Global Eubiotics For Swine Application Market

Market Size in USD Billion

CAGR :

%

USD

5.00 Billion

USD

5.83 Billion

2025

2033

USD

5.00 Billion

USD

5.83 Billion

2025

2033

| 2026 –2033 | |

| USD 5.00 Billion | |

| USD 5.83 Billion | |

|

|

|

|

What is the Global Eubiotics for Swine Application Market Size and Growth Rate?

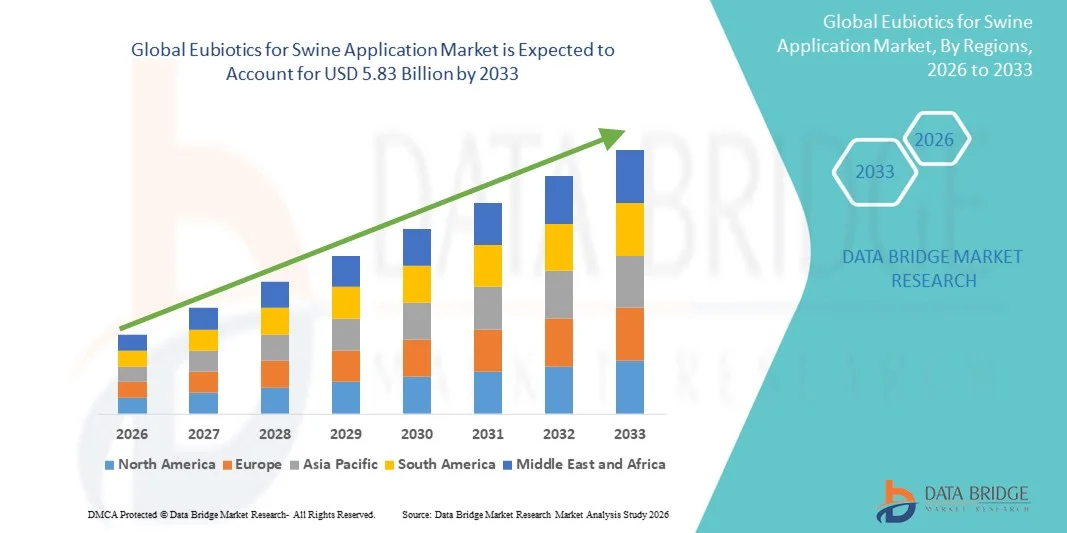

- The global eubiotics for swine application market size was valued at USD 5.00 billion in 2025 and is expected to reach USD 5.83 billion by 2033, at a CAGR of7.30% during the forecast period

- Rise in demand for animal proteins will induce growth of eubiotics for swine application market. Ban on the use of antibiotics imposed by the government will again create lucrative growth opportunities for the eubiotics for swine application market

- Rising awareness about feed quality and safety and increasing personal disposable income will also induce growth of eubiotics for swine application market

What are the Major Takeaways of Eubiotics for Swine Application Market?

- Rising research and development proficiencies in the direction of animal feed and nutrition will indirectly promote growth in the demand for eubiotics for swine application

- However, stringent regulations imposed on the import and export have led to creation of complexities which in turn will adversely affect the eubiotics for swine application market. Fluctuations in the prices of raw materials will also slowdown the market growth rate. Rising disease outbreaks in swine will also challenge the market growth

- Europe dominated the eubiotics for swine application market with a 41.82% revenue share in 2025, driven by strong adoption of natural feed additives, stringent regulations on antibiotic use, and widespread integration of eubiotics into commercial swine production systems across Germany, France, the Netherlands, Spain, and Denmark

- Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by expanding swine populations, rapid modernization of farming systems, and rising awareness of gut health solutions across China, Japan, India, South Korea, Vietnam, and the Philippines

- The Probiotics segment dominated the market with a 38.6% share in 2025, driven by rising demand for natural microbial solutions that improve gut microflora balance, nutrient absorption, immunity, and disease resistance in swine

Report Scope and Eubiotics for Swine Application Market Segmentation

|

Attributes |

Eubiotics for Swine Application Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Eubiotics for Swine Application Market?

