Global Ev Charging Panelboard Market

Market Size in USD Billion

CAGR :

%

USD

8.09 Billion

USD

13.26 Billion

2024

2032

USD

8.09 Billion

USD

13.26 Billion

2024

2032

| 2025 –2032 | |

| USD 8.09 Billion | |

| USD 13.26 Billion | |

|

|

|

|

EV Charging Panelboard Market Size

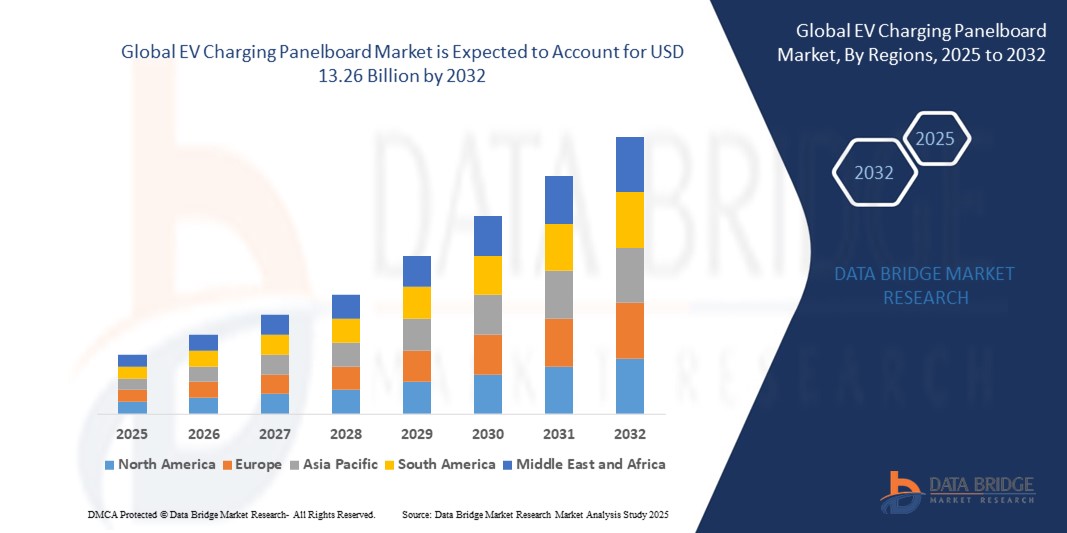

- The global EV charging panelboard market size was valued at USD 8.09 billion in 2024 and is expected to reach USD 13.26 billion by 2032, at a CAGR of 6.37% during the forecast period

- The market growth is largely fueled by the increasing adoption of electric vehicles and the expansion of EV infrastructure across residential, commercial, and public sectors, driving demand for efficient and scalable charging solutions

- Furthermore, rising investments in renewable energy integration, smart grid technologies, and government incentives for EV infrastructure are encouraging the deployment of advanced EV charging panelboards, thereby significantly boosting the industry's growth

EV Charging Panelboard Market Analysis

- EV charging panelboards are electrical distribution units designed to manage and deliver power to EV chargers in residential, commercial, and public applications. They provide load management, safety features, and scalability for multiple charging points, enabling efficient and reliable EV charging operations

- The growing demand for EV charging panelboards is primarily driven by rapid EV adoption, the need for faster and more reliable charging solutions, fleet electrification, and increasing emphasis on sustainable mobility and energy-efficient infrastructure

- North America dominated the EV charging panelboard market in 2024, due to rapid EV adoption, supportive government policies, and increasing investments in public and private charging infrastructure

- Asia-Pacific is expected to be the fastest growing region in the EV charging panelboard market during the forecast period due to rapid EV adoption in countries such as China, Japan, and India

- Single vehicle charging panel boards segment dominated the market with a market share of 52.6% in 2024, due to its simplicity and suitability for residential or small-scale commercial use. These boards are cost-effective, easy to install, and require minimal electrical modifications, making them highly attractive for homeowners and small business operators. Their straightforward operation and compatibility with most EV models support consistent demand in urban and suburban areas

Report Scope and EV Charging Panelboard Market Segmentation

|

Attributes |

EV Charging Panelboard Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

EV Charging Panelboard Market Trends

Growth of High-Power and Smart EV Chargers

- The market for EV charging panelboards is expanding rapidly due to rising demand for high-power fast-charging solutions. These panelboards are enabling efficient energy distribution and intelligent load balancing critical for large-scale EV infrastructure projects

- For instance, Schneider Electric has developed advanced panelboards designed to integrate with smart EV charging networks. Their solutions provide real-time monitoring, safety assurances, and load management features, making them suitable for high-demand charging station environments

