Global Expanded Polypropylene Epp Market

Market Size in USD Billion

CAGR :

%

USD

1.17 Billion

USD

1.82 Billion

2024

2032

USD

1.17 Billion

USD

1.82 Billion

2024

2032

| 2025 –2032 | |

| USD 1.17 Billion | |

| USD 1.82 Billion | |

|

|

|

|

Expanded Polypropylene (EPP) Market Size

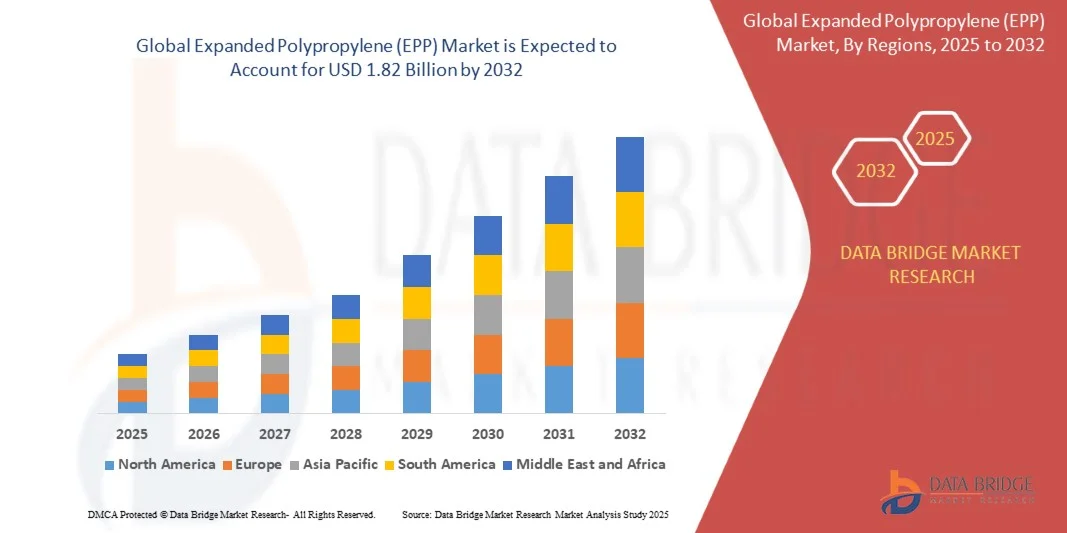

- The global Expanded Polypropylene (EPP) market size was valued at USD 1.17 billion in 2024 and is expected to reach USD 1.82 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the increasing demand for lightweight, durable, and energy-absorbing materials across automotive, packaging, and consumer goods sectors. EPP’s excellent impact resistance, thermal insulation, and recyclability make it a preferred choice for manufacturers aiming to enhance product performance while meeting sustainability goals

- Furthermore, rising adoption of electric vehicles, growth in e-commerce and protective packaging, and the need for environmentally friendly materials are driving the uptake of EPP in various industries. These factors are accelerating product innovation and capacity expansion, thereby significantly boosting the industry’s growth

Expanded Polypropylene (EPP) Market Analysis

- Expanded polypropylene (EPP) is a versatile, closed-cell foam known for its low density, high energy absorption, and resilience. It is widely used in automotive interiors, protective packaging, leisure products, and industrial applications, offering a combination of lightweight structure and superior durability

- The escalating demand for EPP is primarily fueled by its ability to reduce vehicle weight and improve fuel efficiency, provide cushioning and protection for packaged goods, and support circular economy initiatives through recyclable material usage. Growing awareness of sustainable materials and advancements in polymer processing technologies are further propelling market expansion

- Asia-Pacific dominated the Expanded Polypropylene (EPP) market with a share of 41.5% in 2024, due to strong automotive production, rapid expansion in packaging applications, and growing consumer goods manufacturing across developing economies

- North America is expected to be the fastest growing region in the Expanded Polypropylene (EPP) market during the forecast period due to growing demand for lightweight materials in automotive, aerospace, and consumer goods industries

- Low density segment dominated the market with a market share of 47.3% in 2024, due to its superior cushioning properties, lightweight nature, and extensive application in packaging and automotive interiors. Its ability to provide high energy absorption while maintaining low weight makes it ideal for impact-resistant components such as bumpers, headrests, and protective packaging materials. In addition, the recyclability and cost-effectiveness of low-density EPP have further boosted its adoption across industries seeking sustainable and efficient material solutions

Report Scope and Expanded Polypropylene (EPP) Market Segmentation

|

Attributes |

Expanded Polypropylene (EPP) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Expanded Polypropylene (EPP) Market Trends

