Global Exocrine Pancreatic Insufficiency Epi Therapeutics And Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

8.81 Billion

USD

15.38 Billion

2024

2032

USD

8.81 Billion

USD

15.38 Billion

2024

2032

| 2025 –2032 | |

| USD 8.81 Billion | |

| USD 15.38 Billion | |

|

|

|

|

Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Size

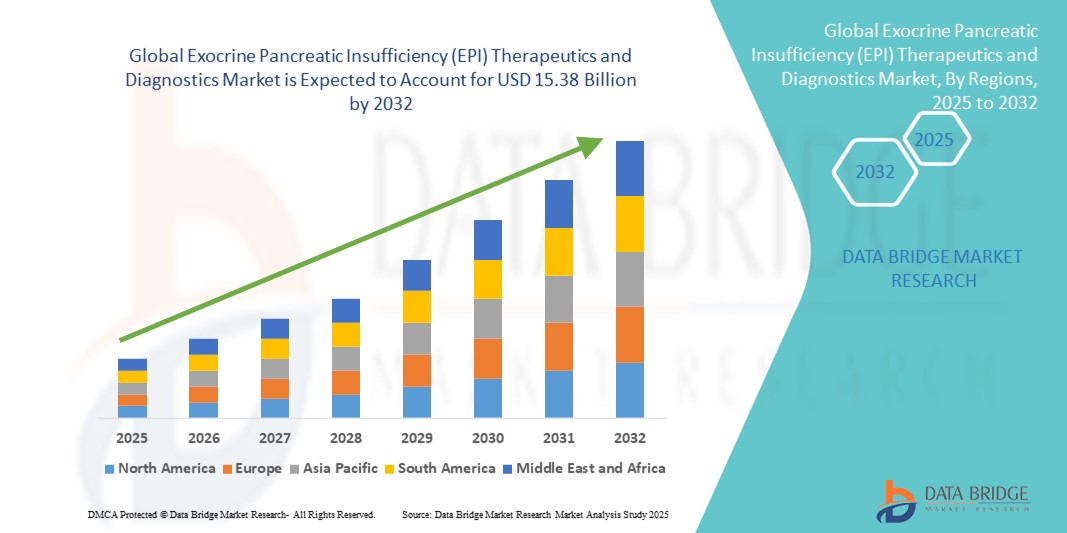

- The global exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market size was valued at USD 8.81 billion in 2024 and is expected to reach USD 15.38 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely fueled by the rising prevalence of pancreatic disorders, increasing awareness of gastrointestinal health, and advancements in diagnostic technologies such as fecal elastase tests and imaging methods. These factors are driving early detection and timely management of exocrine pancreatic insufficiency (EPI)

- Furthermore, the growing adoption of pancreatic enzyme replacement therapies (PERT), coupled with ongoing research into novel treatment approaches and improved diagnostic accuracy, is significantly enhancing patient outcomes. These converging factors are accelerating the uptake of exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics solutions, thereby substantially boosting the industry's growth

Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Analysis

- Exocrine Pancreatic Insufficiency (EPI) therapeutics and diagnostics, comprising enzyme replacement therapies, nutritional management solutions, and diagnostic testing methods, are increasingly vital components of modern gastrointestinal care due to their ability to improve nutrient absorption, enhance patient outcomes, and reduce complications associated with malnutrition

- The escalating demand for EPI therapeutics and diagnostics is primarily fueled by the rising prevalence of chronic pancreatitis, cystic fibrosis, and pancreatic cancer, coupled with growing awareness about early diagnosis, and a rising preference for enzyme replacement therapies as the first-line treatment option

- North America dominated the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market with the largest revenue share of 39.5% in 2024, characterized by advanced healthcare infrastructure, high awareness levels among patients and physicians, and strong presence of key industry players. The U.S. contributed the majority of the regional revenue, supported by increasing adoption of pancreatic enzyme replacement therapies (PERTs) and availability of advanced diagnostic tools

