Global Exhaust Sensors For Automotive Market

Market Size in USD Billion

CAGR :

%

USD

2.09 Billion

USD

4.31 Billion

2024

2032

USD

2.09 Billion

USD

4.31 Billion

2024

2032

| 2025 –2032 | |

| USD 2.09 Billion | |

| USD 4.31 Billion | |

|

|

|

|

Global Exhaust Sensors for Automotive Market Size

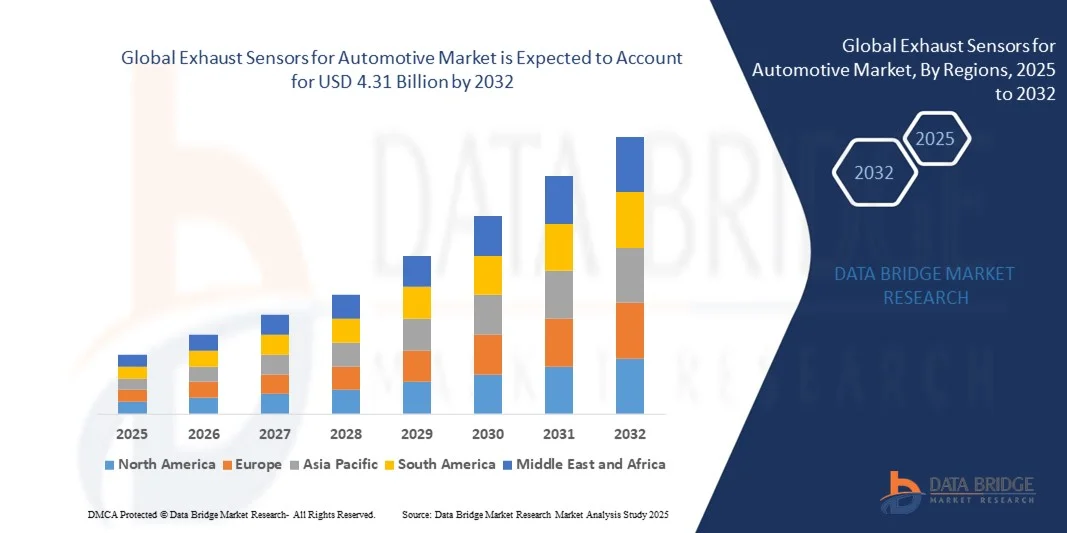

- The global Exhaust Sensors for Automotive Market size was valued at USD 2.09 billion in 2024 and is expected to reach USD 4.31 billion by 2032, growing at a CAGR of 9.50% during the forecast period

- Market expansion is primarily driven by stringent emission regulations and increasing demand for fuel-efficient vehicles, prompting OEMs to integrate advanced exhaust sensing technologies

- Additionally, the shift toward electric and hybrid vehicles, coupled with advancements in sensor accuracy and durability, is accelerating the adoption of exhaust sensors, significantly propelling the market's growth

Global Exhaust Sensors for Automotive Market Analysis

- Exhaust sensors, which monitor and control emissions from automotive engines, are becoming essential components in modern vehicles to meet global environmental standards and improve engine efficiency in both passenger and commercial vehicles, owing to their precision and reliability in detecting harmful gases such as NOx, CO2, and particulate matter

- The rising demand for exhaust sensors is primarily driven by increasingly stringent emission regulations worldwide, growing production of internal combustion engine vehicles in emerging markets, and heightened awareness around vehicle emissions and environmental impact

- Asia-Pacific dominated the exhaust sensors for automotive market with the largest revenue share of 34.7% in 2024, supported by the region’s rigorous emission norms such as Euro 6, strong automotive manufacturing base, and rapid adoption of advanced vehicle technologies, with Germany leading the market due to its high concentration of OEMs and Tier 1 suppliers focusing on emission control innovation

- Europe is expected to be the fastest growing region in the exhaust sensors market during the forecast period, fueled by the rising vehicle production, increasing implementation of emission regulations in countries like China and India, and growing demand for fuel-efficient vehicles

- The NOx sensors segment dominated the market with the largest market revenue share of 46.3% in 2024, driven by strict emission regulations globally, especially for diesel vehicles

Report Scope and Global Exhaust Sensors for Automotive Market Segmentation

|

Attributes |

Exhaust Sensors for Automotive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Exhaust Sensors for Automotive Market Trends

Enhanced Performance Through AI and Predictive Diagnostics

- A significant and accelerating trend in the global Exhaust Sensors for Automotive Market is the growing integration of artificial intelligence (AI) and advanced predictive diagnostics into vehicle exhaust systems. This convergence of technologies is substantially improving real-time monitoring, system efficiency, and proactive maintenance capabilities across both passenger and commercial vehicle segments.

