Global Eubiotics Market

Market Size in USD Billion

CAGR :

%

USD

5.64 Billion

USD

9.75 Billion

2024

2032

USD

5.64 Billion

USD

9.75 Billion

2024

2032

| 2025 –2032 | |

| USD 5.64 Billion | |

| USD 9.75 Billion | |

|

|

|

|

What is the Global Eubiotics Market Size and Growth Rate?

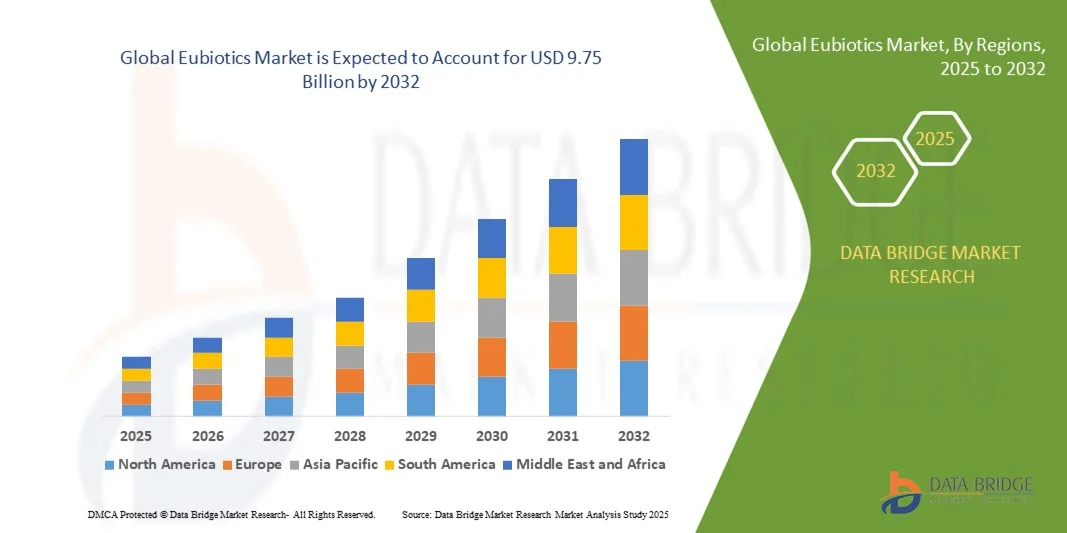

- The global eubiotics market size was valued at USD 5.64 billion in 2024 and is expected to reach USD 9.75 billion by 2032, at a CAGR of 7.07% during the forecast period

- Rising levels of demand for better nutrition and proteins for animals and surge in livestock population base are the major factors fostering the growth of the market

- Changing lifestyle, growing awareness about the availability of such compounds as a replacement of antibiotic growth promoters and rising focus towards maintaining the livestock health are other important factors acting as market growth determinants

What are the Major Takeaways of Eubiotics Market?

- Rising expenditure to undertake research and development proficiencies and growth in the adoption of animal feed will further induce growth in the market value

- However, stringent regulatory procedures in regards to product approvals will pose a major challenge to the growth of the market. High costs associated with the production of these compounds will also hamper the market growth rate

- Europe dominated the eubiotics market with the largest revenue share of 38.5% in 2024, driven by the presence of established animal feed industries, stringent regulations promoting animal health, and increasing adoption of functional feed additives across livestock and aquaculture

- The Asia-Pacific eubiotics market is set to grow at a CAGR of 9.54% between 2025 and 2032, driven by rising livestock and aquaculture production, increasing disposable incomes, and rapid technological adoption in countries such as China, India, and Japan

- The probiotics segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its proven efficacy in improving gut health, enhancing immunity, and promoting growth in livestock

Report Scope and Eubiotics Market Segmentation

|

Attributes |

Eubiotics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Eubiotics Market?