“Rising Use of Lightweight, Sustainable Materials”

- The expanded polypropylene (EPP) market is experiencing significant growth driven by the increasing preference for lightweight and sustainable materials across automotive, packaging, and consumer goods industries. EPP’s combination of low density, superior energy absorption, and recyclability makes it an ideal choice for manufacturers targeting performance efficiency and environmental compliance

- For instance, JSP Corporation offers ARPRO EPP solutions widely adopted in automotive components such as bumper cores, seat structures, and door panels to achieve vehicle weight reduction and improved fuel efficiency. Similarly, BASF SE has advanced its EPP portfolio with eco-friendly variants designed for lightweight protective packaging and logistics applications catering to circular economy goals

- The growing focus on reducing carbon emissions and optimizing transportation efficiency is fueling demand for EPP in industries seeking greener alternatives to conventional plastics. Its lightweight characteristics allow reduced fuel consumption and shipping costs while maintaining structural integrity and durability

- In addition, the material’s reusability and full recyclability align with global sustainability initiatives aimed at minimizing plastic waste. Manufacturers are increasingly using recycled EPP beads in new production cycles to support closed-loop manufacturing efforts and meet environmental standards

- EPP’s versatility extends beyond industrial applications into furniture, consumer electronics, and sports equipment, where lightweight, shock-resistant materials enhance product performance and safety. These cross-sector advancements reflect the broad appeal of EPP as a sustainable design material

- As industries intensify their commitment toward eco-conscious innovation and lifecycle efficiency, the demand for lightweight, high-performance materials such as EPP is expected to strengthen. The ongoing trend reinforces the industry’s transition toward materials that balance durability, energy efficiency, and sustainability across multiple manufacturing sectors

Expanded Polypropylene (EPP) Market Dynamics

Driver

“Growing Demand for Durable and Recyclable EPP”

- The rising global emphasis on durability, resilience, and recyclability in manufacturing materials is driving the widespread adoption of expanded polypropylene. EPP’s unique combination of impact resistance, flexibility, and recyclability positions it as a preferred material in modern engineering and packaging solutions

- For instance, Knauf Industries utilizes high-strength EPP for creating reusable packaging systems for electronics, promoting both durability and cost efficiency. Similarly, Toray Industries develops EPP components with enhanced dimensional stability and shock resistance for electric vehicle battery housings, contributing to product longevity and safety

- EPP’s ability to retain shape and performance after multiple impacts makes it ideal for products that require long-term use without compromising durability. This property supports sustainability by reducing replacement rates and component waste across various applications

- In addition, the recyclability of EPP aligns with environmental objectives encouraging closed-loop systems. Manufacturers can collect and reprocess EPP waste into new molded components, minimizing raw material dependency and supporting resource-efficient production cycles

- As industries increasingly prioritize circular economy principles, materials capable of combining durability with environmental responsibility are gaining importance. The continued innovation in EPP processing and recycling is expected to sustain its growing demand across automotive, construction, and packaging sectors globally

Restraint/Challenge

“High Production Costs in Certain Regions”

- Despite its advantages, the EPP market faces challenges related to high production costs, primarily in regions with limited access to raw materials and advanced manufacturing facilities. The production process involves high-pressure steam molding and specialized extrusion equipment, requiring substantial energy and operational investment

- For instance, companies such as BASF SE and Kaneka Corporation encounter elevated production expenses in regions with high energy tariffs and limited feedstock availability, influencing final product pricing. These cost pressures make it difficult for local manufacturers to compete with large-scale producers operating in lower-cost regions

- The dependence on polypropylene resin, whose price fluctuates with crude oil markets, further contributes to cost variability. Any disruption in petrochemical supply chains directly affects the production economics of EPP, particularly in import-reliant countries

- In addition, the need for specialized molding technologies and quality control systems increases capital expenditure for companies entering the market. This makes small manufacturers hesitant to invest in large-scale production due to uncertain returns and competitive pricing dynamics

- Although technological innovations and automation are gradually improving production efficiency and reducing costs, regional disparities in energy and raw material prices remain a concern. Achieving balanced cost competitiveness through localization, raw material optimization, and process innovation will be critical to sustaining market growth across global EPP production hubs

Expanded Polypropylene (EPP) Market Scope

The market is segmented on the basis of type, process, and application.

