Global Ev Battery Testing Market

Market Size in USD Billion

CAGR :

%

USD

2.03 Billion

USD

7.18 Billion

2024

2032

USD

2.03 Billion

USD

7.18 Billion

2024

2032

| 2025 –2032 | |

| USD 2.03 Billion | |

| USD 7.18 Billion | |

|

|

|

|

EV Battery Testing Market Size

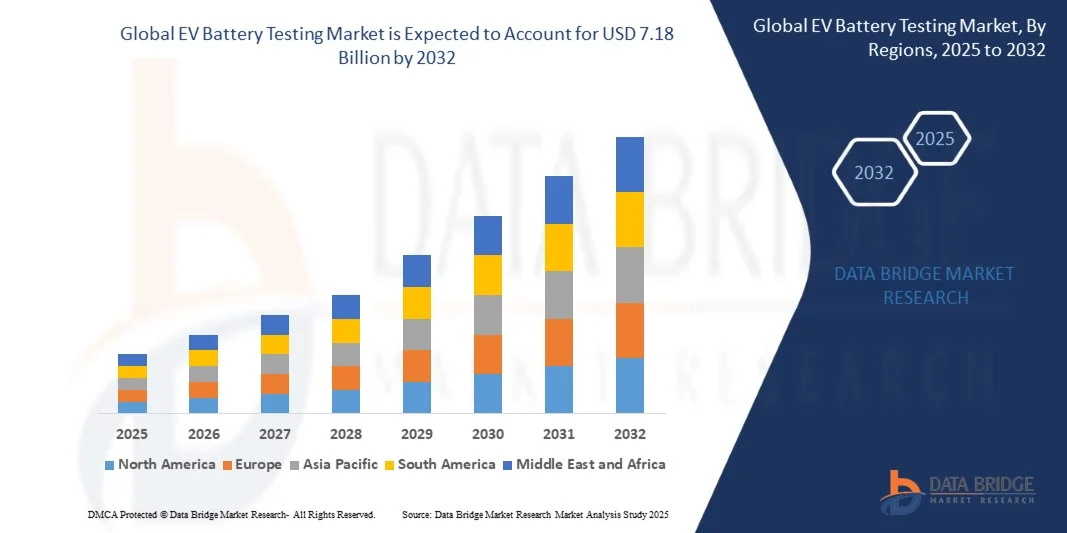

- The global EV battery testing market size was valued at USD 2.03 billion in 2024 and is expected to reach USD 7.18 billion by 2032, at a CAGR of 17.11% during the forecast period

- The market growth is largely fuelled by the rapid adoption of electric vehicles, increasing government regulations for battery safety, and rising investments in battery technologies

- Increasing demand for high-performance, safe, and durable batteries in automotive and energy storage applications is further driving the market expansion

EV Battery Testing Market Analysis

- Rising EV production and the push towards electrification of transportation are creating strong demand for comprehensive battery testing across different vehicle segments

- Technological advancements in battery chemistry, such as lithium-ion and solid-state batteries, are fueling the need for specialized performance, safety, and reliability testing

- Asia-Pacific dominated the EV battery testing market with the largest revenue share of 38.5% in 2024, driven by rapid adoption of electric vehicles, increasing urbanization, and government initiatives supporting EV infrastructure and digitalization

- North America region is expected to witness the highest growth rate in the global EV battery testing market, driven by strong government policies, rising consumer demand for EVs, and expanding R&D initiatives

- The Light Duty Vehicle segment held the largest market revenue share in 2024, driven by the widespread adoption of passenger EVs and increasing consumer preference for electric mobility solutions. Light-duty vehicles benefit from extensive testing protocols to ensure safety, reliability, and performance in daily usage

Report Scope and EV Battery Testing Market Segmentation

|

Attributes |

EV Battery Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

EV Battery Testing Market Trends

“Increasing Adoption of EVs and Stringent Safety Regulations”

- The growing shift toward electric vehicles (EVs) is transforming the battery testing landscape by increasing demand for safety, performance, and durability verification. Testing ensures compliance with regulatory standards, mitigates failure risks, and supports vehicle reliability, which ultimately enhances consumer confidence. This trend is reinforced by automakers’ emphasis on long-term warranty assurances and reduced recall incidents

- Rising adoption of EVs across commercial and passenger segments is accelerating the deployment of advanced battery testing equipment and software solutions. Battery manufacturers and automakers are investing in lab-based, field, and automated testing platforms to reduce operational risks and improve performance validation. In addition, testing integration with digital twins and IoT-enabled monitoring is becoming more prevalent for predictive maintenance