Increasing Shift Toward Natural, High-Purity, and Performance-Enhancing Eubiotics for Swine Health Management

- The eubiotics for swine application market is witnessing growing adoption of natural feed additives, including probiotics, prebiotics, organic acids, and essential oils, driven by rising restrictions on antibiotic growth promoters and the need for safer alternatives

- Manufacturers are introducing high-potency strains, microencapsulated formulations, and multifunctional blends designed to improve gut health, immunity, nutrient absorption, and overall swine productivity

- Increasing demand for cost-efficient, residue-free, and performance-oriented eubiotics is boosting adoption across commercial farms, feed mills, and integrated livestock operations

- For instance, major companies such as Chr. Hansen, DSM, Novus International, Kemin Industries, and Cargill have expanded their swine eubiotic portfolios with advanced probiotic strains, precision-delivered organic acids, and tailored gut-health solutions

- Rising focus on antibiotic-free production, improved feed efficiency, and reduced disease susceptibility is accelerating market growth globally

- As swine producers adopt data-driven nutrition and sustainable livestock management, demand for high-performance, natural eubiotics will continue to strengthen

What are the Key Drivers of Eubiotics for Swine Application Market?

- Rising need for antibiotic-free, safe, and natural growth promoters in swine nutrition due to regulatory restrictions and increasing consumer preference for clean-label meat

- For instance, in 2025, leading companies such as DSM, Novozymes, and Lallemand enhanced their eubiotic solutions with advanced microbial strains, improved digestibility enhancers, and optimized organic acid blends

- Growing adoption of probiotics, prebiotics, essential oils, and organic acids to improve gut microbiota, immunity, and feed conversion ratios across the U.S., Europe, and Asia-Pacific

- Advancements in microencapsulation, fermentation technology, strain stabilization, and controlled-release delivery have significantly improved product efficacy and stability

- Increasing prevalence of gut disorders, heat stress, and pathogen challenges in swine production is driving need for targeted gut-health solutions

- Supported by rising investments in animal nutrition R&D, sustainable livestock production, and precision feeding systems, the eubiotics for swine application market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Eubiotics for Swine Application Market?

- High costs associated with premium microbial strains, stabilized formulations, and advanced eubiotic blends limit adoption among small farms and low-income livestock producers

- For instance, during 2024–2025, fluctuations in fermentation input costs, instability of raw material supply, and increased production expenses impacted pricing across several global manufacturers

- Variability in strain performance, gut microbiota response, and farm conditions increases the need for skilled nutritionists and continuous monitoring

- Limited awareness in emerging markets regarding eubiotic benefits, proper dosage, and synergistic combinations slows adoption across smallholders

- Competition from conventional growth promoters, general feed additives, and low-cost alternatives creates pricing pressure and affects product differentiation

- To overcome these challenges, companies are focusing on cost-optimized formulations, farm-level education, precision dosing systems, and stronger scientific validation to expand global adoption of Eubiotics for Swine Applications

How is the Eubiotics for Swine Application Market Segmented?

The market is segmented on the basis of channel count, application, and vertical.

- By Type

The eubiotics for swine application market is segmented into Probiotics, Prebiotics, Organic Acids, and Essential Oils. The Probiotics segment dominated the market with a 38.6% share in 2025, driven by rising demand for natural microbial solutions that improve gut microflora balance, nutrient absorption, immunity, and disease resistance in swine. High adoption in commercial farms, feed mills, and integrated livestock systems supports strong utilization. Probiotics are widely used to replace antibiotic growth promoters, reduce pathogen load, and enhance feed conversion ratios.

