Global Ethylene Market

Market Size in USD Billion

CAGR :

%

USD

192.50 Billion

USD

406.10 Billion

2024

2032

USD

192.50 Billion

USD

406.10 Billion

2024

2032

| 2025 –2032 | |

| USD 192.50 Billion | |

| USD 406.10 Billion | |

|

|

|

|

Global Ethylene Market Size

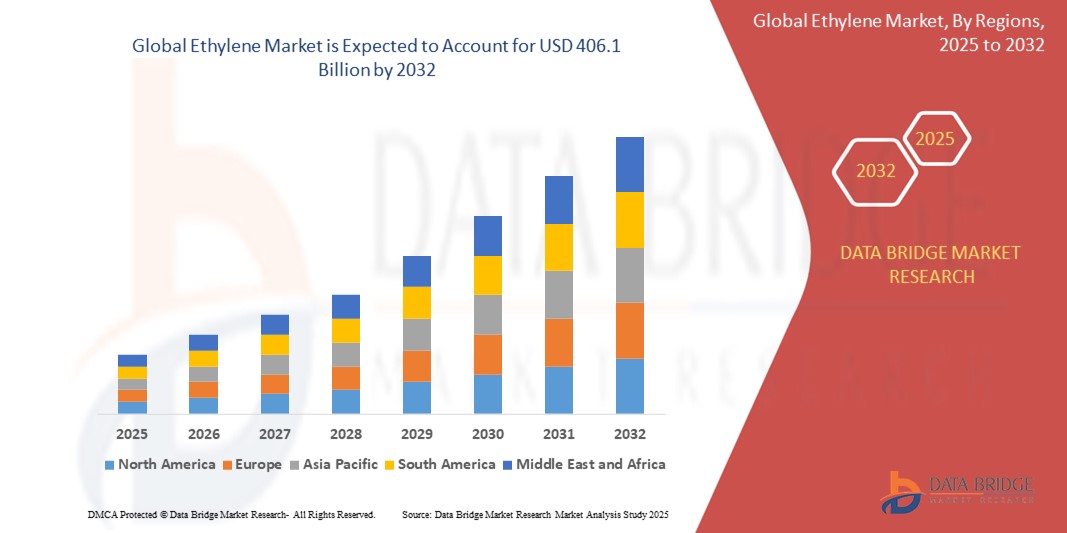

- The Global Ethylene Market size was valued at USD 192.5 billion in 2024 and is expected to reach 406.1 USD billion by 2032, at a CAGR of 9.78% during the forecast period

- The market growth is largely fueled by the increasing demand for polyethylene, which is extensively used in the packaging industry. Additionally, the expanding applications of ethylene derivatives in construction, automotive, and textile industries are significant contributors to market expansion

- Furthermore, rising urbanization and industrialization globally, particularly in the Asia Pacific region, are boosting the demand for ethylene-based products. The trend towards bio-based ethylene and technological advancements in production processes are also expected to create new opportunities and drive market growth

Global Ethylene Market Analysis

- Ethylene (C₂H₄), a colorless and flammable gas, is a foundational petrochemical and the simplest alkene. It is critically important in the global chemical industry as a primary building block for a vast array of chemicals and plastics, making it one of the largest volume organic chemicals produced worldwide. Its derivatives are integral to numerous industrial and consumer products, impacting sectors from packaging to automotive and construction

- The escalating demand for ethylene is primarily fueled by the surging global consumption of polyethylene (its main derivative), which is extensively used in packaging films, containers, bottles, and various household and industrial products. Robust industrialization and urbanization in developing economies, particularly in Asia, further drive demand for ethylene-based products in construction, automotive, and consumer goods sectors. Additionally, the availability of cost-advantaged feedstock like ethane, especially from shale gas in North America, has supported production growth

