Global Ethylene Acrylic Acid Eaa Market

Market Size in USD Billion

CAGR :

%

USD

10.57 Billion

USD

21.30 Billion

2025

2033

USD

10.57 Billion

USD

21.30 Billion

2025

2033

| 2026 –2033 | |

| USD 10.57 Billion | |

| USD 21.30 Billion | |

|

|

|

|

Global Ethylene Acrylic Acid (EAA) Market Size

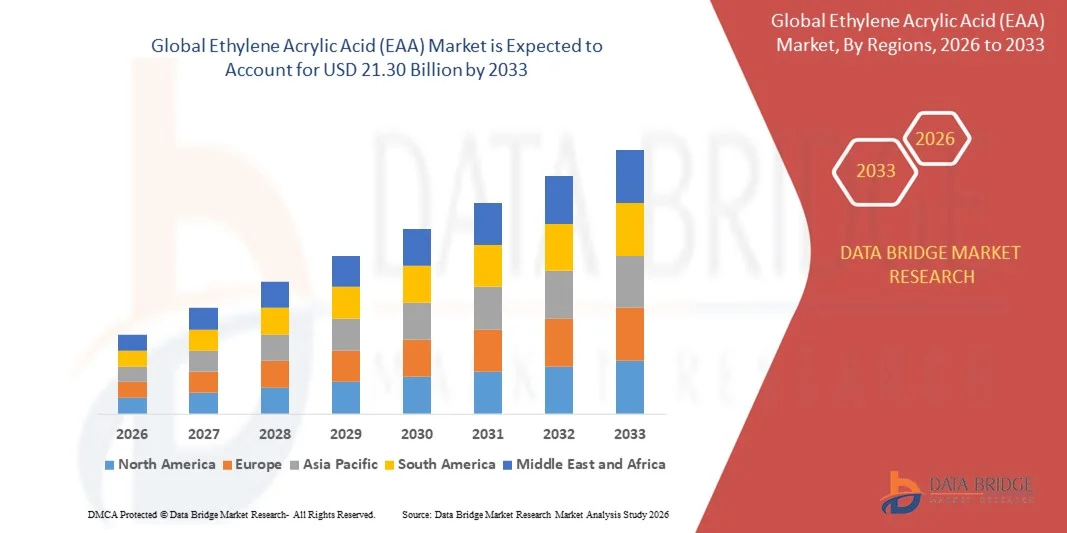

- The Global Ethylene Acrylic Acid (EAA) Market size was valued at USD 10.57 billion in 2025 and is projected to reach USD 21.30 billion by 2033, registering a CAGR of 9.15% over the forecast period.

- Market expansion is primarily driven by the rising utilization of EAA in packaging, coatings, and adhesive applications, supported by advancements in polymer processing technologies that enhance performance, durability, and product versatility.

- Additionally, increasing demand for high-performance, recyclable, and environmentally compliant materials across key industries is strengthening the market outlook, accelerating the adoption of EAA-based solutions and fueling substantial industry growth.

Global Ethylene Acrylic Acid (EAA) Market Analysis

- Ethylene Acrylic Acid (EAA), known for its strong adhesion, flexibility, and excellent compatibility with diverse substrates, is becoming an essential material across packaging, coatings, and adhesive applications due to its superior performance characteristics and ease of processing in both industrial and consumer product segments.

- The accelerating demand for EAA is largely driven by the expansion of flexible packaging, the shift toward high-performance and recyclable materials, and the increasing use of EAA in hot-melt adhesives and barrier coatings across food, healthcare, and industrial markets.

- Europe dominated the Global Ethylene Acrylic Acid (EAA) Market with the largest revenue share of 34.2% in 2025, supported by strong packaging industry growth, advanced manufacturing capabilities, and the presence of major chemical producers, with the U.S. exhibiting significant adoption of EAA in flexible packaging, laminates, and specialty coatings.

- Asia-Pacific is expected to be the fastest-growing region in the Global Ethylene Acrylic Acid (EAA) Market during the forecast period, driven by rapid industrialization, expanding food and consumer goods sectors, and rising demand for cost-effective, high-performance packaging materials.

- The Extrusion Grade segment dominated the market with the largest revenue share of 61.4% in 2025, driven by its widespread use in flexible packaging, extrusion coating, and laminating applications.

Report Scope and Global Ethylene Acrylic Acid (EAA) Market Segmentation

|

Attributes |

Ethylene Acrylic Acid (EAA) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Ethylene Acrylic Acid (EAA) Market Trends

Rising Demand for High-Performance and Sustainable EAA Solutions

- A significant and accelerating trend in the Global Ethylene Acrylic Acid (EAA) Market is the growing shift toward high-performance, sustainable polymer materials, driven by the increasing emphasis on recyclability, environmental compliance, and enhanced functionality across packaging and industrial applications.

