Global Ethoxylates Market

Market Size in USD Billion

CAGR :

%

USD

21.78 Billion

USD

32.56 Billion

2024

2032

USD

21.78 Billion

USD

32.56 Billion

2024

2032

| 2025 –2032 | |

| USD 21.78 Billion | |

| USD 32.56 Billion | |

|

|

|

|

Ethoxylates Market Size

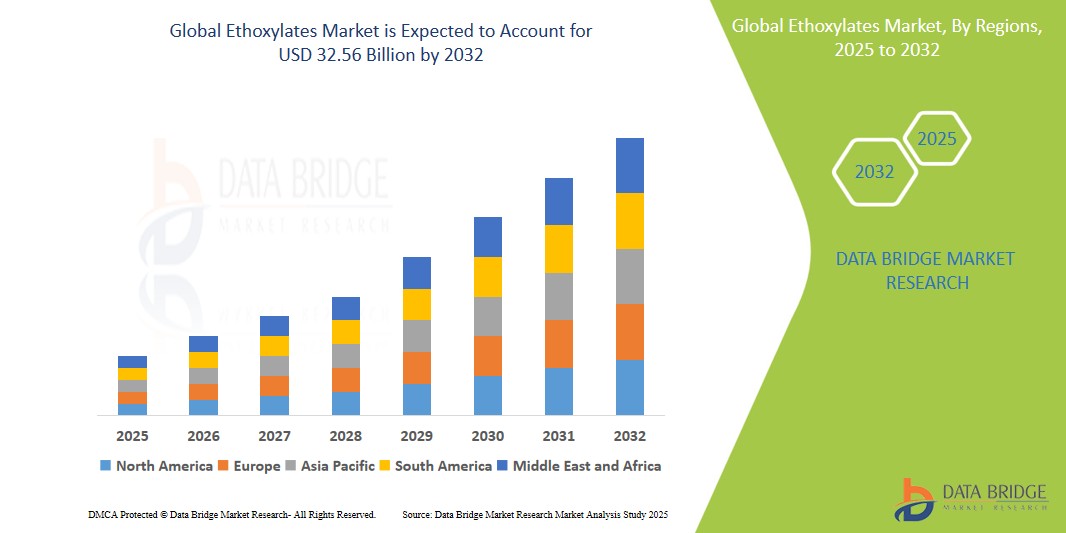

- The Global Ethoxylates Market was valued at USD 21.78 Billion in 2024 and is expected to reach USD 32.56 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.90%, primarily driven by the increasing demand for surfactants in household and industrial cleaning applications, personal care products, and pharmaceutical formulations

- This growth is further supported by expanding industrial and institutional sectors, rising urban population with improved living standards, and innovations in eco-friendly and biodegradable ethoxylate products

Ethoxylates Market Analysis

- Ethoxylates are widely utilized in detergents, emulsifiers, and dispersing agents due to their excellent solubility, low toxicity, and cost-effectiveness, making them essential in a variety of industries such as agriculture, textiles, and oil & gas

- The market is witnessing increased demand for alcohol ethoxylates and fatty acid ethoxylates, especially in non-ionic surfactants for household and personal care applications

- Key drivers include the rising emphasis on sustainable and green chemistry, regulatory support for biodegradable surfactants, and growing industrial use in formulations requiring effective emulsification and foaming properties

- Concerns over environmental impact, especially from non-biodegradable variants like nonylphenol ethoxylates (NPEs), and stringent regulations in developed regions, may pose challenges to market growth

Report Scope and Ethoxylates Market Segmentation

|

Attributes |

Ethoxylates Key Market Insights |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ethoxylates Market Trends

“Rising Demand for Eco-Friendly and High-Efficiency Surfactants”

- The global market is experiencing a notable shift toward sustainable, biodegradable, and low-toxicity ethoxylates as industries aim to meet tightening environmental regulations and cater to eco-conscious consumers

- Major players are investing in green chemistry innovations, such as bio-based alcohol ethoxylates derived from plant-based feedstocks, to replace traditional petrochemical-derived variants

- Technological advancements are also enabling the development of customized ethoxylate surfactants with enhanced emulsifying, dispersing, and wetting properties tailored for specific industrial and consumer applications

- For instance, BASF and Clariant have introduced renewable-based surfactants for use in personal care and cleaning products, which exhibit reduced environmental impact without compromising performance

- This trend underscores a broader move toward sustainable surfactant solutions, supported by consumer preferences, corporate ESG commitments, and government regulations across Europe, North America, and parts of Asia

Ethoxylates Market Dynamics

Driver

“Growing Consumption in Household and Industrial Cleaning Applications”

- A key growth driver is the expanding use of ethoxylates in household detergents, institutional cleaners, and industrial formulations, where they act as efficient emulsifiers and wetting agents

- The rise in urban populations, improved living standards, and growing hygiene awareness have significantly increased the demand for high-performance cleaning agents globally

- In addition, industrial growth in emerging economies is boosting the need for surface-active agents in food processing, textiles, and agrochemicals

- Companies like Unilever and Procter & Gamble are increasing their usage of alcohol ethoxylates in biodegradable formulations to align with sustainability goals and consumer expectations

