Global Ev Charging Card Market

Market Size in USD Billion

CAGR :

%

USD

102.89 Billion

USD

321.38 Billion

2024

2032

USD

102.89 Billion

USD

321.38 Billion

2024

2032

| 2025 –2032 | |

| USD 102.89 Billion | |

| USD 321.38 Billion | |

|

|

|

|

EV Charging Card Market Size

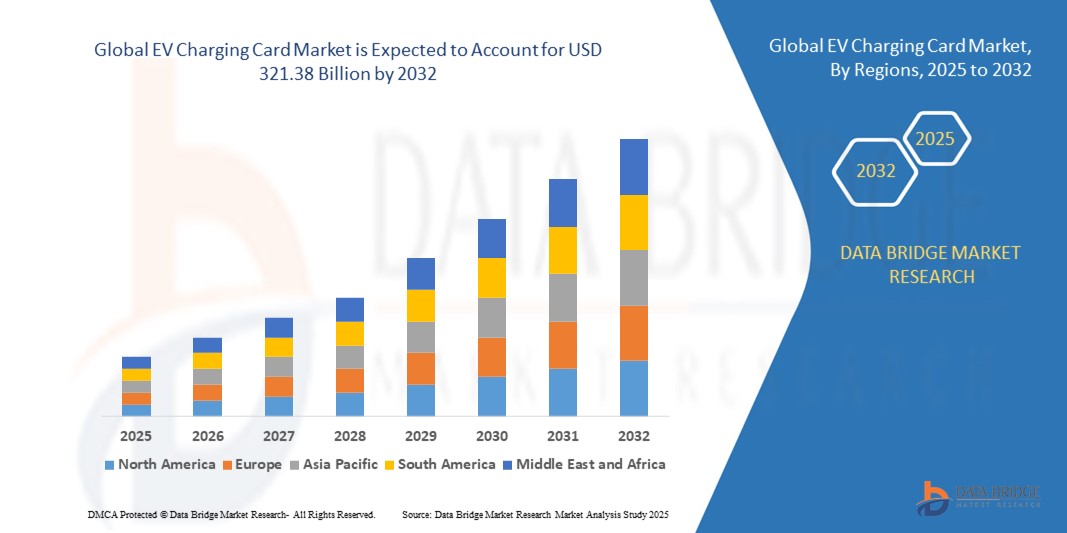

- The global EV charging card market size was valued at USD 102.89 billion in 2024 and is expected to reach USD 321.38 billion by 2032, at a CAGR of 15.30% during the forecast period

- The market growth is largely fuelled by the rapid expansion of electric vehicle infrastructure, increasing EV adoption rates, and the rising demand for seamless, cashless payment solutions for charging services

- Advancements in smart card technology, including contactless payments, real-time charging status updates, and enhanced security features, are further driving market expansion

EV Charging Card Market Analysis

- Growing emphasis on sustainability and government incentives for EV adoption are accelerating the need for efficient charging payment systems, with EV charging cards providing a convenient and secure solution for both public and private charging networks

- The integration of charging cards with mobile applications, loyalty programs, and multi-network interoperability is further enhancing user experience, promoting widespread adoption among EV owners and fleet operators

- Asia-Pacific dominated the EV charging card market with the largest revenue share in 2024, driven by rapid EV adoption, government-backed electrification programs, and significant investments in charging infrastructure across countries such as China, Japan, and India

- North America region is expected to witness the highest growth rate in the global EV charging card market, driven by robust technological advancements, supportive clean energy policies, and rising demand for seamless and interoperable payment solutions for EV charging

- The individual users segment held the largest market revenue share in 2024, driven by the rapid adoption of electric vehicles for personal use and the growing availability of public charging infrastructure. Convenience, cost transparency, and easy access to multiple charging networks have made charging cards an essential tool for everyday EV drivers.

Report Scope and EV Charging Card Market Segmentation

|

Attributes |

EV Charging Card Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

EV Charging Card Market Trends

Integration Of EV Charging Cards With Multi-Network And Digital Payment Platforms

- The increasing integration of EV charging cards with multiple charging networks and digital payment platforms is transforming user convenience by allowing seamless access across different charging providers. This interoperability reduces the need for multiple cards or apps, enabling EV drivers to charge anywhere without administrative hassles

- Growing demand for unified payment solutions is driving the adoption of EV charging cards linked with digital wallets, mobile banking, and subscription services. These integrated systems offer real-time billing, usage tracking, and cost optimization for both fleet operators and individual EV owners

- The expansion of roaming agreements between charging networks is making EV charging cards more versatile, improving cross-border travel convenience. Drivers can now access charging stations in multiple countries using a single card, addressing one of the key barriers to EV adoption in global markets

- For instance, in 2024, several European EV charging operators formed a coalition to launch a universal charging card compatible with over 300,000 stations across the continent, enhancing travel flexibility for EV drivers and boosting charging infrastructure utilization