- For Instance, leading manufacturers such as Dow and DuPont are expanding their portfolios of EAA-based resins designed to improve sealability, adhesion, and barrier performance in flexible packaging while supporting recyclable film structures.

- Advances in EAA technology are enabling improved bonding strength, greater resistance to moisture and chemicals, and better compatibility with multilayer packaging systems. Certain next-generation EAA formulations are engineered to optimize hot-melt adhesive performance, enhance extrusion coating efficiency, and improve durability in demanding end-use environments.

- The integration of EAA with innovative processing technologies allows manufacturers to create lighter, stronger, and more sustainable packaging materials that meet regulatory requirements and consumer expectations for eco-friendly products.

- This trend toward advanced, high-efficiency EAA solutions is influencing major chemical producers—including BASF, Arkema, and ExxonMobil—to invest in research and development for bio-based variations, improved melt-index control, and enhanced copolymer structures tailored for circular packaging systems.

- The demand for EAA materials that deliver superior adhesion, flexibility, and environmental compatibility is rising rapidly across both developed and emerging regions, as industries increasingly prioritize performance, sustainability, and regulatory compliance in packaging and coating applications.

Global Ethylene Acrylic Acid (EAA) Market Dynamics

Driver

Growing Need for High-Performance Materials Driven by Packaging Expansion and Industrial Applications

- The increasing demand for durable, flexible, and high-performance materials across the packaging, adhesives, and coatings industries is a major driver of growth in the Global Ethylene Acrylic Acid (EAA) Market.

- For Instance, leading companies such as Dow and DuPont continue to develop advanced EAA copolymers designed to enhance sealability, adhesion, and barrier performance in flexible packaging—supporting the shift toward lightweight, efficient, and recyclable packaging solutions.

- As manufacturers seek stronger bonding agents, improved chemical resistance, and reliable performance under varying environmental conditions, EAA offers a compelling advantage over conventional polymers, making it a preferred choice in multilayer packaging and extrusion coating applications.

- Additionally, the rapid expansion of the food, medical, and consumer goods sectors—along with the rising adoption of flexible packaging formats—is positioning EAA as an essential material that supports both performance and regulatory compliance.

- The growing emphasis on sustainability, including the push for recyclable packaging structures and reduced environmental impact, further accelerates the adoption of EAA-based materials across various end-use industries. The increasing need for versatile, cost-effective, and eco-friendly polymer solutions is expected to fuel continued market expansion during the forecast period.

Restraint/Challenge

Volatility in Raw Material Prices and Environmental Regulatory Pressures

- Fluctuations in raw material prices—particularly ethylene and acrylic acid—pose a significant challenge to the long-term growth of the EAA market. Since these petrochemical-based feedstocks are influenced by crude oil price changes and global supply-demand dynamics, manufacturers often face cost uncertainties.

- For Instance, periods of sharp increases in acrylic acid prices have historically led to production cost inflation for EAA manufacturers, limiting price flexibility and affecting profitability.

- Additionally, growing environmental regulations related to emissions, polymer waste, and petrochemical production place added pressure on producers to adopt cleaner manufacturing technologies and improve sustainability across the value chain. Companies such as BASF and ExxonMobil are increasingly investing in low-emission production processes and exploring bio-based alternatives to address these concerns.

- The complexity of meeting stringent regulatory requirements—combined with the capital-intensive nature of EAA production—can be a hurdle for smaller manufacturers and a barrier to new entrants. At the same time, rising expectations for eco-friendly materials require ongoing R&D and continuous technological upgrades.

- While advancements in recycling technologies and the emergence of sustainable polymer solutions offer long-term opportunities, the challenges linked to cost volatility and compliance burdens may continue to restrain rapid market expansion if not effectively managed.

Global Ethylene Acrylic Acid (EAA) Market Scope

The ethylene acrylic acid (EAA) market is segmented on the basis of type, product type and application.

- By Type

On the basis of type, the Global Ethylene Acrylic Acid (EAA) Market is segmented into Extrusion Grade EAA Copolymer and Injection Grade EAA Copolymer. The Extrusion Grade segment dominated the market with the largest revenue share of 61.4% in 2025, driven by its widespread use in flexible packaging, extrusion coating, and laminating applications. Industries prefer extrusion-grade EAA for its excellent adhesion, heat-seal capability, and compatibility with multilayer film structures, making it essential in food packaging, medical packaging, and industrial films. Its ability to improve barrier performance and enhance film strength further contributes to its dominant market presence.

The Injection Grade segment is expected to witness the fastest growth rate from 2026 to 2033, supported by its increasing adoption in molded components used across consumer goods, automotive parts, and electronics. The superior toughness, flexibility, and chemical resistance of injection-grade EAA make it well-suited for specialized molding applications.