- Asia-Pacific dominates the global ethylene market with the largest revenue share, accounting for over 50% of demand in 2024. This dominance is characterized by rapid industrial growth, particularly in China and India, substantial manufacturing capacities, significant investments in petrochemical infrastructure, and a large and growing consumer base for ethylene-derived products. China, in particular, leads both in ethylene consumption and production capacity additions

- Asia-Pacific is also expected to be the fastest-growing region in the ethylene market during the forecast period. This growth is attributed to continued strong demand from end-use industries like packaging, construction, and automotive, increasing disposable incomes, ongoing urbanization, and significant capacity expansions in ethylene production within the region

- Polyethylene (PE) segment dominates the ethylene market, accounting for over 50.4% of ethylene consumption in 2024. This dominance is driven by PE's versatility, cost-effectiveness, and wide range of applications across various sectors, especially in the packaging industry (for films, bags, and containers) which constitutes its largest end-use market. The increasing demand for both High-Density Polyethylene (HDPE) and Low-Density Polyethylene (LDPE) for diverse applications solidifies this segment's leading position

Report Scope and Global Ethylene Market Segmentation

|

Attributes |

Global Ethylene Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Ethylene Market Trends

"Growing Emphasis on Sustainable Ethylene Production and Bio-Based Feedstocks"

- A significant and accelerating trend in the global ethylene market is the increasing focus on sustainability, encompassing the development and adoption of bio-based feedstocks and more environmentally friendly production processes. This shift is largely driven by growing environmental concerns, stricter regulations, volatile fossil fuel prices, and increasing consumer and brand owner demand for sustainable products.

- For instance, companies like Braskem have been pioneers in producing "green" ethylene from sugarcane ethanol, which is then used to make bio-based polyethylene. Similarly, Dow Chemical has announced initiatives and partnerships to develop and scale bio-based ethylene production from sources like biomass and waste. Other major players like Sabic and LyondellBasell are also investing in technologies for chemically recycled and renewable-based polymers, which indirectly supports sustainable ethylene routes or reduces reliance on virgin fossil-based ethylene

- The integration of sustainable approaches in ethylene production aims to reduce the carbon footprint associated with this crucial chemical building block. Bio-based ethylene, for example, can be a drop-in replacement for fossil-derived ethylene, allowing its use in existing polyethylene production facilities and downstream applications without requiring new infrastructure. Furthermore, research is ongoing into innovative pathways like oxidative dehydrogenation of ethane (ODHE) which promises lower energy consumption and CO2 emissions compared to conventional steam cracking, and the potential use of CO2 as a feedstock

- The broader adoption of sustainable ethylene production methods facilitates a transition towards a more circular economy. By utilizing renewable resources or waste-derived feedstocks, the industry can lessen its dependence on finite fossil fuels and contribute to reducing plastic waste when coupled with enhanced recycling technologies

- This trend towards more sustainable and circular ethylene production is fundamentally reshaping strategies within the petrochemical industry. Consequently, companies are increasingly investing in research and development, forming strategic alliances, and exploring novel catalyst technologies to make bio-based and lower-carbon ethylene economically viable and scalable. For example, collaborations between technology providers and chemical producers are accelerating the commercialization of new sustainable ethylene pathways

- The demand for ethylene derived from sustainable sources is growing, particularly from sectors such as packaging, automotive, and consumer goods, where end-consumers and brand owners are prioritizing products with a lower environmental impact and a stronger sustainability profile. This is pushing chemical manufacturers to innovate and offer greener alternatives in the ethylene value chain

Global Ethylene Market Dynamics

Driver

“Surging Demand from Packaging, Construction, and Automotive Sectors”

- The increasing global demand for ethylene is significantly driven by its critical role as a primary building block for plastics and chemicals utilized extensively in major end-use industries, particularly packaging, construction, and automotive. The growth in these sectors, fueled by global economic development, urbanization, and rising consumer needs, directly translates to a higher demand for ethylene and its derivatives