- For Instance, leading automotive suppliers are developing AI-powered exhaust sensor platforms that can analyze sensor data to detect anomalies, predict component failure, and optimize emissions control. Bosch’s intelligent exhaust management systems are incorporating machine learning algorithms to enhance the accuracy of NOx and particulate detection while adapting to driving conditions.

- AI integration enables exhaust sensors to go beyond simple gas detection by learning vehicle usage patterns, assessing engine health, and predicting maintenance needs. Continental has introduced exhaust sensor solutions capable of supporting on-board diagnostics (OBD) with AI-driven insights, alerting vehicle owners and fleet managers about potential emission system failures before they escalate.

- The use of AI and cloud-connected diagnostics in exhaust sensor systems supports centralized fleet management, allowing commercial operators to track emissions data, improve compliance, and reduce downtime. These connected systems integrate with broader vehicle telematics platforms, providing a unified interface for managing emissions, fuel efficiency, and maintenance schedules.

- This evolution toward smarter, self-learning, and connected exhaust sensor technologies is transforming how automakers and consumers view emission control—from a regulatory requirement to a performance-enhancing and cost-saving innovation. Companies like Denso and Delphi Technologies are actively investing in AI-driven exhaust sensor R&D to meet these changing expectations.

- The demand for intelligent exhaust sensors that leverage AI and predictive diagnostics is surging across global markets, particularly among OEMs and fleet operators seeking greater system efficiency, environmental compliance, and reduced lifecycle costs.

Global Exhaust Sensors for Automotive Market Dynamics

Driver

Growing Need Due to Emission Regulations and Environmental Awareness

-

The increasing stringency of global emission regulations and growing environmental awareness among consumers and governments are major drivers fueling the demand for advanced exhaust sensors in the automotive industry

- For Instance, in March 2024, the European Union proposed updates to its Euro 7 emission standards, tightening permissible limits for NOx and particulate matter in both diesel and gasoline vehicles. These regulatory changes are prompting automakers to invest in more accurate and responsive exhaust sensor technologies to ensure compliance

- As governments enforce stricter CO₂ and NOx emission limits, automakers are integrating high-performance exhaust sensors—such as NOx, particulate matter (PM), and oxygen sensors—into new vehicle models to monitor real-time emissions and maintain efficiency

- Furthermore, the global push toward sustainable transportation, combined with increased scrutiny of vehicle environmental impact, has elevated the role of exhaust sensors as key components in meeting emission goals without compromising performance

- The demand is further supported by the expansion of the global vehicle fleet, particularly in developing regions, where regulatory bodies are beginning to align with international emission standards. Fleet operators and logistics companies are also increasingly adopting sensor-equipped systems to monitor and reduce their carbon footprints and ensure compliance with environmental policies

Restraint/Challenge

Technical Complexity and High Replacement Costs

- The technical complexity of modern exhaust sensors and their associated systems presents a significant challenge to widespread adoption, particularly in cost-sensitive markets and among older vehicle models that lack the necessary integration infrastructure

- For instance, advanced NOx sensors, which require precise calibration and operate in high-temperature environments, are more expensive to manufacture and replace than traditional sensors. This increases the total cost of ownership, especially for commercial vehicle operators managing large fleets

- In addition, the integration of exhaust sensors with engine control units (ECUs) and onboard diagnostics (OBD) requires specialized design, increasing development time and system complexity for automakers