- The trend toward ultra-fast charging requirements is driving innovations in panelboard capacity. Increased adoption of 150 kW to 350 kW chargers is pushing demand for panelboards capable of reliably handling high-current demands during peak load

- In addition, integration of IoT systems with panelboards is enhancing operational transparency. Features such as predictive maintenance, usage analytics, and dynamic power allocation are enabling operators to optimize performance and reduce downtime in charging infrastructure

- Panelboard manufacturers are also aligning with renewable energy adoption. By supporting solar and wind energy integration, modern EV charging panelboards enhance grid stability while meeting sustainability mandates within fast-growing clean energy charging ecosystems

- The demand for modular and scalable panelboard solutions is rising. Scalable configurations allow utility companies, charge point operators, and municipalities to expand infrastructure progressively without complete overhauls, reducing upfront capital intensities for charging deployment projects

EV Charging Panelboard Market Dynamics

Driver

Rising EV Adoption and Supportive Policies

- Surging consumer adoption of electric vehicles is creating unprecedented pressure on charging infrastructure. Panelboards are essential for ensuring secure, reliable, and efficient power distribution to stations, making them critical components of EV charging expansion strategies

- For instance, ABB has introduced smart distribution panels designed for EV charging stations across Europe. With strong government incentives backing EV adoption, ABB’s solutions enhance operational capacity and compliance with grid standards in fast-growing markets

- Government subsidies, tax credits, and infrastructure funding schemes are boosting demand. These incentives encourage large commercial operators and municipalities to invest heavily in EV charging panelboards, accelerating deployment of smart charging solutions globally

- In addition, automakers are partnering with utilities and technology providers to establish interoperable charging ecosystems. Such collaborations create rising requirements for reliable distribution equipment, with panelboards serving as the backbone of robust charging networks

- Long-term climate goals and zero-emission mandates are solidifying panelboard demand. Regulatory frameworks ensure consistent investments in EV charging infrastructure, tightening the link between automotive electrification strategies and the adoption of modern smart panelboards

Restraint/Challenge

High Installation Costs

- The high installation cost of EV charging panelboards poses a considerable obstacle. Specialized equipment, labor-intensive wiring, and integration with existing infrastructure add to upfront expenses, restraining widespread adoption, especially among small operators and municipalities

- For instance, costs associated with smart panelboard installations were highlighted in several U.S. pilot projects, where developers reported difficulties in achieving cost efficiency. This slowed project expansion despite strong demand for advanced charging infrastructure solutions

- Integration with renewable systems and smart load-management features further increases expense levels. While these features add efficiency, they require advanced designs and complex installations, making affordability a persistent concern for operators with smaller budgets

- In addition, higher energy capacity requirements for ultra-fast chargers necessitate large-capacity panels. This drives material, equipment, and approval costs that become prohibitive, particularly in developing regions with limited infrastructure funding capabilities

- Cost-reduction strategies such as modular designs and government support are emerging. However, without significant price reductions or funding programs, these challenges will continue to limit faster deployment of charging infrastructure long-term across global markets

EV Charging Panelboard Market Scope

The market is segmented on the basis of charging level, board capacity, application, and end use.

- By Charging Level

On the basis of charging level, the EV Charging Panelboard market is segmented into Level 1, Level 2, and Level 3. The Level 2 segment dominated the largest market revenue share in 2024, driven by its balance between charging speed and infrastructure cost. Level 2 chargers are widely preferred in residential and commercial setups due to their ability to provide faster charging than Level 1 while requiring only moderate electrical upgrades. Their compatibility with most electric vehicles and integration with smart energy management systems enhances user convenience and efficiency. Increasing installation in workplaces, parking lots, and multi-unit residential complexes also supports the steady adoption of Level 2 panelboards.

The Level 3 segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for ultra-fast charging solutions along highways and in commercial hubs. Level 3 chargers, often referred to as DC fast chargers, cater to fleet operators and public charging networks where rapid turnaround is critical. Technological advancements reducing charging times and government incentives for fast-charging infrastructure adoption further accelerate the uptake of Level 3 panelboards.

- By Board Capacity

On the basis of board capacity, the EV Charging Panelboard market is segmented into single vehicle charging panel boards and multiple vehicle charging panel boards. The single vehicle charging panel boards segment held the largest market revenue share of 52.6% in 2024, attributed to its simplicity and suitability for residential or small-scale commercial use. These boards are cost-effective, easy to install, and require minimal electrical modifications, making them highly attractive for homeowners and small business operators. Their straightforward operation and compatibility with most EV models support consistent demand in urban and suburban areas.