- For instance, in recent years, there has been a consistent rise in the consumption of polyethylene (a key ethylene derivative) for flexible and rigid packaging applications, driven by e-commerce growth and the need for safe and durable packaging for food, beverages, and consumer goods. Similarly, the construction sector's demand for PVC (derived from ethylene dichloride, an ethylene derivative) for pipes, window frames, and flooring, and ethylene-propylene-diene monomer (EPDM) rubber for roofing and sealing applications, continues to expand with global infrastructure development. The automotive industry also contributes to ethylene demand through the use of various plastics and synthetic rubbers for lightweighting vehicles, improving fuel efficiency, and enhancing performance

- As global populations grow and urbanize, particularly in developing economies, the need for packaged goods, modern housing, infrastructure, and transportation escalates. Ethylene-based products offer versatile and cost-effective solutions to meet these burgeoning demands, providing a compelling impetus for increased ethylene production

- Furthermore, ongoing innovations in polymer science led to new applications and improved properties of ethylene derivatives, further stimulating demand. For example, advancements in specialty polyethylenes for high-performance films or durable automotive parts ensure continued reliance on ethylene as a fundamental raw material

- The convenience, performance characteristics, and economic advantages of ethylene-based materials in a wide array of applications are key factors propelling the demand for ethylene. The trend towards more sophisticated consumer products and industrial components, coupled with the expansion of manufacturing activities globally, further contributes to market growth

Restraint/Challenge

“Stringent Environmental Regulations and Feedstock Price Volatility”

- Significant challenges to broader market expansion for ethylene include increasing concerns and stringent regulations surrounding the environmental impact of plastics, particularly single-use plastics, and the inherent volatility in the prices of petrochemical feedstocks (like naphtha, ethane, and propane). As ethylene production is energy-intensive and a contributor to greenhouse gas emissions, and its derivatives form the basis of many persistent plastics, the industry faces mounting pressure from regulatory bodies and environmentally conscious consumers.

- For instance, initiatives like the European Union's Single-Use Plastics Directive, national targets for plastic recycling rates, and carbon pricing mechanisms in various regions are pushing the industry to innovate and adapt. These regulations can impact demand patterns for certain ethylene derivatives and necessitate significant investments in sustainable practices.

- Addressing these environmental concerns through robust investment in research and development for circular economy solutions (e.g., chemical recycling of plastics back to feedstock), development of bio-based ethylene, and carbon capture, utilization, and storage (CCUS) technologies is crucial for long-term sustainability and maintaining social license to operate. Companies such as BASF, Dow, and SABIC are actively investing in these areas, announcing projects and partnerships aimed at reducing their environmental footprint and promoting circularity. Additionally, the ethylene market is highly susceptible to fluctuations in crude oil and natural gas prices, which directly impact the cost of its primary feedstocks. This price volatility can affect production costs, profit margins, and investment decisions. For example, sharp increases in naphtha prices can make ethylene production less competitive in regions reliant on this feedstock compared to regions with access to cheaper ethane from shale gas.

- While petrochemical companies employ hedging strategies and optimize feedstock flexibility where possible, significant price swings can still create market uncertainty and challenge profitability, especially for producers with less diversified feedstock options or those in highly competitive markets.

- Overcoming these challenges through continuous technological innovation focused on decarbonization and circularity, proactive engagement with regulatory bodies, diversification of feedstock sources, and the development of value-added, more sustainable ethylene derivatives will be vital for sustained market growth and navigating the evolving global economic and environmental landscape.

Global Ethylene Market Scope

The market is segmented on the basis of feedstock, application, and end user.