Rising Adoption of Natural and Sustainable Feed Additives

- A key trend in the global eubiotics market is the growing preference for natural, sustainable, and functional feed additives that improve animal gut health, immunity, and overall productivity. This trend is driven by increasing regulatory restrictions on antibiotics and rising consumer demand for chemical-free livestock products

- For instance, the use of probiotics, prebiotics, organic acids, and phytogenics is rapidly expanding across poultry, swine, and ruminant sectors to enhance digestion, nutrient absorption, and disease resistance. Companies such as DSM and Chr. Hansen are developing tailored Eubiotic solutions for various species, emphasizing safety, efficacy, and sustainability

- Eubiotics are also increasingly integrated with precision livestock farming technologies, enabling real-time monitoring of animal health and optimizing feed formulations. Such integration allows farmers to maximize productivity while minimizing environmental impact, supporting a more data-driven and sustainable approach to livestock management

- The shift toward natural feed additives is reshaping industry standards and consumer expectations, encouraging innovation and collaboration across feed manufacturers, ingredient suppliers, and livestock producers

What are the Key Drivers of Eubiotics Market?

- The rising concerns over antibiotic resistance and food safety are driving the adoption of Eubiotics as alternatives to growth-promoting antibiotics in livestock

- For instance, regulatory actions in the European Union and North America have restricted prophylactic use of antibiotics in feed, increasing the reliance on natural gut health enhancers such as probiotics and enzymes

- Growing demand for high-quality animal protein products with reduced chemical residues is prompting livestock producers to adopt Eubiotics for improved animal growth, feed efficiency, and immunity

- The expansion of intensive livestock farming, particularly in Asia-Pacific and Latin America, is increasing the need for feed additives that optimize animal health, reduce disease incidence, and lower production costs

- Technological advancements in feed formulation, including precision nutrition and customized Eubiotic blends, further fuel market growth by improving feed conversion ratios and promoting sustainability across commercial farms

Which Factor is Challenging the Growth of the Eubiotics Market?

- High costs and limited awareness about eubiotics among small-scale farmers in emerging regions pose a significant challenge to broader adoption. Many producers perceive these additives as expensive compared to conventional feed solutions

- Variability in product efficacy and lack of standardized quality certifications for probiotics and other natural feed additives may also reduce trust among end-users

- Inadequate knowledge regarding correct dosages, storage conditions, and integration into feed formulations can lead to suboptimal results, limiting the perceived benefits of Eubiotics

- While prices are gradually decreasing and regulatory support is increasing, achieving widespread adoption requires farmer education, demonstration of measurable benefits, and affordable solutions

- Overcoming these challenges through awareness campaigns, government incentives, and innovation in cost-effective Eubiotic products will be critical for sustained market growth

How is the Eubiotics Market Segmented?

The market is segmented on the basis of product type, end-use, and distribution channel.

- By Product Type

On the basis of product type, the eubiotics market is segmented into probiotics, prebiotics, enzymes, organic acids, phytogenics, and other functional feed additives. The probiotics segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its proven efficacy in improving gut health, enhancing immunity, and promoting growth in livestock. Probiotics are widely adopted across poultry, swine, and ruminant production due to their safety, compatibility with feed formulations, and measurable benefits in reducing disease incidence.

The enzymes segment is anticipated to witness the fastest growth rate of 22.3% from 2025 to 2032, fueled by rising demand for feed efficiency, nutrient optimization, and reduction of feed costs. Enzymes improve digestibility of nutrients, helping livestock producers maximize productivity while adhering to sustainable farming practices.

- By End-Use

On the basis of end-use, the eubiotics market is segmented into poultry, swine, ruminants, aquaculture, and others. The poultry segment accounted for the largest market revenue share of 42.1% in 2024, owing to the rapid expansion of the global poultry industry, high consumption of poultry meat, and the need for preventive health management.

The aquaculture segment is expected to witness the fastest CAGR of 23.5% from 2025 to 2032, driven by rising seafood demand, intensive aquaculture practices, and increasing adoption of feed additives to improve water quality, digestion, and disease resistance in fish and shrimp farming.