- The push for fast-charging solutions, longer battery life, and higher energy density is driving continuous innovation in testing technologies, allowing stakeholders to optimize battery design, thermal management, and safety protocols. Enhanced thermal runaway simulations, cycling tests, and high-voltage safety protocols are being incorporated to ensure robustness under extreme conditions

- For instance, in 2023, several North American and European EV manufacturers implemented enhanced cell-to-pack and cell-to-module testing procedures, resulting in improved battery reliability and extended vehicle warranties. These implementations also included software-driven predictive analytics to identify potential performance degradation before deployment

- While EV battery testing adoption is increasing, market growth depends on continued innovation, standardized protocols, and integration of AI-driven predictive testing systems to fully capitalize on global EV trends. Collaboration between testing equipment providers and automakers is key to developing scalable and cost-effective testing solutions

EV Battery Testing Market Dynamics

Driver

“Rapid Growth of Electric Vehicles and Focus on Battery Safety”

- The rise in EV adoption is pushing manufacturers and governments to prioritize battery testing as a critical safety and performance measure. Regulatory standards for battery safety, thermal stability, and lifecycle performance are accelerating investments in advanced testing platforms. Emerging regulations on recycling and second-life battery applications are further emphasizing the importance of validated testing protocols

- Automakers are increasingly aware of the financial and reputational risks associated with battery failures, including vehicle recalls, warranty claims, and reduced consumer trust. This awareness has driven widespread adoption of comprehensive testing solutions across multiple EV segments. Many manufacturers are incorporating accelerated aging and abuse testing to ensure battery longevity and reliability

- Public and private sector initiatives, including government incentives and international standardization programs, are strengthening battery testing infrastructure and encouraging adoption. This is particularly evident in regions with ambitious EV electrification targets, such as Europe, China, and North America. Partnerships between regulatory bodies and testing labs are expanding globally to harmonize battery safety standards

- For instance, in 2022, the European Union introduced mandatory EV battery testing standards for passenger and commercial vehicles, boosting demand for performance, safety, and durability testing equipment. Several multinational battery manufacturers adapted their production and testing workflows to comply with these evolving regulations

- While the driver remains strong, there is still a need to expand testing capabilities for emerging chemistries such as solid-state and lithium-sulfur batteries to ensure reliable adoption across all EV types. Integration of modular and AI-based testing platforms is critical to address the complexities of next-generation battery technologies

Restraint/Challenge

“High Equipment Costs and Technical Complexity of Advanced Testing”

- The EV battery testing market faces challenges due to the high cost of advanced testing equipment, software, and infrastructure. Small and mid-sized battery manufacturers may struggle to implement comprehensive testing solutions, limiting market penetration. In addition, recurring costs for calibration, software updates, and safety compliance add to operational expenses

- Complex testing protocols for cell-to-pack, module, and full-vehicle batteries require skilled personnel and specialized laboratories, which are often limited in developing regions. This reduces accessibility and slows adoption of rigorous testing standards. Remote monitoring and automated testing systems are increasingly needed to overcome personnel and logistical constraints

- Fluctuations in raw material supply and battery component quality can impact test repeatability and calibration, leading to increased operational costs and potential delays in production validation. Inconsistent supply of high-grade lithium, cathode materials, and separators poses additional challenges for standardizing testing procedures

- For instance, in 2023, several Asian and North American battery manufacturers reported delays in completing standardized testing cycles due to equipment shortages and technical challenges, affecting EV production schedules. Some manufacturers had to reschedule pilot production lines and extend validation timelines to meet regulatory requirements

- While innovations in automated and AI-enabled testing are ongoing, addressing cost, expertise, and infrastructure limitations remains critical to sustaining growth and global adoption of EV battery testing solutions. Collaboration with government programs, grants for testing infrastructure, and adoption of scalable testing platforms can mitigate some of these challenges

EV Battery Testing Market Scope

The EV battery testing market is segmented on the basis of EV type, form factor, propulsion, battery technology, chemistry, sourcing type, and testing type.

• By EV Type

On the basis of EV type, the market is segmented into Light Duty Vehicle and Heavy Commercial Vehicle. The Light Duty Vehicle segment held the largest market revenue share in 2024, driven by the widespread adoption of passenger EVs and increasing consumer preference for electric mobility solutions. Light-duty vehicles benefit from extensive testing protocols to ensure safety, reliability, and performance in daily usage.

