enhanced RoCE v2 and hardware-level congestion control, aimed at boosting Ethernet fabric efficiency in AI and cloud-native data centers.

- In March 2025, Arista Networks unveiled a next-gen 400G Ethernet spine-leaf switch series optimized for NVMe-oF and AI-driven workloads, providing ultra-low latency and advanced telemetry support.

- In February 2025, Intel Corporation introduced a new Ethernet Adapter E800 series with built-in NVMe-over-TCP acceleration, designed to simplify fabric deployment in hyperconverged and hybrid cloud environments.

- In January 2025, Cisco Systems partnered with leading CSPs to deliver fabric-aware software orchestration tools for enterprise NVMe storage clusters, improving automated provisioning and multi-tenant management.

- In December 2024, Huawei deployed a national-level AI computing network in China using its OceanStor Ethernet fabric with NVMe-oF support, targeting smart city, education, and energy sectors.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ethernet Storage Fabric Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ethernet Storage Fabric Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ethernet Storage Fabric Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.