Global Ev Powder Coating Market

Market Size in USD Million

CAGR :

%

USD

619.61 Million

USD

1,181.28 Million

2024

2032

USD

619.61 Million

USD

1,181.28 Million

2024

2032

| 2025 –2032 | |

| USD 619.61 Million | |

| USD 1,181.28 Million | |

|

|

|

|

EV Powder Coating Market Size

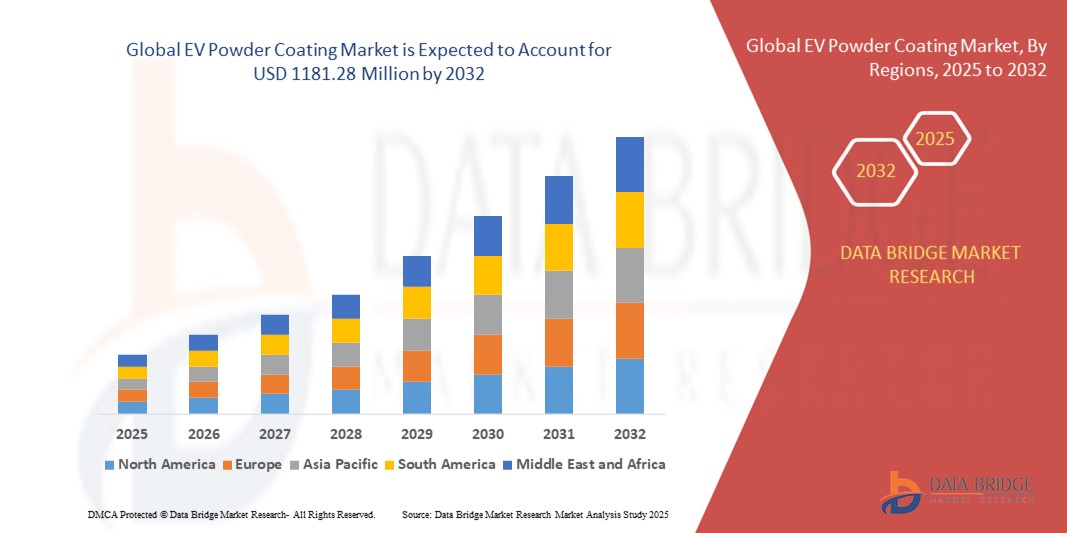

- The global EV powder coating market size was valued at USD 619.61 million in 2024 and is expected to reach USD 1181.28 million by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fuelled by the rising demand for electric vehicles, driven by increasing environmental concerns and government initiatives supporting green mobility

- Advancements in powder coating technologies offering superior durability, corrosion resistance, and energy efficiency are further boosting market expansion

EV Powder Coating Market Analysis

- The EV powder coating market is witnessing strong growth due to the global shift towards sustainable transportation and the rising production of electric vehicles across major economies

- Manufacturers are adopting powder coatings for their enhanced protection against environmental conditions, extended component lifespan, and compliance with eco-friendly manufacturing regulations by reducing VOC emissions

- North America dominated the EV powder coating market with the largest revenue share in 2024, driven by the rapid growth of EV manufacturing, stringent environmental regulations, and strong demand for sustainable coating solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global EV powder coating market, driven by rising electric vehicle production, increasing infrastructure development for EV charging stations, and supportive government policies promoting green technologies

- The Thermoset segment held the largest market revenue share in 2024, driven by its superior durability, chemical resistance, and cost-effectiveness, making it highly suitable for automotive applications requiring long-term performance. Thermoset coatings also provide excellent adhesion and corrosion resistance, aligning well with EV manufacturers’ sustainability goals

Report Scope and EV Powder Coating Market Segmentation

|

Attributes |

EV Powder Coating Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

EV Powder Coating Market Trends

Growing Shift Toward Sustainable Coating Solutions in Electric Vehicles

- The rising adoption of electric vehicles (EVs) is accelerating the demand for eco-friendly, high-performance coating solutions, with powder coatings emerging as a preferred choice due to their zero solvent emissions and superior durability. This trend is reshaping the EV coating landscape as manufacturers prioritize sustainable production practices