- Asia-Pacific is expected to be the fastest growing region in the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market during the forecast period, with a projected CAGR of 8.6% from 2025 to 2032, driven by rising healthcare investments, increasing prevalence of pancreatic disorders, improving access to diagnostic facilities, and rising disposable incomes in countries such as China and India

- The branded drug segment dominated the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market with a market revenue share of 56.1% in 2024, owing to the established presence of leading pharmaceutical companies, strong clinical evidence, and higher physician confidence in branded PERT formulations

Report Scope and Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Segmentation

|

Attributes |

Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Trends

Enhanced Convenience Through Advanced Therapies and Diagnostics

- A significant and accelerating trend in the global exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is the increasing adoption of advanced enzyme replacement therapies (PERTs) and innovative diagnostic approaches that enhance treatment precision, patient convenience, and long-term management of EPI

- For instance, leading pharmaceutical companies are introducing next-generation PERT formulations with improved stability and efficacy, allowing patients to better manage maldigestion and nutrient absorption. Similarly, advancements in non-invasive diagnostic testing are making it easier for clinicians to confirm EPI at earlier stages, reducing diagnostic delays

- The integration of real-world data (RWD) and clinical decision-support tools in EPI care is also enabling healthcare providers to tailor treatment regimens more effectively. These innovations support optimized dosing, minimize side effects, and ensure better long-term adherence among patients managing chronic pancreatic conditions

- Furthermore, improvements in capsule design and enzyme delivery mechanisms are providing more reliable outcomes for patients by ensuring that enzymes remain active until they reach the small intestine, enhancing absorption efficiency and nutritional status

- This trend towards more effective, patient-friendly, and technologically advanced therapies and diagnostics is fundamentally reshaping expectations in EPI care. Pharmaceutical innovators are focusing on therapies with higher bioavailability and diagnostic tools that can deliver rapid and accurate results

- The demand for EPI therapeutics and diagnostics that offer enhanced convenience, improved treatment outcomes, and comprehensive disease management is growing rapidly across hospitals, clinics, and specialty care centers, as patients and providers increasingly prioritize quality of life and long-term nutritional health

Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Dynamics

Driver

Growing Need Due to Rising Disease Awareness and Advanced Therapeutics

- The increasing prevalence of pancreatic disorders, coupled with rising awareness about digestive health and improved diagnostic capabilities, is a significant driver for the heightened demand for exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics

- For instance, in April 2024, leading pharmaceutical companies announced the development of next-generation Pancreatic Enzyme Replacement Therapy (PERT) formulations aimed at enhancing efficacy, tolerability, and patient adherence. Such initiatives by key players are expected to drive the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics industry growth in the forecast period

- As patients and healthcare providers increasingly recognize the importance of early detection and effective management, advanced diagnostics such as imaging tests, pancreatic function tests, and stool-based assays are gaining traction, providing timely interventions and better treatment outcomes

- Furthermore, the growing emphasis on personalized nutrition, combination therapies, and home-based monitoring solutions is enhancing patient-centric care in both clinical and outpatient settings, supporting broader adoption of EPI therapeutics and diagnostics

- The convenience of oral enzyme therapies, targeted nutritional management, and readily accessible diagnostic services are key factors propelling the adoption of Exocrine Pancreatic Insufficiency (EPI) solutions across hospitals, specialty clinics, and homecare settings. The increasing availability of user-friendly and standardized treatment protocols further contributes to market growth

Restraint/Challenge

High Treatment Costs and Limited Awareness in Emerging Markets

- The relatively high cost of advanced PERT formulations and specialized diagnostic tests poses a significant challenge to wider market penetration. In price-sensitive regions, limited access to healthcare infrastructure and financial constraints can restrict adoption

- In addition, a lack of awareness about EPI symptoms and underdiagnosis in certain populations has made early detection and treatment challenging, potentially delaying therapy initiation