- Frequent exposure to harsh exhaust conditions, including heat, vibration, and corrosive gases, also shortens sensor lifespan, making them prone to wear and failure—especially in high-mileage vehicles. Replacing faulty sensors can be costly and time-consuming, leading to operational downtime for fleet operators and additional maintenance burdens for consumers

- While sensor technologies are gradually becoming more durable and cost-effective, continued innovation in materials, sensor miniaturization, and modular design is crucial to reduce production costs and improve ease of integration

- Overcoming these challenges through robust product design, streamlined manufacturing, and broader adoption of standardized sensor platforms will be essential for maintaining market momentum and expanding adoption in emerging markets

Global Exhaust Sensors for Automotive Market Scope

The market is segmented on the basis type, fuel type, vehicle type, component, and sales channel.

- By Type

On the basis of type, The global exhaust sensors for automotive market is segmented into Oxygen/Lambda Sensors, NOx Sensors, Particulate Matter Sensors, Differential Pressure Sensors, Engine Coolant Temperature Sensors, Exhaust Temperature & Pressure Sensors, and MAP/MAF Sensors. The NOx sensors segment dominated the market with the largest market revenue share of 46.3% in 2024, driven by strict emission regulations globally, especially for diesel vehicles. These sensors are essential for real-time monitoring of nitrogen oxide emissions, ensuring compliance with stringent environmental standards such as Euro 6 and EPA Tier 3.

The Particulate Matter (PM) sensors segment is projected to witness the fastest CAGR from 2025 to 2032, due to increasing demand for accurate monitoring of soot and fine particles in diesel engines. Growing adoption of Diesel Particulate Filters (DPFs) and emission control technologies, especially in commercial vehicles, is significantly contributing to the rising deployment of PM sensors.

- By Fuel Type

Based on fuel type, the market is categorized into Gasoline, Diesel, and Others. The Diesel segment held the largest revenue share of 52.1% in 2024, attributed to the higher demand for diesel-powered commercial vehicles globally and the need for advanced emission control in these engines. Diesel vehicles produce more NOx and particulate matter compared to gasoline, driving increased integration of exhaust sensors such as NOx, PM, and differential pressure sensors.

The Gasoline segment is expected to register the fastest growth rate from 2025 to 2032, fueled by the continued production of gasoline-powered passenger cars and hybrid vehicles. As emission regulations tighten for all fuel types, gasoline vehicles are increasingly equipped with oxygen sensors and MAP/MAF sensors to ensure optimal combustion and reduced emissions.

- By Vehicle Type

The market is segmented into Passenger Cars, Light-weight Commercial Vehicles (LCVs), Heavy-weight Commercial Vehicles (HCVs), and Hatchback/Sedan. The Passenger Cars segment accounted for the highest market share of 49.8% in 2024, driven by rising vehicle ownership, increasing urbanization, and the demand for environmentally compliant vehicles in both developed and emerging economies.

The Heavy-weight Commercial Vehicles (HCVs) segment is projected to grow at the fastest CAGR from 2025 to 2032, owing to the rising focus on emission regulation compliance in commercial transport and logistics. The need for robust exhaust management in vehicles with high fuel consumption and emissions is prompting the adoption of multiple sensor types in HCVs, including NOx and PM sensors.

- By Component

On the basis of component, the market is divided into Exhaust Manifold, Muffler, Oxygen Sensor, and Others. The Oxygen Sensor segment led the market with a dominant share of 36.5% in 2024, due to its widespread use across all vehicle categories and fuel types to monitor and optimize the air-fuel mixture. These sensors play a vital role in fuel efficiency and emission control, especially in gasoline engines.

The Exhaust Temperature & Pressure Sensors segment is expected to witness the highest growth from 2025 to 2032, driven by growing adoption in turbocharged engines and diesel vehicles. These sensors help protect exhaust after-treatment systems such as Selective Catalytic Reduction (SCR) and Diesel Particulate Filters (DPFs) by monitoring thermal conditions.

- By Sales Channel

On the basis of sales channel, the market is bifurcated into OEM and Aftermarket. The OEM segment dominated the market with a share of 68.4% in 2024, primarily because exhaust sensors are integrated during vehicle manufacturing to meet mandatory emission standards. OEM-installed sensors ensure high accuracy and are typically covered under vehicle warranty, boosting their demand.