- Increasing focus on lightweight materials in EV manufacturing is driving the need for advanced coatings with excellent adhesion, corrosion resistance, and aesthetic appeal. Powder coatings meet these requirements while reducing environmental impact and enhancing component lifespan

- The rapid expansion of charging infrastructure and battery production facilities globally is boosting demand for powder coatings in battery enclosures, EV chassis, and related components, supporting both functional and protective applications across the value chain

- For instance, in 2023, several EV OEMs in Europe partnered with coating suppliers to develop specialized powder formulations for high-heat battery components, ensuring safety compliance and extended equipment life under harsh operating condition

- While powder coatings offer environmental and performance advantages, market growth depends on continued innovation in heat-resistant formulations, cost efficiency, and large-scale production capabilities to meet surging EV deman

EV Powder Coating Market Dynamics

Driver

Rising EV Production and Stringent Environmental Regulations

- Global EV production is growing rapidly, with automakers expanding capacity to meet emission reduction targets. This surge is fueling demand for coatings that are VOC-free, energy-efficient, and compliant with evolving sustainability standards. The trend is further supported by collaborations between OEMs and coating manufacturers for specialized solutions tailored to EV-specific components, ensuring performance reliability under high thermal and electrical loads

- Stringent environmental regulations across North America, Europe, and Asia-Pacific are prompting manufacturers to shift from liquid coatings to powder-based alternatives, reducing hazardous emissions while improving coating performance. The regulatory focus on sustainable industrial practices is creating a long-term shift toward cleaner coating technologies, with governments providing incentives for early adoption and compliance

- The automotive industry’s focus on achieving carbon neutrality is aligning closely with the adoption of powder coatings, as these products support low-waste, recyclable manufacturing practices. Powder coatings also reduce energy consumption in curing processes, making them ideal for manufacturers looking to meet sustainability benchmarks while improving operational efficiency

- For instance, in 2022, regulatory bodies in the EU introduced stricter VOC emission norms for industrial coatings, leading to accelerated adoption of powder coating solutions in the EV sector. This resulted in several leading coating manufacturers expanding production facilities in Europe to meet rising regional demand, boosting technology transfer and innovation in the sector

- Ongoing government incentives for EV adoption and green manufacturing practices further strengthen the demand trajectory for eco-friendly coating technologies globally. Incentive programs also encourage domestic manufacturing of coating materials, fostering local supply chains and reducing dependency on imported raw materials for high-performance coatings

Restraint/Challenge

High Initial Investment and Technical Limitations in Certain Applications

- The initial setup cost for powder coating systems, including specialized curing ovens and application equipment, can be prohibitive for small and mid-sized manufacturers, limiting early adoption in cost-sensitive markets. In addition, the cost of workforce training and retrofitting existing production lines with powder-coating-compatible infrastructure adds to the financial burden, slowing down widespread acceptance

- Technical challenges such as achieving ultra-thin film coatings and uniform application on complex geometries continue to restrain powder coating usage in certain EV components requiring high precision finishes. Manufacturers are investing in R&D to address issues such as edge coverage and coating flexibility, but scaling these solutions for mass production remains a hurdle for the industry

- Limited awareness among Tier-2 and Tier-3 automotive suppliers about the long-term benefits of powder coatings compared to conventional paints also hinders widespread deployment across the EV value chain. Many small suppliers continue to use liquid coatings due to familiarity and lower initial costs, even though these coatings result in higher VOC emissions and lower durability over time

- For instance, in 2023, industry surveys in Southeast Asia revealed that over 55% of small automotive component suppliers lacked the infrastructure or expertise to integrate powder coating technology into existing production lines. This gap reflects the need for targeted training programs and financial support to enable technology adoption in emerging manufacturing hubs

- Overcoming cost barriers, investing in R&D for advanced formulations, and providing training for manufacturers will be key to unlocking large-scale adoption of powder coatings in the electric vehicle industry. Public-private partnerships and government-backed subsidies could play a crucial role in accelerating technology transfer and making eco-friendly coatings more accessible across all production levels

EV Powder Coating Market Scope

The market is segmented on the basis of type, application method, resin type, and end-use.