The multiple vehicle charging panel boards segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing deployment in large commercial, public, and fleet charging stations. These boards enable simultaneous charging of several vehicles, optimizing space and reducing waiting times for users. Rising EV fleet adoption, expanding public charging networks, and increasing urban vehicle density are key factors fueling the growth of multi-vehicle panelboards.

- By Application

On the basis of application, the EV Charging Panelboard market is segmented into private, semi-public, and public. The private segment dominated the largest market revenue share in 2024, due to the increasing adoption of EVs among individual households and the convenience of home charging solutions. Private panelboards allow for flexible charging schedules, reduced dependency on external infrastructure, and compatibility with smart home energy systems. The ongoing growth in residential EV ownership, along with government incentives for home charging setups, reinforces the dominance of private charging applications.

The public segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the expansion of highway charging networks, commercial hubs, and city-wide EV infrastructure. Public panelboards provide accessible charging for EV users on the go, supporting long-distance travel and urban mobility. Investments in smart grid integration, renewable energy compatibility, and government-led infrastructure initiatives contribute to the accelerated adoption of public EV charging solutions.

- By End Use

On the basis of end use, the EV Charging Panelboard market is segmented into individual, fleet operators, commercial entities, and others. The individual segment dominated the largest market revenue share in 2024, driven by the rising personal adoption of electric vehicles and the growing preference for convenient home charging solutions. Individual panelboards are cost-effective, easy to operate, and compatible with a wide range of EV models, making them highly suitable for residential installations. Consumer awareness campaigns and financial incentives for home EV infrastructure continue to strengthen the segment’s market position.

The fleet operators segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rapid electrification of commercial and logistics fleets. Fleet panelboards enable centralized management of multiple vehicles, reducing downtime and operational costs. Government policies promoting green mobility, corporate sustainability initiatives, and the scaling of e-commerce and delivery services drive the high growth potential for fleet-focused EV charging panelboards.

EV Charging Panelboard Market Regional Analysis

- North America dominated the EV charging panelboard market with the largest revenue share in 2024, driven by rapid EV adoption, supportive government policies, and increasing investments in public and private charging infrastructure

- Consumers and businesses in the region are increasingly focused on reducing carbon emissions and transitioning to electric mobility, fueling demand for advanced charging solutions

- High disposable incomes, widespread availability of EV models, and the growing trend of workplace and residential charging setups further support market growth. The U.S., in particular, leads the market due to extensive federal and state incentives for EV infrastructure development, along with robust technological capabilities in smart grid integration and energy management systems

U.S. EV Charging Panelboard Market Insight

The U.S. EV Charging Panelboard market captured the largest revenue share in North America in 2024, driven by the rapid deployment of home, commercial, and public charging stations. Strong government support through initiatives such as the National Electric Vehicle Infrastructure (NEVI) program encourages installation of Level 2 and Level 3 chargers. The growing focus on fleet electrification, rising consumer awareness of EV benefits, and seamless integration with smart energy systems further propel market expansion. Technologically advanced panelboards offering load management, remote monitoring, and energy optimization are increasingly being adopted across residential, commercial, and public segments.

Europe EV Charging Panelboard Market Insight

The Europe EV Charging Panelboard market is projected to grow at a substantial CAGR, fueled by strict emission regulations, the EU Green Deal, and rising EV adoption across countries such as Germany, France, and the Netherlands. Increasing urbanization and government mandates for public charging infrastructure are supporting panelboard deployment in residential, commercial, and public areas. European consumers value energy-efficient, reliable, and scalable charging solutions, and the trend of integrating EV charging with renewable energy systems further accelerates market growth.

U.K. EV Charging Panelboard Market Insight

The U.K. EV Charging Panelboard market is expected to grow at a noteworthy CAGR during the forecast period, driven by the nation’s aggressive EV adoption targets and government incentives for private and public charging installation. The increasing demand for residential Level 2 chargers and workplace charging solutions, coupled with the expansion of fast-charging networks, supports market development. In addition, rising awareness about sustainable mobility and advancements in smart grid technologies contribute to the accelerated uptake of EV charging panelboards.

Germany EV Charging Panelboard Market Insight

The Germany EV Charging Panelboard market is anticipated to expand at a considerable CAGR, fueled by growing EV ownership, supportive government policies, and robust charging infrastructure development. Germany’s focus on innovation, smart energy management, and integration of renewable energy with EV charging stations encourages adoption across residential, commercial, and public applications. Advanced panelboards offering load balancing, remote monitoring, and multi-vehicle management are increasingly deployed in urban and industrial areas, reflecting local consumer and business priorities.