- By Distribution Channel

On the basis of distribution channel, the eubiotics market is segmented into direct sales, distributors & wholesalers, e-commerce platforms, and others. The distributors & wholesalers segment dominated the market with a revenue share of 45% in 2024, supported by well-established supply chains, ease of product availability, and strong relationships with livestock farms.

The e-commerce segment is anticipated to witness the fastest growth at 21.8% CAGR from 2025 to 2032, driven by the rising adoption of digital platforms for purchasing feed additives, increased accessibility in remote regions, and growing awareness of product efficacy through online information and reviews.

Which Region Holds the Largest Share of the Eubiotics Market?

- Europe dominated the eubiotics market with the largest revenue share of 38.5% in 2024, driven by the presence of established animal feed industries, stringent regulations promoting animal health, and increasing adoption of functional feed additives across livestock and aquaculture

- Consumers and producers in the region highly value the benefits of eubiotics in enhancing gut health, improving immunity, and reducing antibiotic usage in animals, aligning with sustainable and health-focused livestock practices

- The region’s growth is further supported by well-developed feed manufacturing infrastructure, high-quality raw material availability, and strong government initiatives promoting the use of probiotics, prebiotics, and other functional feed additives, making Europe a preferred hub for eubiotics consumption

Germany Eubiotics Market Insight

Germany accounted for 27% of Europe’s Eubiotics market revenue in 2024, making it one of the leading consumers of functional feed additives. The country’s strong livestock and poultry industries prioritize gut health, immunity, and productivity improvements through Eubiotics, helping reduce antibiotic usage. Stringent animal welfare regulations, sustainable farming practices, and advanced feed manufacturing infrastructure further support adoption. Farmers increasingly use probiotics, prebiotics, and phytogenic additives to enhance animal performance and health. In addition, growing awareness among feed manufacturers and integration of cutting-edge technology in feed production is strengthening Germany’s position as a dominant market for Eubiotics in Europe.

U.K. Eubiotics Market Insight

The U.K. eubiotics market is witnessing steady growth due to increasing emphasis on animal welfare, antibiotic-free livestock, and sustainable farming practices. Functional feed additives, including probiotics, prebiotics, and enzymes, are widely adopted to improve gut health and productivity in poultry, dairy, and swine. The country benefits from advanced feed manufacturing infrastructure, strong distribution networks, and government initiatives promoting responsible livestock management. Rising consumer awareness regarding the safety and quality of meat, dairy, and aquaculture products further drives demand. Consequently, the U.K. continues to expand its Eubiotics market share, supporting both domestic production and exports of functional feed-enhanced livestock.

France Eubiotics Market Insight

France’s eubiotics market is growing steadily, driven by a large-scale livestock sector and rising focus on animal health and sustainability. Producers increasingly integrate functional feed additives such as probiotics, prebiotics, and phytogenics to enhance gut health, immunity, and overall productivity. Government initiatives promoting antibiotic reduction in livestock feed and strict regulatory compliance boost market adoption. In addition, France’s strong feed manufacturing capabilities and established distribution channels enable efficient delivery of Eubiotics solutions across the country. Consumer preference for safe, high-quality animal products further encourages farmers and feed manufacturers to adopt Eubiotics, ensuring consistent market growth and enhanced competitiveness in the European livestock sector.

Which Region is the Fastest Growing Region in the Eubiotics Market?

The Asia-Pacific eubiotics market is set to grow at a CAGR of 9.54% between 2025 and 2032, driven by rising livestock and aquaculture production, increasing disposable incomes, and rapid technological adoption in countries such as China, India, and Japan. Growing demand for high-quality animal products, government initiatives promoting sustainable farming, and awareness about reducing antibiotic use in feed are accelerating adoption of Eubiotics. In addition, APAC is emerging as a manufacturing hub, offering affordable feed solutions, making Eubiotics increasingly accessible across the region and supporting growth in both commercial livestock and aquaculture sectors.