The Essential Oils segment is expected to grow at the fastest CAGR from 2026 to 2033, owing to increasing preference for plant-derived compounds that offer antimicrobial, anti-inflammatory, and digestion-enhancing benefits. Rising momentum toward sustainable, residue-free, and multifunctional additives is driving rapid adoption. Continuous advancements in microencapsulation and synergistic blends further support growth across global swine production systems.

- By Form

The market is categorized into Dry and Liquid forms. The Dry segment dominated the market with a 62.4% share in 2025, primarily due to its superior stability, ease of mixing, longer shelf life, and compatibility with commercial feed manufacturing processes such as pelleting and extrusion. Dry eubiotics—including probiotic powders, coated organic acids, and encapsulated essential oils—are widely used across large-scale feed mills and farrow-to-finish operations. Their cost efficiency and reduced transportation complexity further enhance adoption.

The Liquid segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising usage in nursery feed, water-based supplementation, and precision delivery systems. Liquid formulations offer high bioavailability, improved dispersion, and rapid response in stress management programs. Increasing use in early-stage piglets, heat-stress mitigation, and disease outbreak control contributes to accelerating market penetration.

- By Function

On the basis of function, the market is segmented into Nutrition & Gut Health, Yield, Immunity, and Productivity. The Nutrition & Gut Health segment dominated the market with a 44.1% share in 2025, driven by rising concerns over digestive disorders, pathogen challenges, and declining performance associated with antibiotic withdrawal. Eubiotics such as probiotics, prebiotics, and organic acids help maintain intestinal integrity, optimize microbiota composition, and improve nutrient assimilation—making them essential for swine health.

The Immunity segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by increasing disease prevalence, biosafety concerns, and demand for natural immune enhancers. Advanced microbial strains, immunomodulatory organic acids, and plant-based actives are being adopted to improve resilience and reduce mortality. Growing focus on herd health management and preventive nutrition further drives segment expansion.

- By Application

The eubiotics for swine application market is segmented into Gut Health, Immunity, Yield, and Others. The Gut Health segment dominated the market with a 41.7% share in 2025, as maintaining optimal digestive function is critical for growth performance, feed conversion, and disease resistance. Eubiotics help reduce harmful bacteria, enhance beneficial microbes, and stabilize intestinal environments during stress periods such as weaning and feed transition.

The Yield segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for high-efficiency production systems, better carcass quality, and improved average daily gain (ADG). Producers are increasingly adopting synergistic eubiotic combinations to enhance nutrient absorption, reduce feed costs, and maximize output. Continuous innovation in precision nutrition and performance enhancers further accelerates growth.

Which Region Holds the Largest Share of the Eubiotics for Swine Application Market?

- Europe dominated the eubiotics for swine application market with a 41.82% revenue share in 2025, driven by strong adoption of natural feed additives, stringent regulations on antibiotic use, and widespread integration of eubiotics into commercial swine production systems across Germany, France, the Netherlands, Spain, and Denmark. Rising focus on animal welfare, food safety, and sustainable livestock nutrition continues to boost demand for probiotics, prebiotics, organic acids, and essential oils

- Leading European companies are expanding their portfolios with advanced microbial strains, encapsulated organic acids, and multi-functional Eubiotic blends designed to enhance gut health, improve feed efficiency, and strengthen immunity. Extensive research activities, strong veterinary infrastructure, and government-backed programs supporting antibiotic-free production reinforce Europe’s leadership

- High concentration of commercial farms, advanced feed manufacturing capabilities, and strong awareness about gut health and productivity solutions further strengthen regional dominance

Asia-Pacific Eubiotics for Swine Application Market

Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by expanding swine populations, rapid modernization of farming systems, and rising awareness of gut health solutions across China, Japan, India, South Korea, Vietnam, and the Philippines. Increasing outbreaks of digestive disorders, higher feed costs, and growing demand for performance-enhancing additives are pushing producers toward probiotics, prebiotics, and organic acids. Strong growth in commercial farming, along with rising investment from global feed companies and domestic manufacturers, further accelerates eubiotic adoption. Demand is also supported by rising pork consumption, urbanization, and evolving regulations toward safer and residue-free meat production.