- Addressing these challenges through patient education campaigns, insurance coverage expansion, and development of cost-effective diagnostics and therapies is crucial for broadening market access

- Furthermore, ongoing research and innovation aimed at producing affordable and efficient enzyme replacement formulations will be vital for sustaining market growth globally

- While prices of some generic enzyme therapies are gradually decreasing, the perceived premium for branded or advanced diagnostic solutions can still hinder adoption, particularly in developing regions. Overcoming these challenges through enhanced healthcare outreach, cost optimization, and standardized treatment guidelines will be key to long-term industry expansion

Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Scope

The market is segmented on the basis of diagnosis, treatment, drug type, end-user, and distribution channel.

- By Diagnosis

On the basis of diagnosis, the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into imaging tests and pancreatic function tests. The pancreatic function test segment dominated the largest market revenue share of 52.3% in 2024, driven by its high accuracy in assessing enzyme deficiency, widespread adoption in clinical practice, and critical role in guiding treatment plans for patients with chronic pancreatitis and cystic fibrosis. Pancreatic function tests are considered essential for early detection and continuous monitoring, offering actionable insights for both clinicians and patients. They provide reliable results for treatment adjustment and long-term management. The segment also benefits from increasing reimbursement coverage in key developed markets. In addition, healthcare providers favor pancreatic function tests for their diagnostic precision and ability to complement other clinical assessments.

The imaging tests segment is expected to witness the fastest CAGR of 7.9% from 2025 to 2032, fueled by advances in non-invasive imaging technologies such as MRI and CT scans, increasing awareness about early diagnosis, and their growing adoption in specialty clinics and diagnostic centers. Imaging tests provide complementary information to functional assays, aiding in comprehensive evaluation of pancreatic morphology and related complications. The expansion of healthcare infrastructure in Asia-Pacific and Latin America supports rapid uptake. Technological innovations have improved imaging resolution, making detection of subtle pancreatic changes more feasible. Cost reduction in imaging equipment is also driving adoption. Overall, imaging tests are becoming a preferred choice for clinicians seeking a complete diagnostic profile.

- By Treatment

On the basis of treatment, the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into nutritional management and pancreatic enzyme replacement therapy (PERT). The PERT segment dominated the largest market revenue share of 48.7% in 2024, due to its proven efficacy in improving nutrient absorption, reducing malnutrition, and enhancing quality of life for patients with EPI. PERT is widely recommended by gastroenterologists and has strong physician and patient preference across North America and Europe. It ensures standardized enzyme delivery and consistent therapeutic outcomes. Adoption is supported by extensive clinical guidelines. The segment benefits from ongoing product innovations enhancing enzyme stability and bioavailability. Patient adherence programs also strengthen the market position of PERT therapies.

The nutritional management segment is expected to witness the fastest CAGR of 8.4% from 2025 to 2032, driven by increasing adoption of specialized diets, high-protein nutritional supplements, and personalized nutrition plans that support enzyme therapy, particularly in emerging markets with growing awareness of EPI management strategies. Nutritional management complements PERT therapy by addressing overall malnutrition and supporting patient health. Rising focus on lifestyle interventions and dietician-led programs boosts growth. Availability of ready-to-use nutritional formulations accelerates patient compliance. Expanding homecare services for nutritional support is enhancing market uptake. Emerging markets are increasingly investing in patient education programs emphasizing dietary management.

- By Drug Type

On the basis of drug type, the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into generic and branded formulations. The branded drug segment dominated the largest market revenue share of 56.1% in 2024, owing to the established presence of leading pharmaceutical companies, strong clinical evidence, and higher physician confidence in branded PERT formulations. Branded drugs often offer better stability, standardized enzyme content, and regulatory approvals that support widespread adoption. They benefit from strong marketing and educational campaigns. The segment is supported by exclusive distribution networks in developed markets. Branded drugs maintain patient trust due to consistent quality. Clinical trials further reinforce the efficacy of branded formulations.