- By Type

On the basis of type, the EV powder coating market is segmented into Thermoset and Thermoplastic. The Thermoset segment held the largest market revenue share in 2024, driven by its superior durability, chemical resistance, and cost-effectiveness, making it highly suitable for automotive applications requiring long-term performance. Thermoset coatings also provide excellent adhesion and corrosion resistance, aligning well with EV manufacturers’ sustainability goals.

The Thermoplastic segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its recyclability, flexibility, and lower curing temperatures, which help reduce energy consumption and support eco-friendly manufacturing processes.

- By Application Method

On the basis of application method, the EV powder coating market is segmented into Electrostatic Spray, Fluidized Bed Dip, and Electrostatic Fluidized Bed. The Electrostatic Spray segment accounted for the largest revenue share in 2024, as it offers uniform coverage, high material efficiency, and minimal waste, making it ideal for coating complex EV components.

The Fluidized Bed Dip method is expected to witness the fastest growth rate from 2025 to 2032 due to its capability to produce thicker, pinhole-free coatings in a single step, enhancing durability and impact resistance for heavy-duty EV parts.

- By Resin Type

On the basis of resin type, the EV powder coating market is segmented into Epoxy, Polyester, Polyurethane, Acrylic, Polyvinyl Chloride (PVC), Nylon, Polyolefin, Polyvinyl Fluoride (PVF), and Others. The Polyester segment held the largest market revenue share in 2024, driven by its UV resistance, weatherability, and cost-effectiveness, making it ideal for exterior EV applications such as body panels and charging stations.

The Epoxy segment is expected to witness the fastest growth rate from 2025 to 2032 owing to its superior chemical and corrosion resistance, supporting long-term protection for battery enclosures and other critical components.

- By End-Use

On the basis of end-use, the EV powder coating market is segmented into Electric Vehicle Body Panels, Battery Enclosures, Charging Stations, and Others. The Electric Vehicle Body Panels segment accounted for the largest revenue share in 2024, supported by rising EV production volumes and the growing need for durable, lightweight coatings with aesthetic appeal.

The Battery Enclosures segment is expected to witness the fastest growth rate from 2025 to 2032 as demand surges for protective coatings ensuring thermal stability, chemical resistance, and extended battery life in electric vehicles.

EV Powder Coating Market Regional Analysis

• North America dominated the EV powder coating market with the largest revenue share in 2024, driven by the rapid growth of EV manufacturing, stringent environmental regulations, and strong demand for sustainable coating solutions

• The region benefits from advanced R&D capabilities, established automotive infrastructure, and the presence of leading EV manufacturers adopting eco-friendly coatings to meet emission standards

• Supportive government policies promoting electric mobility and green technologies further strengthen the adoption of powder coating solutions across EV components

U.S. EV Powder Coating Market Insight

The U.S. EV powder coating market accounted for the largest revenue share in North America in 2024, driven by high EV production, the presence of major automotive OEMs, and increasing investments in sustainable manufacturing technologies. The demand for VOC-free, energy-efficient coatings continues to rise as automakers work towards carbon neutrality. Furthermore, the expansion of battery manufacturing facilities across the country is boosting the need for high-performance coating materials in EV applications.

Europe EV Powder Coating Market Insight

The Europe EV powder coating market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict environmental regulations, widespread EV adoption, and advanced technological integration. European automotive manufacturers are rapidly transitioning to sustainable production processes, and powder coatings play a key role in meeting EU emission reduction targets. The region also benefits from strong government incentives for electric mobility, accelerating the adoption of eco-friendly coating technologies.