• By Type

On the basis of type, the expanded polypropylene (EPP) market is segmented into low density, medium density, and high density. The low-density segment dominated the largest market revenue share of 47.3% in 2024, owing to its superior cushioning properties, lightweight nature, and extensive application in packaging and automotive interiors. Its ability to provide high energy absorption while maintaining low weight makes it ideal for impact-resistant components such as bumpers, headrests, and protective packaging materials. In addition, the recyclability and cost-effectiveness of low-density EPP have further boosted its adoption across industries seeking sustainable and efficient material solutions.

The high-density segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for durable and structurally strong materials in automotive and construction applications. High-density EPP offers enhanced rigidity, thermal resistance, and dimensional stability, making it suitable for load-bearing parts, HVAC components, and insulation panels. The growing preference for lightweight yet strong materials in electric vehicles and industrial applications is further fueling its demand. Technological advancements in molding processes and material formulations are also contributing to the expansion of this segment.

• By Process

On the basis of process, the expanded polypropylene (EPP) market is categorized into solid-state processing and melt-state processing. The solid-state processing segment held the largest market share in 2024 due to its superior control over bead fusion, density distribution, and mechanical strength. This process allows for precise customization of material properties, making it ideal for applications requiring consistent performance under impact and heat. Its lower energy consumption and minimal material waste also make it a preferred method for large-scale manufacturing, particularly in the automotive and packaging sectors.

The melt-state processing segment is projected to record the fastest CAGR from 2025 to 2032, driven by advancements in polymer processing technologies and the increasing need for complex, high-quality molded components. This method enables uniform melting and molding of polypropylene beads, producing parts with excellent surface finish and structural integrity. The flexibility of melt-state processing to handle a wide range of densities and shapes has made it popular in consumer goods and electronics packaging. Growing R&D efforts to improve process efficiency and reduce production costs are expected to further enhance its market penetration.

• By Application

On the basis of application, the expanded polypropylene (EPP) market is segmented into automotive, packaging, consumer goods, and others. The automotive segment dominated the market in 2024, supported by the rising emphasis on lightweight materials to improve fuel efficiency and vehicle performance. EPP’s ability to provide energy absorption, insulation, and structural support makes it indispensable in car components such as bumpers, door panels, and seat cores. The growing production of electric vehicles and regulatory pressure for eco-friendly materials have further strengthened its use across global automotive manufacturing.

The packaging segment is anticipated to witness the fastest growth rate from 2025 to 2032, attributed to increasing demand for protective and sustainable packaging solutions across e-commerce, food, and electronics sectors. EPP offers excellent shock absorption, reusability, and moisture resistance, making it an ideal choice for delicate or high-value products. With companies increasingly prioritizing circular economy principles, the use of EPP in returnable packaging and logistics containers is expanding rapidly. Its lightweight and versatile nature also help reduce transportation costs, enhancing its adoption across diverse industries.

Expanded Polypropylene (EPP) Market Regional Analysis

- Asia-Pacific dominated the Expanded Polypropylene (EPP) market with the largest revenue share of 41.5% in 2024, driven by strong automotive production, rapid expansion in packaging applications, and growing consumer goods manufacturing across developing economies

- The region’s cost-effective raw material availability, supportive government policies promoting lightweight and sustainable materials, and increasing investments in electric vehicle manufacturing are accelerating expanded polypropylene market growth

- Rising industrialization, a flourishing e-commerce sector, and demand for energy-efficient materials are further fueling the adoption of expanded polypropylene across diverse industries

China Expanded Polypropylene (EPP) Market Insight

China held the largest share in the Asia-Pacific expanded polypropylene market in 2024, supported by its robust automotive manufacturing base, large packaging industry, and expanding infrastructure sector. The country’s push toward lightweight materials for fuel efficiency, coupled with high local production capacity, drives significant expanded polypropylene consumption. Ongoing technological advancements and government incentives for electric vehicles are also boosting demand for expanded polypropylene in structural and energy-absorbing components.

India Expanded Polypropylene (EPP) Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid industrial development, rising automotive production, and growing adoption of sustainable packaging solutions. Increasing foreign investments in manufacturing, supported by the “Make in India” initiative, are enhancing expanded polypropylene utilization in automotive and consumer goods sectors. In addition, the shift toward lightweight, recyclable materials and expansion in logistics packaging are driving the country’s market growth.

Europe Expanded Polypropylene (EPP) Market Insight

The Europe expanded polypropylene market is expanding steadily, driven by strong demand from the automotive, construction, and packaging industries. The region emphasizes sustainability, recycling, and regulatory compliance, leading to greater use of expanded polypropylene as an eco-friendly alternative to traditional foams. Continuous R&D investments in advanced polymers and insulation materials are also contributing to market expansion, particularly in Germany, France, and the U.K.

