Global Explosion Proof Equipment Market

Market Size in USD Billion

CAGR :

%

USD

8.10 Billion

USD

13.60 Billion

2024

2032

USD

8.10 Billion

USD

13.60 Billion

2024

2032

| 2025 –2032 | |

| USD 8.10 Billion | |

| USD 13.60 Billion | |

|

|

|

|

Explosion-Proof Equipment Market Size

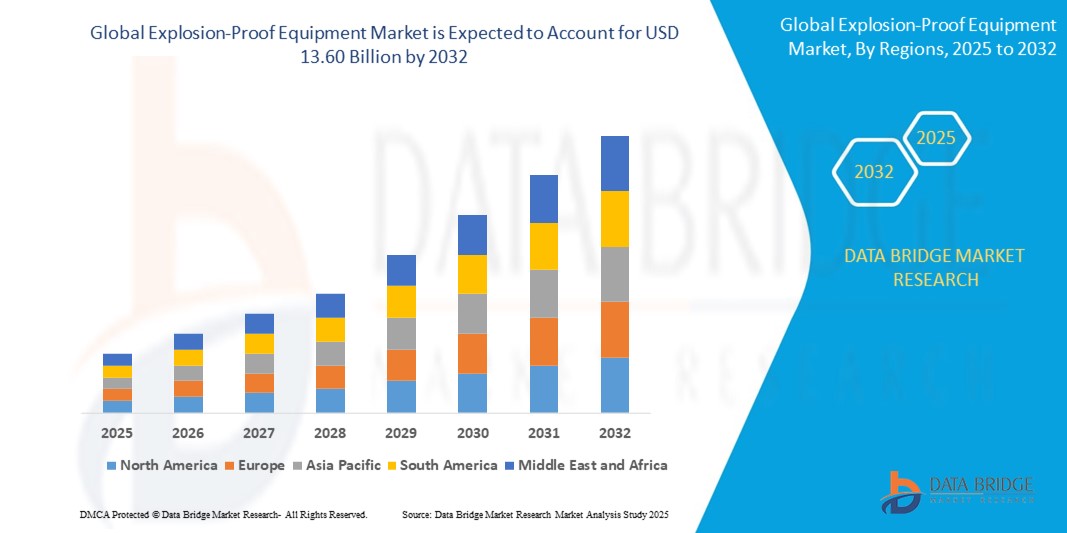

- The global explosion-proof equipment market size was valued at USD 8.10 billion in 2024 and is expected to reach USD 13.60 billion by 2032, at a CAGR of 6.7% during the forecast period

- The market growth is primarily driven by increasing safety regulations and stringent compliance requirements across hazardous industries such as oil & gas, chemicals, and mining, which necessitate the use of certified explosion-proof equipment to prevent industrial accidents

- Furthermore, rising investments in industrial automation, along with growing awareness about workplace safety and equipment reliability in explosive environments, are driving demand for advanced, durable, and standardized explosion-proof solutions across both developed and developing economies

Explosion-Proof Equipment Market Analysis

- Explosion-proof equipment refers to devices specifically engineered to prevent ignition of flammable substances and gases in hazardous environments. These apparatus are designed with robust construction and sealing techniques to contain any potential explosion, minimizing the risk of fire or damage in industrial settings prone to combustible materials and atmospheres

- The growing demand for explosion-proof solutions is largely driven by tightening regulatory frameworks, heightened focus on worker safety, and the expanding use of automation and electrical systems in hazardous locations requiring durable, compliant protection systems

- North America dominated the explosion-proof equipment market with a share of 31.1% in 2024, due to stringent industrial safety regulations, rising investments in oil & gas infrastructure, and a strong presence of hazardous location-based industries

- Asia-Pacific is expected to be the fastest growing region in the explosion-proof equipment market during the forecast period due to rapid industrialization, rising safety awareness, and increasing investments in oil refining, petrochemicals, and power infrastructure

- Explosion prevention segment dominated the market with a market share of 28.1% in 2024, due to increasing demand for intrinsically safe equipment that minimizes energy levels to prevent ignition, particularly in pharmaceutical and chemical industries that prioritize proactive safety measures

Report Scope and Explosion-Proof Equipment Market Segmentation

|

Attributes |

Explosion-Proof Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Explosion-Proof Equipment Market Trends

“Integration of IoT and Smart Monitoring in Hazardous Environments”

- A key trend reshaping the explosion-proof equipment market is the integration of IoT-based smart monitoring systems, which provide real-time diagnostics, predictive maintenance, and remote accessibility in high-risk environments. These systems enhance operational safety, reduce downtime, and support compliance with global safety standards