- While interoperability and payment integration are enhancing user adoption, long-term success will depend on continued collaboration between charging networks, payment providers, and automotive OEMs to deliver a standardized, secure, and scalable ecosystem

EV Charging Card Market Dynamics

Driver

Rising Global EV Adoption And Need For Streamlined Charging Solutions

- The accelerating shift toward electric mobility, supported by government incentives, emission reduction targets, and falling battery costs, is driving the demand for efficient charging solutions. EV charging cards play a critical role in simplifying access and payments, making EV usage more practical for both individuals and fleets

- Fleet operators, in particular, are leveraging charging cards to manage large-scale EV deployments, track expenses, and optimize charging schedules, significantly improving operational efficiency and cost control

- Public and private sector initiatives are expanding charging infrastructure, making charging cards an essential link between users and a growing network of public and semi-public charging points

- For instance, in 2023, the U.S. Department of Energy partnered with multiple charging operators to promote interoperable EV charging cards as part of its National Electric Vehicle Infrastructure (NEVI) program, ensuring nationwide accessibility and ease of use

- While infrastructure growth is boosting charging card usage, continuous innovation in card technology, data integration, and customer support will be vital to sustaining market momentum

Restraint/Challenge

Fragmentation Of Charging Networks And Limited Interoperability In Emerging Markets

- Despite advancements in mature EV markets, many regions still face highly fragmented charging networks, where lack of standardization limits the usability of EV charging cards. Drivers may require separate accounts or cards for different networks, reducing convenience and adoption rates

- In emerging markets, insufficient infrastructure and inconsistent roaming agreements between operators make it difficult for charging cards to deliver full value. Limited coverage and varying tariff structures further discourage widespread usage

- Payment integration challenges also persist in regions with underdeveloped digital payment ecosystems, creating barriers for both local and visiting EV drivers. This is particularly problematic for cross-border travel in regions without unified charging protocols

- For instance, in 2023, EV associations in Southeast Asia reported that over 60% of drivers faced difficulties in finding compatible charging stations during intercity travel due to poor network integration and lack of roaming support

- Overcoming these barriers will require coordinated policy frameworks, investment in network standardization, and adoption of open access protocols to create a seamless charging experience for all EV users

EV Charging Card Market Scope

The market is segmented on the basis of consumer type, charging card type, charging infrastructure type, user demographics, payment methods, application, and end-users.

- By Consumer Type

On the basis of consumer type, the EV charging card market is segmented into individual users and corporate fleets. The individual users segment held the largest market revenue share in 2024, driven by the rapid adoption of electric vehicles for personal use and the growing availability of public charging infrastructure. Convenience, cost transparency, and easy access to multiple charging networks have made charging cards an essential tool for everyday EV drivers.

The corporate fleets segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by large-scale electrification of company vehicle fleets and increasing demand for centralized billing and usage tracking. Fleet operators benefit from charging cards by optimizing charging schedules, reducing operational costs, and gaining insights into energy consumption patterns, making them a vital part of fleet management strategies.

- By Charging Card Type

On the basis of charging card type, the market is segmented into standard charging cards and fast charging cards. The standard charging cards segment dominated the market in 2024 due to their wide compatibility with various charging stations and affordability, making them a preferred choice for daily commuting and routine charging needs.

The fast charging cards segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing installation of high-speed chargers and the rising demand from EV owners seeking reduced charging times during long-distance travel. The growing network of ultra-fast charging stations is further accelerating the adoption of fast charging cards globally.

- By Charging Infrastructure Type

On the basis of charging infrastructure type, the market is segmented into public charging stations and private charging solutions. Public charging stations accounted for the largest market revenue share in 2024, driven by expanding urban charging networks and government-led infrastructure investments. The availability of charging cards that work across multiple public operators adds to their widespread usage.

Private charging solutions is expected to witness the fastest growth rate from 2025 to 2032, as residential and workplace charging setups increasingly incorporate card-based access and billing systems. These solutions provide enhanced convenience, especially for corporate premises and gated communities.

- By User Demographics

On the basis of user demographics, the EV charging card market is segmented into age group and income level. The middle-income segment dominated the market in 2024 due to the affordability of mainstream EV models and the increasing accessibility of charging cards through subscription and pay-as-you-go options.

The high-income segment is expected to witness the fastest growth rate from 2025 to 2032, driven by early adoption of premium EVs and preference for fast charging cards with exclusive network access and priority charging benefits. Younger EV owners, particularly in urban regions, are also emerging as a key demographic driving market growth.

- By Payment Methods

On the basis of payment methods, the market is segmented into subscription-based charging cards and pay-as-you-go charging cards. Subscription-based charging cards accounted for the largest share in 2024, supported by predictable monthly costs, unlimited charging plans, and added benefits such as loyalty rewards.