The Heavy Commercial Vehicle segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising electrification in logistics and public transportation sectors. Commercial EVs require rigorous testing due to higher energy demands, longer operational hours, and stricter safety standards, making this segment a key driver for battery testing market expansion.

• By Form Factor

On the basis of form factor, the market is segmented into Prismatic, Pouch, and Cylindrical. The Prismatic segment held the largest share in 2024 due to its high energy density, compact design, and suitability across multiple EV platforms. Prismatic cells are widely adopted in passenger and commercial EVs for enhanced space utilization and performance.

The Pouch segment is expected to witness significant growth from 2025 to 2032, driven by their lightweight, flexible design and increasing adoption in electric two-wheelers, buses, and compact EVs. Cylindrical cells continue to maintain steady demand due to their proven reliability, thermal stability, and cost-effectiveness.

• By Propulsion

On the basis of propulsion, the market is segmented into Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV), Plug-In Hybrid Electric Vehicle (PHEV), and Fuel Cell Electric Vehicle (FCEV). The BEV segment held the largest share in 2024 owing to rapid adoption of fully electric passenger vehicles and supportive government incentives for clean mobility.

The HEV and PHEV segments is expected to witness significant growth from 2025 to 2032, driven by transitional adoption of hybrid technologies bridging conventional and fully electric vehicles. FCEVs are witnessing emerging interest due to long-range and zero-emission benefits, particularly in commercial and heavy-duty applications.

• By Battery Technology

On the basis of battery technology, the market is segmented into Cell-to-Module, Cell-to-Pack, and Cell-to-Chassis/Cell-to-Body. The Cell-to-Pack segment held the largest share in 2024 due to increasing deployment of large-format battery packs that require rigorous testing for safety, performance, and thermal management.

Cell-to-Module segments is expected to witness significant growth from 2025 to 2032, driven by advanced EV architectures and modular designs that optimize space, weight, and energy efficiency. Comprehensive testing across these formats ensures enhanced battery lifecycle and reliability.

• By Chemistry

On the basis of battery chemistry, the market is segmented into Lithium Ion and Solid State. The Lithium Ion segment dominated in 2024 due to widespread adoption, mature supply chains, and proven performance in both passenger and commercial EVs.

The Solid State segment is expected to witness significant growth from 2025 to 2032, driven by higher energy density, enhanced safety, and increasing development of next-generation EV batteries. Solid-state technologies are anticipated to transform future EV battery testing requirements significantly.

• By Sourcing Type

On the basis of sourcing type, the market is segmented into In-House and Outsourced. The In-House segment held the largest market share in 2024, owing to automakers’ focus on quality control, intellectual property protection, and regulatory compliance.

The Outsourced segment is expected to witness significant growth from 2025 to 2032, as manufacturers increasingly rely on specialized third-party laboratories for cost efficiency, scalability, and access to advanced testing infrastructure.

• By Testing Type

On the basis of testing type, the market is segmented into Safety Testing, Performance Testing, and Other Testing. Safety Testing held the largest revenue share in 2024, driven by stringent global regulations and the critical need to prevent thermal runaway, short circuits, and battery malfunctions.

Performance Testing is expected to witness significant growth from 2025 to 2032, focusing on charge-discharge efficiency, cycle life, operational durability, and optimization of battery management systems. Other testing includes environmental, regulatory compliance, and quality assurance assessments, which are increasingly required for global EV adoption.

EV Battery Testing Market Regional Analysis

- Asia-Pacific dominated the EV battery testing market with the largest revenue share of 38.5% in 2024, driven by rapid adoption of electric vehicles, increasing urbanization, and government initiatives supporting EV infrastructure and digitalization

- Consumers and manufacturers in the region are increasingly prioritizing battery safety, performance validation, and compliance with regulatory standards to ensure vehicle reliability and longevity

- This widespread adoption is further supported by the region emerging as a manufacturing hub for EV batteries and components, providing cost-effective and technologically advanced testing solutions for both domestic and export markets

China EV Battery Testing Market Insight

The China EV battery testing market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by the country’s growing middle class, increasing EV adoption across passenger and commercial segments, and strong government support for smart cities and electrification initiatives. The integration of advanced battery testing platforms for safety, performance, and durability verification is driving market growth. Furthermore, domestic manufacturers’ focus on innovative testing methods for lithium-ion and solid-state batteries is strengthening China’s position as a key contributor to global EV battery testing.

Japan EV Battery Testing Market Insight

The Japan EV battery testing market is expected to witness significant growth from 2025 to 2032 due to the country’s high-tech culture, rapid urbanization, and increasing focus on battery reliability and safety. The rising number of smart and connected vehicles, along with an aging population requiring easier-to-use solutions, is accelerating the adoption of advanced testing equipment. Integration with IoT-based vehicle monitoring systems and predictive analytics further supports market expansion.