- For instance, Pepperl+Fuchs has developed smart sensors and explosion-proof interfaces that enable communication in hazardous zones while offering diagnostics and process data monitoring through industrial Ethernet protocols

- IoT-enabled explosion-proof equipment allows operators to monitor environmental conditions such as gas concentration, temperature, and pressure levels in real-time, ensuring proactive safety responses. This data-driven approach also aids in reducing false alarms and ensuring timely maintenance

- Smart monitoring capabilities are particularly vital in oil & gas, chemical, and mining industries, where the stakes of equipment failure or undetected hazards are extremely high. By combining rugged construction with intelligent functionality, companies can optimize safety and performance simultaneously

- The trend is driving manufacturers such as R. STAHL and BARTEC to innovate digital-ready explosion-proof solutions that integrate easily into broader industrial automation and control systems. These systems support scalable upgrades while meeting zone-specific certification standards

- As industrial operations continue to digitize and demand for safe, efficient solutions in hazardous zones rises, the adoption of intelligent, connected explosion-proof systems is expected to accelerate across both developed and emerging markets

Explosion-Proof Equipment Market Dynamics

Driver

“Stringent Safety Regulations and Growing Industrial Hazard Awareness

- Stringent safety standards imposed by regulatory bodies such as ATEX (Europe), IECEx (International), and NEC (U.S.) are a major force driving the demand for explosion-proof equipment across hazardous industrial environments

- For instance, industries in Europe and the Middle East have increasingly adopted certified explosion-proof solutions following regional compliance mandates aimed at minimizing explosion risks and protecting workers

- The rising awareness of industrial hazards, coupled with increasing investments in safety infrastructure, has propelled demand from industries such as oil & gas, petrochemicals, pharmaceuticals, and mining where volatile atmospheres are common

- Explosion-proof devices including enclosures, lighting systems, motors, and cable glands are essential in preventing ignition sources, and their usage is expanding due to greater automation and the deployment of electrical systems in explosive zones

- Major players such as ABB and Eaton are launching certified products that comply with international safety regulations and also offer digital features, enabling safer and smarter operations in demanding environments

Restraint/Challenge

“High Installation Costs and Maintenance Complexity”

- One of the significant challenges facing the explosion-proof equipment market is the high cost of installation and the ongoing complexity of maintenance in compliance with global safety standards

- For instance, installing certified equipment in Zone 0 or Zone 1 environments requires specialized engineering, robust materials, and skilled labor, which adds to the overall project cost and deters small-scale operators

- Maintaining the performance and compliance of such equipment involves routine inspection, calibration, and documentation, which can be resource-intensive. This is particularly challenging in remote or offshore locations where access is limited

- Failure to maintain certified conditions may lead to regulatory non-compliance or equipment malfunction, increasing liability risks. Consequently, companies must invest in both qualified personnel and sophisticated monitoring systems

- To address this issue, manufacturers are working to streamline product design, extend maintenance intervals, and introduce modular solutions that reduce total lifecycle costs without compromising safety or compliance

Explosion-Proof Equipment Market Scope

The market is segmented on the basis of offering, temperature class, zone, connectivity service, location, method of protection, equipment, and end user.

• By Offering

On the basis of offering, the explosion-proof equipment market is segmented into hardware, software, and services. The hardware segment accounted for the largest market revenue share in 2024 due to the extensive deployment of robust physical safety components, including enclosures, sensors, and control systems, in hazardous environments. These components are essential in industrial facilities to prevent the ignition of flammable materials through sparks or excessive heat, especially in sectors such as oil & gas and chemical processing.

The services segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing demand for installation, inspection, maintenance, and compliance support services to ensure ongoing regulatory adherence and operational safety.

• By Temperature Class

On the basis of temperature class, the market is segmented into T1 (> 450 °C), T2 (> 300 °C to < 450 °C), T3 (> 200 °C to < 300 °C), T4 (> 135 °C to < 200 °C), T5 (> 100 °C to < 135 °C), and T6 (> 85 °C to < 100 °C). The T4 segment dominated the market in 2024 as it covers a wide range of industrial equipment used in potentially explosive atmospheres while maintaining safe operational heat thresholds. T4-rated devices are widely adopted in refineries and processing units where flammable vapors or gases are present.

The T6 segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing deployment in pharmaceutical, food processing, and dust-prone industries where ignition temperatures are extremely low and stringent safety measures are mandatory.

• By Zone

On the basis of zone classification, the explosion-proof equipment market is segmented into Zone 0, Zone 1, Zone 2, Zone 20, Zone 21, and Zone 22. Zone 1 held the largest market revenue share in 2024 owing to its frequent exposure to explosive atmospheres during normal operations, especially in upstream oil and gas facilities, chemical processing plants, and fuel storage areas. Equipment designed for Zone 1 ensures robust sealing and durability to withstand potential ignition sources.