Germany Expanded Polypropylene (EPP) Market Insight

Germany’s expanded polypropylene market is driven by its dominance in automotive engineering, focus on vehicle weight reduction, and high standards for energy efficiency. The country’s strong presence of premium car manufacturers and advanced molding technologies supports steady expanded polypropylene adoption in interior, safety, and structural components. In addition, demand for EPP in HVAC insulation and packaging further reinforces Germany’s leading role within the European market.

U.K. Expanded Polypropylene (EPP) Market Insight

The U.K. market is supported by growing adoption of sustainable materials in packaging, construction, and automotive applications. The country’s increasing emphasis on circular economy practices and the development of recyclable, energy-efficient materials are key drivers. Expanding logistics and e-commerce sectors are also fueling demand for lightweight expanded polypropylene packaging solutions, positioning the U.K. as a significant market within Europe.

North America Expanded Polypropylene (EPP) Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by growing demand for lightweight materials in automotive, aerospace, and consumer goods industries. The region’s focus on energy-efficient and recyclable materials, coupled with strong innovation in polymer engineering, supports expanded polypropylene expansion. Increasing adoption in packaging and insulation applications, along with expanding EV production, further strengthens the market outlook.

U.S. Expanded Polypropylene (EPP) Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by its well-established automotive sector, extensive R&D capabilities, and strong sustainability initiatives. Rising demand for energy-absorbing materials in vehicle interiors and protective packaging is fueling market growth. The presence of leading manufacturers and growing investments in lightweight and eco-friendly material solutions further consolidate the U.S.’s leadership in the regional Expanded Polypropylene market.

Expanded Polypropylene (EPP) Market Share

The Expanded Polypropylene (EPP) industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Kaneka Corporation (Japan)

- Furukawa Electric Co., Ltd. (Japan)

- DS Smith Plc (U.K.)

- Hanwha Solutions Chemical Division Corporation (South Korea)

- Sonoco Products Company (U.S.)

- Woodbridge Group (Canada)

- Dongshin Industry Incorporated (South Korea)

- Knauf Industries (France)

- Clark Foam Products Corp. (U.S.)

- Paracoat Products Ltd. (India)

- Molan-Pino South Africa (South Africa)

- Armacell International S.A. (Luxembourg)

- Lauren Manufacturing (U.S.)

- Cooper Standard (U.S.)

- DuPont (U.S.)

- Dow Inc. (U.S.)

- Huntington Solutions (U.S.)

- Chemical Corporation Inc. (U.S.)

- JSP Corporation (Japan)

Latest Developments in Expanded Polypropylene (EPP) Market

- In December 2022, Kaneka Corporation expanded its expanded polypropylene (EPP) production capacity at its Japan facility to address rising global demand from automotive and packaging sectors. This capacity enhancement strengthens Kaneka’s supply chain resilience and supports the growing adoption of lightweight, recyclable materials in electric vehicles and sustainable packaging. The move positions the company to better serve eco-conscious industries and reinforces its presence in the global EPP market

- In March 2022, BASF broadened its Neopolen expanded polypropylene (EPP) foam product range with the launch of Neopolen P9235+, which offers improved surface quality, 20% greater color depth, and enhanced filling behavior during production. This product upgrade enhances BASF’s competitive positioning in high-performance EPP solutions, catering to industries such as automotive interiors and consumer goods, and contributes to advancing material efficiency and aesthetic performance in molded components

- In March 2022, Hanwha Solutions announced the separation of its advanced materials unit and sold a 49% stake to Glenwood PE for USD 491 million to raise funds for domestic and overseas investments. This strategic restructuring enables Hanwha to focus on expanding its advanced materials portfolio, including EPP applications, while improving its capital flexibility for innovation and global expansion. The move supports the company’s long-term growth within the lightweight and high-performance materials market

- In February 2022, BEWI completed the acquisition of an additional 9.62% stake in Izoblok, raising its ownership to over 54% and securing majority control. This acquisition strengthens BEWI’s market position in Europe by enhancing its vertical integration and production efficiency within the EPP value chain. It enables the company to leverage synergies in innovation, sustainability, and logistics, boosting its competitiveness in automotive and packaging EPP applications

- In January 2022, JSP launched ARPRO Revolution, an expanded polypropylene (EPP) product composed almost entirely of recycled material. Designed for furniture, leisure, and packaging applications, it significantly reduces environmental impact while maintaining quality and performance. This innovation underscores JSP’s commitment to circular economy principles, supporting the market transition toward sustainable EPP solutions with minimal carbon footprint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Expanded Polypropylene Epp Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Expanded Polypropylene Epp Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Expanded Polypropylene Epp Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.