- By Feedstock

On the basis of feedstock, the global ethylene market is segmented into naphtha, ethane, propane, butane, and others. The ethane segment dominates the market, holding the largest revenue share in 2024. This dominance is primarily driven by its cost-effectiveness, particularly due to the abundant supply from shale gas in North America, and its higher ethylene yield compared to other feedstocks. The established infrastructure for ethane cracking in regions like the U.S. and the Middle East further solidifies its leading position

The ethane segment is also anticipated to witness significant growth, though the "fastest-growing" title can be regionally nuanced. However, considering global trends towards feedstock diversification and sustainability, bio-based feedstocks (categorized under 'Others') are poised for the fastest growth rate from 2025 to 2032. This surge is fueled by increasing regulatory pressure to decarbonize, corporate sustainability initiatives, and growing demand for renewable chemicals. Technological advancements in converting biomass and ethanol to ethylene are making this route increasingly viable, despite currently higher costs

- By Application

On the basis of application, the global ethylene market is segmented into Polyethylene (PE), Ethylene Oxide (EO), Ethylene Benzene (EB), Ethylene Dichloride (EDC), Ethylene Glycol (EG), Vinyl Acetate (VA), Alpha Olefins, High Density Polyethylene (HDPE), Low Density Polyethylene (LDPE), and Others. The Polyethylene (PE) segment (comprising HDPE, LDPE, LLDPE, etc.) overwhelmingly held the largest market revenue share in 2024, accounting for over 50-60% of ethylene consumption. This is driven by PE's extensive use in the packaging industry (films, bottles, containers), construction, and consumer goods due to its versatility, durability, and cost-effectiveness

Both HDPE and LDPE/LLDPE sub-segments contribute significantly to this dominance, serving a wide array of applications from rigid containers to flexible films. The Polyethylene segment is also expected to witness a robust CAGR from 2025 to 2032, driven by sustained demand from the packaging sector, especially in developing economies. However, Ethylene Oxide (EO) and its derivatives like Ethylene Glycol (EG) are also projected for strong growth. The demand for EO is fueled by its use in producing surfactants, ethanolamines, and PET (via EG) for polyester fibers and bottles. Growing demand for PET in packaging and textiles, coupled with increasing use of ethoxylates in industrial and consumer cleaning products, contributes to this segment's rapid expansion

- By End User

On the basis of end user, the global ethylene market is segmented into Packaging, Automotive, Building and Construction, Agrochemical, Textile, Chemicals, Rubber and Plastics, Soaps and Detergents, and Others. The Packaging segment accounted for the largest market revenue share in 2024. This is primarily due to the extensive use of polyethylene (an ethylene derivative) in various packaging applications such as films, bags, containers, and bottles, driven by consumer demand for convenience, food safety, and product protection

The Packaging segment is expected to continue its strong growth and maintain a significant share. However, the Building and Construction segment is also anticipated to witness one of the fastest CAGRs from 2025 to 2032. This growth is driven by increasing urbanization, infrastructure development projects globally, and the use of ethylene derivatives like PVC (from ethylene dichloride) for pipes, window frames, and cables, as well as polyethylene for pipes and insulation. The demand for durable and cost-effective plastic materials in construction applications is a key factor

Global Ethylene Market Regional Analysis

North America continues to lead the global smart lock market, holding a substantial revenue share of 39.5% in 2024. This dominance is fueled by a strong demand for home automation and security solutions, coupled with increasing consumer awareness and adoption of smart home technology

Consumers in the region highly prioritize the convenience, advanced security features, and seamless integration of smart locks with other smart devices like thermostats and lighting systems. High disposable incomes, a technologically inclined population, and a growing preference for remote monitoring and control further solidify smart locks as a preferred solution for both residential and commercial properties across North America.

U.S. Smart Lock Market Insight

Within North America, the U.S. smart lock market captured the largest revenue share of 32.0% of the global market and 82.9% within North America in 2024. This is driven by the rapid adoption of connected devices and the expanding trend of home automation. Consumers are increasingly prioritizing enhanced home security through intelligent, keyless entry systems. The growing preference for DIY smart home setups, combined with robust demand for voice-controlled systems and mobile application integration, continues to propel the smart lock industry. Moreover, the increasing integration of smart home technologies, such as Alexa, Google Assistant, and Apple HomeKit, is significantly contributing to the market's expansion. The U.S. market is projected to reach US$ 2,168.4 million by 2030, exhibiting a CAGR of 16.1% from 2025 to 2030.