U.K. EV Powder Coating Market Insight

The U.K. EV powder coating market i is expected to witness the fastest growth rate from 2025 to 2032 , driven by the rising penetration of EVs, government-led clean energy initiatives, and the growing focus on sustainable automotive manufacturing. Local automakers are increasingly adopting powder coatings for battery enclosures, body panels, and charging infrastructure, aligning with the nation’s net-zero emission goals and enhancing production efficiency.

Germany EV Powder Coating Market Insight

The Germany EV powder coating market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s leadership in automotive innovation, strong EV production base, and stringent environmental policies. German manufacturers are emphasizing advanced coating technologies to improve durability, energy efficiency, and corrosion resistance across EV components, fostering widespread market adoption.

Asia-Pacific EV Powder Coating Market Insight

The Asia-Pacific EV powder coating market is expected to witness the fastest growth rate from 2025 to 2032, driven by booming EV production in China, India, and Japan, coupled with supportive government policies promoting clean energy vehicles. The region’s growing automotive manufacturing capabilities, cost-efficient production processes, and expanding EV infrastructure are further accelerating the adoption of powder coatings in electric mobility applications.

Japan EV Powder Coating Market Insight

The Japan EV powder coating market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s advanced automotive sector, strong focus on sustainability, and rising demand for high-performance coatings in EV production. Japanese manufacturers are investing heavily in R&D to develop next-generation powder coating materials offering superior durability, weather resistance, and efficiency for EV components.

China EV Powder Coating Market Insight

The China EV powder coating market captured the largest market share in Asia-Pacific in 2024, fueled by the country’s dominance in EV production, large-scale battery manufacturing, and rapid adoption of eco-friendly automotive technologies. Strong government support for electric mobility, coupled with the presence of major domestic EV manufacturers, is driving substantial demand for powder coating solutions across vehicle body panels, charging stations, and battery enclosures.

EV Powder Coating Market Share

The EV Powder Coating industry is primarily led by well-established companies, including:

- Akzo Nobel N.V. (Netherlands)

- PPG Industries, Inc. (U.S.)

- BASF SE (Germany)

- Jotun (Norway)

- Axalta Coating Systems, LLC (U.S.)

- The Sherwin-Williams Company (U.S.)

- Asian Paints (India)

- Kansai Nerolac Paints Limited (Japan)

- TCI Powder (U.S.)

- Berger Paints India Limited (India)

- Nippon Paint Holdings Co., Ltd. (Japan)

- RPM International Inc. (U.S.)

- Tikkurila (Finland)

- TIGER Coatings GmbH & Co. KG (Germany)

- NOROO Paint & Coatings co.,Ltd. (South Korea)

- IGP Pulvertechnik AG (Switzerland)

- Diamond Vogel (U.S.)

- Brillux GmbH & Co. KG (Germany)

- Teknos Group (Finland)

- Hempel A/S (Denmark)

- TOA Performance (Thailand)

- Hentzen Coatings, Inc. (U.S.)

Latest Developments in Global EV Powder Coating Market

- In February 2023, Axalta Coating Systems, LLC announced it has won three prestigious 2023 Edison Awards. Axalta’s Abcite 2060 Flame Spray Powder Coating, AquaEC Flex and Self Priming Kitchen Cabinet Coating have won for the Sustainability, Smart Transportation and Material Science categories, respectively. AquaEC Flex is a sustainable electrocoat (e-coat) that enables electric vehicle (EV) designs. This product cures over a broad range of temperatures while also reducing emissions, eliminating hazardous materials and enabling water recycling

- In January 2023, Akzo Nobel N.V. has launched a new range of Resicoat EV powder coatings to protect the battery system and electrical components of a new generation of electric vehicles (EVs). Powder coatings can improve the performance of the battery by providing insulation from electric current and protection against corrosion. This means manufacturers can extend battery life, and ensure the battery performs better for longer

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ev Powder Coating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ev Powder Coating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ev Powder Coating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.