- By Product Type

On the basis of product type, the Global EAA Market is segmented into 20 wt% Comonomer, 9 wt% Comonomer, and 5 wt% Comonomer. The 20 wt% Comonomer segment dominated the market with the largest revenue share of 47.8% in 2025, attributed to its high acrylic acid content that delivers superior adhesion, sealing strength, and compatibility with a wide range of substrates. This grade is extensively used in premium flexible packaging, extrusion coatings, and high-performance adhesives, where strong bonding and enhanced barrier properties are required. Its effectiveness in multilayer films makes it a preferred material for food packaging and industrial laminates.

The 9 wt% Comonomer segment is projected to witness the fastest CAGR from 2026 to 2033, driven by its balanced cost-to-performance ratio. It offers moderate adhesion and flexibility, making it suitable for cost-sensitive applications such as general-purpose coatings, laminations, and hot-melt adhesive formulations.

- By Application

On the basis of application, the Global EAA Market is segmented into Packaging, Powder Coating, Hot Melt Adhesive, Water-Based Solvent, and Others. The Packaging segment accounted for the largest revenue share of 54.6% in 2025, fueled by the rapid expansion of the flexible packaging industry. EAA is widely used in sealing layers, barrier coatings, and laminates due to its strong adhesion, durability, and compatibility with recyclable polyethylene-based packaging structures. Growing demand for ready-to-eat foods, e-commerce packaging, and sustainability-focused materials has further boosted the adoption of EAA in packaging solutions.

The Hot Melt Adhesive segment is expected to experience the fastest CAGR from 2026 to 2033, driven by increasing use in hygiene products, labeling, bookbinding, and industrial applications. EAA enhances adhesive strength, flexibility, and low-temperature performance, making it a key component in next-generation high-performance hot melt adhesive systems.

Global Ethylene Acrylic Acid (EAA) Market Regional Analysis

- Europe dominated the Global Ethylene Acrylic Acid (EAA) Market with the largest revenue share of 34.2% in 2025, driven by strong demand from the packaging, adhesives, and coatings industries, along with the region’s advanced manufacturing infrastructure and stringent performance standards across end-use sectors.

- Industries in the region prioritize high-performance materials such as EAA due to its superior adhesion, sealability, and compatibility with recyclable packaging structures, supporting the growing shift toward sustainable and efficient packaging solutions.

- This widespread adoption is further supported by the presence of major chemical producers, high investments in R&D, and strong demand from food, healthcare, and consumer goods sectors, positioning EAA as a preferred polymer solution for high-quality packaging and industrial applications across North America.

U.S. EAA Market Insight

The U.S. EAA market captured the largest revenue share of 35% in 2025 within North America, driven by strong demand from packaging, adhesives, and coatings industries. Manufacturers are increasingly prioritizing high-performance polymers such as EAA for flexible packaging, extrusion coatings, and hot-melt adhesives due to their superior adhesion, sealing performance, and compatibility with recyclable materials. The growth of e-commerce, processed food, and pharmaceutical packaging sectors further supports the demand. Additionally, the presence of leading chemical producers and ongoing R&D investments in polymer technology are strengthening the U.S. market position and accelerating adoption across both industrial and consumer applications.

Europe EAA Market Insight

The Europe EAA market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent packaging regulations, sustainability initiatives, and the increasing demand for high-performance adhesives and coatings. Adoption of EAA in flexible packaging, laminates, and hot-melt adhesive applications is rising, supported by the region’s focus on environmentally friendly and recyclable materials. Key end-use industries, including food, beverage, and pharmaceutical packaging, are integrating EAA to enhance barrier properties and product longevity. Germany, France, and Italy are major contributors to regional growth.

U.K. EAA Market Insight

The U.K. EAA market is anticipated to grow at a noteworthy CAGR, fueled by the increasing adoption of advanced packaging solutions, adhesives, and coatings. The rising emphasis on sustainable packaging materials and stringent quality standards is encouraging manufacturers to utilize EAA in multilayer films, extrusion coatings, and hot-melt adhesive systems. Growth in e-commerce packaging and processed food industries, coupled with consumer demand for safer and longer-lasting packaging, is further supporting market expansion.

Germany EAA Market Insight

The Germany EAA market is expected to expand at a considerable CAGR during the forecast period, supported by strong industrial infrastructure and innovation in polymer technology. The country’s focus on high-quality packaging, automotive adhesives, and specialty coatings drives demand for EAA copolymers. Increasing investments in R&D for recyclable and sustainable materials, along with the adoption of advanced extrusion and molding technologies, enhance the market potential. EAA’s versatility in food, pharmaceutical, and industrial applications makes it a preferred material in Germany.