Europe Smart Lock Market Insight

The Europe smart lock market is projected to expand at a significant CAGR of 18.3% from 2024 to 2030, driven primarily by stringent security regulations and the escalating need for enhanced security in homes and offices. The increase in urbanization, coupled with the demand for connected devices, is fostering the adoption of smart locks. European consumers are also drawn to the convenience and energy efficiency these devices offer. The region is experiencing significant growth across residential, commercial, and multi-family housing applications, with smart locks being incorporated into both new constructions and renovation projects. In 2023, Europe held a 33.0% share of the global smart lock market revenue.

U.K. Smart Lock Market Insight

The U.K. smart lock market is anticipated to grow at a noteworthy CAGR of 16.4% from 2025 to 2030. This growth is driven by the escalating trend of home automation and a desire for heightened security and convenience. Additionally, concerns regarding burglary and safety are encouraging both homeowners and businesses to choose keyless entry solutions. The U.K.'s embrace of connected devices, alongside its robust e-commerce and retail infrastructure, is expected to continue to stimulate market growth. In 2024, the U.K. accounted for 4.9% of the global smart lock market.

Germany Smart Lock Market Insight

The Germany smart lock market is expected to expand at a considerable CAGR of 16.3% from 2025 to 2030, fueled by increasing awareness of digital security and the demand for technologically advanced, eco-conscious solutions. Germany’s well-developed infrastructure, combined with its emphasis on innovation and sustainability, promotes the adoption of smart locks, particularly in residential and commercial buildings. The integration of smart locks with home automation systems is also becoming increasingly prevalent, with a strong preference for secure, privacy-focused solutions aligning with local consumer expectations. Germany accounted for 4.4% of the global smart lock market in 2024.

Asia-Pacific Smart Lock Market Insight

The Asia-Pacific smart lock market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2030. This rapid expansion is driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards smart homes, supported by government initiatives promoting digitalization, is driving the adoption of smart locks. Furthermore, as APAC emerges as a manufacturing hub for smart lock components and systems, the affordability and accessibility of smart locks are expanding to a wider consumer base. Asia-Pacific held a 29.5% share of the global smart lock market in 2024.

Japan Smart Lock Market Insight

The Japan smart lock market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for convenience. The Japanese market places a significant emphasis on security, and the adoption of smart locks is driven by the increasing number of smart homes and connected buildings. The integration of smart locks with other IoT devices, such as home security cameras and lighting systems, is fueling growth. Moreover, Japan's aging population is also likely to spur demand for easier-to-use, secure access solutions in both residential and commercial sectors. The Japan smart lock market was valued at $418.22 million in 2025, with a CAGR of 7.87% from 2019 to 2024.

China Smart Lock Market Insight

The China smart lock market accounted for the largest market revenue share in Asia Pacific in 2024, holding 14.9% of the global market. This is attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China stands as one of the largest markets for smart home devices, and smart locks are becoming increasingly popular in residential, commercial, and rental properties. The push towards smart cities and the availability of affordable smart lock options, alongside strong domestic manufacturers, are key factors propelling the market in China. The China smart lock market is expected to grow at a CAGR of 21.2% from 2025 to 2030.