Asia-Pacific EV Charging Panelboard Market Insight

The Asia-Pacific EV Charging Panelboard market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid EV adoption in countries such as China, Japan, and India. Increasing urbanization, rising disposable incomes, and government incentives for EV infrastructure are fueling demand for residential, commercial, and public charging solutions. The region is emerging as a manufacturing hub for charging equipment, enhancing affordability and accessibility for consumers and businesses. Rapid technological advancements and smart grid integration further accelerate the adoption of EV charging panelboards.

Japan EV Charging Panelboard Market Insight

The Japan EV Charging Panelboard market is gaining momentum due to high EV adoption, technological advancement, and government support for charging infrastructure. Japanese consumers and businesses are focusing on energy-efficient and convenient charging solutions, with increasing installations in residential complexes, workplaces, and public spaces. Integration with smart grids, renewable energy, and IoT-enabled management systems further drives market growth. In addition, Japan’s aging population encourages demand for user-friendly, easily accessible charging solutions.

China EV Charging Panelboard Market Insight

The China EV Charging Panelboard market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s rapid urbanization, expanding EV fleet, and strong government policies promoting EV infrastructure. China’s position as a leading EV market, combined with domestic manufacturing of affordable panelboards and chargers, supports large-scale adoption. Public and commercial charging networks are rapidly expanding, and smart, energy-efficient panelboards integrated with renewable energy sources are increasingly deployed, further strengthening market growth.

EV Charging Panelboard Market Share

The EV charging panelboard industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Delta Electronics (Taiwan)

- Eaton (U.K.)

- Enel X Way S.r.l. (Italy)

- General Electric (U.S.)

- Leviton Manufacturing Co., Inc. (U.S.)

- Schneider Electric (France)

- Siemens (Germany)

- Legrand (France)

- Mitsubishi Electric Corporation (Japan)

- Panasonic Corporation (Japan)

- Fuji Electric Co., Ltd. (Japan)

- JuiceBox (U.S.)

- Webasto (Germany)

- Tesla Inc. (U.S.)

Latest Developments in Global EV Charging Panelboard Market

- In January 2024, MAN Truck & Bus and ABB entered into a collaboration agreement to address electrification challenges in Europe’s trucking fleet. This partnership is set to accelerate the deployment of high-power charging stations specifically for heavy-duty vehicles while also exploring integrated software solutions for fleet management. The collaboration is expected to significantly impact the European commercial EV market by reducing charging times, improving operational efficiency for logistics companies, and supporting the region’s broader goals of decarbonizing road transport. By targeting the unique energy and infrastructure requirements of electric trucks, the initiative strengthens the foundation for large-scale adoption of electrified commercial fleets across Europe

- In 2024, Siemens launched its next-generation EV charging panel boards in North America, designed for commercial and fleet applications. These panel boards feature advanced load management, modular scalability, and compatibility with multiple charging levels, enabling organizations to optimize energy usage and expand infrastructure as demand grows. The launch positions Siemens to capitalize on the increasing deployment of workplace, public, and fleet charging solutions. By addressing both technical efficiency and future scalability, this innovation enhances the reliability and attractiveness of EV charging infrastructure for large commercial users and fleet operators

- In 2024, Schneider Electric introduced the EcoStruxure EV Charging Panelboard in the U.S., a UL-listed solution aimed at simplifying installation, ensuring safety, and supporting commercial EV charging infrastructure. This product is expected to have a notable market impact by reducing installation complexity, shortening project timelines, and increasing confidence among commercial operators. By combining safety compliance with smart energy management features, Schneider Electric strengthens its foothold in the U.S. commercial EV sector, promoting wider adoption of reliable and standardized panel boards across businesses and public charging networks

- In 2024, ABB inaugurated a new manufacturing facility in Texas dedicated to producing EV charging panel boards. This move is strategically significant as it enables ABB to meet the growing U.S. demand for both commercial and fleet charging solutions with reduced lead times and localized production. The facility enhances ABB’s ability to scale rapidly in response to the expanding EV market, supports regional job creation, and reinforces the company’s role as a key infrastructure partner for government and private EV initiatives. It also strengthens supply chain resilience in a market experiencing surging demand for reliable and high-capacity charging equipment

- In 2024, Leviton acquired AmpConnect, a California-based startup specializing in smart EV charging panel boards, to expand its commercial infrastructure portfolio. The acquisition allows Leviton to integrate cutting-edge technologies such as intelligent energy management, remote monitoring, and modular scalability into its panel boards. This strategic move is expected to accelerate Leviton’s presence in the U.S. market, enhance its competitive edge in the commercial and fleet segment, and drive adoption of smart, future-ready EV infrastructure solutions. The integration of AmpConnect’s expertise positions Leviton to capitalize on the rapid electrification of fleets and large-scale commercial EV deployments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.