China Eubiotics Market Insight

China held the largest share in the Asia-Pacific Eubiotics market in 2024, fueled by its extensive livestock and aquaculture sectors. Rising demand for meat, dairy, and aquaculture products, combined with government policies promoting sustainable farming, drives Eubiotics adoption. Producers are increasingly integrating probiotics, prebiotics, and enzymes into feed to improve animal gut health, immunity, and productivity, while reducing antibiotic use. Domestic manufacturing of cost-effective eubiotics products enhances affordability and accessibility. Technological advancements in feed production, growing awareness of food safety, and rapid urbanization further support market expansion, positioning China as a key growth hub in the APAC Eubiotics landscape.

India Eubiotics Market Insight

India’s eubiotics market is expanding rapidly due to increasing poultry, dairy, and aquaculture production, coupled with rising awareness of animal health. Feed manufacturers are adopting probiotics, prebiotics, enzymes, and phytogenics to improve gut health, immunity, and productivity while reducing antibiotic dependency. Government initiatives promoting sustainable livestock practices and better feed standards further encourage adoption. Rising demand for high-quality animal products, coupled with growing investments in feed technology and infrastructure, is propelling market growth. Small- and large-scale farms asuch as are increasingly integrating functional feed additives, making India one of the fastest-growing Eubiotics markets in the Asia-Pacific region.

Japan Eubiotics Market Insight

Japan’s eubiotics market growth is driven by a focus on advanced livestock technologies and high standards for animal health and product safety. Producers are adopting functional feed additives such as probiotics, prebiotics, and enzymes to improve gut health, immunity, and overall productivity in poultry, swine, and aquaculture. The country’s aging farming population and emphasis on efficiency and sustainability support innovative feed solutions. High consumer expectations for safe, antibiotic-free meat and dairy products further encourage adoption. Integration with smart feed management systems and strong manufacturing infrastructure strengthens Japan’s position as a technologically advanced and rapidly growing eubiotics market in APAC.

Which are the Top Companies in Eubiotics Market?

The eubiotics industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- Novozymes (Denmark)

- ASAHI GROUP HOLDINGS, Ltd. (Japan)

- Lesaffre (France)

- Kemin Industries, Inc. (U.S.)

- Lallemand Inc. (Canada)

- BEHN MEYER (Germany)

- NOVUS INTERNATIONAL (U.S.)

- BENEO (Germany)

- Yara (Norway)

- Roquette Frères (France)

- FrieslandCampina (Netherlands)

- Neospark Drugs and Chemicals Private Limited (India)

- MSPrebiotics Inc. (U.S.)

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- ADDCON GmbH (Germany)

What are the Recent Developments in Global Eubiotics Market?

- In April 2025, Evonik introduced Ecobiol, a Bacillus subtilis-based probiotic in mainland China, designed to enhance poultry gut health and improve feed efficiency. This launch addresses the rising demand for sustainable and functional feed additives in livestock production, positioning Evonik as a key contributor to animal health and productivity in the region

- In January 2025, Novus International and Resilient Biotics formed a strategic partnership to develop a microbial feed solution that strengthens immune health and mitigates respiratory issues in swine. The collaboration leverages microbiome-based approaches to support antibiotic-free livestock production, fostering healthier animals and sustainable farming practices

- In October 2024, Novus International partnered with Ginkgo Bioworks to create innovative feed additives aimed at enhancing livestock health and overall productivity. The initial focus was on developing enzymes with improved efficacy, highlighting a commitment to cutting-edge solutions in animal nutrition

- In January 2023, Cargill and BASF expanded their collaboration in feed enzyme development and distribution across the U.S. The partnership aimed to build a joint innovation pipeline catering to animal protein producers, addressing the growing demand for quality animal protein and supporting regional livestock productivity

- In August 2022, Koninklijke DSM NV launched Symphiome, a eubiotic feed additive that promotes gut health, growth, animal welfare, and sustainability in poultry. This product underscores DSM’s focus on enhancing livestock performance while contributing to environmentally responsible and health-conscious animal production practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Eubiotics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Eubiotics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Eubiotics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.