Global Ethylene Market Share

The Ethylene industry is primarily led by well-established companies, including:

- DuPont (US)

- BASF SE (Germany)

- Exxon Mobil Corporation (US)

- Chevron Phillips Chemical Company LLC (US)

- Formosa Plastics Corporation, U.S.A. (US)

- INEOS AG (UK)

- Sasol (South Africa)

- Royal Dutch Shell (UK/Netherlands)

- SABIC (Saudi Arabia)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Westlake Chemical Corporation (US)

- Braskem (Brazil)

- Mitsubishi Chemical Corporation (Japan)

- Huntsman International LLC (US)

- Uz-Kor Gas Chemical (Uzbekistan)

- Praxair Technology, Inc. (US)

- The Linde Group (Germany)

- NOVA Chemicals Corporate (Canada)

- Dycon Chemicals (India)

Latest Developments in Global Ethylene Market

- In April 2023, BASF SE (Germany) announced a significant investment in the expansion of its ethylene cracker unit in Antwerp, Belgium. The upgrade is aimed at enhancing production efficiency and reducing carbon emissions through the integration of advanced steam cracking technologies. This move supports BASF’s long-term strategy toward sustainable ethylene production aligned with its climate-neutral targets

- In March 2023, Exxon Mobil Corporation (US) commenced operations at its new Baytown chemical expansion project in Texas, US, which includes a large-scale ethylene production facility. The site is expected to add approximately 1.5 million metric tons per year of ethylene capacity, strengthening ExxonMobil’s position in the North American ethylene market and catering to growing demand in packaging and industrial sectors

- In March 2023, SABIC (Saudi Arabia), in partnership with ExxonMobil, announced the mechanical completion of the Gulf Coast Growth Ventures (GCGV) project in Texas, US. The joint venture includes an ethane steam cracker with an annual capacity of 1.8 million metric tons of ethylene. The facility is strategically located to leverage US shale gas feedstock, improving production economics and competitiveness

- In February 2023, INEOS (UK) confirmed progress on its Project ONE in Antwerp, Belgium, a state-of-the-art ethylene production facility projected to be the most environmentally sustainable of its kind in Europe. The plant will utilize advanced technologies to achieve the lowest carbon footprint per ton of ethylene produced, aligning with the EU’s Green Deal objectives

- In January 2023, LyondellBasell Industries (Netherlands/US) announced the launch of its Circular Steam Cracker Initiative, aimed at transforming its ethylene production process at selected sites to incorporate waste-derived feedstocks. The initiative supports the company’s broader goals for circular economy integration and reducing greenhouse gas emissions across its ethylene value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ETHYLENE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ETHYLENE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 IMPORT AND EXPORT DATA

2.16 GLOBAL ETHYLENE MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 IMPACT OF COVID-19 PANDEMIC ON THE GLOBAL ETHYLENE MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTUERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL ETHYLENE MARKET, BY FEEDSTOCK