The Zone 21 segment is expected to grow at the fastest CAGR from 2025 to 2032, supported by the rising adoption in industries where explosive dust is present intermittently, including food mills, pharmaceuticals, and agricultural storage facilities.

• By Connectivity Service

Based on connectivity service, the market is bifurcated into wired and wireless. The wired segment held the largest market share in 2024 due to its established use in industrial setups requiring secure, stable communication for mission-critical equipment. Wired systems are preferred where electromagnetic interference could disrupt wireless signals.

The wireless segment is anticipated to grow at the fastest rate from 2025 to 2032, attributed to increasing digitization and the integration of wireless IoT-enabled sensors and monitoring systems in explosion-prone environments. Wireless connectivity enhances real-time data access and simplifies equipment installation in remote or hard-to-reach areas.

• By Location

On the basis of location, the explosion-proof equipment market is segmented into indoor and outdoor. The outdoor segment led the market in 2024 as outdoor installations in oil rigs, gas pipelines, and mining operations require ruggedized, weather-resistant equipment to prevent ignition in exposed environments.

The indoor segment is projected to witness the highest CAGR from 2025 to 2032 due to rising safety requirements in enclosed industrial areas, such as laboratories and production lines, where accumulated gases or dust pose significant ignition risks.

• By Method of Protection

On the basis of method of protection, the market is segmented into explosion proof, explosion prevention, and explosion segregation. Explosion prevention held the dominant revenue share of 28.1% in 2024 due to increasing demand for intrinsically safe equipment that minimizes energy levels to prevent ignition, particularly in pharmaceutical and chemical industries that prioritize proactive safety measures.

Explosion proof is expected to grow at the fastest rate from 2025 to 2032, fueled by its reliability in containing explosions within enclosures, especially in high-risk zones. These systems are heavily used in oil refineries and gas facilities.

• By Equipment

On the basis of equipment, the explosion-proof equipment market is segmented into cable glands and accessories, process instruments, industrial controls, motors, strobe beacons, lightning products, sensors, bells and horns, fire alarms/call points, speakers and tone generators, and visual and audible combination units. Cable glands and accessories accounted for the largest share in 2024 due to their essential role in maintaining the integrity of enclosures and preventing flame propagation through cable entries.

The sensors segment is projected to record the fastest growth from 2025 to 2032 owing to the surge in demand for real-time environmental monitoring and predictive maintenance, which enhances safety in dynamic industrial conditions.

• By End User

On the basis of end user, the market is segmented into oil and gas, chemical and petrochemical, energy and power, mining, pharmaceutical, food processing, marine and ship building, aerospace, military and defense, and others. The oil and gas segment held the largest market share in 2024, driven by the industry's extensive use of explosion-proof solutions to mitigate hazards in extraction, refining, and distribution activities.

The pharmaceutical segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by stringent regulatory requirements for safe manufacturing environments, especially in the presence of volatile solvents and active pharmaceutical ingredients.

Explosion-Proof Equipment Market Regional Analysis

- North America dominates the explosion-proof equipment market with the largest revenue share of 31.1% in 2024, driven by stringent industrial safety regulations, rising investments in oil & gas infrastructure, and a strong presence of hazardous location-based industries

- The region benefits from advanced technological adoption, consistent regulatory enforcement by bodies such as OSHA and NEC, and a strong demand for explosion-proof solutions across chemical processing and energy sectors

- Growth is further supported by a mature industrial base, rapid integration of industrial IoT solutions in hazardous environments, and increased emphasis on worker safety compliance across both legacy and new industrial facilities

U.S. Explosion-Proof Equipment Market Insight

The U.S. explosion-proof equipment market captured the largest revenue share of 85.5% in 2024 within North America, propelled by the country's expansive oil & gas operations, chemical production, and mining activities. The growing focus on workplace safety, supported by mandates from NFPA and NEC, drives significant demand for certified explosion-proof systems. In addition, the rise in automation and smart monitoring in refineries and power plants, coupled with the availability of advanced protective components from major U.S.-based manufacturers, underpins market growth.

Europe Explosion-Proof Equipment Market Insight

The Europe explosion-proof equipment market is projected to expand at a substantial CAGR during the forecast period, supported by the presence of a highly regulated industrial safety environment and strong compliance with ATEX directives. Rapid advancements in process automation and smart manufacturing across countries such as Germany, France, and Italy are fostering greater adoption of certified explosion-proof systems. Demand is particularly strong in chemical, pharmaceutical, and marine industries, where the need to meet stringent EU safety standards accelerates equipment replacement cycles.