The Aftermarket segment is expected to register the fastest growth during the forecast period (2025–2032), driven by increasing replacement rates of sensors in older vehicles and the growing trend of emission testing compliance. As sensor wear and failure are common with usage, especially in high-mileage vehicles, demand in the aftermarket continues to rise steadily.

Global Exhaust Sensors for Automotive Market Regional Analysis

- Asia-Pacific dominated the global exhaust sensors for automotive market with the largest revenue share of 34.7% in 2024, driven by stringent emission regulations such as Euro 6/7 standards and the region’s strong focus on environmental sustainability

- Automakers and consumers across Europe prioritize low-emission and fuel-efficient vehicles, leading to widespread integration of advanced exhaust sensors including NOx, oxygen, and particulate matter sensors in both diesel and gasoline vehicles

- This regional dominance is further supported by the presence of leading automotive OEMs and Tier 1 suppliers, high adoption of cutting-edge vehicle technologies, and government incentives aimed at reducing vehicle emissions. Countries like Germany, France, and the UK are at the forefront of emission control innovation, fueling consistent demand for high-performance exhaust sensor solutions across both passenger and commercial vehicle segments

U.S. Exhaust Sensors for Automotive Market Insight

The U.S. exhaust sensors for automotive market captured the largest revenue share of 78% in 2024 within North America, driven by stringent emission standards enforced by the Environmental Protection Agency (EPA) and the California Air Resources Board (CARB). The increasing adoption of gasoline and diesel-powered vehicles equipped with advanced emission control systems is boosting demand for sensors such as NOx, oxygen (O2), and particulate matter (PM) sensors. The market is further supported by the growing preference for fuel-efficient vehicles, technological advancements in sensor performance, and the shift towards onboard diagnostics (OBD) systems for real-time monitoring and compliance.

Europe Exhaust Sensors for Automotive Market Insight

The Europe exhaust sensors for automotive market is projected to grow at a substantial CAGR over the forecast period, primarily fueled by stringent Euro 6/7 emission norms and the region's strong commitment to reducing vehicle carbon footprints. Countries such as Germany, France, and the U.K. are at the forefront of integrating advanced emission sensors in both passenger and commercial vehicles. The rise of hybrid and plug-in hybrid vehicles also contributes to the increasing demand for accurate and durable exhaust gas sensors. The region’s emphasis on sustainability and regulatory compliance is accelerating the adoption of high-performance sensor technologies.

U.K. Exhaust Sensors for Automotive Market Insight

The U.K. exhaust sensors for automotive market is expected to witness noteworthy growth during the forecast period, driven by a nationwide push toward lower vehicle emissions and cleaner air quality. Increasing investments in automotive R&D, especially in emission control systems, are prompting OEMs to incorporate advanced sensing solutions. Moreover, with government plans to phase out traditional internal combustion engines in the long term, there is a rising short-term demand for efficient exhaust sensors in hybrid and Euro 6-compliant vehicles, as consumers and manufacturers aim to meet evolving standards.

Germany Exhaust Sensors for Automotive Market Insight

Germany, being Europe’s largest automotive hub, is expected to experience strong market growth for exhaust sensors, supported by its robust auto manufacturing base and strict regulatory environment. German automakers are leading in integrating cutting-edge sensor technologies that monitor and reduce NOx, CO2, and particulate emissions. The country’s innovation-driven automotive sector, combined with consumer demand for eco-friendly and high-performance vehicles, is pushing the development and adoption of next-gen exhaust sensing systems across luxury, commercial, and electric-hybrid vehicle segments.

Asia-Pacific Exhaust Sensors for Automotive Market Insight

The Asia-Pacific exhaust sensors for automotive market is projected to grow at the fastest CAGR of 25.6% from 2025 to 2032, fueled by surging vehicle production, rising urban pollution, and tightening emission standards across major economies such as China, India, Japan, and South Korea. The rapid expansion of both passenger and commercial vehicle fleets, along with government-led initiatives targeting environmental sustainability, is creating a robust demand for advanced exhaust gas sensors. The growing adoption of hybrid powertrains and the establishment of local manufacturing capabilities are further accelerating market growth in the region.