North America EV Battery Testing Market Insight

North America held a significant share of the EV battery testing market in 2024, driven by rapid EV adoption, technological advancements, and growing consumer demand for safe and efficient electric mobility. The U.S. market, in particular, captured the largest revenue share within the region due to government incentives, robust R&D infrastructure, and increasing integration of AI-enabled testing systems. Battery manufacturers and OEMs are investing heavily in lab-based and field testing solutions to ensure compliance with evolving safety regulations and to enhance battery performance.

U.S. EV Battery Testing Market Insight

The U.S. EV battery testing market is expected to witness significant growth from 2025 to 2032, driven by the expansion of passenger and commercial EV segments. The growing trend of connected and autonomous EVs, coupled with stringent safety and performance regulations, has led to increased deployment of cell-to-module, cell-to-pack, and full-vehicle testing platforms. Adoption of AI-powered predictive testing systems and real-time monitoring tools is further accelerating market growth.

Europe EV Battery Testing Market Insight

The Europe EV battery testing market is expected to witness significant growth from 2025 to 2032, fueled by regulatory mandates for battery safety, thermal stability, and lifecycle performance. Increasing EV adoption in countries such as Germany, the U.K., and France, along with government support for electrification and emission reduction targets, is driving demand for advanced testing equipment. European manufacturers are focusing on high-precision testing methods and standardization of protocols across battery chemistries, including lithium-ion and emerging solid-state technologies.

Germany EV Battery Testing Market Insight

Germany’s EV battery testing market is expected to witness significant growth from 2025 to 2032 due to the country’s strong automotive sector, emphasis on digital security, and sustainable mobility initiatives. The market growth is supported by the integration of smart battery management systems and rigorous testing of high-capacity batteries for electric passenger and commercial vehicles. Manufacturers are also adopting automated and AI-assisted testing solutions to optimize battery performance and safety while reducing operational costs.

U.K. EV Battery Testing Market Insight

The U.K. EV battery testing market is expected to witness significant growth from 2025 to 2032, driven by the country’s increasing adoption of electric vehicles and government initiatives promoting clean transportation. Rising concerns over battery safety, performance, and durability are encouraging manufacturers and fleet operators to implement comprehensive testing solutions. In addition, the U.K.’s strong automotive R&D infrastructure, along with a growing preference for connected and smart EV technologies, is fueling the demand for advanced testing platforms across passenger and commercial EV segments.

EV Battery Testing Market Share

The EV Battery Testing industry is primarily led by well-established companies, including:

- Bureau Veritas (France)

- TÜV SÜD (Germany)

- UL Solutions (US)

- SGS SA (Switzerland)

- Intertek Group plc (UK)

- DEKRA (Germany)

- TÜV NORD GROUP (Germany)

- Applus+ (Spain)

- TÜV Rheinland (Germany)

- Eurofins Scientific (Luxembourg)

Latest Developments in EV Battery Testing Market

- In July 2024, TÜV SÜD (Germany) inaugurated a new laboratory focused on testing components for new energy vehicles. The facility aims to enhance certification and evaluation of EV technologies, ensuring compliance with strict safety, reliability, and environmental standards. This expansion strengthens TÜV SÜD’s position in the rapidly growing EV sector, supporting automakers with advanced testing solutions and boosting market confidence in vehicle performance and safety

- In December 2023, UL Solutions (US) signed a memorandum of understanding with Hyundai Mobis North America (US) to collaborate on EV battery safety and performance testing. The initiative leverages UL’s Advanced Battery Laboratory in Michigan, providing comprehensive reliability and performance assessments. This partnership accelerates innovation, enhances battery safety, and supports the growth of the North American EV market

- In November 2023, Intertek Group plc (UK) partnered with France-based Emitech Group to expand its electrical testing capabilities in Europe. The collaboration strengthens Intertek’s regional presence, offering enhanced laboratory access and testing services for EV batteries. This development improves testing efficiency, supports regulatory compliance, and meets growing European demand for safe and reliable EV technologies

- In November 2022, SGS SA (Switzerland) launched a new EV battery testing facility in Chakan, Pune, India. The laboratory provides comprehensive testing for durability, safety, and performance of EV batteries. This expansion boosts the Indian automotive sector, facilitates faster adoption of EV technologies, and supports manufacturers with high-quality, reliable battery solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.