Asia-Pacific EAA Market Insight

The Asia-Pacific EAA market is poised to grow at the fastest CAGR of 22% during the forecast period from 2026 to 2033, driven by rapid industrialization, urbanization, and expanding packaging, adhesives, and coating industries in countries such as China, India, and Japan. The region’s growing middle-class population, increasing demand for processed food and pharmaceutical packaging, and government initiatives supporting sustainable materials are propelling the adoption of EAA. Additionally, APAC’s emergence as a manufacturing hub for polymers enhances affordability and accessibility, expanding its market reach.

Japan EAA Market Insight

The Japan EAA market is gaining momentum due to strong demand from the food, pharmaceutical, and consumer goods packaging sectors. Japan’s high technological advancement, focus on high-quality and recyclable packaging, and increasing adoption of multilayer films are driving EAA usage. The growth of hot-melt adhesives and extrusion-coated products in industrial and commercial applications further supports market expansion. Additionally, Japan’s aging population is increasing demand for user-friendly packaging solutions with enhanced durability and safety.

China EAA Market Insight

The China EAA market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding middle-class consumption, and the growth of food, beverage, and pharmaceutical industries. Strong domestic polymer manufacturers, coupled with increasing demand for multilayer packaging, hot-melt adhesives, and specialty coatings, are key growth drivers. The push toward sustainable, recyclable packaging and industrial adhesives further supports market adoption. China’s growing polymer manufacturing capabilities also enhance the availability and affordability of EAA copolymers across diverse end-use industries.

Global Ethylene Acrylic Acid (EAA) Market Share

The Ethylene Acrylic Acid (EAA) industry is primarily led by well-established companies, including:

• Dow Inc. (U.S.)

• ExxonMobil Chemical (U.S.)

• Honeywell International Inc. (U.S.)

• Celanese Corporation (U.S.)

• Arkema Group (France)

• LyondellBasell Industries (Netherlands)

• SABIC (Saudi Arabia)

• INEOS (U.K.)

• Eastman Chemical Company (U.S.)

• Mitsubishi Chemical Corporation (Japan)

• Sumitomo Chemical Co., Ltd. (Japan)

• DuPont (U.S.)

• BASF SE (Germany)

• LCY Chemical Corp. (Taiwan)

• Formosa Plastics Corporation (Taiwan)

• Wanhua Chemical Group (China)

• Shandong Dongyue Chemical Co., Ltd. (China)

• Suzhou Tianlong Chemical Co., Ltd. (China)

• ChemChina (China)

• Reliance Industries Limited (India)

What are the Recent Developments in Global Ethylene Acrylic Acid (EAA) Market?

- In April 2024, Dow Inc., a global leader in specialty chemicals, launched a strategic initiative in South Africa to expand its EAA copolymer portfolio for packaging, adhesives, and coatings applications. This initiative highlights the company’s commitment to delivering high-performance, sustainable polymer solutions tailored to local industrial and consumer needs. By leveraging its global expertise and advanced EAA formulations, Dow is strengthening its position in the rapidly growing global EAA market while supporting regional industries in adopting high-quality polymer solutions.

- In March 2024, Honeywell International Inc. introduced a new high-adhesion EAA grade designed specifically for multilayer food packaging and industrial laminates. This innovative product enhances sealing strength, barrier performance, and recyclability, meeting stringent regulatory standards. The launch underscores Honeywell’s dedication to developing cutting-edge polymer solutions that address both performance and sustainability requirements, reinforcing its leadership in the global EAA market.

- In March 2024, ExxonMobil Chemical successfully expanded its EAA production capabilities at its Asia-Pacific manufacturing facility to meet rising demand in flexible packaging, adhesives, and coatings. This expansion demonstrates the company’s commitment to delivering high-quality, reliable EAA copolymers to emerging markets and highlights the growing importance of EAA in supporting industrial growth and sustainable packaging initiatives.

- In February 2024, Arkema Group, a leading global specialty materials company, announced a strategic partnership with a major European packaging consortium to develop eco-friendly EAA-based films for food and medical applications. This collaboration is designed to improve product performance, enhance recyclability, and reduce environmental impact, emphasizing Arkema’s focus on innovation and sustainability in the global EAA market.

- In January 2024, Celanese Corporation unveiled its next-generation 20 wt% EAA copolymer for extrusion coating and hot-melt adhesive applications at the European Coatings Show 2024. This advanced product offers superior adhesion, processability, and barrier properties, enabling manufacturers to create high-performance, durable, and recyclable packaging solutions. The launch reinforces Celanese’s commitment to integrating innovative polymer technologies into industrial applications, strengthening its presence in the global EAA market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ethylene Acrylic Acid Eaa Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ethylene Acrylic Acid Eaa Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ethylene Acrylic Acid Eaa Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.