Germany Explosion-Proof Equipment Market Insight

The Germany explosion-proof equipment market is expected to grow steadily, fueled by its strong industrial manufacturing base and commitment to safety innovation. With a large number of chemical, automotive, and industrial plants, Germany places high emphasis on explosion protection through robust engineering and regulatory compliance. The country also drives technological advancements in flameproof sensors, motors, and industrial controls, aligning with both energy efficiency and EU safety mandates.

U.K. Explosion-Proof Equipment Market Insight

The U.K. explosion-proof equipment market is anticipated to witness healthy growth during the forecast period, supported by robust activity in offshore oil extraction, pharmaceuticals, and energy sectors. Post-Brexit regulatory alignment with international safety standards and growing investments in upgrading legacy equipment in hazardous areas contribute to sustained market demand. The presence of advanced marine and shipbuilding industries also boosts the adoption of certified explosion-proof components.

Asia-Pacific Explosion-Proof Equipment Market Insight

The Asia-Pacific explosion-proof equipment market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid industrialization, rising safety awareness, and increasing investments in oil refining, petrochemicals, and power infrastructure in countries such as China, India, and Southeast Asia. The expansion of manufacturing hubs and ongoing regulatory updates for workplace safety standards across emerging economies are accelerating demand for explosion-proof systems in both new and existing industrial setups.

China Explosion-Proof Equipment Market Insight

The China explosion-proof equipment market accounted for the largest revenue share in Asia-Pacific in 2024, supported by extensive investments in energy, petrochemical, and mining projects. China's push for modernization of its industrial safety systems, alongside its status as a global manufacturing hub, drives large-scale deployment of explosion-proof sensors, motors, and enclosures. Domestic production capabilities and government initiatives for workplace hazard reduction further fuel market expansion.

India Explosion-Proof Equipment Market Insight

The India explosion-proof equipment market is expected to witness the fastest growth rate within Asia-Pacific, driven by increasing industrial safety regulations, strong growth in oil refining, and infrastructure projects. With expanding pharmaceutical, fertilizer, and mining industries, India is seeing a surge in demand for reliable explosion-proof technologies. Government initiatives such as “Make in India” and increased FDI in energy and heavy industries are contributing to the adoption of certified safety systems across hazardous environments.

Explosion-Proof Equipment Market Share

The explosion-proof equipment industry is primarily led by well-established companies, including:

- R. STAHL AG (Germany)

- Extronics (U.K.)

- Honeywell International Inc (U.S.)

- ABB (Switzerland)

- BARTEC Top Holding GmbH (Germany)

- Eaton (Ireland)

- Pepperl+Fuchs (Germany)

- Bosch Rexroth AG (Germany)

- MarechalElectric (France)

- Pelco (U.S.)

- DEHN SE (Germany)

- Schneider Electric (France)

- nVent (U.K.)

- Axis Communications AB (Sweden)

- ClearView Communications LTD (U.K.)

- Zenitel (Norway)

- MIRETTI (Italy)

- Emerson Electric Co (U.S.)

Latest Developments in Global Explosion-Proof Equipment Market

- In November 2024, Konecranes expanded its explosion-proof equipment portfolio with the launch of the EX C-series electric chain hoist, engineered for use in Zone 1/2/21 hazardous environments. Introduced across the EMEA and APAC regions, the hoist incorporates advanced safety and efficiency features, making it ideal for operations in explosive atmospheres such as oil refineries, chemical plants, and gas facilities

- In August 2022, ARCHON Industries, Inc. launched the EX20100 explosion-proof light, specifically engineered to provide continuous illumination for various industrial equipment in hazardous and non-hazardous areas. Designed for use in Class I Division I Group C&D and Class I Division II Group C&D locations, the luminaire enhances safety and visibility in challenging environments

- In April 2022, Mitsubishi Heavy Industries, Ltd., in partnership with ENEOS Corporation, introduced the second-generation 'EX ROVR' plant inspection robot with explosion-proof capabilities. Utilizing remote maintenance technology, it enhances worker safety, increases work efficiency, and ensures continuous facility inspections in potentially explosive atmospheres, catering to the demands of the explosion-proof equipment market

- In February 2022, Pyroban reintroduced Ex Solutions Consulting to aid manufacturers in addressing their Ex design and certification needs or skill shortages. This service expedites the delivery of explosion-proof products to market, minimizing Ex certification expenses. It serves as a valuable resource for manufacturers navigating the complexities of the explosion-proof equipment market

- In May 2021, Zenitel and AMAG Technology collaborated to provide a cutting-edge security solution for a development in West Los Angeles. Covering 200,000 square feet across eight floors, the project integrates explosion-proof equipment to ensure safety and security in both the creative office space and on-site apartments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Explosion Proof Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Explosion Proof Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Explosion Proof Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.