- The widespread applicability and regulatory favorability of non-ionic surfactants are fueling consistent market expansion

Opportunity

“Expansion in Pharmaceutical and Personal Care Sectors”

- Ethoxylates are gaining traction in the pharmaceutical and personal care industries as solubilizers, emulsifiers, and stabilizers in products such as creams, ointments, shampoos, and drug delivery systems

- The rising global population, increased spending on healthcare and personal grooming, and product innovations are creating new growth avenues

- For instance, PEG (polyethylene glycol) ethoxylates are widely used in oral, topical, and injectable drug formulations due to their high safety profile and compatibility

- The shift toward mild and non-irritating ingredients in skincare and baby care products is also encouraging the use of gentle, non-ionic ethoxylates

- These developments represent significant opportunities for ethoxylate manufacturers to diversify their portfolios into high-margin, value-added applications

Restraint/Challenge

“Environmental Concerns and Regulatory Pressure on Nonylphenol Ethoxylates (NPEs)”

- A major challenge to market growth is the environmental impact of certain ethoxylates, particularly nonylphenol ethoxylates (NPEs), which are persistent and toxic in aquatic environments

- Regulatory bodies like the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) have imposed restrictions or bans on NPEs, compelling industries to seek safer alternatives

- The transition to greener substitutes requires reformulation and incurs significant R&D and compliance costs

- In addition, raw material price volatility and supply chain constraints can impact production scalability and profitability

- These factors, combined with consumer scrutiny and increasing pressure for transparency, pose reputational and financial risks for companies still relying on legacy ethoxylate chemistries

Ethoxylates Market Scope

The market is segmented on the basis of product, raw material, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By End User Industry |

|

Ethoxylates Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Ethoxylates Market

- Asia-Pacific is projected to register the highest growth rate in the Ethoxylates Market during the forecast period, owing to rising industrialization, expanding middle-class population, and rapid urban development

- China, India, Japan, and South Korea are key growth engines, supported by a booming consumer goods sector, increasing demand for agrochemicals, and high-volume manufacturing of cleaning and personal care products

- Government initiatives promoting Make-in-India, smart city development, and clean energy expansion further boost ethoxylate consumption across various industries

- The region also benefits from lower production costs, abundant raw materials, and rising R&D capabilities, attracting significant foreign direct investment in the chemical and surfactant space

- The growing awareness of eco-friendly surfactants and the push toward environmentally safe formulations are expected to reinforce regional growth momentum

Europe is Expected to be One of the Fastest Growing Regions in the Ethoxylates Market”

- Europe holds a significant share in the Global Ethoxylates Market due to its mature industrial base, strong environmental regulations, and demand from household, personal care, and industrial sectors

- Countries such as Germany, the U.K., France, and the Netherlands are major contributors, benefiting from the presence of leading chemical and surfactant manufacturers like BASF, Clariant, and Croda International

- Additionally, Europe’s shift towards circular economy practices and investments in sustainable home and personal care products are enhancing the consumption of greener ethoxylate alternatives

- Increased innovation in formulated surfactants and a focus on reducing carbon footprints continue to strengthen Europe’s position in the global market.

Ethoxylates Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF SE

- Clariant

- Nouryon

- Shell group of companies

- Sasol LTD

- Solvay

- Evonik Industries AG

- Arkema

- Akzo Nobel N.V.

- Dow

- DuPont.

- Huntsman International LLC

- SABIC

- India Glycols Limited.

- Mitsui Chemicals, Inc.

- Stepan Company

- INEOS AG

- J.C. Enterprises

- Nikko Chemicals Co., Ltd.

- VENUS ETHOXYETHERS PVT.LTD.

- Air Products Inc.

Latest Developments in Global Ethoxylates Market

- In August 2024, Shandong Longhua completed the integration of its Ethoxylates upgrading project, reaching a production capacity of 310,000 tons per year. This expansion supports the company's broader goal of achieving one million tons of polyether products, addressing rising demand in clean energy and construction sectors.

- In August 2024, BASF announced it would exclusively offer bio-based ethyl acrylate (EA) starting Q4 2024, phasing out fossil-based EA. This move aligns with its carbon reduction and sustainability goals.

- In July 2024, Clariant entered a partnership with OMV to reduce the carbon footprint of ethylene and ethylene oxide derivatives, both critical precursors for ethoxylates, strengthening the company’s position in low-carbon chemical production.

- In March 2024, Clariant introduced the Sapogenat T range, a replacement for banned nonylphenol ethoxylates (NPEs). The range includes non-ionic emulsifiers designed to enhance pesticide efficacy and environmental safety

- In January 2023, BASF launched a new line of eco-friendly ethoxylates, designed to deliver high-performance surfactant properties with reduced environmental impact, meeting demand from industries like home care, personal care, and I&I cleaning.

- In November 2021, Solvay launched a reactive waterborne emulsifier for solid epoxy resins, a key innovation addressing growing demand for sustainable and high-performance emulsifiers in coatings and adhesives.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ethoxylates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ethoxylates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ethoxylates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.