China Eubiotics for Swine Application Market Insight

China leads the Asia-Pacific region due to its massive pork production volume, extensive commercial farming base, and strong transition toward antibiotic-free feed systems. Government-led initiatives promoting animal health, increased focus on gut resilience post-ASF impact, and rapid adoption of advanced eubiotic blends drive market expansion. Local manufacturing capacity and growing investment in microbial strain development further strengthen domestic consumption.

Japan Eubiotics for Swine Application Market Insight

Japan demonstrates steady adoption supported by high-quality livestock practices, strong emphasis on feed safety, and preference for premium biological additives. Advanced farming systems, improved biosecurity measures, and continuous innovation in precision nutrition drive interest in multi-functional eubiotics. Increasing focus on immunity enhancement and gut microbiota optimization supports sustained market growth.

India Eubiotics for Swine Application Market Insight

India is emerging as a high-potential market fueled by rapid expansion of organized livestock farms, government-backed animal health programs, and growing adoption of gut-health enhancers in commercial feed. Rising demand for cost-effective performance boosters, increasing awareness of feed efficiency improvement, and expansion of domestic feed production play a key role. Growing investment in regional R&D and local manufacturing supports long-term market penetration.

South Korea Eubiotics for Swine Application Market Insight

South Korea contributes significantly due to strong adoption of functional additives in high-value pork production, growing use of probiotics and organic acids for disease prevention, and increased emphasis on gut integrity under intensive farming conditions. Expansion of advanced feed mills, technological innovations, and rising demand for residue-free pork products drive continuous market growth.

Which are the Top Companies in Eubiotics for Swine Application Market?

The eubiotics for swine application industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DSM (Netherlands)

- Novozymes (Denmark)

- DuPont (U.S.)

- Cargill, Incorporated (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- ASAHI GROUP HOLDINGS, Ltd. (Japan)

- Lesaffre (France)

- Kemin Industries, Inc. (U.S.)

- Lallemand Inc. (Canada)

- BEHN MEYER (Germany)

- NOVUS INTERNATIONAL (U.S.)

- BENEO (Germany)

- Yara (Norway)

- Roquette Frères (France)

- FrieslandCampina (Netherlands)

- Neospark Drugs and Chemicals Private Limited (India)

- MSPrebiotics Inc. (U.S.)

- ADDCON GmbH (Germany)

- ADVANCED BIONUTRITION CORP (U.S.)

What are the Recent Developments in Global Eubiotics for Swine Application Market?

- In April 2025, Evonik launched Ecobiol, a Bacillus subtilis-based probiotic designed to strengthen poultry gut health and improve feed conversion efficiency in mainland China. This introduction supports the rising demand for sustainable and functional feed additives in modern livestock production

- In January 2025, Novus International partnered with Resilient Biotics to develop a microbial feed solution aimed at improving immune function and reducing respiratory challenges in swine. This collaboration reinforces the shift toward microbiome-driven approaches for maintaining gut and respiratory health in antibiotic-free livestock system

- In October 2024, Novus International and Ginkgo Bioworks established a partnership to create advanced feed additives focused on enhancing livestock health and overall productivity. This initiative initially prioritizes developing next-generation enzymes with improved performance, strengthening innovation in animal nutrition

- In December 2021, Novus International entered into a research partnership with Agrivida, a U.S.-based biotechnology firm, to explore new product development opportunities in eubiotics. This collaboration is expected to accelerate innovation and broaden Novus’s future eubiotics portfolio

- In July 2021, Koninklijke DSM NV (Royal DSM) acquired Midori USA Inc., a start-up specializing in targeted eubiotics aimed at improving animal health and environmental impact. This acquisition introduced novel glycan-based technology that supports consistent gut microbiome modulation and enhances nutrient utilization in livestock

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.