The generic drug segment is expected to witness the fastest CAGR of 9.2% from 2025 to 2032, fueled by cost-effectiveness, increasing healthcare coverage, and expanding availability in developing regions. Generic formulations make EPI therapeutics more accessible to a larger patient base. Increasing regulatory approvals for generics are encouraging manufacturers to enter the market. Patient and provider acceptance is rising due to comparable efficacy with branded drugs. Bulk procurement by hospitals and retail pharmacies supports growth. Affordability drives adoption in emerging markets. Educational programs for clinicians about generic efficacy are further supporting uptake.

- By End-User

On the basis of end-user, the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into hospitals, specialty clinics, homecare, diagnostic centers, research and academic institutes, and others. The hospital segment dominated the largest market revenue share of 50.4% in 2024, due to high patient footfall, integrated care facilities, and strong physician networks managing EPI therapeutics and diagnostics. Hospitals serve as primary centers for both diagnosis and PERT administration, ensuring adherence and continuous monitoring. They offer comprehensive care including dietetic counseling and follow-up services. Established distribution and procurement channels in hospitals strengthen market share. Hospitals also drive clinical trials and research collaborations for EPI management. Institutional preference for standardized therapies supports dominance.

The homecare segment is expected to witness the fastest CAGR of 10.1% from 2025 to 2032, driven by increasing patient preference for at-home enzyme therapy, remote monitoring support, and rising adoption of telemedicine platforms for disease management. Homecare improves patient convenience and adherence. Expansion of specialized homecare providers is facilitating therapy delivery. Remote education and monitoring enhance treatment effectiveness. The segment growth is accelerated by supportive insurance coverage for home-based care. Awareness campaigns targeting patients and caregivers encourage home-based management. Technology-enabled delivery of PERT and nutritional support boosts adoption.

- By Distribution Channel

On the basis of distribution channel, the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is segmented into direct tender, retail pharmacy, third-party distributors, and others. The direct tender segment dominated the largest market revenue share of 45.6% in 2024, driven by bulk procurement by hospitals, specialty clinics, and government programs, ensuring consistent supply and cost advantages for high-volume buyers. Direct tender agreements often include preferential pricing and supply contracts. Hospitals and large institutions prefer this channel for reliability. Strong logistics networks support distribution efficiency. The segment ensures access to branded formulations at scale. Government initiatives for EPI awareness and treatment coverage further reinforce this channel. Long-term contracts maintain market stability and reduce stock-outs.

The retail pharmacy segment is expected to witness the fastest CAGR of 9.5% from 2025 to 2032, fueled by growing patient awareness, over-the-counter availability of nutritional supplements and PERT products, and expanding retail networks in urban and semi-urban regions. Retail pharmacies provide convenient, immediate access to therapies for patients. Increasing patient education on EPI management supports adoption. Partnerships with manufacturers enhance stock availability. Retail expansion in emerging markets improves accessibility. The segment benefits from marketing campaigns targeting caregivers and patients. Rising preference for self-managed therapy at home drives retail channel growth.

Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Regional Analysis

- North America dominated the exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market with the largest revenue share of 39.5% in 2024, characterized by advanced healthcare infrastructure, high awareness levels among patients and physicians, and the strong presence of key industry players

- The market growth is driven by increasing adoption of pancreatic enzyme replacement therapies (PERTs), improved nutritional management solutions, and availability of advanced diagnostic tools for early detection and monitoring of pancreatic insufficiency

- Robust research activities, growing focus on body-focused digestive disorders, and widespread healthcare coverage further support market expansion in the region

U.S. Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The U.S. exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market captured the majority of North America’s revenue in 2024, fueled by high patient awareness, extensive clinical research, and rapid adoption of innovative treatment options. The increasing prevalence of chronic pancreatic disorders, coupled with the availability of comprehensive diagnostic platforms such as imaging and pancreatic function tests, is driving significant demand. In addition, the growing pipeline of advanced PERT formulations and focus on patient-centric therapeutic approaches are propelling market growth.