7.1 OVERVIEW

7.2 NAPHTHA

7.3 ETHANE

7.4 PROPANE

7.5 BUTANE

7.6 OTHERS

8 GLOBAL ETHYLENE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 POLYETHYLENE

8.3 ETHYLENE OXIDE

8.4 ETHYLENE BENZENE

8.5 ETHYLENE DICHLORIDE

8.6 ETHYLENE GLYCOL

8.7 VINYL ACETATE

8.8 ALPHA OLEFINS

8.9 OTHERS

9 GLOBAL ETHYLENE MARKET, BY END-USE

9.1 OVERVIEW

9.2 PACKAGING

9.2.1 NAPHTHA

9.2.2 ETHANE

9.2.3 PROPANE

9.2.4 BUTANE

9.2.5 OTHERS

9.3 AUTOMOTIVE

9.3.1 NAPHTHA

9.3.2 ETHANE

9.3.3 PROPANE

9.3.4 BUTANE

9.3.5 OTHERS

9.4 CONSTRUCTION

9.4.1 NAPHTHA

9.4.2 ETHANE

9.4.3 PROPANE

9.4.4 BUTANE

9.4.5 OTHERS

9.5 AGROCHEMICAL

9.5.1 NAPHTHA

9.5.2 ETHANE

9.5.3 PROPANE

9.5.4 BUTANE

9.5.5 OTHERS

9.6 TEXTILE

9.6.1 NAPHTHA

9.6.2 ETHANE

9.6.3 PROPANE

9.6.4 BUTANE

9.6.5 OTHERS

9.7 CHEMICALS

9.7.1 NAPHTHA

9.7.2 ETHANE

9.7.3 PROPANE

9.7.4 BUTANE

9.7.5 OTHERS

9.8 RUBBER & PLASTICS

9.8.1 NAPHTHA

9.8.2 ETHANE

9.8.3 PROPANE

9.8.4 BUTANE

9.8.5 OTHERS

9.9 SOAPS & DETERGENTS

9.9.1 NAPHTHA

9.9.2 ETHANE

9.9.3 PROPANE

9.9.4 BUTANE

9.9.5 OTHERS

9.1 OTHERS

10 GLOBAL ETHYLENE MARKET, BY GEOGRAPHY

10.1 GLOBAL ETHYLENE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.2 OVERVIEW

10.3 NORTH AMERICA

10.3.1 U.S.

10.3.2 CANADA

10.3.3 MEXICO

10.4 EUROPE

10.4.1 GERMANY

10.4.2 U.K.

10.4.3 ITALY

10.4.4 FRANCE

10.4.5 SPAIN

10.4.6 SWITZERLAND

10.4.7 RUSSIA

10.4.8 TURKEY

10.4.9 BELGIUM

10.4.10 NETHERLANDS

10.4.11 REST OF EUROPE

10.5 ASIA-PACIFIC

10.5.1 JAPAN

10.5.2 CHINA

10.5.3 SOUTH KOREA

10.5.4 INDIA

10.5.5 AUSTRALIA & NEW ZEALAND

10.5.6 HONG KONG

10.5.7 TAIWAN

10.5.8 SINGAPORE

10.5.9 THAILAND

10.5.10 INDONESIA

10.5.11 MALAYSIA

10.5.12 PHILIPPINES

10.5.13 REST OF ASIA-PACIFIC

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.2 ARGENTINA

10.6.3 REST OF SOUTH AMERICA

10.7 MIDDLE EAST AND AFRICA

10.7.1 SOUTH AFRICA

10.7.2 EGYPT

10.7.3 SAUDI ARABIA

10.7.4 UNITED ARAB EMIRATES

10.7.5 ISRAEL

10.7.6 REST OF MIDDLE EAST AND AFRICA

11 GLOBAL ETHYLENE MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.4 COMPANY SHARE ANALYSIS: EUROPE

11.5 MERGERS & ACQUISITIONS

11.6 NEW PRODUCT DEVELOPMENT & APPROVALS

11.7 EXPANSIONS

11.8 REGULATORY CHANGES

11.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 SWOT ANALYSIS

13 GLOBAL ETHYLENE MARKET – COMPANY PROFILE

13.1 SABIC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 DOW

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 EXXON MOBIL CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 ROYAL DUTCH SHELL

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 CHINA PETROLEUM & CHEMICAL CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 CHEVRON PHILLIPS CHEMICAL COMPANY

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATES

13.7 CHEVRON PHILLIPS CHEMICAL COMPANY

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATES

13.8 TOTAL

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 REPSOL

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 BASF SE

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATES

13.12 WESTLAKE CHEMICAL CORPORATION

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT UPDATES

13.13 SASOL

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATES

13.14 MITSUBISHI CHEMICAL CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT UPDATES

13.15 NOVA CHEMICALS CORPORATION

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT UPDATES

13.16 RELIANCE INDUSTRIES

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT UPDATES

13.17 INDIAN OIL CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT UPDATES

13.18 HALDIA PETROCHEMICALS

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT UPDATES

13.19 GAIL INDIA LIMITED

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT UPDATES

13.2 HANNONG CHEMICALS INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

16 ABOUT DATA BRIDGE MARKET RESEARCH

Global Ethylene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ethylene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ethylene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.