Pay-as-you-go charging cards is expected to witness the fastest growth rate from 2025 to 2032, attracting users who prefer flexibility and only pay for actual usage, making them ideal for occasional EV drivers or those relying on mixed charging solutions.

- By Application

On the basis of application, the market is segmented into household and commercial. The household segment led the market in 2024 as residential EV charging adoption surged alongside increased home charger installations compatible with card-based authentication.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by retail chains, hotels, and business centers offering charging card-based services to attract customers and enhance brand loyalty.

- By End-Users

On the basis of end-users, the EV charging card market is segmented into residential, commercial, and fleet operators. The residential segment held the largest share in 2024, driven by rising personal EV ownership and the convenience of card-linked home charging systems.

Fleet operators is expected to witness the fastest growth rate from 2025 to 2032, as charging cards enable centralized cost tracking, optimize charging routes, and provide detailed usage analytics, making them indispensable for large-scale EV fleet operations.

EV Charging Card Market Regional Analysis

• Asia-Pacific dominated the EV charging card market with the largest revenue share in 2024, driven by rapid EV adoption, government-backed electrification programs, and significant investments in charging infrastructure across countries such as China, Japan, and India.

• The region’s strong manufacturing base, increasing affordability of EVs, and growing network of interoperable charging stations are accelerating the adoption of EV charging cards among both private users and corporate fleets.

• Rising environmental awareness, expanding smart payment ecosystems, and supportive policy frameworks are further strengthening Asia-Pacific’s leadership in the global market, with demand surging across urban, suburban, and intercity charging networks.

China EV Charging Card Market Insight

The China EV charging card market captured the largest revenue share within Asia-Pacific in 2024, fueled by the country’s massive EV ownership base, rapid urbanization, and aggressive rollout of nationwide charging infrastructure. Affordable, app-integrated charging cards are enabling seamless access to thousands of public and private charging points. Strong domestic manufacturing capabilities, combined with government subsidies and innovative shared-charging business models, are further boosting adoption across both residential and commercial sectors.

Japan EV Charging Card Market Insight

The Japan EV charging card market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s high-tech payment systems, strong commitment to clean mobility, and advanced smart city initiatives. Charging cards in Japan are increasingly linked with multi-service mobility platforms, allowing users to combine EV charging, public transport, and parking into a single account. The demand is further propelled by the expansion of fast-charging stations in urban hubs and along major highways.

North America EV Charging Card Market Insight

The North America EV charging card market is expected to witness the fastest growth rate from 2025 to 2032, supported by the expansion of public charging networks, growing EV adoption rates, and favorable government policies. Consumers and fleet operators value the convenience of integrated payment systems, real-time station availability, and cross-network compatibility. The presence of leading EV manufacturers and technology providers in the region further enhances innovation and service quality in charging card offerings.

U.S. EV Charging Card Market Insight

The U.S. EV charging card market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer demand for electric mobility, nationwide infrastructure development, and growing preference for subscription-based charging plans. Integration with mobile apps and loyalty programs is further enhancing customer retention. Federal and state-level incentives for EV infrastructure deployment continue to encourage both residential and commercial users to adopt unified charging card systems.

Europe EV Charging Card Market Insight

The Europe EV charging card market is expected to witness the fastest growth rate from 2025 to 2032 due to strict emission regulations, widespread EV adoption, and cross-border charging interoperability agreements. The collaboration between charging providers, automotive OEMs, and governments is enabling seamless travel across EU member states using a single charging card. Rapid installation of ultra-fast chargers along highways and in urban areas is boosting demand among both individual EV owners and corporate fleets.

Germany EV Charging Card Market Insight

The Germany EV charging card market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s advanced EV infrastructure, strong environmental policies, and growing consumer demand for sustainable mobility. Fleet operators in Germany are increasingly using centralized charging card systems for cost control and operational efficiency. The integration of renewable energy sources into charging networks further adds to the appeal for environmentally conscious consumers.

U.K. EV Charging Card Market Insight

The U.K. EV charging card market is expected to witness the fastest growth rate from 2025 to 2032, fueled by expanding public charging coverage, government grants for zero-emission vehicles, and the rise of corporate sustainability commitments. Charging cards offering access to nationwide networks and flexible payment options are gaining popularity. Increasing adoption by ride-hailing and delivery fleets is also driving the need for centralized, multi-user card systems.

EV Charging Card Market Share

The EV charging card industry is primarily led by well-established companies, including:

- E-Flux (U.S.)

- Octopus Energy Ltd (U.K.)

- Shell Recharge (U.S.)

- Zapmap Limited (U.K.)

- UK Fuels Limited (U.K.)

- ChargePoint Holdings, Inc. (U.S.)

- EVgo Services LLC (U.S.)

- Greenlots (U.S.)

- BP Pulse (U.K.)

- Blink Charging Co. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.