Europe Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The Europe exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing prevalence of pancreatic disorders, rising healthcare expenditure, and supportive regulatory frameworks for diagnostics and therapeutics. Growing awareness among healthcare professionals about early diagnosis and optimal treatment strategies is fostering the adoption of both pharmacological and nutritional management approaches. Key European countries are witnessing notable investments in healthcare infrastructure, enhancing access to specialized clinics and diagnostic facilities for EPI patients.

U.K. Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The U.K. exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened awareness of digestive health, increasing diagnosis rates, and adoption of both PERT and supportive nutritional management. In addition, the expansion of specialty clinics and research centers focused on pancreatic disorders is contributing to market development, while healthcare programs promoting early intervention encourage broader treatment uptake.

Germany Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The Germany exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is expected to expand at a considerable CAGR, fueled by a strong emphasis on precision healthcare, growing investments in diagnostic technologies, and the demand for technologically advanced therapeutic solutions. The increasing prevalence of pancreatic insufficiency, along with well-developed hospital infrastructure and a high level of patient education, supports adoption of both enzyme replacement therapy and advanced diagnostic testing.

Asia-Pacific Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The Asia-Pacific exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is expected to be the fastest-growing region during the forecast period, with a projected CAGR of 8.6% from 2025 to 2032. Growth is driven by rising healthcare investments, increasing prevalence of pancreatic disorders, improving access to diagnostic facilities, and rising disposable incomes in countries such as China and India. Expanded public health awareness campaigns, government initiatives supporting digestive health, and development of local pharmaceutical manufacturing capabilities are accelerating market penetration.

Japan Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The Japan exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market is gaining momentum due to rapid urbanization, an aging population, and increasing focus on digestive and pancreatic health. Adoption of advanced PERT therapies and comprehensive diagnostic solutions is supported by a technologically adept healthcare system and growing patient awareness.

China Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Insight

The China exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics market accounted for a significant revenue share in Asia-Pacific in 2024, attributed to rising healthcare infrastructure, a growing middle class, and government-led initiatives to improve early diagnosis and treatment of pancreatic disorders. Increasing prevalence of digestive health issues and expanding healthcare access in urban and semi-urban regions are key factors propelling market growth.

Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market Share

The exocrine pancreatic insufficiency (EPI) therapeutics and diagnostics industry is primarily led by well-established companies, including:

- EagleBio (U.S.)

- AbbVie Inc. (U.S.)

- Nordmark Pharma GmbH. (Germany)

- Digestive Care, Inc. (U.S.)

- LUMITOS AG (Germany)

- Alcresta Therapeutics, Inc. (U.S.)

- ChiRhoClin, Inc. (U.S.)

- Abbott (U.S.)

- Bioserv Analytics and Medical Devices GmbH (Germany)

- LabCorp (U.S.)

- Organon Group of Companies (U.S.)

- Metagenics LLC (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Nestlé Health Science (Switzerland)

- VIVUS LLC (U.S.)

- ScheBo Biotech AG (Germany)

Latest Developments in Global Exocrine Pancreatic Insufficiency (EPI) Therapeutics and Diagnostics Market

- In May 2025, a study published in the Pharmaceutical Journal highlighted that pancreatic exocrine insufficiency (PEI) occurs when the pancreas is unable to produce sufficient enzymes to aid digestion, leading to malnutrition due to inadequate absorption of nutrients

- In August 2021, AzurRx announced that it had engaged in the development of yeast-derived lipase, MS1819, which has been engineered to have superior enzymatic activity as compared to current treatments

- In February 2023, Codexis, Inc. and Nestlé Health Science announced the interim findings from a Phase 1 trial examining the safety, tolerability, pharmacokinetics (PK), and pharmacodynamics of CDX-7108. A lipase variation called CDX-7108 was created expressly to get around the drawbacks of the current pancreatic enzyme replacement treatment (PERT). This has aided the business in marketing the product

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.