Japan Exhaust Sensors for Automotive Market Insight

Japan’s exhaust sensors for automotive market is experiencing significant growth, driven by its technologically advanced automotive industry and commitment to achieving low-emission transportation. Automakers are investing in exhaust sensors that support compliance with Japan’s rigorous emissions regulations, particularly in hybrid and clean diesel vehicles. Moreover, the widespread use of in-vehicle diagnostics and smart sensor integration is propelling demand for high-precision exhaust sensors. The aging vehicle fleet and emphasis on sustainable urban mobility also contribute to rising adoption across both OEM and aftermarket channels.

China Exhaust Sensors for Automotive Market Insight

China dominated the Asia-Pacific exhaust sensors market in 2024, accounting for the largest revenue share, due to its massive automotive production base, aggressive emission control policies, and rapid urbanization. The implementation of China 6 emission standards has mandated the integration of NOx and PM sensors across most vehicle platforms. As one of the leading markets for both passenger and commercial vehicles, China’s growing focus on smart mobility, coupled with government incentives for cleaner vehicles, is driving significant demand for advanced exhaust sensor solutions. Local sensor manufacturers are also gaining ground, offering cost-effective and high-performance alternatives to imported systems.

Global Exhaust Sensors for Automotive Market Share

The Exhaust Sensors for Automotive industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Delphi Co. (U.Κ.)

- Denso Corporation (Japan)

- Sensata Technologies (U.S.)

- Hella KGAA Hueck (Germany)

- Hitachi Ltd. (Japan)

- Valeo S.A (France)

- STMicroelectronics NV (Switzerland)

- BorgWarner Inc. (U.S.)

- PHINIA Inc. (U.S.)

- Niterra North America, Inc (U.S.)

- Eberspächer (Germany)

- FORVIA HELLA (Germany)

What are the Recent Developments in Global Exhaust Sensors for Automotive Market?

- In April 2023, Bosch, a leading global automotive technology provider, announced the expansion of its advanced NOx sensor production line in Germany to meet rising demand from global OEMs complying with Euro 7 and other emission norms. This strategic move reflects Bosch’s ongoing investment in emissions control technologies and its commitment to supporting automakers in achieving lower emissions through precise and durable exhaust sensor systems. The expansion also enhances Bosch’s production capacity and reinforces its position as a market leader in the global exhaust sensors segment.

- In March 2023, Denso Corporation introduced a next-generation particulate matter (PM) sensor capable of real-time soot measurement with improved accuracy and extended lifespan. This sensor is designed to support the increasing demand for precise emission monitoring in diesel and hybrid vehicles. Denso’s new solution helps OEMs meet stricter global emission regulations, particularly in commercial vehicle applications. The launch underscores Denso's focus on sustainable mobility and innovation in clean engine technologies.

- In February 2023, Continental AG unveiled its enhanced line of integrated exhaust temperature and pressure sensors for use in both gasoline and diesel engines. These compact, multi-functional sensors offer improved resistance to extreme exhaust conditions and are optimized for use in turbocharged engines and vehicles with advanced after-treatment systems. This development aligns with Continental’s strategy to offer high-performance, space-saving sensor solutions for evolving vehicle architectures.

- In January 2023, NGK Spark Plug Co., Ltd. (now operating as Niterra Co., Ltd.) announced a major R&D initiative focused on developing AI-integrated exhaust sensors for predictive diagnostics and enhanced vehicle efficiency. The company aims to incorporate machine learning to enable real-time condition monitoring and early fault detection, particularly in NOx and O₂ sensors. This move reflects Niterra's strategic direction toward digitalization and smart mobility solutions.

- In January 2023, Delphi Technologies, a brand under BorgWarner Inc., launched a new series of aftermarket NOx sensors compatible with a wide range of European diesel vehicles. The product line aims to serve the growing replacement demand for emission sensors due to increasing maintenance compliance in regions with stringent testing regimes. The launch supports BorgWarner’s broader strategy to strengthen its presence in the automotive aftermarket and deliver cost-effective, regulation-compliant sensor solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.